We analyse the effect of the media on the informativeness of accounting earnings. We collected news articles on a sample of non-financial listed firms over the 1996 to 2014 period in Spain, a country characterised by the widespread presence of dominant owners. Our results indicate that disclosing information through financial media coverage in newspaper articles positively affects earnings informativeness. Moreover, results show that publishing media news reports which have a negative tone has a positive effect on the informativeness of accounting earnings. Results suggest that the media serves as an effective external corporate governance mechanism in improving the informativeness of accounting earnings within the context of Spain.

The media has been posited as a relevant corporate governance mechanism, serving as an essential channel through which information is disseminated to investors (e.g., Fang and Peress, 2009; Armstrong et al., 2012; Jansson, 2013; Ahern and Sosyura, 2014). The media may therefore act as an information intermediary between firms and external investors (e.g., Miller, 2006; Tetlock, 2007; Bushee et al., 2010) increasing the level of transparency and enhancing the level of protection of interests afforded to external agents (e.g., La Porta et al., 2000; Djankov et al., 2008; Anderson et al., 2009). The media select, analyse, communicate and can influence the informativeness of earnings reported by firms. They can play a key role in controlling the actions of dominant owners and directors by reducing informational asymmetries between internal and external agents and by influencing internal agents’ image and reputation (e.g., Dyck and Zingales, 2002; Farrell and Whidbee, 2002; Miller, 2006; Dyck et al., 2008; Bushee et al., 2010; Bednar, 2012; Liu and McConnell, 2013). Works addressing the role played by media coverage of the quality of financial reporting remain scarce and tend to focus on contexts that differ significantly from a continental European setting. Chahine et al. (2015) and Qi et al. (2014) report a positive relationship between media coverage and the quality of accounting information in a US and Chinese context, respectively.

The current work seeks to explore the media's impact on the informativeness of accounting earnings disclosed by firms in a continental European context. To do this, we use a sample of Spanish non-financial listed firms over the period 1996–2014. Spain provides a particularly interesting setting to study the media's impact on earnings informativeness, since it is a country characterised by the widespread presence of dominant owners (large shareholders who effectively control firms). Spain is also a country where people feel that the level of media independence from undue political and business influence is similar to the UK or US (Reuters Institute, 2016). Our results show that media coverage and publication of news items with a negative tone positively affect the informativeness of accounting earnings. More specifically, the media affects the financial reporting quality of firms through coverage and by creating reputation. Results may be extrapolated to other continental European countries which display similar institutional features and a similar level of media independence, such as Italy or France (e.g., La Porta et al., 1998; Djankov et al., 2008; Reuters Institute, 2016).

We provide fresh evidence concerning the effect of media coverage on earnings informativeness that is difficult to capture in the US or China. In contrast to an Anglo-American context, weak legal protection in continental Europe encourages opacity of the accounting information disclosed by firms (e.g., Riahi-Belkaoui, 2004; Cahan et al., 2008). This is because the widespread presence of dominant owners with the ability and the incentive to play an active role in management (e.g., Cuervo, 2002; Faccio and Lang, 2002; La Porta et al., 1999; Santana and Aguiar, 2006) allows them to either use accounting information to protect themselves from their competitors or to hide the consequences of actions which conflict with external investors’ interests (e.g., Fan and Wong, 2002; Leuz et al., 2003; Anderson et al., 2009). Consequently, the presence of dominant owners allows relationship-based governance due to dominant owner ability to economise on the costs of monitoring management (e.g., LaFond, 2005; Villalonga and Amit, 2006). As a result, ownership concentration increases the likelihood that information asymmetries between managers and shareholders will be resolved by private communication channels rather than by ‘arm's length’ public disclosure (e.g., Peek et al., 2010; Ball and Shivakumar, 2005; LaFond, 2005; Dargenidou et al., 2007; Bona Sánchez et al., 2011). Although ownership concentration is common in China, the media context differs from a continental European setting since Chinese media are characterised by a high degree of opacity, less freedom to determine the content of media coverage, and less legal protection when sued by individuals or companies, added to which they tend to be government owned (Qi et al., 2014).

Our study contributes to the literature exploring the effect of media coverage on the informativeness of accounting earnings by providing evidence concerning the link between media and accounting information in a continental European context in which the presence of dominant owners is prevalent and media independence is high. To the best of our knowledge, this issue has not been addressed in previous literature. Our work allows us to explore the role of the media in an environment where private channels play a key role as sources of information and, therefore, where media coverage might affect the quality of accounting information, and which may differ to what is expected in a wide ownership context (Bednar, 2012). Many papers have examined the media's role as a corporate governance mechanism using US or international samples (e.g., Dyck and Zingales, 2002; Agrawal and Chadha, 2005; Miller, 2006; Core et al., 2008; Fang and Peress, 2009; Bushee et al., 2010; Engelberg and Parsons, 2011; Gurun and Butler, 2012; Khunen and Niessen, 2012; Ahern and Sosyura, 2014; Drake et al., 2014; Cahan et al., 2017; Chahine et al., 2015; Ahmad et al., 2016; Lauterbach and Pajuste, 2017). However, the results of these studies are not transferrable to the continental European setting since, as Jansson (2013) points out, the institutional logic sought by the media varies between different contexts because actions considered correct in one country may not be in another. Finally, we analyse media coverage over a long period of time (1996–2014), spanning an interval in which the media's role as a corporate governance mechanism has increased in Europe (Koning et al., 2010).

The remainder of the paper is structured as follows. First, we set out our hypotheses on the relation between family firms’ media coverage and the informativeness of accounting earnings. Secondly, we describe our research design and present the empirical results. Finally, we provide a summary and the study's conclusions.

Related literature and hypotheses developmentMedia and information asymmetryDisclosure, or media coverage, is action taken by the media that mainly affects the market (Drake et al., 2014). The media can play a major role as a governance mechanism since it collects, accumulates, disseminates and amplifies information. The media has an incentive to maintain a good reputation by providing accurate and credible information, particularly in a context of strong competition (Gentzkow and Shapiro, 2006). Dyck et al. (2008) note that the work done by the media reduces the costs of dealing with the rational ignorance paradox (Downs, 1957), which emerges when the costs of being well informed exceed the benefits obtained from the information. Media disclosure of information allows external investors to overcome the consequences associated with rational ignorance (Dyck et al., 2013). As Bushee et al. (2010) note, the financial press may well be the information intermediary with the greatest potential for diffusion, reaching qualified as well as non-qualified investors, in addition to managers, shareholders, regulators and other market participants.

In the continental European setting, ownership concentration can serve as a credible commitment which the dominant owner uses not to expropriate minority shareholders (e.g., La Porta et al., 2000; Fan and Wong, 2002). According to these authors, commitment is credible because minority shareholders know that if dominant owners engage in expropriation while holding a substantial amount of shares, they will discount the stock price accordingly, reducing the controlling owner's share value. From a supply perspective, disseminating information through the media reduces informational asymmetries between external investors and dominant owners and managers. As a result, the media can play a complementary role in disclosing the accounting information offered by the firm by improving the alignment effect of large ownership stakes of dominant owners and by limiting dominant owner ability to obtain private benefits at the expense of minority shareholder wealth (e.g., Dyck and Zingales, 2004; Bushee et al., 2010; Soltes, 2010). Media coverage would increase the incentives to align interests between dominant owners and minority shareholders and, consequently, improve earnings informativeness (Fan and Wong, 2002), since the market would attach less information capacity to the accounting information disclosed by internal agents who have a greater incentive to expropriate.

However, media can also play a substitutive role in the disclosing the accounting information offered by the firm. Prior literature has shown that the concentration of ownership environments encourages the presence of an information effect to protect the company's competitive advantage from competitors (e.g., Fan and Wong, 2002; Bona et al., 2014). The information effect implies adopting opaque financial reporting practices that limit the flow of information which can be accessed by external investors. In this context, media coverage can increase the incentives to protect competitive advantage from public scrutiny, reducing the informativeness of accounting earnings. In this way, managers and dominant owners might counteract the increased knowledge of the firm afforded by the media.

