The objective of this study is to compare the effects of a company's perceived levels of trust, reputation, risk perception, and quality, on consumers’ purchasing intention in two contexts. The first context posits a company in stable financial condition, while the second a company in bankruptcy reorganization. After proposing the theoretical model, we conducted research using two questionnaires, which resulted in 187 respondents for the stable company situation, and 189 who responded to questions about companies undergoing corporate bankruptcy reorganization. The results support our assumptions that the state of a company's financial situation has an effect on the relationship of trust on perceived quality, and reputation on purchase intention. These results lead to the conclusion that an unfavourable financial situation does not generally harm consumer perceptions of the supplier company but may cause changes in perceptions of their trust and reputation.

The financial health of a company depends on the competence of its managers, and a company's external economic context, which is fluid and thus can have various possible effects on the company. When a company does not remain financially sustainable, the result may be its extinction, which is referred to as corporate bankruptcy. However, due to social interests in the preservation of business activity, the State does allow companies in a critical financial situation to obtain special conditions to provide relief for them to continue their business. Corporate Bankruptcy Reorganization (CBR) seeks to enable the restoration of the financial health of a company by suspending claims against the debtor and by drawing up a financial recovery plan, in agreement with creditors, with the planning and execution of this plan being under the supervision of the judiciary (Evans & Borders, 2014).

Although the consumer is not directly considered by the legislation as a participant in the arrangement, their importance in the process is undeniable: the resources coming from these consumers will make feasible any reorganizational plan, be it corporate or otherwise. In this sense, and given the publicity allowed for CBR proceedings (which are not secrets, as a rule), this legal phenomenon may have potential market repercussions, growing in importance in the theme of relationship management between a company and its consumers, especially in customers’ purchase intention (Williams & Naumann, 2011).

Factors such as trust, reputation, perceived quality, and risk of purchase can be influenced by the consumer's perception which varies depending on the financial situation of a company from which they have already purchased or will purchase products or services in the future. Thus, the objective of this study is to compare the coefficients of the relationships between trust, reputation, perceived quality, perceived risk, and purchase intention in two distinct categories: as relating to companies in stable condition and to those in CBR. We verify this by reading the relation between perceptions of trust and reputation on perceptions of quality, on perceived risk, and of these constructs on purchase intention in relation to both positive and negative financial situations for the companies from whom they wish to purchase.

The possible influences of the financial situation of a company on the non-financial aspects are dealt with, in the literature, mostly in the area of finance, with few studies to be found on the effects of a company's indebted situation on its marketing efforts (Malshe & Agarwal, 2015; Rollins, Nickell, & Ennis, 2014). Thus, this research aims to contribute to the understanding of how the specific situation of CBR can influence consumer behaviour. In the same vein, the better understanding of a company's new financial situation in the market, in terms of its financial situation effects on the perceptions of consumers, can help inform managers and other stakeholders so that they can develop better marketing strategies to help ameliorate the detrimental effects that CBR may have on their perception.

2Theoretical frameworkThe creditors of companies undergoing CBR tend to pressure their managers to adopt strategies more aligned to short-term objectives, resulting in the emphasis on cost cutting actions and reduction of investments in intangible assets such as advertising and research and development (Malshe & Agarwal, 2015; Rollins et al., 2014). Nevertheless, there is evidence that marketing actions help the company overcome the financial crisis (Evans & Borders, 2014).

Purchase intention is the consumer's preference to buy a product or service after evaluating it. Although sociocultural elements guide the purchasing decision process (Calvo-Porral & Lévy-Mangin, 2017), other factors may influence consumer intent while they are considering possible consumption alternatives. Younus, Rasheed, and Zia (2015) suggest that external factors have greater influence in the choice of a purchase. And, given that the two distinct financial situations of a company may result in different effects on factors such as reputation, trust, quality, and risk perception, it is reasonable to say that they may also influence purchase intention.

