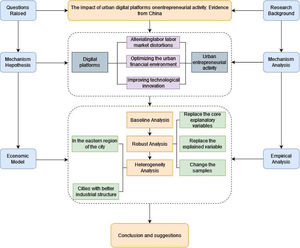

The development of urban digital platforms has changed its entrepreneurial environment and affected regional innovation vitality. We calculated the development index of digital platforms of 294 prefecture-level cities in China between 2013 and 2020 using the principal component analysis method. We used the microdata of enterprise registration information to describe the urban entrepreneurial activity. Digital platforms have promoted urban entrepreneurial activity significantly. Moreover, alleviating labour market distortions, optimizing the urban financial environment, and improving technological innovation are virtual channels for digital platforms to increase urban entrepreneurial activity. Furthermore, digital platforms play a more significant role in promoting urban entrepreneurial activity in the eastern region and cities with better industrial structures. This impact has a nonlinear increasing “marginal effect” in which the faster the development of digital platforms, the more significant the promoting effect on urban entrepreneurial activity.

Cities are essential to economic expansion, and entrepreneurial activities are an important driving factor for urban economic development, so the entrepreneurial activity of a city reflects its economic vitality. With the wide application of digital technology, urban digital platforms have developed rapidly in recent years. So, will the development of digital platforms affect urban entrepreneurial activity? Existing studies mainly examine the influencing factors of entrepreneurial activity from the macro and micro levels. At the macro level, studies primarily focus on economic development (Asencio et al., 2022), institutions (Chowdhury et al., 2018), and innovation (Gregori & Holzmann, 2020); at the micro level, researchers focused on individual entrepreneurs (Dougherty et al., 2019) on entrepreneurial activity.

Digital platforms are not only an essential component of the digital economy, but they also contribute significantly to economic growth. Digital platforms combine resources that enable external producers and consumers to create value and interact. Such digital platforms typically have three core characteristics: mediating effects, demand-side driving, and digital technology empowerment (Hu, Qi, et al., 2023; Song, 2019; Wang, Zhang, et al., 2023). However, the continuous expansion of digital platforms will also bring some disadvantages. For example, Srnicek (2017) believes that digital platforms will become a tool for capital to intercept profits by acquiring massive amounts of data and controlling and monitoring the existing rules, thus not conducive to the country's development. Schor (2017) also emphasized that the platform economy's development would weaken workers’ bargaining power and further aggravate the income gap of the bottom 80 %. Thus, what role do digital platforms play in the advancement of society? As a solution to this issue, we compiled the body of research and discovered that the majority of the papers addressed the topic of digital platform governance (Chen et al., 2020; Gawer, 2022) and their ecosystem (Hein et al., 2020; Karhu et al., 2018). In addition, a few studies focus on the impact of platforms on innovation and entrepreneurship (C. Li et al., 2023a,b; S. Li et al., 2023c; Schreieck et al., 2019; Srinivasan & Venkatraman, 2018; Srnicek, 2017), but these studies were almost exclusively qualitative rather than quantitative. There still needs to be more research on digital platforms and even less on their impact on urban entrepreneurial activity.

Data released by the Shanghai Entrepreneurship Evaluation Center shows that the failure rate of start-ups in China is as high as 90 %. However, many start-ups’ survival and growth rates based on digital platforms are significantly higher. Through reading and sorting relevant literature, we find that the development of digital platforms may affect urban entrepreneurial activity through the following three channels: one is to alleviate the distortion of the labour market and promote the free flow of human resources; The second is to enhance the efficiency of capital allocation and optimize the urban financial environment; Third, we will raise the level of technological innovation and give full play to the enabling role of technology. Specifically, in alleviating labour market distortions, digital platforms can promote workers’ full employment and motivate enterprises’ enthusiasm for independent innovation (Hu, Xu, et al., 2023; Laudien & Pesch, 2019). From the perspective of optimizing the financial environment, digital platforms, based on their characteristics, such as economies of scale and scope, can provide entrepreneurs and start-ups with low-cost funds from pre-loan to post-loan and other links (Li, Li, et al., 2022; Wang et al., 2021). In terms of improving the efficiency of technological innovation, digital platforms can effectively play the role of technological innovation from the three aspects of entrepreneurial costs, entrepreneurial opportunities, and entrepreneurial resources through technological empowerment.

Based on this, this paper uses the empirical analysis method and the panel data of 294 prefecture-level cities in China from 2013 to 2020 to verify the impact of the development of digital platforms on urban entrepreneurial activity. First, this paper concludes that developing digital platforms can promote urban entrepreneurial activity through the Bidirectional fixed effects model. Second, considering the existence of endogenous problems such as autocorrelation, this paper uses the lag phase of the digital platforms development index to replace the current value for regression and uses the instrument variables for testing. In addition, after promulgating the “Broadband China” pilot policy, we also see that digital platforms are growing more rapidly. Therefore, we use the differential method to verify further the relationship between digital platforms and urban entrepreneurial activity, and the results remain unchanged.

Possible contributions of this paper are as follows: First, from the city level, we research the impact of digital platforms on urban entrepreneurial activity through empirical analysis, enriching the effect of research on digital platforms. The existing literature mainly starts from the related concepts, categories, and applications of digital technology (Li, He, et al., 2022; Wang, Deng, et al., 2023), exploring digital artefacts (Porter & Heppelmann, 2014; Wang, Liang, et al., 2023) and digital infrastructure (Chalmers et al., 2020; Wang et al., 2022) on the process, the practice and outcome of new entrepreneurship (Hu, Xiong, et al., 2023; Nambisan, 2017). A few studies focus on platforms’ impact on innovation and entrepreneurship (Schreieck et al., 2019). However, all the above studies only conducted qualitative analysis without quantitative analysis. To this end, we use quantitative studies to complement the existing literature.

Second, this paper constructs the digital platform development level index through the principal component analysis. Referring to Szerb et al. (2022) and data available at the city level, we set up a multi-dimensional evaluation system consisting of three first-level indicators: digital technology base, multilateral digital platforms, and digital users. Regarding the selection of specific indicators, this paper takes Szerb et al. (2022) as the benchmark, selects 12 second-level indicators, calculates the development of digital platforms in 294 cities in China from 2013 to 2020, and finally obtains the development index of digital platforms. In addition, according to the structural differences, this paper also constructs corresponding development indexes from the three dimensions of digital technology foundation, multilateral digital platform, and digital users, which further enriches the research content and provides more research ideas.

Third, this paper makes some innovations in the influencing factors of urban entrepreneurial activity, especially analyzing its impact on urban entrepreneurial activity from the perspective of digital platforms (Asencio et al., 2022). Specifically, we test the model by building a mediation effect to ease labour market distortions, optimize the financial environment, improve technological innovation in the three channels, and further depict the digital platforms of urban influence mechanism of entrepreneurial activity. In addition, it explores the heterogeneous impact of digital platforms on entrepreneurial activities in different cities. It provides more direct suggestions for developing entrepreneurial activities in the city.

The structure is as follows: Part 2 is the theoretical analysis and research hypothesis. Section 3 is empirical design, including model construction, data, and variable definition. Part 4 is empirical results and analysis. The part 5 is the mechanism analysis. Section 6 provides further discussion. Section 7 provides conclusions and policy recommendations.

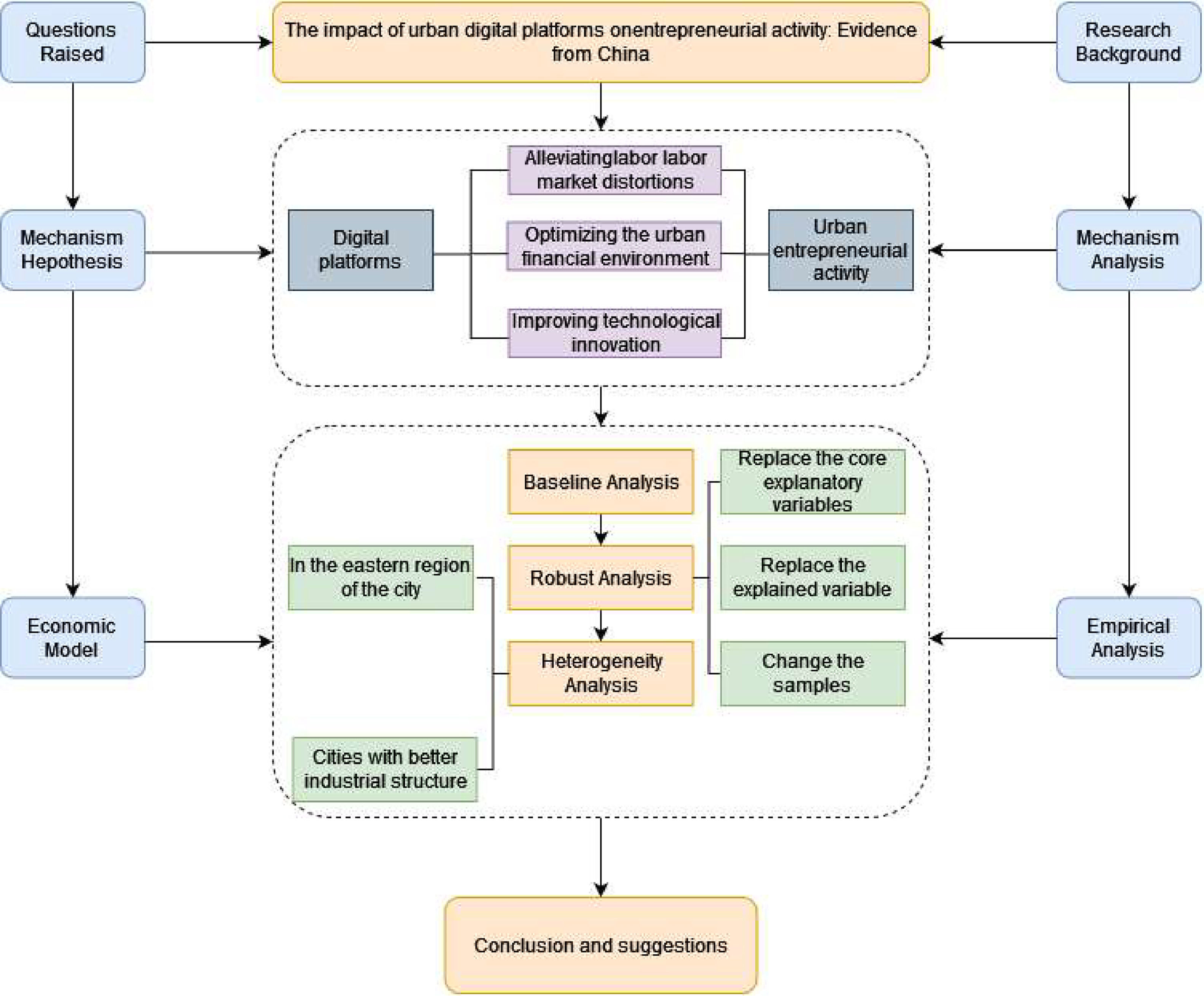

The research framework is shown in Fig. 1.

Theoretical analysis and research hypothesisDigital platforms are characterized by economies of scale and scope (Gawer, 2014), which show strong network effects, data, and algorithm advantages, optimize factor allocation, and promote technological innovation. At the same time, the development of a city is also inseparable from the role of human, material, and financial resources. According to the available research, We found that entrepreneurial activity in cities is influenced by environmental factors (Aslan & Kumar, 2021), individual entrepreneurs or individual firms (Zhang, et al., 2023), and Entrepreneurial attitudes (Bosma & Schutjens, 2009). Therefore, we explore the mechanism of the impact of the growth of digital platforms on urban entrepreneurial activities through three channels: easing labour market distortions, optimizing the financial environment, and improving the efficiency of technological innovation.

The development of digital platforms can alleviate labour market distortions, thereby increasing urban entrepreneurial activityDigital platforms can not only promote the free flow of human resources but also mobilize the enthusiasm of enterprises to innovate independently, thus easing the distortion of the labour market and promoting the activities of urban entrepreneurship.

From the perspective of workers, according to the “pre-market discrimination” theory, Discrimination in the labour market occurs when a worker or a group of workers get paid less than other workers for doing the same job. The four main types of discrimination in labour markets are wage, employment, employee, and customer. Wage discrimination is the most common type of labour discrimination. Specifically, labour employment is based on employment opportunities and expected earnings. When the labour market distortion is severe, the probability of work and the expected wage will be very low; the expected return of labour can hardly make up for the human capital workers invest.

