Our paper develops theoretical and methodological principles of grounding assessing the dominant trends in intersectoral academic research related linked to the main tools and instruments of funding innovations in business companies. We employ the analytical approach as well as the two-stage bibliometric analysis of scientific articles published in the past 80 years and indexed in Scopus abstract and citation database which has been selected for its clarity, coverage, as well as its scope. In addition, we employ the outcomes of analytical analysis conducted using with the help of Google Trends tool. This approach described above allowed allows us to compare the peak periods for the changing the search queries of main concepts on this problem with the periods of the most significant events in the innovation sphere and financial policy. Moreover, we apply the VOSViewer software for identifying the dominant trends in intersectoral research related to funding innovation of business companies, as well as for finding out which instruments for the implementation of the financial policy implementation are more relevant for academics and scholars.

Our results from the first stage demonstrate that the researchers’ focus on funding innovation of business companies and financial regulation was targeted on such topics as tax, monetary, budget, and investment instruments. Additionally, our results from the second stage additionally helped us to determine the dominant trends in intersectoral research connected to each group of the identified instruments. Thence, our findings contributed to the clustering of the theory of funding innovation of business companies by structure and main instruments. These results can be useful for by the multidisciplinary scientists, entrepreneurs, investors, innovators, as well as other relevant stakeholders and practitioners in making their everyday decisions on funding innovations in business companies.

Nowadays, as the competitive pressure in domestic and foreign markets increases, innovations are becoming the important drivers of sustainable development of business companies (see Bilan, Vasilyeva, Kryklii & Shilimbetova, 2019; Kasych & Vochozka, 2017; Khoshnava et al., 2019; Lu et al., 2019; Strielkowski, Tarkhanova, Baburina & Streimikis, 2021). In general terms, innovations not only strengthen the competitiveness of companies, but can also be an important driver of sustainability through ever more efficient and resource-efficient solutions (Domenech & Bahn-Walkowiak, 2019; Hao, Zhang & Wei, 2022; Seclen-Luna, Moya-Fernández & Pereira, 2021). A good example of this are the renewable energy companies that are characterized by the advanced technologies and the respect for the environment. They are playing an increasingly important role in achieving economic development by reducing the burden on the environment (Baleta, Mikulčić, Klemeš, Urbaniec & Duić, 2019; Hao, Wu, Wu & Ren, 2020). In effect, more and more companies are viewing sustainability as a means to seek new market advantages and to enhance public image and reputation through pollution reduction and new communications (Chang & Slaubaugh, 2017; Mukonza & Swarts, 2020). A growing number of consumers willing to pay extra charges for organic products also support opportunities for environmentally sustainable small business initiatives (Chin, Jiang, Mufidah, Persada & Noer, 2018; Nelson, Partelow, Stäbler, Graci & Fujitani, 2021). The “greener” companies base their activities on a sustainability standard, minimize the environmental impact of their activities, and strive to use renewable energy sources (Asiaei, Bontis, Alizadeh & Yaghoubi, 2022; Dell'Anna, 2021).

In order to achieve sustainable growth, today's business companies need to meet the changing needs and expectations of sustainability-conscious clients, address the pressing sustainability challenges, and comply with the United Nations Sustainable Development Goals (SDGs) (Ahmed, Mubarik & Shahbaz, 2021; Saeed & Kersten, 2020). They have to carry on transforming resources for direction and innovation, models, products, and markets. Most recently, we have seen a wave of progressive and profit-oriented companies and entrepreneurs using innovative models to capture sustainable business opportunities and drive long-term growth (David-West, Iheanachor & Umukoro, 2020; Tengeh & Gahapa Talom, 2020). A new way of thinking about how companies can implement core business strategies while generating greater environmental and socioeconomic benefits becomes a must for any business that wants to be truly sustainable (Stubbs, 2019; Vo-Thanh et al., 2021).

In this paper, we combine the experiences of these companies with previous research findings to illustrate what sustainable-focused innovation looks like and to describe how companies can foster entrepreneurial mindsets and behaviors that can drive such efforts. The scientific significance of this study is to integrate research in the fields of innovation. Sustainability-driven innovation takes many forms: from developing new or improved products or services to creating new processes and business models that benefit the environment or society as a whole. Innovation is absolutely necessary for the new world of sustainability, helping to differentiate between "leaders" and "followers" (Hughes et al., 2021; Pham, Pham & Dang, 2021). Many organizations employ sustainability not only as a marketing tool to promote their products, but as a powerful driver of change in their innovation process (Borowski, 2021; Nguyen-Anh et al., 2022). Over the past few decades, production and consumption patterns have changed significantly, resulting in social and environmental changes, and placing demands and constraints on companies. Therefore, competitiveness is becoming increasingly relevant to the implementation of innovation management, including possible persistent. With regard to this, sustainability can spur innovation by introducing new design constraints that determine how key resources are used in products and processes. Operational innovation is critical to building sustainable supply chains that improve energy efficiency and reducing companies' reliance on fossil fuels. Hence, organizations with broader and more strategic sustainability programs would not only drive innovation in large enterprise organizations, including the transformation of key processes, but would also influence what customers want and how suppliers operate.

Furthermore, innovations are both interdependent and complementary with today's challenges, in particular the necessity to develop one's business in accordance with the principles of the green economy and the corporate social responsibility on its way to profitability (Myroshnychenko, Makarenko, Smolennikov & Buriak, 2019; Sukhonos & Makarenko, 2017). They help entrepreneurs to become the leaders in fast-changing business environment. However, investments in research and development (R&D) by business sector are often limited (Situm, Plastun, Makarenko, Serpeninova & Sorrentino, 2021), especially due to financial performance, negative consequences of economic and financial crises (Vasylieva, Harust, Vinnichenko & Vysochyna, 2018, 2020), COVID-19 pandemic, and other events, either predictable ones or the “Black Swans” just like the current coronavirus Infection.

Therefore, in order to bring many of the amazing ideas and concepts from the drawing board to the commercial market, it is necessary to add sufficient funds and capital to the compan’'s cash flow. Hence, the financial policy in the sphere of business innovation activity remains a very relevant issue and often constitutes an important research topic pursued by the authors in many countries. Therefore, it appears very interesting to assess the magnitude of the research on these topics in the scientific literature for the last several decades and to analyze the main topics and trends stemming from this literature.

The main scientific value-added of this paper is in developing scientific and methodological principles aimed for determining the dominant trends in cross-sectoral research related to financing innovation of business companies and its main instruments based on the analytical analysis and two-stage bibliometric analysis of scientific papers published in the last 80 years in journals, books, as well as conference proceeding indexed in the Elsevier's Scopus abstract and citation database. Thence, the paper employs the scientometric analysis related to the issues of management and business economies and based on the plethora of scientific data and substantial research output. All of these constitutes its value-added and its contribution to the field of the research in management and business economics.

Our paper is structured as follows: Section 2 presents the literature review. Section 3 briefly outlines the research methods and methodology. Section 4 provides the overview of main results. Section 5 concludes by outlaying the main conclusions and implications.

Literature reviewThere are many aspects of structural and functional clustering and trends identification in the evolution of innovation theory in various spheres of economic activity that have been covered in an array of research papers and reports. Rossetto, de Carvalho, Bernardes and Borini (2017) studied the state of international scientific production in terms of general and innovative opportunities over the past 25 years using bibliometric methods. The authors proved the absorptive capacity of topics of scientific publications and innovations. Merigó, Cancino, Coronado and Urbano (2016) conducted analysis of the countries with regard to the level of academic research in the innovation sphere on the basis of the results of bibliometric analysis. The countries in question included the top countries in innovation research (academic aspect) from 1989 to 2013, with the most influential countries determined and key development trends developed.

In addition, D'Auria, Tregua, Russo Spena and Bifulco (2016) studied the essence of innovation systems, innovation networks, and innovation ecosystems, identified common and different elements, conducting a bibliometric analysis within this context. The actual issue of information, social and economic security and innovations in this sphere was shown by V. Novikov (2021), using qualitative and quantitative bibliometric analysis. Additionally, V. Novikov (2021) or Su, Obrenovic, Du, Godinic and Khudaykulov (2022) described the interconnection between educational, economic, and financial transformations based on VOSviewer tool. Lehenchuk, Valinkevych, Vyhivska and Khomenko (2020), Paskevicius and Keliuotyte-Staniuleniene (2018), and Andrade, Neto and Sandro (2020) investigated financial technologies innovations and its impact. Visualization of theory development in the context of economic and sociological research and, in particular, financing affordable housing was presented by Ianchuk (2021). Most recently, Didenko and Sidelnyk (2021) determined some vectors of society's readiness for innovations and modern challenges using VOSviewer software and tools of the Scopus database.

Furthermore, Kovács, Van Looy and Cassiman (2015) made a literature review of a ten-year period of research in open innovation on the basis of citations analysis to visualize links between publications on this issue and to identify specific groups of thematically connected publications. The authors determined four networks of related research streams and seven thematic clusters, focusing on existing opportunities to deploy a wider range of topics to drive dynamism, impact and disseminate open innovation. Similarly, the field of open innovation was structured into two interconnected networks on the basis of bibliometric analysis by Remneland Wikhamn and Wikhamn (2013) who discussed the correlation of open innovation theory with innovation management, innovation competitions, crowdsourcing, and intermediary innovation. Shkarlet, Kholiavko and Dubyna (2019) analyzed the relationship between innovation, educational, and research determinants of information economy. Petroye, Lyulyov, Lytvynchuk, Paida and Pakhomov (2020) paid attention on the issue of innovations, and information security and its effects on country's image.