Zeithaml (1988) explains that levels of quality perceived are the result of a consumer judgement on the excellence or superiority of a product or service. Research indicates that there is a positive influence between perceived quality levels and consumers’ purchase intention (Bao, Bao, & Sheng, 2011; Castelo, Cabral, de, & Coelho, 2016; Snoj, Pisnik Korda, & Mumel, 2004; Sweeney & Soutar, 2001). Moreover, with the perception of consumer quality resulting more from abstract aspects regarding the company and their products and services than their tangible attributes (Dodds, Monroe, & Grewal, 1991; Bao et al., 2011), we can infer that it is possible to modulate this evaluation according to the different contexts in which we find a relationship between suppliers and consumers. In view of the aforementioned, we propose the following hypothesis:H1 The influence of the perceived quality of products or services on the purchase intention of products from a financially sound company is greater than that of a company undergoing CBR.

Perceived risk is associated with the degree of uncertainty that consumers may experience in their purchasing decision process considering the probability of losses resulting from that decision (Chiu, Wang, Fang, & Huang, 2014; Fortes & Rita, 2016). There are empirical studies showing that exists a negative influence between perceived risk and purchase intention (e.g. Chiu et al., 2014). Several aspects of the purchase can influence the risk perception as the environment or channel in which the buyer and seller relate, the brand or tangibility of the product and the reputation of the selling company (Laroche, Yang, McDougall, & Bergeron, 2005). Considering the elements explained above, we propose the following hypothesis:H2 Customers are less influenced in their purchase intentions by perceived risk when they are purchasing from a stable company as opposed to a company in CBR.

The assessment of levels of consumer trust are due to their successive interactions with a product or service and its supplier. These interactions make up the experiences that the consumer evaluates in aggregate, adjusting their behaviour towards the supplier according to this evaluation (Bapna, Qiu, & Rice, 2017; Caldwell & Clapham, 2003). Therefore, the level of consumer trust over the supplier tends to positively influence their purchase intention (Lu, Fan, & Zhou, 2016).

Considering, therefore, that consumers tend to base their suppliers trust levels by assessing the supplier's ability to deliver products or services according to certain expected standards, as well as their in their ability and intention to maintain a good relationship over time and to serve the interests of the consumer (Delgado-Ballester, Munuera-Aleman, & Yague-Guillen, 2003; Lu et al., 2016), it is possible that trust levels could differ in two different contexts: a stable company and a company in CBR. In view of the above, we propose the following hypotheses in this study:H3a The influence of consumer's trust on their perceived quality of the product or service of a financially stable company is greater than that of a company undergoing CBR. The influence of consumer's trust on their purchase intention for the product or service of a financially stable company is greater than that of a company undergoing CBR. The influence of consumer's trust on their risk perception of purchasing a product or service from a financially stable company is less than that of a company undergoing CBR.

Reputation of a company in the consumer market is generally understood as the general impression that this company or brand has in the minds of individuals. This impression may result in a positive or negative assessment of the company and its products/services (Burke, Dowling, & Wei, 2018; Eberle, Milan, & de Matos, 2016; Flanagin, Metzger, Pure, Markov, & Hartsell, 2014). Research shows that a good reputation influences consumers’ positive perception of the quality and reliability of a company's products and services, positively influencing consumer behaviour regarding their satisfaction and purchase intention (Akdeniz, Calantone, & Voorhees, 2013; Doney & Cannon, 1997; Raithel & Schwaiger, 2015). Considering, therefore, the possibility of having different influences of reputation on the perceptions of quality, risk and purchase intention according to the financial context in which a company is located, we propose the following hypotheses:H4a The influence of reputation, as perceived by a consumer of a financially stable company, on the consumer's perceived quality of products or services is greater than that of a company undergoing CBR. The influence of reputation, as perceived by a consumer of a financially stable company, on the consumer's purchase intention is greater than that of a company undergoing CBR. The influence of reputation, as perceived by a consumer of a financially stable company, on the consumer's risk perception on the purchase of products or services is less than that of a company in CBR.

Information about the financial difficulties of a company can represent negative connotations in the consumers’ imagination, naturally leading researchers to raise questions about the effects of this information on their purchase decisions (Malshe & Agarwal, 2015). Therefore, external factors associated with the company, such as reputation and trust; with the product, such as perceived quality, and with risk of the purchase itself, can clearly influence the purchase intention, as determined by the financial situation of the company (Younus et al., 2015).

