The aim of this study is to investigate the effect of work experience, professional competence, motivation, accountability and objectivity of the auditor on audit quality from the viewpoint of auditors employed in firms. The present study leads to the identification of factors affecting audit quality, which have not been studied sufficiently in Iran. According to the results of this study, professional competence, accountability and objectivity of the auditor show significant effect on the quality of the audit. Employing people with high experience increases audit quality by enhancing the professional competence of the auditor; auditors gain a deeper knowledge and better judgement to achieve audit quality. Accountability improves auditor's performance and objectivity of auditors enables them to operate without the influence of another individual.

Work experience will improve auditor's ability to do the audit. Auditor's work experience influences the length of time and number of tasks that have been performed by the auditor. Both of these increase auditor expertise in doing the audit. Professional competence consists of personal quality, general knowledge and special skill. Increase in personal quality, general knowledge and special skill will increase auditor professional competence and expertise, and give higher audit quality.

Auditors need motivation to perform their duties properly. Motivation is encouragement that belongs to auditors that support performance in effort to reach goals. Auditors can obtain encouragement from themselves, co-workers, work place or employer. Ramadhanis (2012) considers that with motivation someone will have high morale to achieve the goals and meet the existing standards. Morale makes auditors complete their job with great toughness, introspection and consistency (not influenced by mood in examinations) and to maintain the results of the audit, so auditor's work will comply with the standards that have been established, which indicates the high quality of audit. The auditor's motivation is divided into four parts, including: (1) character type: the kind of personality characterized, (2) internal and external control: behaviour is shown in the company's auditors, (3) audit norms: the implementation of the rules on company and (4) ethical culture in firm: ethics in the organization is in compliance.

In performing their duties, auditors will certainly attempt to meet the standards, which then raise accountability. Singgih and Bawono (2010) define accountability as a form of psychological encouragement that marks someone trying to account for all actions and decisions taken by the environment. If the auditor has accountability, then work will be done with the entire efforts and thinking, so that the auditor conducts an audit completed on time in accordance with the auditing standards. Thus, the auditor work will be better and audit quality will increase. This is in line with research of Ardini (2010), Ilamiyati and Suhardjo (2012) and Saripudin, Herawaty, and Rahayu (2012).

Auditors should maintain objectivity and should be free from conflicts of interest in fulfilling professional obligations. Auditors who are free from conflicts of interest will be able to act fairly without being influenced by pressure or demand from certain parties. This suitability indicates that audit quality is higher. This study was conducted to analyze whether auditor's work experience, competency, motivation, accountability and objectivity have significant effect on audit quality.

2Literature review and hypothesis developmentAudit quality is the auditor's work result shown with a reliable audit report based on the determined standards (Sukriah, Akram, & Inapty, 2009). Audit qualities are positively influenced by work experience, professional competence, motivation, accountability and objectivity. The research conducted by Saripudin et al. (2012) indicates that there is a simultaneous positive effect of independence, experience, due professional care and accountability on audit quality. Ramadhanis (2012) finds that professional competence, independence and motivation simultaneously give positive effects on the audit quality. Research by Sukriah et al. (2009) also finds that work experience, independence, objectivity, integrity and professional competence of auditors simultaneously have effect on audit quality.

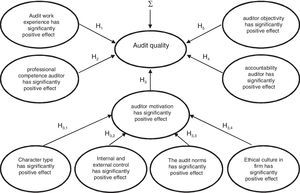

Singgih and Bawono (2010) define work experience as a learning process and increase of potential development of good behaviour from formal and non-formal education; they consider it a process of bringing a person to a higher behaviour pattern. Purnamasari (as cited in Samsi, Riduwan, & Suryono, 2013) states that an employee having high work experience will have advantages to detect, understand and look for the error causes. Length of work as an auditor and experience will increase the audit quality (Carolita & Rahardjo, 2012). Thus we can formulate the following hypotheses:H1 The auditor's work experience has a significantly positive effect on audit quality.

Auditor's professional competence is the ability of an auditor to apply the knowledge and experience that have been possessed in auditing so that the auditor can perform the audit carefully, accurately and objectively (Carolita & Rahardjo, 2012). The higher competency level, the more audit quality (Sukriah et al., 2009). Variables of experience and skills, which have been chosen to represent the competence variable, have a negative relationship with the duration of the execution and completion of auditing operations (Rafiee, Karimian, Mahmoudi, & Haghighi, 2013). Thus we can formulate the following hypotheses:H2 The auditor's professional competency has a significantly positive effect on audit quality.

