Entrepreneurs, opportunities, and entrepreneurial behaviors play an important role within the theory of entrepreneurship. However, we have limited knowledge about possible associations among these factors. Therefore, this study investigates these interactions. The study aims to identify the combinations of entrepreneurship dimensions, entrepreneur motivation, and opportunity perception that lead to an increase in a firm's performance. This study focuses on the small and medium-sized enterprise (SME) sector, wherein the entrepreneurial spirit is dominant. It is based on a sample of 61 SMEs operating in the Lesser Poland region of Poland. The factor's combinations are identified with a fuzzy-set qualitative comparative analysis (fsQCA). The analysis reveals previously unknown combinations of the investigated factors leading to performance in SMEs, with varying roles depending on accompanying factors. Specifically, this study reveals the following combinations that lead to a firm's performance: opportunity openness with proactiveness, heterogeneity of motivation with innovativeness, and risk-taking with proactiveness. These observations highlight the role of combining various conditions to improve performance. This study's findings contribute to the entrepreneurship and SME literature by explaining the role of different combinations of factors in determining a firm's performance (including the motivations and opportunity perception of the entrepreneur). It also provides meaningful implications for entrepreneurs and managers, indicating combinations of factors that lead to an increase in firm performance, the role of the diversification of opportunities, and the importance of motivation differentiation.

The sector of small and medium-sized enterprises (SMEs) is crucial to the economic development of a country. Specifically, SMEs significantly contribute to the employment and GDP of many countries worldwide (Ayyagari, Beck, & Demirguc-Kunt, 2007). In the European Union (EU), micro and SMEs account for 56.4% of the value added by the non-financial business sector (above 70% in Lithuania, Cyprus, Estonia, and Malta) and 66.6% of employment (above 80% in Cyprus and Greece) (European Commission, 2019a). In Poland, these values are 52.9 and 67.1%, respectively (European Commission, 2019b). The relationship between the development of SMEs, the economic development of a country, and the counteracting poverty was reported by Beck, Demirguc-Kunt, and Levine (2005). A substantial share of SMEs is characteristic of a well-developed economy; however, this is not a crucial condition of economic success (Beck, Demirguc-Kunt, & Maksimovic, 2005). Thus, the development of SMEs is one of the priorities of the EU; the SME sector is substantially supported, mainly to drive economic growth, boost employment, and counteract poverty in particular regions. An example of such support includes the Competitiveness and Innovation Framework Program (with a budget of €3.6 billion) or the Program for the Competitiveness of Enterprises and Small and Medium-sized Enterprises (with a budget of €2.3 billion) (European Commission, 2019c).

The SME sector has been extensively studied. It has been investigated from various perspectives, including through entrepreneurship theory (where the role of opportunities is highlighted) (Eckhardt & Shane, 2003) as well as the particular characteristics of entrepreneurial orientation (EO) such as risk-taking, innovativeness, and proactiveness (Craig, Pohjola, Kraus, & Jensen, 2014; Semrau, Ambos, & Kraus, 2016; Arzubiaga, Iturralde, Maseda, & Kotlar, 2018; Presutti & Odorici, 2019). The role of entrepreneur motivation is also explored, along with its impact on the decision to start a company and entrepreneurial success (Edelman, Brush, Manolova, & Greene, 2010; Olugbola, 2017). In general, entrepreneurs (along with their entrepreneurial motivation) and opportunities (along with the processes of their recognition and pursuit) are among the central elements of the theory of entrepreneurship (Stevenson & Jarillo, 1990). The main attitudes of entrepreneurial behaviors are risk-taking, innovativeness, and proactiveness (Miller, 1983; Covin & Slevin, 1989). Despite numerous studies in these fields, we have limited knowledge on possible associations among the dimensions of entrepreneurship, perceiving opportunities, and entrepreneurial motivation; therefore, this study focuses on investigating such interactions. Moreover, these interactions have not been fully examined within the SME sector. Previous studies report that EO and its dimensions can explain the performance of SMEs (e.g., Khedhaouria, Gurău, & Torrès, 2015). However, a positive relationship between EO and performance is not always present, suggesting that the relationship may be complicated (Andersen, 2010) and affected by other factors. Thus, this study aims at exploring the impact of the dimensions of entrepreneurship, perceiving opportunities, and entrepreneur motivation (separately and in coexistence) on the performance of SMEs. Specifically, this study intends to identify the combinations of these factors that lead to an increase in a firm's performance.

This study refers to the level of organization and focuses on entrepreneurial organizational configurations (Wales, Covin, & Monsen, 2020). The nature of this research is exploratory. As recommended by Wales et al. (2020), we employ a fuzzy-set qualitative comparative analysis (fsQCA) to investigate the organizational configurations in the context of the EO of an organization. The fsQCA method can significantly contribute to our research, not only by allowing us to consider the configurational patterns, equality, and variety of the conditions but also by giving an additional benefit of a mid-sized or small analysis research sample (Ragin, 2008). This is the case of our sample, which consists of 61 SMEs. By examining the sample, this study strives to contribute to the entrepreneurship and SME literature by explaining the role of different combinations of factors that determine a firm's performance (including the motivations and opportunity perception of an entrepreneur). This examination intends to deliver new insights into EO and its dimensions, as well as the association between entrepreneurship and firm performance. It also demonstrates the utilization of the fsQCA method, which supports the methodology development. Additionally, this study aims to provide implications for managers and entrepreneurs about combining different factors to increase firm performance and strengthen their impact on performance, the role of the diversification of opportunities, and the importance of motivation differentiation.

The remainder of the article is organized as follows. In the next section, we briefly review the literature and propose research problems. Subsequently, the sample and method are presented. Next, the results are presented and discussed. Finally, the limitations and conclusions are provided, along with our suggestions for practical implications and future research.

Theoretical frameworkEntrepreneurial orientationEntrepreneurship is perceived as one of the characteristics of an organization (Covin & Wales, 2019). Generally, entrepreneurship is understood as a pursuit of opportunities (Stevenson & Jarillo, 1990). One manifestation of entrepreneurship is as a “new entry” (Lumpkin & Dess, 1996) or as the creation of an organization (Gartner, 1989). Entrepreneurship also occurs in existing organizations through “formal or informal activities aimed at creating new business in established companies through product and process innovations and market developments” (Zahra, 1991, p. 261).

