This paper reflects on the history and enduring relevance of Keynes’ economics. Keynes unleashed a devastating critique of classical macroeconomics and introduced a new replacement schema that defines macroeconomics. The success of the Keynesian revolution triggered a counter-revolution that restored the classical tradition and now enforces a renewed classical monopoly. That monopoly has provided the intellectual foundations for neoliberalism which has produced economic and political conditions echoing the 1930s. Openness to Keynesian ideas seems to fluctuate with conditions, and current conditions are conducive to revival of the Keynesian revolution. However, a revival will have to overcome the renewed classical monopoly.

Este artículo reflexiona en torno a la historia y permanencia de la economía de Keynes. Este autor desató una crítica de la macroeconomía clásica que fue devastadora e introdujo un nuevo esquema que reemplazó a la concepción que se tenía hasta entonces de macroeconomía. El éxito de la revolución keynesiana desencadenó una contrarrevolución que restauró a la tradición clásica y ahora mantiene un monopolio renovado. Este monopolio proporcionó las bases intelectuales del neoliberalismo que ha producido condiciones económicas y políticas remembrando a los años treinta. La apertura a las ideas keynesianas parece fluctuar con las condiciones, y las actuales conducen al resurgimiento de la revolución keynesiana. Sin embargo, un renacimiento tendrá que superar al renovado monopolio clásico.

2016 marked the 80th anniversary of the publication of Keynes’ (1936) The General Theory of Employment, Interest and Money, which founded modern macroeconomics. As evidenced by its continued real world relevance and the continued intellectual ferment it provokes, The General Theory is one of the great books in economics.

This paper reflects on the history and enduring relevance of Keynes’ economics. In many regards, Keynes’ General Theory should be viewed as the economics analogue of Charles Darwin's (1859) On the Origin of the Species by Means of Natural Selection1. Darwin advanced a theory of natural selection that is bedrock of the theory of evolution, and the theory of evolution is in turn the bedrock of biology. In The General Theory, Keynes advanced a theory of demand determined output, and that theory should be the bedrock theory of macroeconomics.

Darwin's Origin of the Species was the first step in evolutionary biology, and there have been major advances since then. So too, Keynes’ General Theory should be seen as the first step in Keynesian economics and not the last and final word. Keynes unleashed a devastating critique of classical macroeconomics and introduced a grand new replacement schema which defines macroeconomics. However, there were also things Keynes got wrong and many things Keynes omitted. Additionally, Keynes was committed to neoclassical micro-foundations for macroeconomics. Such foundations are consistent with Keynesian economics, but so too are other micro-foundations —and I would argue those other micro-foundations provide a better basis for Keynesian economics.

The success of the Keynesian revolution triggered a counter-revolution that restored the classical tradition and now enforces a renewed classical monopoly. That monopoly has provided the intellectual foundations for neoliberalism which has produced economic and political conditions that echo the 1930s. Openness to Keynesian ideas seems to fluctuate with economic conditions, and current conditions are conducive to revival of the Keynesian revolution. However, a revival will have to overcome the renewed classical monopoly.

KEYNESIAN ECONOMICS AND THE HISTORY OF ECONOMIC THOUGHTThe best way to understand Keynes's contribution is to place Keynesian economics within the history of economic thought. Doing so also helps understand why Keynes’ revolution in economic theory was derailed and redirected back toward classical macroeconomics which Keynes sought to discredit.