According to Robbins and Judge (2009), motivation is a process of producing individual intensity, objectives and perseverance in an effort to achieve goals. Ardini (2010) divides the motivations into two parts: positive and negative motivations. Positive motivation is a process of trying to influence others to do something that we want by giving the possibility to get a prize. The negative motivation is the process of trying to influence others to do something that we want but the basic technique used is by power. There is a positive correlation between personality types of the auditors, internal and external control centre, ethical culture in the audit firm and audit team's norms and audit quality (Aghaei & Ahmadi, 2015). Although many of the issues related to the quality of international standards containing explicit and clear conditions (thus allowing easy assessment of whether or not everyone is compatible with what is presumed) are covered, such a statement cannot be extrapolated in the field of ethics of audit quality. One of the main reasons lies in the fact that the business environment is very dynamic and business practices and traditions are different from one country to another. On the one hand, the emergence of ethics is different across countries; on the other hand, the threats of impartiality are very specific and sometimes unexpected. Since the standard process needs the stabilized repetition of a standard target for a particular time period, the effective response of the standard to the changing pressures that is applied to the quality of auditors is not possible. A positive and significant impact of time budget pressure on the report is less than the real time. In addition, the results show a significant adverse impact of ethics on time budget pressure (Malekian & Tavakolnia, 2014). Thus we can formulate the following hypotheses:H3 Auditor's motivation has a significantly positive effect on audit quality.