Considering that the previous theoretical arguments have opposite effects (alignment effect vs. information effect), we state our first hypothesis as follows:H1 Media coverage affects the informativeness of accounting earnings. Media coverage positively affects the informativeness of accounting earnings. Media coverage negatively affects the informativeness of accounting earnings.

In addition, the media can also affect a firm's reputation (e.g., Dyck and Zingales, 2002; Farrell and Whidbee, 2002; Miller, 2006; Dyck et al., 2008; Joe et al., 2009; Bushee et al., 2010; Bednar, 2012; Liu and McConnell, 2013). According to Wiesenfeld et al. (2008), negative information disclosed by the media can act as a legitimacy mechanism, affecting the reputation of dominant owners and managers, since the news leads investors to form opinions about the performance of the company and those who control the decision-making process (e.g., Pollock and Rindova, 2003; Dyck and Zingales, 2002; Bednar, 2012; Chahine et al., 2015). This is particularly relevant in the continental European context, where reputation stands as a substitute for the legal system (e.g., La Porta et al., 1998; Cuervo, 2002). In this way, pursuit of positive media treatment might encourage value-maximizing behaviour in the decision-making process (e.g., Malmendier and Tate, 2008; Liu and McConnell, 2013), aligning the interests of dominant owners and minority shareholders and, consequently, increasing the informativeness of accounting earnings. Negative news might increase dominant owners’ incentives to offer quality accounting information in order to enhance their reputation and improve earnings informativeness. Based on the above arguments, we formulate our second hypothesis:H2 Negative media coverage positively affects the informativeness of accounting earnings.

The sample is composed of 97 Spanish non-financial listed firms with financial information in the Osiris database over the 1996–2014 period. Moreover, in our regression analysis we apply the method developed by Hadi (1994) to eliminate outliers, which represent 11.1% of the total sample. We finally obtain an unbalanced panel of 95 firms (1162 firm-year observations), with 96% of firms having eight or more observations over the period. The final sample covers 98% of the capitalisation of Spanish listed non-financial firms in 2014.

Variables and modelsConsistent with previous literature, media coverage is measured by the number of news reports on companies (e.g., Dyck and Zingales, 2002; Tetlock, 2007; Dyck et al., 2008; Core et al., 2008; Joe et al., 2009; Engelberg and Parsons, 2011; Gurun and Butler, 2012; Khunen and Niessen, 2012; Jansson, 2013; Liu and McConnell, 2013; Ahern and Sosyura, 2014; Borochin and Weihua, 2014; Dai et al., 2014; Lauterbach and Pajuste, 2017; Liu et al., 2014). We compiled a database by collecting articles from specialised financial press, both nationally and internationally. To obtain this information, we used the Factiva database, which provides news for each company and year published in different financial media. We analysed eight financial publications. From Spanish financial press, we included Expansión, Cinco Días and El Economista.1 From international financial media, we analysed the Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire.

The choice of financial media is based on two aspects. First, we selected Expansión, Cinco Días and El Economista as national media since they are the three main financial publications in Spain (Information and Control of Publications, S.A., Office of Justification of Disclosure). Following previous literature, we included those international publications considered leaders in financial news (e.g., Miller, 2006; Core et al., 2008; Dyck et al., 2008; Engelberg and Parsons, 2011; Drake et al., 2014; Cahan et al., 2017; Hooghiemstra et al., 2015).

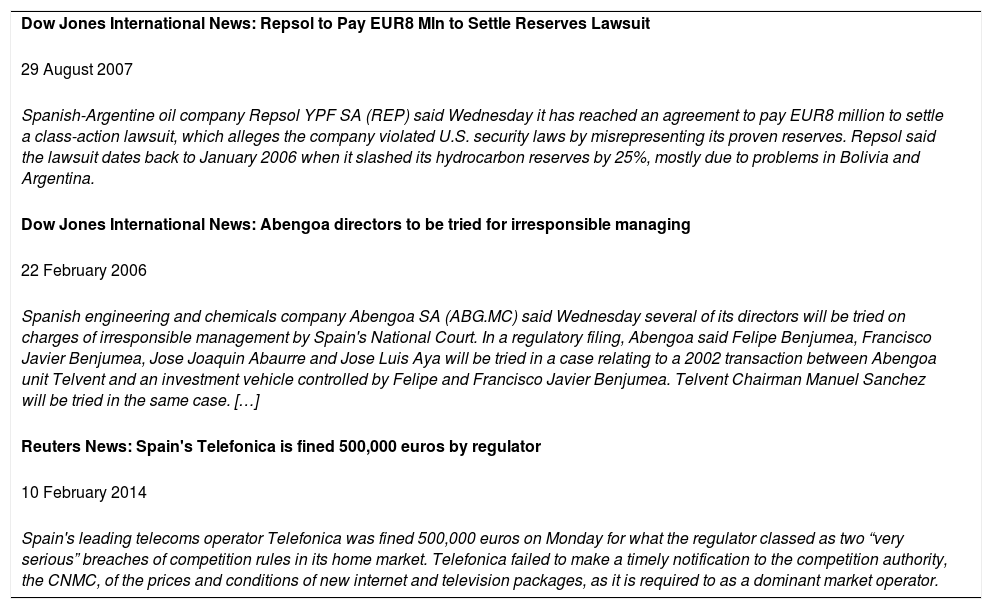

Moreover, in order to measure media coverage, and in consonance with the works of Ahern and Sosyura (2014) and Chahine et al. (2015), we considered only articles that offer information about Spanish listed companies, excluding news items that do not contain any informative content such as dividend payment announcements or quotations listings. In addition, and in line with previous literature (e.g., Ahern and Sosyura, 2014; Core et al., 2008; Hooghiemstra et al., 2015), we provide greater robustness to the results. Specifically, as representative measures of media coverage, we used (a) the number of news reports about a particular company, (b) the number of news reports about a particular company considering only news articles of over fifty words, and (c) the number of news reports about a particular company considering only articles that mention the name of the company in the first 25 words. Finally, consistent with previous literature, we collected negative news articles from the Factiva database regarding firms’ activities2 (e.g., Tetlock, 2007; Core et al., 2008; Loughran and McDonald, 2011; Gurun and Butler, 2012; Qi et al., 2014; Hooghiemstra et al., 2015). The variables measuring media coverage are thus defined as follows:

MEDIAit: Number of news reports published on each company.

MEDIA_50it: Number of news reports published on each company when the news contains at least 50 words.

MEDIA_25it: Number of news reports published on each company when the name of the company appears in the first 25 words.

MEDIA_NEGit: Number of negative news articles published on each company.

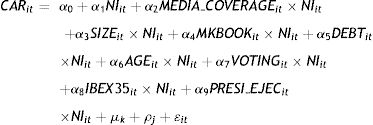

Following previous literature (e.g., Teo and Wong, 1993; Imhoff and Lobo, 1992; Warfield et al., 1995; Subramanyam and Wild, 1996; Fan and Wong, 2002; Yeo et al., 2002; Francis et al., 2005; Ahmed et al., 2006; Santana et al., 2007; Bona Sánchez et al., 2013; Bona et al., 2014, 2017), we measure informativeness of accounting earnings by examining the earnings response coefficient (ERC) from a regression of cumulative abnormal stock returns (CAR) on net income:

where CARit is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year.3NIit is net earnings in year t divided by the market value of equity at the beginning of year t.

We also include dummy variables μt and ρj to control for year and industry effects, respectively. ¿it is the error term for firm i in year t.

