The aim of this paper is to examine whether Islamic finance could be an alternative to the traditional financial system and could guarantee stability in times of crisis. To this end, 78 Islamic banks in 12 countries have been studied over the 2004–2013 period. A series of bank-specific and other country-specific indicators are combined to explain the soundness of Islamic banking in terms of profitability as measured by ROA and ROE, and risk divided into credit risk measured by IMLGL and EQL, and insolvency risk measured by Z-SCORE. The aim is to estimate five regressions using dynamic panel data econometrics (GMM system). The results indicate that bank size and capital are the main factors responsible for increasing profitability and stability of Islamic banks and reducing their credit risk. However, the ratios forming the variable liquidity and asset quality often lead to inconclusive results. It is also found that macroeconomic variables, except inflation, are able to improve Islamic banks’ stability. This is not the case for credit risk where the ratio is still unfavorable.

The conclusion is that there are no major differences between IBs and CBs in terms of their profitability and risk features.

The subprime lending crisis that shook the world in 2007 showed the limits of the traditional financial system (Fakhfekh, Hachicha, Jawadi, Selmi, & Idi Cheffou, 2016; Trabelsi, 2011). All financial institutions have been destabilized and the economy was crippled while the Islamic financial system kept its stability and sustainability (Ftiti, Nafti, & Srairi, 2013; Mat Rahim & Zakaria, 2013). The emergence of this crisis and the economic recession that followed have raised several questions about the role of banks in such an incident and led various stakeholders to seek solutions to financial failures (Bourkhis & Nabi, 2013; Rosman, Abd Wahab, & Zainol, 2014). Therefore, special attention has been given to Islamic finance as a remedy for a system that continues to present difficulties by questioning its strength and ability to absorb the turmoil dominating the financial landscape (Hasan & Dridi, 2010; Said, 2012; Zarrouk, 2012). Survival and sustainability of these banks attracted the attention of everyone. Several studies claim that the current financial crisis could have been avoided if Islamic finance was introduced instead of conventional finance because it provided alternatives and promised a better future for humanity (Beck, Demirgüç-Kunt, & Merrouche, 2013; Choong, Thim, & Kyzy, 2012). According to them, to ensure the effective functioning of the global financial system, the shortcomings of conventional finance need to be addressed. Hence, valuing Islamic finance appears to be a cure to various problems.

Experts and ethical finance supporters have always claimed that an Islamic bank (IB) free of interest is not only fair, but is also more stable with a higher capacity for shock absorption than a conventional bank (CB) (Ftiti et al., 2013; Mat Rahim & Zakaria, 2013; Zehri & Al-Herch, 2013). However, some studies have questioned the effectiveness of Islamic finance by suggesting that shock absorption capacity and prevention of crises is limited (Ariff, Bader, Shamsher, & Hassan, 2008; Said, 2012). With the trust crisis that currently prevails the world of finance, better risk management has become a need. Since IBs are now part of the global banking landscape, they are concerned by this need. In light of these events, banking crisis and Islamic finance are more than ever at the heart of the debate. The former is an adverse event because of poorly mastered risk-taking and deterioration of solvency while the latter presents itself as a possible alternative for funding national and international projects. Lack of consensus on the strength of these banks calls for more specific attention. This is one of the issues behind the motivation of this study to examine specifically the strength of IBs in times of crisis and also, to determine whether Islamic finance could be a true growth vector that deserves to be an alternative or just a financial system at its preliminary stages.

The methodology consists of combining a series of micro and macro variables and testing their effects on the profitability and risk of 78 IBs in 12 countries of the MENA region and Pakistan, known by a strong presence of IBs over the 2004–2013 period. The selected period takes into account the effects record before and after the 2007 subprime crisis. Indeed, since the aftermath of the credit crunch and the global financial crisis (2007–2009), CBs have been severely criticized, while IBs became increasingly considered as an alternative form of banking. The parameters are estimated by the GMM system method.

The second section consists of a review of the literature dealing with the strength of IBs during the global financial crisis. The description of data and methodology are discussed in the third section. Results are analyzed in the fourth section, followed by conclusion and implications.

2Banking crises: a literature reviewSeveral researchers have studied the profitability of IBs (Choong et al., 2012; El Khamlichi, Sarkar, Arouri, & Teulon, 2014; Fun Ho, AbdRahman, Muhamad Yusuf, & Zamzamin, 2014; Hasan & Dridi, 2010; Jawadi, Jawadi, & Louhichi, 2014; Mat Rahim & Zakaria, 2013; Onakoya et al., 2013) and their level of risk (Bourkhis & Nabi, 2013; Rajhi & Hassairi, 2013) and this is by combining micro- and macroeconomic indicators and making a comparative analysis with the conventional financial system.