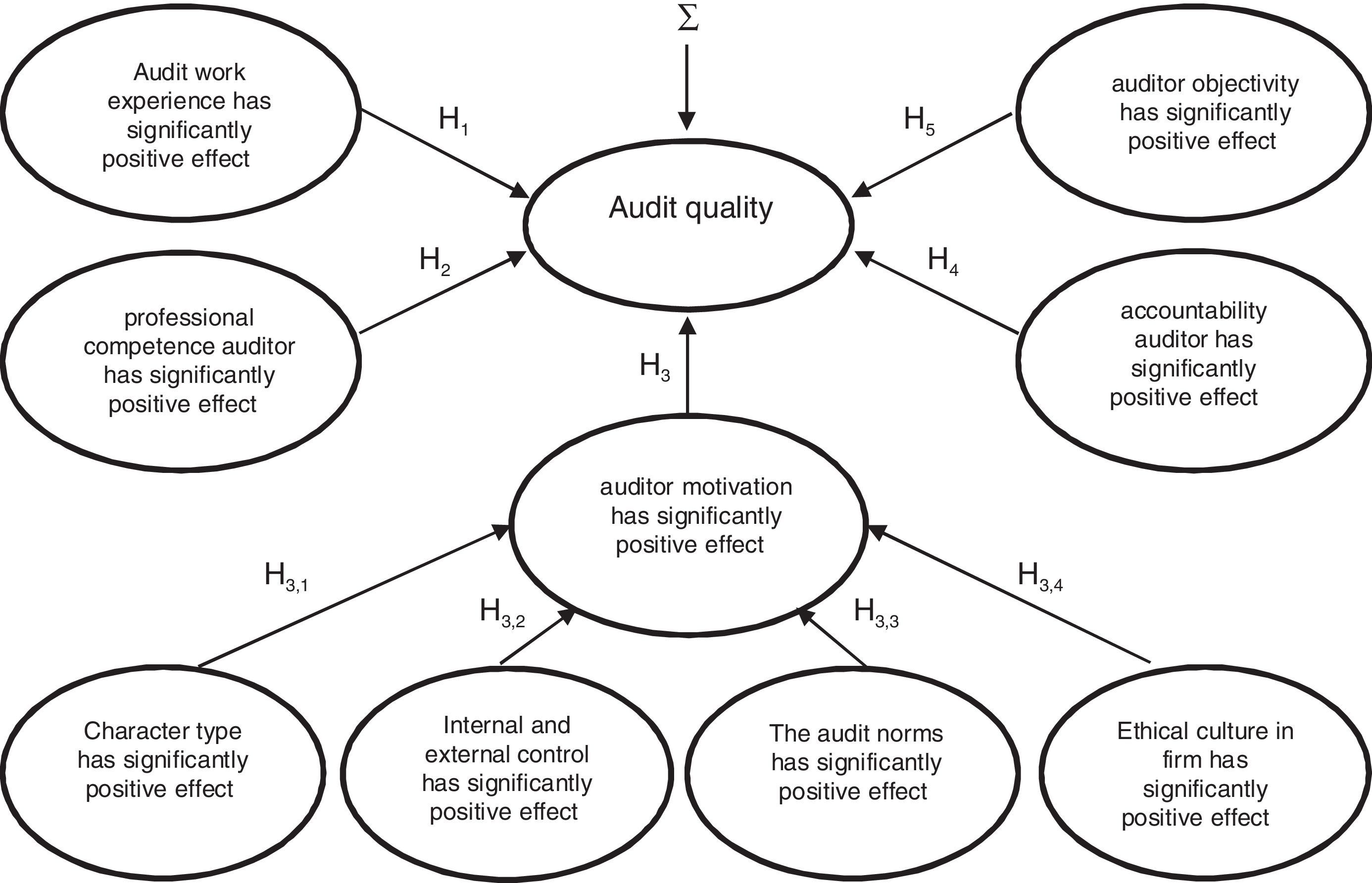

The third hypothesis (H3) contains four parts:H3.1 Character type has a significantly positive effect on auditor motivation. Internal and external control has a significantly positive effect on auditor motivation. The audit norms have a significantly positive effect on auditor motivation. Ethical culture in firm has an effect on auditor motivation.

According to Tetclock (as cited in Ilamiyati & Suhardjo, 2012), accountability is a form of psychological impulse that makes someone try to account for all actions and decisions taken by the environment. In case of facing evidence in conflict with the initial findings in the audit process, responsibility and accountability for audit work performed and the pressure of time leads to raised concern over the loss of reputation and the possibility of concealment of audit evidence is increased (Barzideh & Kheirollahi, 2012). Thus we can formulate the following hypotheses:H4 Auditor's accountability has a significantly positive effect on audit quality.

Sukriah et al. (2009) indicates that a person is said to be objective when in the audit process, the auditor can free from any conflicts of interest and be able to express the statement according to the facts. Objectivity and delay in independent audit are inversely related but the internal audit size variable has no significant relationship with this variable (Hajiha & Rafiee, 2014). Thus we can formulate the following hypotheses:H5 Auditor's objectivity has a significantly positive effect on audit quality.

Based on the above hypothesis formulation, the framework of this study is as follows (Fig. 1):

3Research methodThis is a practical research. It is developed based on studies on audit quality and relevant research results. In terms of type of data collection, it is a descriptive-correlational research. Methods of data collection are applied using survey questionnaires of independent variables of work experience, professional competence, motivation, accountability and impartiality of auditors and audit quality variables. After data collection, the findings are tested with the help of statistical software SPSS and EViews. In this study, in order to test the relationship between variables and the significance of the proposed model for explaining the dependent variable, the regression analysis was used. Data were collected by a questionnaire. Statistical population included all the listed companies in the year 2016 in Iran. The study took place in the offices of auditors employed in public accounting companies.

In this study, 200 questionnaires were distributed to public accounting firms of auditors. A total of 80 questionnaires (40%) have the wrong frequency questionnaire and 18 (9%) incomplete questionnaires are not eligible for the study. So questionnaires that can be used in the study are 102 questionnaires (51%).

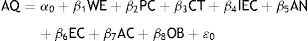

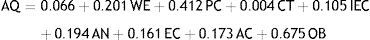

The regression used to test the hypothesis is as follows:

where AQ, audit quality; WE, audit work experience; PC, professional competence auditor; MO, auditor motivation, which includes three parts: CT, character type; IEC, internal and external control; AN, audit norms; EC, ethical culture in firm; AC, auditor accountability; OB, auditor objectivity; ¿0, residual.3.1Variables definitionAudit quality: One of the most common definitions of audit quality is the definition that de Angelo (1981) has provided. This author has defined audit quality as “evaluation (inference) of market” of the possibility that the auditor (1) discovers cases of material misstatement of the financial and accounting system of an employer, and (2) to report the discovery of material misstatement. Whether the auditor discovers significant cases of material misstatement depends on the auditor's competence and whether the auditor reports these cases of discovered material misstatement depends on auditor independence. de Angelo's (1981) definition of real audit quality is based on the perception of consumers or the understanding of the market of audit quality. Using this definition in determining real audit quality is based on the fundamental assumption that the interpretation of audit quality reflects real audit quality. Krishnan and Schauer (2000) have accepted de Angelo's (1981) definition without separating it into real audit and interpretation of audit quality.

Audit work experience: Auditor's experience results in increased independence and, in turn, quality, and as the auditor gains better command over the employer's system, auditing experience increases as well. On the other hand, knowledge and expertise on the client's industry comprises an important part of experience that improves audit quality. As auditor knowledge and experience increases, it will enable him to explore more potential deviations and errors in the audit process.