We expect a positive and significant coefficient on α1, suggesting that earnings play an information role. This means that the stock market incorporates earnings informativeness into the price formation process. To analyse the effect of our variables on earnings informativeness, we expand the ERC model in Eq. (1) by including interactions between NIit and our media coverage variables and between NIit and the control variables (Eq. (2)):

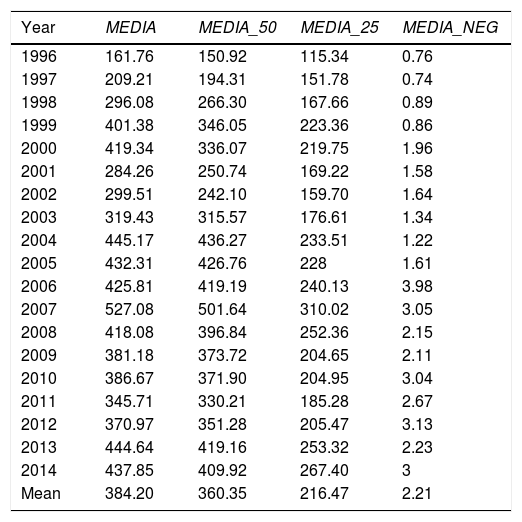

where MEDIA_COVERAGE includes, separately in regressions, MEDIA, MEDIA_50, MEDIA_25 and MEDIA_NEG. To control the effect of firm dimension, we include SIZE, measured as the natural logarithm of total assets. We expect firm size to positively affect the informativeness of accounting earnings (Fan and Wong, 2002). The effect of growth opportunities is included in the variable MKBOOK, defined as the market value of equity divided by the book value of equity. We expect it to positively affect earnings informativeness (e.g., Collins and Kothari, 1989; Fan and Wong, 2002). Additionally, to control the effect of leverage, we include the variable DEBT, measured as total debt divided by total assets (Dhaliwal et al., 1991). As Fan and Wong (2002) argue, the sign of debt's impact on informativeness must be determined empirically. This same reasoning is applied when we consider the company's life cycle, measured through the variable AGE, which indicates the number of years to have elapsed since the firm was set up (e.g., Dechow et al., 2001; Myers et al., 2003). In addition, we include the company's presence in the selective index of the Spanish stock market through the variable IBEX35. This is a dichotomous variable that takes the value 1 if the company is listed in the index, which is representative of the Spanish stock market (IBEX-35), and 0 otherwise. We expect the higher level of scrutiny to which companies in the index are subject to positively affect the informativeness of accounting earnings. We also include the variable VOTING, which measures the level of ownership concentration for the company (e.g., Warfield et al., 1995; Yeo et al., 2002; Fan and Wong, 2002; LaFond and Roychowdhury, 2006; Santana et al., 2007) as the percentage of voting rights in the hands of the main shareholder. Considering the mixed results to emerge from previous literature, the sign of the VOTING effect on earnings informativeness of debt will be determined empirically. In order to identify ownership structure, we use data from Santana and Aguiar (2006), Bona et al. (2014) and Guerra et al. (2015) who use the control chain method to identify the ultimate or dominant owner of Spanish listed firms during the period 1996–2012. Since our study also covers the years 2013 and 2014, we complete the previous database with additional information from those years.4 Finally, in line with Ahmed et al. (2006), we include PRESI_EJEC as a dichotomous variable that takes the value 1 if the president of the board of directors has an executive role and 0 otherwise. Results from early literature addressing the relation between the duality role of the president of the board of directors and accounting quality are mixed (e.g., Klein, 2002; Gul and Wah, 2002).ResultsDescriptive statisticsTable 1 shows the average number of news items where the sample companies are the main actors. We see that the average news coverage (MEDIA) is approximately 384 articles per company for the whole of the period analysed. This number does not drop significantly when we consider only news reports with over 50 words (MEDIA_50), indicating that the news items considered in the study are not mere announcements. However, when using news articles in which the name of the company analysed appears in the first 25 words (MEDIA_25), the average number of news articles falls to 216. When focusing on negative news (MEDIA_NEG), the average number of articles drops significantly, showing that news items which might call into question the reputation of managers and dominant owners carries less weight than the rest of the non-negative news.

Media coverage of Spanish non-financial listed firms: 1996–2014.

| Year | MEDIA | MEDIA_50 | MEDIA_25 | MEDIA_NEG |

|---|---|---|---|---|

| 1996 | 161.76 | 150.92 | 115.34 | 0.76 |

| 1997 | 209.21 | 194.31 | 151.78 | 0.74 |

| 1998 | 296.08 | 266.30 | 167.66 | 0.89 |

| 1999 | 401.38 | 346.05 | 223.36 | 0.86 |

| 2000 | 419.34 | 336.07 | 219.75 | 1.96 |

| 2001 | 284.26 | 250.74 | 169.22 | 1.58 |

| 2002 | 299.51 | 242.10 | 159.70 | 1.64 |

| 2003 | 319.43 | 315.57 | 176.61 | 1.34 |

| 2004 | 445.17 | 436.27 | 233.51 | 1.22 |

| 2005 | 432.31 | 426.76 | 228 | 1.61 |

| 2006 | 425.81 | 419.19 | 240.13 | 3.98 |

| 2007 | 527.08 | 501.64 | 310.02 | 3.05 |

| 2008 | 418.08 | 396.84 | 252.36 | 2.15 |

| 2009 | 381.18 | 373.72 | 204.65 | 2.11 |

| 2010 | 386.67 | 371.90 | 204.95 | 3.04 |

| 2011 | 345.71 | 330.21 | 185.28 | 2.67 |

| 2012 | 370.97 | 351.28 | 205.47 | 3.13 |

| 2013 | 444.64 | 419.16 | 253.32 | 2.23 |

| 2014 | 437.85 | 409.92 | 267.40 | 3 |

| Mean | 384.20 | 360.35 | 216.47 | 2.21 |

MEDIA is the number of news articles published for each company and year in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). MEDIA_50 is the number of news articles published on each company when the news contains at least 50 words. MEDIA_25 is the number of news articles published on each company and year in the eight publications analysed, where the name of the company appears in the first 25 words of the news report. MEDIA_NEG is the number of news articles with a negative tone published on each company and year in the eight publications analysed.

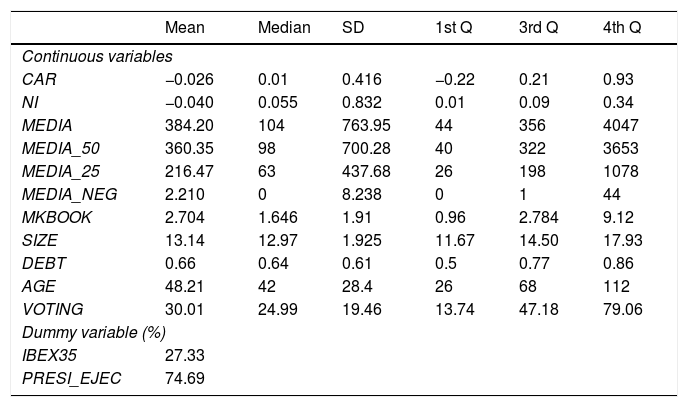

Table 2 reports the descriptive statistics of the variables. The variable CAR has a negative mean value of 0.026, and net income (NI) shows a negative average value of 0.04. As regards the control variables, we see that the average age of the companies (AGE) is 48 years, that the level of debt (DEBT) has an average value of 0.66 and that voting rights in the hands of the dominant owner reach an average of 30.01% (VOTING). Furthermore, with regard to the presence of companies in the IBEX35, data indicate that 27.33% of the companies analysed form part of the index. Finally, the percentage of companies in which the president of the board of directors holds an executive role is 74.69%.

