Business model innovation is critical to firm survival and success. Digital revolution has reshaped value-creation methods in recent years, spawning various novel business models. However, we still have limited understanding of how a start-up's business model innovation efforts translate into superior performance in the digital economy. Drawing on insights from the demand-side perspective, this study disassembles the business model innovation architecture into three elements—value proposition, value creation, and value capture innovation—and investigates how business model innovation contributes to digital start-up performance. Based on a survey of Chinese digital start-ups, we find that value proposition innovation is positively related to digital start-up performance. Moreover, this relationship is mediated by value creation and value capture innovation. This study contributes to business model research by examining the impact mechanism of business model innovation on firm performance and providing new insights into the demand-side perspective of business model innovation.

New digital technologies challenge existing business models (Amit & Han, 2017; Nambisan, 2017; Rindfleisch, O'Hern, & Sachdev, 2017; Autio, Nambisan, Thomas, & Wright, 2018; Teece, 2018), and businesses are under pressure to transform their business models to remain relevant in the emerging digital economy (Yoo, Henfridsson, & Lyytinen, 2010; Rindfleisch et al., 2017; Soluk, Kammerlander, & Darwin, 2021). The concept of business model, which emerged during the Internet revolution, has attracted scholars’ attention and stimulated numerous studies in fields such as strategy, innovation, and entrepreneurship (e.g., Amit & Zott, 2001, 2012; Teece, 2010; Foss & Saebi, 2017). Business model innovation in start-ups can help entrepreneurs seize fleeting business opportunities and translate business ideas into entrepreneurial practices (Ireland, Hitt, & Sirmon, 2003; George & Bock, 2011). This is certainly relevant for digital start-ups (Soluk et al., 2021). On the one hand, the proliferation of new digital technologies such as cloud computing, mobile computing, and internet of things has created new means of value creation (Kohli & Melville, 2019). On the other hand, digital innovation has spawned a host of new business models (Karimi & Walter, 2016; Amit & Han, 2017; Nambisan, 2017; Sorescu, 2017). Thus, it is important to understand how start-ups convert business model innovation into superior firm performance in the digital economy.

Existing literature recognizes the performance implications of business model innovation (Foss & Saebi, 2017). Among the various definitions of the business model, the value-structure view is a popular one, which treats business model as an architecture that explains a firm's value creation logic (Teece, 2010; Foss & Saebi, 2017). Therefore, business model innovation is regarded as changes to the value architecture of an organization (Bock, Opsahl, George, & Gann, 2012; Baden-Fuller & Haefliger, 2013). However, previous research has tended to treat business model as a kind of holistic architecture, focusing on its overall impact on firm performance. One stream of research considers business model innovation as a separate but integrated construct (Cucculelli & Bettinelli, 2015; Kim & Min, 2015; Karimi & Walter, 2016; Futterer, Schmidt, & Heidenreich, 2018). Another stream divides business model innovation into different types and then links them to firm performance (Zott & Amit, 2007, 2008; Wei, Yang, Sun, & Gu, 2014; Guo, Tang, Su, & Katz, 2017). Business model innovation is a multi-dimensional construct composed of three central elements: value proposition, value creation, and value capture innovation (Demil & Lecocq, 2010; Teece, 2010; Zott & Amit, 2010; Baden-Fuller & Haefliger, 2013; Sjödin, Parida, Jovanovic, & Visnjic, 2020). Therefore, this study primarily aims to investigate the mechanism by which the three elements of business model innovation contribute to firm performance.

Given that the elements of business model innovation are combined into various configurations, this impact mechanism may include multiple paths. For example, in manufacturing industries, business model innovation could be driven by value creation innovation, focusing on key resources and activities. Consumer demand is increasingly valued in business model design in the digital age, as digital technologies significantly reduce the distance between enterprises and their customers (Priem, Wenzel, & Koch, 2018). Meanwhile, a growing number of scholars are conducting business model research by adopting the demand-side perspective, which emphasizes consumers as the key source of firm value creation (Rietveld, 2018; Guo, Wang, Su, & Wang, 2020; Sohl, Vroom, & McCann, 2020; Aversa, Haefliger, Hueller, & Reza, 2021; Denoo, Yli-Renko, & Clarysse, 2021). Therefore, in the digital business era, value proposition innovation emphasizing the role of consumers has become the key element of business model innovation.

Based on the demand-side perspective, this study opens the “black box” of business model innovation and examines its relationship with digital start-up performance by addressing the following two questions: (1) How does value proposition innovation impact digital start-up performance? (2) How do value proposition, value creation, and value capture innovation jointly contribute to digital start-up performance? The results of our on-site survey of 285 digital start-ups in China reveal that value proposition innovation is positively related to digital start-up performance. This relationship is mediated by value creation and value capture innovation.

This study makes two major contributions. First, we enrich the business model literature by examining the contribution of business model innovation toward firm performance. Specifically, we find that business model innovation improves digital start-up performance through value creation and value capture innovation, both of which are initiated by value proposition innovation. Second, this study provides new insights on the demand-side perspective of business model. From the database of digital start-ups compiled from our survey, we find evidence for a demand-side explanation of how digital start-ups translate business model innovation into firm performance. Our results indicate that value proposition innovation aimed at meeting consumer demand is the most critical element for the success of business model innovation in digital start-ups. It initiates value creation and value capture innovation that improve business performance.

Theoretical backgroundBusiness model innovation and firm performanceAs mentioned earlier, business model comprises three fundamental elements—value proposition, value creation, and value capture (Clauss, 2017; Clauss, Abebe, Tangpong, & Hock, 2021). Accordingly, business model innovation involves the discovery and adoption of novel techniques of value proposition, value creation, and value capture (Teece, 2010; Amit & Zott, 2012; Bock et al., 2012; Clauss et al., 2021; Hiteva & Foxon, 2021).

Value proposition innovation refers to a company's portfolio of new products and services for consumers, as well as how it develops new consumers or market segments and new consumer relationships (Morris, Schindehutte, & Allen, 2005; Chesbrough, 2007; Johnson, Christensen, & Kagermann, 2008; Zott & Amit, 2010; Baden-Fuller and Haefliger, 2013; Chandler, Broberg, & Allison, 2014). Value creation innovation refers to the means and methods by which a company creates new values and increases the total value in the value network using its resources as well as intra- and inter-organizational process capabilities (Teece, 2010; Achtenhagen, Melin, & Naldi, 2013; Amit & Han, 2017; Massa, Tucci, & Afuah, 2017). Value capture innovation is defined as how a company innovatively builds its revenue model and/or cost structure to better distribute and capture value in the value network (Johnson et al., 2008; Teece, 2010; Baden-Fuller & Haefliger, 2013; Clauss et al., 2021).

Although the overall impact of business model innovation on firm performance has been well recognized, we still have limited knowledge on the underlying mechanism by which the three elements of business model innovation jointly lead to an improvement in firm performance.