Professional competence auditor: The auditor's professional competence is determined based on observable behaviours of the person. In addition, overseeing superior performance and required competencies for normal operation are not included. The greater the professional competence, the better audit quality. Professional auditors must provide professional services with care, competence and diligence. They must always keep their level of knowledge and skills high enough to ensure that their services are acceptable based on the latest standards and regulations.

Auditor motivation: According to the theory of planned behaviour, auditor's motivation to report errors and fraud is categorized into two groups of individual and organizational factors. Auditor's behaviour reflects their personality traits (Paino, Ismail, & Smith, 2010). In addition to personality traits, according to the theory of planned behaviour, other environmental factors, including organizational and team factors can also affect motivation. Most studies have focused on the relationship between individual characteristics and the impact of other factors such as company agents and teams have not been evaluated. In this study, the impact of three groups of individual, organizational and team factors such as auditor's character traits, ethical culture in the firm and audit team norms on the motivation of auditors to report deviations and errors as audit quality will be investigated. Theory of planned behaviour is an important theory in psychology that explains the basic mechanism for accepting behaviour. According to this theory, when a person is motivated to conduct behaviour, the behaviour is more likely to occur. There are two general categories of motivation for conducting behaviour: individual factors and environmental factors. Individual factors include internal and external control and personality type. Environmental factors include ethical culture in firm, and the audit team norms.

Character type: Psychology researchers have found that people with different personality types deal with ethical issues in different manners (Fisher, 2001). In fact, most people with type A personality are more committed to their work and put more effort into achieving organizational goals without being involved in unethical behaviour than type B people (Mohd Nor, 2011).

Internal and external control: According to the theory of planned behaviour, the more people have control over their behaviour, it is more likely to be performed. The level of control that individuals have on the conduct and results of their behaviour is determined through internal and external control agent.

Audit norms: According to the theory of planned behaviour, audit norms are another factor in the environment of the audit firm that affects the behaviour of the auditor. Norms of the audit team is the group's beliefs in ethical behaviour which members are expected to follow.

Ethical culture in firm: According to the theory of planned behaviour, when people are under pressure from the environment into adhering to moral behaviour, moral behaviour is more likely to be observed. This pressure is applied by ethical culture in audit firms. Sweeney and Roberts (1997) found that ethical culture in the environment has an important role in providing incentives for auditors to encourage moral behaviour.

Accountability auditor: Accountability for the audit work performed and time pressures increase concerns over loss of reputation and lead to concealing evidence which is in conflict with decisions that were based on earlier findings. By conducting an experimental project, auditors investigate concerns over loss of reputation due to finding further conflicting evidence and the possibility of concealing such evidence.

Auditor objectivity: An independent auditor should be clear, honest and sincere in their professional work. The independent auditor must be impartial and not allow prejudice or bias shift his objectivity. An independent auditor must maintain his objectivity and avoid cases that, regardless of its actual effects, may be in conflict with his honesty and objectivity. Avoiding contradictions that may appear in action and objectivity of auditors in carrying out audit is essential in order to maintain credibility. Maintaining objectivity includes on going assessment of relations with the unit under audit and other interested parties; it is a responsibility of the auditor to the community.

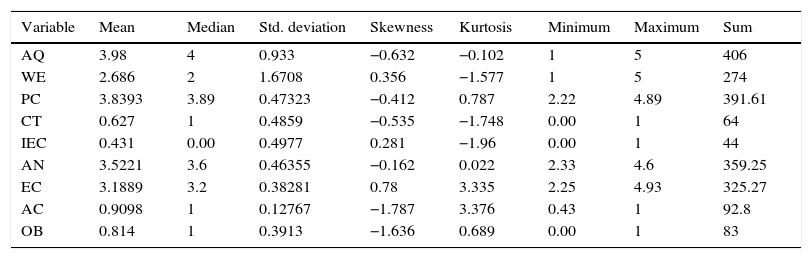

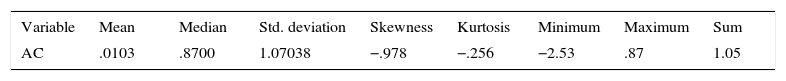

4Results4.1Descriptive statisticsWhen a mass of quantitative data is collected for research, it is essential to organize and summarize it first, in a way that is significantly understandable. Thus, descriptive statistical methods are recommended. Often the most useful and also the first step in organizing data is sorting data based on a logical criteria and then extracting central and dispersion parameters and, if necessary, calculating the correlation between the two sets of data and the use of more advanced analysis such as regression and prediction (Table 1).