Additionally, Broström and Karlsson (2017) justified the development of academic efforts to determine the relationship at the firm level between R&D investment and productivity. The influence of the 28 most cited publications in this area of research was studied by the authors through a combination of bibliometric methods and analysis of the citation function during the 2000s. Escobar-Sierra, Lara-Valencia and Valencia-DeLara (2017) proposed a model of corporate innovation management based on corporate entrepreneurship, taking into account bibliometric analysis over the past 15 years using VOSviewer software. The analysis of tendencies in the scientific literature in the context of banking business model and strategic management was conducted by Kryvych and Goncharenko (2020). Lazorenko, Saher and Jasnikowski (2021) studied the problem of innovations in the context of online business and e-commerce and determined marketing and management determinants due to bibliometric, trend, and comparative content analysis. Some organizational and digital innovations for business were described by Kolosok and Myroshnychenko (2015), Skrynnyk (2021), or Taraniuk, Qiu and Taraniuk (2021). Some aspects of innovations’ impact on business efficiency were presented by Malyarets, Koibichuk, Zhukov and Grynko (2021), Taraniuk, Kobyzskyi and Thomson (2018). In addition, Goncharenko (2020) focused on the key patterns (information management, digital technologies, e-commerce) during the bibliometric analysis of research in the sphere of leadership and business innovation. Fila, Levicky, Mura, Maros and Korenkova (2020) studied innovations for business management. The research clusters of the integration of digitalization, education, business leadership in the field of national security were also studied by V. Novikov (2021) who followed the evolution of scientific research. Terziev & Zolkover (2020) investigated the research tendencies on the business and shadow economy using Scopus, Web of Science, and VOSviewer tools.

In the field of medical innovation and financial policy, VOSviewer tools were used by De-Miguel-Molina, Cunningham and Palop (2016). The authors analyzed funding schemes and their development in terms of several topics of medical research, taking into account transnational funding, the evolution of subject headings in the field of medicine, patterns of funding, and co-financing. Moreover, bibliometric trends and prospects in the field of medical innovation became the basis of the study by Leydesdorff, Rotolo and Rafols (2012). Scientists built visualization maps and made a bibliometric analysis of the medical innovations’ development. Tiutiunyk, Humenna and Flaumer (2021) studied the impact of the COVID-19 pandemic on the functioning of the business sector through bibliometric analysis, including a cluster of innovations.

Another interesting example comes from the United Kingdom where Innovate UK, a governmental innovations agency (established in 2004 and becoming an independent body in 2007) plays a vital role in funding innovative companies in the early stages of idea development and commercial success assisted by the British Business Bank which is an important part of the UK innovative financial system that continues to work hard to facilitate investment in innovative companies (Mina, Di Minin, Martelli, Testa & Santoleri, 2021; Sergeeva & Zanello, 2018; UKRI, 2022). The cooperation helps to simplify work for innovative companies by developing an online finance and innovation hub between Innovate UK and British Business Bank. As a part of this symbiosis, regional funds are provided by specialized fund managers with experience in investing in innovation and collectively represent 40% of global R&D spending from all sources, including corporate and government (Department for Business, Energy & Industrial Strategy, 2021). All of that helps to make major improvements to the data collection process to get a more accurate and complete picture of innovation spending.

Yet, one more example is the research on the public health sector which has been highly focused on technological innovation, with a focus on products and processes (Clapp, 2021; Kohli & Melville, 2019). The social dimension of innovation is seen in the public sector as a means of ensuring the efficiency and effectiveness of new products or processes (Cannavale, Esempio Tammaro, Leone & Schiavone, 2022). Therefore, innovation can be seen as a novelty or invention that can, in its turn, strongly influence health policy (Niang, Dupéré, Alami & Gagnon, 2021). This is due to the well-known fact that from a purely scientific and economic perspective, innovation is a case when a perceived new idea, knowledge, technology, product, policy, process or practice is designed and developed in the R&D department and then naturally by executing and using the system (Peykani, Namazi & Mohammadi, 2022). In general terms, the innovation process takes place in an ecosystem in which companies, public research institutions, higher education institutions, financial institutions, charities, government agencies, and many other actors communicate with each other nationally and internationally (Cai, Ma & Chen, 2020; Ma, Liu, Huang & Li, 2019; Naqshbandi & Jasimuddin, 2022). In other words, this is where skills, knowledge, as well as ideas interact at all levels. Inter-sectoral collaboration, seen as productive, is becoming a major source of innovation, and its importance is growing, innovation processes are increasingly organized according to distributed knowledge bases across economic sectors (Bennat & Sternberg, 2020; Vivona, Demircioglu & Audretsch, 2022). Research conducted by universities and other publicly funded institutions is also an important part of the innovation process, from basic to applied and translational research. Such innovation strategies focus on how the relevant stakeholders support private sector innovation by leveraging the entire business ecosystem (Ilgenstein, 2022; Marques, Morgan, Healy & Vallance, 2019).

The real problem in the future, exacerbated by the technological and organizational innovation of some low-tech companies, may be that the majors and courses offered by the public education system will no longer match the actual needs of the industry and its modern times (Gao, Hu, Liu & Zhang, 2021). The gap between widespread and increasingly rapid technological innovation and organizational change processes must be bridged through short-term in-company training (Haaman & Basten, 2019). Market pressure is forcing business companies to continuously optimize their processes and innovate their services and products. The described innovation model shows that the main innovation processes are localized not in high-tech companies, but, on the contrary, between companies from the different sectors (Lam, Nguyen, Le & Tran, 2021). In particular, one can found collaborative innovation processes in many industries involving agents both of high-tech and low-tech companies. Business-specific factors include high-quality executive leadership skills, active introduction of ICT (information and communication technologies), as well as a solid level of entrepreneurship (Sunday & Vera, 2018). When global investment in R&D is targeted at commercially viable targets, it greatly benefits developed and developing countries alike which, in turn, offers a viable market for technological innovation. Indeed, it is becoming a wide-spread practice that today's pharmaceutical and biotech companies worldwide often apply a cost-based pricing strategy in which valuable innovations are analyzed through a cost-benefit lens (Festa, Kolte, Carli & Rossi, 2021).

However, one can agree with us that despite significant scientific achievements, the dominant trends in intersectoral research related to funding innovation of business companies and its main instruments are not investigated enough. All of the above raises the timeliness and novelty of our research approaches and methods and the value-added of this paper both for the academics and the practitioners.

Research methods and methodologyThe research methods employed in this paper include statistical, comparative, bibliometric, analytical, structural, and graphical analysis made on the basis of Excel 2010 software, the Scopus database tools, VOSViewer software (version v.1.6.15), and Google trends.

Our selection of the Scopus database (e.g. over Web of Science or, for example, PubMed databases) has been predetermined by the its functionality (since it offers a broader list of more up-to-date sources as well as the independent sources system) and its user-friendliness (it offers better analytics and paper and citation tracking system). Another advantage of using the data from Scopus database is due to the fact that it covers more sources from the fields of humanities and social sciences (thence, it includes the papers and published materials in the domains of innovations and knowledge).

An analytical analysis of the change in search queries of key concepts in terms of the theory of funding innovation of business companies and the evolution of its main instruments was made using Google Trends tool (Szatylowicz, 2021). It allowed to compare the peak periods for the frequency of search requests of key concepts on this issue with the periods of the most significant changes in the environment of innovation and financial system.

A two-stage bibliometric analysis of scientific articles presented for more than eighty years in the Scopus scientometric database was made using the VOSViewer software (using its latest available version v.1.6.15) as well as the tools offered by the Elsevier's abstract and citation Scopus database in order to identify the dominant trends in intersectoral research connected with the theory of funding innovation, as well as to find out which instruments for the financial policy implementation in investigated sphere attract the most attention of scholars (Perianes-Rodriguez, Waltman & Van Eck, 2016; Waltman & Van Eck, 2010, 2011; Waltman & Van Eck, 2020). Therefore, VOSviewer tool that allows to make visualizations of bibliometric networks is often used with Scopus data and is matchable with them for producing meaningful results. The clustering of the theory of funding innovation of business companies was carried out by structure and main instruments.