In considering, therefore, that external aspects, as perceived by the consumer in general, especially those directly associated with the situation of the supplier companies, can influence the evaluations of the consumer itself, we can infer that the different financial situations of the company can have different results on the consumption decision (Williams & Naumann, 2011). Thus, factors such as trust and reputation can clearly influence the perception of quality and risk, in the same way that these constructs can influence purchase intention also distinctly according to the different financial situations of the company.

3MethodsTo reach the objective of this study, we adopt the quantitative, descriptive, cross-sectional approach. We consider the Brazilian market as the field of study, with consumers of products or services in general as target population, without distinction of any kind between individuals. Samplings were non-probabilistic for accessibility.

We applied two questionnaires to identify the different perceptions of consumers under two different contexts: one in which the company is characterized as being in a stable financial situation and another in which the company is in CBR. The questionnaires are auto filled and accessed via the online platform, both of which begin with a brief presentation on the theme, followed by the purpose of the research, clarification of the confidentiality of the study and the author's presentation. In order to identify, in the profile of the respondents, if they belong to the target population, which is a consumer likely to be influenced by the financial situation of the company providing the good or service of their interest, the control question in the opening of the questionnaire is to verify whether the respondent has autonomy to exercise their purchase intention, excluding those who assume they do not have such autonomy.

In order to measure the consumer's intention to purchase a product or service from a certain company, we use 5 questions by Dodds et al. (1991). The 4 questions on consumer trust in a company originate from Delgado-Ballester et al. (2003). The dimension on consumer risk perception on a purchase comes from research by Laroche et al. (2005) with 4 questions. Doney and Cannon (1997) served as sources of the 3 questions for measuring the reputation perceived by the consumer over a supplier company. And finally, we measured the perceived quality aspect by the consumer about a product or service from the scale by Sweeney and Soutar (2001) with 4 questions. We detailed the constructs that we measured and respective indicators in the appendix of this study. We adopted the five-point Likert scale as answers, with purchase intention ranging from “not likely at all” (1) to “quite likely” (5). We adopted, for the other dimensions, the variation of “totally disagree” (1) to “totally agree” (5).

The distinction between the types of questionnaires happened through the characterization of the different financial situations of the companies that supply products or services: while, in one questionnaire the company is characterized as financially stable, in the other questionnaire we evidence it as being in CBR, clarifying in the questionnaire that this is a situation of serious financial problems for the company. At the end of the questionnaire we characterize the respondents through demographic questions: gender, age, marital status, schooling, and income.

In order to give the best possible efficacy to the questionnaires, the following measures were taken: the questions were elaborated based only on research already validated by the scientific literature; the questions were translated and adapted to the Portuguese language by a translator specialized in scientific articles; and pre-tests were performed with 10 respondents for each questionnaire, avoiding the risks of using ambiguous terms or interpretation biases. It was also taken care that the questionnaires were published by different channels (Facebook, WhatsApp and e-mail, for example) and for different groups in different regions of Brazil, between February and July 2017, trying to avoid the likelihood that the same individual would respond to both questionnaires.

The final samples are made up of 187 respondents for stable companies and 189 for companies in CBR. Both samples are similar regarding the gender of respondents, with 52% of them females and 48% of them males. As for income, the majority range in both samples is above eight minimum wages, with 67% in the sample being in stable companies and 51% in the sample on companies in CBR. In the age group, there is a majority of 51% between 20 and 50 years of age of respondents in both samples. Regarding education, 79% of respondents for stable companies have higher education or above, whereas it is 83% for the same age range among respondents on companies in CBR.

To analyse the data of this study, we adopt as our statistical approach the Structural Equations Modelling technique, with estimation by the Partial Least Square (PLS-SEM) (Hair et al., 2014). After, we verify whether there are statistically significant differences between the path coefficients according to the financial contexts of the company. For this purpose, we use the multi-group analysis technique proposed by Keil et al. (2000) for the comparative hypotheses testing between stable companies and companies undergoing CBR.

4Research results4.1Validation of the structural modelFor validation of the constructs we apply a confirmatory factor analysis. We started by analysing the factor loadings, which resulted in the exclusion of the indicators with values lower than 0.5: 2nd and 3rd purchase intention indicators (PI) for stable companies and the 3rd purchase intention indicator (PI) for companies undergoing CBR. After the exclusion, we performed a new confirmatory factor analysis, the results of which are shown in appendix.