Entrepreneurship varies in organizations in terms of its degree and amount (Morris, 1998). The characteristics of an entrepreneurial firm are that it “engages in product-market innovation, undertakes somewhat risky ventures, and is first to come up with ‘proactive’ innovations, beating competitors to the punch” (Miller, 1983, p. 771). Accordingly, Covin and Slevin (1989) built a scale to measure an organization's EO. This scale consists of three dimensions: risk-taking, innovativeness, and proactiveness. Other scales include additional dimensions such as autonomy and competitive aggressiveness (Lumpkin & Dess, 1996) and inter-organizational cooperation (Kusa, Palacios-Marques, & Ribeiro-Navarrete, 2019). EO is interpreted as a firm's willingness to engage in (rather than its actual involvement in) entrepreneurial behavior (Kollmann & Stockmann, 2014). EO reflects “how a firm is organized in order to discover and exploit opportunities” (Wiklund & Shepherd, 2003, p. 1310); this is exhibited by “the policies and practices that provide a basis for entrepreneurial decisions and actions” (Rauch, Wiklund, Lumpkin, & Frese, 2009, p. 763).

Prior research findings indicate a significant impact of EO on a firm's performance (Saeed, Yousafzai, & Engelen, 2014) and the development of the company (Hughes & Morgan, 2007; Chaston & Sadler-Smith, 2012). Numerous studies confirm that EO influences the performance of SMEs (e.g., Stam & Elfring, 2008; Alshanty & Emeagwali, 2019; Monteiro, Soares, & Rua, 2019). This study joins the stream of research focusing on the EO-firm performance relationship (Covin & Wales, 2019). In addition to EO dimensions, it includes entrepreneur motivation and opportunity openness, as well as their interrelated impact on firm performance.

One of the EO dimensions is risk-taking. Risk is identified with threats and/or opportunities, which are the positive or negative consequences of various events and are accompanied by uncertainty (Islam, Tedford, & Haemmerle, 2008). Risk accompanies business activity, and enterprises are exposed to different types of risk (including financial, operational, and strategic) (Casualty Actuarial Society, 2003). These stem from various forces (e.g., markets, financial assets or liabilities, economic shifts, and changes in society) in politics and the environment (Casualty Actuarial Society, 2003; Giorgino & Travaglini, 2008; Mutezo, 2013).

A high level of risk is a characteristic of entrepreneurial activity. In the EO context, risk-taking relates to the uncertainty and riskiness of self-employment (Lumpkin & Dess, 1996). In an organization, risk-taking refers to “the degree to which managers are willing to make large and risky resource commitments – i.e., those which have a reasonable chance of costly failures” (Miller & Friesen, 1978, p. 923). In EO scales, risk-taking is measured through a firm's proclivity to engage in risky projects and manager preferences for bold versus cautious acts to achieve the firm's objectives. It can also be measured by asking managers about the extent to which they follow tried-and-true paths or tend to support only those projects in which the expected returns are certain (Lumpkin & Dess, 1996).

According to the entrepreneurship approach, risk acceptance and risk-taking readiness are conditions of entrepreneurial activity. This is visible in the SME context (Kreiser, Marino, Kuratko, & Weaver, 2013; Schachtebeck, Groenewald, & Nieuwenhuizen, 2019). SMEs have scant resources; therefore, they are highly vulnerable to risk (Blanc-Alquier & Lagasse-Tignol, 2006). There is an ongoing discussion on how to adopt risk management practices in SMEs (Trossmann & Baumeister, 2004; Ferreira de Araújo Lima, Crema, & Verbano, 2020), as the tools used by large firms are usually too expensive or complex for SMEs (Pereira, Tenera, Bispo, & Wemans, 2015). As a dimension of EO, risk-taking (along with other EO dimensions) enables the pursuit of entrepreneurial opportunities and determines the performance of entrepreneurial initiatives; thus, we propose the following:

P1: The presence of risk-taking in an organization leads to performance.

Another dimension of EO is innovativeness. Innovativeness affects the development of individual companies and a country's economy (Chen, 2017). Regardless of the level of a country's development, governments focus on innovation to accelerate growth and competitiveness (Acs, Audretsch, Lehmann, & Licht, 2016; Chen, Yin, & Mei, 2018; Piñeiro-Chousa, López-Cabarcos, Romero-Castro, & Pérez-Pico, 2020). On the enterprise level, innovativeness is perceived as a source of competitive advantage, firm performance (Woodward, 2009; Liao & Rice, 2010), and market value (Feeny & Rogers, 2003). The positive impact of innovativeness on firm performance can be affected by additional factors, such as social capital (Rass, Dumbach, Danzinger, Bullinger, & Moeslein, 2013) or market engagement (Liao & Rice, 2010). Innovation can also mediate the impact of other factors (e.g., environmental regulations) on performance (Ramanathan, Black, Nath, & Muyldermans, 2010). Innovativeness is exhibited by the intensity of R&D, the acquisition of machinery and equipment, the introduction of technological innovations, and the employment of people with PhD, master's, and technical degrees, along with the possession of staff training or external knowledge (Liao & Rice, 2010; de Oliveira, Basso, Kimura, & Sobreiro, 2018). Innovativeness is a significant component of EO, as it reflects the important means by which firms pursue new opportunities (Lumpkin & Dess, 1996). The impact of innovativeness on performance is ambiguous; some studies report a positive impact (e.g., Bierly & Chakrabarti, 1996; Rangus & Slavec, 2017), while others report a negative one (e.g., Kandybin, 2009; Artz, Norman, Hatfield, & Cardinal, 2010), or even a lack of association (Santos, Basso, Kimura, & Kayo, 2014). The impact of innovations can be mitigated by the costs and risks of innovative activities (Simpson, Siguaw, & Enz, 2006), especially in the case of market innovation in international markets (Silva, Styles, & Lages, 2017) or disruptive innovations (Christensen, Raynor, & McDonald, 2015). Moreover, innovations can have no positive impact on financial gains in the short term (de Oliveira et al., 2018). The impact of innovations on SME performance is also reported in the literature (e.g., Soto-Acosta, Popa, & Palacios-Marques, 2016). Thus, we posit the following:

P2: The presence of innovativeness in an organization leads to performance.

The next dimension of EO is proactiveness. From the EO perspective, proactiveness refers to those processes aimed at anticipating and acting on future needs by “seeking new opportunities which may or may not be related to the present line of operations, introduction of new products and brands ahead of competition, strategically eliminating operations which are in the mature or declining stages of life cycle” (Venkatraman, 1989, p. 949). This may be crucial for entrepreneurial activities as it represents a forward-looking perspective. Lumpkin and Dess (1996, p. 147) proposed that “the conceptual opposite of proactiveness is passiveness” (which refers to “indifference or the inability to seize opportunities or lead in a marketplace”). Proactiveness may be estimated with measures related to a firm's tendency to lead (rather than follow) in the development of new procedures and technologies, as well as the introduction of new products or services (Lumpkin & Dess, 1996). Proactiveness plays an important role within SMEs (Tang, Tang, & Katz, 2014); specifically, proactiveness can explain almost all the EO dimensions’ total effect on firm performance in low-tech SMEs (Lomberg, Urbig, Stöckmann, Marino, & Dickson, 2017). Thus, we posit the following:

P3: The presence of proactiveness in an organization leads to performance.

