Edited by: Abbas Mardari

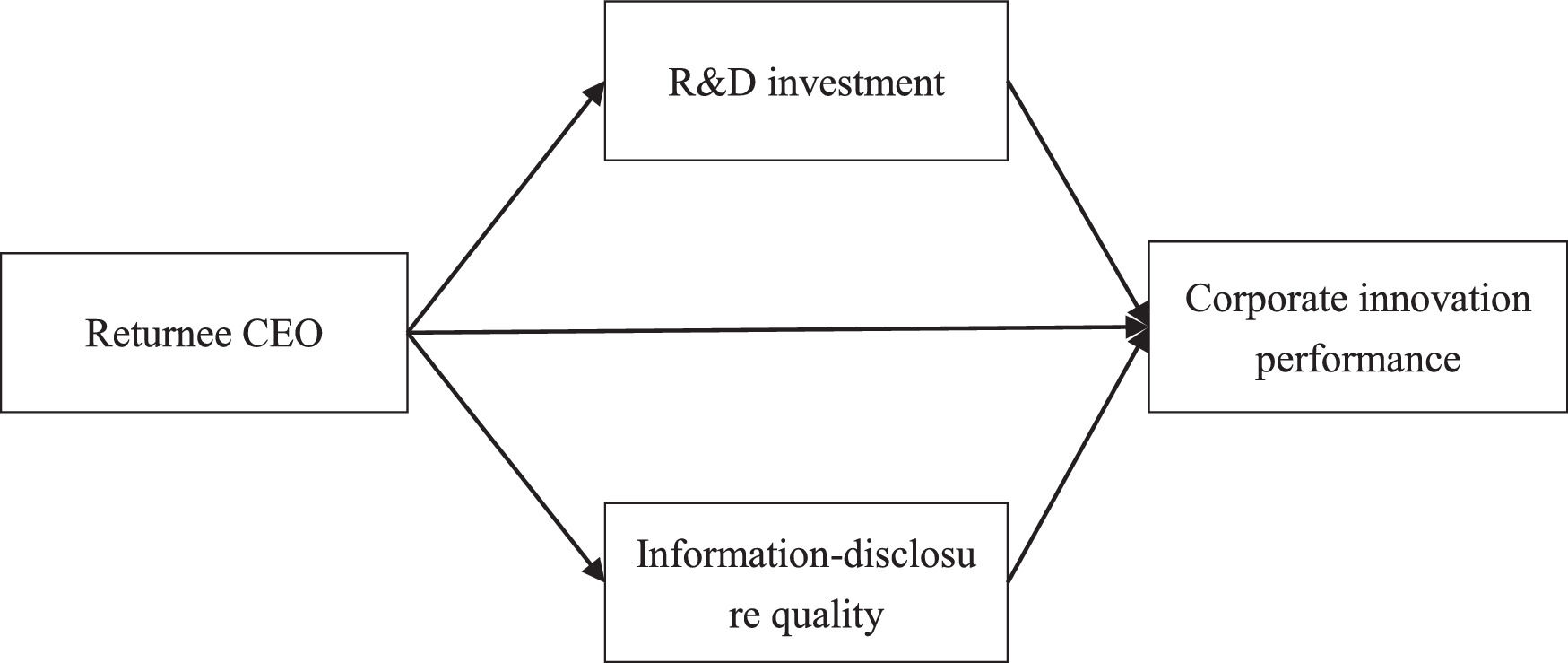

More infoWith growing competition among enterprises globally, innovation has become a significant measure of competitiveness. In the present study, we sample enterprises listed on China's A-share stock market (traded on the Shanghai Stock Exchange and Shenzhen Stock Exchange) from 2008 to 2020 to empirically explore the impact of chief executive officers’ (CEOs’) overseas experience on enterprises’ innovation performance. We find that CEOs’ overseas experience positively impacts enterprises’ innovation performance, and that research and development (R&D) investment and information-disclosure quality play intermediary roles. CEOs’ overseas background promotes enterprises’ innovation performance by increasing R&D investment and information-disclosure quality. Further analyses reveal that CEOs’ overseas experience plays a more significant role in boosting invention patents than in promoting utility-model and design patents, and that the positive role of CEOs’ overseas experience is more prominent in high-tech firms and enterprises with stronger internal control. The research results have certain theoretical and practical value in configuring top management to promote enterprises’ innovation.