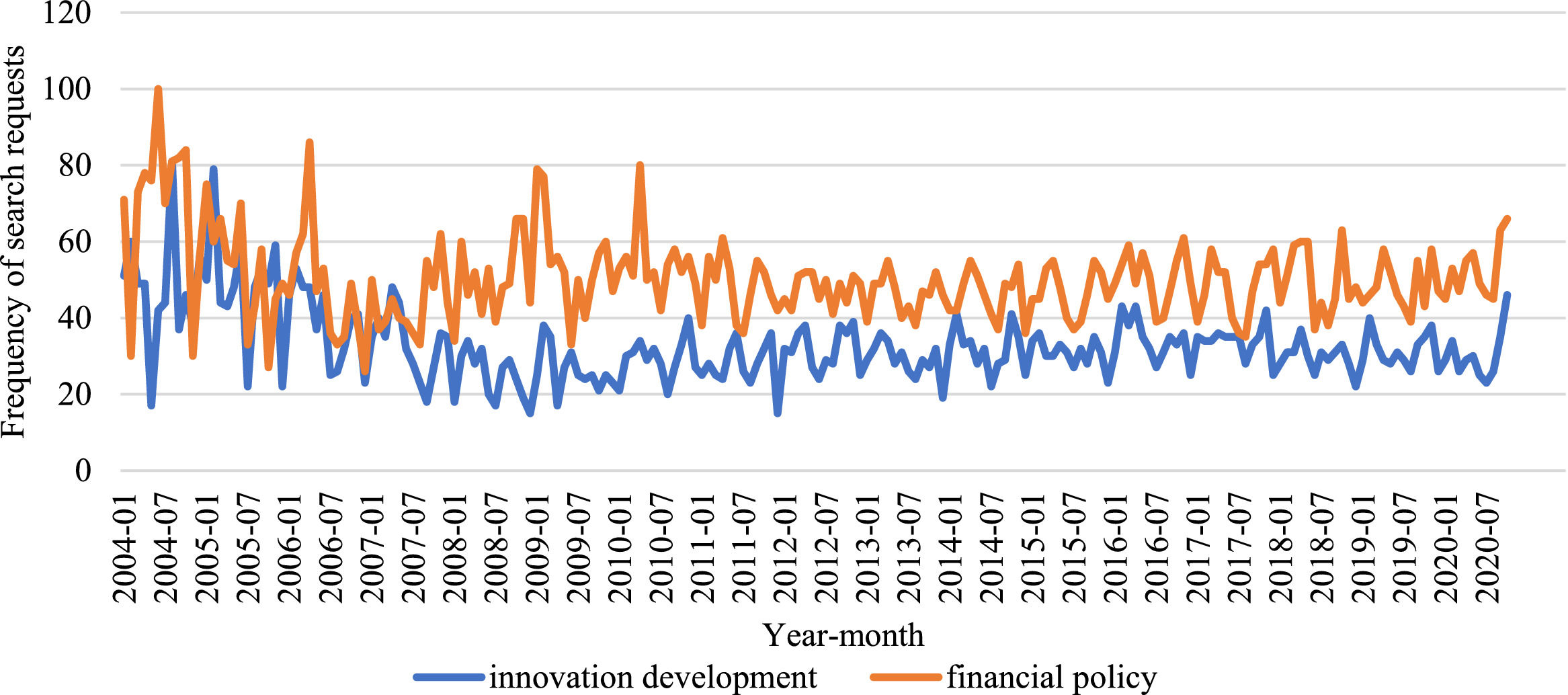

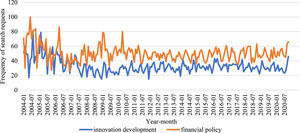

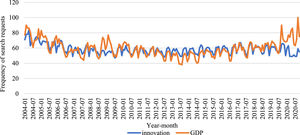

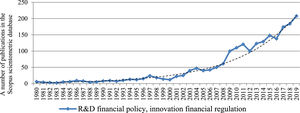

Results and discussionDue to an analytical analysis on the basis of Google Trends toolkit, the change of search queries of main concepts in the research was determined to compare its peak periods with the periods of the most significant changes in innovation, regulatory environment and financial system, as well as time periods of radical changes connected with the emergence and introduction of innovative goods and services in the market. In particular, there is a similar dynamic of the change of search requests of such key concepts as “innovation development” and “financial policy” with a slightly different number of search requests of them (see Fig. 1).

At the same time, during the global financial and economic crisis of 2007–2008 and after the crisis, the frequency of search requests of the concept of “innovation development” decreased with the growth of search requests on the issue of “financial policy”. That is explained by the negative financial consequences of crises and intensification of search ways to overcome them. After 2010, the trends were almost the same, because of the role of financial aspect in the global innovation development, the close relationship between both spheres of economic relations, development of alternative sources of funding, the place of innovation in financial development, improvement of knowledge economy, nanotechnology, intangible production, and services, digitalization, expectations of the Fourth Industrial Revolution.

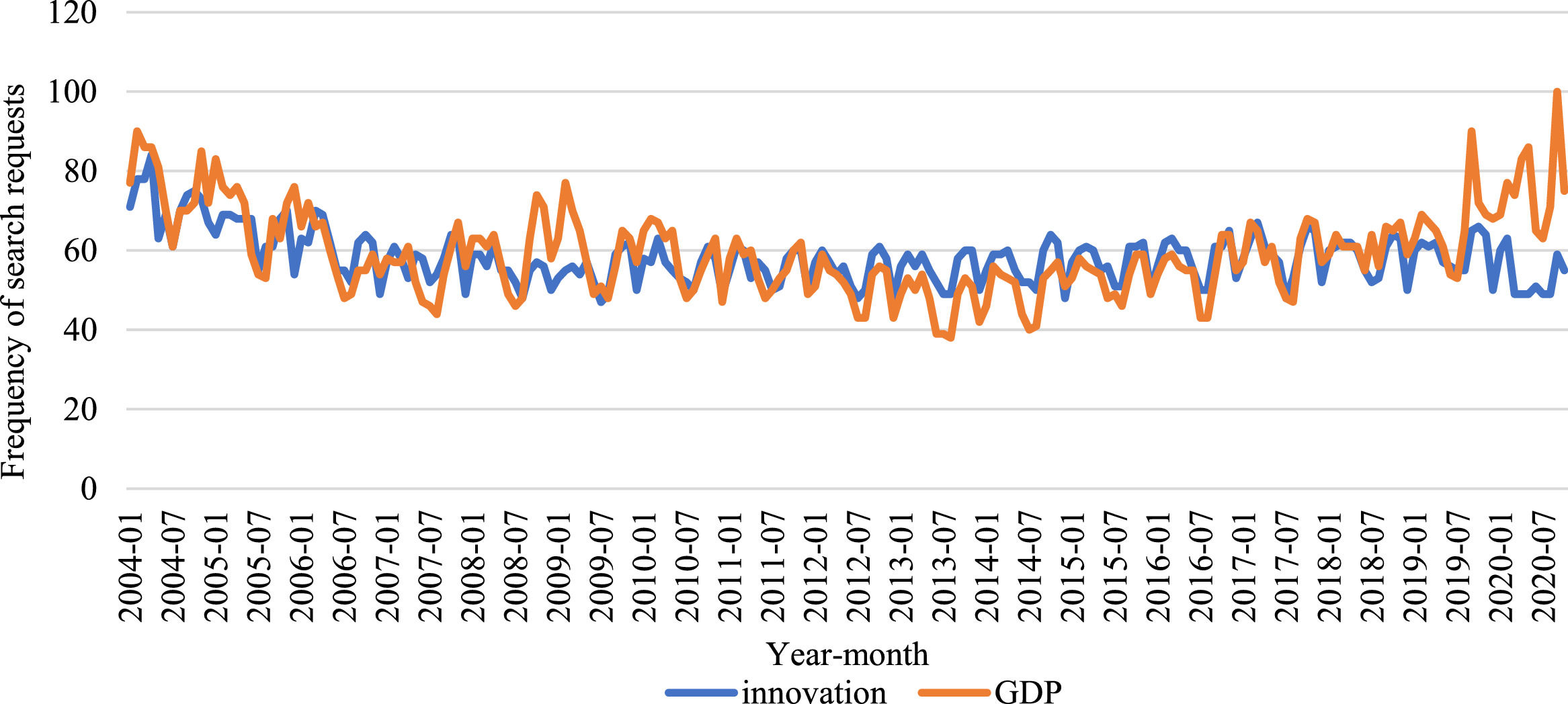

In the 2000s, influential international and European organizations gave their recommendations on the economic development of the world in the context of globalization and post-industrial society, and at the same time the uneven development of national economies, differences in living standards and incomes. A special role was given to innovation in the United Nations Sustainable Development Goals. Today innovation is also positioned as a mainstream of economic growth. Therefore, it is obvious that there is the same trend in the dynamics of frequency of search requests of such concepts as “innovation” and “GDP” (Fig. 2).

At the same time, there was a peak growth of search requests for “GDP” in the crisis period of 2008 and in 2019–2020, due to declining gross domestic product in many countries, including the influence of the pandemic COVID-19 and geopolitical factors, etc.