Demand-side perspective of business modelAccording to scholars, the issue of how the value of resources is created is largely neglected in the supply-side strategy research (Priem & Butler, 2001; Nickerson, Silverman, & Zenger, 2007; Hamel, 2012). They suggest that the value of resources lies in the ability to solve consumer problems, enhance their willingness-to-pay, and turn them into repeat consumers (Priem, 2007; Priem, Li, & Carr, 2012). Therefore, it is equally important to address the demand-side because consumers1 are the value creators for a business (Adner & Zemsky, 2006; Priem, 2007; Bhide, 2009; Priem et al., 2012; Yli-Renko, Denoo, & Janakiraman, 2020). Moreover, the demand-side perspective is being increasingly recognized in fields such as strategic management (Schmidt, Makadok, & Keil, 2016; Manral & Harrigan, 2018; Wang, Aggarwal, & Wu, 2020) and entrepreneurship (Bhide, 2008; Priem et al., 2018; Rietveld, 2018).

The demand-side perspective is consumer-centered and considers that consumers are heterogeneous and have dynamic preferences (Priem, Butler, & Li, 2013). It argues that value creation is determined by consumers’ willingness-to-pay (Priem, 2001; Priem et al., 2013) rather than the potential cost-related benefits described in supply-side studies. The power of the demand-side perspective is magnified in the digital economy. On the one hand, consumer demands become even heterogeneous and uncertain in the digital environment (Srinivasan & Venkatraman, 2017; Rietveld & Eggers, 2018). On the other hand, as products are co-created, the development of new digital technologies shifts power away from marketers and toward consumers (Autio et al., 2018; Bhide, 2009). Therefore, Priem et al. (2013) suggest that, in the new world of the “consumer internet,” we must pay equal attention to the demand side and the supply side.

Recently, a few studies have attempted to develop a demand-side perspective of business model (Priem et al., 2018) by examining issues such as the freemium business model, business model design, and business model diversification (Rietveld, 2018; Guo et al., 2020; Sohl et al., 2020; Aversa et al., 2021; Denoo et al., 2021). Priem et al. (2018, p. 22) argue that, “value creation for consumers, as the conditio sine qua non for value capture, is at the heart of demand-side strategy research and is a core element of almost any business model.” We agree with this perspective and believe that the demand-side perspective is more useful in business model research. On the one hand, it may contribute to business model research by providing a more sophisticated understanding of value proposition development (Priem et al., 2018) because value proposition articulates consumers’ central position (Chesbrough, 2007; Johnson et al., 2008; Baden-Fuller & Haefliger, 2013). On the other hand, value creation and value capture define how an organization mobilizes and configures resources and formulates appropriate revenue models to better meet consumer demands (Teece, 2010; Achtenhagen et al., 2013; Baden-Fuller & Haefliger, 2013; Amit & Han, 2017; Massa et al., 2017).

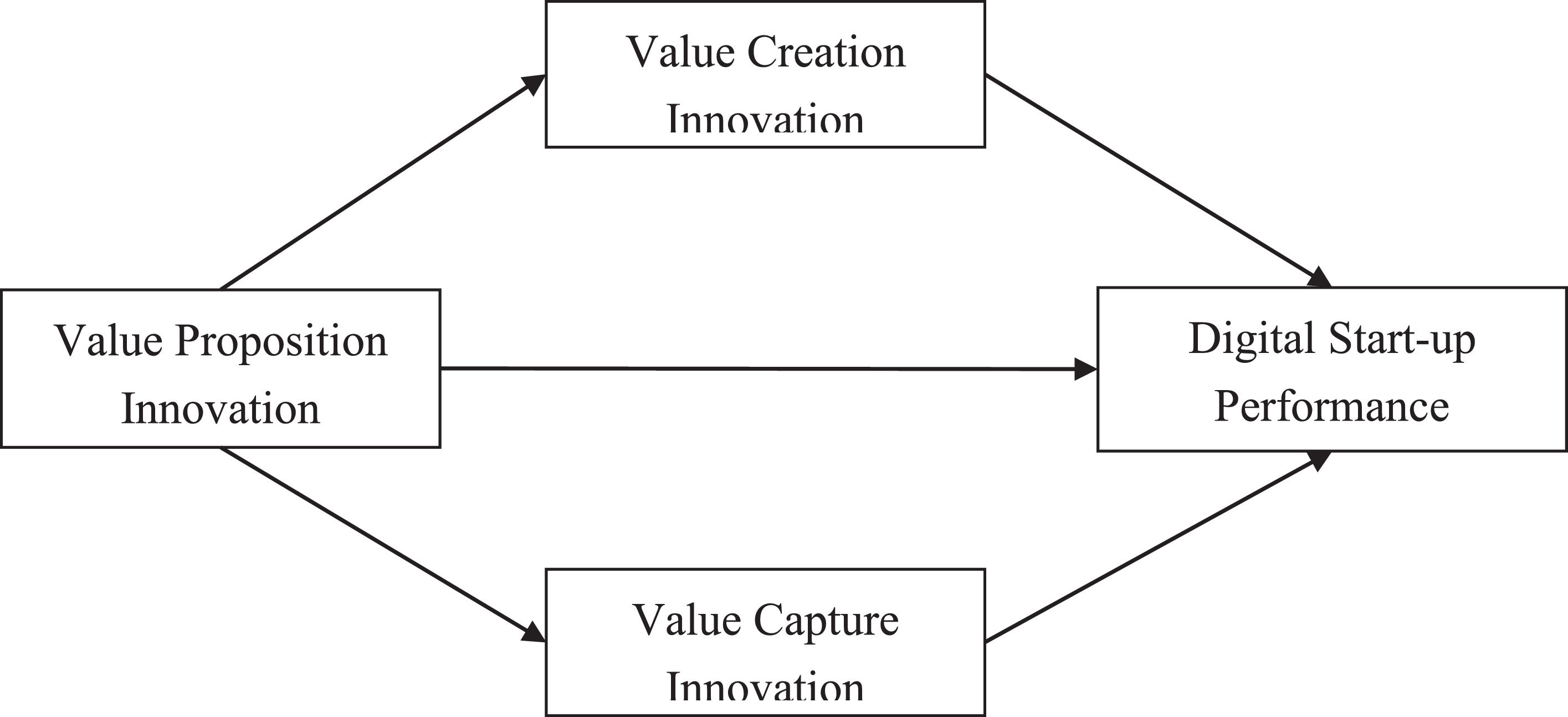

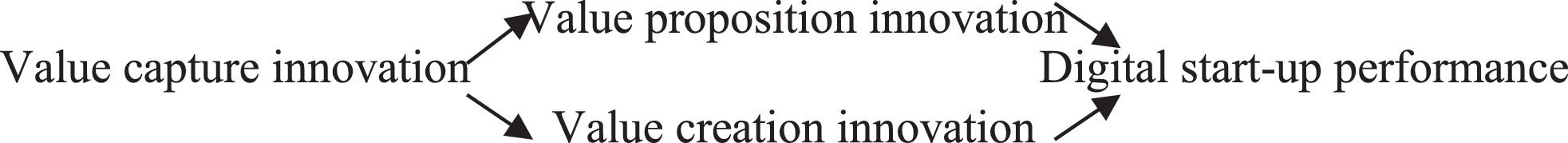

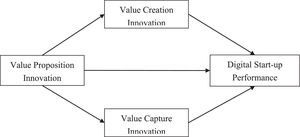

Conceptual model and hypotheses developmentDrawing insights from the demand-side perspective, we propose a mediation model of the relationship between business model innovation and digital start-up performance in the context of China's digital economy. First, as consumers’ willingness-to-pay is at the front end of the value chain or value network, we posit that the business model innovation is more likely to be initiated by value proposition innovation. Second, we suggest that value proposition innovation impacts digital start-up performance in two ways—value creation innovation and value capture innovation. In other words, value proposition innovation initiates the mechanism, while value creation and value capture innovation are actions that serve as conduits between value proposition innovation and digital start-up performance (see Fig. 1).