On the one hand, it will reduce the enthusiasm of potential employees and the investment of human capital. On the other hand, it will weaken the motivation of those who have already entered the labour market to learn and train the human capital level of future generations. From the perspective of enterprises, labour market distortions will provide cost advantages and increase profit margins for enterprises, so enterprises will be more inclined to use undervalued factors to reduce production costs rather than invest in technological research and development, which will reduce the enthusiasm of enterprises to carry out technological innovation.

However, relevant studies show that digital platforms are vital in reducing market friction, especially in effectively alleviating the information asymmetry between customers and suppliers (Galperin & Greppi, 2017; Liu et al., 2023; Pallais, 2014; Tadelis, 2016). Specifically, the “ABCD” technology builds an interconnected network among various subjects. On the one hand, digital platforms are conducive to acquiring shared and user information feedback so employees can better understand market information and promote employment equity. In turn, labour market distortions are alleviated, and entrepreneurial activity in the region is boosted (Gaglio et al., 2022). On the other hand, it is helpful to break the market access barriers of enterprises, limit the government's intervention in the market, promote the free flow of labour factors on cross-regional digital platforms, and improve the innovation motivation of enterprises (Sandberg et al., 2020; Simsek et al., 2019). Based on this, each party can capitalize on their unique advantages, improve collaboration and the division of labour, achieve complementary advantages, achieve an efficient flow of production factors, lessen labour market distortion, and boost the city's entrepreneurial vibrancy.

Therefore, we propose hypothesis 1: Developing digital platforms can alleviate labour market distortions and promote urban entrepreneurial activity.

The development of digital platforms can optimize the financial environment and improve urban entrepreneurial activityAccording to its characteristics, such as economies of scale and scope, the digital platforms can alleviate financing constraints for entrepreneurs and start-ups from the links of pre-loan and post-loan, optimize the financial environment, and thus promote urban entrepreneurial activity.

In the pre-loan stage, it is difficult for entrepreneurs to obtain enough start-up capital through traditional financing methods due to asymmetric information in the market, so seeking funds to alleviate financing constraints has become a fundamental goal for entrepreneurs. Digital platforms can broaden the financing channels of entrepreneurs and reduce their financing costs. Specifically, the digital platforms through a digital credit evaluation system, relying on the new digital financial business such as the network, microfinance lending, and digital payments, reduce the threshold of the financial services for entrepreneurs to provide affordable, diversified, comparable, and comprehensive financial services and products, meet the demand of entrepreneurs in the different start-up period of financial services, enhance the willingness of entrepreneurs to make entrepreneurial decisions and carry out entrepreneurial activities. Wu and Mao (2020) also drew a similar research conclusion: entrepreneurial motivation is significantly influenced by socioeconomic conditions and the availability of financial and non-financial support. Barbara Bernhofer and Li (2014) also agree with this view. He believes the entrepreneurial environment includes cultural, economic, and political factors, and individuals have different motivations for entrepreneurship in different environmental backgrounds.

In the middle stage of lending, digital platforms can use the mature Internet and extensive data analysis technology to change the risk assessment mode and reduce credit assessment costs, improve the allocation efficiency of entrepreneurial credit resources, and alleviate the credit mismatch probability of entrepreneurs. Specifically, for individual entrepreneurs, digital platforms can help them lower the threshold of entrepreneurship (von Briel et al., 2017), promote the equalization of entrepreneurial opportunities, and stimulate individual entrepreneurial vitality. For entrepreneurial enterprises, digital platforms can provide a better atmosphere for enterprise innovation and entrepreneurship, improving the matching efficiency between supply and demand (Autio, 2017), the entrepreneurial opportunities, and the success rate.

In the post-loan stage, developing digital platforms can constrain lenders’ behaviour, reducing loan-related risks (Sutherland, 2018). Digital platforms also use technologies to promptly detect fund use violations or other potential default risks, use machine learning to deal with threats, ensure the security of borrowed funds, and further alleviate the financing constraints of all parties.

Based on this, this paper puts forward hypothesis 2: The expansion of digital platforms helps to optimize the financial environment, reduce the financial barriers faced by business owners, and boost urban entrepreneurship.

The development of digital platforms has the potential to spur technical innovation and, in turn, boost urban entrepreneurshipWith the help of technological advantages, the network effect formed by digital platforms can effectively promote the opportunity interaction and resource integration of all parties and reduce the cost of entrepreneurship, thus providing many entrepreneurial opportunities and promoting urban entrepreneurial activity.

From a start-up cost perspective, digital platforms’ core value is pooling information and reducing information asymmetry. On the one hand, it can reduce the start-up cost of digital technology (Song, 2019). Specifically, virtual network subjects and digital platforms are thriving in the digital economy era. As an intermediary, digital platforms can form an entrepreneurial network centred on entrepreneurs through network effects, connect all entrepreneurial subjects, and form a digital entrepreneurial team, thereby reducing the cost of resource acquisition (Ferreira et al., 2019; Huang et al., 2017; Matarazzo et al., 2021) and team communication (Nambisan et al., 2017; Siachou et al., 2021), thus improving innovation efficiency (Hung et al., 2023). On the other hand, digital platforms use technologies represented by cloud computing so that enterprises can obtain the required computing, storage, and network resources at a lower cost, lowering the technological threshold. According to the Ali Research Institute, using cloud computing can reduce IT costs by 70 % and improve innovation efficiency by three times.

From the perspective of entrepreneurial resources, digital platforms use digital technologies to empower traditional industries, which can promote the upgrading of industrial structure and then release many production factors to improve more available resources for regional entrepreneurial subjects. Furthermore, with the power of efficient digital information technology, digital platforms can connect all parties, improve the penetration and synergy of resources, promote the reorganization and integration of entrepreneurial resources (Sousa-Zomer et al., 2020; Yoo et al., 2012), and then promote entrepreneurship and improve the entrepreneurial vitality of the region. From the angle of entrepreneurial opportunities, digital platforms use digital technology to increase the effectiveness of information and thus create new industries and fields, stimulating the main market body of entrepreneurial enthusiasm and promoting regional entrepreneurial energy (Khan & Tao, 2022). Digital platforms can not only overcome the “resource constraint” and “cost constraint” faced by new enterprises but also provide more entrepreneurial opportunities for entrepreneurs and significantly improve regional entrepreneurial activity.

Based on this, this paper puts forward hypothesis 3: The development of digital platforms is conducive to improving technological innovation efficiency and thus promoting urban entrepreneurship's activeness.

Research designModel constructionWhere i stands for the city, t stands for the year, UEA is the entrepreneurial activity of the city, and DPDI represents the developmzent level of the digital platforms. Control is a series of Control variables, including city scale, urban economic development level, urban public expenditure, urban financial environment, the average annual wage of urban residents, and the proportion of urban tertiary industry employees. μi and δt are the city and time fixed effect, respectively, and εit is the random error term. It should be noted that the coefficient mainly concerned in this paper is α1. If the coefficient of α1 is greater than 0, x positively promotes y, and vice versa.

Variable measurement and explanationMeasurement of urban entrepreneurial activityIn the existing research, the measurement of entrepreneurial activity mainly includes the labour market and ecological research approaches. The basic logic of both methods is to measure the regional entrepreneurial activity by observing the number of new ventures in the period (Reynolds et al., 2005). Therefore, we select the number of newly registered enterprises in a city and take the logarithm to measure city entrepreneurial activity.

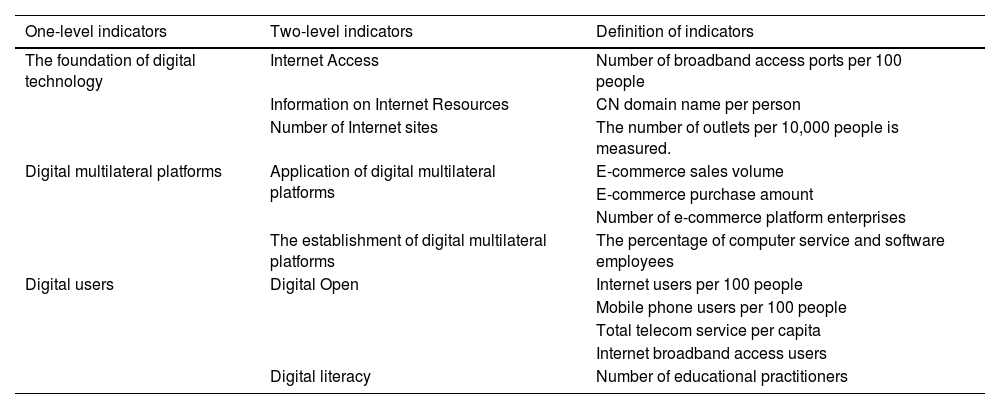

Measurement of digital platformsAt present, many scholars have measured the digital economy and platform economy index, but there needs to be a measurement system for the index of digital platforms. Referring to Szerb et al. (2022) and combining with the data available at the city level, this paper sets up a multi-dimensional evaluation system consisting of three first-level indicators: digital technology foundation, multilateral digital platform, and digital user. In the selection of specific indicators, this paper mainly refers to Szerb et al. (2022), selects 12 second-level indicators, calculates the development of digital platforms in 294 cities in China from 2013 to 2020, and finally obtains the development index of digital platforms, which is recorded as DPDI. a. Digital technology foundation

The foundation of digital technology is people's access to digital infrastructure. With access to the Internet, people can effectively use relevant services, including digital platforms. Therefore, the foundation of digital technology is the basis for developing digital platforms. In this paper, the development of the digital technology foundation is measured by Internet access, Internet resources, and the number of Internet sites, and then measured by the number of broadband access ports per 100 people, the number of CN domain names per person, the number of outlets per 10,000 people and other indicators. b. Multilateral digital platforms

Multilateral digital platforms are intermediaries for users and enterprises to connect and knowledge media to realize and promote innovation, entrepreneurship, and value creation (Song, 2019). This paper measures the development of multilateral digital platforms from the perspective of the construction and application of digital platforms. Specifically, in constructing digital platforms, this paper adopts the index of the proportion of computer service and software employees to measure. This paper uses e-commerce sales, e-commerce purchase amount, and the number of e-commerce platforms enterprises to measure in applying digital platforms. c. Digital users

Digital users are residents who can participate in digital activities and enjoy digital services. The rapid development of digital platforms is also inseparable from the massive growth of digital users, so this paper measures the development of digital users from the two dimensions of digital literacy and digital openness. Precisely, this paper measures the number of educational practitioners in terms of digital literacy. Regarding digital openness, we measure four secondary indicators: Internet users per 100 people, mobile phone users per 100 people, total telecom services per capita, and Internet broadband access users.

Table 1 is the measurement system of the digital platform development index in this paper:

Measurement index of digital platforms.

Next, we first studied the relationship between the above 12 second-level indicators and obtained the correlation coefficient matrix of the 12 indicators. In addition, this paper first standardised the original data to eliminate the possible adverse effects caused by different dimensions. Then, Bartlett's Test of Sphericity and KMO test shows that the data in this paper are suitable for PCA. Furthermore, this paper uses the method to determine whether the cumulative variance contribution rate of the first K principal components reaches more than 85 %. Finally, as shown in (2), the development index of the digital platforms obtained in this paper is standardized to the interval [0,1] to measure the development level of the digital platforms.

Mediating variablesa. Financial environment

With the promotion and reference of digital technology, digital platforms have nurtured more digital-inclusive financial services. The development degree of urban digital inclusive finance reflects its economic environment to some extent, including the higher the degree of digital finance development, the greater the vitality of urban financial innovation and the better the economic environment. Therefore, this paper uses China's Peking University Digital Financial Inclusion Index (PKU-DFII) as a proxy variable of the financial environment. If the PKU-DFII is more extensive, finance is more inclusive, the financial environment is better, and vice versa. b. Labor factor market distortion

Concerning Yang et al. (2018), we use the production function method to measure the distortion degree of factor markets and adopt the trans-log form of the production function, which is expressed as follows:

Where Y is the regional output, measured by the gross regional product and balanced to 2013 constant prices using the GDP deflator, L is the regional labour force, which adopts the number of employed persons in urban units at the end of each region. λ0 is a constant term, and λ1, λ2, λ3, λ4 and λ5 represent the regression coefficients of the explained variables, respectively. εit denotes the random disturbance term.

According to Eq. (3), the marginal output of the labour force can be obtained by taking the derivative of L:

In Eq. (4), MPL is the marginal output of the labour force. According to the definition of factor market distortions, labour factor market distortions can be expressed as the marginal output of labour divided by its price, i.e.,

In Eq. (5), DIST_L represents the degree of labour market distortion. ω is the labour price, that is, the wage level. In this paper, the average index of urban unit employment in each region is used to characterize it, and it is calculated as the constant price of 2013 based on the consumer price index of urban residents. c. Technological innovation

This paper refers to Riaz et al. (2018) and uses the total number of patent applications to measure the level of technological innovation. The more patent applications a city has, the higher technological innovation.