In addition to the dimensions of EO, we investigate the role of an entrepreneur's motivations and opportunity perception in enhancing a firm's performance.

Entrepreneurial motivationAn individual's motivations are decisive to the emergence of entrepreneurial behavior (Stevenson & Jarillo, 1990) and creating new businesses (Barba-Sánchez & Atienza-Sahuquillo, 2017). Stevenson and Jarillo (1990, p. 24) posit that “by definition, nobody will pursue an opportunity if he/she does not want to, and we have seen argued that the very exceptional nature of pursuing opportunities without adequate resources makes it very difficult for top management to ‘force’ that pursuit through the typical managerial mechanisms by prespecifying task goals.” Holland and Garrett (2015) argue that motivation is as important as the ability and aptitude to create a new business. Carsrud and Brännback (2011) observed the existence of a relationship between motives or reasons for starting companies and entrepreneurial success.

The significance of the role of motivation is reflected in the implementation of the expectancy theory (also known as the rational intention theory) (Barba-Sánchez & Atienza-Sahuquillo, 2017), the planned behavior theory, and the motivation-opportunity-ability concept in entrepreneurship studies (Hui-Chen, Kuen-Hung, & Chen-Yi, 2014).

Vroom (1964) identifies motivation with an individual's expectancy that a certain effort will lead to the intended outcome. In the entrepreneurship context, an entrepreneur's motivation is expressed by their willingness to gain financial success and family autonomy and find work (Heilman & Chen, 2003), the desire for independence or overcoming a challenge (Carter & Cannon, 1991), the need for achievement, passion (Shane, Locke, & Collins, 2003), or the readiness to invest time, energy, and money on their business plan (Zanakis, Renko, & Bullough, 2012). Entrepreneurs’ motivations to persist with existing businesses are determined by the outcome valences (Holland, 2011). Mahto and McDowell (2018) associate an individual's entrepreneurial motivation with an identity related to entrepreneurial exposure in their social environment. The personal motivation of an entrepreneur is linked to exploiting international opportunities more closely than the demands of the competitive environment (Santos-Álvarez & García-Merino, 2016). There are some differences between men's and women's motivations to engage in entrepreneurial activities (Mas-Tur, Ribeiro-Soriano, & Roig-Tierno, 2015). For example, internal character traits (such as the desire for independence) have a greater influence among women, while men tend to be motivated by external factors such as spotting an opportunity in a market (Hisrich & Brush, 1984; Stanger, 1990; Huarng, Mas-Tur, & Yu, 2012; Ramadani, Dana, Gerguri, & Tasaminova, 2013). Additionally, motivating factors at the start-up stage differ from those during the operation of a firm (Bartha, Gubik, & Bereczk, 2019).

This study aims to explore the impact of an entrepreneur's motivation on firm performance. In the literature, motivational force is proposed to measure motivation. Motivational force represents the amount of effort a person will invest into achieving a specific goal (Lawler & Suttle, 1973). Contrary to motivational force, we focus on the differentiation of motivations. We posit that entrepreneurs act in a highly volatile environment offering varied opportunities that can satisfy entrepreneurial expectations. An entrepreneur can follow different motivations; the more these motivations lead to actions, the more active an entrepreneur. Furthermore, the differentiation of factors that motivate entrepreneurs can positively influence entrepreneurial activity. Thus, we propose the following:

P4: The heterogeneity of an entrepreneur's motivations leads to firm performance.

Opportunities can trigger entrepreneurial activity. Many entrepreneurs are recognized as opportunity-driven (contrary to necessity-driven). According to the Global Entrepreneurship Monitor (GEM) methodology, necessity-driven entrepreneurs get involved in entrepreneurship because they have no better options for work. However, entrepreneurs driven by opportunity get involved for becoming independent or increasing their income rather than just maintaining it (Bosma & Kelley, 2018). Following this observation related to the role of opportunities, we next analyze entrepreneurial opportunities in the context of EO and firm performance.

Entrepreneurial opportunitiesOpportunities play an important role in every entrepreneurial activity; Morris (1998, p. 8) states that entrepreneurship “starts with an opportunity.” Consequently, entrepreneurship is defined as pursuing opportunities (Stevenson & Jarillo, 1990) and resources (McGrath & MacMillan, 2000). Opportunity is defined as a “future situation which is deemed desirable and feasible” (Stevenson & Jarillo, 1990, p. 23) “…in which new goods, services, raw materials, and organizing methods can be introduced and sold at greater than their cost of production” (Casson, 1982, as cited in Shane & Venkataraman, 2000, p. 220). Opportunities are rooted in the external environment (Morris, 1998), and they are objective phenomena that are not known to all parties at all times; however, the recognition of entrepreneurial opportunities is a subjective process (Shane & Venkataraman, 2000). Eckhardt and Shane (2003) point to the significance of incomplete information in the process of opportunity identification.

Opportunities are different in their nature. D'Souza (2010) distinguishes innovative and imitative opportunities. Opportunities can be sourced in new markets and technologies (Teece, 1998) and can result from innovative activity (Holcombe, 2003). Stevenson and Jarillo (1990, p. 23) argue that “opportunities vary among individuals and for individuals over time because individuals have different desires and they perceive themselves with different capabilities.” Moreover, desires can vary with the current position and future expectations, while capabilities vary depending upon innate skills, training, and the competitive environment. Factors that influence the process of opportunity recognition include entrepreneurial alertness, information asymmetry and prior knowledge, social networks, personality traits (including optimism, self-efficacy, and creativity), and the type of opportunity itself (Ardichvili, Cardozo, & Ray, 2003). Chandler and Hanks (1994) highlight the ability to recognize and envision opportunities. An individual's entrepreneurial success is determined by opportunity recognition (alongside opportunity exploitation, innovation, and value creation) (Leutner, Ahmetoglu, Akhtar, & Chamorro-Premuzic, 2014). Opportunity identification competencies are positively associated with entrepreneurial employee activities (expressed as to how often employees were involved in innovation-related activities) (Baggen, Lans, Biemans, Kampen, & Mulder, 2016). Prandelli, Pasquini, and Verona (2016) posit that opportunity identification can be enhanced by an entrepreneur's ability to take the perspective of the user in a market and prior knowledge of the market.

Potential opportunities can be tracked and transformed into suitable and profitable decisions by sense-making processes (Teece, 1998). Sense-making involves “turning circumstances into a situation that is comprehended explicitly in words and that serves as a springboard into action” (Weick, Sutcliffe, & Obstfeld, 2005, p. 409). In organizations, sense-making comprises cognitive strategies for interpreting reality (Baez & Abolafia, 2002). Sense-making that lends coherence to decisions affects firm performance (Lounsbury & Glynn, 2001; Holt & Macpherson, 2010).