Value proposition innovation is reckoned as the central component of business model innovation (Morris et al., 2005; Johnson et al., 2008; Zott & Amit, 2010). It provides new offerings for consumers and explains why consumers would choose the products or services of a start-up (Baden-Fuller & Haefliger, 2013). First, by introducing a new value proposition, a start-up offers new products or services to satisfy heterogeneous consumer needs (Priem et al., 2013). Satisfying consumer needs assists start-ups in attracting more consumers and increase the possibility of improving consumers’ willingness-to-pay (Rietveld, 2018). Second, new start-up offerings signify differences in products or services from previous versions, which may enable the firm to provide complementary functions to consumers and realize the potential of demand synergy (Ye, Priem, & Alshwer, 2012; Schmidt et al., 2016). In other words, new products and services, by creating more complementary values for consumers, increase the total value delivered by an organization. Third, the digitization of products and services open a broad range of new ways for consumers to interact with businesses (Amit & Han, 2017; Sorescu, 2017). A start-up develops new relationships with its consumers through value proposition innovation, which could help the organization to better understand consumer needs, leading to an increased consumer retention rate and superior revenue generation (Chesbrough, 2007; Sjödin et al., 2020). Thus, we hypothesize the following:

H1 Value proposition innovation is positively related to digital start-up performance.

In the digital age, the power of individual consumers has been elevated owing to the proliferation of product and service information available through digitally enabled platforms and social interactions (Amit & Han, 2017). Therefore, value proposition innovation has become the starting point of business model innovation (Teece, 2010, 2018; Baden-Fuller & Haefliger, 2013; Clauss et al., 2021). To meet consumer demands, start-ups must engage in innovative value-creation activities, such as introducing new technologies, building new capabilities, developing new processes, or building new partnerships, either independently or collaboratively. Internally, a start-up's new resources, capabilities, or processes, such as the adoption of digital technologies, enable it to better exploit entrepreneurial opportunities (Teece, Pisano, & Shuen, 1997; Achtenhagen et al., 2013). Externally, partnerships with consumers, partners, or even peers enable a firm to conduct value co-creation activities. In other words, value creation innovation enables a start-up to work together with its value co-creators to increase consumers’ willingness-to-pay, thereby adding value to the value system (Zott & Amit, 2010). Therefore, we suggest that value creation innovation serves as an important conduit between value proposition innovation and digital start-up performance.

Business digitization substantially reduces information asymmetry in the market, making it easier for firms to understand and satisfy consumer demands (Barua, Konana, Whinston, & Yin, 2004). Hence, the mediating role of value creation innovation becomes more prominent in the digital economy. A representative example is ByteDance, a Chinese digital start-up that delivers customized news (TouTiao) and short videos (TikTok) to its users. Different from other news medias and video websites, ByteDance does not employ journalists or video producers but has hundreds of programmers. The value proposition of ByteDance is to enable every person to read news and watch short videos that they care about anywhere, at any time. To fulfill this task, ByteDance develops strong data-mining and content delivery technologies, which have earned it a market value of US$140 billion. Thus, we hypothesize the following:

H2 Value creation innovation mediates the relationship between value proposition innovation and digital start-up performance.

Value capture innovation serves as another mediator between value proposition innovation and digital start-up performance. From the demand-side perspective, value proposition innovation helps a start-up to better understand consumer needs and increases the expected benefits for a wide range of consumers (Amit & Han, 2017; Rietveld, 2018). Value proposition innovation is a prerequisite for revenue maximization as it increases the number of potential customers. However, without a novel value capture mechanism, firms “leave money on the table” by ceding value to consumers and forgoing revenues (Rietveld, 2018). Even with a novel value proposition, start-ups cannot generate profit without designing appropriate value capture mechanism. Thus, value capture innovation, in the form of a novel revenue model or cost model, enables a start-up to effectively convert consumers’ willingness-to-pay into revenue (Johnson et al., 2008; Rietveld, 2018), allowing the firm to capture more value from the value system and gain a competitive advantage.

The freemium model, for example, is becoming more popular in the digital economy (Rietveld, 2018). Companies, such as Google and Facebook, are all supporters of this business model. Compared to the traditional premium model, the freemium model is different in terms of the revenue model and cost structure designs, further leading to performance differences. Using data from online PC games, Rietveld (2018) finds that freemium games are played less and generate less revenue than premium games. Hence, to better create and capture value, firms operating the freemium model must operate at lower costs by reshaping their cost models or transfer to a premium model by increasing the variety of paid items available in the game menus. Considering this, we hypothesize the following:

H3 Value capture innovation mediates the relationship between value proposition innovation and digital start-up performance.

Our sampled firms were digital start-ups, which are defined as venture companies that create value through various digital technologies, with the internet start-up being one of the most common (Nambisan, 2017). Both business model research and demand-side perspective emphasize the central role of consumers in value creation. With a population of 1.4 billion, demand-driven business models are flourishing in China's digital economy. For example, the business models of Alibaba, Tencent, and TikTok are all demand-driven but have different features. Therefore, China represents an ideal context for this study.

We began our data collection by distributing a questionnaire to digital start-ups in China. The following procedures were used to create the questionnaire. First, all items were developed based on a systematic literature review, and the scale was revised according to the characteristics of Chinese digital start-ups. Second, we conducted several rounds of interviews with entrepreneurs to revise the questionnaire, ensuring that all scales and items were accurate and easily understood. Finally, we performed a pilot study on ten entrepreneurs from digital start-ups for further feedback.

The survey was conducted in 20172. We collected data from five provinces or municipalities of China—Beijing, Zhejiang, Shandong, Hunan, and Anhui. To improve response rates and avoid potential misunderstandings, we chose to conduct an on-site survey over online-based or mail-based survey (Sheng, Zhou & Li, 2011). Five hundred digital start-ups located in 34 incubators or start-up parks were randomly selected as samples. The telephone numbers and e-mail addresses of the selected firms were obtained from government agencies. With this information, we contacted these firms and invited them to participate in the survey. First, with the help of local governments and management committees of incubators, an interviewer contacted the start-up founders seeking consent and appointment for the interview. Second, in the face-to-face field survey, the interviewer explained the study purpose and the questionnaire to the respondents to avoid possible confusions. Finally, the interviewer thoroughly reviewed the completed questionnaires.