Descriptive statistics.

| Mean | Median | SD | 1st Q | 3rd Q | 4th Q | |

|---|---|---|---|---|---|---|

| Continuous variables | ||||||

| CAR | −0.026 | 0.01 | 0.416 | −0.22 | 0.21 | 0.93 |

| NI | −0.040 | 0.055 | 0.832 | 0.01 | 0.09 | 0.34 |

| MEDIA | 384.20 | 104 | 763.95 | 44 | 356 | 4047 |

| MEDIA_50 | 360.35 | 98 | 700.28 | 40 | 322 | 3653 |

| MEDIA_25 | 216.47 | 63 | 437.68 | 26 | 198 | 1078 |

| MEDIA_NEG | 2.210 | 0 | 8.238 | 0 | 1 | 44 |

| MKBOOK | 2.704 | 1.646 | 1.91 | 0.96 | 2.784 | 9.12 |

| SIZE | 13.14 | 12.97 | 1.925 | 11.67 | 14.50 | 17.93 |

| DEBT | 0.66 | 0.64 | 0.61 | 0.5 | 0.77 | 0.86 |

| AGE | 48.21 | 42 | 28.4 | 26 | 68 | 112 |

| VOTING | 30.01 | 24.99 | 19.46 | 13.74 | 47.18 | 79.06 |

| Dummy variable (%) | ||||||

| IBEX35 | 27.33 | |||||

| PRESI_EJEC | 74.69 | |||||

CAR is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year. NI is net earnings in year t divided by the market value of equity at the beginning of year t. MEDIA is the number of news articles published for each company and year in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). MEDIA_50 is the number of news articles published on each company when the news contains at least 50 words. MEDIA_25 is the number of news articles published on each company and year in the eight publications analysed, when the name of the company appears in the first 25 words of the news. MEDIA_NEG is the number of news articles with a negative tone published for each company and year in the eight publications analysed. SIZE is the natural logarithm of total assets. MKBOOK is the market value of equity divided by the book value of equity. DEBT is total debt divided by total assets. AGE indicates the number of years to have elapsed since the firm was set up. VOTING is the percentage of voting rights in the hands of the main shareholders. IBEX35 is a dichotomous variable that takes the value 1 if the company is part of the representative index of the Spanish stock market (IBEX-35) and 0 otherwise. PRESI_EJEC is a dichotomous variable that takes the value 1 if the president of the board of directors has an executive role and 0 otherwise.

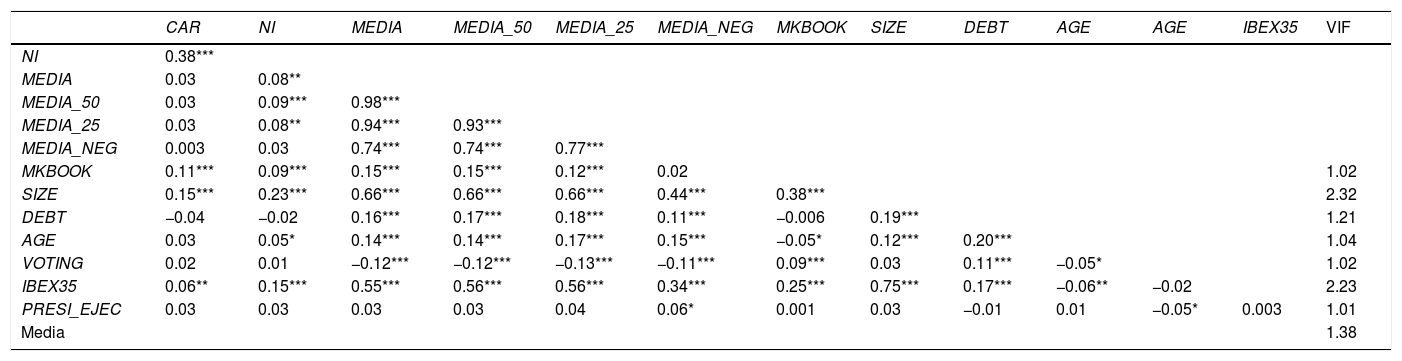

Table 3 shows the correlations among variables and suggests that multicollinearity does not affect subsequent regressions. Nevertheless, we conduct a formal test to ensure that multicollinearity is not present in our regressions. Specifically, we calculate the Variance Inflation Factor (VIF) for each independent variable included in the estimated model. The highest VIF for our models is well below 5, the threshold value for multicollinearity concerns (Studenmund, 1997). We thus conclude that multicollinearity is not a problem in our sample.

Correlation matrix and VIF ratios.

| CAR | NI | MEDIA | MEDIA_50 | MEDIA_25 | MEDIA_NEG | MKBOOK | SIZE | DEBT | AGE | AGE | IBEX35 | VIF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NI | 0.38*** | ||||||||||||

| MEDIA | 0.03 | 0.08** | |||||||||||

| MEDIA_50 | 0.03 | 0.09*** | 0.98*** | ||||||||||

| MEDIA_25 | 0.03 | 0.08** | 0.94*** | 0.93*** | |||||||||

| MEDIA_NEG | 0.003 | 0.03 | 0.74*** | 0.74*** | 0.77*** | ||||||||

| MKBOOK | 0.11*** | 0.09*** | 0.15*** | 0.15*** | 0.12*** | 0.02 | 1.02 | ||||||

| SIZE | 0.15*** | 0.23*** | 0.66*** | 0.66*** | 0.66*** | 0.44*** | 0.38*** | 2.32 | |||||

| DEBT | −0.04 | −0.02 | 0.16*** | 0.17*** | 0.18*** | 0.11*** | −0.006 | 0.19*** | 1.21 | ||||

| AGE | 0.03 | 0.05* | 0.14*** | 0.14*** | 0.17*** | 0.15*** | −0.05* | 0.12*** | 0.20*** | 1.04 | |||

| VOTING | 0.02 | 0.01 | −0.12*** | −0.12*** | −0.13*** | −0.11*** | 0.09*** | 0.03 | 0.11*** | −0.05* | 1.02 | ||

| IBEX35 | 0.06** | 0.15*** | 0.55*** | 0.56*** | 0.56*** | 0.34*** | 0.25*** | 0.75*** | 0.17*** | −0.06** | −0.02 | 2.23 | |

| PRESI_EJEC | 0.03 | 0.03 | 0.03 | 0.03 | 0.04 | 0.06* | 0.001 | 0.03 | −0.01 | 0.01 | −0.05* | 0.003 | 1.01 |

| Media | 1.38 | ||||||||||||

CAR is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period ending three months after the end of the fiscal year. NI is net earnings in year t divided by the market value of equity at the beginning of year t. MEDIA is the number of news articles published on each company and year in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). MEDIA_50 is the number of news articles published on each company when the news contains at least 50 words. MEDIA_25 is the number of news articles published on each company and year in the eight publications analysed, when the name of the company appears in the first 25 words of the news. MEDIA_NEG is the number of news articles with a negative tone published on each company and year in the eight publications analysed. SIZE is the natural logarithm of total assets. MKBOOK is the market value of equity divided by the book value of equity. DEBT is total debt divided by total assets. AGE indicates the number of years to have elapsed since the firm was set up. VOTING is the percentage of voting rights in the hands of the main shareholders. IBEX35 is a dichotomous variable that takes the value 1 if the company is part of the representative index of the Spanish stock market (IBEX-35) and 0 otherwise. PRESI_EJEC is a dichotomous variable that takes the value 1 if the president of the board of directors has an executive role and 0 otherwise. VIF: Variance Inflation Factor.

We estimate all the regressions using a panel data procedure, namely, fixed-effects and Generalised Method of Moments (GMM). Unlike cross-sectional analysis, panel data allows us to control for individual heterogeneity. This is crucial in our study because earnings informativeness is closely related to firm specificity. To address this source of endogeneity,5 we control for this heterogeneity by modelling it as an individual effect, which is then eliminated by taking first differences of the variables (GMM). Additionally, the GMM estimator allows us to address another source of endogeneity; namely, the simultaneity that arises when at least one of the explanatory variables is determined simultaneously together with the dependent variable (Wooldridge, 2002). Therefore, all GMM models have been estimated using these instruments. Specifically, we used all the right-hand-side variables in the models lagged twice and six times as instruments. The only exceptions are the year-effects variables, which are considered exogenous. The original Arellano and Bond (1991) approach may, however, perform poorly if the autoregressive parameters are too large or if the ratio of the variance of the panel-level effect to the variance of the idiosyncratic error is too large. Drawing on Arellano and Bover (1995), Blundell and Bond (1998) develop a system GMM estimator that addresses these problems by expanding the instrument list to include instruments for the levels equation. In this paper, we use the system GMM approach to estimate our models.6

The consistency of GMM estimates depends on both an absence of second-order serial autocorrelation in the residuals and the validity of the instruments. To check for potential model misspecification, we use the Hansen statistic of over-identifying restrictions. We next examine the m2 statistic developed by Arellano and Bond (1991) to test for the absence of second-order serial correlation in the first-difference residual. Finally, we conduct three Wald tests that include a Wald test of the joint significance of the reported coefficients (Z1), a Wald test of the joint significance of time dummies (Z2) and a Wald test of the joint significance of industry dummies (Z3).