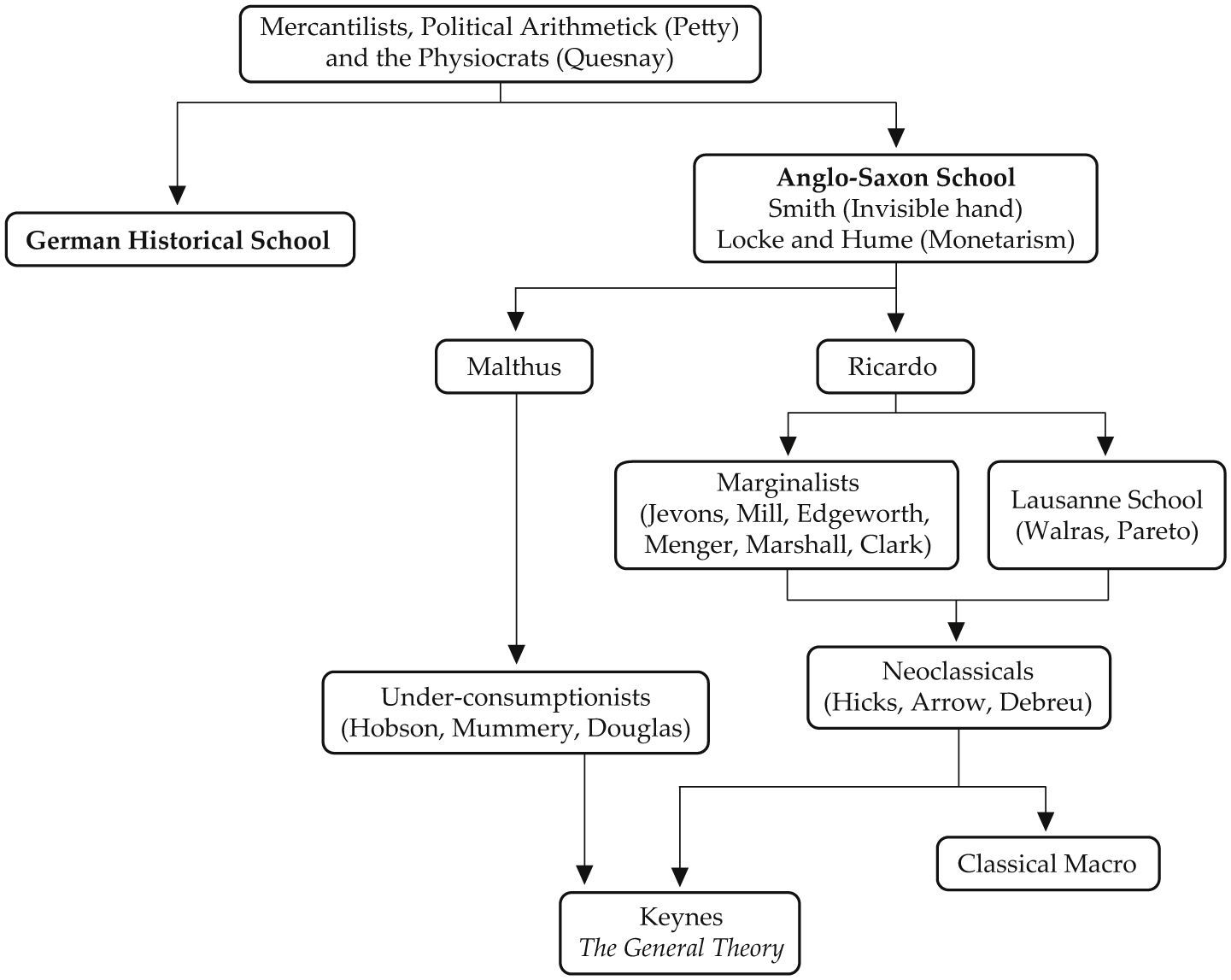

Figure 1 provides a stylized construction of the history of economic thought. The origins of modern economic thought can be identified with mercantilism, the 17th century political arithmetick of William Petty, and the 18th century tableau economique of Francois Quesnay. The political arithmetick of Petty provides the origins of national income accounting, while the tableau economique of Quesnay provides the origins of input-output analysis. Mercantilism tackles the complicated question of the relationship between the balance of trade, domestic economic activity, and the international economy.

