The transition economies of Eastern Europe present both the opportunities and challenges for companies operating in these markets. On one hand, these countries have a large number of technology savvy young consumers, and on the other, the markets must also take into consideration the macro-environment of a country and market conditions which make the use of certain market technologies more feasible and attractive compared to others. It is certainly true in terms of the timing for introduction of various technologies in a country. Drawing analogy for the “IDITAROD RACE” we develop three different “Sled Dog Team layouts” for market characteristics and technologies for three Eastern European countries, namely, Slovakia, Bulgaria, and Albania. The ten market characteristics included in our research are: digital connectivity divide, economic power, demand type, privacy laws, demographics, and competitive conditions, attitude towards technology, institutional maturity, corporate social responsibility, and corruption. The ten marketing technologies included in our research are: digital profiling, segmentation, websites, and search engines marketing, campaign management, content management, social media, mobile application, digital collaborations, and analytics. Company case studies are analyzed and reported for each of these three countries which support the three models presented in our research.

Las economías de transición de Europa Oriental presentan a la vez oportunidades y retos para las empresas que operan en dichos mercados. Por un lado, estos países cuentan con un gran número de jóvenes y expertos consumidores tecnológicos y, por otro, los mercados deben tener en cuenta el macroentorno de un país y las condiciones del mercado, que pueden facilitar el uso de ciertas tecnologías y hacerlas más atractivas en comparación con otras. Esto es realmente cierto al elegir la oportunidad para introducir diversas tecnologías en un país. Utilizando la analogía de la “CARRERA IDITAROD”, desarrollamos tres diferentes “diseños de equipos de perros de trineo” para las características del mercado y las tecnologías de tres países del este de Europa, es decir, Eslovaquia, Bulgaria y Albania. Las diez características del mercado que incluimos en nuestra investigación son: clasificación de la conectividad digital, poder económico, tipo de demanda, leyes de privacidad, características demográficas y condiciones competitivas, actitud hacia la tecnología, madurez institucional, responsabilidad social corporativa y corrupción. Las diez tecnologías de marketing incluidas en nuestro estudio son: perfil digital, segmentación, sitios web y marketing de motores de búsqueda, gestión de campañas, gestión de contenidos, medios sociales, aplicación móvil, colaboraciones digitales y analítica. Se analizan y reportan los estudios de los casos empresariales para cada uno de estos tres países, que respaldan los tres modelos presentados en nuestro trabajo de investigación.

To a casual observer, the revolution that is unfolding in the transformation of traditional marketing into digital marketing is breathtaking. New tools, techniques and paradigms continue to enrich, simplify and speed how marketers and their audiences interact. In perusing contemporary literature on this revolution, a deeper examiner may also find the revolution bewildering. Most publications, blogs and expert opinions espouse the merits of a particular technology or method, or perhaps a couple of closely related ones. Tactical retrospectives of real life use cases, both successful and unsuccessful, tell discrete stories. Consider just four examples from McKinsey (Galante, Moret, & Said, 2013).

- 1.

McDonald's attempt at soliciting positive customer feedback via the hashtag “#McDStories” was pulled within two hours, when customers started posting derogatory tweets.

- 2.

Oreo's 2013 tweet when the lights went out during the Super Bowl, “You can still dunk in the dark”, was retweeted 15 000 times and gained 20 000 Facebook “likes” and 34 000 new Instagram followers.

- 3.

Kraft launched Nabisco 100-calorie packs in response to trends in online discussions, racking up $100 million in sales within a year.

- 4.

A European CPG company used advanced analytics of SKU data to match retail assortments with consumer preferences, achieving a higher sales growth.

Engrossing as these case studies are, the overarching question one is left with is, “Is there a method to this madness?” That is not to say there isn’t; just that it is hard to glean how one goes about marrying specific tools and methods to specific problems. The McKinsey article cited in the previous paragraph says that even experienced executives at consumer-packaged-goods (CPG) companies are seeking to understand how their staff can leverage these technologies more effectively.

There is a plethora of technologies available for today's marketers, especially for targeting young customers in emerging markets, many of which are undergoing tumultuous political, economic, socio-cultural and demographic changes. This paper proposes a holistic and methodical approach to determine which technologies and competencies to invest in, based on marketing goals and segment characteristics. This paper develops a conceptual model for this purpose. We label this model “Iditarod Model”.

The Iditarod is a grueling annual race held in Alaska, where teams of 12 to 16 sled dogs, with one human musher, compete over 1 000 miles of harsh territory and about 10 exhausting days. Winning requires many elements to work in harmony. Routes are planned in advance, but conditions change along the way. The terrain, conditions, individual skills, and complex dynamics between team members determine which dogs are best suited for a given year's race, and in which positions they should run. Some mushers may choose to run with fewer dogs than others. The musher's ability to adjust tactics (pace, resting times, attention to dogs’ health), and the overall strength of his/her race plan are both important.

An objective of this paper is to provide a useful technology selection framework for marketers to penetrate emerging Eastern European markets in transition economies. The usefulness of the Iditarod framework is illustrated by applying it to three sample countries in Eastern Europe, chosen to represent each of the three groups of countries described by the “Three-Speed Eastern Europe” model (Lynn, 1993). These nascent and emerging markets represent a complex array of factors, including their degrees of “Marketization” and “Westernization” (Dana-Nicoleta, Manrai, & Manrai, 1997) that make it particularly relevant to apply a technology selection framework. In our research, we cover ten market characteristics and ten technologies.

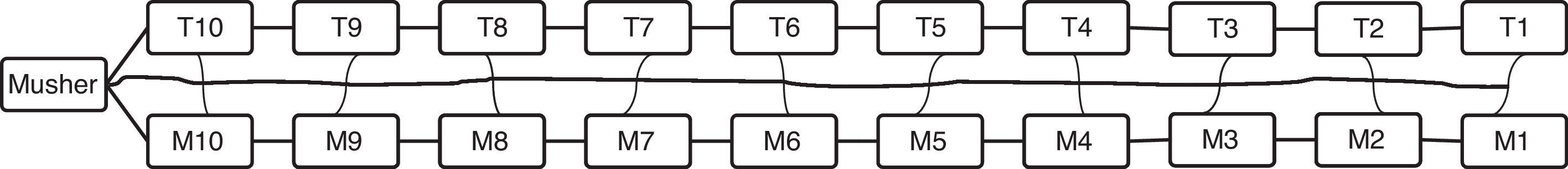

2Proposed iditarod framework2.1An analogyTo understand the proposed approach, we will use an analogy of an Iditarod team as depicted in Figure 1. The analogy between the Iditarod and digital marketing may be conceived as follows:

Musher=Competitive strategy. Provides clarity on goals and priorities. Maps the route. Picks the right team and puts them in the right positions.

M1 through M10=Market (terrain) characteristics. Direction, trail conditions, weather, checkpoint locations.

T1 through T10=Technology (dog) capabilities. Individual and team strengths.

The harnesses and lines tie all the dogs together. Even though dogs are most influenced by the other dogs that are closest to them (stronger correlations amongst market and technology variables), each one is also affected by ones farther up or down the line (weaker correlations amongst market and technology variables).