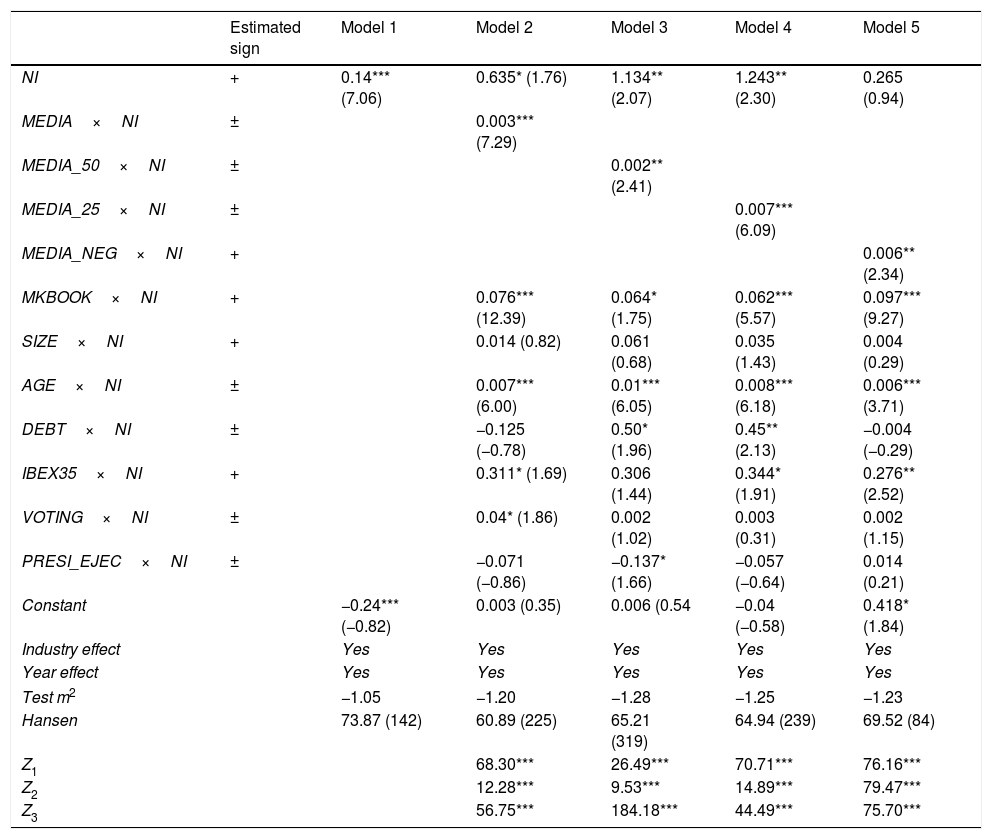

Model 1 (Table 4) reports the results on the relationship between earnings and stock returns. As expected, the variable NI positively affects market return. This result suggests that the stock market incorporates firms’ earnings into the price formation process. Moreover, Models 2, 3 and 4 (Table 4) show that media coverage (MEDIA, MEDIA_50 and MEDIA_25, respectively) has a positive and statistically significant effect on earnings informativeness. These results support H1a, which is consistent with media coverage increasing the alignment of interests between dominant owners and minority shareholders. Therefore, the market affords greater credibility to the accounting information disclosed by internal agents who have less incentive for expropriation.

Media coverage and informativeness of accounting earnings.

| Estimated sign | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|---|

| NI | + | 0.14*** (7.06) | 0.635* (1.76) | 1.134** (2.07) | 1.243** (2.30) | 0.265 (0.94) |

| MEDIA×NI | ± | 0.003*** (7.29) | ||||

| MEDIA_50×NI | ± | 0.002** (2.41) | ||||

| MEDIA_25×NI | ± | 0.007*** (6.09) | ||||

| MEDIA_NEG×NI | + | 0.006** (2.34) | ||||

| MKBOOK×NI | + | 0.076*** (12.39) | 0.064* (1.75) | 0.062*** (5.57) | 0.097*** (9.27) | |

| SIZE×NI | + | 0.014 (0.82) | 0.061 (0.68) | 0.035 (1.43) | 0.004 (0.29) | |

| AGE×NI | ± | 0.007*** (6.00) | 0.01*** (6.05) | 0.008*** (6.18) | 0.006*** (3.71) | |

| DEBT×NI | ± | −0.125 (−0.78) | 0.50* (1.96) | 0.45** (2.13) | −0.004 (−0.29) | |

| IBEX35×NI | + | 0.311* (1.69) | 0.306 (1.44) | 0.344* (1.91) | 0.276** (2.52) | |

| VOTING×NI | ± | 0.04* (1.86) | 0.002 (1.02) | 0.003 (0.31) | 0.002 (1.15) | |

| PRESI_EJEC×NI | ± | −0.071 (−0.86) | −0.137* (1.66) | −0.057 (−0.64) | 0.014 (0.21) | |

| Constant | −0.24*** (−0.82) | 0.003 (0.35) | 0.006 (0.54 | −0.04 (−0.58) | 0.418* (1.84) | |

| Industry effect | Yes | Yes | Yes | Yes | Yes | |

| Year effect | Yes | Yes | Yes | Yes | Yes | |

| Test m2 | −1.05 | −1.20 | −1.28 | −1.25 | −1.23 | |

| Hansen | 73.87 (142) | 60.89 (225) | 65.21 (319) | 64.94 (239) | 69.52 (84) | |

| Z1 | 68.30*** | 26.49*** | 70.71*** | 76.16*** | ||

| Z2 | 12.28*** | 9.53*** | 14.89*** | 79.47*** | ||

| Z3 | 56.75*** | 184.18*** | 44.49*** | 75.70*** | ||

CAR is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year. NI is net earnings in year t divided by the market value of equity at the beginning of year t. MEDIA is the number of news articles published on each company and year in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). MEDIA_50 is the number of news articles published on each company when the news contains at least 50 words. MEDIA_25 is the number of news articles published on each company and year in the eight publications analysed, when the name of the company appears in the first 25 words of the news. MEDIA_NEG is the number of news articles with a negative tone published for each company and year in the eight publications analysed. SIZE is the natural logarithm of total assets. MKBOOK is the market value of equity divided by the book value of equity. DEBT is total debt divided by total assets. AGE indicates the number of years to have elapsed since the firm was set up. VOTING is the percentage of voting rights in the hands of the main shareholders. IBEX35 is a dichotomous variable that takes the value 1 if the company is part of the representative index of the Spanish stock market (IBEX-35) and 0 otherwise. PRESI_EJEC is a dichotomous variable that takes the value 1 if the president of the board of directors has an executive role and 0 otherwise. ***, **, * statistically significant at 1%, 5% and 10%, respectively. Hansen, test of over-identifying restrictions under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of industry dummies. Z3, Wald test of the joint significance of time dummies. In parentheses, t-statistics based on robust standard errors.

Model 5 (Table 4) shows that publishing negative news items (MEDIA_NEG) positively affects earnings informativeness. These results support H2. This evidence is consistent with the fact that disclosing negative news encourages value-maximizing behaviour in the decision-making process, with the aim of improving the reputation of the firm and, consequently, the reputation of internal agents. The media therefore act as a mechanism that allows the behaviour of dominant owners and managers to be disciplined, thereby increasing the informativeness of accounting earnings.