According to the Chinese 2021 Government Work Report, the country has vigorously promoted scientific and technological innovation and accelerated the pace of industrial transformation and upgrading, adhering to the innovation-driven development of a modern industrial system. As economic development enters a new normal, China must quickly build a development model with innovation at the core. The Chinese National Development and Reform Commission mentioned in the “Big Data Analysis of Employment of Returnees in 2021,” released in September 2021, that it was necessary to improve and refine the management of returnees and achieve a balance between the supply of and demand for human resources. According to the report on “Employment and Entrepreneurship of Overseas Returnees 2020,” the total number of Chinese studying abroad was 703,500 in 2020, up 6.25% from the previous year, while the number of returnees was 583,300, up 11.73% from the previous year. The development of enterprises requires a strengthening of human resources, which involves not only the training of local employees, but also the introduction of advanced technology and management personnel from abroad, thus promoting the realization of “mass innovation and entrepreneurship” in China. Aghmiuni et al., (2019) and Shu et al. (2015) believe that government plays an important role in fostering and promoting enterprise innovation. Aghion et al. (2013) believe that innovation is the source of and driving force for the continuous growth of enterprises in a country or region. As economic development enters the new normal, China must rapidly build a development model with innovation at the core. In the face of numerous crises, such as the influx of foreign, high-tech industries and the transformation and upgrading of traditional enterprises, innovation is adopted to promote enterprises’ renewal and evolution. Molina-castillo et al. (2021) proposed that innovation was premised on a sustainable development of entrepreneurship. Therefore, maintaining sustainable development in domestic and foreign markets has become a top priority in the deployment of enterprises’ strategies.

The strategy of scientific and technological, innovation-driven development and the high-quality development of the economy requires the government's macro-control and the participation of many enterprises as the main body. In the context of China's macro environment, the Internet has been combined with the economy, society, and big data, while traditional industries have gradually adopted innovation as the main driving force for enterprise survival and development. If an enterprise intends to excel in the fierce competition, it must adopt innovation as the first productive force and establish its own core advantages. Innovation has become the main driving force for enterprises’ long-term, stable operation and development. Enterprises’ long-term and effective development cannot be separated from continuous innovation.

This study chooses China as the research object for two reasons. First, China's talent and innovation are closely integrated with its national strategy. In 2021, the country proposed “implementing the strategy of reinvigorating China with a talent for a new era and building the world's major talent center as well as innovation hub.” In the fifth Plenary Session of the 19th CPC Central Committee, it was pointed out that China would enter the forefront of innovative countries by 2035 and build itself into a talented power. Second, Zezhonghao et al. (2022) have observed that, although the number of patent applications in China reached the highest in the world in 2019, instead of being invention-related, Chinese patents are generally of low value, with low, overall, innovation level and investment.

From the perspectives of executive shareholding, network embedding, regional differences, R&D investment, political connection heterogeneity, executive education background, distance of business environment, and government R&D subsidies, Gompers et al. (2003), Boxu et al. (2022), Dai et al. (2009), Haveman et al. (1993), Zhang et al. (2022), Zhou et al. (2021), Zhao et al. (2022), and Zuo et al. (2022), respectively, as well as Acharya and Subramanian (2009) and Fang et al. (2017), have explored the relationship between enterprise innovation and enterprises’ and investors’ legal protection systems, as well as the mediating effects of financing constraints and resource relaxation. However, few studies have explored the relationship between innovation performance and the chief operating officer's (CEO's) characteristics. According to the high ladder team theory, managers’ characteristics influence their choice of corporate strategy, which is ultimately reflected in corporate performance and output. Therefore, as the backbone of an enterprise's development, a CEO's personal ability affects the entire enterprise's development to a certain extent. In recent years, some studies have gradually begun to focus on the impact of a CEO's personal characteristics on enterprise development. For example, Yang et al. (2021) found that a CEO's financial background would accelerate their enterprise's financialization. Malmendier et al. (2008) found that CEOs’ overconfidence would lead them to engage in low-quality mergers and acquisitions. Murphy and Zabojnik (2006) found that an increasing number of enterprises tended to recruit CEOs with rich professional experience, thus enhancing their value creation abilities. Hou et al. (2021) found that a CEO's early market experience would affect enterprise innovation. Benmelech et al. (2015) found that a CEO's military career significantly impacted management decisions and company performance, while Cao et al. (2019) found that directors with overseas experience could help reduce the risk of enterprises’ stock price collapse. However, few published studies have focused on the impact of a CEO's overseas background on enterprises’ innovation performance. A CEO's overseas background directly affects their own style and attitude toward enterprise innovation. Miller and Upadhyay (2000) confirmed that different levels of human capital could influence economic growth through innovation. Their mathematical model and empirical research results show that the level of human capital has a significant and positive impact on economic growth through innovation. Based on these, this study selects data on A-share listed companies on the Shanghai and Shenzhen stock markets from 2008 to 2020 as a sample to explore the relationship between CEOs’ overseas backgrounds and enterprise innovation performance.