Using ordinary least squares (OLS), Wasiuzzaman and Tarmizi (2010) examined the impact of internal and external factors on the profitability of 16 Malaysian IBs. The study concluded that, unlike the sign of the liquidity variable, assets quality and capital negatively affect bank profitability, which is inconsistent with the results of Kosmidau, Tanna, and Pasioures (2005). Choong et al. (2012) found a positive effect of credit risk, concentration and liquidity on the performance of 13 Malaysian Islamic commercial banks. Similarly, using multivariate regression models, Akhtar, Ali, and Sadaqat (2011) found that capital ratios have a significant positive impact on the performance of IBs in Pakistan during the 2006–2009 period, unlike the variable bank size which acts negatively on the performance of these institutions. However, despite inflation and the official exchange rates that have led to financial instability, Rajhi and Hassairi (2013) found that bank size, its liquidity and GDP growth have contributed to banking stability. However, Asharaf, Rizwan, and L’Huillier (2016) found that GDP growth has no significant effect on the financial stability of 136 IB over the 2000–2013 period. Likewise, using a GLS regression and the CAMELS model, Rashid and Jabeen (2016) studied the performance of a group of IBs and CBs during the 2006–2012 period. The results indicate that the impact of GDP and credit interest rate on performance is negative for the groups of banks. However, bank size positively yet insignificantly affects their performance.

After an inter-period comparison (before and after the crisis) of 20 IBs of the GCC countries, Zarrouk (2012) showed that bank-specific factors have a negative impact on banking performance in 2008. However, when real economic activity was affected by the crisis in 2009, a sharp decline in profitability and liquidity was recorded for IBs in Bahreïn, UAE and Kuwait. However, excessive risk-taking was observed for IBs in UAE during and after the crisis compared to other countries.

To reach more robust results on the financial stability of Islamic banking, some researchers have conducted comparative studies with conventional banking. Indeed, Beck et al. (2013) compared 88 IBs to 422 conventional banks (CBs) in 22 countries where both groups of banks coexist over the period 1995–2009. The results of this study show that IBs are better capitalized and have better asset quality and an ability to take risks. Moreover, Mat Rahim and Zakaria (2013) compared the stability of a group of Malaysian IBs and CBs during the period 2005–2010 using the Z-score and NPL as proxies for financial stability. These authors found that IBs are more resistant in times of crisis compared to CBs. These findings are in line with the work of Onakoya et al. (2013) and Zehri and Al-Herch (2013) who found that IBs are more profitable and stable during the 2007–2008 crisis because of Shariah requirements. However, these conclusions are not always checked like in a comparative analysis of the performance of 3 IBs and 6 CBs in Egypt over the period 2008–2010. Indeed, Fayed (2013) showed the superiority of CBs in terms of liquidity, credit risk management, solvency and profitability. Similarly, Miah and Sharmeen (2015) showed that CBs are more efficient in managing cost than IBs. In terms of financial risk, Jawadi, Chaffou, and Jawadi (2016) showed that there are only a few significant differences between IBs and CBs.

Bearing the above assumptions in mind, the following three hypotheses can be formulated and tested, using econometric regressions.H1 There is significant relationship between profitability of IBs and micro and macro-economic indicators. There is significant relationship between insolvency risk of IBs and micro and macro-economic indicators. There is significant relationship between credit risk of IBs and micro and macro-economic indicators.

