A suitable organizational structure is necessary for companies to effectively manage foreign activities. Firms can choose from among several modes of foreign market entry, including exporting, contractual agreements, joint venturing, acquiring an existing company, and establishing a wholly owned greenfield investment from scratch. However, the majority of literature on foreign market entry mode choices has focused on large multinational enterprises. Small and medium enterprises (SMEs) with limited financial and personnel resources are likely to base their foreign market entry mode choice on the resources available. Building on a literature review, this study analyzes the determinants of SMEs’ foreign market entry mode. The findings suggest that innovation, product characteristics, advertising intensity, export intensity, and industry have positive effects on the high-level resource commitment choice in foreign markets.

Internationalizing firms can enter foreign markets through different entry modes, such as direct exports, licensing, greenfield joint ventures, and full acquisitions. Firms must find a suitable organizational structure to manage their foreign activities effectively (Anderson & Gatignon, 1986). Deciding on a suitable foreign market entry mode is also an important consideration in international management research (Pla-Barber, León-Darder, & Villar, 2011; Werner, 2002). For international firms, foreign market entry mode choice is a core strategic decision. It determines the level of a firm's commitment of resources to a foreign market, the risks the firm bears in the host country, and the level of control a firm has in its foreign activities (Anderson & Gatignon, 1986; Hill, Hwang, & Kim, 1990; Hill & Kim, 1988; Sanchez-Peinado, Pla-Barber, & Hébert, 2007). A suitable entry mode can enhance a firm's strategic performance (León-Darder, Villar-García, & Pla-Barber, 2011; Lu & Beamish, 2001; Nakos & Brouthers, 2002), and changing the entry mode can be expensive and time-consuming. The majority of the literature on foreign market entry mode choices has focused on multinational enterprises (MNEs). However, small and medium enterprises (SMEs) have specific characteristics that are likely to influence their foreign market entry mode choice in terms of the level of commitment to the foreign market, how they deal with risks in the host country, and the level of control it exerts on foreign market activities.

Internationalization can extend market opportunities, increase a firm's customer base, and reduce trade and transaction costs while increasing profits (Kogut, 1985). Moreover, it can increase a firm's competitive advantage and further increase a firm's performance (Kogut, 1985; Porter, 1985). For SMEs, the international development of opportunities and the resource limitations of their domestic market often drive them toward investing in international markets. Entry modes are one of the core research topics in the research of international management (Werner, 2002). Many studies have examined the determinants and performance of a firm's choice among foreign market entry modes. However, SMEs have limited financial and personnel resources (Brouthers & Nakos, 2004; Nakos & Brouthers, 2002). The choice of entry mode is an important strategic decision for SMEs as it involves committing resources in different target markets with different levels of risk, control, and profit return. Resource constraints can limit SMEs to choosing entry modes with relatively low resource commitment in order to overcome resource constraints and minimize foreign risks (Ripollés et al., 2012). In contrast to large MNEs, SMEs have specific ownership structures and management characteristics that are influential factors for their internationalization (Cheng, 2008; Pinho, 2007). SMEs are flexible in nature and tend to perform their business activities within low-cost structures, thereby minimizing the perceived risk associated with the SME's host country.

Owing to their specific characteristics, SMEs restrict their internationalization to exporting alone. In addition, studies show that SMEs are prone to choosing low-commitment entry modes (Laufs & Schwens, 2014; Zacharakis, 1997). However, scholars have reported that some SMEs opt for high-commitment entry modes, particularly those with prior international experience (Brouthers & Nakos, 2004; Maekelburger, Schwens, & Kabst, 2012; Young, 1987). Foreign market entry mode choice is one of the most critical decisions that an international firm makes (Root, 1994). However, research on the determinants of SMEs entering foreign markets is limited (Agarwal & Ramaswami, 1992; Anderson & Gatignon, 1986; Brouthers & Hennart, 2007; Laufs & Schwens, 2014) and research on large MNEs cannot directly be applied to SMEs (Shuman & Seeger, 1986). With the assumption that SMEs choose low resource commitment entry modes, the study of foreign direct investment and other forms of resource commitment in multiple countries has been neglected (Ripollés et al., 2012). Although many entry mode studies have concentrated on large MNEs and ignored the activities of smaller firms, an increasing trend toward internationalization among SMEs has resulted in some scholars focusing on SMEs (Burgel & Murray, 2000; Jones, 1999; Laufs & Schwens, 2014; Zacharakis, 1997).