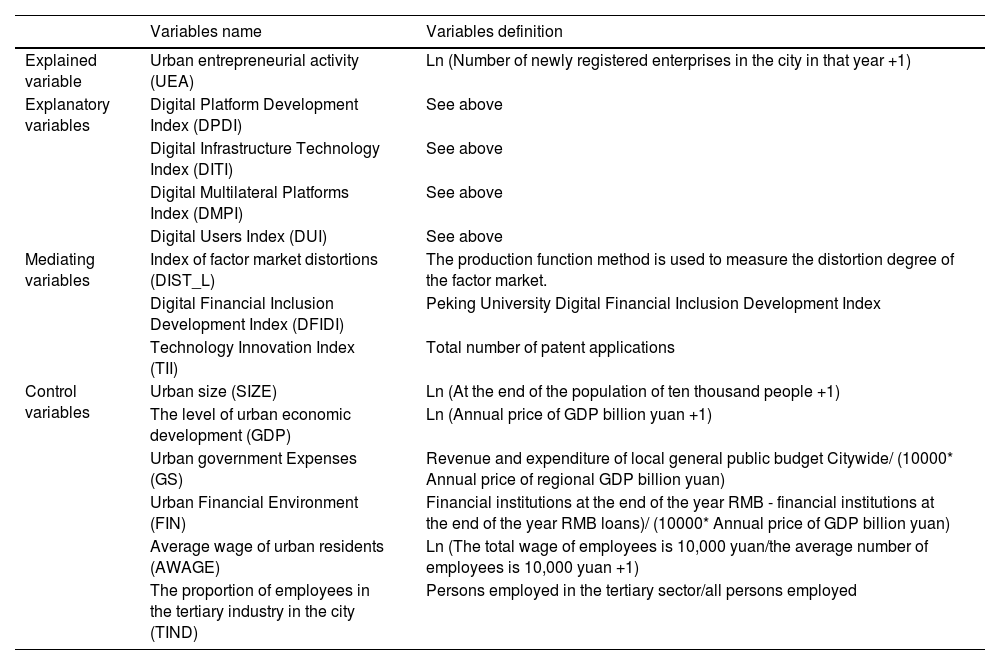

Control variablesRefer to Capozza et al. (2018), Goel and Saunoris (2020), and we select city scale, urban economic development level, urban public expenditure, urban financial environment, the average annual wage of urban residents, and the proportion of employees in the tertiary industry as control variables. The above variables are calculated as shown in Table 2.

Definition of main variables.

Since this paper studies the impact of digital platforms on entrepreneurial activity in cities, the research samples focus on the city level. The primary data are from the China City Statistical Yearbook, the State Statistical Bureau, the annual statistical bulletins of each city, and the CSMAR database. Besides the mediate variable, the Digital Financial Inclusion Development Index (DFIDI) comes from the Peking University Digital Finance Center. This paper conducts the following processing to make the sample data representative: first, eliminate the cities with apparent missing data; Second, the linear interpolation and smooth index methods are used to fill in some missing data reasonably. After the above processing, this paper takes 2013-2020 as the sample period and determines 294 prefecture-level cities as the whole sample for the empirical study.

Descriptive analysisDescriptive statistical analysis is to describe the relevant data of all variables, mainly including the frequency analysis of data, the central trend analysis of data, the degree of data dispersion analysis, the distribution of data, and some basic statistical graphs. A descriptive statistical analysis describes the data distribution in this paper. Table 3 shows the results of the primary descriptive analysis in this paper. The mean value of the urban entrepreneurial activity is 10.529, the minimum value is 7.411, and the maximum is 13.767, which indicates that the entrepreneurial activity level of different cities has apparent differences, which is consistent with the conclusion of existing literature (Song & Winkler, 2014). The average value of the development index of digital platforms is 0.652, and the development of digital platforms has apparent differences. Individual differences in the other control variables are also evident, meaning that the sample is well-represented.

Descriptive analysis.

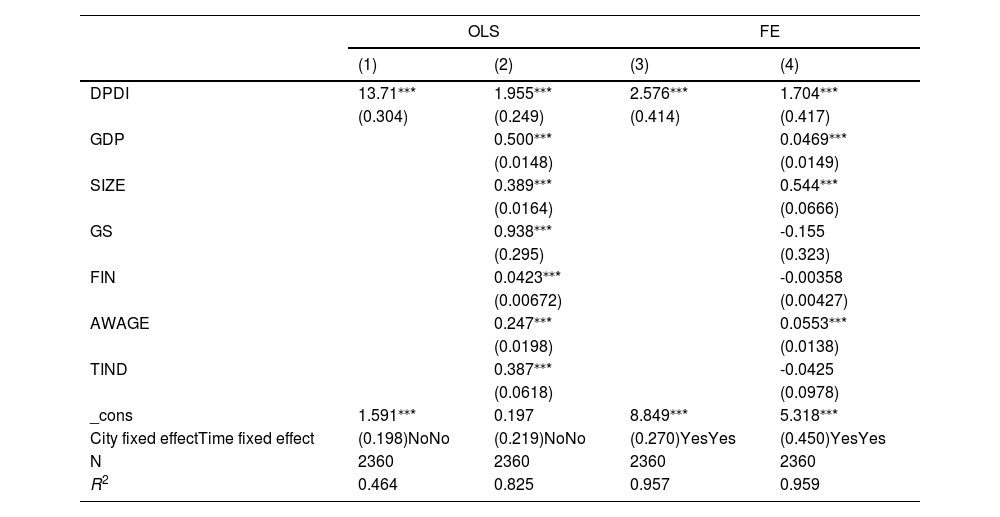

In Table 4, columns (1) and (2) show the results of mixed regression (OLS), and columns (3) and (4) show the results of fixed effects regression (FE). The regression coefficients of these four columns are significantly positive, indicating that digital platforms can promote urban entrepreneurial activity. In control variables, the regression coefficients of the city's economic development level (GDP), size (SIZE), and average annual wage of residents (AWAGE) are all significantly positive, indicating that the faster the city's economic growth, the more population, the more average yearly salary of residents, and the higher the urban entrepreneurial activity.

Baseline regression results.

| OLS | FE | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DPDI | 13.71⁎⁎* | 1.955⁎⁎* | 2.576⁎⁎* | 1.704⁎⁎* |

| (0.304) | (0.249) | (0.414) | (0.417) | |

| GDP | 0.500⁎⁎* | 0.0469⁎⁎* | ||

| (0.0148) | (0.0149) | |||

| SIZE | 0.389⁎⁎* | 0.544⁎⁎* | ||

| (0.0164) | (0.0666) | |||

| GS | 0.938⁎⁎* | -0.155 | ||

| (0.295) | (0.323) | |||

| FIN | 0.0423⁎⁎* | -0.00358 | ||

| (0.00672) | (0.00427) | |||

| AWAGE | 0.247⁎⁎* | 0.0553⁎⁎* | ||

| (0.0198) | (0.0138) | |||

| TIND | 0.387⁎⁎* | -0.0425 | ||

| (0.0618) | (0.0978) | |||

| _cons | 1.591⁎⁎* | 0.197 | 8.849⁎⁎* | 5.318⁎⁎* |

| City fixed effectTime fixed effect | (0.198)NoNo | (0.219)NoNo | (0.270)YesYes | (0.450)YesYes |

| N | 2360 | 2360 | 2360 | 2360 |

| R2 | 0.464 | 0.825 | 0.957 | 0.959 |

Note: ⁎⁎⁎

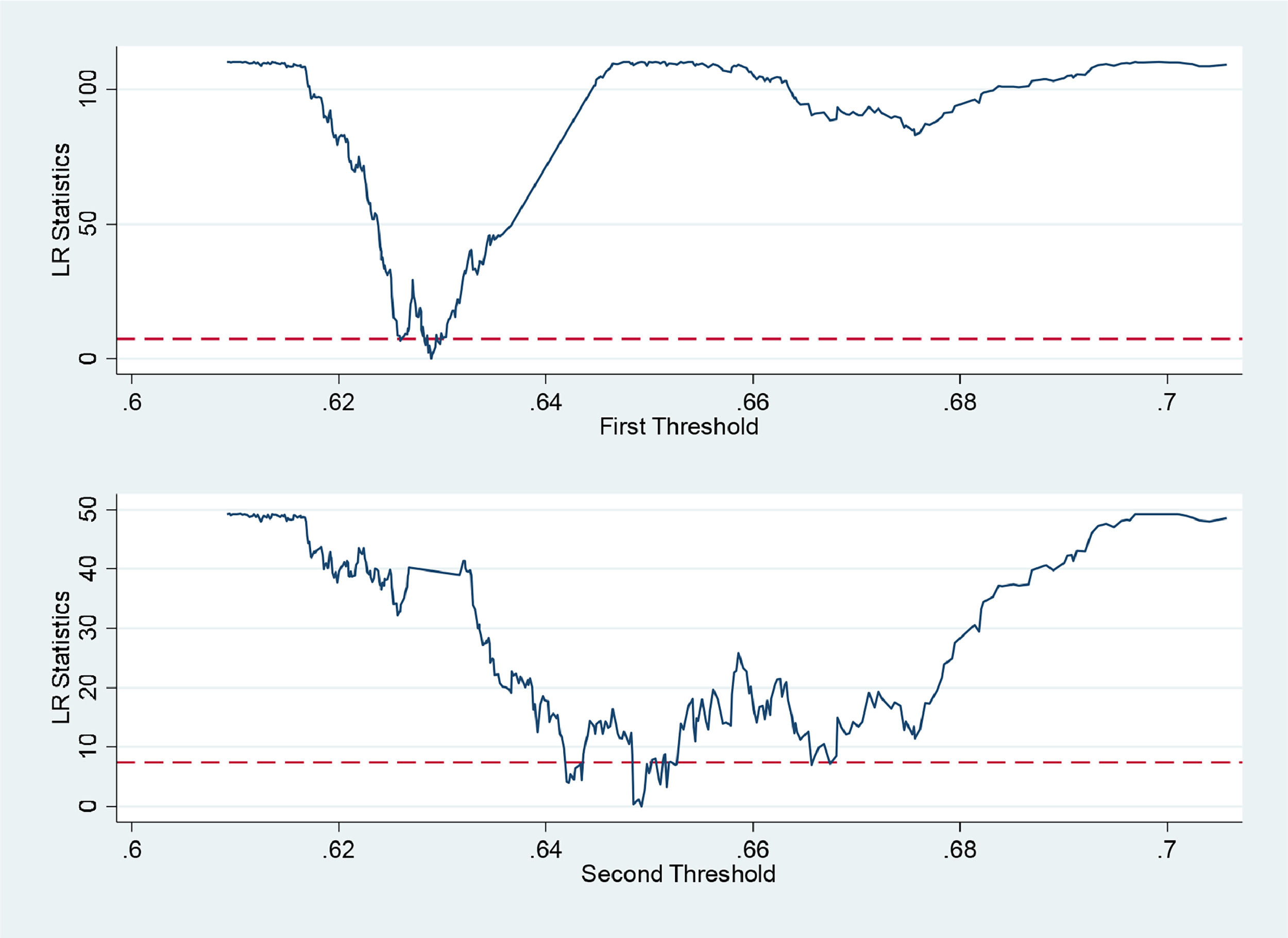

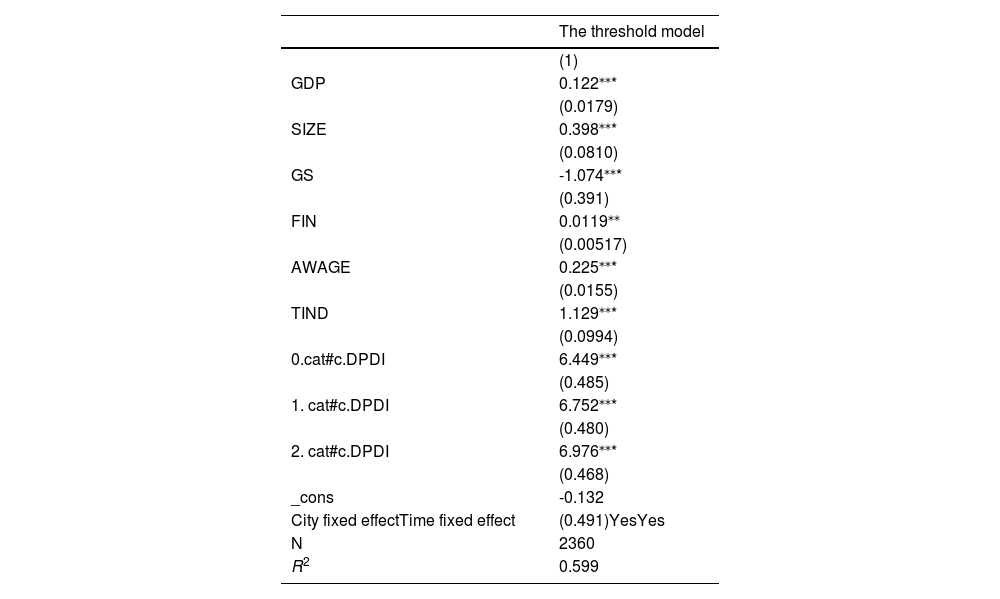

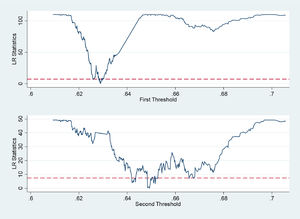

The development of digital platforms is closely related to the Internet. In other words, the development of digital platforms will also exist in the “Metcalfe Law” of the Internet. The network value equals the square of the number of nodes, and the marginal effect of network spillover increases. The impact of digital platforms on urban entrepreneurial activity may also have nonlinear characteristics. As digital platforms evolve, the marginal cost of interdepartmental interaction continues to decrease, and the benefits to participants will increase geometrically. This effect will become more and more evident as digital platforms evolve. Therefore, this paper takes the development index of digital platforms as the threshold variable to carry out threshold effect regression (Fig. 2).