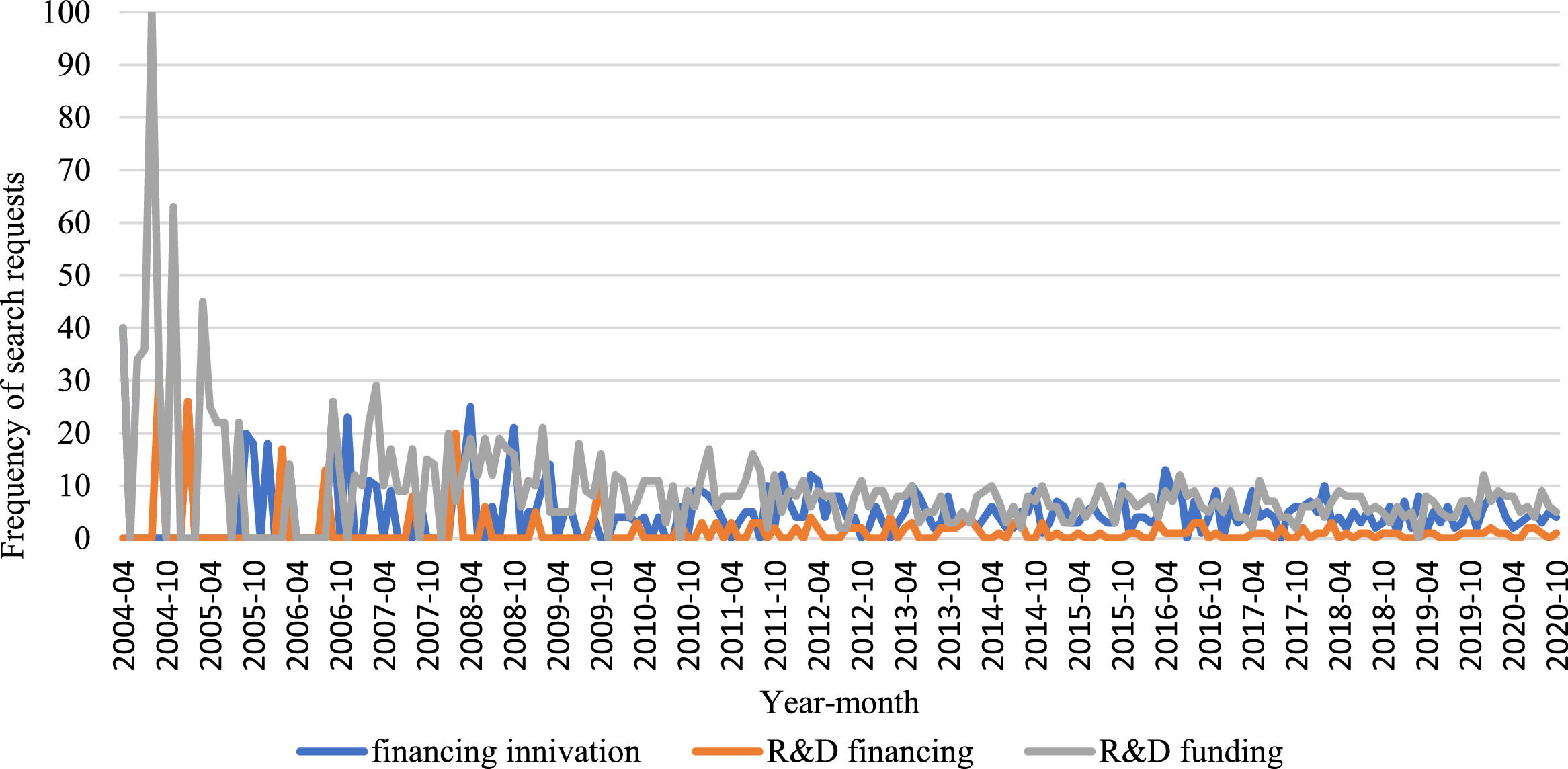

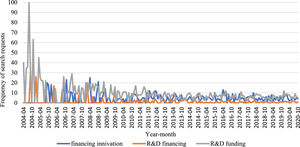

One of the key concepts of funding innovation of business companies is “financing innovation”. Its definitions vary significantly. In Fig. 3 the dynamics of search requests of such concepts as “financing innovation”, “R&D financing” and “R&D funding” is compared.

The conducted analysis allows us to assert about various quantitative characteristics of distribution of using the above-stated concepts in different countries of the world, but with the identical qualitative tendency. Moreover, there is a decline in search activity regardless of the variation of definitions. During the same period, there was a reduction in innovation funding (the share of R&D expenditures in GDP) in many countries around the world, especially in the post-Soviet space. In addition, after the financial crisis, the search was specified by specific sources of funding and types / areas of innovation (digitalization, online technology, etc.).

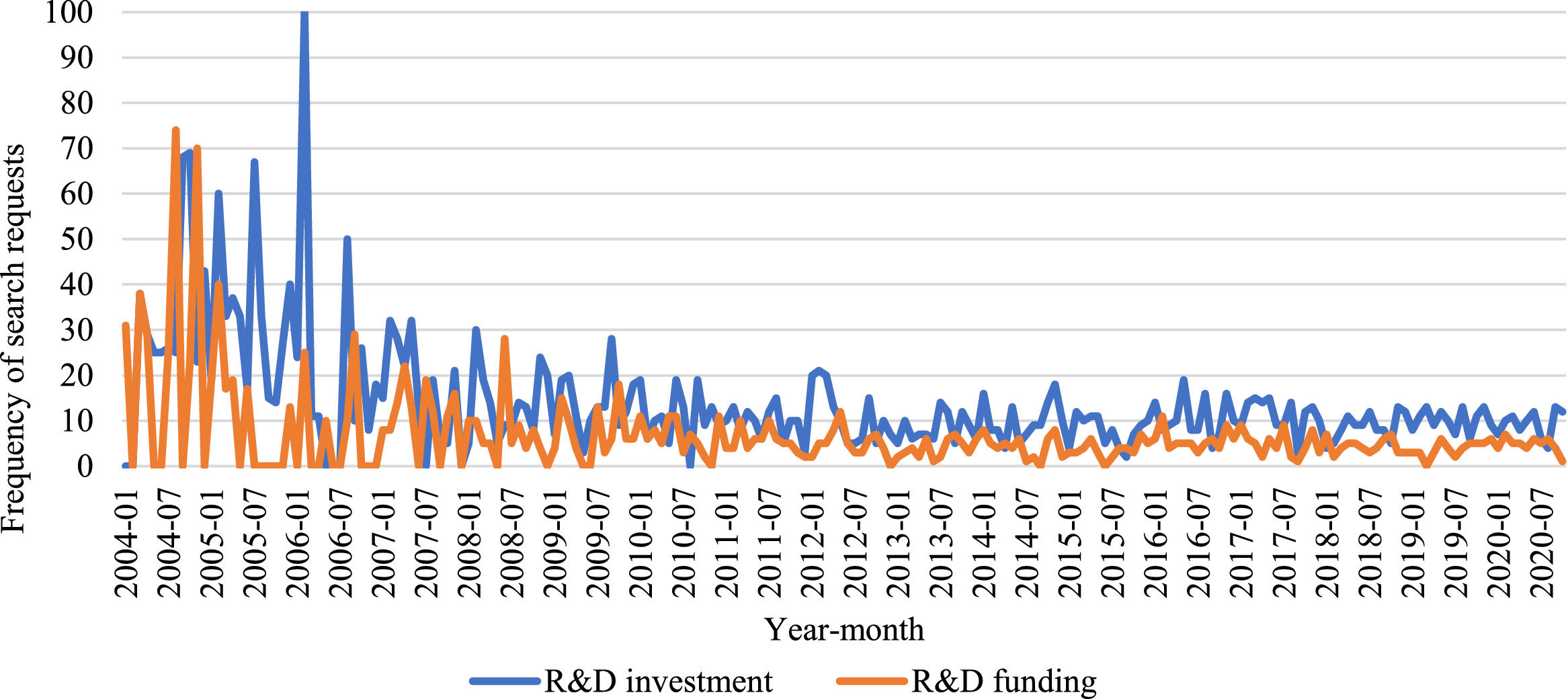

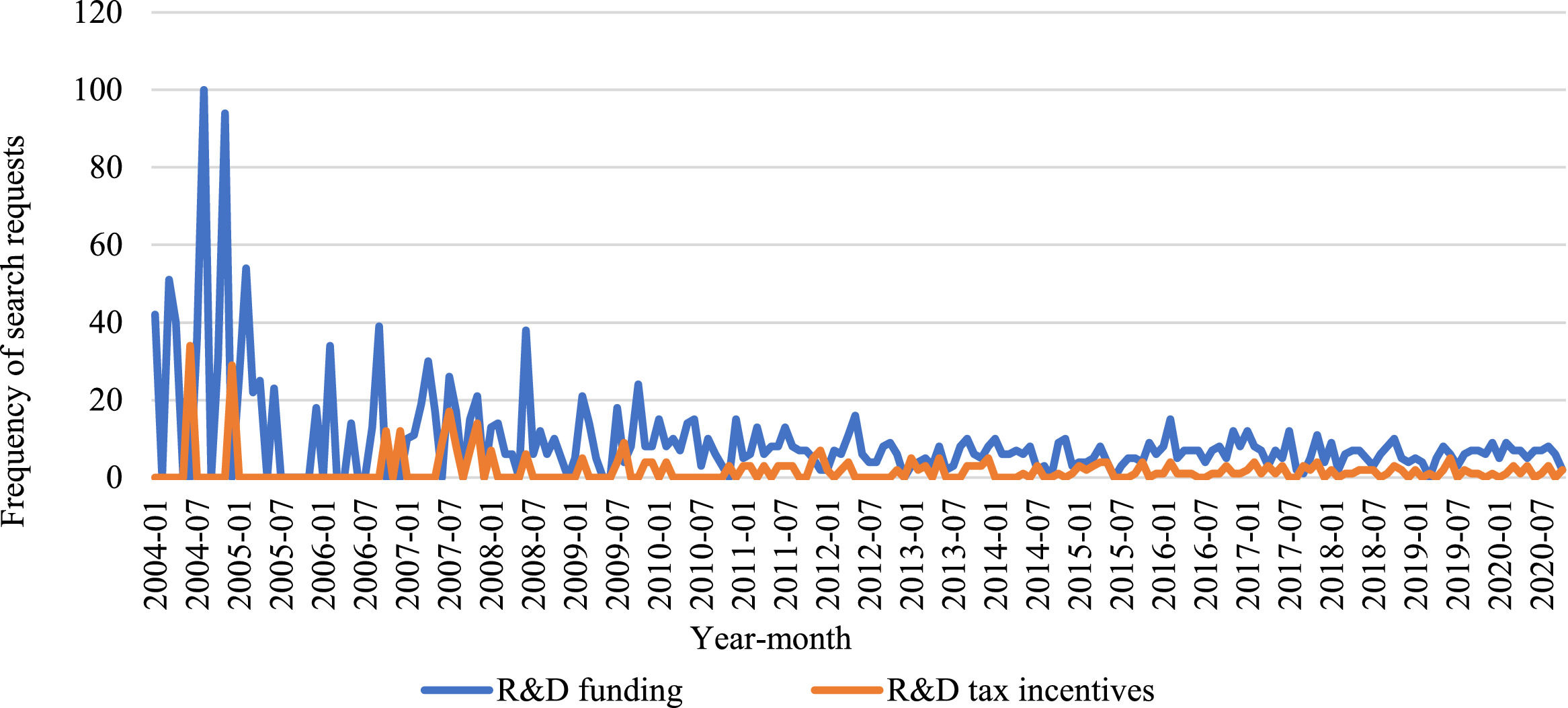

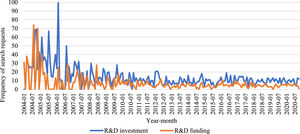

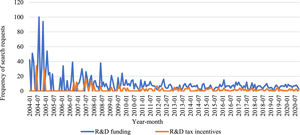

Trends in search requests for some individual instruments of financial policy indented to provide innovation development are shown in Figs. 4–5 (the key concepts of “R&D investment” vs “R&D funding” and “R&D tax incentives” vs “R&D funding”).