As regards the control variables, the results in Table 4 show that the presence of greater investment opportunities (MKBOOK) and level of debt (DEBT) positively affect informativeness of accounting earnings. These results are consistent with previous works focusing on other institutional settings (e.g., Fan and Wong, 2002; Francis et al., 2005). Firm age (AGE) and company presence in the selective index of the Spanish stock market (IBEX35) have a positive impact on earnings informativeness. These results may reflect the notion that the market gives superior earnings informativeness to companies with a greater projection and a higher level of scrutiny. Finally, the models show a non-significant effect of company size (SIZE), the level of dominant owner voting rights (VOTING) and the executive role of the president of the board of directors (PRESI_EJEC) on the informativeness of accounting earnings.

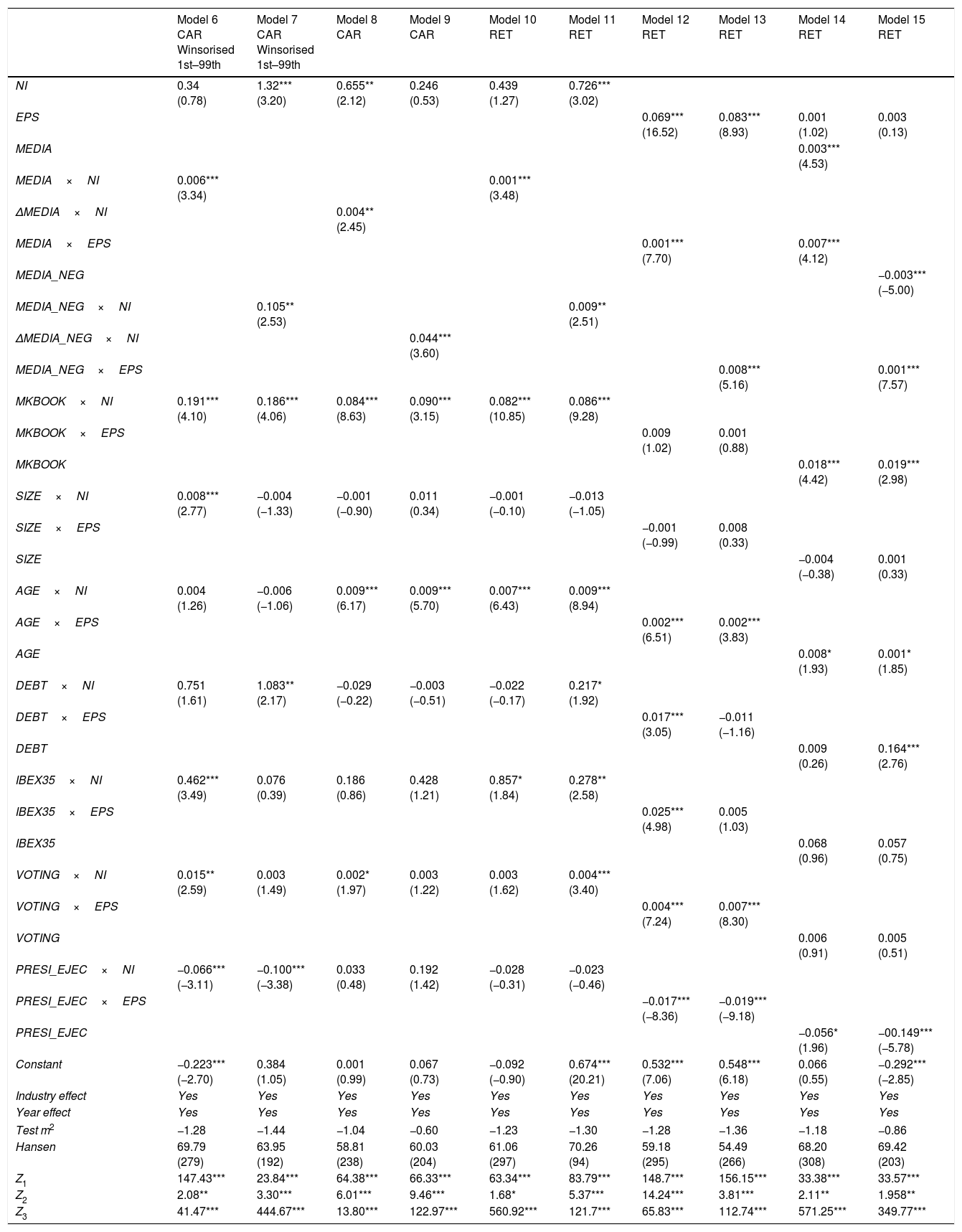

Additional analysisIn this section, we extend our analysis in order to increase the robustness of the results. In an effort to determine whether our results are sensitive to the use of the method developed by Hadi (1994) for eliminating outliers, in Models 6 and 7 (Table 5) the variables are now winsorised at the two extreme percentiles (i.e., values less (greater) than the 1st (99th) percentile are set equal to the value of the 2nd (98th) percentile. Results do not differ from those obtained in Table 4. We also examine the total effect of a marginal increase in media coverage. To address this issue, we define ΔMEDIA as the number of news items published for each company and year adjusted by the annual average in the eight financial publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire), and ΔMEDIA_NEG as the number of news articles with a negative tone published for each company and year adjusted by the annual average in the eight publications analysed. Results are reported in Table 5 (Models 8 and 9) and are consistent with previous findings.

Media coverage and informativeness of accounting earnings. Additional analysis.

| Model 6 CAR Winsorised 1st–99th | Model 7 CAR Winsorised 1st–99th | Model 8 CAR | Model 9 CAR | Model 10 RET | Model 11 RET | Model 12 RET | Model 13 RET | Model 14 RET | Model 15 RET | |

|---|---|---|---|---|---|---|---|---|---|---|

| NI | 0.34 (0.78) | 1.32*** (3.20) | 0.655** (2.12) | 0.246 (0.53) | 0.439 (1.27) | 0.726*** (3.02) | ||||

| EPS | 0.069*** (16.52) | 0.083*** (8.93) | 0.001 (1.02) | 0.003 (0.13) | ||||||

| MEDIA | 0.003*** (4.53) | |||||||||

| MEDIA×NI | 0.006*** (3.34) | 0.001*** (3.48) | ||||||||

| ΔMEDIA×NI | 0.004** (2.45) | |||||||||

| MEDIA×EPS | 0.001*** (7.70) | 0.007*** (4.12) | ||||||||

| MEDIA_NEG | −0.003*** (−5.00) | |||||||||

| MEDIA_NEG×NI | 0.105** (2.53) | 0.009** (2.51) | ||||||||

| ΔMEDIA_NEG×NI | 0.044*** (3.60) | |||||||||

| MEDIA_NEG×EPS | 0.008*** (5.16) | 0.001*** (7.57) | ||||||||

| MKBOOK×NI | 0.191*** (4.10) | 0.186*** (4.06) | 0.084*** (8.63) | 0.090*** (3.15) | 0.082*** (10.85) | 0.086*** (9.28) | ||||

| MKBOOK×EPS | 0.009 (1.02) | 0.001 (0.88) | ||||||||

| MKBOOK | 0.018*** (4.42) | 0.019*** (2.98) | ||||||||

| SIZE×NI | 0.008*** (2.77) | −0.004 (−1.33) | −0.001 (−0.90) | 0.011 (0.34) | −0.001 (−0.10) | −0.013 (−1.05) | ||||

| SIZE×EPS | −0.001 (−0.99) | 0.008 (0.33) | ||||||||

| SIZE | −0.004 (−0.38) | 0.001 (0.33) | ||||||||

| AGE×NI | 0.004 (1.26) | −0.006 (−1.06) | 0.009*** (6.17) | 0.009*** (5.70) | 0.007*** (6.43) | 0.009*** (8.94) | ||||

| AGE×EPS | 0.002*** (6.51) | 0.002*** (3.83) | ||||||||

| AGE | 0.008* (1.93) | 0.001* (1.85) | ||||||||

| DEBT×NI | 0.751 (1.61) | 1.083** (2.17) | −0.029 (−0.22) | −0.003 (−0.51) | −0.022 (−0.17) | 0.217* (1.92) | ||||

| DEBT×EPS | 0.017*** (3.05) | −0.011 (−1.16) | ||||||||

| DEBT | 0.009 (0.26) | 0.164*** (2.76) | ||||||||

| IBEX35×NI | 0.462*** (3.49) | 0.076 (0.39) | 0.186 (0.86) | 0.428 (1.21) | 0.857* (1.84) | 0.278** (2.58) | ||||

| IBEX35×EPS | 0.025*** (4.98) | 0.005 (1.03) | ||||||||

| IBEX35 | 0.068 (0.96) | 0.057 (0.75) | ||||||||

| VOTING×NI | 0.015** (2.59) | 0.003 (1.49) | 0.002* (1.97) | 0.003 (1.22) | 0.003 (1.62) | 0.004*** (3.40) | ||||

| VOTING×EPS | 0.004*** (7.24) | 0.007*** (8.30) | ||||||||

| VOTING | 0.006 (0.91) | 0.005 (0.51) | ||||||||

| PRESI_EJEC×NI | −0.066*** (−3.11) | −0.100*** (−3.38) | 0.033 (0.48) | 0.192 (1.42) | −0.028 (−0.31) | −0.023 (−0.46) | ||||