As you set out to use new digital marketing technologies to penetrate Eastern European markets, you must first create your marketing strategy in support of your broader business strategy (musher's plan and preparation), identify the relevant market characteristics that you need to contend with (M1 through M10), and focus on the technologies that would be most suitable (T1 through T10). These market characteristics and technologies form the two dimensions of the Iditarod framework.

The following sections provide lists of these market characteristics and technologies. The paper describes how these are broadly related to each other. Not all of them may be applicable for a particular situation, or the marketer may have some additional ones to incorporate.

2.2Market characteristicsThere are ten market characteristics included in our research. These consist of digital connectivity/divide, economic power, demand type, privacy laws, demographics, competitive conditions, attitude towards technology, institutional maturity, corporate social responsibility, and corruption. The attributes associated with each of these characteristics are given in Table 1.

Market characteristics and associated attributes.

| Characteristic | Attributes | |

|---|---|---|

| M1 | Digital connectivity/divide (Digital connectivity means an Internet connection. Mere cellular usage does not constitute digital connectivity, although it can be used for SMS marketing.) | Urban vs. rural location |

| Extent of population with access to the Internet | ||

| Total number of people with access to the Internet | ||

| Speed of the Internet connection | ||

| Bandwidth of the Internet connection | ||

| Laws on Internet usage | ||

| Types of devices available | ||

| Quality of devices available | ||

| M2 | Economic power (consumer buying power) | Purchasing power parity |

| Median income | ||

| Top quartile income | ||

| Bottom quartile income | ||

| Median debt | ||

| Top quartile debt | ||

| Bottom quartile debt | ||

| M3 | Demand type | Emerging vs. mature |

| Strength of business demand | ||

| Strength of consumer demand | ||

| Prevalence of traditional media (print, billboards, radio and television) | ||

| M4 | Privacy laws | Consumer expectations |

| Consumer rights | ||

| Business rights | ||

| Clarity of regulation | ||

| Degree of regulation | ||

| Censorship | ||

| Surveillance | ||

| Prevalence of violations | ||

| M5 | Demographics | Age: median, mean, standard deviation |

| % of Boomers vs. Gen X vs. Gen Y in the population | ||

| Education level | ||

| Gender discrimination | ||

| Technology savvy | ||

| M6 | Competitive conditions | Relative market share |

| Competitors’ experience with marketing technology | ||

| M7 | Attitudes towards Technology | Openness |

| Degree of personal use | ||

| Degree of commercial use | ||

| Degree of government use | ||

| Degree of school use | ||

| Trust in online transactions | ||

| Prevalence of online communities | ||

| M8 | Institutional maturity | Consumer protection |

| Tax laws | ||

| Physical stores/outlets | ||

| Banking | ||

| Credit cards | ||

| Credit bureaus | ||

| Payment engines | ||

| Fraud prosecution | ||

| M9 | Corporate Social Responsibility (CSR) | Attitude of government |

| Attitude of companies | ||

| Attitude of consumers | ||

| Attitude of managers | ||

| M10 | Corruption | Prevalence of public sector corruption |

| Prevalence of private sector corruption | ||

| Attitudes of consumers |

There are ten technologies included in our research. These consist of digital profiling, segmentation, websites, search engine marketing, campaign management, content management, social media, mobile applications, digital collaboration, and analytics. The key features associated with each of the technologies are given in Table 2.

Technologies and key features.

| Technology | Key features | |

|---|---|---|

| T1 | Digital profiling | Anonymous identifiers |

| Unique identifiers | ||

| Identity management | ||

| Activity log data | ||

| User maintained attributes | ||

| External intelligence | ||

| T2 | Segmentation | Demographic attributes |

| Geographic attributes | ||

| Past activity attributes | ||

| Recent interaction attributes | ||

| Digital profile/body language | ||

| Relationship attributes | ||

| Channel attributes | ||

| T3 | Website | Security |

| Personalization | ||

| Device optimized form factor | ||

| Consistent content (Omni-channel) | ||

| Consistent pricing (Omni-channel) | ||

| Identity management | ||

| T4 | Search engine marketing | Penetration of different engines in target segment |

| Optimization parameters (SEO) | ||

| Localization parameters | ||

| Pricing models (pay per click, other) | ||

| Analytics | ||

| T5 | Campaign management | Real time location |

| Past activity | ||

| Recent activity | ||

| Intelligent forms | ||

| Landing pages | ||

| Lead nurturing | ||

| Lead scoring | ||

| A/B testing | ||

| Integration with sales and service | ||

| Effectiveness analytics | ||

| T6 | Content management | Dynamic personalization |

| Multi-media | ||

| Localization | ||

| User-generated content | ||

| Quick response codes | ||

| Quality management | ||

| Version control | ||

| Device specific renditions | ||

| Access governance | ||

| Regulatory compliance | ||

| T7 | Social media | Collaboration |

| Integration with other 3rd party applications (share credentials, profile, etc.) | ||

| Sentiment analyses | ||

| Word of mouth (WOM) | ||

| T8 | Mobile applications | Design for engagement |

| Integration with other channels | ||

| Pricing model | ||

| Branding | ||

| Device compatibility | ||

| Security | ||

| Ease of updates | ||

| T9 | Digital collaboration | Blogs |

| Live chat | ||

| SMS | ||

| T10 | Analytics Analytics is the lifeblood of successful digital marketing. It appears in most cells of the market-technology matrix. | Structured data and content |

| Unstructured data and content | ||

| Big Data | ||

| User data | ||

| Machine/sensor data | ||

| Data mining | ||

| Visualization | ||

| Statistical techniques | ||

| Prediction algorithms | ||

| Prescriptive intelligence |

NOTE: T2, T5, T6, T8 and T10 are internal/operational technologies. They are not dependent on customers being digitally connected, but are enriched if they are. They can be used for traditional (non-digital) marketing also. Examples include badge scanning at trade shows, mobile apps that are self-contained. T1, T3, T4, T7 and T9 are external/customer facing technologies, which require customers to be digitally connected.

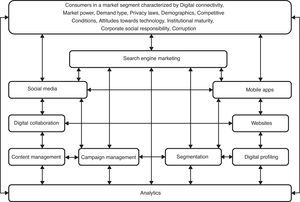

This section reviews literature under the two broad themes of Eastern European markets and digital marketing technologies, corresponding to the two main dimensions of the Iditarod framework. Each of these two themes has sub-themes related to the market characteristics and technologies discussed in the Iditarod framework. We provide a conceptual diagram showing links between consumers, market characteristics and technologies in Figure 2.

3.1Eastern European marketsWe must preface this review by acknowledging that the very definition of “Eastern Europe” is evolving. In a 2010 article, The Economist questioned this label, as an economic crisis unfolded in Europe. Nevertheless, this label is usually applied to the former Soviet bloc countries that are geographically east of Germany and west of Russia.