As Keynes noted in The General Theory (chapter 24), mercantilism is misunderstood and has an underserved bad reputation in mainstream economics. Keynes sought to recover certain aspects of mercantilist thinking and logic. Mercantilists argued bullion is the source of wealth; shortage of bullion restricts economic activity; and exports are a way to acquire bullion. Keynes argued the restriction on economic activity is shortage of aggregate demand (ad), and not money which can always be created in a fiat money economy. Exports are a way of capturing ad, which explains the Keynesian dimension to export-led growth policy.

There are two essential features to Figure 1. The first is it shows that, very early on, a fundamental split developed within economic theory between the “German historical school” and what I have called the “Anglo-Saxon school”. That split was formally articulated in the great “methodenstreit” (method dispute) controversy that erupted among German economists in the 1880s. The Anglo-Saxon school has come to dominate modern economics and the ideas of the German school have been pushed to fringe. However, the ideas of the German School (about such things as history, critique of equilibrium, institutions, social relations, culture, and psychology) persistently resurface to trouble mainstream economics. Furthermore, in many regards, Post Keynesian economics can be viewed as an attempt to introduce the ideas of the German school into Keynesian economics.

The second essential feature of Figure 1 concerns the place of Keynes and his relationship to the Anglo-Saxon School. Keynes comes out of the Anglo-Saxon School, reflecting his education at Cambridge, but he merges establishment Anglo-Saxon thinking with malcontent Anglo-Saxon thinking. Mainstream establishment economics runs through Smith, Locke, Hume, Ricardo, the marginalists, the Lausanne School, the neoclassicals, and on to classical macroeconomics and its modern descendant traditions of new classical macroeconomics, real business cycle theory, and so-called new Keynesian economics. The malcontent line runs through Malthus and the under-consumptionists. Viewed in that light, Keynes can be understood as breaking with neoclassical economics by reintroducing ideas associated with Malthus, which were discarded early in the development of the Anglo-Saxon tradition.

Adam Smith (1723-1790) is widely viewed as the founder of the Anglo-Saxon school. His importance is captured in the celebrated “invisible hand” passage in Smith's The Wealth of Nations, whereby the pursuit of private self-interest works to the benefit of all. Smith can be viewed as the founding father of micro economics, and his metaphor of an invisible hand has become central to Arrow-Debreu general equilibrium theory which interprets it as symbolizing the price system. Keynes accepted the idea of the price system performing vital allocative functions, but he rejected the general equilibrium claim that it always ensured full employment. The invisible hand is therefore compatible with Keynes, but it has Parkinson's disease and trembles.

A second seminal contribution to the Anglo-Saxon school came from John Locke (1632-1704) and David Hume (1711-1776) who can be viewed as the founding fathers of monetary macroeconomics. Locke and Hume were opponents of mercantilism. They argued increases in the money supply, resulting from inflows of bullion caused by trade surpluses, only generate an increase in prices. In effect, Locke and Hume were the progenitors of classical monetarism and the quantity theory which have significantly shaped the history of monetary macroeconomics. A major element of Keynes’ General Theory was to overthrow this classical notion of money neutrality, or money as a veil, whereby money only affects the price level.

The next critical stage in the development of the Anglo-Saxon school was the conflict between Thomas Malthus (1766-1834) and David Ricardo (1772-1823) regarding full employment. Whereas Malthus challenged Say's law and believed in the possibility of gluts, Ricardo assumed full employment as the normal condition and that became the standard assumption of classical economics. Keynes believed this to be the decisive wrong turn in economics, as succinctly and beautifully stated in this passage from chapter 3 of The General Theory: The idea that we can safely ignore the aggregate demand function is fundamental to the Ricardian economics, which underlie what we have been taught for more than a century. Malthus, indeed, had vehemently opposed Ricardo's doctrine that it was impossible for effective demand to be deficient: but vainly. For since Malthus was unable to explain clearly (apart from an appeal to the facts of common observation) how and why effective demand could be deficient or excessive, he failed to furnish an alternative construction: and Ricardo conquered England as completely as the Holy Inquisition conquered Spain. Not only was his theory accepted by the city, by statesman and by the academic world. But controversy ceased; the other point of view completely disappeared; it ceased to be discussed. The great puzzle of effective demand with which Malthus had wrestled vanished from economic literature. You will not find it mentioned even once in the whole works of Marshall, Edgeworth and Professor Pigou, from whom classical theory has received its most mature embodiment. It could only live on furtively, below the surface, in the underworlds of Karl Marx, Silvio Gesell or Major Douglas (Keynes, 1936, p. 32).