Descriptive statistics.

| Variable | Mean | Median | Std. deviation | Skewness | Kurtosis | Minimum | Maximum | Sum |

|---|---|---|---|---|---|---|---|---|

| AQ | 3.98 | 4 | 0.933 | −0.632 | −0.102 | 1 | 5 | 406 |

| WE | 2.686 | 2 | 1.6708 | 0.356 | −1.577 | 1 | 5 | 274 |

| PC | 3.8393 | 3.89 | 0.47323 | −0.412 | 0.787 | 2.22 | 4.89 | 391.61 |

| CT | 0.627 | 1 | 0.4859 | −0.535 | −1.748 | 0.00 | 1 | 64 |

| IEC | 0.431 | 0.00 | 0.4977 | 0.281 | −1.96 | 0.00 | 1 | 44 |

| AN | 3.5221 | 3.6 | 0.46355 | −0.162 | 0.022 | 2.33 | 4.6 | 359.25 |

| EC | 3.1889 | 3.2 | 0.38281 | 0.78 | 3.335 | 2.25 | 4.93 | 325.27 |

| AC | 0.9098 | 1 | 0.12767 | −1.787 | 3.376 | 0.43 | 1 | 92.8 |

| OB | 0.814 | 1 | 0.3913 | −1.636 | 0.689 | 0.00 | 1 | 83 |

In general, if skewness and kurtosis are in range (2,2), the data is normally distributed. Statistical information shows descriptive variables, it can be concluded that there is moderate dispersion in all the variables and it can be inferred from the standard deviation. Elongation of independent variables of ethics in firm and accountability of auditors are not normal. The rest of the variables have normal kurtosis and skewness.

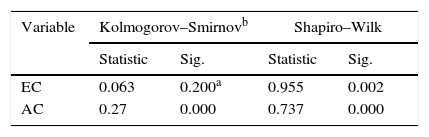

After reviewing routine or normality of elongation or skewness of data distribution, the Shapiro–Wilk test or Kolmogorov–Smirnov test is used to ensure normality of the data. When analysing normality of data, we assume that the data is normally distributed by error rate of 0.05 in our tests. Therefore if the test statistic is greater than or equal to 0.05, then there will be no reason to reject the null hypothesis that the data is normal. In other words, the data is normally distributed (Table 2).

Usually, if the level of significance of these tests that are shown in the table with sig is greater than 0.05, it can be assumed, with high reliability, that data is normal. Otherwise, it cannot be said data distribution is normal. According to the table above, the independent variable of auditor accountability in the Kolmogorov–Smirnov and the Shapiro–Wilk tests has a less than 0.05 significance level of sig; the hypothesis of normal distribution of the auditor accountability variable is rejected. In other words, as was predicted in the descriptive analysis, we cannot say the variable data distribution is normal. But the independent variable of ethics in firm has sig above 0.05 in the Kolmogorov–Smirnov test and it can be said it has normal distribution (Table 3).

The independent variable of auditor accountability is normalized through the logarithmic method.

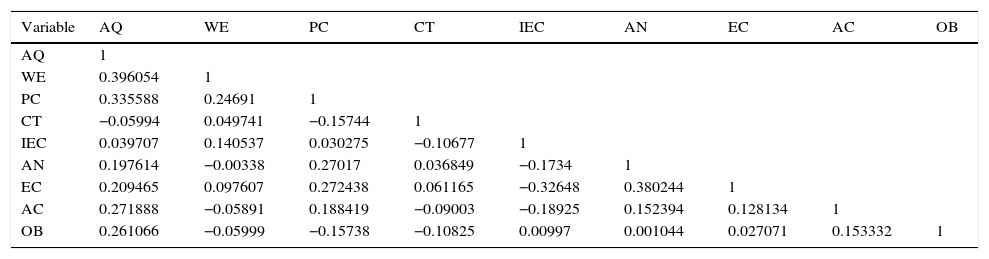

4.2CorrelationsIf the variables are not independent from each other, they are certainly not correlated. The correlation coefficient is a statistics tool used to measure the strength or degree of a linear relationship between two variables. The most famous of the correlation coefficient is Pearson correlation. This index is defined in a way that it takes values between −1 to +1 (Table 4).

Correlation.

| Variable | AQ | WE | PC | CT | IEC | AN | EC | AC | OB |

|---|---|---|---|---|---|---|---|---|---|

| AQ | 1 | ||||||||

| WE | 0.396054 | 1 | |||||||

| PC | 0.335588 | 0.24691 | 1 | ||||||

| CT | −0.05994 | 0.049741 | −0.15744 | 1 | |||||

| IEC | 0.039707 | 0.140537 | 0.030275 | −0.10677 | 1 | ||||

| AN | 0.197614 | −0.00338 | 0.27017 | 0.036849 | −0.1734 | 1 | |||

| EC | 0.209465 | 0.097607 | 0.272438 | 0.061165 | −0.32648 | 0.380244 | 1 | ||

| AC | 0.271888 | −0.05891 | 0.188419 | −0.09003 | −0.18925 | 0.152394 | 0.128134 | 1 | |

| OB | 0.261066 | −0.05999 | −0.15738 | −0.10825 | 0.00997 | 0.001044 | 0.027071 | 0.153332 | 1 |

According to the table, the higher correlation coefficient of the variable means a stronger correlation.