3.1.1The “Three-Speed Eastern Europe” modelDana-Nicoleta et al. (1997) formulated a grid with four clusters of Eastern European countries, based on the dimensions of “Marketization” and “Westernization”. This is a useful construct to simultaneously highlight both similarities and differences across these countries, so as to tailor marketing approaches. Referenced in this 4-cluster model is the macroeconomic perspective of a “three speed Eastern Europe” (Lynn, 1993). A later section of this paper draws on these ideas to select three countries for discussion.

3.1.2Demand conditionsMarketline (2014) estimated the European advertising industry to be worth about $25 billion in 2013, and expects it to grow to $31 billion by 2018, at a CAGR of 4.2%. Almost half of the 2013 market was in the Western European countries of the U.K., Germany, France, Spain and Italy. This indicates that there is room for growth in Eastern Europe as those economies transform and new consumers enter various markets. It may also mean that traditional media usage is not very entrenched in Eastern Europe, thereby opening the door for new age digital media to thrive.

Alexa, Alexa, and Stoica (2012) write about the opportunity for expanded social media usage in the general Romanian population of Internet users. About 50% of these users have Facebook accounts, of which 80% are between 13 and 34 years of age. If these numbers are reflective of other Eastern European emerging markets, there are potentially vast markets of young consumers reachable via digital marketing.

3.1.3Corporate Social ResponsibilityBester and Jere (2012) investigated whether consumers’ involvement with a cause, and the way in which the message is framed, influence purchase intention. They found that the former significantly influenced purchase intention, while the latter did not. In a similar vein of the benefits of cause-related marketing to society, Kuznetsova (2010) discusses the potential for Corporate Social Responsibility (CSR) to contribute to socio-economic development in Russia's emerging market economy. She mentions the low social trust in post-communist countries, wherein the public does not believe private businesses care about social needs. In such conditions, CSR may actually be a vehicle businesses can use to increase both public and state trust. She provides useful quantitative data on the attitudes and perceptions of Russian managers toward CSR and the public image of firms. Marketing efforts of companies interested in these post-communist markets should consider such data.

3.1.4Culture and demographicsA paper by Yoo, Donthu, and Lenartowicz (2011) proposes a 26-item “CVSCALE”, which assesses individual cultural values based on Hofstede's five-dimensional national measure. Such a measurement may be very useful for foreign companies seeking to enter new markets, or even for local companies in times of significant cultural change. Data from such measurements may be useful in choosing technologies, and in crafting methodologies for local use of the chosen technologies.

McKenzie (2010) studied the retail sector in the transition economies of Estonia, Latvia and Lithuania, who joined the European Union in 2004. An interesting point is made that one reason for high retail growth in these three Baltic States is the desire of their people to demonstrate social change, i.e., a break away from Soviet to Western concepts. Results of a 5-year retail survey empirical study (2003-2008) of Baltic shoppers’ perceptions of shopping behavior are discussed. Key findings are that (a) Baltic consumers’ brand attitude formation is not strongly oriented, (b) store loyalty is not strong, and (c) retailers must not consider these countries as one market. Vincent (2006) also stresses that technologies and marketing programs applied in one European country may not produce the same results in others, due to differences in cultures, market maturity and the stage of the “online evolution”.

McKinsey Global iConsumer Research (2012) provides the following insights into how digitally connected US consumers under 35 years of age are changing marketing requirements. Given the effects of globalization and the Internet on youth around the world, we can reasonably assume similar behaviors of such consumers in many countries (McKinsey & Company, 2013). Compared to older consumers, these young consumers are much more likely to do the following:

- 1.

Own smart phones, tablets, internet enabled gaming consoles and internet video boxes.

- 2.

Adopt VOIP, video chat, social media, mobile apps, on-demand video, and Over the Top (OTT) video (internet video on TV).

- 3.

Pay for premium digital content and purchase apps.

- 4.

Spend over three times the number of minutes on their mobile devices, especially for browsing the web, using social networks, VOIP, or video chat.

- 5.

Displace e-mail with social networks, particularly Facebook.

- 6.

Show stronger affiliation to certain brands.

Peng (2006) describes the blurring of legal and illegal boundaries in the post-Soviet transition economies of Central and Eastern Europe (CEE). Many of these countries still rank poorly on corruption indices, such as those published by Transparency International (2013). Such corruption is also described by Vachudova (2009). Companies pursuing Eastern European markets should not underestimate the challenges posed by corruption to their ability to conduct business legally and ethically. To overcome this barrier, they should institutionalize anti-corruption focus, processes and structures, as an integral part of their market strategies in these countries.

Groom (2014) describes the state of flux of European Union regulations that are being designed to increase consumer data privacy protection. While it is not clear when new laws will be adopted, or what specific impacts they will have on marketers, it is very likely that companies will have to invest in processes, systems and personnel to comply with more complex regulations. This serves as a caution for any European market penetration strategy that relies heavily on cutting edge technology.

Vissa and Chacar (2006) note that the impact of social networks on venture outcomes is particularly relevant in emerging markets, to mitigate the lack of strong institutions. Gelbuda, Meyer, and Delios (2008) have compiled a collection of five papers on the influence of institutions on businesses in Central and Eastern Europe. They offer economic and sociological perspectives on this topic.

Writing about multi-cultural marketplaces, Demangeot et al. (2013) mention the vulnerability of certain groups of consumers who are at risk for harm or unfair treatment. They also describe a framework to develop intercultural competency. As companies target such emerging markets, they would be prudent to follow the advice of Gupta and Pirsch (2014), who write about the ethics of targeting poor consumers at the “bottom of the pyramid” (BOP). Their research indicates that non-BOP consumers will punish companies perceived to engage in unethical exploitation of BOP segments. A lack of ethical practices faces dire consequences in a world of powerful, digital consumer networks.

3.1.6Standardization versus customizationDigital marketing has lowered the costs of reaching wider audiences, as compared to the traditional media. This makes it tempting to adopt a global standard for branding and customer engagement. Perhaps this is one reason why literature appears to be more widespread on regional or global case studies, while being scarce on deliberate local adaptations. In a sense, some digital marketers may be using a “spray and pray” approach, regardless of a lack of fit with an overall marketing strategy or competitive strategy.

3.2Going digitalA report from the Economist Intelligence Unit (2014) describes what organizations should do to effectively harness data from digital platforms. The report says that “the most competitive organizations deliver superior experiences that keep their customers engaged across all channels”. This requires the ability to personalize marketing, which is the essence of what makes digital marketing superior to traditional marketing. A CIO is cited as saying that mobile technologies and social media have transformed customer interaction dynamics. One analyst is cited as saying the traditional “4Ps” of marketing have been abstracted by mobile devices.

Hazan and Wagener (2012) profile European consumers’ digital purchasing behavior. They report increasing use of the online channel, mobile phones and search engines. They cite an average of four sources used by consumers for digital research, spanning search engines, retailer web sites, manufacturer web sites, YouTube, eBay and price comparison sites. They make several recommendations on how companies should develop consistent messages across these touch points. They found that customers’ “online journeys” vary by customer segment, product category and geography. They advocate personalization of marketing and diversion of marketing spend to the most efficient channels, which they classify as “paid”, “owned” or “earned”. A supporting viewpoint is provided by Galante, Moret and Said (2013), who picture how digital media affect every aspect of the consumer decision journey, from initial consideration, to active evaluation, purchase, consumption and loyalty. They also mention the emergence of roles such as “Chief Content Officer”, “Data Whisperer”, “Community Manager” and “E-commerce Expert”.