| PRESI_EJEC×EPS | −0.017*** (−8.36) | −0.019*** (−9.18) | ||||||||

| PRESI_EJEC | −0.056* (1.96) | −00.149*** (−5.78) | ||||||||

| Constant | −0.223*** (−2.70) | 0.384 (1.05) | 0.001 (0.99) | 0.067 (0.73) | −0.092 (−0.90) | 0.674*** (20.21) | 0.532*** (7.06) | 0.548*** (6.18) | 0.066 (0.55) | −0.292*** (−2.85) |

| Industry effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Test m2 | −1.28 | −1.44 | −1.04 | −0.60 | −1.23 | −1.30 | −1.28 | −1.36 | −1.18 | −0.86 |

| Hansen | 69.79 (279) | 63.95 (192) | 58.81 (238) | 60.03 (204) | 61.06 (297) | 70.26 (94) | 59.18 (295) | 54.49 (266) | 68.20 (308) | 69.42 (203) |

| Z1 | 147.43*** | 23.84*** | 64.38*** | 66.33*** | 63.34*** | 83.79*** | 148.7*** | 156.15*** | 33.38*** | 33.57*** |

| Z2 | 2.08** | 3.30*** | 6.01*** | 9.46*** | 1.68* | 5.37*** | 14.24*** | 3.81*** | 2.11** | 1.958** |

| Z3 | 41.47*** | 444.67*** | 13.80*** | 122.97*** | 560.92*** | 121.7*** | 65.83*** | 112.74*** | 571.25*** | 349.77*** |

CAR is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year. RET is the firm's cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year. NI is net earnings in year t divided by the market value of equity at the beginning of year t. EPS is earnings before extraordinary items per share. MEDIA is the number of news articles published on each company and year in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). MEDIA_NEG is the number of news articles with a negative tone published for each company and year in the eight publications analysed. ΔMEDIA is the number of news articles published for each company and year adjusted by the annual average in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). ΔMEDIA_NEG is the number of news articles with a negative tone published for each company and year adjusted by the annual average in the eight publications analysed. SIZE is the natural logarithm of total assets. MKBOOK is the market value of equity divided by the book value of equity. DEBT is total debt divided by total assets. AGE indicates the number of years to have elapsed since the firm was set up. VOTING is the percentage of voting rights in the hands of the main shareholders. IBEX35 is a dichotomous variable that takes the value 1 if the company is part of the representative index of the Spanish stock market (IBEX-35) and 0 otherwise. PRESI_EJEC is a dichotomous variable that takes the value 1 if the president of the board of directors has an executive role and 0 otherwise. ***, **, * statistically significant at 1%, 5% and 10%, respectively. Hansen, test of over-identifying restrictions under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of industry dummies. Z3, Wald test of the joint significance of time dummies. In parentheses, t-statistics based on robust standard errors.

In Table 5, we report additional results using different specification models, following Ahmed et al. (2006). In Models 10 and 11, we use RET as the dependent variable, measured as the firm's cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year. In Models 12 and 13, we use earnings before extraordinary items per share (EPS) as a measure of accounting earnings. Finally, in Models 14 and 15, we include our principal variables as separate variables and as an interaction with earnings per share. Results are basically unaffected and bear out the impact of media on earnings informativeness.

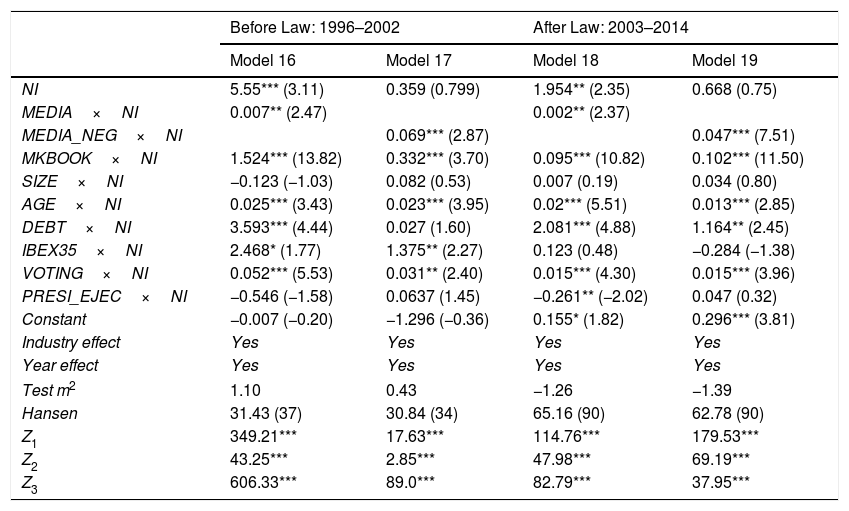

After Enron, US listed companies were affected by substantial new regulations aimed at increasing the transparency of financial reporting. Driven by such European scandals as Parmalat or Royal Ahold, Europe then followed suit. As did other European countries like Germany or France, Spain passed a law in 2003 “with the aim of strengthening the transparency of listed companies”. As this legislative change might have affected the media-earnings informativeness relationship, we decided to split our timeframe into two periods: before (1996–2002) and after (2003–2014) fresh legislation was introduced. The results for each scenario are reported in Table 6 (Models 16–19) and are fully consistent with previous results in models 2 and 5, providing further support for the notion that the media positively affects earnings informativeness.

Media coverage, informativeness of accounting earnings and Law 26/2003 “with the aim of strengthening the transparency of listed companies”.