The questionnaire was filled by 389 firms, resulting in a response rate of 77.8%. The date and total time spent on the questionnaire were recorded for each respondent. Furthermore, 104 responses were excluded from the study in any of the following cases: (i) one or two respondents completed the questionnaire in less than 10 minutes, implying that they were distracted and the questionnaire might have been of poor quality; (ii) the questionnaire was incomplete; (iii) the company was not entirely a digital start-up according to our definition. Thus, the final sample size was 285 firms, leading to a response rate of 57%. To avoid non-response bias, we compared key attributes, such as firm size, firm age, and firm ownership of the responding and non-responding firms. The t-tests for them were all insignificant, indicating a low possibility of non-response bias.

Measures and validationThe survey measures were developed based on established scales. All items for continuous variables were measured on a 5-point Likert-type scale ranging from “1” (strongly disagree or very bad) to “5” (strongly agree or very good). Table 1 lists survey items for our key constructs along with the results of the validity assessment.

Items and scales.

Note: AVE = average variance extracted; C.R. = composite reliability; α = Cronbach's alpha.

The measures for the three elements of business model innovation were adapted from Clauss (2017). We revised the scale to better fit China's digital entrepreneurship context based on the current state of China's digital economy and feedback from respondents during the preliminary research. Notably, the revised scale passed the reliability and validity tests.

Value proposition innovation: We asked each respondent to evaluate the extent to which their firm had engaged in distinct types of value proposition innovation activities. These activities included providing new offerings, targeting new consumers and markets, and building new consumer relationships. Exploratory factor analysis yielded a single factor with an eigenvalue of 3.390, with factor loadings greater than 0.65. The scale reliability of Cronbach's α was 0.84, and the composite reliability was also 0.84.

Value creation innovation: The value creation innovation activities were measured using a nine-item scale that included four major aspects—new capabilities, new technologies or equipment, new partnerships, and new processes or structures. The items of value creation innovation loaded on a single factor with an eigenvalue of 5.403, with factor loadings greater than 0.72. The scale reliability of Cronbach's α was 0.916, and the composite reliability was 0.92.

Value capture innovation: This variable was measured using three items, considering two important dimensions—a new revenue model and a new cost structure. The two items loaded on a single factor with an eigenvalue of 2.089. Factor loadings ranged from 0.82 to 0.86 with high scale reliability (Cronbach's α = 0.78), and the composite reliability was 0.77.

Dependent variableDigital start-up performance: Unlike established firms, start-ups place a greater emphasis on growth rather than profit (Zott & Amit, 2007). The incubator—as an entrepreneurship-supporting ecosystem—increases the survival rate and growth potential of start-ups by compensating for gaps in knowledge, competencies, and resources (Grimaldi & Grandi, 2005; Kakabadse et al., 2020). In the context of business incubators, prior research has identified sales growth, employee growth, and assets growth as key indicators for assessing start-up success (Baum & Bird, 2010; Marlow & McAdam, 2012; Sullivan, Marvel, & Wolfe, 2021). By further referring to entrepreneurship literature (Chandler, McKelvie, & Davidsson, 2009; Brinckmann, Salomo, & Gemuenden, 2011), we used three items—sales growth, employee growth, and asset growth—to measure digital start-up performance. Sales growth reflects the market potential of a start-up, a growth in the number of employees implies organizational development, and an increase in total assets denotes an increase in organizational capabilities. The loadings of all items were above 0.82. The Cronbach's alpha for the scale was 0.82, and the composite reliability was 0.79.

Control variablesSeven variables were controlled in the study. First, given the critical role played by a founder in a venture's success, founder education was controlled and measured using five ordered educational degrees (high school and below, junior college, bachelor's, master's, and doctoral). Second, founder age was controlled and measured using six age intervals (20 years and below, 21–30, 31–40, 41–50, 51–60, and 61 years and above). At the firm level, we controlled for firm size and firm age. Firm size was measured by the logarithm of the number of employees. Firm age was measured by calculating the number of years since the firm was established. At the industrial level, uncertainty has become a key feature of the external environment and a key determinant of venture growth in the digital economy (Nambisan, 2017). Following existing literature (Child, 1972; Jaworski & Kohli, 1993; McCarthy, Lawrence, Wixted, & Gordon, 2010), we developed scales for three types of environmental uncertainties in the context of China's digital economy. Specifically, we used three items to measure demand uncertainty, two key items to reflect technological uncertainty, and three items to measure institutional uncertainty. Loadings of all items were significantly above 0.60. The Cronbach's alphas for the three scales varied between 0.65 and 0.93, and the composite reliabilities were between 0.72 and 0.85.

Addressing common method varianceFollowing Podsakoff, MacKenzie, Lee, and Podsakoff (2003), procedural and statistical remedies were conducted to minimize the magnitude of common method variance (CMV). Furthermore, to reduce social desirability bias, we phrased all the questions with neutral words, informed all respondents of the project's academic purpose, and assured them that their answers were confidential. Subsequently, for data collection, we used two informants rather than one from each firm. One informant responded to questions about business model innovation, while another responded to questions concerning digital start-up performance.

As statistical remedies, we first employed Harman's single-factor test to address potential CMV. Consequently, both the screen plot and Kaiser Criterion yielded four distinct factors with eigenvalues greater than one. No single factor was dominant, with the first factor explaining 23.37% of the variance. Second, the latent variable control method was adopted for testing (Anderson & Williams, 1992), and two measurement models were created, with one model linking all items to a common method factor and another model loading items onto their theoretically assigned latent variables. The results demonstrated that the model's fitting indexes—after incorporating the deviation latent variables of the common method—were satisfactory (RMSEA = 0.059, RMR 0.120, CFI = 0.941, TLI 0.932, IFI = 0.942, PGFI = 0.703, PNFI = 0.770). However, the t-test between each fitting index and the original model (RMSEA = 0.068, RMR 0.043, CFI = 0.920, TLI 0.909, IFI = 0.921, PGFI = 0.692, PNFI = 0.757) revealed that there was no significant difference between the fitting degrees of the model with latent variable and the original model. This suggested that CMV was insignificant. Third, the marker variable method was adopted (Lindell & Whitney, 2001). We added a marker variable in the test whose correlation coefficient with other variables was significantly low. The results reveal that the χ2 of the marker variable model, at 468.106 (df=203), is significantly higher than that of the original model (χ2 = 448.132, df =204). Thus, CMV is unlikely to influence the results of this study.

ResultsMulticollinearity checksTable 2 summarizes the descriptive statistics and correlations between all the constructs. Although the correlations are generally low, some constructs, such as value proposition innovation, value creation innovation, and value capture innovation, may be conceptually related and empirically correlated. To deal with this issue, we compared our measurement models with alternative measurement models (Tanriverdi & Venkatraman, 2005). As shown in Table 3, Models 1, 3, and 5 are baseline models that treat two constructs as two distinct factors, respectively. Conversely, Models 2, 4, and 6 are one-factor models with two constructs combined into one single factor. The results clearly demonstrate that the three baseline two-factor models have consistently better model fits, indicating that the three constructs are distinct from each other.