The aim of this study is to review the current research on SME foreign market entry mode choices and – based on this review – to further develop a theoretical framework to identify the determinants of an SME's ability to commit to foreign markets. We examine the data from Taiwanese SMEs that have been identified as the leading contributors to the country's economic growth. SMEs account for 97% of all enterprises, and their employees comprise over 75% of the employed population in Taiwan. In the 1980s, Taiwanese firms’ competitiveness was eroded due to an increase in operating costs, such as labor costs and real estate. To compete in Taiwan's rapidly changing environment, Taiwan's SMEs had to concentrate on growth, enhancing their performance, and ensuring survival. Given the deteriorating business environment in Taiwan in the 1980s, many manufacturing firms, especially those in labor intensive industries relocated to other developing countries (Wei & Christodoulou, 1997). Taiwan's limited market size leads firms to extend their market base abroad. In an era of escalating global competition, overseas expansion and investment are critical for Taiwanese SMEs to continue to grow and sustain their competitive advantage. Therefore, firms place great emphasis on internationalization (Lin, 2010).

The remainder of this article is organized as follows: In Section “Conceptual background”, we examine the literature to develop a model that identifies the motivations behind the various foreign market entry mode choices. Section “Methodology” describes the data and logistic regression, where the dependent variable is categorical. Section “Empirical results” presents the empirical results. In Section “Conclusion”, we outline the implications of the findings.

Conceptual backgroundTaiwan's SMEs are the main driving force behind national economic development. Taiwanese SMEs have played a significant role in sustaining economic growth, providing jobs, and developing industries (Hu & Chi, 1998). As Taiwan's economy became increasingly well-developed and living standards rose, Taiwan's domestic wages gradually rose and the New Taiwan (NT) dollar appreciated. The appreciation of the NT dollar led to a significant upsurge in asset values, which gave rise to strong incentives for outward investment (Lin, 2010). The limited scale and scope of domestic demand is another push factor that encourages firms to identify foreign market opportunities. The development of a competitive export base is critical to eliminate dependence on the home market and to stimulate economic development. Hence, the government of Taiwan has launched a number of export-based policies to enhance firms’ competitive advantage. Although all businesses can exploit new opportunities and respond to threats from increasing internationalization irrespective of business size, in practice, there is a concern that smaller businesses lose out (Smallbone, Piasecki, Venesaar, Todorov, & Labrianidis, 1999); this is due to numerous size-related characteristics that may affect their ability to identify, cope with, and respond to new sources of threats and opportunities. As a result of a limited resource base and a combination of ownership and management structures, SMEs have a distinct set of behavioral characteristics.

To investigate the driving factors that affect the decisions of SMEs’ relating to foreign market entry modes, this paper focuses on two themes: the theoretical development and determinants of the entry mode of SMEs. The current state of knowledge on SME foreign market entry mode choices is limited: First, the research on theoretical development is inconclusive. The theoretical frameworks used to explain SME foreign market entry mode choices are limited (Laufs & Schwens, 2014). Second, studies that examine the theory behind this choice largely apply the same theories that have been used to explain large MNE entry mode choices. It is crucial to reflect on the boundary conditions of the existing theoretical approach and to develop potential theories for SMEs. The aim of this study is to review the current state of SME foreign market entry mode choice research and – based on this review – to identify gaps in the literature in order to map future research directions. On the basis of a comprehensive overview, we develop a structure with nine independent constructs and one dependent construct. The potential impact of each construct is discussed first, following which the research hypothesis is presented.