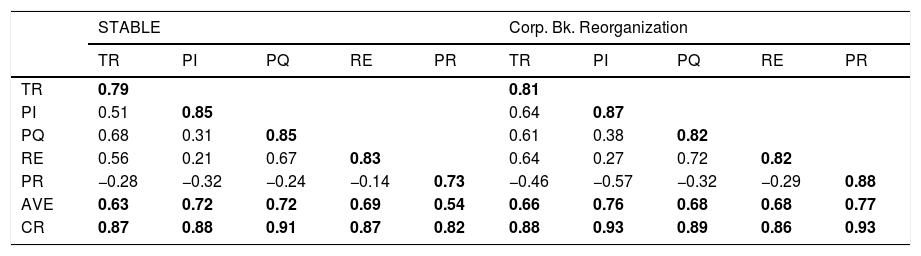

After, we proceeded to verify the convergent validity. We initially compared the factor loadings of each indicator between different constructs, determining that the greatest factor loadings are in their respective construct and values above 0.63, evidencing that the indicators of each construct converge to the construct itself. Then, we verified the average variance extracted (AVE), whose results are shown in Table 1, with all presented values being determined as above 0.5, corroborating for the validation of convergence. After concluding the verification of the convergent validity, we also verified that the composite reliability values present values higher than 0.70, also considering as valid values slightly above 0.90 (Table 1), verifying the convergent validity.

Correlations between constructs, average variance extracted, composite reliability and square roots of the average variance extracted.

| STABLE | Corp. Bk. Reorganization | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| TR | PI | PQ | RE | PR | TR | PI | PQ | RE | PR | |

| TR | 0.79 | 0.81 | ||||||||

| PI | 0.51 | 0.85 | 0.64 | 0.87 | ||||||

| PQ | 0.68 | 0.31 | 0.85 | 0.61 | 0.38 | 0.82 | ||||

| RE | 0.56 | 0.21 | 0.67 | 0.83 | 0.64 | 0.27 | 0.72 | 0.82 | ||

| PR | −0.28 | −0.32 | −0.24 | −0.14 | 0.73 | −0.46 | −0.57 | −0.32 | −0.29 | 0.88 |

| AVE | 0.63 | 0.72 | 0.72 | 0.69 | 0.54 | 0.66 | 0.76 | 0.68 | 0.68 | 0.77 |

| CR | 0.87 | 0.88 | 0.91 | 0.87 | 0.82 | 0.88 | 0.93 | 0.89 | 0.86 | 0.93 |

Note: Trust (TR); Purchase Intention (PI); Perceived Quality (PQ); Reputation (RE); Perceived Risk (PR); Average Variance Extracted (AVE); and Composite Reliability (CR).

Note: The main diagonals represent the square roots of the AVEs.

We then proceeded to check the discriminant validity to confirm whether each construct is indeed unique, differentiating themselves from the others in the same empirical research model. We initiated this verification by comparing the groups of factor loadings of latent variables, verifying that the group of each construct had factor loadings higher than the other groups, indicating the discriminant validity, because the factor structure we found indicates various constructs. The verification of the discriminant validity was concluded with the analysis of the criterion by Fornell and Larcker (1981), according to which the square root of the AVE should be greater than its highest correlation with any other construct. As we verified by the values on the main diagonals of Table 1 in each financial context of the company, these results confirm the discriminant validity, verifying the validation of the empirical model and its respective constructs.