Means, standard deviations, and correlations

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Founder education | 3.023 | 0.803 | 1 | |||||||||

| 2. Founder age | 2.756 | 0.787 | 0.192⁎⁎ | 1 | ||||||||

| 3. Firm age | 3.852 | 4.017 | - 0.034 | 0.389⁎⁎⁎ | 1 | |||||||

| 4. Firm size | 34.712 | 89.020 | 0.043 | 0.021 | 0.206⁎⁎⁎ | 1 | ||||||

| 5. Demand uncertainty | 3.678 | 0.753 | 0.010 | 0.021 | 0.091* | 0.025 | 1 | |||||

| 6. Technological uncertainty | 3.693 | 0.977 | 0.058 | 0.146* | 0.133* | 0.104 | 0.213⁎⁎⁎ | 1 | ||||

| 7. Institutional uncertainty | 3.478 | 0.730 | - 0.105 | 0.051 | 0.123* | 0.056 | 0.108 | 0.168⁎⁎ | 1 | |||

| 8. Value proposition innovation | 4.155 | 0.613 | - 0.058 | 0.018 | 0.006 | 0.126* | 0.220⁎⁎⁎ | 0.242⁎⁎⁎ | 0.027 | 1 | ||

| 9. Value creation innovation | 4.309 | 0.608 | - 0.008 | 0.022 | 0.037 | 0.041 | 0.206⁎⁎⁎ | 0.365⁎⁎⁎ | 0.141* | 0.655⁎⁎⁎ | 1 | |

| 10. Value capture innovation | 3.727 | 0.849 | 0.071 | - 0.006 | - 0.034 | 0.121* | 0.157⁎⁎ | 0.102 | 0.015 | 0.590⁎⁎⁎ | 0.309⁎⁎⁎ | 1 |

| 11. Digital start-up performance | 3.363 | 0.795 | - 0.050 | - 0.196⁎⁎ | - 0.137* | 0.364⁎⁎⁎ | - 0.003 | 0.081 | 0.058 | 0.209⁎⁎⁎ | 0.234⁎⁎⁎ | 0.226⁎⁎⁎ |

Note: †p<0.1

Comparison of measurement models (N = 285)

Notes: †p < 0.1

*p < 0.05

**p < 0.01

***p < 0.001; DF = degree of freedom; RMSEA = root mean square error of approximation; NFI = normed fit index; CFI = comparative fit index.

Two approaches were used to test for and avoid the problem of multicollinearity. First, all variables were mean-centered before regression (Aiken & West, 1991). Second, the variance inflation factor (VIF) was calculated. The test results presented in Table 3 reveal that the largest VIF is 2.525, which is significantly below the marginal value of 10 (Neter, Wasserman, & Kutner, 1990). Therefore, multicollinearity is not a significant issue in our analysis.

Hypotheses testsTable 4 presents the ordinary least squares (OLS) results. Models 1, 3, and 5 are baseline models with only control variables. Model 6 strongly supports H1—value proposition innovation (β = 0.214, p < 0.01) is positively and significantly related to digital start-up performance. H2 and H3 predicted that value creation and value capture innovation mediate the relationship between value proposition innovation and digital start-up performance, respectively. The three-step procedure of Baron and Kenny (1986) was adopted to test the two mediating effects. The first step of the process requires the independent variable to be significantly related to the dependent variable and the suggested mediating variable. This is satisfied by Model 6, which reveals a positive link between value proposition innovation and digital start-up performance. Second, as shown by Models 2 and 4, value proposition innovation is significantly and positively related to value creation innovation (β = 0.603, p < 0.001) and value capture innovation (β = 0.810, p < 0.001). The third step requires the mediating variable to be significantly related to the dependent variable when controlling the independent variable. As shown by Models 7 and 8, value creation innovation (β = 0.258, p < 0.01) and value capture innovation (β = 0.115, p < 0.1, p = 0.062) are both significantly linked to digital start-up performance. The effect of value proposition innovation on digital start-up performance is eliminated in Model 7 when value creation innovation is added (β reduces from 0.214 to 0.059, p = 0.523) and Model 8 when value capture innovation is added (β reduces from 0.214 to 0.121, p = 0.168). These results strongly support the existence of mediating effects. Similarly, when value proposition, value creation, and value capture innovation are all included in the regression (see Model 9), the results continue to support the mediating effects strongly.

Results of OLS regression analyses: Mediation model

| Value creation innovation | Value capture innovation | Digital start-up performance | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

| Founder education | - 0.013 | - 0.030 | 0.063 | 0.040 | - 0.042 | - 0.048 | - 0.040 | - 0.053 | - 0.045 |

| Founder age | - 0.017 | - 0.015 | - 0.005 | - 0.003 | - 0.146* | - 0.145* | - 0.141* | - 0.145* | - 0.140* |

| Firm age | - 0.003 | 0.002 | - 0.016 | - 0.009 | - 0.033⁎⁎ | - 0.032⁎⁎ | - 0.032⁎⁎ | - 0.031* | - 0.031⁎⁎ |

| Firm size | 0.002 | - 0.032 | 0.087* | 0.041 | 0.248⁎⁎⁎ | 0.236⁎⁎⁎ | 0.244⁎⁎⁎ | 0.231⁎⁎⁎ | 0.239⁎⁎⁎ |

| Demand uncertainty | 0.105* | 0.016 | 0.165* | 0.045 | - 0.017 | - 0.048 | - 0.052 | - 0.054 | - 0.059 |

| Technological uncertainty | 0.207⁎⁎⁎ | 0.131⁎⁎⁎ | 0.058 | - 0.045 | 0.065 | 0.037 | 0.004 | 0.043 | 0.007 |

| Institutional uncertainty | 0.061 | 0.072† | - 0.004 | 0.011 | 0.051 | 0.055 | 0.037 | 0.054 | 0.033 |

| Value proposition innovation | 0.603⁎⁎⁎ | 0.810⁎⁎⁎ | 0.214⁎⁎ | 0.059 | 0.121 | - 0.065 | |||

| Value creation innovation | 0.258⁎⁎ | 0.282⁎⁎ | |||||||

| Value capture innovation | 0.115† | 0.136* | |||||||

| R2 | 0.156 | 0.488 | 0.050 | 0.357 | 0.188 | 0.213 | 0.233 | 0.223 | 0.247 |

| Adjusted R2 | 0.135 | 0.473 | 0.026 | 0.338 | 0.167 | 0.190 | 0.208 | 0.197 | 0.219 |

| R2 change | 0.156⁎⁎⁎ | 0.332⁎⁎⁎ | 0.050* | 0.307⁎⁎⁎ | 0.188⁎⁎⁎ | 0.025⁎⁎ | 0.020⁎⁎ | 0.010† | 0.059⁎⁎⁎ |

| Mean VIF | 1.112 | 1.124 | 1.112 | 1.123 | 1.112 | 1.124 | 1.309 | 1.233 | 1.408 |

| Maximum VIF | 1.228 | 1.231 | 1.228 | 1.230 | 1.228 | 1.231 | 1.953 | 1.645 | 2.525 |

| F value | 7.325⁎⁎⁎ | 32.877⁎⁎⁎ | 2.088* | 19.131⁎⁎⁎ | 9.145⁎⁎⁎ | 9.323⁎⁎⁎ | 9.286⁎⁎⁎ | 8.753⁎⁎⁎ | 8.972⁎⁎⁎ |