Firm sizeThe size of a firm is often an indicator of its competitive advantage in financial, physical, human, technological, or organizational resources. These resources are identified as the drivers of a firm's competitive advantage (Wernerfelt, 1984). A large firm size reflects a firm's ability to absorb the high costs and risks associated with international activities through sole ownership of foreign affiliates (Ekeledo & Sivakumar, 2004; Buckley & Casson, 1976). Empirical studies have indicated that the impact of firm size on foreign direct investment is positive (Buckley & Casson, 1976; Caves & Mehra, 1986; Cho, 1985; Kimura, 1989; Yu & Ito, 1988); this means that the size of a firm is positively correlated with its propensity to enter foreign markets in general and to choose highly committed methods of investment, such as sole and joint venture modes. Firm size can influence many factors, such as firm-specific advantages or the resources a firm has. The size of a firm and its propensity to engage in foreign direct investment (FDI) activities instead of other modes of international involvement are highly correlated (Dunning, 1977). In the literature, researchers have discussed the impact of firm size on its propensity to engage in FDI and its probability of becoming a foreign investor. Studies have suggested that the probability of foreign investment increases with firm size (Yu & Ito, 1988). Given the strategic advantage of FDI, the larger a firm grows relative to the domestic market, the less profitable it would be to increase its domestic share instead of expanding to foreign markets or diversifying. Foreign market penetration and diversification in domestic markets then become alternatives for the domestic growth of a firm. Therefore, a firm that is successful at home tends to be successful abroad, and that firm's size may be merely a reflection of these strategic advantages.

International experienceThe level of international experience has also been reported to influence a firm's decision on entry mode choices (Agarwal & Ramaswami, 1992). Firms with less international experience are likely to experience greater difficulty in managing foreign market activities. These firms are not expected to have sufficient resources or skills to enter numerous foreign markets. Therefore, they can be expected to employ a selective strategy and concentrate their efforts in foreign markets using methods with the highest potential for profit maximization. This is because their chances of obtaining higher returns are relatively better in such markets. This results in these firms choosing strategies that involve a low level of resource commitment in foreign markets (Agarwal & Ramaswami, 1992; Caves & Mehra, 1986; Gatignon & Anderson, 1988). Conversely, firms with a higher level of international experience may be expected to prefer modes of entry that involve a higher commitment of resources. Firms with more international experience prefer complete control of their foreign operations because overall profit maximization requires that their foreign investments be tightly subordinated to the parent company (Agarwal & Ramaswami, 1992). The firm usually selects nearby, culturally similar countries (Engwall, 1984). International experience enhances a firm's understanding, competence, and confidence, as well helping it to develop a more accurate perception of foreign risks and returns. This means that an experienced multinational firm is confident, assertive, desirous of control, and willing to take risks to enter foreign markets. Therefore, a firm's cumulative international experience is positively related to the degree of control it exerts on the foreign business entity.

InnovationMany studies have demonstrated the importance of SMEs, especially in developing and emerging countries. Presently, competitive SMEs should consider maintaining development as well as their responses to the demands of their environment (Roxas, 2008). Howell (2005) suggests that innovation is an influential factor for developing and sustaining economic growth in SMEs. Schumpeter (1934) reports that innovation is a production function to improve output; therefore, innovation can generate technology as well as improve it. “SMEs have inherent advantages in carrying out technological innovations: simple organizational structure, more open internal communication, better focus, quick decision making, and greater flexibility, among others” (Krishnaswamy, Bala-Subrahmanya, & Mathirajan, 2010). Research suggests that innovation (process and product) may be crucial for gaining a competitive advantage in many international and global markets (Porter, 1990).