Sense-making is relevant to the awareness of substantive interruptions (Baez & Abolafia, 2002) and opportunity recognition, which requires skills in identifying the trends and patterns of business changes (Teece, 2007) and discerning the resources and capabilities that are needed to exploit business opportunities (Barreto, 2010). Sensing capabilities also include detecting fundamental shifts in one's industry, observing and anticipating technological trends, and recognizing new opportunities to serve clients (Rezazadeh & Nobari, 2018). Among the factors that require recognition are new information, new technology, shifts in governmental policies, or changes in funding (Baez & Abolafia, 2002).

Along with opportunity exploitation, opportunity search and discovery are crucial elements of the entrepreneurial process (Shook, Priem, & McGee, 2003). The role of opportunities in entrepreneurial action is highlighted in the GEM research, wherein “perceived opportunities” constitute one of the indicators of entrepreneurship. This reflects the percentage of the population aged 18–64 years who see good opportunities to start a firm in the area where they live (Bosma & Kelley, 2018). Belda and Cabrer-Borrás (2018) report that opportunity entrepreneurs are more successful (in terms of survival probability) than necessity entrepreneurs. Entrepreneurial activity driven by opportunities is affected by institutional factors such as the number of procedures to start a new business, private credit coverage, and access to communication (Urbano, Audretsch, Aparicio, & Noguera, 2019). The impact of these factors is especially significant in transition economies, wherein market and regulation failures are common constraints for entrepreneurial initiatives. Furthermore, the development of an entrepreneurial ecosystem can encourage one to become involved in entrepreneurial activity. However, the lack of other options to enter the labor market (e.g., during an economic crisis) can also be a motivation to start a new business (Mühlböck, Warmuth, Holienka, & Kittel, 2018). Among the opportunities that can increase a firm's performance are new resources available in the market (including financial resources). In countries where subsidies play a crucial role in a firm's development (e.g., in EU countries), the availability of this category of resources can be perceived as an opportunity.

Building on the above observations, we assume the importance of an entrepreneur's openness to different types of opportunities. Furthermore, considering the significant role of opportunities in entrepreneurial activity, we posit that an entrepreneur's openness toward opportunities (exhibited by the entrepreneur's ability to concurrently perceive various opportunities) positively influences the firm's performance. The positive relationship between opportunity recognition and performance was empirically established in SMEs (Guo, Tang, Su, & Katz, 2017). Thus, we propose the following:

P5: An entrepreneur's openness toward opportunities leads to firm performance.

Thus far, we have considered five specific factors that can separately impact a firm's performance. However, we can expect that any interactions among them can result in strengthening or weakening their impact on firm performance. Previous studies reported that these factors impact the performance in different ways (Putniņš & Sauka, 2019), both positively (e.g., Arshad, Rasli, Arshad, & Zain, 2014; Mason, Floreani, Miani, Beltrame, & Cappelletto, 2015) and negatively (e.g., Avlonitis & Salavou, 2007; Hughes & Morgan, 2007). Their impact on performance can be affected by other factors; for example, individualism (Kreiser et al., 2013). Olugbola (2017) identified a relationship between motivation and opportunity identification in the context of entrepreneurial readiness. Thus, we will look for combinations of the abovementioned factors that lead to a firm's performance (assuming the following):

P6: The combination of EO dimensions with both/either entrepreneur motivation and/or opportunity openness leads to firm performance.

Research methodologySample and data collectionThis study aims to explore the impact of the dimensions of EO along with the perception of opportunities and entrepreneurial motivation on the performance of SMEs. Among the 50 countries examined in the GEM, the highest level of opportunity perception was observed in Poland (87.3% of adults in Poland experience good opportunities to start a business) (Bosma, Hill, Ionescu-Somers, Kelley, Levie, & Tarnawa, 2020, p. 29). Thus, our study focuses on entrepreneurs who operate in Poland. Our sample comprises SMEs operating in the Lesser Poland region (located in southern Poland, with Krakow serving as the region's capital city). These enterprises were classified based on their number of employees (between 10 and 249—following the EU definition of SMEs) regardless of the values of their assets and income (which resulted from the specification of the data source). In our sample, 57% of the enterprises employ between 10 and 49 people, and 43% of them employ between 50 and 249 people. The enterprises are located in both urban (39%) and rural areas (61%) and represent different industries (39% manufacturing and 61% service). The data were collected using the PAPI method from March 2019 through January 2020. A total of 77 questionnaires were returned, and 61 were properly completed and then analyzed.