The number of requests for investment in innovation exceeds the number of requests for innovation funding for the most of investigated period. At the same time, the crisis periods are characterized by an increase of interest in investment with a decrease in search activity for R&D financing. This can be explained by the urgency of the practical implementation of innovations of business companies and the search for investment for their implementation, while R&D, as a rule, covers more basic research than applied research. If we compare the dynamics of search activity connected with R&D financing and R&D tax incentives (Fig. 5), the number of requests is higher in the first case. This can be explained by the actual lack and underdevelopment of tools for tax incentives for innovation of business companies in many countries. However, in general, Internet users do not lose interest in this issue, nowadays the dynamics is stable.

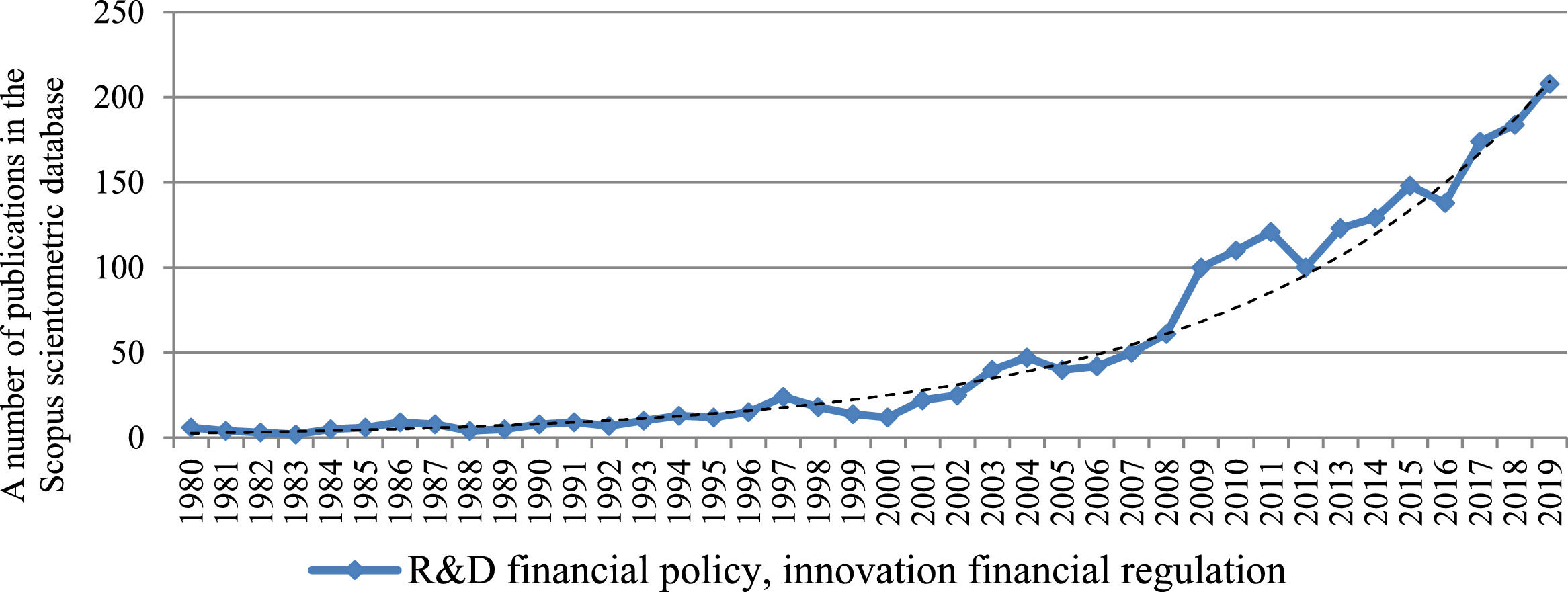

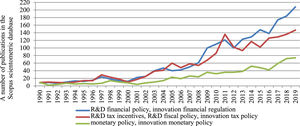

In order to identify the priority trends in cross-sectoral research connected with funding innovation of business companies, as well as to find out which financial policy instruments for development of business companies’ innovation attract the most attention of researchers, a two-stage literature analysis of research on this problem was conducted. For this purpose, at the first stage, a sample of 2 082 items was generated from scientific articles on investigated problem covered by the Scopus database for 1935–2019 with the following keywords: “R&D financial policy” and “innovation financial regulation”. The first publication in the study was dated to 1935, but significant activity was observed much later, so for graphical visualization of the results the period was narrowed to the last forty years – from 1980 to 2019 (Fig. 6).

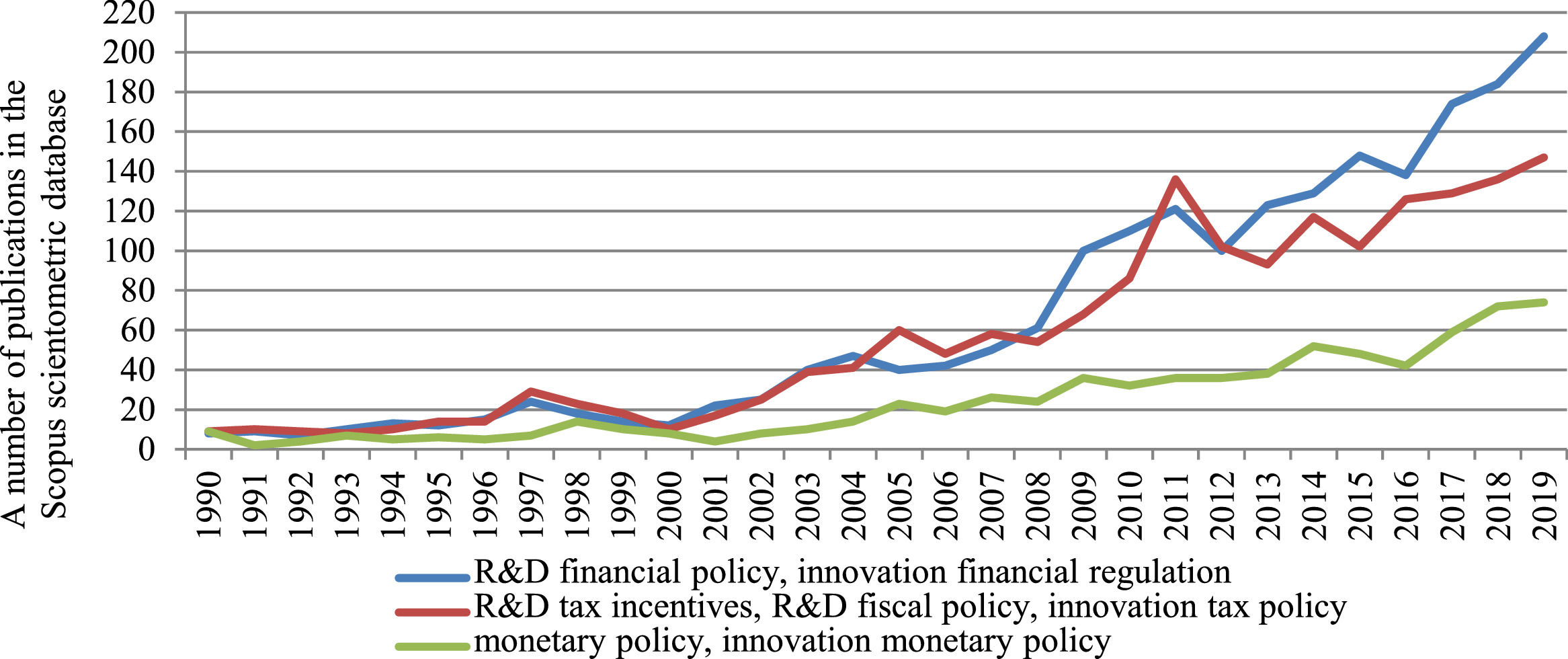

Since 2000, there has been an increase in publishing activity connected with the theory of funding innovation of business companies. The dynamics is positive, and this trend continues today. Moreover, the change of publishing activity connected with the theory of funding innovation of business companies was compared with the change of publishing activity on tax policy and R&D tax incentives, as well as monetary policy related to the providing innovation of business companies for 1990–2019 (Fig. 7). The investigated period was narrowed by 10 years more, because from the data of Fig. 6 it was obvious that in the 1990s publications were isolated, their number was fixed at about the same level, so the dynamics for that period was practically absent.

The results stemming from our analysis showed that the theory of funding innovation of business companies is still forming – about half of publications recorded in 1935–2019 were published during the last five years. In addition, the theories of funding innovation of business companies, tax and monetary incentives for innovation are characterized by the same development dynamics in the context of publishing activity, but with a different quantitative indicator of publications.