The major contributions of the present study are as follows: (1) It extends the scope of research on corporate innovation performance. Although some studies have explored the positive and negative effects of CEOs’ professional training in finance on corporate innovation (Cao et al., 2019), while some have analyzed the impact of CEOs’ incentives on corporate innovation performance (Hill and Snell, 1988), the influence of CEOs’ overseas experience on enterprises’ innovation performance has rarely been examined. Therefore, this study enriches the existing literature in this regard. (2) Focusing on disclosure quality and R&D investment as mediating paths, the present study explores how CEOs’ overseas experience influences corporate innovation performance; additionally, heterogeneity analysis is performed from three perspectives—innovation and enterprise types as well as corporate internal control. (3) The present study is of practical significance. As pointed out in “Big Data Analysis of Employment of Returnees in 2021,” released in September 2021, “we need to improve management of returnees to balance the supply and demand of talents and improve human resource management to promote the development of enterprises.” To improve human resource management will involve the training of local employees and requires the introduction of high-level technical and managerial talents from abroad. A CEO with an overseas background has extensive knowledge, rich experience, and international vision. Recruiting such talents as CEOs can help companies overcome cultural barriers in overseas market expansion, attract more investment, and become more sensitive to market sentiment. The present study is expected to provide a theoretical foundation for the introduction of returnees.

The remainder of the paper is organized as follows: Section 2 reviews the relevant literature and proposes the research hypotheses. Section 3 introduces the modeling process and variable measurements, while Section 4 presents the empirical analysis and verifies the robustness of the model. Section 5 provides further analyses, and Section 6 concludes.

Literature review and research hypothesesCEOs’ overseas experience and corporate innovation performanceThe upper echelons theory proposed by Hambrick & Mason (1984) indicates that the characteristics of an organization's top management have varied impacts on its decision-making, and hence its operational outcomes (Gompers et al., 2003). Studies that have explored the influence of a CEO's personal characteristics on corporate governance can be divided into two groups: The first focuses on a CEO's demographic characteristics, including gender, age, length of service, family background, and education. The second group shifts to a CEO's personal experience, such as their political connection, educational background, and financial management experience. For example, it has been reported that management's political connection is positively correlated with an organization's innovation behavior (Benmelech et al., 2015): management's stronger ties with the government mean a higher likelihood of establishing a partnership with the latter, which will improve the external environment and encourage the top management to invest more in R&D and improve the organization's innovation capacity. A CEO's educational background also plays a role. He et al. (2021) found that the higher the proportion of senior executives with academic backgrounds, the more significant the investment in enterprise innovation could be. This influence is more obvious when senior managers hold important positions or have higher education levels. In terms of financial management experience, some researchers contend that CEOs with financial experience have a deep understanding of the operation of the capital market and a sound, cooperative relationship with the capital suppliers in their work, which have a profound impact on their enterprises' innovation processes.