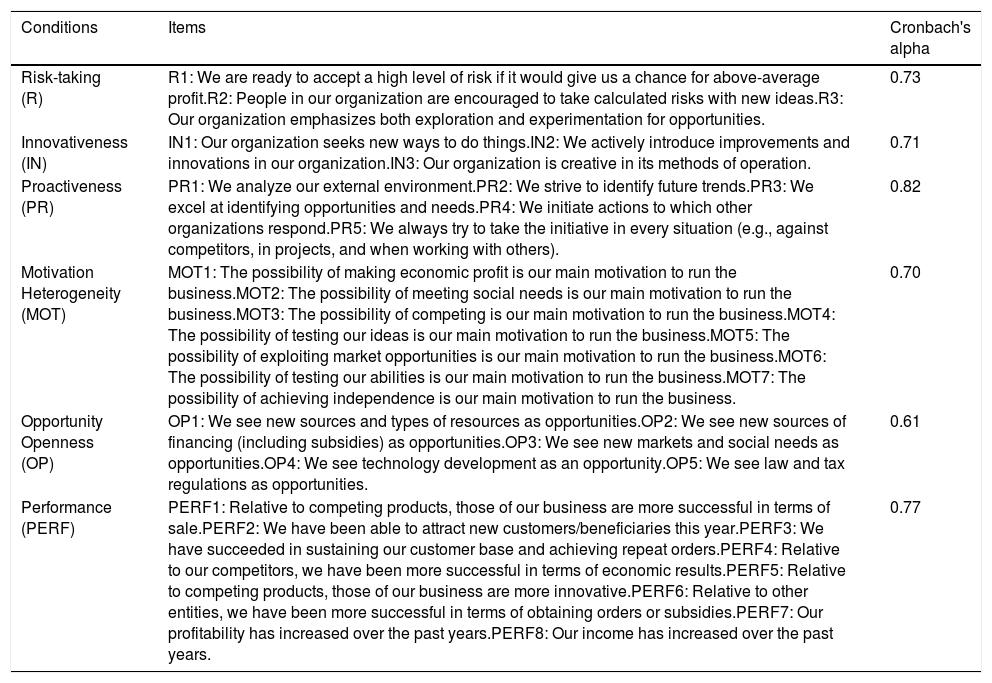

Variable definitionOur variables are the dimensions of EO (risk-taking, innovativeness, and proactiveness), heterogeneity of entrepreneurial motivation, openness toward opportunities, and firm performance. All variables are indices; each is calculated based on several questions. The EO dimensions and firm performance were measured with a questionnaire based on the one proposed by Hughes and Morgan (2007); some items were adjusted to the SME context. The “firm performance” index contains items related to product and market performance as well as economic performance. Motivation heterogeneity and opportunity openness required us to create indexes. Thus, we propose a “motivation heterogeneity index”—which reflects the assumption that an entrepreneur is motivated by several different motivators simultaneously—and an “opportunity openness index”—which reflects the perception of several different opportunities and taking advantage of them simultaneously. Based on a review of the literature, we included seven potential motivations in our motivation heterogeneity index (related to the possibilities of making an economic profit, meeting social needs, competing, testing new ideas, exploiting market opportunities, testing an entrepreneur's abilities, and achieving independence) and five items in the opportunity openness index (new sources and types of resources, new sources of financing [including subsidies], new markets and social needs, technology development, and law and tax regulations). All the items are presented in Table 1. The overall value of each index is counted as an average of the items included in the index. In total, our questionnaire comprised 31 items measuring the six constructs. Each item was assessed by the respondents on a seven-point scale.

Internal reliability.

As our variables comprise several indicators, they were analyzed with Cronbach's alpha coefficients to verify their reliability; the analysis results are presented in Table 1. Cronbach's alpha coefficients for risk-taking, innovativeness, proactiveness, heterogeneity of entrepreneurial motivation, and firm performance were all above 0.7, demonstrating satisfactory strengths of association regarding its sub-items. This indicates that the variables were internally consistent and that they measured the same construct. The Cronbach's alpha coefficient for openness toward opportunities is lower (0.61), which may also be acceptable in the case of exploratory studies and research in the social sciences, according to Hair, Celsi, Money, Samouel, and Page (2011). As the examination of the opportunity-openness coefficient is a novel attempt, its level of consistency is acceptable.

The methodTo verify which of the analyzed factors affect a company's success (performance) and in which configuration, we employed the fsQCA method. The foundations of this method were developed by Ragin (1987). This method belongs to the group of configurational comparative methods and was created as an alternative to the still-existing methods based on regression analysis. In its assumptions, QCA aims at a systematic comparison of cases to identify the complex causation relationships between the conditions and their effects (Schneider & Wagemann, 2012). The analysis is based on determining and calculating each conditional combination appearing in the data set and then applying the principles of logical inference to determine which of the descriptive inferences or implications apply to the analyzed data.

Over time, however, limitations in this method have been observed. These limitations were because the analysis could only be conducted on dichotomous variables (hence, the method was initially called the Crisp-Set QCA). Nevertheless, these limitations were eliminated by Ragin (2008), who suggested the use of the Fuzzy Set theory and Boolean theory in his work. Thus, he initiated the new method—fsQCA. Compared with the traditional QCA method, the modified fsQCA enables us to use variable continuous types or the interval scale. These variabilities must be calibrated before being converted into fuzzy categories or variabilities. Schneider and Wagemann (2012) also made a significant contribution to the development of this method.

The fsQCA method belongs to the data analysis techniques whose goal is to determine the logical conclusions resulting from a data set. It enables the study of complex causational relationships. By building different alternative configurations with this technique, it is possible to determine which of the selected conditions (e.g., risk-taking, innovation, proactivity, opportunity perception, and motivation [separately or combined]) leads to the achievement of an outcome (firm performance) and which conditions are necessary or sufficient to achieve the outcome needed.

Many studies highlight the significant advantage of this method over classical regression analysis methods (e.g., Fiss, 2011; Schneider & Wagemann, 2012). Its advantages are in the following areas (Ragin, 2008):

- •

asymmetric relationships (inter alia interrelations of dependent and independent variables);

- •

equifinality (a principle that says that the same results may be reached regardless of the sources or paths used);

- •

complexity of causes (combinations of causes and determinants leading to the outcome).

There has also been a discussion on the number of cases that can be investigated using this method. Notably, although fsQCA was created to analyze only a few cases (e.g., 10–100), it has been successfully used in many studies to analyze more than 100 cases (e.g., Palacios-Marques, Roig-Dobon, & Comeig, 2017). As Woodside (2012) points out, there are no mathematical restrictions that would prevent this methodology from being used for numerous cases. Nonetheless, in such cases, using this method can cause difficulties in appropriately analyzing such a large number of cases, which can lead to mistakes in the results and, thus, inappropriate conclusions. However, there are some indications regarding the relationship between the number of conditions adopted and the analyzed cases. The number of cases should be at least four times greater than that of conditions, and the number of conditions should be kept low (four to eight) (Emmenegger, Kvist, & Skaaning, 2013).

Recently, this method has become increasingly popular in many scientific fields, and research shows that the number of publications using QCA methods has increased significantly (Roig-Tierno, Gonzalez-Cruz, & Llopis-Martinez, 2017). This method can be found in the literature of numerous scientific disciplines and analyses, including entrepreneurship (Kraus, Ribeiro-Soriano, & Schüssler, 2018), innovation performance (Palacios-Marques et al., 2017), knowledge management, risk-taking tolerance, business model innovation (Ziemianczyk & Krakowiak-Bal, 2017; Hock-Doepgen, Clauss, Kraus, & Cheng, 2020), and business networking (Ricciardi, Zardini, & Rossignoli, 2018).

From the technical side, we can distinguish three basic stages of operation in the QCA analysis that allow for the selection of the appropriate conditions and combinations of variabilities. These are as follows:

- a)

Calibration (data transformation)

- b)

Building a truth table

- c)

Logical minimization

However, according to Ragin (1994), the right selection of cases and the theoretical knowledge of the analyzed cases, as well as the interpretation of the obtained results, are equally important in this analysis.

CalibrationIn the first stage of the analysis, all variabilities are converted into sets. The sets represent the degree of belonging of a given variability to a specific category. The sets can take any value from 0 to 1 (Woodside & Zhang, 2013). The variabilities in a set can be calibrated unequivocally (i.e., the variability belonging to a category is determined in binary form: “0” for non-membership and “1” for membership) or fuzzy values (variabilities take different degrees of belonging to a range of 0–1) (Skarmeas, Leonidou, & Saridakis, 2014). The analysis of fuzzy sets usually uses three limit values for calibration: 0.05 as a non-belonging threshold, 0.50 as a turning point of maximum ambiguity, and 0.95 as the threshold of fully belonging to the set (Ragin, 2000;2008). It is the researcher's discretion to determine the procedure for assigning the fuzzy values of the belonging cases and the adoption of the threshold values, although the procedure must be clear for verification and replication by others (Ragin, 2000). In the present analysis, the calibration procedure was conducted using the direct method (Ragin, 2008). Regarding our considerations, the selection of the cut-off points was based on percentiles (Beynon, Jones, & Pickernell, 2016; Dul, 2016). In particular, the 95th percentile as the full membership threshold, the 50th percentile as the turning point of maximum ambiguity, and the 5th percentile as the non-membership threshold were adopted in our study.