Before estimating the threshold model, this paper conducts the existence test of panel thresholds based on Hansen (1999) ’s method. After repeated sampling by the bootstrap method 1000 times, the results show that the threshold variable of the digital platforms development index has passed the double threshold significantly but failed the triple threshold test. It can be seen from Table 5 that with the development of digital platforms, the coefficient of urban entrepreneurial activity will increase correspondingly.

Regression results of the threshold effect.

| The threshold model | |

|---|---|

| (1) | |

| GDP | 0.122⁎⁎* |

| (0.0179) | |

| SIZE | 0.398⁎⁎* |

| (0.0810) | |

| GS | -1.074⁎⁎* |

| (0.391) | |

| FIN | 0.0119⁎⁎ |

| (0.00517) | |

| AWAGE | 0.225⁎⁎* |

| (0.0155) | |

| TIND | 1.129⁎⁎* |

| (0.0994) | |

| 0.cat#c.DPDI | 6.449⁎⁎* |

| (0.485) | |

| 1. cat#c.DPDI | 6.752⁎⁎* |

| (0.480) | |

| 2. cat#c.DPDI | 6.976⁎⁎* |

| (0.468) | |

| _cons | -0.132 |

| City fixed effectTime fixed effect | (0.491)YesYes |

| N | 2360 |

| R2 | 0.599 |

Note: ⁎⁎⁎

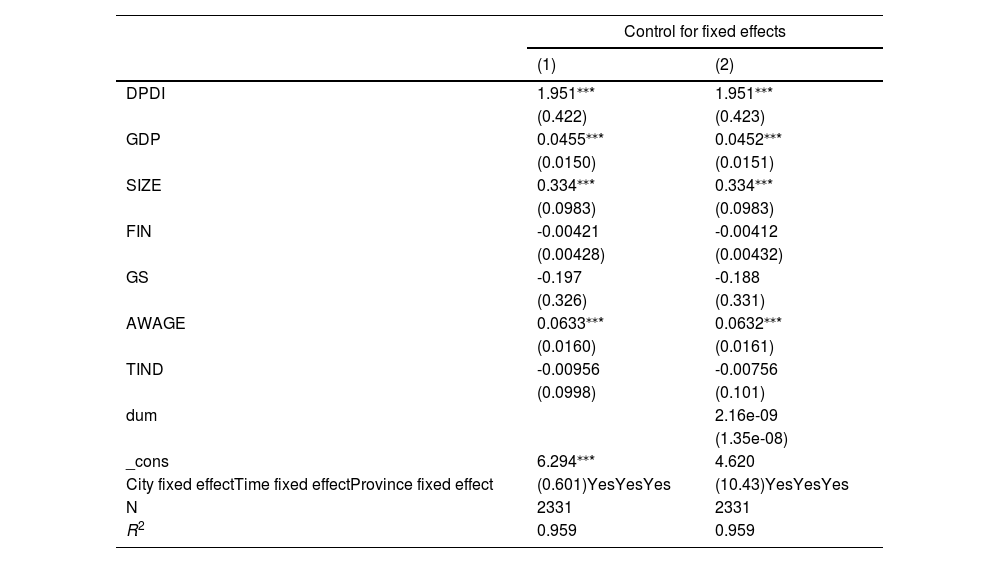

To avoid the endogeneity problems, such as causality between the development of digital platforms and urban entrepreneurial activity, we set the provincial fixed effect and the interaction effect between provinces and years. In Table 6, column (1) is the result after the province effect is fixed based on the baseline regression, and column (2) is the result after the interaction term of province and year is added based on column (1). However, the results of columns (1) and (2) are consistent with the basic regression.

Fixed effect regression.

| Control for fixed effects | ||

|---|---|---|

| (1) | (2) | |

| DPDI | 1.951⁎⁎* | 1.951⁎⁎* |

| (0.422) | (0.423) | |

| GDP | 0.0455⁎⁎* | 0.0452⁎⁎* |

| (0.0150) | (0.0151) | |

| SIZE | 0.334⁎⁎* | 0.334⁎⁎* |

| (0.0983) | (0.0983) | |

| FIN | -0.00421 | -0.00412 |

| (0.00428) | (0.00432) | |

| GS | -0.197 | -0.188 |

| (0.326) | (0.331) | |

| AWAGE | 0.0633⁎⁎* | 0.0632⁎⁎* |

| (0.0160) | (0.0161) | |

| TIND | -0.00956 | -0.00756 |

| (0.0998) | (0.101) | |

| dum | 2.16e-09 | |

| (1.35e-08) | ||

| _cons | 6.294⁎⁎* | 4.620 |

| City fixed effectTime fixed effectProvince fixed effect | (0.601)YesYesYes | (10.43)YesYesYes |

| N | 2331 | 2331 |

| R2 | 0.959 | 0.959 |

Note: ⁎⁎⁎

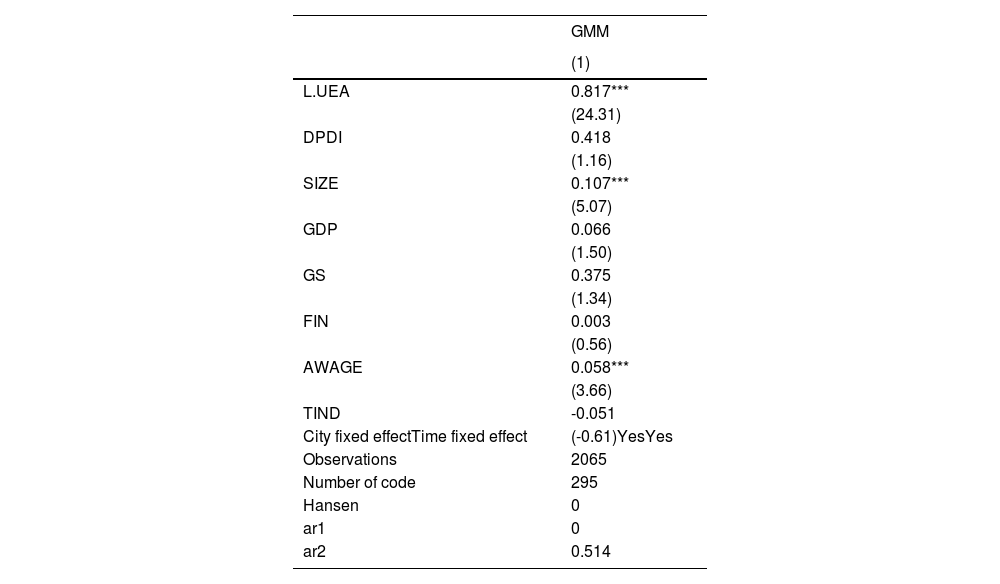

A systematic GMM approach examines the baseline results to reduce potential endogeneity problems. Since urban entrepreneurial activity may persist over time, the system GMM can dynamically model urban entrepreneurial activity. Considering that the urban entrepreneurial activity of the current period may be affected by the entrepreneurial activity of the previous period, this paper introduces the lagged one-stage L.UEA of the explained variable. Then, the baseline results were tested using the system GMM estimation method. As shown in Table 7, the DPDI is significantly positive, consistent with the regression results above.

System GMM regression results.

Note: ⁎⁎⁎⁎⁎, and * indicate significance at the 1 %, 5 %, and 10 % statistical levels, respectively.

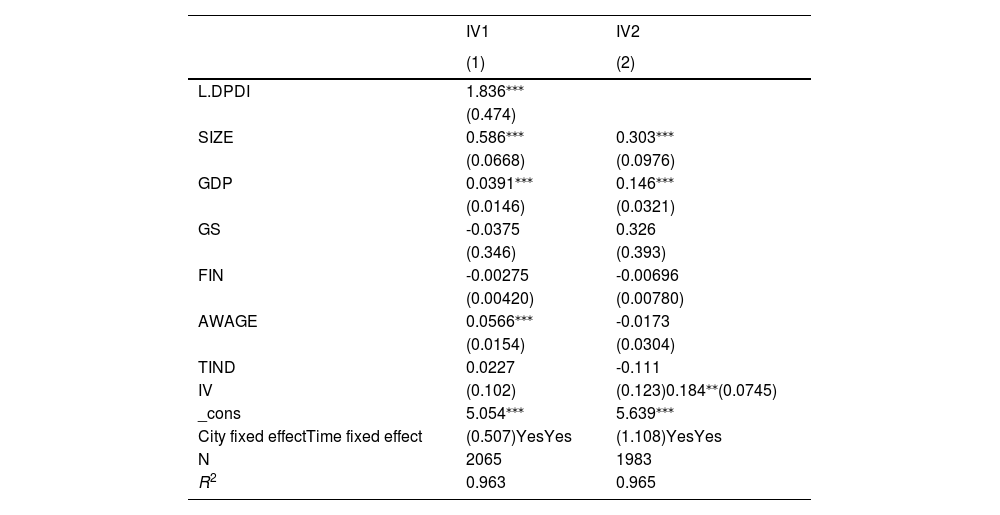

The development of digital platforms will affect the entrepreneurial activity of cities; likewise, the development of cities will also promote the development of digital platforms. Therefore, digital platforms and urban entrepreneurial activity may have a reciprocal cause-effect relationship. To solve the potential endogeneity problem, this paper adopts the following two methods to avoid the influence of endogeneity. (1) The regression estimation is re-performed by using the digital platforms’ lag period to replace the current value. In column (1) of Table 8, the coefficient of DPDI is still significantly positive.

Instrumental variable method.

Note: ***, **, and * indicate significance at the 1 %, 5 %, and 10 % statistical levels, respectively.

(2) Referring to relevant literature, this paper adopts the historical data of posts and telecommunications 1984 as the instrumental variable. The development of telecom technology facilities in history will affect the subsequent application of the Internet and other technologies and then affect the development of digital platforms. This paper introduces the time-changing variable of the number of Internet users in China in the previous year and multiplicates it with the historical data of posts and telecommunications of provinces in 1984 to construct instrumental panel variables and conduct regression analysis. In column (2) of Table 8, the regression coefficients of instrumental variables are still significantly positive, indicating that the results of this paper are still robust.