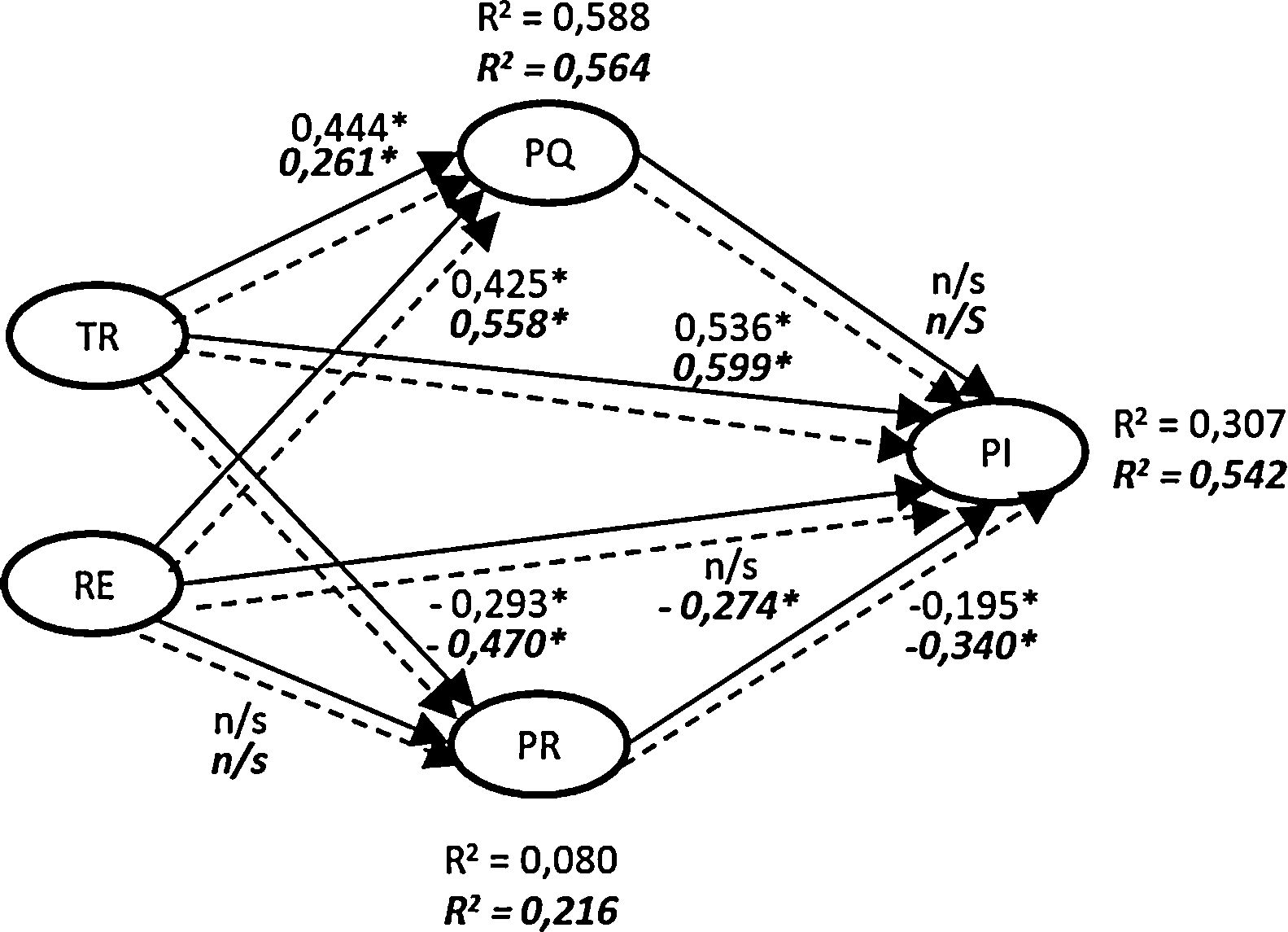

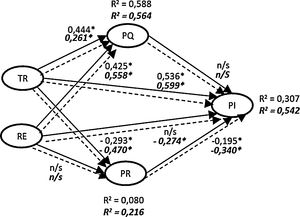

4.2Analysis of the structural modelWe can represent dependence relations, as well as the nature and magnitude of the relations between the constructs, by means of a structural model (Hair et al., 2014). To analyse the structural model of this study, we verify the path coefficients and the coefficients of determination obtained from the data (Fig. 1).

Structural models combined with paths on stable company (values at the top) and company undergoing CBR (values at the bottom).

Note: Trust (TR); Purchase Intention (PI); Perceived Quality (PQ); Reputation (RE); Perceived Risk (PR); Coefficient of Determination (R2); *p-value <0.05; n/s: statistically insignificant value; Source: Own elaboration.