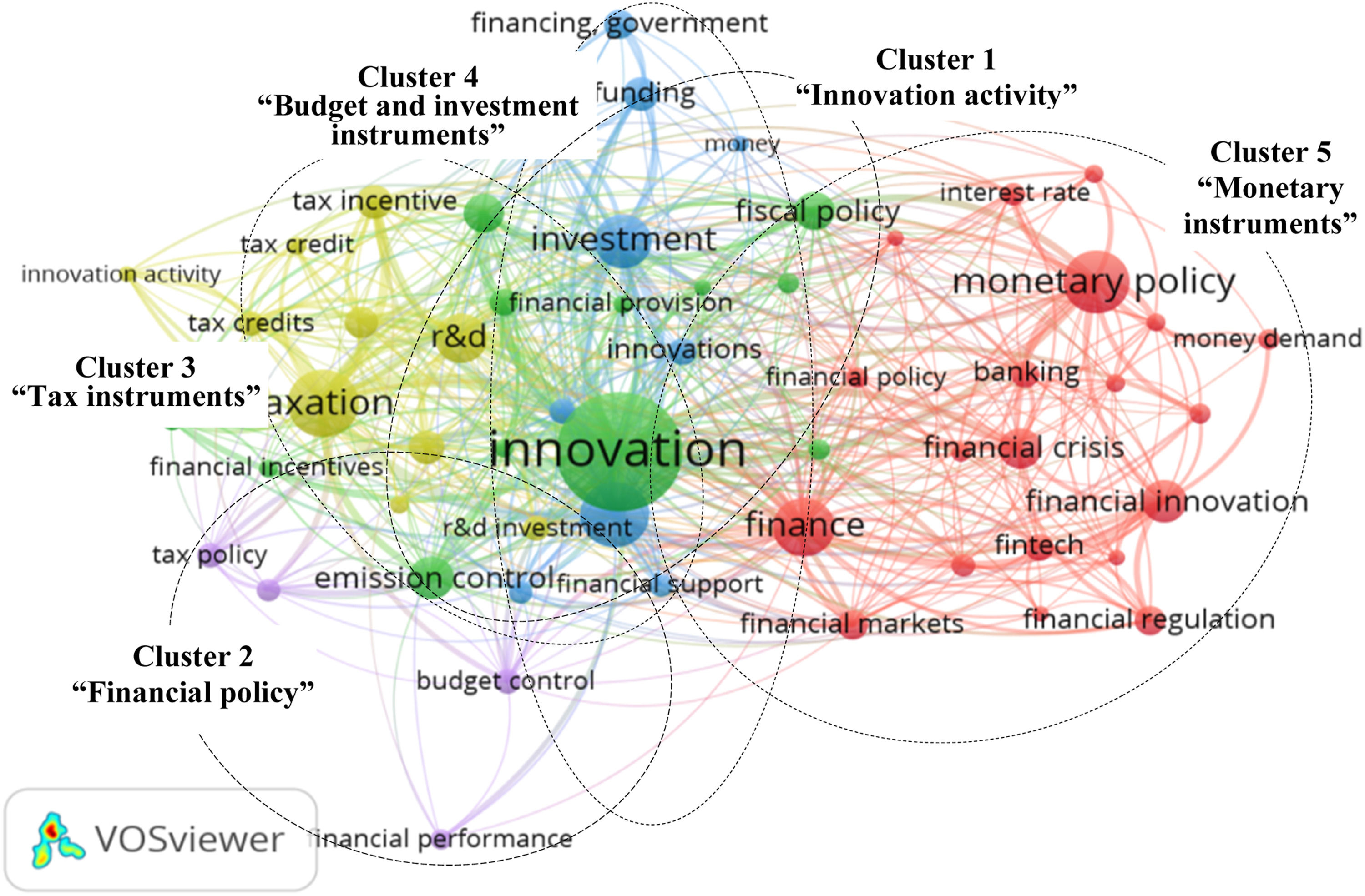

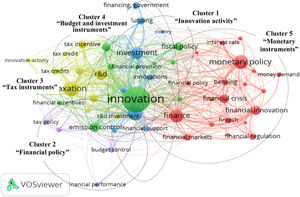

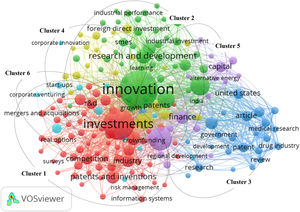

According to the bibliometric analysis results of the change of using the key phrases “R&D financial policy” and “innovation financial regulation” in scientific papers, conducted on the basis of the VOSViewer v.1.6.15 software, fifty-six key phrases were identified. The frequency of their use is a multiple of fifteen and more (Fig. 8).

The analysis of using key words and phrases in scientific articles showed that terms connected with “R&D financial policy” and “innovation financial regulation” are the most often related to the following: 1) innovation activity (cluster 1); 2) financial policy (cluster 2); 3) tax instruments for financing innovations (cluster 3); 4) monetary instruments for financing innovations (cluster 4); 5) budget and investment instruments for financing innovations (cluster 5). All other instruments of funding innovation of business companies and financial regulation (pricing, customs, tariffs, etc.) have much less attention from researchers. Therefore, on the second level of bibliometric analysis the focus is made on the investigation of tax, monetary, budget, and investment instruments of funding innovation of business companies and financial regulation.

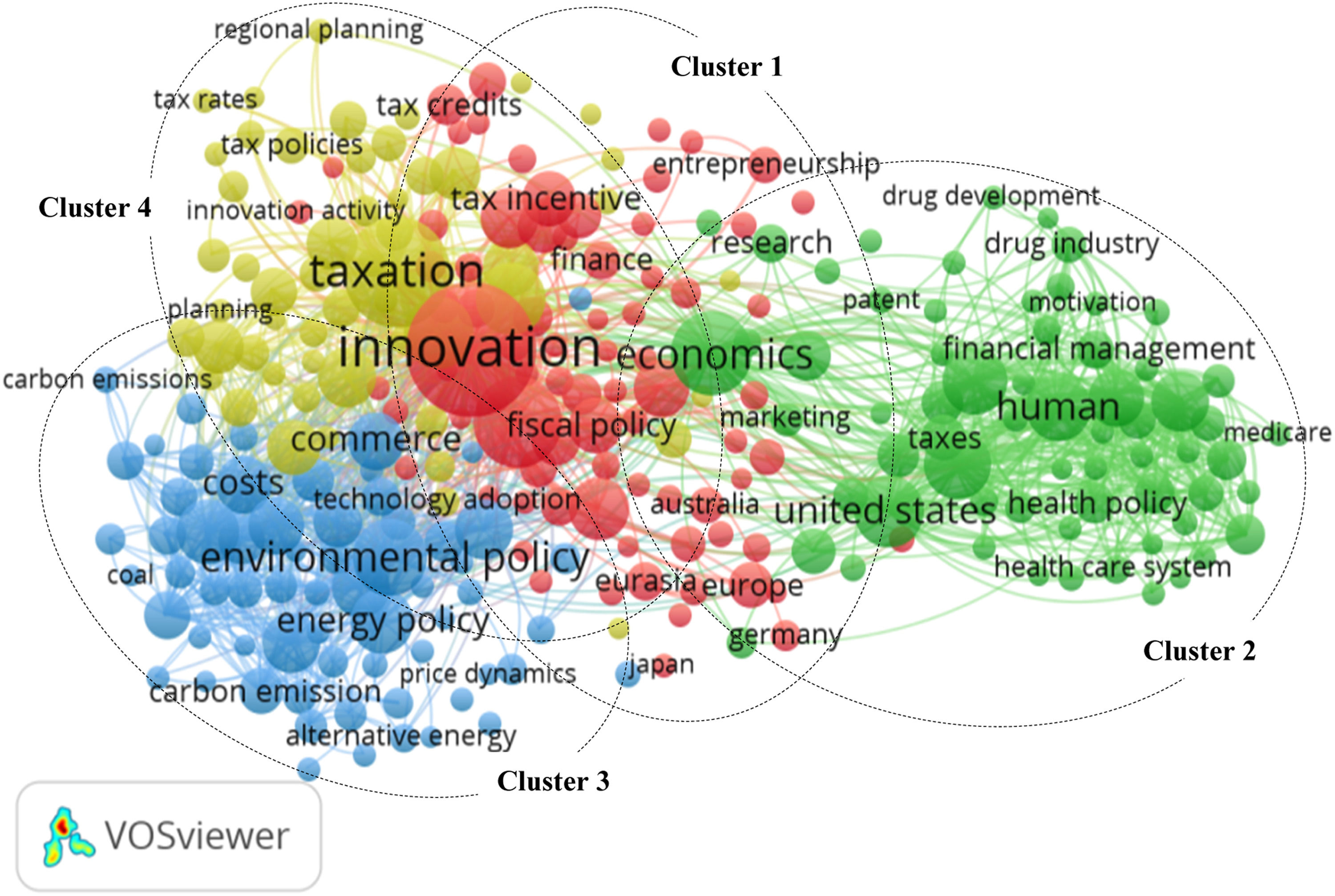

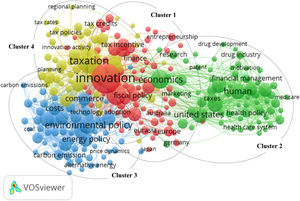

The second stage of bibliometric analysis reveals the dominant trends in intersectoral research related to each group of these tools. According to the results of bibliometric analysis of the frequency of using the key phrases “R&D tax incentives”, “R&D fiscal policy” and “innovation tax policy" in scientific papers, a sample of 1 960 articles was formed, 262 keywords were identified (the frequency is a multiple of 10 or more). The analysis showed that tax instruments to stimulate innovative development of business companies are most often studied simultaneously with research in the following areas: 1) innovation, finance and entrepreneurship; 2) human capital, health care, and medical innovation; 3) environmental protection, energy policy and technological development; 4) taxation, tax policy, planning and economic analysis (clusters 1–4 in Fig. 9).