Exogenous shock test – the impact of the pilot policy of “Broadband China”a. Difference-in-differences method

We use the “Broadband China” pilot policy shock to analyze the causal relationship between digital platforms and urban entrepreneurial activity. In August 2013, the Ministry of Industry and Information Technology and the National Development and Reform Commission selected 120 cities in three batches as “Broadband China” demonstration sites in 2014, 2015, and 2016. This policy significantly promotes the local broadband user scale, broadband network speed, broadband coverage, and so on, which is conducive to developing digital platforms. Therefore, this paper uses the difference-in-differences model to test whether the pilot policy of “Broadband China” promotes the development of urban entrepreneurial activity and the mechanism behind it. Specifically, we constructed the following difference-in-differences model:

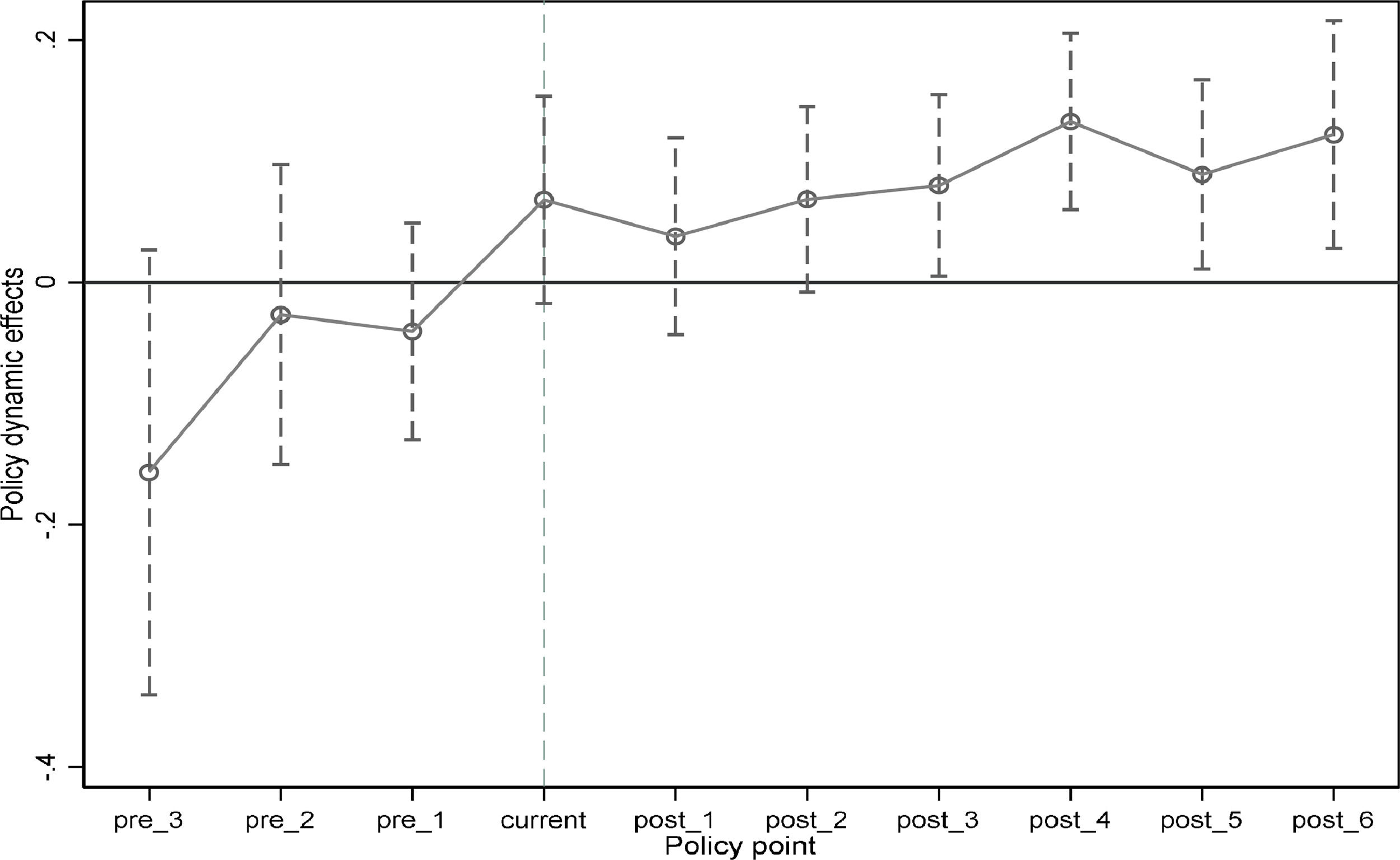

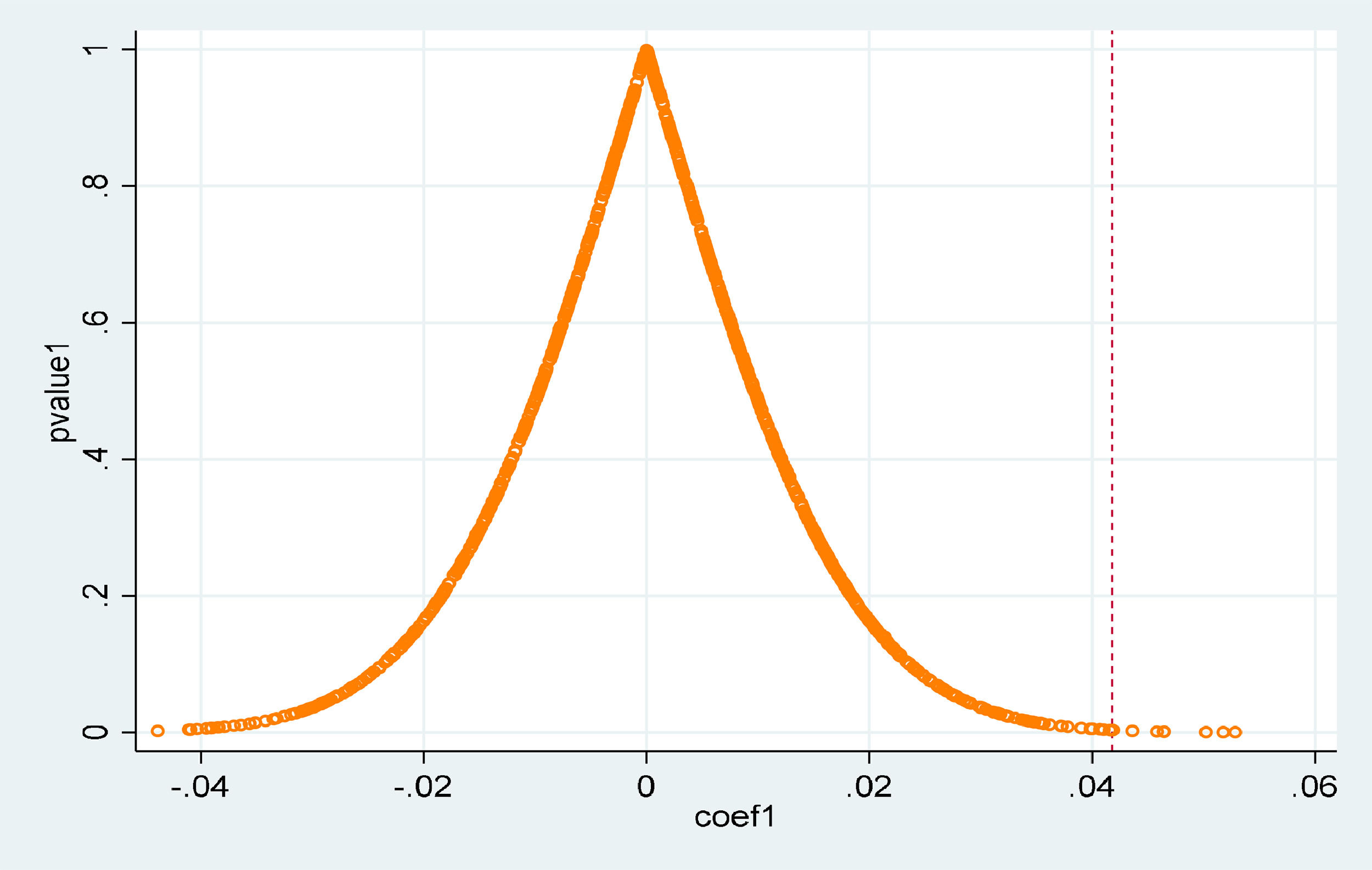

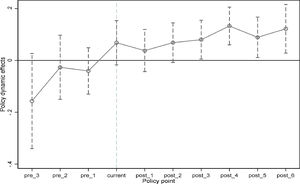

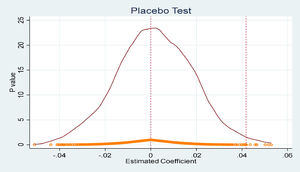

Where the coefficient of Postit*Treatitreflects the treatment effect of this policy on urban entrepreneurial activity, subscript I represents city individuals, subscript t represents time, and UEA represents city entrepreneurial activity. Treatment is a dummy variable, 1 for digital platforms with a high level of development and 0 for digital platforms with a low level of development. Postit is also a dummy variable, equal to 1 if the city sample is after the policy was enacted and 0 otherwise. Controls are additional control variables, including city size, city economic development level, city public expenditure, city financial environment, and average annual wage of city residents. μ and δare city-fixed and time-fixed effects, and ε refers to the error term. Before running the difference-difference model, a parallel trend test is carried out in this paper to check whether the data is feasible. The results of the parallel trend test are shown in Fig. 3. In the three periods before the policy pilot, the results all float around 0, indicating that the parallel trend hypothesis is supported and the difference-in-differences method can be used for analysis.

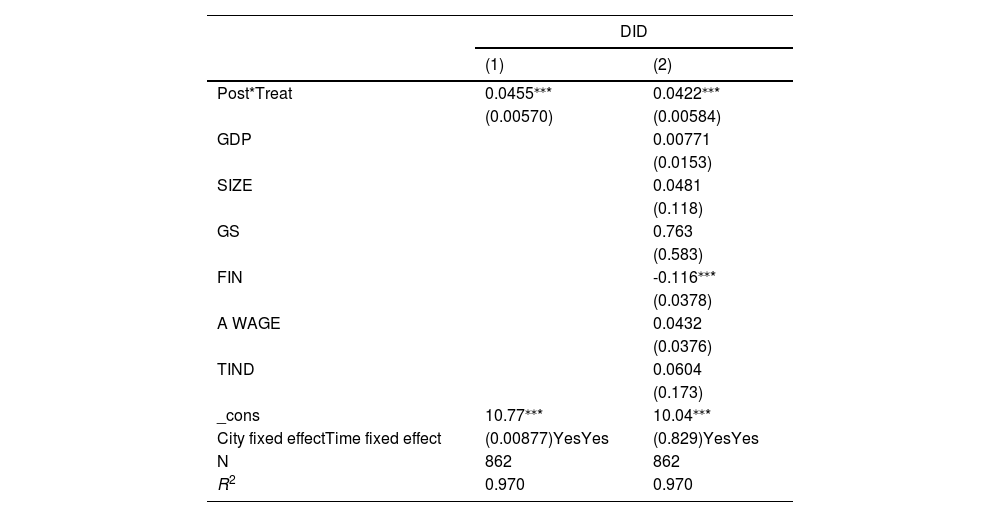

Next, this paper conducts regression through the difference-in-differences model, and the results are shown in Table 9. The coefficients of Post*treat in the two columns are significantly positive, indicating that the impact of digital platforms on urban entrepreneurial activity is positive. Therefore, the results in this paper are consistent with the baseline regression, indicating that it is not due to the underlying endogenous bias. b. Placebo test

Impact of digital platforms on urban entrepreneurial activity.