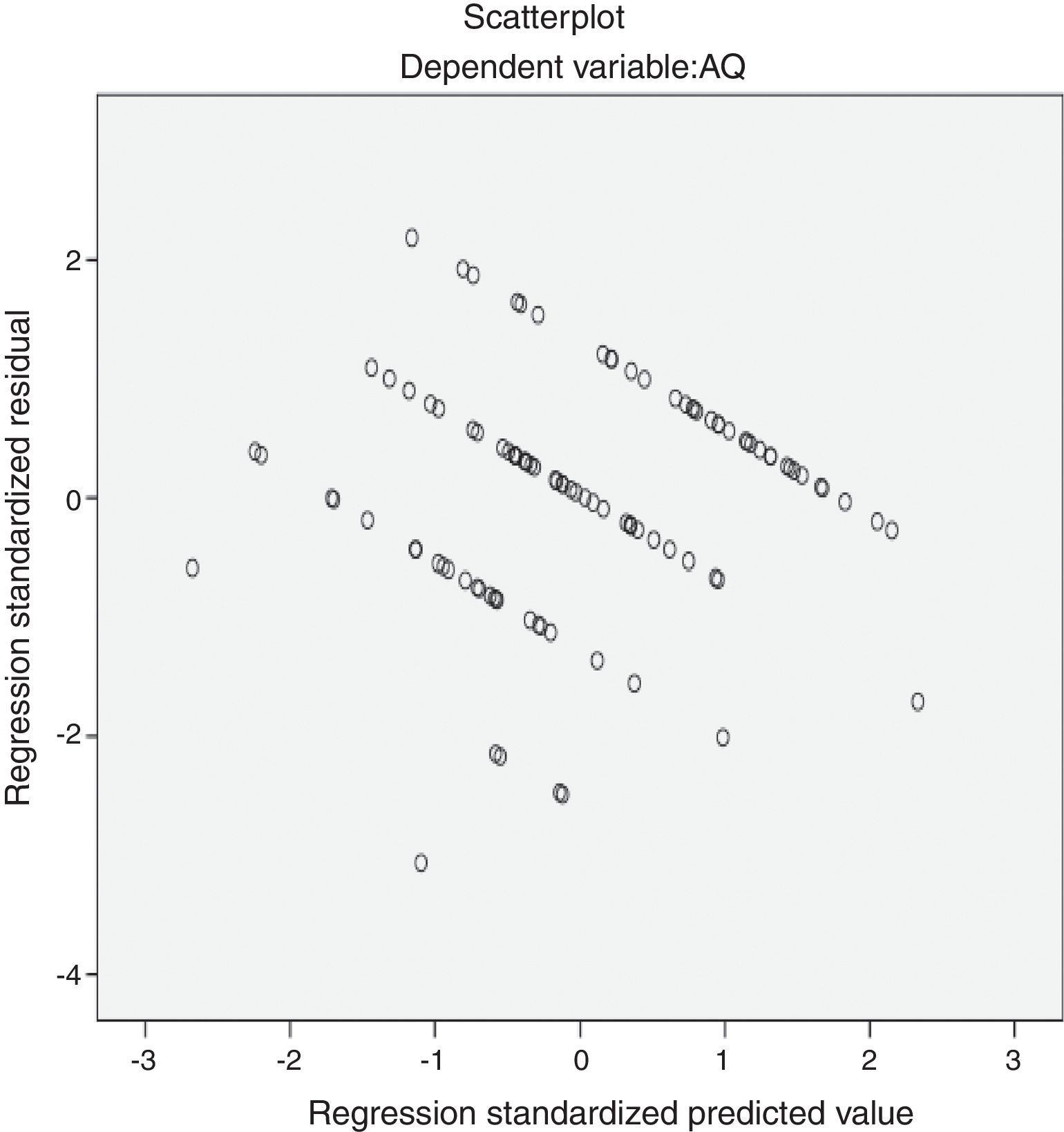

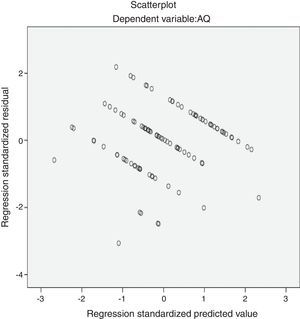

According to Fig. 2, the correlation is reverse and complete. More efficiency is between −1 and +1.