After Ricardo, the story enters the more familiar terrain of the neoclassical revolution in economics based on the application of the principle of marginalism, and the development of the general equilibrium model by Walras’ Lausanne school. Marginalism was applied to individual choice by the likes of Jevons, Mill, Edgeworth, and Menger. It was also applied to production theory by John Bates Clark to generate marginal productivity distribution theory. However, the triumph of Ricardian thinking made full employment the normal assumption of economics.

Putting the pieces together, one sees how Keynes draws from conventional neoclassical economics, while also being a radical who draws from the under-consumptionists. Thus, Keynes accepted marginalism but he challenged the assumption of full employment.

Keynes’ neoclassical connection has been a major source of misunderstanding. The misunderstanding arises because neoclassical microeconomics (marginal utility theory, marginal productivity theory, the price system, general equilibrium analysis and welfare economics) was gradually elaborated, and the pieces combined, to form neoclassical competitive general equilibrium theory (Hicks, 1939; Arrow and Debreu, 1954) which is the analytical core of contemporary economics. Since Keynesian economics is opposed to the conclusions of general equilibrium theory, it is easy to mistakenly think neoclassical microeconomics is inconsistent with Keynesian economics.

In fact, Keynesian economics is consistent with the “original pieces” of neoclassical microeconomics. However, it is also consistent with other micro foundations, and in this author's view it is improved by other micro foundations. It is even possible that Keynes was attracted to other micro foundations, but The General Theory definitively used neoclassical micro foundations. Perhaps Keynes thought taking on both neoclassical microeconomics and classical macroeconomics too big a task: we just do not know.

Unfortunately, the neoclassical competitive general equilibrium (cge) revolution was happening at the same time Keynes was developing his General Theory and launching the Keynesian revolution in economics. Since cge theory is significantly contrary to Keynesian economics, it blunted Keynes’ revolution and contributed to derailing it. A great irony is Hicks was a major contributor to both revolutions. His 1937 article (Hicks, 1937) on The General Theory introduced the Keynesian is-lm framework, while his 1939 book Value and Capital laid out the foundations of modern cge theory.

CLASSICAL MACROECONOMICS AND KEYNES’ ATTACK ON THE CLASSICSThe other piece of the Anglo-Saxon canon is classical macroeconomics, which developed in tandem at the hip of neoclassical microeconomics. Classical macroeconomics contributes two key additional features to neoclassical microeconomics. First, it incorporates money using Locke and Hume's quantity theory analysis, and the role of money is to determine the price level. Money is neutral with respect to real economic variables, and there is a dichotomy between real and nominal variables. The claim is doubling the money supply will double the price level, while leaving real output and all other real variables unchanged.

Second, classical macroeconomics adds the loanable funds theory of interest rates. The loanable funds market determines the real interest rate that equilibrates saving and investment, thereby equilibrating the demand and supply for goods. According to classical macroeconomics, the loanable funds real interest rate is the mechanism that clears the goods market and ensures Say's law holds. Demand for additional supply of output is created by a lower real interest rate.

Keynes’ General Theory is both a critique and a replacement of classical macroeconomic theory. Both are necessary for an intellectual revolution. On one hand, it is a critique and demolition of classical macroeconomics. On the other hand, it offers a novel replacement theory of the workings of a modern industrial capitalist economy.