The question that remains unanswered is how best to choose the right channels or technologies to invest in. The following sections dwell on what contemporary literature has to say about different digital technologies.

3.2.1Search engine marketingMeadows-Klue (2006) says search engines “connect buyers and sellers together at the very moment of greatest interest”. He reported how the success of search engines transformed direct marketing and customer acquisition in Western Europe and had started to reach a tipping point in Central and Eastern Europe, with Internet ad spending growth rates between 25% and 50% from 2005 to 2006.

Schroder and Spillecke (2013) write about McKinsey's Digital Marketing Factory in Munich, which trains sales and marketing personnel on topics such as search engine marketing, while measuring clicks per day, cost per click, conversion rates and cost per order.

3.2.2Web analytics and social mediaGiudice, Peruta and Carayannis (2013) write extensively about social media in emerging economies. They cover practices and tools for emerging markets, social networking versus social media sites, statistics, Web 2.0, peer opinion, buzz marketing, viral marketing, word of mouth (WOM), amplification of WOM, transition economies of Central and Eastern Europe (TECEE), emerging economies, network society, CSR and social media.

David Meerman Scott (2011) has published a popular book on how to use new marketing technologies. He covers social media, online video, mobile apps, blogs, news releases and viral marketing.

Bernoff and Schadler (2010) articulate why every business needs “HEROes” (Highly Empowered and Resourceful Operatives) to succeed in a world where both consumers and employees have increasingly useful information and technologies available to them. Using stories from real companies, they show how to recognize the impact of mobile devices, pervasive video, cloud computing and social technology, to achieve a competitive advantage, by allowing employees to serve customers better. Specifically for marketing, they explain how to listen to customers, respond to them, enable them to become fans, amplify their voices by connecting them to each other, and seek their ideas to revise marketing and products.

Tonkin, Whitmore and Cutroni (2010) advocate a philosophy of “performance marketing” that calls upon marketers to continuously experiment and improve their approach, by listening to customer clicks, page views and points of interaction. They advise marketers about five realities of the Web: (a) users lead businesses, (b) search algorithms determine which websites, brands and stories are more visible, (c) customers have enormous power via comparison shopping, (d) web users trust each other more than they trust marketers, and (e) low entry barriers online make competition much more intense even for physical stores.

Harrysson, Metayer and Sarrazin (2014) outline some of these new data related opportunities that stem from consumers’ use of social media. They say “a mosaic formed from shards of information found only on social media” may help in the creation of a new product or service. They suggest several principles in order to capitalize on these opportunities: (a) engaging senior executives in social media analyses, (b) creating dispersed networks of people with a deep understanding of the business, (c) equipping employees to browse blogs, create followers and match their interests to in-store retail offerings, (d) using insights cross-functionally across marketing, sales, product development and customer support, and (e) placing the authority to act on data signals as close to the front lines as possible.

Soares, Pinho and Nobre (2012) surveyed university students to understand how social interactions may predict marketing interactions. They report that social relationships are a positive predictor of information disclosure and word of mouth, while they are a negative predictor of attitude toward advertising. They also report that trust is not a predictor of attitude toward advertising. They propose that this may be because social network users’ trust of advertising may involve a complex model of trust; one that separates trust toward their interactions with friends in the social network from their trust of the content on the social network. Marketers must understand these factors to effectively reach social media users.

Kelly (2012) provides a guide to the measurement of social media ROI for different strategies, such as brand awareness and reputation management, lead generation, increasing revenue, customer service and referrals. She explains how to align the use of social media to business objectives and the sales funnel. She reviews available tools to collect social media metrics.

Sponder (2012) provides a broad overview of social media analytics, including topics such as determining the worth of “friends, fans and followers”, measuring influence, combining (“mash up”) data from multiple sources, tools and technologies.

Bhandari, Gordon and Umblijs (2012) suggest an enhanced Marketing Mix Model (MMM) for measuring the impact of social media, by plugging in Gross Ratings Points (GRPs), similar to how TV advertising's effectiveness is measured.

Hieronimus and Kullmann (2013) describe the Online Marketing Excellence (OMEX) dashboard, developed by a McKinsey-Google partnership, in response to the lack of a standardized approach to measuring online marketing performance (Codita, 2011). It uses nearly thirty digital marketing Key Performance Indicators (KPIs).

3.2.3Customer analytics and digital campaignsBecker (2014) quotes the former CEO of Google, Eric Schmidt, as saying that society now generates as much data every two days as it did from the dawn of civilization until 2003. While there are many such estimates that vary widely among various business pundits and professional market analysts, there is no denying that an unprecedented amount of data is being generated, that the rate of data generation will continue to increase, and that this creates unprecedented opportunities to benefit society, while simultaneously opening new doors for illegal and unethical exploitation of individuals.

A marketing professional or organization that sets out to engage customers with new technologies, and glean insights through new data collection and analytical methods, must first be clear on what metrics would be valuable. A comprehensive guide to Marketing metrics is provided by Farris et al. (2010). They point out the increasing expectations to align Marketing metrics with a company's core financial metrics, and they explain how to gain insights from a wide variety of data. While they cover traditional metrics, such as market share, sales force performance, rebates, reach and revenues, they also discuss digital age metrics, such as specialized metrics for web campaigns, opportunities and leading indicators of financial performance.

Ramos and Cota (2009) describe the practice of Search Engine Marketing (SEM). They stress the importance of aligning online and offline (traditional media) marketing, using effective key performance indicators (KPIs), designing effective analytics, search engine optimization (SEO) and pay per click (PPC) marketing campaigns.

Surma (2011) describes the evolution of Business Intelligence (BI) technologies and techniques. One advanced application is data mining for customer intelligence (CI), in the realm of modern marketing. He lists four areas where compelling advances are being made: (a) the convergence of media (radio, television, the press, the Internet) and personalization on portable devices, (b) analyses of user behavior on the Internet, (c) correlation of consumers’ behavior and their physical locations, (d) development of systems that can converse in natural language with consumers. All of these areas affect marketing practices and provide companies opportunities for competitive differentiation.

Blazevic et al. (2013) have developed a scale for measuring general online social interaction propensity (“GOSIP”). The argue that interactivity on online channels is a consumer characteristic, and propose the use of the 8-item GOSIP scale as a trait based individual difference, one that firms can use to connect to their customers.

Davenport, Harris and Morison (2010) use the acronym DELTA (Data-Enterprise-Leadership-Targets-Analysts) to describe the five elements required for successful use of analytics in decision making. They outline a 5-stage model of organizational progress on analytics - impaired, localized, aspiring, analytical and competitive. They also articulate how to embed analytics in business processes and build an analytical culture.