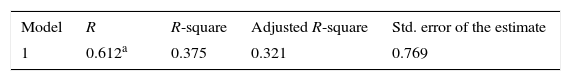

4.3Coefficient of determination testThe R-value indicates that there is correlation between the dependent and independent variables. An adjusted R-square value shows that several percent of audit quality variable is explained by five independent variables (Table 5).

The R-value is 0.612, indicating that there is a strong correlation between the dependent variable (audit quality) and independent variables (work experience, professional competence, motivation, accountability and objectivity). The adjusted R-square value 0.321 shows that 32.1% of the audit quality variable is explained by five independent variables, while the remaining 67.9% is explained by other variables outside the model.

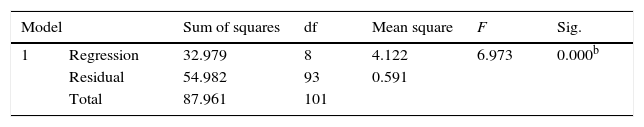

4.4Result of simultaneous significance testBased on the F test, the F value has significance less than 0.05. The results show how much of the regression model can be used to predict quality audit (Table 6).

Based on F test, the obtained F value is 6.973 with a significance of 0.000 or less than 0.05. The results show that the regression model can be used to predict quality audit. Work experience, professional competence, motivation, accountability and objectivity simultaneously have a significant effect on audit quality. The result of the F-test is consistent with research of Ardini (2010), Arianti, Sujana, and Putra (2014), Ilamiyati and Suhardjo (2012), Ramadhanis (2012), Saripudin et al. (2012), Singgih and Bawono (2010), Sukriah et al. (2009), and Suyono (2012).

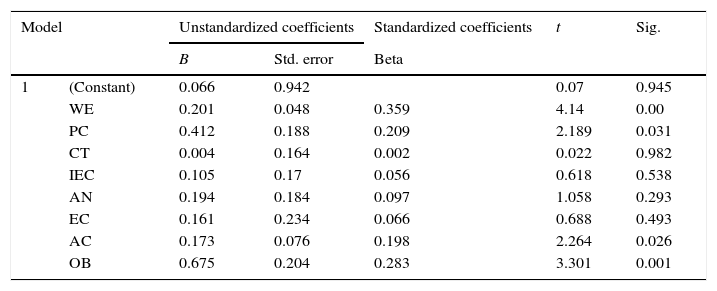

4.5Results of partial significance testAccording to Table 7, work experience has a regression coefficient amounted to 0.201 and has a t value of 4.14 with a significance level of 0.00 or less than 0.05. This suggests that H1 is accepted which means that work experience has a significant effect on audit quality. The result of this research is consistent with research of Carolita and Rahardjo (2012), Saripudin et al. (2012) and Sukriah et al. (2009). But these results contradict Samsi et al. (2013) and Singgih and Bawono (2010).

Coefficients.a

| Model | Unstandardized coefficients | Standardized coefficients | t | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. error | Beta | ||||

| 1 | (Constant) | 0.066 | 0.942 | 0.07 | 0.945 | |

| WE | 0.201 | 0.048 | 0.359 | 4.14 | 0.00 | |

| PC | 0.412 | 0.188 | 0.209 | 2.189 | 0.031 | |

| CT | 0.004 | 0.164 | 0.002 | 0.022 | 0.982 | |

| IEC | 0.105 | 0.17 | 0.056 | 0.618 | 0.538 | |

| AN | 0.194 | 0.184 | 0.097 | 1.058 | 0.293 | |

| EC | 0.161 | 0.234 | 0.066 | 0.688 | 0.493 | |

| AC | 0.173 | 0.076 | 0.198 | 2.264 | 0.026 | |

| OB | 0.675 | 0.204 | 0.283 | 3.301 | 0.001 | |

Professional competence has a regression coefficient equal to 0.412. The t value is 2.189 with significance level of 0.031 or less than 0.05, suggesting that H2 is accepted. This means that professional competence has effect on audit quality. The result of this research is consistent with research of Ardini (2010), Ilamiyati and Suhardjo (2012), Kharismatuti and Hadiprajitno (2012), Ramadhanis (2012) and Sukriah et al. (2009). Moreover, this research result contradicts with Carolita and Rahardjo (2012), Rafiee et al. (2013) and Samsi et al. (2013).