SMEs initiate international activities earlier in their life cycle and expand them rapidly in pursuit of opportunities for growth by taking advantage of their ability to innovate (Sapienza, Autio, Gerard, & Zahra, 2006). Through historic research and development (R&D) investments, or mergers and acquisitions, some SMEs have an opportunity to collect the knowledge associated with intangible assets, such as patents, licenses, and know-how (Carpenter, Pollock, & Leary, 2003; Kotha, Rindova, & Rothaermel, 2001). This knowledge base may be used to explore further R&D investment as well as in knowledge exploitation through the international expansion of sales (Lane, Koka, & Pathak, 2006). A focus on R&D enhances a firm's in-house technical capability and facilitates the assimilation of new technology developed elsewhere. Evenson and Kislev (1975) report the importance of R&D efforts in international diffusion. Technological developments increase a firm's knowledge base, therefore increasing its absorptive capability. The international experience has been proven to increase absorptive capability related to foreign market investment (Denison, Dutton, Kahn, & Hart, 1996).

Product characteristicsInternationalization is the product of a series of incremental decisions (Johanson & Vahlne, 1977). Resources located in a firm's home country and used in the development and production of products for a separate market also constitute commitment to a foreign market. If the resources cannot easily be directed to foreign markets or used for other purposes, the products manufactured by this firm tend to involve entry modes with a lower commitment. Product diversification moderates the relationship between international diversification and performance (Hitt, Hoskisson, & Kim, 1997). Research has indicated that product characteristics are related to patterns of international trade and investment (McGuinness, 1981). New products are expected to be competitive internationally. Exports begin and grow during this period.

Ekeledo and Sivakumar (1998) report that entry mode selection differs significantly with different product characteristics. They divide products into soft services and hard services. Soft service requires close physical proximity between the provider and clients (or their possession), thereby the choice of foreign market entry modes is influenced by the locations of customers as well as familiarity with local customers (Sampson & Snape, 1985). In the service context, the relationship between provider and customer plays an influential role in the internationalization process. Because of the personal interaction involved, strong cooperation between service provider and customer is necessary for a successful service delivery (Czepiel, 1990). The nature of soft services requires greater control over the service process and firms tends to select a high level of resource commitment to ensure controllability and governance toward the service process. By contrast, hard service providers may select a foreign market entry mode that involves a lower commitment (Ekeledo & Sivakumar, 1998).

Advertising intensityAdvertising intensity is another parameter used to measure a firm's marketing know-how. Relevant literature evidences that advertising intensity has a positive effect on the decision of entry mode choice and encourages firms from preferring high level of resource commitment (Erramilli, Agarwal, & Kim, 1997; Gatignon & Anderson, 1988; Gomes-Casseres, 1989). In advertising intensive industries, multinational corporations require close cooperation with local partners to prevent the local operation from diluting or confusing the international positioning of the brand. Local partners with market knowledge and cultural adaptation skills can help firms to communicate effectively with customers. Hence, local partners of JVs are more likely to have more equity shares than foreign partners (Demirbag, Glaister, & Tatoglu, 2007; Gatignon & Anderson, 1988).

Export intensityA firm always starts by exporting to a country, following which it sets up a selling subsidiary and finally builds a production subsidiary (Johanson & Vahlne, 1977). The prior experience of a firm in a country tends to have an influence on its investment there rather than in other countries. The available research indicates that a firm's successful marketing in the foreign market depends critically on the sales efforts and nonmanufacturing activities organized in the local market and control over its own distribution subsidiaries (Yamawaki, 1991). Exporting is an effective method toward further internationalization. The governance structure that firms choose to manage their export relationships requires different levels of specific investment dedicated to foreign markets (Nooteboom, 1993; Tallman & Li, 1996). Firms develop export activities either after building up specific governance structures or after developing dedicated resources. Export performance is the result of a series of macroeconomic and industry factors such as the growth rate of demand in the domestic and export markets, exchange rate variability, and industry trends. Yamawaki (1991) indicates that export intensity appears to be a volatile variable, especially for SMEs when unforeseen events like an unsolicited order or its sudden disappearance can abruptly increase or depress the level of export performance.