Davenport (2013) has compiled research from many faculty members of the International Institute for Analytics, to explain how enterprises can use analytics to optimize processes, decisions and performance. A model to measure online engagement is proposed as a function of eight indices (click-depth, recency, duration, brand, feedback, interaction, loyalty and subscription). Also described is an analytical path to creating “Next Best Offers” (NBOs) for customers, designed to increase the likelihood of purchase.

Davenport (2014) describes how Big Data (a term that has varied definitions, but is primarily used to describe large volumes of unstructured data) is being used for many new applications that drive efficiencies and/or provide competitive differentiation.

3.2.4Mobile applications (“apps”)Eddy (2013) reports the results of a 2013 survey of 1000 smartphone users in the U.S. Significant numbers of respondents over the age of forty, and even higher numbers of those under forty, reported how much they use their mobile apps in everyday activities, such as waking up, managing money, doing their jobs, shopping and connecting with friends. Six percent of respondents actually said they could not be happy without their mobile apps! Such demand presents a staggeringly lucrative channel for marketers who have the right mindsets and skills to exploit it.

Bhave, Jain and Roy (2013) conducted a qualitative study of Gen Y smartphone users in India, to understand their attitudes toward branded mobile apps and in-app advertising. They also cite other researchers’ findings on cross-cultural Gen Y attitudes, SMS marketing, QR codes and Bluetooth advertising. The findings from their focus groups and interviews show the extent, contexts and purposes of Gen Y smartphone usage, gender based differences in app usage, correlation between level of app engagement and response to in-app advertising, perceptions of specific attributes of in-app advertisements (location, format, relevance, credibility, etc.), correlation between brand recognition and willingness to share information, and how recommendations from friends drive app downloads.

The outcomes of a focus group study of Gen Y mobile app users in the U.S. are reported by Keith (2011). She uses the study results to classify users into four types; Planner, Collaborator, Freeloader and Gossiper. She stresses that marketers should understand behavioral differences across these types of users, even as they address common needs, such as access to credible content generated by other users.

Save (2014) provides insights into effective mobile device based marketing, based on usage characteristics in emerging markets like India. Many young people in India have only ever connected to the Internet via a mobile device. Many developing countries, which had only small numbers of traditional land based phone lines, have established cellular networks much more rapidly and mobile phone usage has had explosive growth, catering to pent up demand. Local versions of smart phones, tablets and phablets are cheaper and readily available to a growing middle class. As Save puts it, “mobile-first is the new digital native”. These users do not use google.com (or a similar search engine web page) to start their content search. They start with mobile applications which are geared toward specific tasks, such as finding a restaurant. He advocates a 7-step process to design and execute a mobile marketing project in these market conditions.

Willmott (2014) makes specific recommendations for marketers to address the growing trend of consumers browsing retail stores, to touch, feel and try products, only to make purchases online, particularly via smartphones. Forward thinking retailers can take advantage of this behavior by delivering context sensitive messaging to the mobile device, conducting micro-locational targeting within specific store aisles, analyzing customer movements and “dwell times” within the store, offering differentiated service or pricing or rewards, and increasing wallet share.

Hopkins and Turner (2012) provide a comprehensive view of mobile marketing, covering location based marketing, mobile applications, mobile optimized ad campaigns, 2D codes and other strategies. They provide many do's and don’ts for mobile marketing, including both strategic (marketing foundation, 4Ps, 5Cs) and tactical advice (specific devices, popular apps, setting up websites, SMS and MMS). A novel framework for designing campaigns is described, based on whether they should be location centric or not, and whether they are brand-oriented (long term) or promotion-oriented (short term). A list of 17 objectives, called the “17 Rs of mobile marketing” is provided to aid campaign design, as is advice on how to measure the ROI of mobile campaigns. These are useful for companies venturing into Eastern European markets with mobile marketing as one of the vehicles.

Researchers’ interest in mobile marketing has grown over the last decade. Published accounts of practitioners’ experiences with mobile applications are also easy to find. Gupta (2013) says apps will trump immature and ineffective traditional ads (tiny banners) on mobile devices, because consumers will find them less intrusive. A great example of a functional, convenient app comes from South Korea. Subway commuters can order home delivery of grocery items by scanning QR codes on a life size picture of a grocery store shelf, i.e., a virtual store. Winkler (2014) provides an example of mobile applications integrating with search engine marketing. There are many other examples of the power of combining digital marketing technologies. Content management and campaign management systems send rich images to native mobile ads (Marshall, 2014a), while mobile ads are seamlessly embedded within social media (Albergotti and Marshall, 2014; Koh, 2014; Shields, 2014).

It is clear that mobile devices are becoming the platforms of choice for many digital marketing technologies. With sales of smart phones and tablets overtaking the sale of PCs in recent years (Wall Street Journal, 2013), marketers are embracing the mobile medium.

We are witnessing a paradigm shift in the balance of influence, from the physical to the virtual world of marketing.

3.3Conclusions from the literature reviewThere is a wide body of academic and professional literature on the different elements of this paper's topic: emerging markets, Eastern Europe, digital marketing technology, social media, mobile applications and data analytics. It is hard to find literature that applies to all of these topics together. We will extract insights from the available literature, based on market attributes and technology attributes that are similar to the topic of this paper, and then extrapolate them for applicability in the context of this paper.

- •

These countries cannot be treated as a homogeneous market; local competitors have relevant cultural knowledge and should be expected to quickly adopt new marketing skills and technologies. These countries are also at different points regarding Internet connectivity, Internet usage and availability of local workers and managers with the required skills.

- •

Corruption is a real and present danger. Invest in formal programs and structures to combat this threat as a core part of your market entry/expansion strategy, especially for partner selection and collaboration.

- •

Seize any green-field, technology driven, marketing initiative in these markets as an opportunity to expand your organization's corporate social responsibility initiatives. The young audiences you reach are especially sensitive to how a company does business. Companies perceived to be unethical will be punished by a loss of increasingly powerful, well informed and networked consumers.

- •

Even though there are many nascent and rapidly evolving marketing technologies and techniques, there are valuable lessons to be learned from the successes and failures of companies who have embraced them. Invest in identifying such lessons and incorporating them into your marketing strategy. Recognize that new attitudes, methods and skills are essential amongst managers and workers, for effective use of these technologies.

- •

Expect consumer demand and legal protections for data privacy and identity security to increase the cost and complexity of deploying new technologies into these markets. A breach of trust can have rapid and dire consequences to brands in these highly networked communities of consumers.

- •

Create roles and competencies to actively participate in relevant online communities. Transparency and honesty in these communities, as well as helping customers share opinions with each other, are required to build trust and develop brands in these low-trust, post-communist cultures.

- •

Build mobile applications for an audience that has not been through the PC era. Make these apps functional —focus on engaging customers with brands— while solving specific customer problems. Do not embed tiny banner ads.

- •

Use a proven framework to methodically build an analytics competency and apply it across the chosen technologies, to improve customer experience and to measure the ROI against the chosen business goals of deploying these technologies.

- •

As more data is generated than ever, at a faster rate than ever, organizations that can sort through the data to find relevant insights are more likely to create competitive differentiation. It is not sufficient to acquire technologies or their associated skills; sustainable success requires a deep rooted ability to embrace change, a mindset of evolution, a passion to question old ways and the discipline to make data driven decisions across all aspects of business.