Note: †p < 0.1

Several statistical methods were used to test the robustness of our results. First, following Preacher and Hayes (2008), we used the bootstrapping approach to further test the mediating effects. The bootstrapped overall indirect effect of value creation innovation on digital start-up performance across 1,000 bootstrapped samples is 0.165 (the 95% confidence interval for the mediated effect ranges from 0.047 to 0.311 and does not straddle zero). This indicates that the mediating effect is significant (p < 0.05). Similarly, the overall indirect effect of value capture innovation on digital start-up performance across 1,000 bootstrapped samples is 0.137 (the 95% confidence interval for the mediated effect ranges from 0.031 to 0.275 and does not straddle zero). This indicates that the mediating effect is significant (p < 0.05). Considered together, both the aforementioned methods evidence the mediating roles played by value creation and value capture innovation.

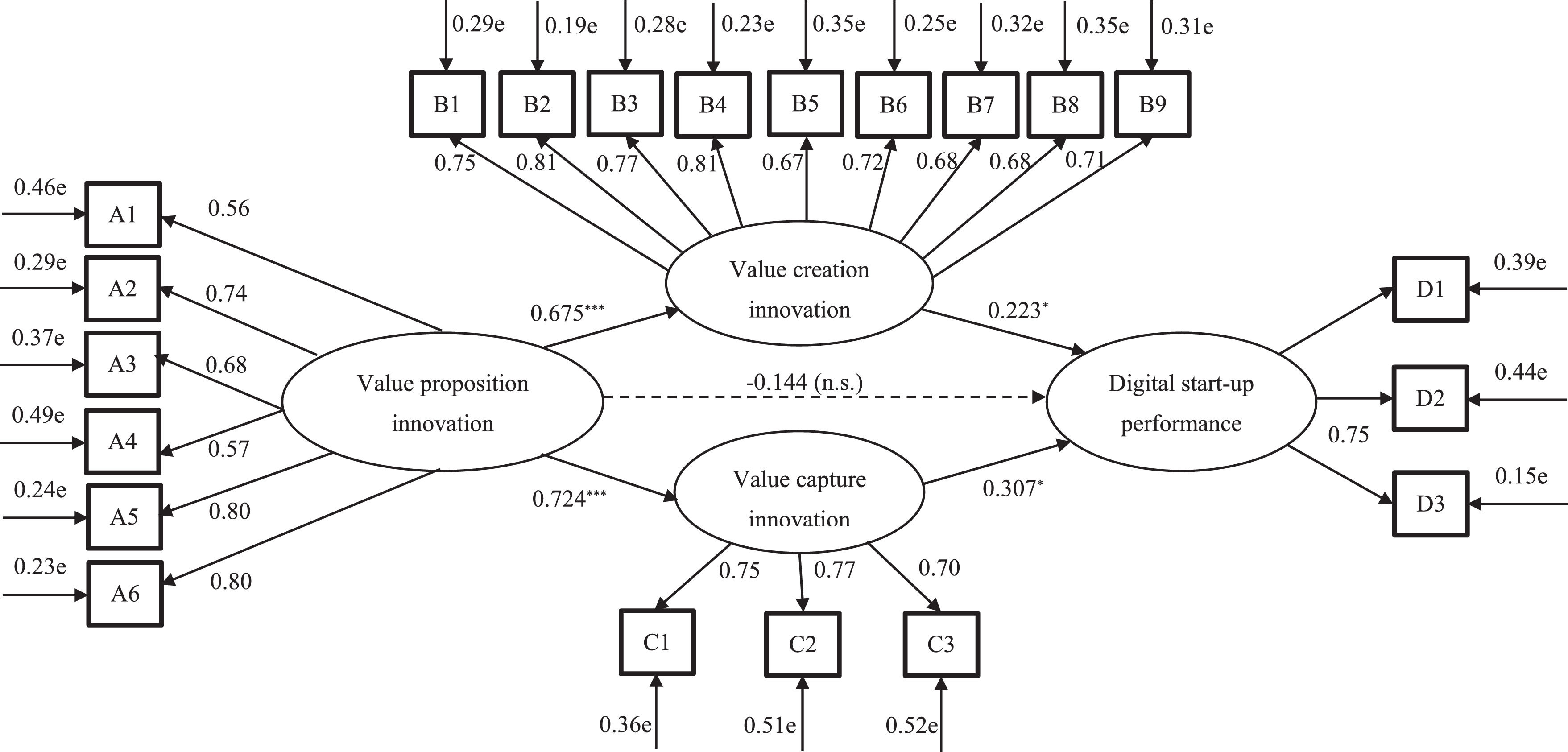

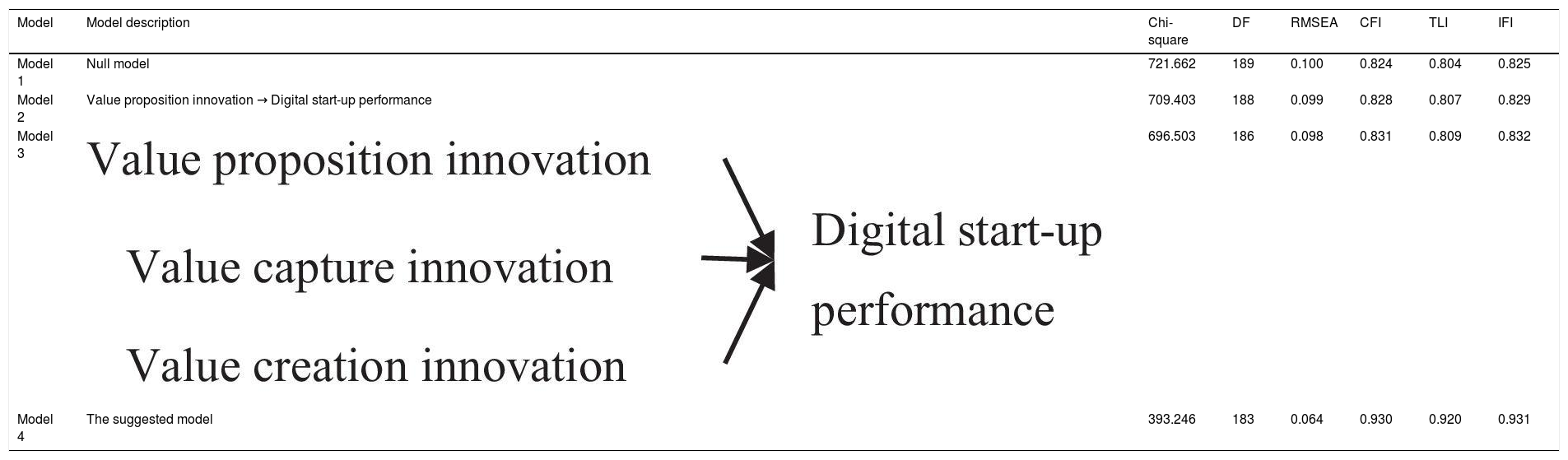

Second, AMOS software was employed to perform maximum structural equation modeling (SEM) to test the mediating effects. Table 5 presents a sequence of nested structural models. Here, Model 1 presents the null model that constraints relationships among all latent variables to zero, and Model 2 adds value proposition innovation and firm performance relationship to Model 1. Further, Model 3 links value creation and value capture innovation to firm performance, and Model 4 adds value proposition innovation to value creation and value capture innovation to obtain the fully loaded mediation model. We find that each subsequent model has a better model fit than the earlier one. Model 4 shows a reliable and the strongest model fit (Chi-square = 393.246, degrees of freedom = 184, p < 0.001; RMSEA = 0.064, CFI = 0.930, TLI = 0.920, IFI = 0.931). Furthermore, the results indicate that value creation and value capture innovation fully mediate the relationship between value proposition innovation and digital start-up performance (β = 0.282, p = 0.297 (not significant)). Fig. 2 shows the results of SEM analysis.

Summary of fit indices for SEM analyses

Note: DF = degree of freedom; RMSEA = root mean square error of approximation; CFI = comparative fit index; TLI = Tucker-Lewis index; IFI = incremental fit index.

Third, to confirm that the mediation model is the most suitable model, we tested two alternative moderation models. Theoretically, scholars might suspect that the three elements of business model innovation are complementary or even contradictory in contributing to firm performance. Thus, we conducted an additional group of regressions by treating value creation and value capture innovation as moderators rather than mediators. Model 4 in Table 6 reveals that the interaction between value proposition and value creation innovation is not significantly related to digital start-up performance (β = 0.024, p = 0.561). Similarly, Model 6 shows that the interaction between value proposition and value capture innovation is only marginally and negatively related to digital start-up performance (β = -0.100, p = 0.068). Overall, these results suggest that the moderation model does not fit well with our data.