Holmstrom (1989) maintains that innovation is a strategic and purposeful investment behavior of enterprises that is accompanied by risks and uncertainties. Executives who have rich employment experience abroad can, having understood the production procedures, techniques, marketing strategies, and internal administration systems, well manage all issues within the organization and improve its performance. If an enterprise is in the process of globalizing, returnee executives can resolve problems the organization faces in its foray into the global market and contribute to the organization's innovation performance. Therefore, the following hypothesis is proposed here:

Hypothesis 1H1 Other things being equal, a CEO's overseas experience is positively correlated with corporate innovation performance.

Based on H1, the mechanism underlying the influence of a CEO's overseas experience on the organization's innovation performance is explored in the present study. Signaling theory (1973) indicates that executives who have stayed abroad have a “celebrity halo” effect in China. An organization's executives with overseas experience send a positive signal to investors that its top management has a sound education background, rich work experience, and wide social networks, which effectively solves the problem of information asymmetry between enterprises and investors, allowing enterprises to win more investments, increase R&D inputs, and improve their innovation performance.

CEOs’ overseas experience, information-disclosure quality, and corporate innovation performanceReturnee CEOs are more familiar with foreign enterprises’ information disclosure. Lu and Wang (2020) found that under a more advanced legal system abroad, foreign enterprises’ social responsibilities were reflected in their information disclosure, while China still had a long way to go to improve the relevant laws and regulations. In this regard, overseas enterprises outperform their Chinese counterparts. Zhen (2010) found that increasing the proportion of experts and scholars among independent directors helped to improve listed companies’ information-disclosure quality. Most experts and scholars have overseas experience (Sra et al., 2021); having returned home, they can incorporate advanced ideas and concepts into enterprises’ internal governance, which helps improve the quality of information disclosure. Jiang and Yan (2019) found that executives’ overseas background and both their work and academic experience positively impacted the disclosure of information on corporate social responsibility in areas with strong regulatory pressure. Jiang et al. (2020) found that the quality of environmental information disclosure could significantly promote highly polluting enterprises’ innovation. Therefore, it is assumed, in the present study, that a CEO's overseas experience will affect a corporate's innovation performance by regulating the corporate's information-disclosure quality.

Given the analyses above, the following hypotheses are proposed:

Hypothesis 2H2 Other things being equal, a CEO's overseas experience will increase R&D investment and improve an enterprise's information-disclosure quality.

Hypothesis 3H3 Other things being equal, a CEO's overseas experience can promote corporate innovation output by improving R&D investment and disclosure quality; that is, R&D investment and disclosure quality mediate the impact of the CEO's overseas experience on corporate innovation performance. Fig. 1 outlines the present study's research framework.

Companies listed on China's A-share stock market (traded on the Shanghai Stock Exchange and Shenzhen Stock Exchange) from 2008 to 2020 were selected as the research sample. The sample was preprocessed as follows: (1) Listed companies in the finance, insurance, and real estate sectors were excluded. (2) ST and *ST shares were excluded. (3) Companies with missing data were excluded. (4) Companies that had not released information about investment in patent development and application were excluded. (5) To avoid extreme values, the sample data were winsorized at 1%. A total of 18497 companies were obtained for the final sample. Data on patents were manually collected from the official website of the China National Intellectual Property Administration, while other data were obtained from the China Stock Market & Accounting Research (CSMAR) database. Some missing data on returnee CEOs were manually collected from Baidu, Sina, and individual enterprises’ official websites.

Variable definitionsDependent variableThe dependent variable is corporate innovation performance (PA1). In previous studies, the major indicators for enterprises’ technological innovation include the number of patent applications and number of licensed patents, the former being a direct indicator of an enterprise's innovation output. According to the literature, the natural logarithm of the sum of 1 and the number of licensed patents, including invention, utility model (UMPs), and design patents, is used to measure innovation input.

Explanatory variableThe explanatory variable in the model is a CEO's overseas experience (CEOsea). In previous studies, a CEO is considered to have overseas experience or defined as a returnee CEO if they have studied or worked outside mainland China; however, according to the definition of “returnee entrepreneur” proposed by Liu et al. (2010), a returnee is not necessarily one who has actually studied or worked abroad in person. Thus, in our study, we follow Zx and Liang (2021) and define overseas experience as study or employment experience outside China, which is treated as a dummy variable. The value of the dummy variable is 1 if a CEO has overseas study or work experience, and 0 otherwise.