In doing these things, Keynes challenged major elements of the Anglo-Saxon tradition. First, Malthus and the under-consumptionist tradition replaced the Ricardian full employment tradition. Second, Keynes’ own approach to money replaced the Locke-Hume monetary tradition.

At the core is the rehabilitation of Malthus’ claim that economies can be subject to persistent supply gluts, contrary to Say's law. As shown in Figure 1, classical macroeconomics exiled Malthus’ claim to the underworld of economics (i.e. the world outside of respectable academic economics, which includes the 17th century mercantilists and under-consumptionists like Hobson and Mummery). Keynes legitimized that underworld, and chapter 23 of The General Theory explicitly acknowledges their insights. However, before Keynes, the underworld was just a collection of loose insights. Keynes gave those insights logical coherence and formalized them in his theory of effective demand determined output, which is the cornerstone of Keynesian economics.

Keynes’ argument involves sweeping away old theory and introducing new theory. First, Keynes rejected the loanable funds theory of interest rates. The loanable funds market is an intellectual fiction, and the market does not exist in reality. Unfortunately, Keynes did not say this clearly enough.

The rejection of loanable funds theory totally negates classical macroeconomics because it means the economy has no mechanism for equilibrating full employment saving and full employment investment. That is why the theory of interest rates dominated discussion of The General Theory immediately after it was published2. It is also why mainstream economics, with its classical bent, keeps circling back to interest rate theory —evidenced by the current revival of the natural rate of interest doctrine and appeal to the zero lower bound on nominal interest rates as the cause of unemployment and stagnation.

Second, Keynes introduced the notion of “fundamental uncertainty”, which is presented in chapter 12 of The General Theory, titled “The state of long-term expectation”. Keynes linked fundamental uncertainty to investment demand. However, that is not its major theoretical implication. Instead, as Davidson (1972) has argued, fundamental uncertainty is critical because it explains the existence of money. In a world of fundamental uncertainty, agents have a need for liquid stores of value to deal with uncertainty. That provides a micro-foundation for money, and money can now become a sink that traps spending power and diminishes ad. Expectations about the fundamentally uncertain future will impact the demand for money and spending, including investment.

Additionally, I argue that fundamental uncertainty explains why agents cannot contract their way to full employment via Arrow-Debreu styled state contingent contracts. However, that is an argument Keynes would not have considered because the Arrow-Debreu model did not exist yet.

Third, Keynes’ General Theory introduced the liquidity preference theory of interest rates, which replaces the loanable funds theory of interest rates. The interest rate equilibrates the demand and supply of liquidity (i.e. the money market), and is the reward for giving up liquidity (and not the reward for delaying consumption as per classical macroeconomics). The interest rate also becomes an intrinsically monetary phenomenon, which demolishes the classical notion of money neutrality.

In Keynes’ schema the interest rate depends on money demand, which is influenced by expectations of the fundamentally uncertain future. It is only by pure chance that the resulting interest rate will be consistent with the level of full employment output (what Keynes called the “neutral” rate of interest). Indeed, if fundamental uncertainty worsens in bad times, that will tend to increase money demand and increase interest rates.

Fourth, Keynes criticized the argument that the labor market bargain determines real wages and the labor market generates a real wage consistent with full employment. Recall, Keynes had a neoclassical view of the labor market in which the real wage equals the marginal product of labor. Just as the loanable funds market is a fiction, so too it is a fiction that workers can determine the real wage. The real wage is determined by the level of production which determines the marginal product of labor, and the level of production is determined by ad. If firms’ have market power, the real wage is also influenced by firms’ mark-up, which is determined by the structure of product market competition. Workers cannot control either the level of ad or the structure of competition. Ergo, they cannot determine the real wage or set a full employment labor market clearing wage. Thus, in chapter 2 at the very beginning of The General Theory, Keynes writes: For there may be no method available to labour as a whole whereby it can bring the wage-goods equivalent of the general level of money-wages into conformity with the marginal disutility of the current volume of employment. There may be no expedient by which labour as a whole can reduce its real wage to a given figure by making revised money bargains with entrepreneurs. This will be our contention (…). We shall argue that there has been a fundamental misunderstanding of how in this respect the economy in which we live actually works (Keynes, 1936, p. 13).