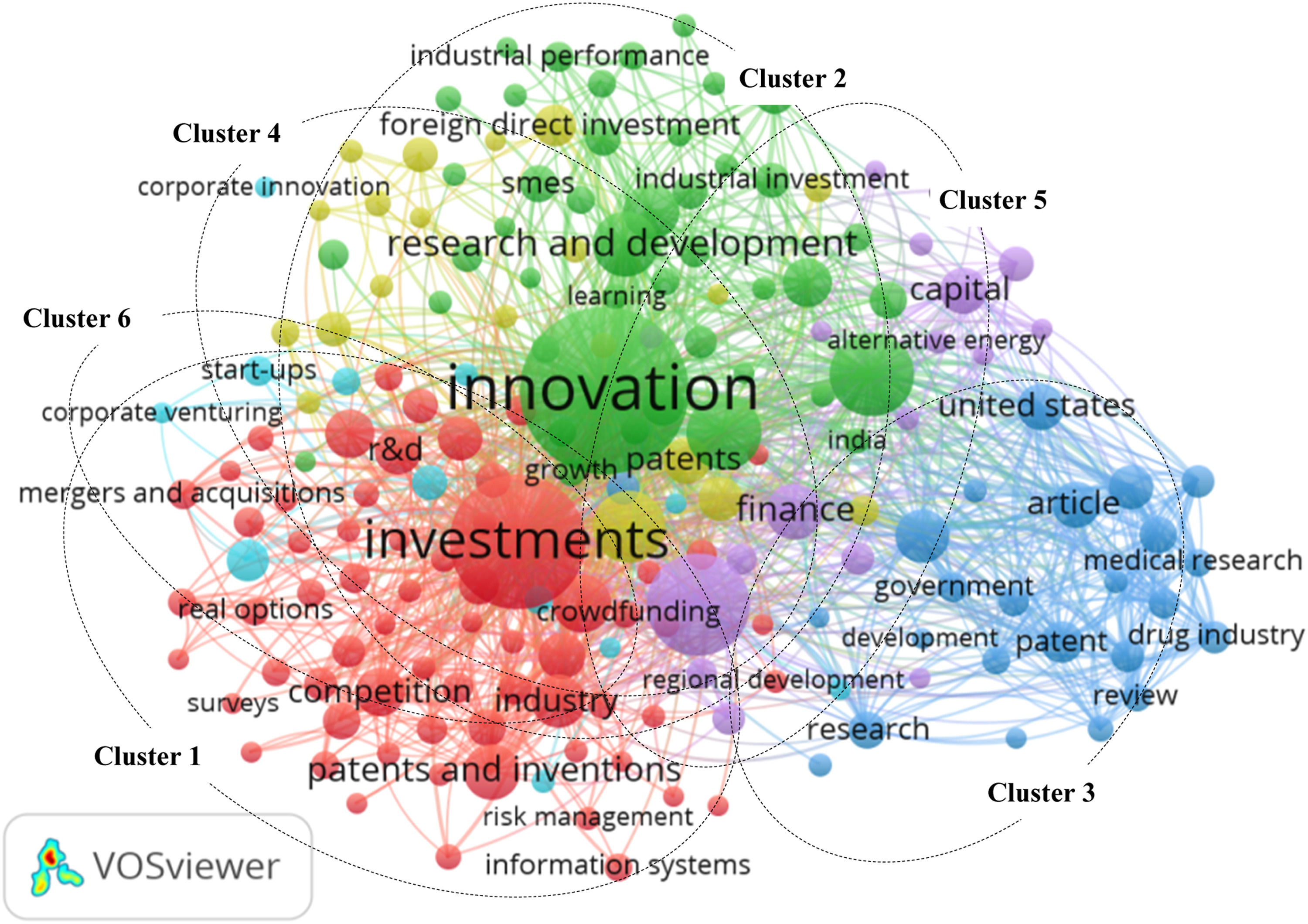

For the purposes of the bibliometric analysis of research about budget and investment stimulation of innovation development of business companies, a sample of 1 578 scientific articles was selected on the basis of using the key phrases “investment”, “venture capital”, “budget”, “government funding”, “innovation” and “R&D”. In total, 184 key words and phrases were picked, taking into account the frequency of their using was a multiple of ten and more. Conducting a bibliographic analysis on the basis of this sample made it possible to determine six clusters. They reveal that the aspect of budget and investment incentives for innovation of business companies is most often investigated in close relationship between the following theories: 1) investing in innovation, venture financing and technology transfer; 2) innovation and investment activities, entrepreneurship, economic growth and competitiveness; 3) innovations in medicine, educational activities, public and organizational management; 4) innovation policy, intellectual property, transformational economy, technological innovations; 5) capital, business development, finance, venture capital; 6) strategic and corporate governance, business modeling, start-ups (clusters 1–6 in Fig. 10).

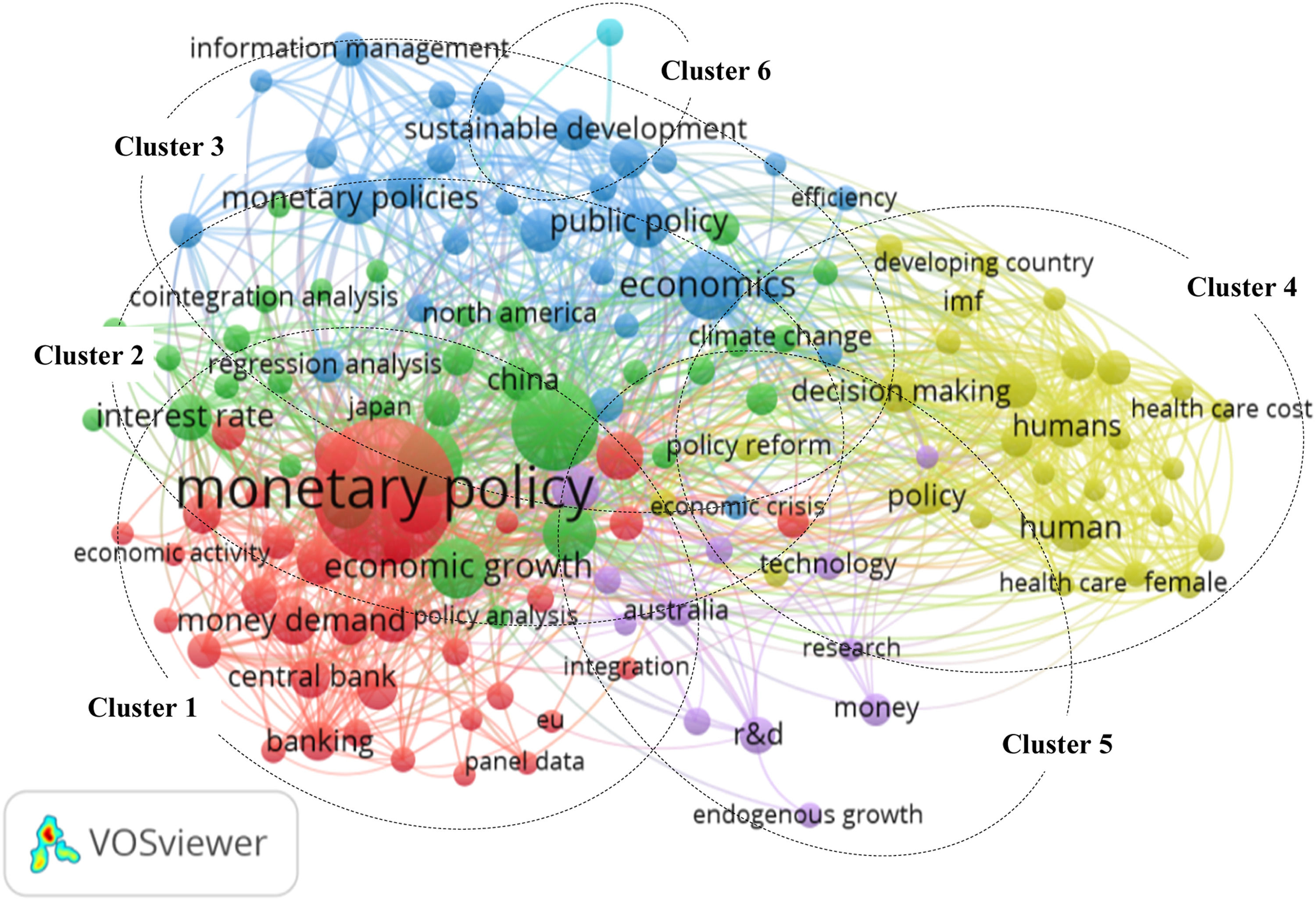

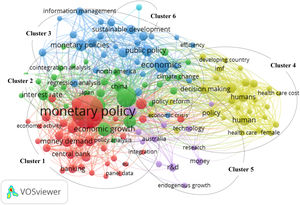

For the literature analysis of research about monetary instruments to stimulate innovation development of business companies, a sample of 1 494 scientific papers was generated on the basis of the key words and phrases “R&D monetary policy”, “innovation monetary policy” and “R&D interest rate”. In total, 137 key words were selected, and the frequency of their using is multiple 5 and more (Fig. 11).

Based on the results of the bibliometric analysis, we found that monetary instruments of innovation development stimulation of business companies are most often investigated in close connection with the following research: 1) monetary policy and banking; 2) methodology of innovation; 3) public administration and sustainable development; 4) human capital and health care policy; 5) economic growth and crises; 6) inflation targeting (clusters 1–6 in Fig. 11).

Conducting research bibliometric analysis of funding innovation of business companies and financial regulation in general (the sample of 2 082 scientific articles in the Scopus database, on the key words and phrases “R&D financial policy” and “innovation financial regulation”), the attention was paying on countries, that carries out the largest number of research on this issue (Table 1).