| DID | ||

|---|---|---|

| (1) | (2) | |

| Post*Treat | 0.0455⁎⁎* | 0.0422⁎⁎* |

| (0.00570) | (0.00584) | |

| GDP | 0.00771 | |

| (0.0153) | ||

| SIZE | 0.0481 | |

| (0.118) | ||

| GS | 0.763 | |

| (0.583) | ||

| FIN | -0.116⁎⁎* | |

| (0.0378) | ||

| A WAGE | 0.0432 | |

| (0.0376) | ||

| TIND | 0.0604 | |

| (0.173) | ||

| _cons | 10.77⁎⁎* | 10.04⁎⁎* |

| City fixed effectTime fixed effect | (0.00877)YesYes | (0.829)YesYes |

| N | 862 | 862 |

| R2 | 0.970 | 0.970 |

Note: ⁎⁎⁎

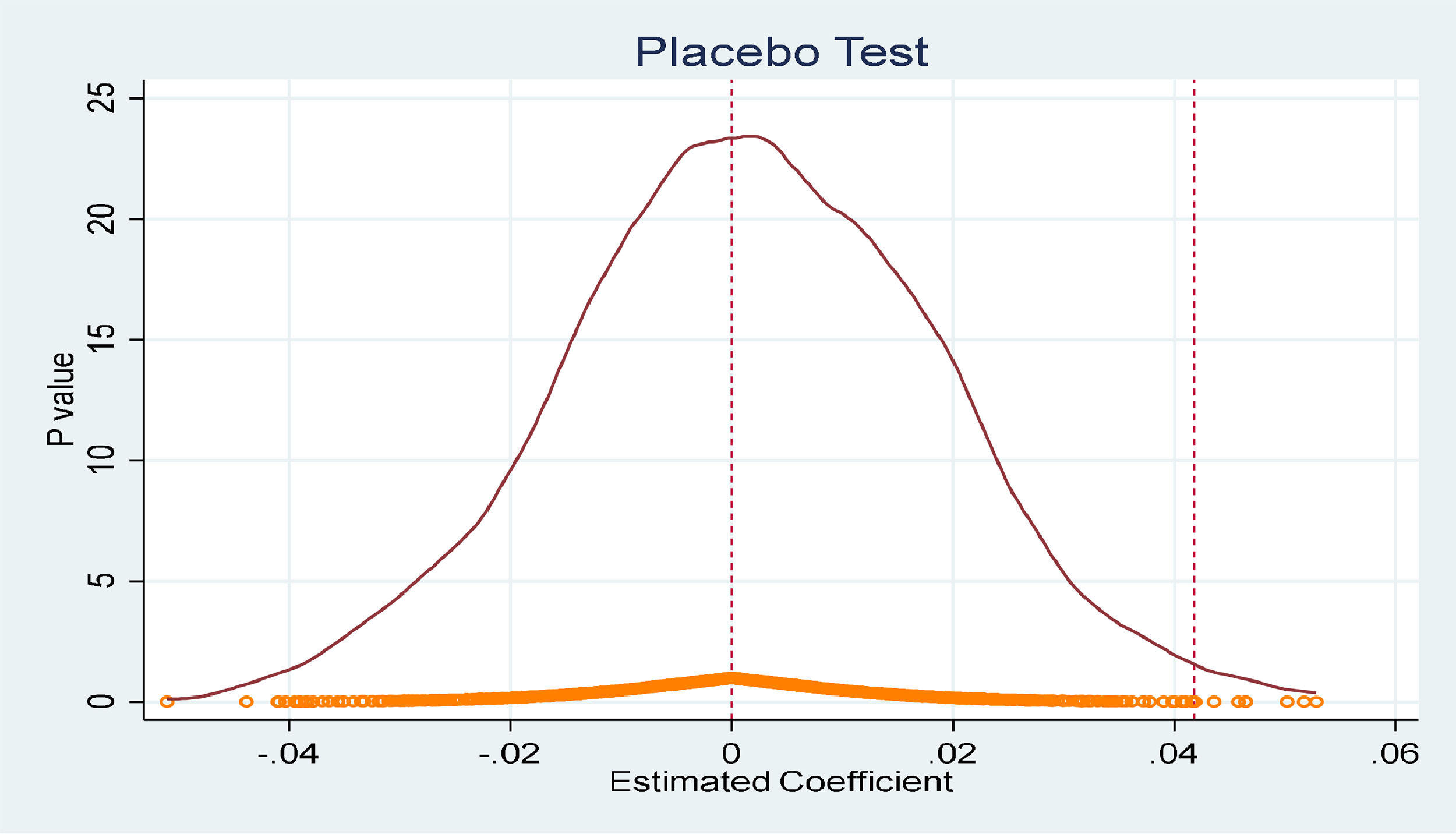

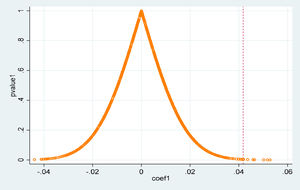

To eliminate the interference of some random factors, we randomly selected a virtual experimental group and control group with a placebo, namely the data according to the city to group first, and then in each city within the year variable random time one year as a policy, to construct a policy and virtual variables for regression model (1). In the following figure, we repeated the above process 1000 times and plotted the kernel density distribution and significance of the above 1000 times of randomized simulated regression coefficients. The results in Fig. 4 show that the randomly assigned estimates approximately follow a normal distribution around 0. Specifically, after 1000 simulations, the mean value of the regression coefficient of the core explanatory variable is 0.0418, which is close to 0 and far smaller than the estimated result of the baseline regression. As seen in Fig. 5, the empirical results of this paper are relatively robust.

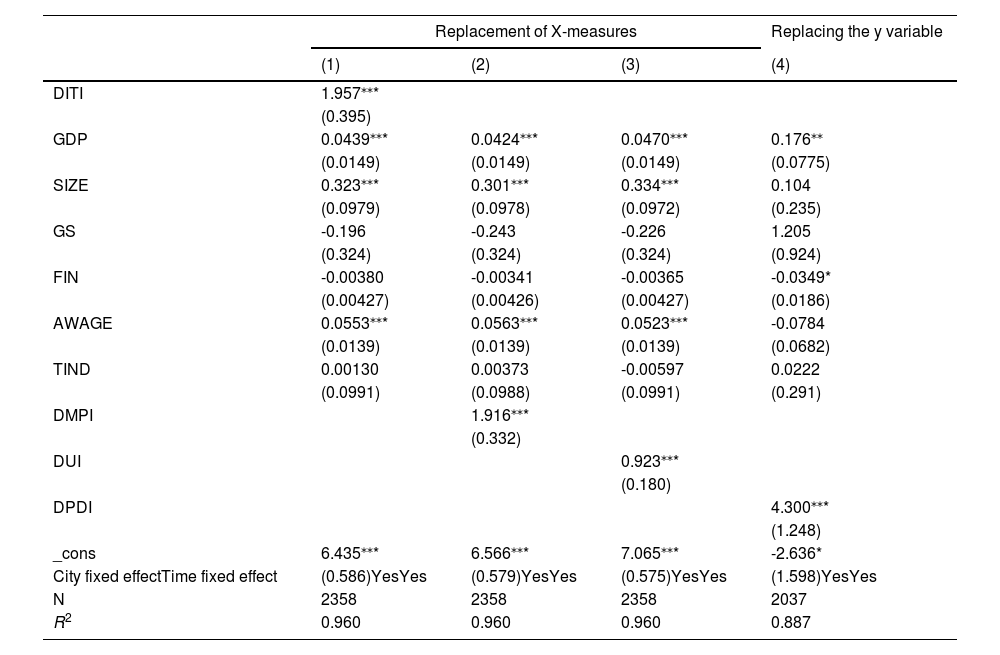

Robustness analysisChanging variable measurement methodThe digital platform's development composite index in the baseline regression is comprehensively constructed based on 12 indicators from three dimensions: digital technology foundation, multilateral digital platforms, and digital user. This paper further uses the single-dimension indicator as the proxy variable of the digital platforms. Table 10 displays the regression findings in columns (1), (2), and (3) following the replacement of the construction approach used to create the digital platforms composite index. Column (1) takes the dimension indicator of the digital technology foundation, column (2) only takes the dimension indicator of the multilateral digital platforms, and column (3) only takes the dimension indicator of the digital user. The development index of digital platforms in columns (1), (2), and (3) are all significantly positive, indicating that the development of digital platforms will greatly promote urban entrepreneurial activity.

Robustness test.

| Replacement of X-measures | Replacing the y variable | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DITI | 1.957⁎⁎* | |||

| (0.395) | ||||

| GDP | 0.0439⁎⁎* | 0.0424⁎⁎* | 0.0470⁎⁎* | 0.176⁎⁎ |

| (0.0149) | (0.0149) | (0.0149) | (0.0775) | |

| SIZE | 0.323⁎⁎* | 0.301⁎⁎* | 0.334⁎⁎* | 0.104 |

| (0.0979) | (0.0978) | (0.0972) | (0.235) | |

| GS | -0.196 | -0.243 | -0.226 | 1.205 |

| (0.324) | (0.324) | (0.324) | (0.924) | |

| FIN | -0.00380 | -0.00341 | -0.00365 | -0.0349* |

| (0.00427) | (0.00426) | (0.00427) | (0.0186) | |

| AWAGE | 0.0553⁎⁎* | 0.0563⁎⁎* | 0.0523⁎⁎* | -0.0784 |

| (0.0139) | (0.0139) | (0.0139) | (0.0682) | |

| TIND | 0.00130 | 0.00373 | -0.00597 | 0.0222 |

| (0.0991) | (0.0988) | (0.0991) | (0.291) | |

| DMPI | 1.916⁎⁎* | |||

| (0.332) | ||||

| DUI | 0.923⁎⁎* | |||

| (0.180) | ||||

| DPDI | 4.300⁎⁎* | |||

| (1.248) | ||||

| _cons | 6.435⁎⁎* | 6.566⁎⁎* | 7.065⁎⁎* | -2.636* |

| City fixed effectTime fixed effect | (0.586)YesYes | (0.579)YesYes | (0.575)YesYes | (1.598)YesYes |

| N | 2358 | 2358 | 2358 | 2037 |

| R2 | 0.960 | 0.960 | 0.960 | 0.887 |

Note: ⁎⁎⁎

In addition, the measurement method of entrepreneurial activity will also affect the empirical results. To ensure the robustness of the empirical results, we use the number of newly registered enterprises and the total urban population as the standardized base to obtain the alternative variable of urban entrepreneurial activity and regent the baseline results. Column (4) in Table 10 shows the regression results after replacing the urban entrepreneurial activity measure variable. The results show that developing digital platforms can significantly promote urban entrepreneurial activity.

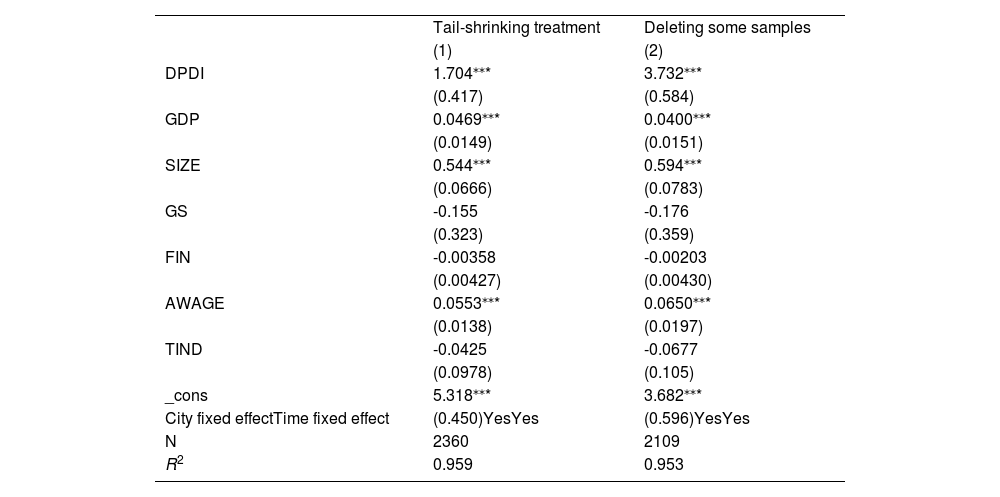

Changing the sampleTable 11, column (1) is the regression result after the tail-shrinking treatment. To eliminate the influence of some extreme values on the regression results, we reduced all the continuous variables in the sample by 1 % before regression, and this result is still consistent with the above. Column (2) shows the regression results after deleting the data from Beijing, Shanghai, Guangdong, Xinjiang, and Xizang. To avoid the impact on the baseline results, we deleted part of the sample data and then conducted the regression, and the results are still significant. These megacities and outlying cities do not drive the conclusions of this paper.

Robustness analysis.

| Tail-shrinking treatment | Deleting some samples | |

| (1) | (2) | |

| DPDI | 1.704⁎⁎* | 3.732⁎⁎* |

| (0.417) | (0.584) | |

| GDP | 0.0469⁎⁎* | 0.0400⁎⁎* |

| (0.0149) | (0.0151) | |

| SIZE | 0.544⁎⁎* | 0.594⁎⁎* |

| (0.0666) | (0.0783) | |

| GS | -0.155 | -0.176 |

| (0.323) | (0.359) | |

| FIN | -0.00358 | -0.00203 |

| (0.00427) | (0.00430) | |

| AWAGE | 0.0553⁎⁎* | 0.0650⁎⁎* |

| (0.0138) | (0.0197) | |

| TIND | -0.0425 | -0.0677 |

| (0.0978) | (0.105) | |

| _cons | 5.318⁎⁎* | 3.682⁎⁎* |

| City fixed effectTime fixed effect | (0.450)YesYes | (0.596)YesYes |

| N | 2360 | 2109 |

| R2 | 0.959 | 0.953 |

Note: ⁎⁎⁎

To further explore the development mechanism of digital platforms’ development on urban entrepreneurial activity, this paper conducts mechanism analysis from three channels: alleviating labour market distortion, optimizing the financial environment, and improving technological innovation. Based on the stepwise method of mediating effects proposed by Preacher and Hayes (2008), a multi-mediating effect model consisting of three progressive equations was constructed in this paper. Among them, the med in models (8) and (9) represent the mediating variable of digital platforms affecting urban entrepreneurial activity.