IndustryFirms seek to balance the risks due to industry structural barriers and liabilities of foreignness while seeking entry into international markets (Elango & Sambharya, 2004). It is useful for firms to identify which host country industry factors are most relevant in choosing among the various modes of entry. Kogut and Singh (1988) argue that industries that require intense R&D are associated with a likelihood of selecting joint ventures. Caves and Mehra (1986) report that the type of goods produced (durable vs. nondurable), firm size, product diversity, and the extent of a firm's multinationality are likely to be predictors of acquisition as a preferred entry mode, depending on the industry structure. Hennart and Reddy (1997) report that joint ventures are preferred by firms in instances where nondesirable assets are linked with desirable assets, such as when a Japanese firm has previous experience, when there is good product compatibility, and where there is a growing market.

MethodologyLogistic regression was used to measure the relationship between the function of a dependent variable with the type of qualitative dichotomous variables, and independent variables of qualitative and quantitative analyses. Logistic regression is the most appropriate regression analysis to conduct when the dependent variable is dichotomous (binary). Akin to all regression analyses, logistical regression is a predictive analysis. This process is conducted after identifying the component elements and ascribing a new name to each factor, after which this component is included in the logistic regression model. This regression analysis is employed to predict the probability of an event. The logistic regression analysis in this study examines the factors that influence the choice of foreign market entry modes. Dependent variables used in the logit model measure the level of resource commitment. The result is “yes” if the firm selects high-commitment entry modes and “no” if it selects low-commitment entry modes.

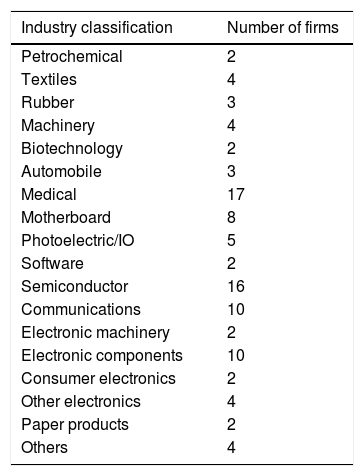

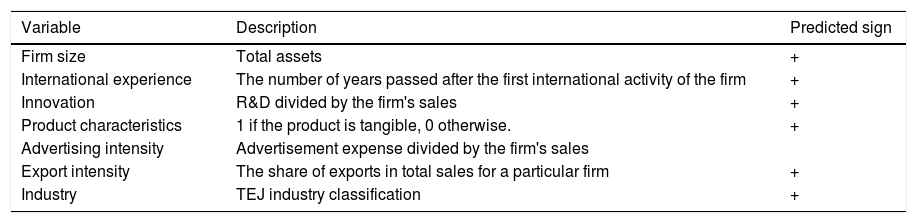

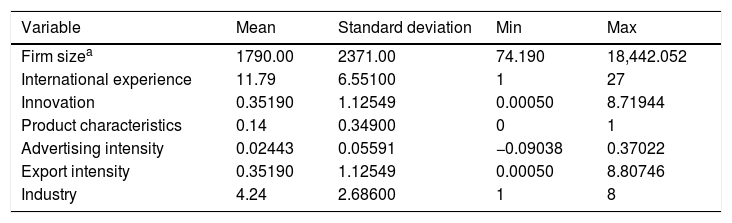

The data for the analysis were obtained from an empirical investigation of Taiwanese SMEs in the manufacturing sector in 2015. The goal of this research is to examine the determinants of SMEs’ foreign market entry mode choice. We collected the data from each government ministry through direct contacts after examining a wide range of government white papers and other government publications, and they were as close as possible to an exhaustive list of all of Taiwan's SMEs that engage in international activities. The firm-level financial data were obtained from the Taiwan Economic Journal (TEJ) data set, which provides macroeconomic indicators and financial reports for companies that were listed and traded on the Taiwan Stock Exchange (TAIEX). We use the annual reports of the TEJ in 2015 to compile the data set, which includes the information needed to calculate the variables. We use the definition provided by the Taiwanese government to define SMEs to include firms with less than 250 employees. Some SMEs are excluded from the original dataset. First, these SMEs do not have a primary industry classification. Second, some SMEs submitted reports with missing values. Third, certain SMEs have not been active in the same industry classification throughout the observed period. After taking these factors into consideration, the final database consists of 5409 observations for 601 firms. Then, 50 firms are randomly selected to represent a high level of resource commitment of entry mode choices as well as 50 firms to represent a low level of resource commitment. The industry classifications and the numbers of firms in the final sample are listed in Table 1. The descriptions of the independent variables and their predicted signs are provided in Table 2. Table 3 presents the summary statistics.