- •

Opportunities for innovation in identifying, nurturing, acquiring, retaining and growing customers exist across many digital marketing technologies. Coupled with sound analytics, these technologies elevate the depth and breadth of market segmentation and customer engagement to unprecedented levels.

The next section of the paper illustrates the use of the Iditarod framework for Eastern Europe. We hope the framework provides a cohesive way of applying insights from prior literature, while also allowing readers to generate new insights into the use of digital marketing technologies.

4Applying the iditarod framework for “three-speed Eastern Europe”Combining the ideas of Lynn (1993) and Dana-Nicoleta et al., 1997, we propose grouping the Eastern European countries into the following three clusters:

- 1.

High speed cluster: Defined as highly westernized and highly marketized countries who have been members of the E.U. for at least ten years. Their markets closely resemble those of Western Europe, and they have mostly shed their Soviet-bloc legacies. Examples include Slovakia, the Czech Republic, Hungary, Poland and Slovenia.

- 2.

Medium speed cluster: Defined as highly westernized, but not very marketized countries who have been members of the E.U. for less than ten years. Examples include Bulgaria, Romania and Croatia.

- 3.

Low speed cluster: Defined as somewhat westernized or marketized countries who are E.U. candidates, but with no definitive membership date. Examples include Albania, Macedonia, Serbia, Iceland and Turkey. Note that Turkey has some high speed and medium speed westernization and marketization characteristics, but is categorized as low speed for being outside the E.U. trade and regulatory framework.

The following section selects Slovakia, Bulgaria and Albania as representative examples of the three clusters, to illustrate the use of the Iditarod framework. Table 3 uses publicly available data to highlight differences between these three countries, in terms of the ten market characteristics of the Iditarod framework. Some of the data relate directly to the market characteristics, while others are believed by the authors to be reasonable proxies for them.

Comparison of market characteristics for Slovakia, Bulgaria and Albania.

| Market characteristics and supporting data | High speed country Slovakia | Medium speed country Bulgaria | Low speed country Albania |

|---|---|---|---|

| M1 Percentage of households with Internet access | 78% Reference M1-1 | 57% M1-1 | 22% Reference M1-2 |

| M1 Broadband Internet connections per 1000 people (2012) | 147.57 Reference M1-3 | 178.71 Reference M1-3 | 50.6 Reference M1-3 |

| M1 Fixed broadband Internet subscribers per 100 (2013) | 15.52 Reference M1-4 | 19.34 Reference M1-4 | 5.75 Reference M1-4 |

| M1 Active mobile broadband subscriptions per 100 inhabitants (2013) | 53.6 Reference M1-5 | 58.3 Reference M1-5 | 24.7 Reference M1-5 |

| M1 Spend on computer data storage units (2013) | USD 188 million Reference M1-6 | USD 29 million Reference M1-65 | USD 3 million Reference M1-6 |

| M1 Information and communication technology (ICT) goods imports as % of total goods imports (2012) | 12.8% Reference M1-7 | 6.2% Reference M1-7 | 3% Reference M1-7 |

| M1, M2 Mean and median income before social transfers | 2013: 5068 Reference M1M2-1 | 2013: 2168 Reference M1M2-1 | Inequality of income distribution (2008) = 4.07 Reference M1M2-2 |

| M1, M2 Percentage of total population that is rural (2013) | 46% Reference M1M2-3 | 27% Reference M1M2-3 | 45% Reference M1M2-3 |

| M1, M2 Rural development | Low Reference M1M2-4 | Low Reference M1M2-4 | Low Reference M1M2-4 |

| M1, M2 Purchasing power parities (PPPs) (GDP per capita, as a % of the EU28 average) | 75% Reference M1M2-5 | 45% Reference M1M2-5 | 28% Reference M1M2-5 |

| M1, M2 Comparative price levels (% of EU28 average) | 69.4% Reference M1M2-6 | 49.0% Reference M1M2-6 | 50.0% Reference M1M2-6 |

| M1, M2 Average monthly disposable salary after tax (2014) | USD 905.62 Reference M1M2-7 | USD 502.78 Reference M1M2-7 | USD 434.19 Reference M1M2-7 |

| M2, M3, M9 Domestic material consumption (tones per capita, 2008) | 11.7 Reference M2M3M9-1 | 17.3 Reference M2M3M9-1 | 7.4 Reference M2M3M9-1 |

| M3 R&D expenditure (2013 percentage of GDP) | Business: 0.4 Government: 0.2 Higher Education: 0.3 Reference M3-1 | Business: 0.4 Government: 0.2 Higher Education: 0.1 Reference M3-1 | 0.2% in 2008 Reference M3-2 |

| M4 Satisfaction with public Internet access (2006, Index of 0-100) http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=urb_percep⟨=en | Bratislava 82.8 | Sofia 83.3 | N/A |

| M4 Satisfaction with Internet access at home (2006, Index of 0-100) http://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=urb_percep⟨=en | Bratislava 88.3 | Sofia 91.9 | N/A |

| M5 Population projection | 2013: 5.41 million 2030: 5.31 million 2080: 3.87 million Reference M5-1 | 2013: 7.28 million 2030: 6.48 million 2080: 4.93 million Reference M5-1 | 2013: 2.89 million 2014: 2.89 million Reference M5-1 |

| M5 Early leavers from education (2013) | 4.7% to 7.9% Reference M5-2 | 4.8% to 19.8% Reference M5-2 | 30.5% Reference M5-3 |

| M5, M7 Human Resources in Science and Technology (2013) | By age group 15-24 & 65-74: 118,000 25-34: 321,000 35-44: 240,000 45-64: 342,000 Reference M5M7-1 Reference M5M7-2 | By age group 15-24 & 65-74: 183,000 25-34: 321,000 35-44: 320,000 45-64: 512,000 Reference M5M7-1 Reference M5M7-2 | Percentage of GDP spent on public education (2013)=3.3% Reference M5M7-3 |

| M6, M7 High tech industries and knowledge intensive services (Number of enterprises) | 2012: 12,247 Reference M6M7-1 | 2012: 8,843 Reference M6M7-1 | 1998: 885 Reference M6M7-2 |

| M6, M7 Employment in knowledge intensive activities | 2013: 697,000 Reference M6M7-3 | 2013: 790,000 Reference M6M7-3 | % employed in knowledge intensive manufacturing and services in 2007=22% Reference M6M7-4 |

| M6, M7 Number of patent applications by residents | 2011: 224 2012: 168 Reference M6M7-5 | 2011: 262 2012: 245 Reference M6M7-5 | 2011: 3 Reference M6M7-5 |

| M7 Percentage of private Internet users who use the Internet for advanced communication (2008, excluding e-mail) | Instant messaging: 38 Posting messages: 37 Reading blogs: 17 Creating blogs: 4 Telephoning: 45 Reference M7-1 | Instant messaging: 15 Posting messages: 32 Reading blogs: 17 Creating blogs: 4 Telephoning: 50 Reference M7-1 | E-mail and instant messaging are the most used features of the Web Reference M7-2 |