Fifth, Keynes rejected the ability of price and nominal wage adjustment to ensure full employment. Here, and only here, he departed radically from the neoclassical canon. The price system is a core building block of neoclassical economics, accomplishing the tasks of resource allocation and market clearing. On one hand, Keynes accepted the Marshallian single market partial equilibrium price mechanism. On the other hand, he rejected the capacity of the price system to deliver full employment equilibrium in the economy as a whole.

First, there is the problem of the inability of labor markets to determine the real wage (General Theory, chapter 2). Second, in chapter 19 on “Changes in Money-Wages” Keynes provides a broader and even more explicit critique of the price system (which includes the money wage). Classical economics is accused of transferring reasoning that applies for firms and industries to the economy as a whole and disregarding the effects of changes in money wages on aggregate effective demand. His conclusion is: “There is, therefore, no ground for the belief that a flexible wage policy is capable of maintaining a state of continuous full employment (Keynes, 1936, p. 267).”

Furthermore, a flexible wage system would create uncertainty associated with price instability, thereby further reducing employment. Instead of a flexible wage system, a better system is one of downwardly rigid money wages. If real wages need to fall, that can be better accomplished by expansionary monetary policy that increases employment and the price level.

In sum, Keynes’ General Theory broke decisively with classical macroeconomics. It rejected the loanable funds theory of interest rates and the money neutrality doctrine, and substituted his liquidity preference theory of interest rates. However, Keynes’ relation to neoclassical microeconomics is more ambiguous. The one microeconomic issue on which Keynes broke decisively with the neoclassicals is the price system's ability to ensure full employment.

THE FIRST WORD IN KEYNESIAN ECONOMICS, NOT THE LASTKeynes’ General Theory represents a profound break with classical macroeconomics, and it also breaks with a central component of neoclassical microeconomics. However, it is just the first word in Keynesian economics, not the last. It contains profound new insights, some errors, and plenty of omissions. It is not possible for everything to be in one book.

For instance, one clear error was Keynes’ theory of consumption (The General Theory, chapter 8). Whereas Keynes’ aggregate consumption function was major analytic innovation, its prediction of a falling average propensity to consume has proven inconsistent with the time series data3.

An example of an omission is lack of a theory of inflation, which was later supplied by Phillips curve theory4. However, that should hardly be a surprise as the 1930s were a period of depression and deflation. In that context, addressing inflation would have been out of touch with the time. It would also have been a distraction from Keynes’ purpose in The General Theory, which was to present his new theory of macroeconomics. Phillips curve theory constitutes an elaboration of that theory.

Most importantly, The General Theory provides a general theoretical platform that can be built out, perhaps using different microeconomic foundations. That implies the possibility of competing forms of Keynesian economics.

THE CLASSICAL BACKLASH AND THE BLUNTING OF THE KEYNESIAN REVOLUTIONWith the publication of The General Theory in 1936, Keynes initiated an intellectual revolution that substantially overthrew classical macroeconomics. In the United Kingdom, Keynesianism dominated both theory and policy. In the United States, it dominated policy but was more theoretically contested. The revolution was weakest in Germany where classical macroeconomics remained robust in both theory and policy.

Like all revolutions, the Keynesian revolution was resisted by some. That resistance gradually developed into a counter-revolution which eventually succeeded in putting Keynesian economics back in the box of classical macroeconomics. The story of that counter-revolution is complicated and involves both politics and ideas, particularly the theoretical missteps of the neo-Keynesian school which was the dominant branch of Keynesianism.