Industry classifications and the number of firms in the sample data.

| Industry classification | Number of firms |

|---|---|

| Petrochemical | 2 |

| Textiles | 4 |

| Rubber | 3 |

| Machinery | 4 |

| Biotechnology | 2 |

| Automobile | 3 |

| Medical | 17 |

| Motherboard | 8 |

| Photoelectric/IO | 5 |

| Software | 2 |

| Semiconductor | 16 |

| Communications | 10 |

| Electronic machinery | 2 |

| Electronic components | 10 |

| Consumer electronics | 2 |

| Other electronics | 4 |

| Paper products | 2 |

| Others | 4 |

Description and predicted signs of variables.

| Variable | Description | Predicted sign |

|---|---|---|

| Firm size | Total assets | + |

| International experience | The number of years passed after the first international activity of the firm | + |

| Innovation | R&D divided by the firm's sales | + |

| Product characteristics | 1 if the product is tangible, 0 otherwise. | + |

| Advertising intensity | Advertisement expense divided by the firm's sales | |

| Export intensity | The share of exports in total sales for a particular firm | + |

| Industry | TEJ industry classification | + |

Summary statistics.

| Variable | Mean | Standard deviation | Min | Max |

|---|---|---|---|---|

| Firm sizea | 1790.00 | 2371.00 | 74.190 | 18,442.052 |

| International experience | 11.79 | 6.55100 | 1 | 27 |

| Innovation | 0.35190 | 1.12549 | 0.00050 | 8.71944 |

| Product characteristics | 0.14 | 0.34900 | 0 | 1 |

| Advertising intensity | 0.02443 | 0.05591 | −0.09038 | 0.37022 |

| Export intensity | 0.35190 | 1.12549 | 0.00050 | 8.80746 |

| Industry | 4.24 | 2.68600 | 1 | 8 |

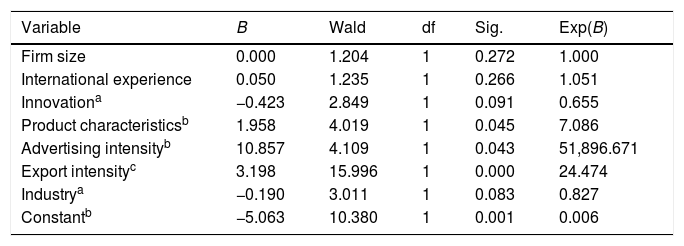

This research study applies logistical regression to predict the relationship between dependent and independent variables, with the main objective of predicting the probability of the proposed factors (firm size, international experience, innovation, network, product characteristics, assets, export intensity, and industry) affecting the level of resource commitment in firms’ entry mode choices. Table 4 presents the individual coefficient test results of the factors affecting the choice of foreign market entry mode. If the variable is a positive coefficient, it means the probability of the firm selecting a high-level approach of resource commitment will increase, which can accurately explain the parameters of the logistical model. The results indicate that the size of SMEs strongly and positively affects the extent to which firms engage in entry mode choices. International experience also has a strong influence on firms’ decisions to engage in certain entry modes. As predicted, network relationships significantly affect the choice of foreign market entry modes. Asset and export intensity are both indicated to be positive and highly significant.