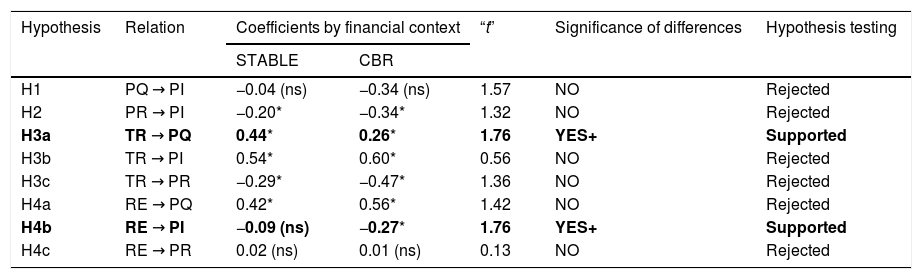

In order to test the hypotheses, we needed to verify if there is a statistically significant difference between the context path coefficients of a stable company and their respective values in the context of CBR. In order to confirm or reject the statistical difference between the coefficients, we adopt the multi-group analysis methodology proposed by Keil et al. (2000), and the value of the test “t” expresses the significance of differences with reliability greater than 95% if its value exceeds 1.96; or above 90% and less than 95% if the value is greater than 1.65 in a one-tailed distribution and greater than 1.96 in a two-tailed distribution.

We consolidated, in Table 2, the results according to each relation between constructs and respective financial contexts of the company. Based on these results, we verified that there were no statistically significant differences in the pairs of coefficients related to hypotheses H1, H2, H3b, H3c, H4a and H4c, implying their rejection.

Path coefficients, variables and “t” results.

| Hypothesis | Relation | Coefficients by financial context | “t” | Significance of differences | Hypothesis testing | |

|---|---|---|---|---|---|---|

| STABLE | CBR | |||||

| H1 | PQ → PI | −0.04 (ns) | −0.34 (ns) | 1.57 | NO | Rejected |

| H2 | PR → PI | −0.20* | −0.34* | 1.32 | NO | Rejected |

| H3a | TR → PQ | 0.44* | 0.26* | 1.76 | YES+ | Supported |

| H3b | TR → PI | 0.54* | 0.60* | 0.56 | NO | Rejected |

| H3c | TR → PR | −0.29* | −0.47* | 1.36 | NO | Rejected |

| H4a | RE → PQ | 0.42* | 0.56* | 1.42 | NO | Rejected |

| H4b | RE → PI | −0.09 (ns) | −0.27* | 1.76 | YES+ | Supported |

| H4c | RE → PR | 0.02 (ns) | 0.01 (ns) | 0.13 | NO | Rejected |

*p-value<0.05; ns: not significant; +: reliability above 90%; Note: Trust (TR); Purchase Intention (PI); Perceived Quality (PQ); Reputation (RE); Perceived Risk (RP); Source: Own elaboration.

For both the H3a hypothesis and the H4b hypothesis, the respective differences between the coefficients are significant with reliability above 90% according to value “t” of 1.76 in a one-tailed distribution, both of which are supported in this study. For Hypothesis H3a we were able to infer statistically that there has been a deterioration in the relation between trust and perceived quality due to the reduction of the coefficient by 0.44 in the context of stable company to 0.26 in the context of company undergoing CBR. For hypothesis H4b, in turn, there is also a significant difference, since, whereas the value of the coefficient of reputation-to-purchase intention ratio is not significant in the context of stable company, the value becomes significant and negative in the context of CBR, indicating, therefore, that there has been a change in this relation, thus supporting the hypothesis.

5DiscussionIn this stage, we sought to analyse the results of the comparison between the relationships of the constructs of trust and reputation on constructs of perceived quality and risk, and all of them on the construct of purchase intention, as it relates to the two different contexts (the company in stable financial condition and the company undergoing CBR). Firstly, there was no significant effect of the perceived quality on purchase intention in both contexts of financial condition of the company, implying the rejection of the H1. This result suggests that the financial situation of the company tends not to influence the relationship between the perceived quality of the product or service on the purchase intention. Although the literature indicates a positive relation of perceived quality on purchase intention (Snoj et al., 2004), here the influence is not significant in contexts associated with the financial health of the selling company. One explanation for the result is that the perceived quality may not be a decisive factor in the purchase intention, but rather a criterion of consumer evaluation, which will lead them to attribute value to the product or service, with perceived value being the determining factor of purchase.