Neo-Keynesianism is part of the post-war neoclassical synthesis which sought to fuse neoclassical microeconomic theory, Keynesian macro theory, and neoclassical growth theory. The macroeconomic component of the neoclassical synthesis is termed neo-Keynesianism. Neo-Keynesians sincerely believed they were Keynesians and were fully aligned with Keynes’ policy agenda. However, their analytical thinking had unseen cracks, particularly regarding the belief that the price mechanism could ultimately restore full employment, something Keynes had rejected. Those cracks gradually contributed to recasting the neo-Keynesian interpretation of Keynesian economics into so-called “new Keynesian” economics, which is just a version of classical macroeconomics with market imperfections, frictions, and nominal rigidities.

The other half of the story concerns the remnants of the classical school and their revival. With the triumphant spread of Keynesianism, the classical school was substantially diminished. However, it continued at the University of Chicago under the leadership of Milton Friedman, and gradually re-asserted intellectual dominance in the form of new classical macroeconomics. That process involved an important dialectic, whereby the neo-Keynesians developed new Keynesian economics in response to the Chicago School's intellectual challenge. In this fashion, the intellectual missteps of the neo-Keynesians interacted dialectically with the Chicago School's revival of classical macroeconomics. The end result was the dilution of Keynesian thinking and the eventual capture of mainstream Keynesian economics by a modernized version of classical macroeconomics.

Politics was also involved. The neo-Keynesians thought of themselves as Keynesians, sought to defend Keynes, and were strongly supportive of Keynes’ framing of policy and his agenda of policy assisted full employment. In contrast, the Chicago School never accepted Keynes’ core ideas and always opposed the Keynesian policy agenda. That opposition to the Keynesian policy agenda expressed itself politically and attracted the support of big business. It is evident in the Chicago School's embrace of Hayek and active participation in the Mont Pelerin Society, which is identified with the birth of neoliberalism (Burgin, 2012). It is also evident in the support given to Chicago School economists via the American Enterprise Institute and the Hoover Institution, both of which are funded by business and promote a business friendly economic policy agenda.

SOME CONSEQUENCES OF THE TRIUMPH OF THE CLASSICAL COUNTER-REVOLUTIONThe success of the classical counter-revolution means contemporary mainstream macroeconomics is a neoclassical monopoly, consisting of new Keynesian economics on one side and new classical real business cycle theory on the other. The two constitute a sealed system that derives great strength from its internal differences.

New classicals believe market economies generate approximately Pareto optimal outcomes. Market failures tend to be rare, relatively small, and not worthy of corrective market intervention. Furthermore, even if market failures are large, corrective policy interventions are still not worth it because of the problem of government failure. Policy interventions generate failures of their own owing to inappropriate timing, bureaucratic incompetence and corruption, and rent seeking by private agents who try to milk policy to their advantage. The costs of these government failures is large and usually exceeds the cost of the initial market failure. Ergo, policy interventions to correct market failures are unwise. This logic also applies to macroeconomics, and new classicals argue macroeconomic problems are often attributable to mistaken or mistimed macroeconomic policy.

New Keynesians argue the opposite. Market economy outcomes are far from Pareto optimal, market failures and imperfections are frequent and large, and policy interventions can improve things. Moreover, this is particularly true of macroeconomic stabilization policy, conducted via automatic fiscal stabilizers and monetary policy.

These are very significant and important differences, and they have major policy implications. However, they are not differences of theoretical perspective as new classicals and new Keynesians share a common theoretical core, rooted in competitive general equilibrium theory.

The fact that new classicals and new Keynesians share a common theoretical core has created an intellectual monopoly that keeps other theoretical perspectives and their associated policy recommendations off the table. Far from being a weakness, the intense policy differences between new classicals and new Keynesians is actually a strength as it creates the illusion of “theoretical” differences. That illusion serves to block admission of other theoretical perspectives on grounds that economics already is diverse and other perspectives are not needed. The only new ideas that are permissible under the terms of this monopoly are those that can be incorporated into the analytical framework shared by new classicals and new Keynesians.