Logistic model.

| Variable | B | Wald | df | Sig. | Exp(B) |

|---|---|---|---|---|---|

| Firm size | 0.000 | 1.204 | 1 | 0.272 | 1.000 |

| International experience | 0.050 | 1.235 | 1 | 0.266 | 1.051 |

| Innovationa | −0.423 | 2.849 | 1 | 0.091 | 0.655 |

| Product characteristicsb | 1.958 | 4.019 | 1 | 0.045 | 7.086 |

| Advertising intensityb | 10.857 | 4.109 | 1 | 0.043 | 51,896.671 |

| Export intensityc | 3.198 | 15.996 | 1 | 0.000 | 24.474 |

| Industrya | −0.190 | 3.011 | 1 | 0.083 | 0.827 |

| Constantb | −5.063 | 10.380 | 1 | 0.001 | 0.006 |

The empirical results reveal that innovation not only significantly affects a firm's foreign market entry mode choices, but are also consistent with the predicted direction. We report that the product characteristic factor has a strongly positive effect. Moreover, firms engaging in higher levels of advertisement are more likely to select high-level resource commitments, such as joint ventures or direct investment. A high level of export intensity also encourages firms to select high-level resource commitments. The industry also positively correlates with the probability of selecting high level resource commitments in the chosen foreign market entry mode.

ConclusionThe success of Taiwanese SMEs has been well acknowledged (Lin, 1996; Lin & Lin, 2012). They have played a vital role in promoting rapid growth during Taiwan's economic transition. The scale, scope, organization, and management of SMEs have changed over time in response to evolving markets, technologies, and economic conditions. Foreign market expansion and investment are the most critical factors for Taiwanese SMEs to continue to grow and sustain a competitive advantage. Therefore, an in-depth study of the management practices of Taiwanese SMEs’ foreign market entry mode choices may reveal the characteristics of their success.

Many SMEs in Taiwan are family-owned, and it is likely that their strategic orientation, particularly with respect to internationalization, is sensitive to external environments. Hence, the choice of a suitable foreign market entry mode is an influential parameter in their international activities. SMEs’ domination of Taiwan's export market is explained by the fact that SMEs are export driven. By contrast, large enterprises mainly focus on domestic markets because of the policy of import substitution, and thus protectionist measures are employed for domestic markets. Many SMEs shifted their production base to the Association of Southeast Asian Nations (ASEAN) region first and then China in order to utilize the cheap and abundant supply of labor and land. It is notable that Taiwan's FDI abroad are mostly in SMEs, which is quite different from that of other developed countries, which involved mainly multinational corporations.

SMEs’ entry mode selection is an important new research area (Burgel & Murray, 2000; Jones, 1999; Zacharakis, 1997). However, research on entry mode choices has mainly concentrated on large firms (Agarwal & Ramaswami, 1992; Anderson & Gatignon, 1986; Erramilli & Rao, 1993). SME entry mode selection has received little attention. Lu and Beamish (2001) indicate that choosing the right entry mode can have significant performance implications for SMEs. Erramilli and D'Souza (1993) suggest that SMEs differ from their larger competitors, and their entry mode choice may also differ. Hence, theories of large firm entry mode selection cannot be applied to SMEs. This study collects data from Taiwanese SMEs and suggests that innovation, product characteristics, advertising intensity, export intensity, and industry have positive effects on the high-level resource commitment choice in foreign markets.

There are limitations to this study. The generalization of the results based on data obtained from government publications requires some caution. These data underestimate the volume of Taiwan's investment in foreign markets. This can be identified by comparing the number of projects and amounts listed by the Taiwanese government with those listed by global authorities. In addition, due to data constraints, some of the influential variables in this analysis are only available for a particular year. The results of this study suggest that further investigation of the effects of motivation factors on a firm's decisions in choosing a foreign market entry mode is warranted. In addition, a further survey of countries other than the Taiwanese industry would be particularly worthwhile in future research. This study incorporates variables based on a review of the literature, and so we hope this study will stimulate further research based on new variables.