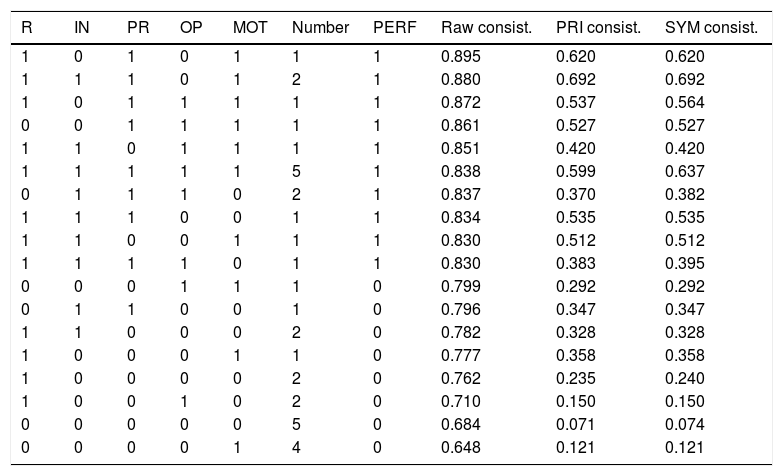

Building the truth tableThe basic purpose of creating a truth table is to show which combinations of conditions in the analyzed cases help us gain the expected result. The truth table has several lines equal to 2n, where n is the number of conditions assumed in the analysis. The whole table presents all the possible combinations of conditions and the result (Ragin, 2008). However, the number of cases belonging to different combinations may vary (Fiss, 2011). In our consideration, the number of all possible combinations was 25. Using the fsQCA 3.0 software (Ragin & Sean, 2016), a truth table was created for the analyzed cases and conditions (see Table 2). Only those combinations that were reflected in at least one of the cases were included. As can be seen from the 32 combinations, 18 were reflected in at least one of the analyzed cases.

Truth table.

Note: R: Risk-taking; IN: Innovativeness; PR: Proactiveness; OP: Opportunity Openness; MOT: Motivation Heterogeneity; PERF: Performance; PRI consist.: Proportional reduction in consistency; SYM consist.: Symmetric consistency.

Next, the number of rows in the truth table should be reduced to determine the appropriate causal combinations leading to the outcome. The reduction criterion is based on two quantities. The first is the minimum number of cases we deem necessary to consider the appropriate combination relevant. This minimum number of cases is usually related to the total number of cases we analyze. In our consideration, the combinations that led to success in at least one case were considered due to the relatively small number of cases. The second factor for deciding whether to remove combinations from the truth table is the quantity known as consistency. Consistency means the extent to which a combination of causal conditions is reliably associated with the outcome (Crilly, 2011). The level of consistency is within a range of 0 to 1 (where a value of 1 indicates total consistency). At this stage, it is assumed that the combinations for which the consistency is less than 0.8 are revealed in the fsQCA analysis (Schneider & Wagemann, 2012). After removing from the truth table the combinations that do not meet the above conditions, the third stage of the analysis can start.

Logical minimizationAs previously mentioned, the fsQCA method uses Boolean algebra and algorithms that allow for the logical reduction of numerous random conditions. The result is a set of configurations related to the result (effect) (Fiss, 2011). The algorithm for building the truth table generates several probable solutions; opposing analysis is used to analyze them (Ragin & Fiss, 2008). Owing to this, the main components and marginal connections between the causes and results can be distinguished (Ragin, 2008). The main connections relate to the underlying causes that have a strong causal relationship to the result (effect); the marginal connections are superfluous or exchangeable because they show a weaker causal relationship to the result (Fiss, 2011).

Three solutions can be adopted in fsQCA: complex, intermediate, and parsimonious (Rihoux & Ragin, 2009). The obtained results of the fsQCA analysis are evaluated in relation to the consistency and coverage of the empirical data in the model. Adequate consistency is an initial condition for the testing of the harvest. The consistency measure can be seen as a correlation coefficient (Woodside, 2013). A consistency threshold of 0.75–0.95 should be maintained (Ragin, 2008). However, the data coverage indicator (which demonstrates the empirical significance of the solution) indicates to what extent the result (effect) is explained by the adopted solutions. The model is considered sufficiently explainable if coverage is set at 0.25–0.65 (Rihoux & Ragin, 2009).

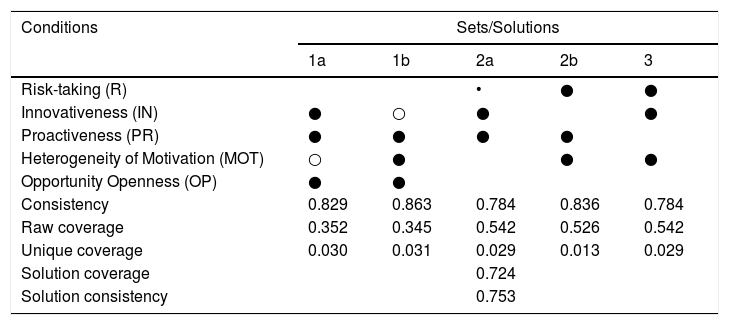

Using the fsQCA 3.0 application, as a result of logical minimization and connection simplifications, we received three main solutions that were obtained based on a parsimonious solution (see Table 4). Considering the intermediate solution, two of them may indicate two slightly different paths to success (Ragin, 2008). Analyzing the matching parameters (i.e., the consistency and degree of coverage for the obtained solutions), it can be concluded that the assumptions made regarding their values are met in all cases. The consistency in all solutions and for the entire solution is greater than 0.75, while the degree of coverage also falls within the accepted range.

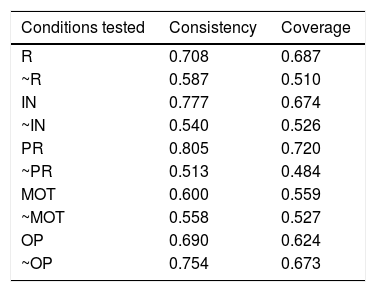

Analysis of necessary conditionsUsually, before proceeding to the next stage of fsQCA (i.e., building a truth table), we examine whether any of the causal conditions could be considered necessary. In an fsQCA analysis, the interpretation of the results is based on consistency. A condition is considered necessary when the value of the consistency is greater than 0.9 (Schneider & Wagemann, 2012). Table 3 shows the relationships of the necessity of the five conditions (R, IN, PR, OP, MOT) and the outcome (PERF). As shown, none of the five conditions is necessary for success; from this analysis, we can conclude that none of the analyzed conditions will occur in all the obtained combinations of conditions that lead to the outcome.