| Before Law: 1996–2002 | After Law: 2003–2014 | |||

|---|---|---|---|---|

| Model 16 | Model 17 | Model 18 | Model 19 | |

| NI | 5.55*** (3.11) | 0.359 (0.799) | 1.954** (2.35) | 0.668 (0.75) |

| MEDIA×NI | 0.007** (2.47) | 0.002** (2.37) | ||

| MEDIA_NEG×NI | 0.069*** (2.87) | 0.047*** (7.51) | ||

| MKBOOK×NI | 1.524*** (13.82) | 0.332*** (3.70) | 0.095*** (10.82) | 0.102*** (11.50) |

| SIZE×NI | −0.123 (−1.03) | 0.082 (0.53) | 0.007 (0.19) | 0.034 (0.80) |

| AGE×NI | 0.025*** (3.43) | 0.023*** (3.95) | 0.02*** (5.51) | 0.013*** (2.85) |

| DEBT×NI | 3.593*** (4.44) | 0.027 (1.60) | 2.081*** (4.88) | 1.164** (2.45) |

| IBEX35×NI | 2.468* (1.77) | 1.375** (2.27) | 0.123 (0.48) | −0.284 (−1.38) |

| VOTING×NI | 0.052*** (5.53) | 0.031** (2.40) | 0.015*** (4.30) | 0.015*** (3.96) |

| PRESI_EJEC×NI | −0.546 (−1.58) | 0.0637 (1.45) | −0.261** (−2.02) | 0.047 (0.32) |

| Constant | −0.007 (−0.20) | −1.296 (−0.36) | 0.155* (1.82) | 0.296*** (3.81) |

| Industry effect | Yes | Yes | Yes | Yes |

| Year effect | Yes | Yes | Yes | Yes |

| Test m2 | 1.10 | 0.43 | −1.26 | −1.39 |

| Hansen | 31.43 (37) | 30.84 (34) | 65.16 (90) | 62.78 (90) |

| Z1 | 349.21*** | 17.63*** | 114.76*** | 179.53*** |

| Z2 | 43.25*** | 2.85*** | 47.98*** | 69.19*** |

| Z3 | 606.33*** | 89.0*** | 82.79*** | 37.95*** |

CAR is the firm's equal-weighted market-adjusted cumulative monthly stock return for the 12-month period concluding three months after the end of the fiscal year. NI is net earnings in year t divided by the market value of equity at the beginning of year t. MEDIA is the number of news articles published on each company and year in the eight publications analysed (Expansión, Cinco Días, El Economista, Financial Times, Wall Street Journal, Reuters, Dow Jones and Business Wire). MEDIA_NEG is the number of articles with a negative tone published on each company and year in the eight publications analysed. SIZE is the natural logarithm of total assets. MKBOOK is the market value of equity divided by the book value of equity. DEBT is total debt divided by total assets. AGE indicates the number of years to have elapsed since the firm was set up. VOTING is the percentage of voting rights in the hands of the main shareholders. IBEX35 is a dichotomous variable that takes the value 1 if the company is part of the representative index of the Spanish stock market (IBEX-35) and 0 otherwise. PRESI_EJEC is a dichotomous variable that takes the value 1 if the president of the board of directors has an executive role and 0 otherwise. ***, **, * statistically significant at 1%, 5% and 10%, respectively. Hansen, test of over-identifying restrictions under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of industry dummies. Z3, Wald test of the joint significance of time dummies. In parentheses, t-statistics based on robust standard errors.

In this work, we analyse how the media affects internal agents’ incentives vis-à-vis the publication and disclosure of accounting information policy. More specifically, we explore the media's impact, as an external governance mechanism, on the informativeness of accounting earnings.

Our results indicate that reporting information through the financial media positively affects earnings informativeness. These results are consistent with the alignment of interests between internal and external agents, sparked by the reduction in informational asymmetries caused by the publication of news. In a continental European context, the media play a complementary role in the disclosure of accounting information, improving the alignment effect of dominant owners’ voting rights stakes and limiting dominant owner ability to obtain private benefits. Media coverage increases the incentives for aligning interests between dominant owner and minority shareholder and, consequently, earnings informativeness (Fan and Wong, 2002).

In addition, the media can impact on a firm's performance through the latter's reputation. We study the effect on earnings informativeness of news reports which have a negative tone. Results show that publishing negative news articles positively affects the informativeness of accounting earnings. This empirical relationship might be explained by the fact that, in the continental European context, where reputation stands as a substitute for the legal system (e.g., La Porta et al., 1998; Cuervo, 2002) negative news items increase dominant owner incentives to offer quality accounting information in order to enhance their reputation, thereby increasing earnings informativeness. These results are robust to different metrics of media coverage, stock returns and earnings accounting. The results also hold when we analyse different legislative transparency scenarios and are consistent with Qi et al. (2014) and Chahine et al. (2015). More specifically, the media serves as an effective external corporate governance mechanism for improving the informativeness of accounting earnings.

Our study expands current knowledge of the role played by external governance mechanisms in the accounting earnings reported by firms, in a context where the main agency conflict stems from the divergence of interests between dominant owners and minority shareholders and where media independence is high. Although we focus on Spain, our results are potentially applicable to similar institutional contexts, such as those prevalent in many continental European countries.

The study offers several practical implications. Gaining an insight into how media coverage affects the informativeness of accounting earnings might prove beneficial to market participants such as investors, analysts or auditors since the study emphasises the importance of the media as a corporate governance mechanism. In particular, results suggest that these agents should encourage disclosure through the media, as this can positively affect earnings informativeness. Our results are also important for regulators since they suggest that the media's role might affect how successful their work is. Our results also highlight the importance of considering issues such as freedom of the press, competition in the media and disclosure of company information through alternative channels. More specifically, high quality financial press may enhance the transparency of the accounting earnings disclosed by companies.

Our study does, however, suffer from several limitations related to the difficulty in measuring the diffusion of information and the negative tone of news articles. Although we used a range of measures, there are others, such as each the financial media's level of social influence, which might affect the level of disclosure and corporate reputation.

This paper points to several avenues for future research. It would be interesting to continue exploring the role played by the media and other external governance mechanisms in the quality of accounting reporting in order to know which other factors may affect internal agents’ incentives to provide accurate information on accounting earnings. Moreover, it would also prove interesting to analyse the relationship between media and earnings informativeness depending on the nature of the dominant owner, for example, family firms or institutional shareholders.

The authors are grateful for the financial support received from the Spanish Ministry of Economy, Industry and Competitiveness (research project ECO2017-84132-R). We also wish to thank the Associate Editor Gabriel de la Fuente and the anonymous reviewers of BRQ for the proposed comments and suggestions.

| Dow Jones International News: Repsol to Pay EUR8 Mln to Settle Reserves Lawsuit |

| 29 August 2007 |

| Spanish-Argentine oil company Repsol YPF SA (REP) said Wednesday it has reached an agreement to pay EUR8 million to settle a class-action lawsuit, which alleges the company violated U.S. security laws by misrepresenting its proven reserves. Repsol said the lawsuit dates back to January 2006 when it slashed its hydrocarbon reserves by 25%, mostly due to problems in Bolivia and Argentina. |

| Dow Jones International News: Abengoa directors to be tried for irresponsible managing |

| 22 February 2006 |

| Spanish engineering and chemicals company Abengoa SA (ABG.MC) said Wednesday several of its directors will be tried on charges of irresponsible management by Spain's National Court. In a regulatory filing, Abengoa said Felipe Benjumea, Francisco Javier Benjumea, Jose Joaquin Abaurre and Jose Luis Aya will be tried in a case relating to a 2002 transaction between Abengoa unit Telvent and an investment vehicle controlled by Felipe and Francisco Javier Benjumea. Telvent Chairman Manuel Sanchez will be tried in the same case. […] |

| Reuters News: Spain's Telefonica is fined 500,000 euros by regulator |

| 10 February 2014 |

| Spain's leading telecoms operator Telefonica was fined 500,000 euros on Monday for what the regulator classed as two “very serious” breaches of competition rules in its home market. Telefonica failed to make a timely notification to the competition authority, the CNMC, of the prices and conditions of new internet and television packages, as it is required to as a dominant market operator. |

All of them are available in Factiva for the 19 years under study, with the exception of El Economista, whose information is available from 2007.

The Factiva database has a tool that identifies news articles containing negative words such as fraud, breach, lawsuit, insider training, charges, bankruptcy, etc. Once identified, we analysed them to make sure the news had a negative tone. As examples, we include an Appendix with news articles that adopt a negative tone.

In line with earlier literature focusing on the Spanish market (e.g., Santana et al., 2007; Bona Sánchez et al., 2013; Bona et al., 2014, 2017), we use the Ibex35 as a benchmark of the Spanish market to estimate market-adjusted abnormal returns.

The control chain method developed by La Porta et al. (1999) allows us to analyse ownership concentration, divergence between the dominant owner's voting and cash flow rights, and the type of dominant owner (e.g., La Porta et al., 1999; Claessens et al., 2000; Faccio and Lang, 2002). Specifically, this method allows for correct specification of ownership structure in environments where the use of pyramids is prevalent (e.g., La Porta et al., 1999; Francis et al., 2005; Bona Sánchez et al., 2011).

Following Greene (2000) and Wooldridge (2002), broadly speaking we define endogeneity bias as any situation where the disturbance term of the structural equation is correlated with one or more independent variable.

More specifically, we use the two-step system GMM estimation included in the xtabond2 stata routine written by Roodman (2008).