Motivation has regression coefficients according to four independent variables: character type, internal and external control, audit norms and ethical culture in firm. The regression coefficients are equal to 0.004, 0.105, 0.194 and 0.161. The t values are 0.022, 0.618, 1.058 and 0.688, with significance levels of 0.982, 0.538, 0.293 and 0.493 or greater than 0.05. Thus, suggest H3 is rejected, which means motivation has no effect on audit quality. The result of this research is consistent with research of Ardini (2010) and Ramadhanis (2012). However, this result contradicts with that of Aghaei and Ahmadi (2015), Efendy (2010), Malekian and Tavakolnia (2014) and Rosnidah, Rawi, and Kamarudin (2011).

Accountability has a regression coefficient amounted to 0.173 and a t value of 2.264 with a significance level of 0.026 or less than 0.05. Thus, H4 is accepted, which means that accountability has effect on audit quality. The result of this research is consistent with research of Barzideh and Kheirollahi (2012), Bustami (2013), Saripudin et al. (2012) and Singgih and Bawono (2010). However, this research result contradicts with Ardini (2010).

Objectivity presents a regression coefficient of 0.204 and a t value amounted to 3.301 with significance level of 0.001 or less than 0.05. Given that H5 is accepted, objectivity affects audit quality. The result of this research is consistent with Arianti et al. (2014), Carolita and Rahardjo (2012) and Sukriah et al. (2009), but contradicts with Hajiha and Rafiee (2014).

Multiple regression equation of this research is:

5ConclusionThe first hypothesis is accepted. Thus, people with more experience provide higher audit quality. Because most of the people who filled the questionnaire had more working experience and this has led to better audit quality. They are involved in spectrum of the process of audit and have special capabilities of auditing. Some of the duties of the audit that has been done are enough for the average of learning.

The second hypothesis: Accepted, which means professional competency affects audit quality. The increasing of auditor's competency shows that the auditor has a great curiosity, broadminded, able to handle uncertainty and able to work in teams. The auditor also has the ability to conduct an analytical review, knowledge concerning the organizational theory, auditing and public sector, as well as accounting. The auditors also have the expertise to interview, quick read, understand statistic science, expertise to use computers, so the audit quality is increasing as well. Competencies are important for the auditor. The competency principle requires the auditor to maintain professional knowledge and expertise required to ensure the competent professional service provision for the clients or employers. Auditor also still has to maintain and improve his competences on an on going level which can be done by joining the sustainable professional education so that clients can receive competent professional services.

The third hypothesis: Audit motivation is rejected, which means that there is no significant relationship between the auditor incentives and quality of audit. Considering that audit was measured by four control variables of character type, internal and external control, audit norms and ethical culture in firm, all the four variables are significantly related to audit quality. None of the variables intended in organization are observed. It is based on some auditors who do not understand general accounting. In fact, sanctions, imprisonment and criminal fines that are set so that for public accountants may do their job based on standards are not applicable. Iran's civil law is applied for public accounting.

The fourth hypothesis: Accepted, which means accountability affects audit quality. Accountability indicates that the auditor can complete the audit work well and on time, convinced that his work is carefully examined, reviewed by the supervisor, and accountable to the employer. Auditors also conduct an audit based on a vigorous effort, using the power of thought, mobilizing energy and mind. Thus, audit quality is increased. Accountability is very important for the auditor as a factor affecting the audit quality. Accuracy and precision emphasize the auditor's responsibility in carrying out his job.

The fifth hypothesis: Accepted, which mean objectivity affects audit quality. The increasing auditor's objectivity indicates that the auditor who can act fairly without pressure or demand influenced by certain interested parties on the audit will refuse to accept audits if he has a cooperative relationship with the party being examined. The auditor's objectivity can be developed based on the willingness to conduct an audit considering the generally accepted standards and the real situation.

The limitations of this study include using one source (questionnaire) to collect information. This limitation means that the results cannot be generalized. Because the data is collected through a questionnaire, the results are influenced by the honesty and integrity of respondents. According to previous research, the case of auditors reporting discovered errors is only attainable by asking them questions.

In this study only independent auditors’ opinions were investigated and internal and governmental auditors were not studied. This limitation does not allow results to be generalized to other sectors and other levels of audit.

The distribution of the questionnaire was done in the peak season, so call auditors in filling out the questionnaires is low. Should not be done when auditors in the course of doing better respond to the questionnaire.

The adjusted R-square value is 0.321. This indicates that the remaining 67.9% is explained by other variables that are not used in this study. The researchers should add other independent variables such as independence, integrity, time budget pressure, remuneration and auditor tenure.