Results of OLS regression analyses: Alternative moderation model

| Digital start-up performance | ||||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Founder education | - 0.043 | - 0.049 | - 0.041 | - 0.042 | - 0.053 | - 0.057 |

| Founder age | - 0.144* | - 0.144* | - 0.140* | - 0.140* | - 0.143* | - 0.143* |

| Firm age | - 0.169⁎⁎ | - 0.160⁎⁎ | - 0.162⁎⁎ | - 0.164⁎⁎ | - 0.154* | - 0.140* |

| Firm size | 0.376⁎⁎⁎ | 0.358⁎⁎⁎ | 0.370⁎⁎⁎ | 0.373⁎⁎⁎ | 0.351⁎⁎⁎ | 0.331⁎⁎⁎ |

| Demand uncertainty | 0.016 | - 0.046 | - 0.050* | - 0.052 | - 0.051 | - 0.046 |

| Technological uncertainty | 0.079 | 0.046⁎⁎⁎ | 0.004 | 0.004 | 0.052 | 0.062 |

| Institutional uncertainty | 0.047 | 0.051 | - 0.034 | 0.039 | 0.049 | 0.045 |

| Value proposition innovation | 0.165⁎⁎ | 0.045 | 0.042 | 0.093 | 0.078 | |

| Value creation innovation | 0.197⁎⁎ | 0.215⁎⁎ | ||||

| Value capture innovation | 0.123† | 0.144* | ||||

| Value proposition innovation * Value creation innovation | 0.024 (n.s.) | |||||

| Value proposition innovation * Value capture innovation | - 0.100† | |||||

| R2 | 0.188 | 0.213 | 0.233 | 0.234 | 0.223 | 0.232 |

| Adjusted R2 | 0.167 | 0.190 | 0.208 | 0.206 | 0.197 | 0.204 |

| R2 change | 0.188⁎⁎⁎ | 0.025⁎⁎ | 0.020⁎⁎ | 0.001 | 0.010† | 0.009† |

| Mean VIF | 1.112 | 1.124 | 1.309 | 1.348 | 1.233 | 1.235 |

| Maximum VIF | 1.228 | 1.231 | 1.953 | 2.280 | 1.645 | 1.672 |

| F value | 9.145⁎⁎⁎ | 9.323⁎⁎⁎ | 9.286* | 8.371⁎⁎⁎ | 8.753⁎⁎⁎ | 8.281⁎⁎⁎ |

Note: †p < 0.1

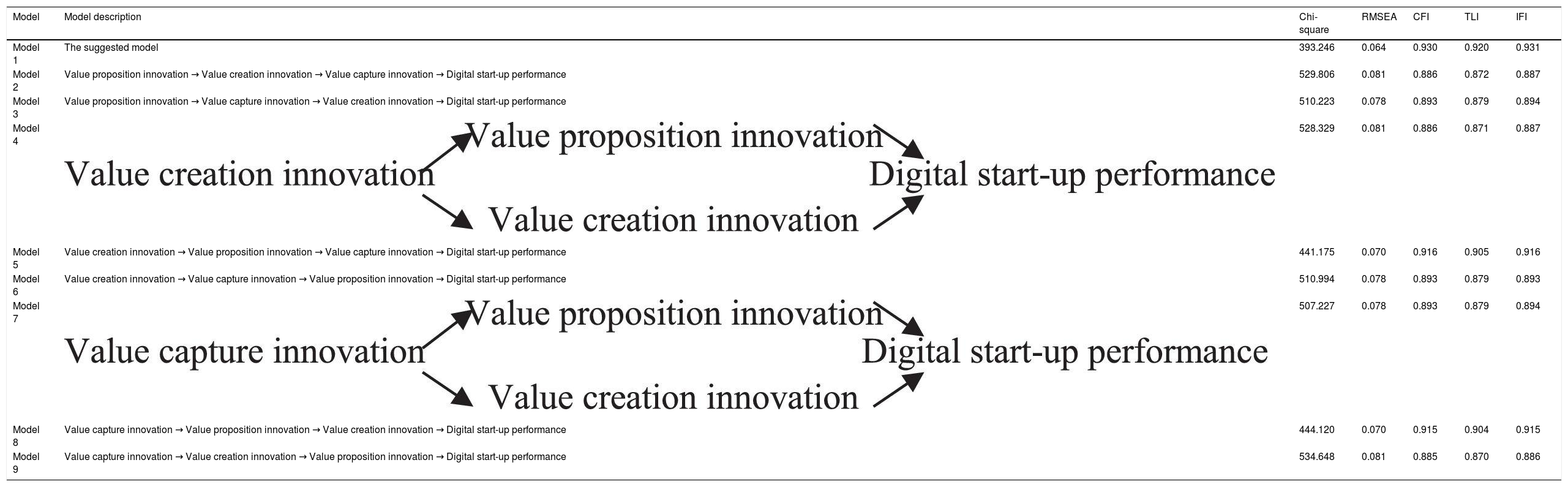

Finally, we tested eight alternative mediation models to ensure that our mediation model shows the right paths. Table 7 shows that the suggested model (Model 1) of this study has the best model fit when compared to all other models. Models 2 and 3 do not fit well with our data as they suggest that value creation and value capture innovation are more likely to be independent in translating value proposition innovation into digital start-up performance. Models 4, 5, 7, and 9, indicating that the impact mechanism is most likely initiated by value proposition innovation, show consistently worse model fits when compared to Model 1. Although not ideal, Models 6 and 8 also fit our data to an acceptable extent. These results suggest that there may be two alternative models—one triggered by value creation innovation and the other by value capture innovation. These findings have been further discussed in subsequent sections.