Perceived risk had a significant and negative influence on purchase intention in both scenarios, which is in agreement with studies about this relationship (Khan, Liang, & Shahzad, 2015). Although the coefficient in the CBR context may suggest an increase in risk perception relative to the stable company, there was no significant statistical difference between the coefficients. Hence, H2 is not confirmed. This suggests that the company CBR's financial situation does not enhance the effect of perceived risk on purchase intention, perhaps because of the time when consumer risk assessment occurs most often: upon purchase (Khan et al., 2015). That is, considering that the consumer assesses the risk predominantly at the time of purchase, it is likely that they do not simply take into account the supplier's situation but consider the attributes of the product or service more.

We verified that there is a significant difference between the effects of trust on the quality which is perceived between the contexts of the stable company and the company undergoing CBR, supporting H3a. The relationship is significant and positive in both financial contexts of the company, corroborating with the literature on the subject (e.g., Akdeniz et al., 2013). As a company in CBR, however, the value of the coefficient is lower than in the condition of the stable company, suggesting that the company's unfavourable financial condition implied mitigation of the effect of trust on perceived quality. This result is in line with the idea that consumers tend to base their trust on an assessment of the ability of companies to deliver products/services to certain expected standards, that is, in the case of the company experiencing financial difficulties, can the consumer presume that the quality of their product or service has been undermined by the company's need to reduce costs (Delgado-Ballester et al., 2003; Lu et al., 2016).

The effect of trust on purchase intention in both scenarios is significant and positive, thus, being in accordance with the literature (Lu et al., 2016). However, the indicators do not have a statistically significant difference between companies that are in a stable situation or the ones undergoing CBR, thus rejecting H3b. This lack of difference suggests that the information on the company undergoing CBR does not influence the effect of trust on purchase intention, perhaps due to the fact that trust arises from the direct experiences of the consumer with the product or supplier (Caldwell & Clapham, 2003), possibly being of little relevance to external information about the company's financial situation.

Trust on perceived risk presented significant and negative coefficients in both contexts, corroborating previous studies (e.g., Bapna et al., 2017), without there being, however, a significant difference between them, implying the rejection of H3c. This absent difference suggests that the company's financial situation does not affect trust on perceived risk. This result is consistent with the rejection of H3b, perhaps due to the fact that, since trust is the result of direct consumer experiences with the company, its influence on perceived risk is supported by elements more or less sedimented in the consumer's imagination, and can therefore be confirmed or denied by the consumer themselves after a new contact with the company, even if the consumer is in financial difficulty.

There is no significant difference in the influence of reputation on the quality perceived in both contexts of the company's financial situation, implying the rejection of H4a. The path coefficients are significant and positive, corroborating research on the theme (Raithel & Schwaiger, 2015). This result suggests that the financial situation of the company has no effect on the influence of reputation on perceived quality. The similarity of influences can be explained by the fact that reputation and quality values are elaborated by the individual either by personal experiences with companies and their products or by third-party evaluations. Thus, it can be assumed that, as long as there is no new concrete experience of changing quality about a product, the individual will first avail himself of his past experiences to evaluate his present opinion. Isolated news of judicial recovery will not change his mind about the quality of a company's products.

There was a difference between the influence coefficients of reputation influence on the purchase intention between both financial condition scenarios, having been insignificant when the company is stable and negative and significant when the company is undergoing CBR, which supports H4b. The significant and negative coefficient in the context of a company undergoing CBR apparently appears against the literature in that it is expected to have a positive relationship between reputation and purchase intention: the better the reputation, the greater the intention of the consumer to acquire the products or services of the company would be, and not the opposite (Raithel & Schwaiger, 2015). This result suggests that the financial situation of the company may influence the reputation relationship with purchase intention. A possible explanation for this phenomenon may be that when the consumer learns about the weak financial situation of the company, he or she assumes that it will take more aggressive action against the competition in order to attract buyers and secure more sales. Thus, the company's CBR situation could represent an opportunity in the consumer's imagination, to obtain benefits such as lower prices, aggressive price discounts, and better payment conditions among other opportunities.