Mediator variablesThe mediator variables in the model include information-disclosure quality (KV) and R&D investment (RD1). KV is a comprehensive measure of listed companies’ information-disclosure quality, with a higher value of KV corresponding to a lower disclosure quality. The larger the difference between a company's internal and market values, the poorer its disclosure quality. The disclosure-quality measurement method proposed by Lin et al. (2016) is adopted in the present study:

where Pt is the closing price on the t-th day; Volt is the trading volume (shares) on the t-th day; Vol0 is the average trading volume for all the trading days within the study period; β is obtained by least squares regression. KV is inversely proportional to the disclosure quality because a smaller β corresponds to a smallerKV, and thus a higher quality of corporate-information disclosure. The trading day on which ΔPt=0 is removed.Control variablesIn addition to the explanatory variable, corporate innovation performance is subject to influences from other factors. Having explored the literature, we control for the following variables, following previous scholars: asset-liability ratio (LEV), enterprise size (SIZE), enterprise age (AGE), the proportion of independent directors (INDENP), size of the board of directors (INBOARD), number of shareholding executives (EXCUHLDN), and proportion of female executives (FEMALE). In addition, the industry virtual (IND) and year virtual (YEAR) variables are introduced to control for cross-industry differences and changes in years. Table 1 lists all the control variables.

Definitions and meanings of variables.

Following previous authors, a new model is constructed to evaluate the impact of a CEO's overseas experience on corporate innovation performance:

To verify the mediating effects of disclosure quality and R&D investment, we adopt a three-pronged approach: First, we evaluate whether a CEO's overseas experience can significantly increase an enterprise's innovation output. Second, we assess whether a CEO's overseas experience can promote R&D investment and disclosure quality. Third, we identify how the interactions between a CEO's overseas experience and R&D investment and disclosure quality simultaneously affect corporate innovation performance. Therefore, we construct the following models:

where CEOsea is the explanatory variable, i.e., a CEO's personal characteristics, which encompasses two proxy variables: a CEO's work experience and educational background; Control represents the control variables, including seven variables: the asset-liability ratio (LEV), corporate size (SIZE), enterprise age (AGE), the proportion of independent directors (INDENP), size of the board of directors (INBOARD), number of shareholding executives (EXCUHLDN), and proportion of female executives (FEMALE). Model (3) is used to assess the correlation between a CEO's overseas experience and corporate innovation performance; Models (4), (5), (6), and (7) examine how disclosure quality and R&D investment mediate the impact of a CEO's overseas experience on corporate innovation performance.Empirical analysisDescriptive statistical analysisTable 2 presents a descriptive statistical analysis of the variables. The sample companies' average innovation output is 1.865, indicating an increased emphasis on corporate innovation; however, the gap between the maximum of 6.068 and minimum of 0.000 is large, which reveals varying degrees of engagement in innovation and a differentiated level of innovation output among the sample enterprises as well as a lack of motivation for innovation among some enterprises. The average value for a CEO's overseas experience is 0.137, which means that only a few CEOs among the sample enterprises have been abroad. The average LEV is 0.465, which indicates a high asset-liability ratio for the sample enterprises; the average INBOARD is 2.162. The average number of members on a board of directors for the sample enterprises is eight, with a maximum of 2.708 and a minimum of 1.609, which means that board size can reach a maximum of 14 members and a minimum of eight members. This reflects a large difference in board size among the sample enterprises. The average FEMALE is 0.143, which means that most sample enterprises have a small proportion of female executives. However, the maximum value of FEMALE is 0.600, while the minimum is 0.000, which shows a substantially differentiated degree of emphasis on female executives among the sample enterprises.

The descriptive statistical analysis of the variables.

Table 3 shows the correlations among the major variables; all the correlation coefficients are <0.5, which rules out the problem of multilinearity. A CEO's overseas experience (CEOsea) is positively and significantly correlated with corporate innovation performance (PA1) at the 1% level, which supports H1. The correlation coefficients between CEOsea and disclosure quality (KV) and R&D investment (RD1) are 0.060 and 0.048, respectively, which are significant at the 1% level. The correlation coefficients between PA1 and KVand RD1 are 0.173 and 0.426, respectively, and are significant at the 1% level, which supports H2. Nonetheless, further regression analysis is required to validate the correlation analysis outcomes.