Analysis of necessary conditions.

| Conditions tested | Consistency | Coverage |

|---|---|---|

| R | 0.708 | 0.687 |

| ~R | 0.587 | 0.510 |

| IN | 0.777 | 0.674 |

| ~IN | 0.540 | 0.526 |

| PR | 0.805 | 0.720 |

| ~PR | 0.513 | 0.484 |

| MOT | 0.600 | 0.559 |

| ~MOT | 0.558 | 0.527 |

| OP | 0.690 | 0.624 |

| ~OP | 0.754 | 0.673 |

Note: R: Risk-taking; IN: Innovativeness; PR: Proactiveness; MOT: Motivation Heterogeneity; OP: Opportunity Openness.

The results of our analysis (presented in Table 4) show that each condition (i.e., risk-taking, innovativeness, proactiveness, opportunity openness, and heterogeneity of motivation) belongs to at least one combination (solution) that leads to an increase in a firm's performance. However, they are met in various combinations. This general observation is in line with Kreiser et al. (2013), who observed that different relationships exist among risk-taking, innovativeness, proactiveness, and SME performance. Our findings suggest that different relationships can result from accompanying factors.

Analysis of sufficient conditions.

Note: • = core causal condition (present); ● = contributing causal condition (present);

○ = contributing causal condition (absent); Blank spaces indicate a “don't care” condition (Fiss, 2011);

Consistency cut-off: 0.8; Frequency cut-off: 1.00; Vector of expected directions (1,1,1,1,1) (Ragin & Sean, 2016).

Solutions 1a and 1b indicate that the combination of proactiveness and opportunity openness leads to a firm's increased performance. These two core conditions (i.e., proactiveness and opportunity openness) can be supported by the presence of innovativeness and absence of motivation's heterogeneity (Solution 1a) or the presence of motivation's heterogeneity and absence of innovativeness (Solution 1b). This confirms P3 (the presence of proactiveness in an organization leads to performance) and P5 (an entrepreneur's openness toward opportunities leads to firm performance). This observation is especially valuable for SMEs, as they are more adaptive to changes in the environment (and emerging opportunities); the impact of opportunity openness can be stronger when accompanied by proactiveness.

Solutions 2a and 2b indicate that risk-taking and proactiveness together can lead to an increase in a firm's performance. These solutions support P1 (the presence of risk-taking in an organization leads to performance) and P3 (the presence of proactiveness in an organization leads to performance). Solution 2a (where risk-taking and proactiveness are accompanied by innovativeness) confirms the role of EO and is in line with the numerous studies that report a positive correlation between EO and firm performance (e.g., Hughes & Morgan, 2007; Chaston & Sadler-Smith, 2012). Solution 2b additionally indicates the role of motivation's heterogeneity. In this solution, motivation's heterogeneity (as a contributing causal condition), along with risk-taking and proactiveness, leads to increased performance. Together with the previous solutions (1a and 1b), proactiveness was visible in four of the five solutions. This indicates that proactiveness is an important factor that leads to an increase in SME performance. This finding confirms the observations of Tang et al. (2014) and Lomberg et al. (2017) on the significant role of proactiveness within SMEs.

Solution 3 unveils the role of motivation's heterogeneity, which together with innovativeness leads to an increase in firm performance. Motivation's heterogeneity and innovativeness can be strengthened by the presence of risk-taking (which is a contributing causal condition in this solution). Therefore, it supports P2 (the presence of innovativeness in an organization leads to performance) and P4 (the heterogeneity of an entrepreneur's motivations leads to a firm's performance). However, the innovativeness and heterogeneity of an entrepreneur's motivations are only present as core causal conditions in one of the five solutions; based on the overall results, P2 and P5 are only partly supported.

The obtained solutions support P6 in the sense that the combinations of EO dimensions with entrepreneur motivation and/or opportunity openness lead to firm performance (however, we should note the limited role of innovativeness and heterogeneity of an entrepreneur's motivations). Consequently, the inclusion of these two conditions (i.e., entrepreneur motivation and opportunity openness) can help explain the impact of EO dimensions on firm performance. To summarize, all the propositions raised are accepted, although to various degrees. P1 (pertaining to risk-taking), P5 (pertaining to openness toward opportunities), and P3 (pertaining to proactiveness, which appears in most of the combinations) are accepted, while P2 (regarding innovativeness) and P4 (regarding the heterogeneity of an entrepreneur's motivations) are accepted with constraints, as they are only present in individual solutions. Consequently, P6 is also accepted with constraints (sourced in the role of innovativeness and the heterogeneity of an entrepreneur's motivations).

The positive role of innovativeness in increasing firm performance is in line with numerous research studies that have reported a positive relationship between innovativeness and firm performance (e.g., Bierly & Chakrabarti, 1996; Liao & Rice, 2010; Rangus & Slavec, 2017). However, these studies suggest the expectation that innovativeness would be more commonly present as a core causal condition that leads to an increase in a firm's performance. Among the solutions obtained in our analysis, innovativeness is also present in Solutions 1a and 2a (but only as a contributing causal condition). Moreover, the absence of innovativeness can contribute to increased performance (according to Solution 1b). The latter finding is in line with studies that indicate the negative impact of innovativeness on firm performance (Kandybin, 2009; Artz et al., 2010). This can be associated with the costs and risks of innovative activities (Simpson et al., 2006), for example, in the case of market innovation in international markets (Silva et al., 2017) or disruptive innovations (Christensen et al., 2015). Innovativeness is not present among those conditions that lead to increasing a firm's performance (observed in Solution 2b), which is in line with those studies that indicate a lack of association between innovativeness and performance at the firm level (Santos et al., 2014). Thus, our results exhibit an ambiguous role for innovativeness in increasing firm performance. This role requires further examination.

This study's findings contribute to the entrepreneurship theory (especially including the EO literature). Specifically, our analysis reveals new combinations of determinants of a firm's performance, in line with the previous observation that the components of EO contribute to performance but in different ways (Lumpkin & Dess, 1996; Putniņš & Sauka, 2019). Moreover, it discloses motivation's heterogeneity and opportunity openness as factors that can impact a firm's performance (alone or in combination with dimensions of EO). In general, this study confirms the role of motivations and opportunities in entrepreneurial activities. Additionally, it introduces new measures related to entrepreneurial opportunities (the opportunity openness index) and motivations (the motivation heterogeneity index). This study also contributes to innovation research by indicating those combinations of factors wherein innovativeness can positively or negatively impact a firm's performance (or have no impact at all).