The fragment of countries ranking by publishing activity connected with funding innovation of business companies and financial regulation.

Source: Own results based on VOSViewer v.1.6.15 software.

When it comes to the conclusions stemming from analyzing the data depicted in Fig. 1, one can come up with the following observations: First of all, USA and UK are leading both in the number of publications and citations connected with the topics funding innovation of business companies and financial regulation. Second, even though China comes third in this ranking, the ratio of citations to publications is much lower than in the case of the first top countries (7.9 compared to 24.8 in the case of USA and 21.3 in the case of UK). This yields the prevalence of quantity over quality of the research output on the given topics in this country. Third, even though Russian Federation comes sixth in the ranking with a total number of 88 publications, the number of citations in its case is mediocre making it 2.9 citations to publications ratio. Countries like France, Spain, or the Netherlands yield a better citation to publications ratio even though the total number of the research output is lower than in the cases of the previous countries. The conclusion from all that is that quality matters more than quantity in terms of informing the relevant researchers, practitioners, and policy-makers on the innovations and financial issues in business companies.

Due to bibliometric analysis based on VOSViewer v.1.6.15 software fifty-seven countries were determined according to which the affiliation of the authors is recorded in more than five scientific publications from the formed sample. Table 1 demonstrates the ranking results of the ten top countries by the quantity of scientific publications and the quantity of citations. The results are also given for ten individual countries, including twenty-five publications in Ukraine (fifty-one citations). In Poland, the Czech Republic, and Estonia, despite the smaller number of publications compared to Ukraine, the number of citations is significantly higher.

Among the organizations for which the authors of scientific articles in the Scopus database are affiliated, the following should be noted on the issues of funding innovation of business companies and financial regulation: Princeton University (USA), Harvard Business School (USA), Renmin University School of Business (China), Bucharest University of Economics (Romania), centre for European Economic Studies (Germany), University of California, Berkeley (USA), University of Finance under the Government of the Russian Federation (Russian Federation), University College London (UK), and Volgograd State University (Russian Federation).

Conclusion and implicationsOverall, the analytical analysis conducted in this paper on the basis of Google Trends and VOSviewer tools allowed us to compare the peak periods for the change of search requests of key concepts related to funding innovation of business companies and main instruments of financial regulation with the time periods of the most important changes in innovation development and financial system environment, as well as time periods of radical changes in the emergence and marketing of innovative goods and services. As a result of the research using the Scopus database tools, it was grounded that the theory of funding innovation of business companies and financial regulation is still forming – about half of scientific articles for 1935–2019 were published during the last five years.

Based on the two-stage bibliometric analysis of scientific articles presented for more than eighty years in the Scopus database, the dominant trends in intersectoral research connected with the development of financial policy instruments of funding innovation of business companies were identified using VOSViewer. Our results represent a valuable food for thought for the researchers working in the field of knowledge and innovations, business practitioners as well as policy-makers.

When it comes to the limitations of our research, we have to acknowledge that in the future comparing the data from various bibliometric databases (e.g. Web of Science) might be used alongside with the data from Scopus (using the data from Google Scholar would be even more interesting). However, this would require more resources and time and therefore was outside the scope of our paper. Another issue that our research has not touched upon is the fact that given the scope and the topic of this research, looking at the data of the social relevance and applicability might be more useful for informing the practitioners dealing with funding innovations in business companies. Therefore, the use of such metrics as PlumX (available in Scopus) and focusing on the mentioning of the research papers in various social networks, or on the Internet, rather than in academic journals and conference papers, might be more relevant and meaningful.

Summarizing our main results, we can recapitulate that at the first stage, a sample of 2082 items on this issue was generated from scientific publications covered by the Scopus database for 1935–2019. The analysis showed that the theory in question is still forming (about half of articles were published during the last 5 years). The analysis of the change of using key phrases “R&D financial policy” and “innovation financial regulation” showed that these concepts are connected with innovation and financial policy; tax, monetary and budget-investment instruments of funding innovation (cluster 1–5). All other instruments (customs, prices, tariffs etc.) attract less attention of scholars. Therefore, on the second level of bibliometric analysis the focus is made on the study of tax (a sample of 1 960 articles), budget and investment (a sample of 1 578 articles), and monetary (a sample of 1 494 articles) instruments of financing innovation of business companies. Tax instruments are most often studied simultaneously with research in the following areas: 1) innovation, finance, and entrepreneurship; 2) human capital, health, and medical innovation; 3) environmental protection, energy policy and technological development; 4) taxation, tax policy, planning and economic analysis (clusters 1–4). The formation of a sample of scientific articles, which used the keywords “investment”, “venture capital”, “budget”, “government funding”, “innovation” and “R&D”, and bibliometric analysis on its basis made it possible to find six clusters, which show that the issue of budget and investment incentives for innovations is investigated in close relationship with the following theories: 1) investing in innovation, venture financing and technology transfer; 2) innovation and investment activities, entrepreneurship, economic growth and competitiveness; 3) innovations in medicine, educational activities, public and organizational management; 4) innovation policy, intellectual property, transformational economy, technological innovations; 5) capital, business development, finance, venture capital; 6) strategic and corporate governance, business modeling, start-ups (clusters 1–6). Monetary instruments of innovation stimulation (according to the frequency of using the key phrases “R&D monetary policy”, “innovation monetary policy” and “R&D interest rate”) are most often analyzed in close relationship with the following research: 1) monetary policy and banking; 2) methodology of innovation; 3) public administration and sustainable development; 4) human capital and health policy; 5) economic growth and crises; 6) inflation targeting (clusters 1–6). Our results might help to increase the understanding which would assist organizations and the practitioners in making better decisions on funding innovation in business companies.

All of these issues come together to create an overarching company vision to help people make better and more efficient decisions. Business intelligence can help companies make more informed decisions by displaying current and historical data in the context of their business. The information that business users extract from relevant data can help organizations make faster and more efficient decisions. Business intelligence combines business intelligence, data mining, data visualization, data tools and infrastructure, and best practices to help organizations make better decisions.

It becomes clear that the confluence of an increasingly complex world, huge data proliferation, and a strong desire to stay at the forefront of competition has prompted organizations to focus on using analytics to make strategic business decisions. Nowadays, more and more organizations are moving to a modern business intelligence model that takes a self-service approach to data. From using detailed data to customize products and services, to scaling digital platforms to match buyers and sellers, businesses use business intelligence to enable faster, fact-based decision making. From enabling companies to make consumer-facing marketing decisions to helping them address key operational weaknesses, analytics is revolutionizing the importance of data. Big data analytics can provide insight into product capabilities, development decisions, measure progress, and steer improvements in a direction that suits business customers. To successfully use business analytics, companies must collect data and then use it to make decisions and improve processes, the same article explains. Effective decision making requires business leaders to rethink what matters, who or what is involved, and rethink how to use data and analytics to improve decision making. For this reason, many organizations remain effective by being stuck on a neutral position, and management sees decision making as a result, not as something that requires active and proactive decision.

The advantage of all this is that decisions can be made quickly and the disadvantage is that leaders may not consider long-term consequences. Another important step that executives sometimes overlook is analyzing the legal implications of their decisions before making them. Decision alternatives must be evaluated in a context-sensitive way that goes beyond a single event or transaction. Business professionals and policy-makers can then make informed recommendations about policies and decisions that could impact the corporate culture. Even more important aspect might be an understanding of the role those other members of the organization play in decision making, including the specific responsibilities of key decision makers and groups. Through the effectiveness of information systems, an organization can make better decisions, plan better, and ultimately achieve better results. Implementing an information system in a business can bring numerous benefits and help manage the internal and external processes that a business faces on a daily basis and make decisions for the future. A good information system stores data in a complete and complex database, which makes the search process convenient. Combinations of raw data, documents, personal knowledge and/or business models can be applied to help users make decisions. Management, operations and planning levels of an organization can be supported for making better decisions by assessing the importance of the uncertainties and trade-offs associated with making one decision versus another. All of this enables large and complex organizations to effectively identify, develop and evaluate opportunities, helping them make informed decisions. Business analysts can use this intelligence for providing performance and competition benchmarks to make an organization run smoother and more efficient. In fact, our research shows that data-driven organizations not only make better strategic decisions, but also experience higher operational efficiency, higher customer satisfaction, and consistent profit and revenue levels. Instead of acting intuitively when maintaining inventories, pricing decisions, or hiring talent, companies use systematic statistical analysis and reasoning to make decisions that improve efficiency, manage risk, and profit. Organizations and teams need to adapt to new behaviors to make informed decisions faster, but managers need to change too. All actors of this process need to strengthen and accelerate their creative decision-making processes, including multiple perspectives, clarifying decision-making rights, matching the pace of decision-making with the speed of learning, and encouraging direct and serious conflict in the service of end customers. Essentially, it becomes apparent there is a modern business intelligence when there exists a comprehensive view of the organization's data and this data can be used to make changes, eliminate inefficiencies, and quickly adapt to market or supply changes. Quite often, organizations fail to deliver their business data and analytics with the same personalization they know consumers expect. In short, organizations embrace business intelligence as part of their broader business intelligence strategy. Armed with this information, companies can analyze how certain activities affect the business and prepare cost estimates and future forecasts.

All in all, we can conclude that it helps to stay relevant to business leaders' stakeholders, while the innovative business practices can help improve brand image and awareness. Our research indicates which companies can provide long-term investment value through innovative practices. The key difference is that sustainability-driven innovation is distinct from sustainable, reactive, and proactive approaches to sustainability in some companies and more similar to innovation-driven and sustainability-based approaches in others.