The correlations among the major variables.

Note: * * *, * *, and * indicate significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

Table 4 shows the regression results for H1. Column (1) in Table 4 lists only CEOsea, and shows that the correlation between CEOsea and PA1 is positive and significant at the 1% level; Column (2) displays the regression results after the introduction of the control variables, and the correlation coefficient is positive and significant at the 1% level; Column (3) displays the regression outcome after the introduction of the dummy variables for industry and year: CEOsea and PA1 are positively and significantly correlated at the 1% level, which supports H1 and indicates the positive role of CEOs’ overseas experience in promoting corporate innovation performance.

Basic model regression.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

In addition, many factors contribute to corporate innovation performance. As shown in Column (3) in Table 4, the variable, LEV, is negatively and significantly correlated with PA1 at the 1% level, which means that corporation innovation performance decreases with an increasing asset-liability ratio. With a high asset-liability ratio, an enterprise will attach less importance to innovation and thus show poorer innovation performance. SIZEis positively and significantly correlated with PA1 at the 1% level, whereas AGEis negatively and significantly correlated with PA1 at the 1% level. This may be because younger enterprises have more room for trial and error in innovation attempts, whereas older companies are more financially capable of investing in innovative projects. INDENP is positively and significantly correlated with PA1 at the 10% level. In enterprises with a more independent board of directors, management have more power, while there will be less hindrance in starting innovative projects; meanwhile, the social connections of a more independent board of directors are more complex, while such directors have more domain-specific expertise to solve problems in innovation attempts. EXCUHLDN is positively and significantly correlated with PA1 at the 1% level: in companies with more shareholding executives, the top management have stronger control over the company and hence suffer fewer obstacles in their innovation attempts.

Test for endogeneityThere might be an endogeneity problem in the correlation between CEOs’ overseas experience and corporate innovation performance because innovative companies prefer job applicants with overseas experiences. To test for the endogeneity, we selected a variable for treaty port cities in the late Qing Dynasty (Local) as the instrumental variable. Local=1 when an enterprise is headquartered in a treaty port city (Shanghai, Beijing, Tianjin, Fujian, Hubei, Shandong, Jiangsu, Guangdong, or Jiangxi); otherwise, Local=0 (Ang et al., 2014). In Table 5, Column (1) shows the result of the first-step regression. This instrumental variable (Local) is positively and significantly correlated with PA1 at the 1% level, which is consistent with our assumption. Column (2) in Table 5 presents the regression result when the endogeneity problem is accounted for, and reveals that CEOsea remains positively correlated with PA1 at the 1% significance level; this means that CEOs’ overseas experience contributes positively to corporate innovation performance, and that H1 still holds.

Endogeneity test.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

We select the natural logarithm of 1 plus the number of invention patents, UMPs, and design patents (with weights of 3:2:1 assigned to these three types of patents, respectively) as a proxy variable for PA1, which is renamed PA2 for further regression. Column (1) in Table 6 shows the regression result when the dependent variable is changed: CEOs’ overseas experience (CEOsea) still shows a positive and significant correlation with PA2 at the 1% level, which further supports H1 and demonstrates the robustness of our research finding. Additionally, we use the natural logarithm of 1 plus the number of invention patents, UMPs, and design patents as a proxy variable for corporate innovation performance, and label it Patent1 for further regression. Column (2) of Table 6 shows the regression result after the change of the dependent variable: CEOsea still shows a positive and significant correlation at the 1% level, which validates H1. The major research conclusions do not change with a change of the dependent variable, which demonstrates the robustness of our research conclusion.

Robustness test.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

We replace the hybrid ordinary least squares (OLS) model with a fixed-effects model to further examine the correlation between CEOsea and PA1. Column (3) in Table 6 shows the regression result after the change of model. CEO's overseas experience (CEOsea) still shows a positive and significant correlation at the 10% level, which is consistent with the result displayed in Column (3) of Table 4. Therefore, the research conclusion is demonstrated to be robust.