Reputation does not have significant influence on perceived risk in both contexts; therefore, the difference is not evidenced, which leads to the rejection of H4c, suggesting that the company's financial situation has no effect on the relationship between these constructs. These results were different from what the literature predicts, in that reputation is expected to have a significant and negative influence on perceived risk, so that the better the reputation of a company, the less risky the consumer would perceive to be the purchase of a product or service from that same company (Khan et al., 2015).

A possible explanation for this phenomenon may be that, given that the reputation of a company is also formed in the consumer imagination by direct experiences involving them and the supplier company (Ashley & Tuten, 2015), the consumer will tend to change their opinion on the reputation of that company only when a new experience confirms or denies their past experiences. Thus, the information of the company's financial situation alone would not have significant effects on the reputation of the consumer's perceived risk.

The results of this study indicate that, if we keep the other factors constant, the isolated information of companies financial situation does not have relevant effects on the majority of the relations studied, such as trust on purchase intention or on perceived risk, reputation on perceived quality and risk, and the constructs perceived quality and risk on purchase intention. However, we evidence the influence of the information of the financial situation on the relationship of trust on perceived quality and reputation on purchase intention. These results indicate that the disclosure of the companies’ financial situation can have a deleterious effect on the relationship of trust on perceived quality, as well as reputation conversely starting to influence purchase intention, something that the consumer can regard as a purchasing opportunity, as discussed.

6ConclusionsThese results lead to the conclusion that an unfavourable financial situation does not generally harm consumer perceptions of the supplier company but may cause changes in perceptions of trust and reputation, which tend to influence quality and purchase intention. In the theoretical field, this study contributes by verifying the influences of constructs associated with marketing in consumers’ purchase intentions, according to the different financial contexts of a company. The main theoretical contribution refers especially to the demonstration that the financial context of the company can affect the relations between these elements of marketing. This study tends to contribute to a better understanding of the influence of environmental factors on the behaviour of individuals in a context of consumption, even if these factors are not directly related to this context, such as the financial situation of the company supplying products or services.

As for the management aspects of the companies, the research contributes with evidence that the consumer's purchase intention is affected when the company is undergoing CBR, and marketing actions can help the company overcome financial crisis by restoring the consumer's purchase intention. However, as creditors of companies undergoing CBR tend to pressure their managers to adopt strategies which result in reduction of investments in advertising and research and development, the research can contribute with guidelines on what aspects the managers should focus on more with the limited marketing resources available to companies undergoing CBR.

This research has limitations in view of the samples being based on the B2C market (consumer), with possible different implications in the corporate market (B2B), something that can be revealed in future studies. Another aspect that may be considered is that the survey does not specify to respondents aspects such as type or tangibility of the product or service, the payment and receipt times, the differentiation between manufacturer and supplier, given that these aspects may imply modulation in the perceptions about the constructs studied. Another limitation in this study, is that the samples are small in size, although statistically sufficient, and non-probabilistic for accessibility, which does not allow inferences about the population of consumers as a whole, despite providing evidence of behaviour that can be confirmed in later studies.

As for suggestions on future studies, surveys may consider specific aspects in the consumer relations scenarios such as the type of product (food, technology, automobile, appliance) or its tangibility (product or service), regarding the business environment (whether physical or virtual), or when vendor is a reseller or manufacturer. We also suggest applying the research on B2B market samples since, for the corporate client, aspects such as reputation and the financial situation of the company tend to be critical information in their purchase intention. Finally, this research elicits an element little considered in marketing, but that potentially can interfere in the relations between the companies and their consumers.

Conflict of interest statementOn behalf of all authors, the corresponding author states that there is no conflict of interest.

This research was supported by Brazilian National Council for Scientific and Technological Development (CNPq/Brazil), project 304209/2018-0, by Foundation for Research Support of Espírito Santo (FAPES/Brazil), projects 84513772 (599/2018) and 85395650 (228/2019), by Portuguese Science Foundation (FCT/Portugal) through NECE (Núcleo de Estudos em Ciências Empresariais), project UID/GES/04630/2019, and by IFTS (Instituto Fucape de Tecnologias Sociais), project 2018-2021.