The exclusion of other theoretical perspectives and policy possibilities can have huge costs if the excluded ideas are right and the excluded policies are the ones that are needed. However, this monopoly exclusion is little understood and difficult to expose. Two is a powerful number as people are inclined to think in a binary way. The intensity and policy significance of the differences between new Keynesians and new classicals misleads people into thinking the two views cover the full spectrum of theory.

That misunderstanding is encouraged and compounded by a range of other factors. First, powerful political interests which fostered the classical revival, benefit from having macroeconomics framed in this narrow closed way. Second, the fact that new Keynesian and old Keynesian policy recommendations often overlap, obscures the differences and raises questions about need for additional ideas. Third, the differences are further obscured by the “new Keynesian” label which makes people think the economics of Keynes already has a front seat in the room.

THE ENDURING RELEVANCE OF KEYNES’ GENERAL THEORYThe 80th anniversary of the General Theory is cause for celebration, but it also occurs at an unhappy time. In the academy, the Keynesian revolution has been derailed and the classical macroeconomic tradition has been revived and reinvigorated. This has been accomplished by the creation of a neoclassical monopoly that blocks economic ideas and policies outside the space of the monopoly defined by new Keynesian and new classical real business cycle theory. In the global economy, the unhappiness is visible in economic conditions that exhibit clear parallels with 1930s when the Great Depression followed the financial crisis of 1929. There are also ugly political parallels.

These conditions are the product of thirty years of neoliberal economic policy. They show the enormous economic, social, and political consequences of the derailing and capture of Keynesianism.

The current stagnation can be viewed as closing a long cycle that began in 1945, and which provides overwhelming evidence of the enduring importance of Keynesian economics. After World War II, the global economy enjoyed an unparalleled era of prosperity that is widely referred to as the “Golden Age” or “Age of Keynes”. That prosperity was built on Keynesian foundations and shows the importance of Keynesian economics. In the late 1960s and early 1970s, prosperity created problems of inflation, income distribution conflict, and resource shortages that manifested themselves in a new phenomenon of stagflation. Rather than fixing the problems, stagflation was opportunistically exploited by the opponents of Keynesianism to roll back the Keynesian revolution. In its place, the counter-revolutionaries restored classical macroeconomics and instituted the neoliberal economic policy era. The result has been a thirty-year slow erosion of shared prosperity that provides confirmation, from another angle, of the merits of Keynesianism.

Most recently, Keynesianism has again proved its merits by helping prevent the financial crisis of 2008 turning into a second Great Depression. Timely economic policy interventions, inspired by the vestigial Keynesian lessons learned from the 1930s, prevented the worst. However, stagnation still ensued because the interventions were not large enough, they were prematurely curtailed, and the aggregate demand generation process remains damaged and unrepaired from forty years of neoliberal policy (Palley, 2012b).

Openness to Keynes’ ideas seems to fluctuate with conditions. In the 1930s, the Great Depression provided the historical context needed for Keynes’ General Theory to succeed in changing economic theory and policy. Now, on the 80th anniversary of The General Theory, current conditions may provide the historical context for a revival of the economics of Keynes and the Keynesian revolution. The good news is we have the knowledge and the historical record of economic performance is on Keynes’ side. Unfortunately, that is the only silver lining in a bleak sky.

My thanks to Matias Vernengo for this analogy.

This paper was presented at a conference celebrating the 80th anniversary of the publication of Keynes’ (1936) The General Theory of Employment, Interest and Money, and the 75th anniversary of the inauguration of Investigación Económica, held at the Universidad Nacional Autónoma de México (unam) in Mexico City on December 5th, 2016.

See Keynes (1938) exchange with Robertson (1938).

An alternative theory of consumption that remedies this failing, while retaining many of the features of the Keynesian consumption function, is the relative permanent income theory of consumption (Palley, 2010).