Changing the sampleTo avoid the influence of the data distortion that might be caused by the 2008–2009 financial crisis, we perform a regression analysis of CEOsea against PA1, but with the pre-2010 data removed. Column (4) of Table 6 shows the regression result with the sample data changed. With the industry and year dummy variables controlled for, the regression coefficient of CEOs’ overseas experience (CEOsea) is 0.108, with a significant correlation with PA1 at the 1% level, which demonstrates the robustness of our conclusion.

Test for mediating effectsColumn (1) of Table 7 verifies the impact of CEOs’ overseas experience (CEOsea) on disclosure quality (KV); the result shows that the correlation between CEOsea and PA1 is positive and significant at the 5% level. The regression results show that CEOs’ overseas experience can improve disclosure quality, which validates H2. Column (2) of Table 7 shows the results of the test for the impact of CEOs’ overseas experience and disclosure quality on corporate innovation performance. In this case, the correlation between CEOsea and PA1 is positive and significant at the 1% level, which suggests a direct impact of the former on corporate innovation performance, consistent with the result shown in Column (3) of Table 4. KV and PA1 are positively and significantly correlated at the 1% level, implying a positive impact of disclosure quality on corporate innovation performance. As shown in the aforementioned analyses, disclosure quality plays a mediating role in the relationship between CEO's overseas experience and corporate innovation performance.

Examination of intermediate effects.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

In Table 7, Model (3) verifies the impact of CEOs’ overseas experience on R&D investment (RD1); the result shows that CEOsea is positively and significantly correlated with RD1 at the 1% level. The result reveals that CEOs’ overseas experience can increase R&D investment, which supports H2. Column (4) in Table 7 shows the result of the test for the impacts of CEOsea and RD1 on PA1. In this case, CEOsea is positively and significantly correlated with PA1 at the 1% level (with a regression coefficient of 0.006), which suggests a direct impact of the former on corporate innovation performance. This is consistent with the result in Column (3) in Table 4. RD1 and PA1 are positively and significantly correlated at the 1% level, which means that R&D investment positively affects an organization's innovation performance. Given the analyses above and the results of the mediating-effect tests, disclosure quality and R&D investment mediate the impact of CEOs’ overseas experience on organizational innovation performance.

Heterogeneity testInnovation typesCompared with those without overseas experiences, returnee CEOs can considerably increase the number of invention patents and patent applications. This is because organizations employing returnee CEOs attach more importance to technical innovation; a returnee CEO with both theoretical and technical expertise often has the final say in decision-making and can fulfill an organization's needs for innovation. Compared with UMPs and design patents, invention patents are more widely recognized and hence are more valued by returnee CEOs. In the present study, invention patents are distinguished from the other two types of patents. We use the natural logarithm of 1 plus the number of licensed invention patents (PA3) to measure the innovation output of invention patents, as shown in Column (1); the natural logarithm of 1 plus the number of licensed UMPs and design patents (PA4) is used to measure the innovation output of UMPs and design patents, as shown in Column (2). The control as well as year and industry dummy variables are introduced into the model.

Table 8 presents the verification results. Column (1) shows that the correlation between CEOsea and PA3 is significant at the 1% level (with a regression coefficient of 0.118); as Column (2) shows, the correlation between CEOsea and PA4 is significant at the 5% level (with a regression coefficient of 0.080). The considerable difference between the two coefficients indicates that returnee CEOs play a more salient role in promoting invention patents than in increasing UMPs and design patents, which is consistent with our assumption.

Innovation types.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

High-tech firms are the driving force for future innovation; the high-tech sector, which is financially powerful and promotes enterprise incubation and industry agglomeration, holds great appeal to returnees and is thus the cradle of innovation. In contrast, non-high-tech firms that boast cost advantages find it challenging to survive in a fiercely competitive environment; these firms are rather conservative and require governmental support; thus, they show little appeal to talents and have limited capacities for innovation. In the present study, whether a firm is a high-tech firm is used as a control variable in the regression model: if a firm is high-tech, the variable assumes a value of 1, as in Column (1); otherwise, the variable assumes a value of 0, as in Column (2). The control as well as year and industry dummy variables are controlled for.