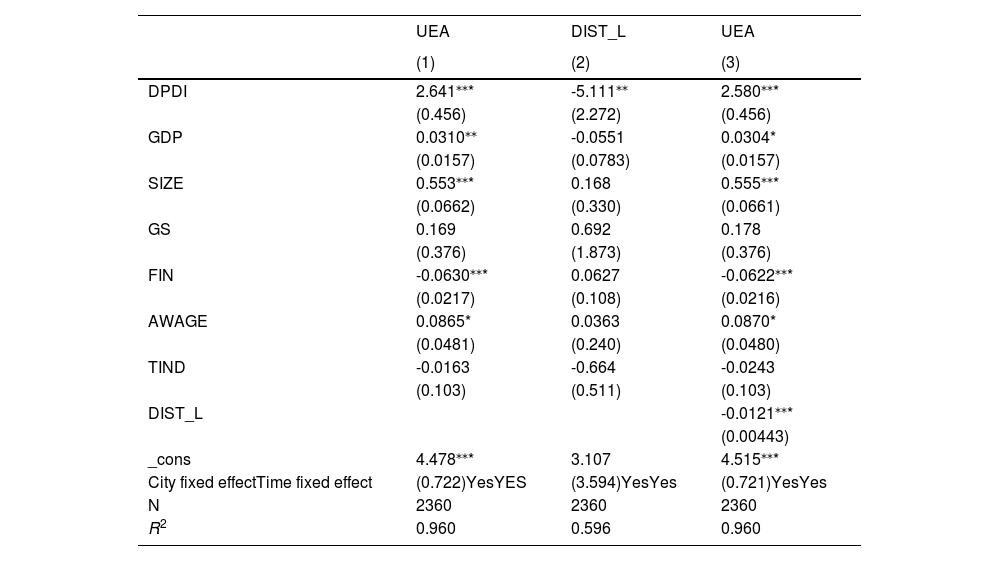

Labor market distortionsIn Table 12, it can be seen from the first column (2) that the development of digital platforms (DPDI) estimates the coefficient of the labour market distortion index to be significantly negative. The estimated coefficient of digital platforms development (DPDI) is significantly positive when the core and intermediate variables are added. In contrast, the estimated coefficient of market factor distortion index (DIST_L) is negative. These findings are corroborated by the regression results in column 1 (3). The above results indicate that the development of digital platforms can significantly alleviate the labour market distortion and promote the entrepreneurial activity of cities. Therefore, hypothesis 1 is true.

Mechanism test.

| UEA | DIST_L | UEA | |

|---|---|---|---|

| (1) | (2) | (3) | |

| DPDI | 2.641⁎⁎* | -5.111⁎⁎ | 2.580⁎⁎* |

| (0.456) | (2.272) | (0.456) | |

| GDP | 0.0310⁎⁎ | -0.0551 | 0.0304* |

| (0.0157) | (0.0783) | (0.0157) | |

| SIZE | 0.553⁎⁎* | 0.168 | 0.555⁎⁎* |

| (0.0662) | (0.330) | (0.0661) | |

| GS | 0.169 | 0.692 | 0.178 |

| (0.376) | (1.873) | (0.376) | |

| FIN | -0.0630⁎⁎* | 0.0627 | -0.0622⁎⁎* |

| (0.0217) | (0.108) | (0.0216) | |

| AWAGE | 0.0865* | 0.0363 | 0.0870* |

| (0.0481) | (0.240) | (0.0480) | |

| TIND | -0.0163 | -0.664 | -0.0243 |

| (0.103) | (0.511) | (0.103) | |

| DIST_L | -0.0121⁎⁎* | ||

| (0.00443) | |||

| _cons | 4.478⁎⁎* | 3.107 | 4.515⁎⁎* |

| City fixed effectTime fixed effect | (0.722)YesYES | (3.594)YesYes | (0.721)YesYes |

| N | 2360 | 2360 | 2360 |

| R2 | 0.960 | 0.596 | 0.960 |

Note: ⁎⁎⁎

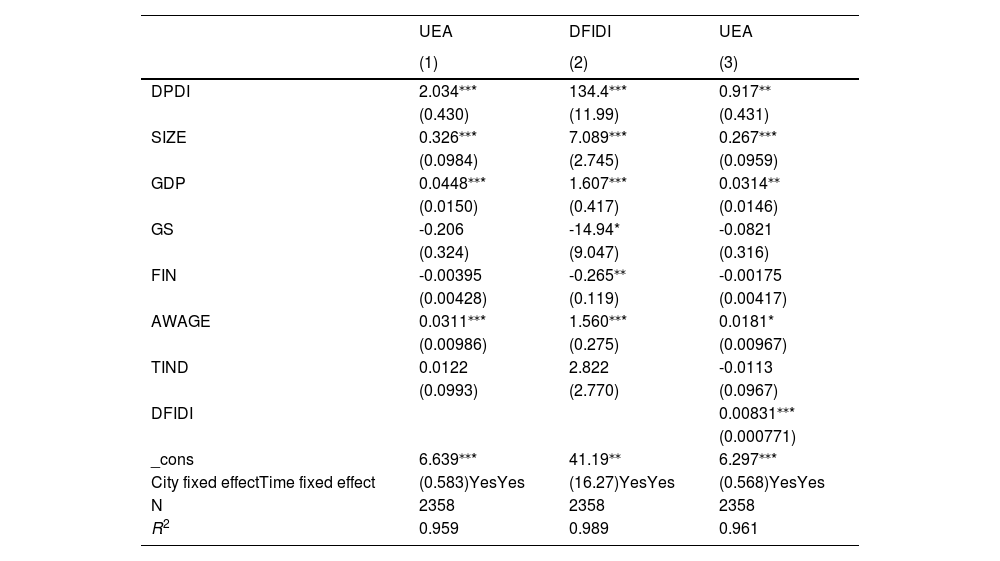

In column (2) of Table 13, the estimated coefficient of the development of digital platforms (DPDI) on the urban financial inclusion development index is significantly positive. Combined with the regression results of column (3), the estimated coefficient of the development of digital platforms (DPDI) is significantly positive when the core explanatory variables and mediating variables are added, and the estimated coefficient of the mediating variable, Financial Inclusion Development Index (DFIDI), is quite positive. The above results show that developing digital platforms will significantly improve financial inclusion, alleviate financing constraints, and promote urban entrepreneurial activity. In conclusion, hypothesis 2 is true.

Mechanism test.

| UEA | DFIDI | UEA | |

|---|---|---|---|

| (1) | (2) | (3) | |

| DPDI | 2.034⁎⁎* | 134.4⁎⁎* | 0.917⁎⁎ |

| (0.430) | (11.99) | (0.431) | |

| SIZE | 0.326⁎⁎* | 7.089⁎⁎* | 0.267⁎⁎* |

| (0.0984) | (2.745) | (0.0959) | |

| GDP | 0.0448⁎⁎* | 1.607⁎⁎* | 0.0314⁎⁎ |

| (0.0150) | (0.417) | (0.0146) | |

| GS | -0.206 | -14.94* | -0.0821 |

| (0.324) | (9.047) | (0.316) | |

| FIN | -0.00395 | -0.265⁎⁎ | -0.00175 |

| (0.00428) | (0.119) | (0.00417) | |

| AWAGE | 0.0311⁎⁎* | 1.560⁎⁎* | 0.0181* |

| (0.00986) | (0.275) | (0.00967) | |

| TIND | 0.0122 | 2.822 | -0.0113 |

| (0.0993) | (2.770) | (0.0967) | |

| DFIDI | 0.00831⁎⁎* | ||

| (0.000771) | |||

| _cons | 6.639⁎⁎* | 41.19⁎⁎ | 6.297⁎⁎* |

| City fixed effectTime fixed effect | (0.583)YesYes | (16.27)YesYes | (0.568)YesYes |

| N | 2358 | 2358 | 2358 |

| R2 | 0.959 | 0.989 | 0.961 |

Note: ⁎⁎⁎

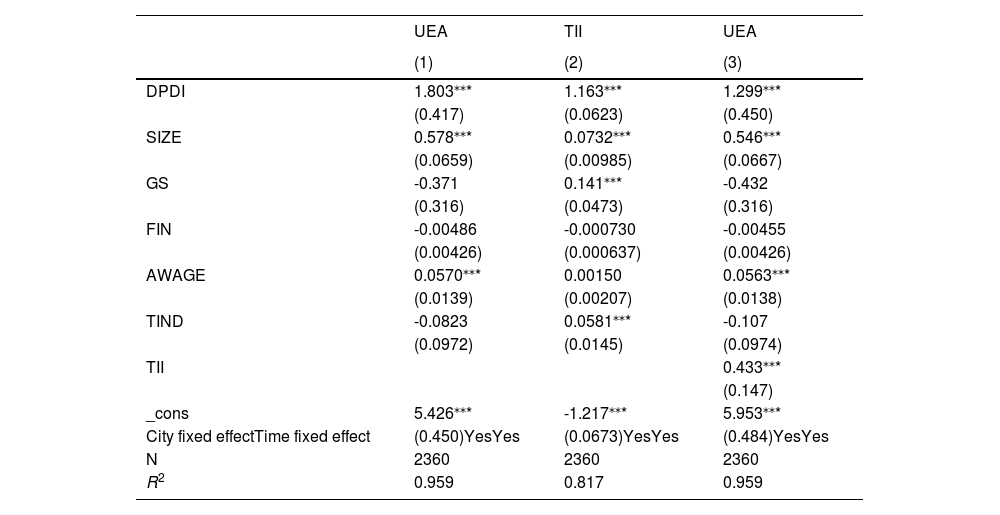

In column (2) of Table 14, the estimated coefficient of the DPDI on technological innovation efficiency is significantly positive. Combined with the regression results of column (3), the estimated coefficient of DPDI is significantly positive when core explanatory variables and mediating variables are added. The estimated coefficient of the mediating variable technology innovation efficiency (TII) is quite positive. The above results show that the development of digital platforms will significantly improve the efficiency of technological innovation and then promote urban entrepreneurial activity. Therefore, hypothesis 3 is valid.

Mechanism test.

| UEA | TII | UEA | |

|---|---|---|---|

| (1) | (2) | (3) | |

| DPDI | 1.803⁎⁎* | 1.163⁎⁎* | 1.299⁎⁎* |

| (0.417) | (0.0623) | (0.450) | |

| SIZE | 0.578⁎⁎* | 0.0732⁎⁎* | 0.546⁎⁎* |

| (0.0659) | (0.00985) | (0.0667) | |

| GS | -0.371 | 0.141⁎⁎* | -0.432 |

| (0.316) | (0.0473) | (0.316) | |

| FIN | -0.00486 | -0.000730 | -0.00455 |

| (0.00426) | (0.000637) | (0.00426) | |

| AWAGE | 0.0570⁎⁎* | 0.00150 | 0.0563⁎⁎* |

| (0.0139) | (0.00207) | (0.0138) | |

| TIND | -0.0823 | 0.0581⁎⁎* | -0.107 |

| (0.0972) | (0.0145) | (0.0974) | |

| TII | 0.433⁎⁎* | ||

| (0.147) | |||

| _cons | 5.426⁎⁎* | -1.217⁎⁎* | 5.953⁎⁎* |

| City fixed effectTime fixed effect | (0.450)YesYes | (0.0673)YesYes | (0.484)YesYes |

| N | 2360 | 2360 | 2360 |

| R2 | 0.959 | 0.817 | 0.959 |

Note: ⁎⁎⁎

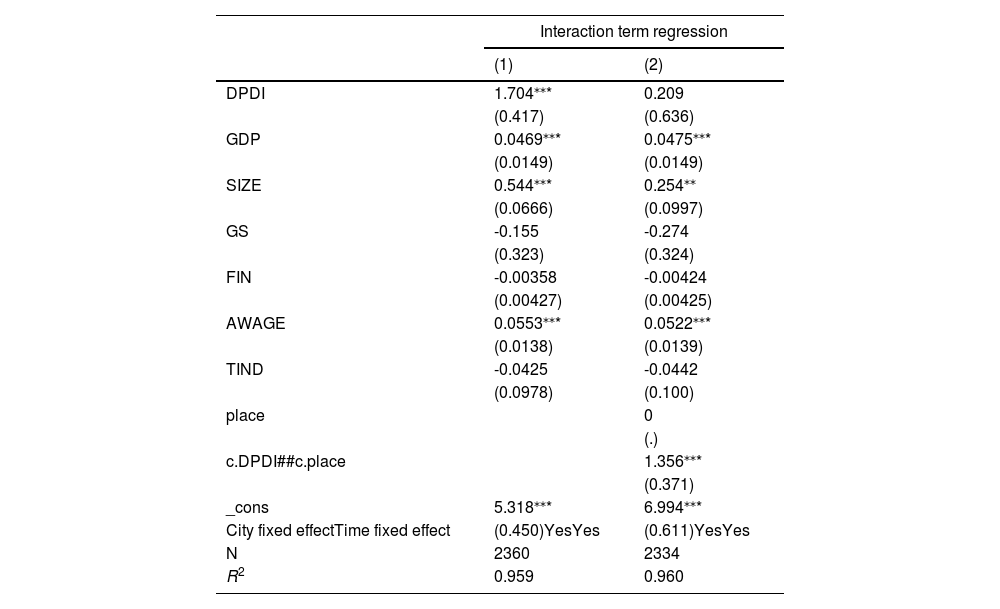

Due to the differences in resource endowment and economic development level, the impact of the development of digital platforms on urban entrepreneurial activity is heterogeneous in cities in different regions. As the most developed region of economy, industry, and finance in China, the development of the digital economy in the eastern part is far more than that in other areas, and digital platforms are the core component of the development of the digital economy. To this end, this paper divides all cities into eastern, central, and western regions according to the characteristics of their geographical locations. Then, by setting up a dummy variable (place), the value of the eastern city is “2”, the value of the central city is “1”, and the value of the western city is “0”. The intersection term between the dummy variable (place) and the development index of digital platforms (DPDI) was constructed again, and finally, the regression analysis was carried out.