Summary of fit indices for alternative mediation models

Note: RMSEA = root mean square error of approximation; CFI = comparative fit index; TLI = Tucker-Lewis index; IFI = incremental fit index.

Drawing on the demand-side perspective, this study examines the impact of business model innovation on digital start-up performance in the context of China's digital economy. Our empirical results, based on a sample of digital start-ups, reveal that value proposition innovation is the starting point of the impact mechanism and is positively related to digital start-up performance. More importantly, the linkage between value proposition innovation and digital start-up performance is mediated by both value creation and value capture innovation.

ContributionsThis study makes two major contributions. First, as a response to Foss and Saebi (2017), this study opens the “black box” of business model innovation. The study examines the mechanism through which it contributes to business performance, thereby adding to the existing knowledge on business model innovation. The business model innovation architecture has been analyzed by disassembling it into three elements (value proposition, value creation, and value capture innovation) and exploring how the three elements are linked to digital start-up performance.

Our empirical findings demonstrate that value proposition innovation initiates firm performance, while value creation and value capture innovation serve as two key conduits in the mechanism. Further, our robustness checks show that the two conduits are most likely independent—value proposition innovation can be translated into digital start-up performance by conducting either value creation innovation or value capture innovation activities or both. Moreover, our findings suggest that value proposition innovation is more likely to trigger a start-up's value-creation activities in the digital environment, which aligns with the findings of Teece (2010, 2018) and Baden-Fuller and Haefliger (2013). Notably, our robustness tests indicate the possibilities of other impact mechanisms being initiated by value creation or value capture innovation of an organization. These findings demonstrate that value proposition innovation is more likely, but not always, the catalyst for start-up business model innovation.

Second, by addressing the relationship between business model innovation and performance from the demand side, this study injects fresh insights into cross-fertilization between business model and demand-side research. The demand-side perspective (Adner & Zemsky, 2006; Priem, 2007; Priem, Li, et al., 2012; Priem, Butler, et al., 2013) explains how a firm better creates value by understanding and meeting consumer demands (Ye et al., 2012; Schmidt et al., 2016; Manral & Harrigan, 2018; Priem et al., 2018; Rietveld, 2018). Similarly, business model scholars highlight the importance of value creation while emphasizing the role of consumers (Teece, 2010; Baden-Fuller & Haefliger, 2013; Priem et al., 2018). Scholars are now increasingly recognizing the importance of focusing on the demand side in business model research. While recent works have highlighted the role of freemium business models (Rietveld, 2018), heterogeneous consumer and demand complementarity in business model design (Guo et al., 2020), business model diversification (Sohl et al., 2020; Aversa et al., 2021), and adaption (Denoo et al., 2021), the role of consumers in business model innovation has been ignored.

This study provides a specific explanation of how consumers and demand factors contribute to the relationship between business model innovation and firm performance by using a demand-side perspective in the creation of theoretical models and hypotheses. Value proposition innovation refers to new offerings for consumers and emphasizes consumers’ role in creating products or services (Morris et al., 2005; Chesbrough, 2007; Johnson et al., 2008; Zott & Amit, 2010; Baden-Fuller & Haefliger, 2013; Chandler et al., 2014). Our results clearly suggest that the most important factor in the success of business model innovation in digital start-ups is value proposition innovation aimed at meeting consumer demand. It initiates the two impact paths and contributes to firm performance through value creation and value capture innovation. Additionally, this study shows that there are two paths to transform consumer value into firm performance. These two intermediary mechanisms indicate that demand and consumer factors may need to be combined with other factors (such as business processes) to contribute to firm performance.

Managerial implicationsThis study has important practical implications. First, the study emphasizes the need for digital start-ups to be business model innovators. In the process of business model innovation, start-ups could disassemble the overall business model into three components and innovate by redesigning value proposition, value creation, and value capture activities. Further, start-ups must pay attention to the sequence of the three types of innovation activities in the digital economy. Our findings suggest that a digital start-up would be better off conducting value proposition innovation activities considering its existing value offerings. The new value proposition can then be realized through value creation or value capture innovation. On the one hand, digital start-ups can create and capture more value by developing new capabilities, utilizing new technologies, attracting new partners, or building new processes. On the other hand, they can also do so by designing novel revenue models or new cost structures.

Second, heterogeneous consumer demand is the source of a firm's competitive advantage. We suggest that digital start-up entrepreneurs prioritize understanding consumer needs and address them by designing novel value propositions. Consequently, a series of value creation and value capture activities should be designed and conducted to meet the needs of consumers and improve consumers’ willingness-to-pay, thereby ensuring successful translation of business model innovation into business success.

Limitations and scope for future researchThis study has certain limitations that should be addressed in future research. First, generalization of our findings to other economies must be done cautiously as China, being one of the world's largest and most active digital economies, provided an ideal context for this study. Moreover, the features of the digital economy vary across countries. China's digital economy is largely market-driven, owing to its demographic dividend. Conversely, the digital economy of the United States, led by Silicon Valley, is more technology-driven. Furthermore, considering “Industry 4.0” as a national strategy, Germany's digital economy is famous for the digitization of manufacturing industries. Thus, it would be interesting for future studies to investigate how start-ups create and capture value in various digital economies. Second, our research design is cross-sectional, limiting our ability to identify causal relationships. A longitudinal design would help uncover the dynamic process of how digital start-ups reinvent their business models over time. Third, our measures are based on entrepreneurs’ views, which may or may not correspond to reality. Future studies must employ objective measures to validate our propositions. Furthermore, future research must also focus on developing objective measures for both business model and business model innovation.

This study is supported by the National Natural Science Foundation of China (72072175; 71872178; 71972084).

In this study, we generally use the term “consumer” instead of “customer.” The two notions are distinct in that a customer purchases goods, but a consumer uses them. In the digital economy, the consumer plays a greater role than the customer.

In 2014, China released the “Mass Entrepreneurship and Innovation” initiative to promote digital entrepreneurial activities. Meanwhile, with the development of 4G and mobile Internet technology, Chinese digital start-ups ushered in an outbreak period from 2013 to 2014, and numerous successful digital firms were founded during this period. However, the development of China's digital economy was overheated at that time, and the business models of digital start-ups were unstable and changed rapidly. By 2017, China's digital entrepreneurship had developed for several years and reached a relatively stable state. Therefore, it is representative to choose 2017 to conduct the questionnaire survey.