As Column (1) in Table 9 shows, CEOsea shows a positive and significant correlation at the 1% level (with a regression coefficient of 0.131); however, in Column (2), the correlation coefficient of CEOsea is not significant, which means that the impact of returnee CEOs on corporate innovation performance is mainly felt in high-tech firms.

Types of enterprises.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

Internal control restrains and balances organizational behaviors in corporate management to ensure a stable operation. Internal control, as a procedure that influences every aspect of an enterprise, is often compulsory and requires deference from all members of the enterprise, from the chair to the general employees. Furthermore, well-organized internal control can boost investment in R&D in an organization and hence promote corporate innovation performance. Thus, in the present study, a dummy variable for internal control is introduced: sample enterprises whose values are larger than the median of the internal control variable are marked as 1, as in Column (1), whereas those with values lower than the median are marked as 0, as in Column (2). The other variables, including the year and industry dummies, are controlled for in the model.

Table 10 shows the test results. In Column (1), CEOsea shows a positive and significant correlation with corporate innovation performance at the 1% level (with a regression coefficient of 0.113); in Column (2), the correlation of CEOsea with corporate innovation performance is positive and significant at the 5% level (with a regression coefficient of 0.104). This means that as internal control strengthens, an organization will experience a higher demand for innovation and will be more likely to invest more in innovative projects.

Internal control.

Note: * * *, * *, and * denote significance at the 1%, 5%, and 10% levels, respectively, with t-values in brackets.

In the present study, companies listed on China's A-share market from 2008 to 2020 are used as the research sample to explore the correlation between CEOs’ overseas experience and corporate innovation performance. Compared with previous studies (Yu et al., 2022), most of which explore the influence of top management's overseas background on enterprises’ innovation performance, this study explores the influence of CEOs’ overseas background from a different perspective. This study affirms previous research conclusions and proposes its own, novel views. The major findings are as follows: First, returnee CEOs are more likely to promote corporate innovation output than those who have not been abroad. Second, R&D investment and information-disclosure quality mediate the impact of returnee CEOs on corporate innovation performance. Specifically, returnee CEOs can boost R&D input and improve disclosure quality, thereby promoting corporate innovation performance. Third, CEOs’ overseas experience plays a stronger role in promoting invention patents than in promoting UMPs and design patents. Fourth, whether a company is a high-tech company affects the correlation between CEOs’ overseas experience and corporate innovation performance: The former plays a more significant role in promoting corporate innovation performance in high-tech firms than in other types of organizations. Fifth, the role of CEOs’ overseas experience in promoting corporate innovation performance is more prominent in enterprises with stronger internal control.

The study verifies the positive effect of a CEO's overseas experience on corporate innovation performance and recognizes the significant role that returnees play in promoting Chinese enterprises’ innovation initiatives; in addition, the impacts of R&D investment, disclosure quality, the type of innovation, type of enterprises, and internal control on the correlation between CEOs’ overseas experience and corporate innovation performance are revealed. Finally, given all the findings, the following suggestions are offered:

For enterprises: (1) Targowski, (2019) finds that enterprises must strive to be leaders of innovative R&D and optimize their organizational structures. To improve innovation performance, enterprises must expand their channels for recruiting top executives, optimize the structures of their top management, and enroll a proper number of returnees in their managerial teams. While exploiting returnee employees’ expertise, enterprises also need to encourage the interaction of returnees with native employees and manage possible conflicts. Compared with high-tech ones, non-high-tech firms need to strengthen internal control, increase investment in R&D, recognize the significant role of innovation in promoting their development, and enroll returnees when necessary to compensate for their intrinsic defects.

For the government: (1) The research findings from this study provide a theoretical basis for the government's and enterprises’ policy-making. The government should expand the channel for the introduction of returnees, recognize returnees’ positive role in promoting corporate innovation, and fully exploit these talents in boosting corporate development. (2) The government must provide more preferential policies for non-high-tech firms, promote the transformation of economic growth models, and encourage enterprises to invest more in innovation.

Funding StatementThe authors did not receive specific funding.

Data Availability StatementThe data used to support the findings of this study are included within the article.