Another important contribution of this study concerns SMEs. The factor combinations that can lead to the success of SMEs are identified in this study. The existence of such combinations confirms the results of numerous studies indicating the positive impact of EO on the performance of SMEs (e.g., Arshad et al., 2014; Khedhaouria et al., 2015; Mason et al., 2015). In parallel, our results somehow confirm the ambiguity of the impact of EO on firm performance in some dimensions—a relationship between EO or its dimensions and performance can be negative as well (e.g., Avlonitis & Salavou, 2007; Hughes & Morgan, 2007). Our study indicates that the role of a particular factor is determined by accompanying ones, both for EO dimensions and other variables (here, motivation heterogeneity and opportunity openness). This research answers the recommendation to explore the factors that enable SMEs to capture recognized opportunities and then achieve performance (Guo et al., 2017). Our study confirms that opportunity recognition can be critical for SME performance; moreover, it shows that opportunity openness needs to be accompanied by proactiveness to lead to SME performance.

Finally, the study contributes to the fsQCA methodology by expanding its utilization to new conditions (i.e., motivation heterogeneity and opportunity openness).

ConclusionsThis study identifies several combinations of factors leading to performance in SMEs. Among these factors are risk-taking, innovativeness, proactiveness, opportunity openness, and heterogeneity of motivation. However, their roles vary depending on many accompanying factors. An especially valuable observation is related to the role of opportunity openness and heterogeneity of motivation. The analysis reveals that opportunity openness (in combination with proactiveness) and heterogeneity of motivation (in combination with innovativeness) can lead to performance. This observation contributes to our understanding of the association between entrepreneurship and firm performance. Nevertheless, the roles of openness for opportunities and the heterogeneity of entrepreneurial motivation need to be further explored. Considering our findings, this is a promising field for future research. This study highlights the role of combining the determinants of firm performance and confirms the usefulness of fsQCA in entrepreneurship research.

This research presents important implications for entrepreneurs. It indicates the need for searching for different opportunities (e.g., customer needs, market conditions, resources, technology, legal regulations) and following various motivations (e.g., gaining financial profit, idea verification, opportunity exploitation, competition), as these can increase a firm's performance. The results confirm the need to develop every dimension of EO and show that their impact can be strengthened by other factors (opportunity openness and motivation heterogeneity). In particular, the results suggest that a proactive approach requires the support of an open posture toward different opportunities. The role of entrepreneurs’ and managers’ motivations (which can support their risk-taking) is highlighted, as well as innovative and proactive behaviors; thus, motivation is worthy of development. Regarding the development of a firm's innovativeness, entrepreneurs need to consider other factors that can strengthen innovativeness's impact on performance (it was heterogeneity of motivation in our sample). Moreover, entrepreneurs should consider developing other abilities instead of innovativeness, as innovativeness in many configurations does not lead to increases in performance (which is visible among the SMEs in our sample). This observation is especially valuable for SMEs, as they face limited access to the resources necessary for innovative activity. Consequently, focusing on other abilities can be more effective. Instead of focusing on one particular factor, the right combinations of factors determining performance are critical. Thus, each entrepreneur should build a portfolio of abilities; however, the effectiveness of these abilities depends on the accompanying determinants. Searching for optimal combinations of abilities is a strategic challenge for all enterprises (including SMEs).

This study has various limitations, the first of which is sourced in the employed method. Although fsQCA has proven to be a useful methodology for analyzing the configurations that lead to performance, it has some limitations. Specifically, we have to consider the role of the justification of the calibrations as well as indicating the cut-off points—their modification may result in obtaining different findings. Here, we focus on the presence model. The absence model was omitted; however, it would make our analysis more comprehensive (as in the study of Vázquez-Rodríguez, Romero-Castro, & Pérez-Pico, 2020). The analysis of an absence model would deliver valuable data about the configuration of factors that lead to the absence of performance. Such an in-depth analysis is recommended as a subject of future studies. Future research on associations among our variables should consider the use of other methods that allow estimation of the strengths of the impact of each variable on performance (as well as the strength of other interferences). Moreover, the implementation of a method that enables the identification of moderating and mediating factors is recommended. Concerning the use of the fsQCA methodology (especially in the entrepreneurship field), further research involving combinations of new factors is recommended. Finally, employing methods that enable us to statistically assess the differences between different groups of enterprises and identify the different ways in which the examined variables affect the performance of smaller companies as compared to large ones is recommended.

The second limitation is our use of measures that are weak in terms of reliability. This is the case in the opportunity openness index, which is a newly introduced index that requires further development.

Other limitations of the study are its relatively small sample size, the structure of the sample (only SMEs), the sample selection (based only on the number of employees), and the use of enterprises in only one region of Poland, which limits the generalization of the findings. In response to the size of the sample, we employed fsQCA (which is believed to identify existing combinations of conditions despite a small number of entities in a sample). Nevertheless, future research should use larger and more diverse samples to be able to contribute more accurate conclusions. Such a sample would enable us to investigate the configurations of those factors that lead to performance, depending on a company's size, age, or industry.

With its set of variables, this study has confirmed the role of each variable in achieving success. However, the results indicate different combinations in which particular factors are more or less important; moreover, the absence of a particular factor is suggested in some combinations. Thus, it is recommended to explore more deeply the association between performance determinants along with their combinations and their impact on performance. This study does not investigate the possible moderating impact of the tested variables; therefore, an examination of such an impact is also recommended in any forthcoming study. Our study indicates that an examination of entrepreneur motivation and opportunity perception in the context of EO is a promising line of potential future research.

Funding: This work was financed from the statutory funds for the maintenance and development of the research capacity of the Faculty of Management of AGH University of Science and Technology in Krakow, Poland.

Rafał Kusa is an Assistant Professor in the Faculty of Management at the AGH University of Science and Technology in Krakow (Poland), with a PhD in Economics from the Faculty of Economics and International Relations at Krakow University of Economics (Poland) and a Degree in Management and Marketing from the Faculty of Management at Krakow University of Economics (Poland). He is a member of the local board of the Scientific Society for Management and Organization (Poland). His research interests include organizational management, organizational entrepreneurship, social entrepreneurship, non-profit organizations, and tourist management.

Joanna Duda is an Associate Professor in the Faculty of Management at the AGH University of Science and Technology in Krakow (Poland), with a Ph.D. DSc. in Economics and Master Degree in Management from the Faculty of Management at the AGH University of Science and Technology in Krakow (Poland). She is a member of the local board of the Scientific Society for Management and Organization (Poland) and associations of small and medium-sized enterprises "Krak-Business”. Her research interests are related to problems of small and medium-sized enterprises. She conducts her empirical studies on entrepreneurship, organizational management, internationalization of small business, non-profit management and development barriers as well as financing strategies of innovation activities of small and medium-sized enterprises in the context of globalization processes in Poland, Germany and Finland. She is an author of more than 130 scientific publications, including several monographs.

Marcin Suder is an Assistant Professor in the Faculty of Management at the AGH University of Science and Technology in Krakow (Poland), with a PhD in Economics from the Faculty of Management at the AGH University of Science and Technology in Krakow (Poland) and Master Degree in Mathematics from Jagiellonian University in Krakow (Poland). His research interests include the application of econometrics method in economic and organizational studies.