| M7 Percentage of private Internet users who use the Internet for leisure activities related to audiovisual content (2008) | Music: 39 Movies: 30 Web radio/TV: 26 Games: 17 File sharing: 10 Podcasting: 3 News feeds: 12 Uploading content: 7 Reference M7-3 | Music: 51 Movies: 51 Web radio/TV: 37 Games: 18 File sharing: 16 Podcasting: 2 News feeds: 2 Uploading content: 7 Reference M7-3 | Electronic communications market overview 2012: Mobile: 75% Fixed voice: 17% Internet services: 9% Data communications: 2% Cable television: 0% Reference M7-4 |

| M7 Number of Facebook users (Dec 2012) | 2,032,200 Reference M7-5 | 2,522,120 Reference M7-5 | 1,097,800 Reference M7-5 |

| M7 Percentage of students using Internet (2013) | 100% Reference M7-6 | 98% Reference M7-6 | Youth (14-24 year olds) using public internet access points: Internet café: ∼50% Home: ∼10% Work: <10% School: ∼10% Reference M7-7 |

| M7 Percentage of individuals using the Internet for interaction with public authorities (2014) | 57% Reference M7-8 | 21% Reference M7-8 | E-Gov readiness index=49.7% Reference M7-9 |

| M7 Percentage of individuals using mobile devices to access the Internet on the move (2014) | 50% Reference M7-10 | 27% Reference M7-10 | Mobile Internet penetration=31.5% Reference M7-11 |

| M7 Percentage of enterprises (with at least 10 employees) using the Internet for interaction with public authorities (2010) | 88% Reference M7-12 | 64% Reference M7-12 | % of businesses with contracts for Internet connection (2011)=23% Reference M7-13 |

| M8 Domestic credit provided by banking sector (% of GDP, 2005) | 31.2% Reference M8-1 | 36.8% Reference M8-1 | 10% Reference M8-1 |

| M9 Greenhouse gas emissions by industries and households (2012, tones) | 30.2 million Reference M9-1 Reference M9-2 | 47.3 million Reference M9-1 Reference M9-2 | 2003: 3.04 Reference M9-3 |

| M9 CO2 emissions (metric tones per capita, 2010) | 6.07 Reference M9-4 | 6.0 Reference M9-5 | 1.5 Reference M9-6 |

| M10 Corruption Perceptions Index (2014) | World rank: 54 Score on 0-100 scale (higher is better): 50 Reference M10-1 | World rank: 69 Score on 0-100 scale (higher is better): 43 Reference M10-1 | World rank: 110 Score on 0-100 scale (higher is better): 33 Reference M10-1 |

*All sources for M1-1 to M10-1 and Annon, Business Park Sofia, Digital Training Academy, DM Consulting Services, GoalEurope, Iditarod, International Telecommunication Union, Konsort, Marshall, 2014b, 2014c, Oracle Corporation Partners & Solutions, The Economist, 2010, The Economist Intelligence Unit, 2014, The Wall Street Journal, 2013, Vodafone are provided within the References section.

As marketers view a particular segment in light of the characteristics listed in the above table, they can begin to choose appropriate digital marketing technologies. Not all technologies are necessarily relevant, or are likely affordable, in a given marketing scenario. Some industry experts advocate an “AND” philosophy, i.e. they advocate a broad strategy of using as many of these technologies as feasible. Other experts recommend using an “OR” philosophy, i.e. they advocate using a deep strategy of using fewer technologies, while refining their deployment and deriving increasing value from them.

Given the cost and time constraints of the real world, here are a few considerations to aid in “Iditarod configuration” or “sled configuration”:

- •

Some technologies are simple and/or more mature, such as search engines, which have affordable payment models, such as Pay per Click (PPC). For example, SEO is employed even in Albania (see reference listing for DM Consulting Services). Consider placing these at the front of the sled, i.e. implementing these first.

- •

Building a multi-channel or omni-channel digital profile of customers across all interactions over multiple technologies is complex and expensive. Consider placing digital profiling toward the rear of the sled.

- •

A full blown campaign management solution that can be executed across channels, to provide optimal customer experience and return on marketing investments, is complex. Consider placing this toward the rear of the sled.

- •

There are many vendors for each of these technologies. Some offer many of these technologies, either as discrete solutions, or as part of an integrated suite. Others are niche vendors. To avoid being overwhelmed by choices, consider using reports from independent analyst companies, such as Gartner and Forrester.

Based on the conclusions from our survey of literature, as well as data pertaining to the market characteristics in the table above, the following sections recommend Iditarod configurations for Slovakia, Bulgaria and Albania. We stress that these configurations are illustrative in nature. While they may serve as a technology deployment guide in these clusters, marketers should adjust the configurations based on the particular product or service they want to market, their available resources, their perspectives on current data related to specific market characteristics, and their short and long term goals in the target segments. More resources should be allocated to the technologies at the front of the sled. The rear of the sled may be shortened to focus on fewer market characteristics and technologies.

4.1High speed country example: SlovakiaWe suggest the Iditarod configuration for the high speed country of Slovakia in Figure 3. The markets in the high speed cluster are characterized by excellent access to high speed Internet connections, via a variety of devices, including mobile phones. Student usage of the Internet is universal. Internet usage is widespread across home, commercial and government users, for a variety of informational, entertainment and public service purposes. Mobile devices are gaining popularity and are widely used.

Surprisingly, e-commerce transactions are still uncommon, both in the business-to-consumer (B2C) and business-to-business (B2B) sectors. Given the high education rates, technical savvy of the population (especially amongst the young), favorable government policies, and maturity of supporting institutions, we expect the non-commerce use of the Internet to lead to higher e-commerce rates in the next few years. It is also conceivable that the next generation of consumers will forego the use of traditional websites and rely instead on mobile applications for commerce, relying on other consumers’ word of mouth over social media to choose products and services.

The following is a real-life success story of marketing technologies applied in the high speed country of Slovakia. We can see the story would align with the choice of technologies recommended in the above configuration.

4.1.1Case study 1 on high speed country: SlovakiaDigital Training Academy (2012) reports on the success of a Facebook campaign launched by Lay's potato chips in Slovakia. In a country with a population of just over five million, the campaign racked up over 400 000 visits per week, by cleverly linking potato chips to a widely popular national potato dish, “Halusky”. This was a cost effective and appealing way to significantly raise brand awareness.

4.2Medium speed country example: BulgariaWe suggest the Iditarod configuration for the medium speed country of Bulgaria in Figure 4. The markets in the medium speed cluster also have excellent access to the Internet, but the speed of access and the choice of devices are somewhat inferior to those in the high speed cluster. Medium speed markets have a lower purchasing power than high speed markets. These factors translate to a lower degree of use of the Internet overall. As with the high speed cluster, the heaviest use of the Internet is among students, which implies that the next generation of consumers will likely be more similar to their high speed peers.

Corruption is higher than in the high speed markets, and concern for the environment is lower, as measured by the ability to spend on such programs. Interestingly, mobile phone demand and usage are somewhat higher than in high speed markets, perhaps due to a historic lack of land lines, leading to faster adoption of mobile devices.