The results are shown in Table 15. Column (1) is the result of the baseline regression, and column (2) is the regression result of adding the intersection term of Place and DPDI. The coefficient of the intersection term in column (2) is positive, indicating that compared with the central and western regions, the development of digital platforms in the eastern region has a better effect on promoting urban entrepreneurial activity. The reason for this result may be that with the better geographical location and more developed economy in the eastern region, the development of the digital platforms is relatively more complete, and the dividend is more fully released, which significantly promotes urban entrepreneurial activity.

Heterogeneity analysis.

| Interaction term regression | ||

|---|---|---|

| (1) | (2) | |

| DPDI | 1.704⁎⁎* | 0.209 |

| (0.417) | (0.636) | |

| GDP | 0.0469⁎⁎* | 0.0475⁎⁎* |

| (0.0149) | (0.0149) | |

| SIZE | 0.544⁎⁎* | 0.254⁎⁎ |

| (0.0666) | (0.0997) | |

| GS | -0.155 | -0.274 |

| (0.323) | (0.324) | |

| FIN | -0.00358 | -0.00424 |

| (0.00427) | (0.00425) | |

| AWAGE | 0.0553⁎⁎* | 0.0522⁎⁎* |

| (0.0138) | (0.0139) | |

| TIND | -0.0425 | -0.0442 |

| (0.0978) | (0.100) | |

| place | 0 | |

| (.) | ||

| c.DPDI##c.place | 1.356⁎⁎* | |

| (0.371) | ||

| _cons | 5.318⁎⁎* | 6.994⁎⁎* |

| City fixed effectTime fixed effect | (0.450)YesYes | (0.611)YesYes |

| N | 2360 | 2334 |

| R2 | 0.959 | 0.960 |

Note: ⁎⁎⁎

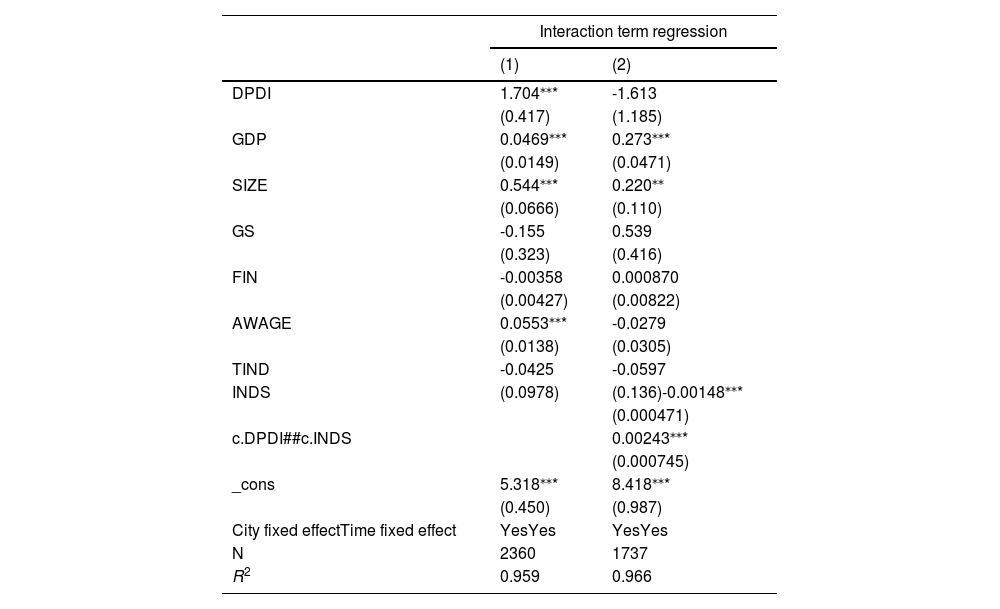

The development of digital platforms will also have a heterogeneous impact on urban entrepreneurial activity due to the differences in industrial structure. On the one hand, optimising and upgrading industrial structure will give birth to many emerging industries, especially to promote the development of the science and technology service industry and improve the ability of technological innovation. On the other hand, it will require workers to have heterogeneous skills and higher knowledge literacy to absorb more scientific and technological personnel. Optimizing and upgrading industrial structures can provide more technical talents and improve the technological innovation ability for urban entrepreneurial activity. Based on this, we use the proportion of the added value of the tertiary industry in GDP to measure the optimization and upgrading of industrial structure, construct the intersection term of digital platforms (DPDI) and industrial structure (INDS), and then conduct regression analysis.

In Table 16, column (1) is the result of the baseline regression, and column (2) is the regression result after adding the intersection terms of INDS and DPDI. The coefficient of the intersection term in column (2) is positive, indicating that the optimization and upgrading of industrial structure will promote the positive impact of digital platforms on urban entrepreneurial activity.

Heterogeneity analysis.

| Interaction term regression | ||

|---|---|---|

| (1) | (2) | |

| DPDI | 1.704⁎⁎* | -1.613 |

| (0.417) | (1.185) | |

| GDP | 0.0469⁎⁎* | 0.273⁎⁎* |

| (0.0149) | (0.0471) | |

| SIZE | 0.544⁎⁎* | 0.220⁎⁎ |

| (0.0666) | (0.110) | |

| GS | -0.155 | 0.539 |

| (0.323) | (0.416) | |

| FIN | -0.00358 | 0.000870 |

| (0.00427) | (0.00822) | |

| AWAGE | 0.0553⁎⁎* | -0.0279 |

| (0.0138) | (0.0305) | |

| TIND | -0.0425 | -0.0597 |

| INDS | (0.0978) | (0.136)-0.00148⁎⁎* |

| (0.000471) | ||

| c.DPDI##c.INDS | 0.00243⁎⁎* | |

| (0.000745) | ||

| _cons | 5.318⁎⁎* | 8.418⁎⁎* |

| (0.450) | (0.987) | |

| City fixed effectTime fixed effect | YesYes | YesYes |

| N | 2360 | 1737 |

| R2 | 0.959 | 0.966 |

Note: ⁎⁎⁎

Digital platforms have become a new economic model in the digital era, affecting regional entrepreneurial vitality, but there needs to be literature to explore the internal mechanism of its impact. We measured the development index of digital platforms of 294 prefecture-level cities in China from 2013 to 2020. We used the microdata of enterprise registration information to describe the urban entrepreneurial activity to conduct an empirical analysis. The results show that the development of digital platforms has significantly promoted urban entrepreneurial activity. In addition, developing digital platforms can increase urban entrepreneurial activity mainly through three channels: alleviating labour market distortions, optimizing the city's economic environment, and improving technological innovation. Other scholars have also come to a consistent conclusion when studying this topic: the impetus for innovation is significantly affected by the external environment, including socioeconomic conditions and financial availability (Barbara Bernhofer & Li, 2014; Wu & Mao, 2020). Based on heterogeneity research, we find that digital platforms in eastern cities with better industrial structures are more important in fostering urban entrepreneurship. Moreover, we use the threshold model to characterise further digital platforms’ impact on urban entrepreneurial activity, which has a nonlinear increasing “marginal effect”. It means the faster the development of digital platforms, the greater the promoting effect on urban entrepreneurial activity. Therefore, the research of this paper provides micro evidence for digital platforms to empower urban development and promote urban entrepreneurial activities.

The above conclusions have the following implications: First, improve the relevant infrastructure, accelerate the application of digital technologies such as cloud computing, and vigorously promote the application of digital platforms to promote the development of urban entrepreneurship and enhance the vitality of urban entrepreneurship. This includes improving network coverage and connection speeds, providing reliable data storage and processing capabilities, and building a secure and reliable digital platform infrastructure. By investing in and supporting the development of digital technologies, cities can provide entrepreneurs with a better environment and resources for innovation, thereby stimulating innovation vitality.

Secondly, to promote the cooperation between entrepreneurs of all parties, give play to the synergy effect, integrate talents, capital, technology, and other resources, and constantly improve innovation and entrepreneurship in the city. Cities can promote cooperation and exchanges among entrepreneurs by establishing an innovation and entrepreneurship ecosystem, providing entrepreneurship training and consulting services, and providing innovative and entrepreneurial infrastructure such as financial support and business incubators. At the same time, large enterprises are encouraged to cooperate with start-ups to jointly promote innovation and entrepreneurship to achieve resource sharing, risk sharing and innovation capacity improvement.

Third, promote the application of digital platforms in economically less developed areas, give preferential policies and support measures to encourage innovation and entrepreneurship in economically less developed areas, narrow the gap with developed areas, and promote economic development. In economically underdeveloped regions, governments can provide preferential policies and support measures such as tax breaks, start-up subsidies, technical support and training to attract and support entrepreneurs. In addition, establishing digital platforms and e-commerce infrastructure provides enterprises in economically underdeveloped regions with broader markets and business opportunities, thereby helping them enhance their competitiveness and achieve sustainable development. In short, by improving infrastructure, promoting cooperation, and promoting the application of digital platforms, the entrepreneurial vitality of cities can be enhanced, the level of innovation and entrepreneurship can be promoted, and the development of economically underdeveloped regions can be promoted. These measures will provide more opportunities and support for entrepreneurs and inject new impetus into economic growth and social progress.

However, there are specific other issues with this paper as well. Firstly, we only gathered data from China to investigate this problem because of data limitations. Since digital platforms are changing quickly and have different effects on different nations, it is essential to think about how digital platforms affect the world and innovation in other nations. We will keep looking at the data that is now accessible to learn more and develop this research topic in the future. Secondly, this paper needs to classify the industry of urban entrepreneurship. However, the impact of digital platforms on entrepreneurial activity in different industries may be heterogeneous. Therefore, in the subsequent research, this paper should classify various sectors in the city and further distinguish the impact of digital platforms on entrepreneurial activity in different industries in different cities. Thirdly, there are areas for improvement in the measurement method of the comprehensive index of digital platform development. Since the existing literature still needs to be completed in this research area, this paper only considers three dimensions: digital infrastructure, multilateral digital platforms, and digital users. However, digital platforms should contain more dimensions and content. This paper needs to further enrich the construction system of indicators and evaluate the degree of development of digital platforms as objectively and as possible. Finally, we only consider the differences in geographical location and industrial structure of different cities if we consider the heterogeneity of other aspects, which needs further improvement and analysis in the future.

CRediT authorship contribution statementGuosheng Hu: Conceptualization, Formal analysis, Investigation, Data curation, Writing – original draft, Supervision. Si He: Methodology, Writing – review & editing. Xiaoqi Dong: Validation, Resources, Writing – original draft, Writing – review & editing. Chengming Li: Formal analysis. Zeyu Wang: Software. Zengwen Wang: Conceptualization, Methodology, Software, Validation, Investigation, Resources, Writing – original draft, Visualization. Abbas Mardani: Writing – review & editing.

CRediT authorship contribution statementGuosheng Hu: Conceptualization, Formal analysis, Investigation, Data curation, Writing – original draft, Supervision. Si He: Methodology, Writing – review & editing. Xiaoqi Dong: Validation, Resources, Writing – original draft, Writing – review & editing. Chengming Li: Formal analysis. Zeyu Wang: Software. Zengwen Wang: Conceptualization, Methodology, Software, Validation, Investigation, Resources, Writing – original draft, Visualization. Abbas Mardani: Writing – review & editing.