4.2.1Case study 2 on medium speed country: BulgariaBusiness Park Sofia (see reference section for URL) has many tenants. The park's Hewlett-Packard (HP) page says HP is the largest technology company, operating in more than 170 countries. For over 30 years, HP has been present in the Bulgarian market and for well over ten years the company has been the ultimate leader providing products, services and solutions for its customers. HP works in both public and private sectors of Bulgaria and is helping the country meet the E.U. conditions of membership and move towards the information society. The three core business groups HP works through include Enterprise Business, Personal Systems Group, and Imaging and Printing Group.

For high tech companies like HP, Bulgaria provides a pool of well-trained workers at a great price (EBSCO Industries Inc., 2015). Bulgaria has a good network of technical schools and the country was one of the main suppliers of computer technology to the Soviet bloc. Even more appealing to some, the wages for all workers average only $200 per month.

GoalEurope (see reference section for URL) says HP's business groups provide technological solutions for the country as a whole. In addition, the company is working alongside the Bulgarian government to install a faster and more reliable IT infrastructure, which processes national identity documents. Oracle Corporation's Partner Solutions website (see reference section for URL) says OneHP® is a methodology used solely by HP that connects its combined resources to deliver a unique and individual customer experience solution tailored to individual needs. In this way HP is able to help clients develop, revitalize and manage their applications and information assets. Licenses, support, professional services, and software-as-a-service are some of the offerings included through OneHP®, in order to provide an end-to-end solution to customers.

4.3Low speed country example: AlbaniaWe suggest the Iditarod configuration for the low speed country of Albania in Figure 5. Data on markets in the low speed cluster is harder to find. One reason is that they are not yet studied to the degree that E.U. members are. They have varying degrees of policy and institutional progress to be achieved (political, economic, judicial, educational social and security) before they are granted E.U. membership. Internet infrastructure may range from poor (in rural areas) to just acceptable (in urban areas). Consumers are less educated, less technologically savvy, economically poorer, and less receptive to non-traditional ways of marketing. The rural-urban divide is stark. However, these markets are also in a position to leapfrog from antiquated infrastructure to cutting edge infrastructure, as we have seen in other emerging markets. As they become E.U. members and enjoy factor mobility across open orders, receive E.U. funds, and develop economically, a new generation of consumers and entrepreneurs will be hungry to participate in the global marketplace. Until then, marketers should carefully complement traditional media with select digital technologies.

4.3.1Case study 3 on low speed country: AlbaniaAccording to the United Nations agency ITU (see reference section for URL), Vodafone has been successfully operating in Albania with sales totaling $195,500,000 in 2010. In fact, in 2012, Vodafone Albania was ranked the 7th largest company in Albania (Draper and Gale, 2015).

Vodafone's website (see reference section for URL) says Albania is a segment of the Vodafone Group Plc, an international leading mobile communication company with significant presence throughout the United States, Europe, Middle East, Africa, and Asia Pacific. Vodafone Albania's mobile network covers 86% of the territory of the Republic of Albania and reaches up to 92% of the Albanian population in both urban and rural areas. In 2008 Vodafone partnered with Alcatel-Lucent to introduce new attractive services to its clientele, such as voice and SMS packages. The SurePay® project gave users the ability to integrate prepaid services.

With its ability to introduce prepaid services, Vodafone often runs promotions through this channel. For instance, in January 2010, customers were able to take advantage of a promotion called “Vodafone ClubNon Stop”. For a price of 700 Albanian Leke (1 USD=approximately 102 ALL), a customer could get 1 000minutes of airtime for conversation within their groups and 30minutes for all other networks. With another promotion called “Super Recharge”, Vodafone subscribers could receive ALL 2 000 worth of phone time for a cost of ALL 1 000.

Vodafone also offers flexible business packages, one of which is called ‘Vodafone Paketa Professionale’. Options through this plan include 60 voice minutes per month within group for ALL 350, or unlimited airtime within group for ALL 1 100 per month.

Growing in popularity and increasing its customer base, Vodafone Albania decided to partner with Konsort to assist them with surveillance of its network of sites, localize fault sites, rescue data and repair the possible problems on time. Vodafone needed constant surveillance and an improved data collection system in a user-friendly manner, which Konsort was able to provide with its SiteInfo application. Their application was the best solution to cover Vodafone's needs on Data Collection, Fault Management, Site Management, Network Performance KPIs Reporting and Analysis. According to Konsort (see reference section for URL), the SiteInfo System, which was built from scratch, offered complete geographical coverage and availability while predicting sustainability and continuity. A second version was then released to embrace Vodafone's newest technology, 3G. Since Konsort's successful implementation in 2009, Vodafone is a more structured and organized company receiving ad-hoc information, upgraded fault and site administration functionalities and detailed, improved reports for analysis.

5Conclusions and discussionRecall the use of OMEX 2.0 (Hieronimus and Kullmann, 2013) mentioned earlier in this paper. Interestingly, its use in the analysis of 100 large European multi-chain retailers identified that success factors for online marketing are similar to those for traditional (offline) marketing. That McKinsey study found that success is determined by being strategically located, creating an attractive environment and memorable shopping experience, and nurturing loyal customers. These findings are a reminder that the core principles of marketing are timeless, even as the technological means to apply them become more sophisticated. McKinsey's insights from a 2013 CMO summit conclude with the advice that CMOs need to master the digital future, while sharpening the craft of traditional marketing.

These McKinsey articles underscore the foundational element of the Iditarod framework, which applies classic marketing principles to the use of digital marketing technologies. In this paper, we have described ten market characteristics (M1 through M10) and ten digital marketing technologies (T1 through T10), which collectively form the two dimensions of the Iditarod framework. These market characteristics are a holistic view of factors that are especially relevant to digital marketing. We have illustrated how the framework can be applied in choosing appropriate technologies for a market.

Using three different countries from Eastern Europe with distinct market characteristics, we have proposed three corresponding configurations of the Iditarod sled, i.e. different combinations of technologies that suit these markets. Public data made available by the E.U. is used extensively to understand absolute and relative differences between these countries, with regard to the ten market characteristics. A marketer who wishes to use the Iditarod framework can use one of these three configurations as a starting point, merely by understanding which cluster (high/medium/low speed) their targeted Eastern European country belongs to. This provides a “standardization” approach. Next, the marketer can adjust the baseline configuration for a particular country's unique market characteristics, thus adding a “localization” approach.

6Limitations and directions for future research6.1Limitations- 1.

This paper draws insights from prior literature, but is not supported by its own empirical study.

- 2.

The combined effects of variables from the referenced literature are hypothesized, but are not proven.

- 3.

This paper focuses on product companies. It needs to incorporate additional marketing mix considerations for service companies.

We intend to continue this discussion of the Iditarod framework in two future papers on the following topics:

- 1.

How to correlate market characteristics and marketing technologies using the classic marketing mix matrix?

- 2.

Formulating several hypotheses on the relationships between market characteristics and marketing technologies, for empirical testing.