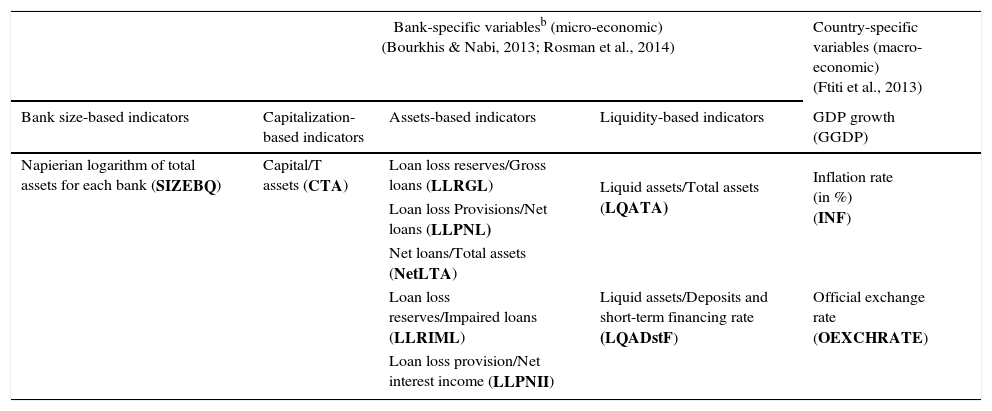

Unlike previous studies, this is a study on the strength of IBs in terms of both risk and profitability. The sample consists of 78 IBs in 12 countries of the MENA region with the addition of Pakistan noted by MENAP (Table 1) over the 2004–2013 period. The sample is large enough to provide reliable conclusions. Data are taken from the Bankscope base.

To evaluate the financial and banking system, taking profitability and risk indicators as dependent variables seems useful. A bank is said to be stronger than another if it is stable with a higher capacity to absorb risks, on the one hand, and increased performance on the other hand, during a crisis.

3.1.1ProfitabilityIn this study, to determine profitability of banks, two financial ratios that have already been adopted in previous studies (Fayed, 2013; Jawadi et al., 2014) are used as reliable measures of banking performance, namely return on assets (ROA) and return on equity (ROE).

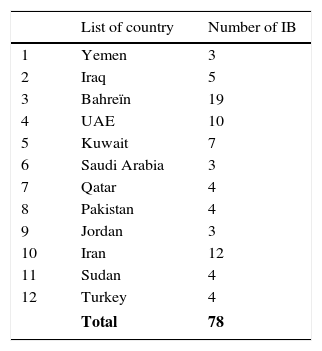

3.1.2RiskOther than specific risks, IBs are subject to the same risk category as CBs such as credit risk and insolvency risk. Insolvency risk, which is the inability of the bank to repay its debts and financial obligations because of bankruptcy is measured by Z-SCORE. To measure credit risk, the EQL or IMLGL ratio is used. These three steps are defined in Table 2.

Financial strength indicators.

| Risk-based indicators | Retained measures |

|---|---|

| Insolvency risk | |

| Z-SCORE | (Returns on assets+capital Ratio)/returns on assets standard deviation |

| Credit risk | |

| EQL | Total equity/Net loans |

| IMLGL | Impaired loans/Gross loans |

| Returns-based indicators | Retained measures |

| ROA | Net returns/Total assets |

| ROE | Equity/Total assets |

These financial ratios are considered the main strength pillars of banks to identify signs of increased financial vulnerability and to assess their resilience to financial shocks.

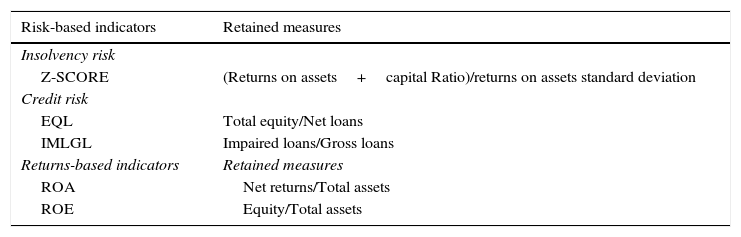

3.2The Control variablesIn this study, bank-specific internal indicators are combined, including bank size, capitalization, liquidity and asset quality and as well as country-specific external indicators, namely, real gross domestic product, inflation rate and official exchange rates as independent variables. The choice of these ratios aims at determining an instrument to provide information on the strength of IBs. Table 3 shows all of these indicators.

Micro and Macro-economic Indicators.a

| Bank-specific variablesb (micro-economic) (Bourkhis & Nabi, 2013; Rosman et al., 2014) | Country-specific variables (macro-economic) (Ftiti et al., 2013) | |||

|---|---|---|---|---|

| Bank size-based indicators | Capitalization-based indicators | Assets-based indicators | Liquidity-based indicators | GDP growth (GGDP) |

| Napierian logarithm of total assets for each bank (SIZEBQ) | Capital/T assets (CTA) | Loan loss reserves/Gross loans (LLRGL) | Liquid assets/Total assets (LQATA) | Inflation rate (in %) (INF) |

| Loan loss Provisions/Net loans (LLPNL) | ||||

| Net loans/Total assets (NetLTA) | Liquid assets/Deposits and short-term financing rate (LQADstF) | Official exchange rate (OEXCHRATE) | ||

| Loan loss reserves/Impaired loans (LLRIML) | ||||

| Loan loss provision/Net interest income (LLPNII) | ||||

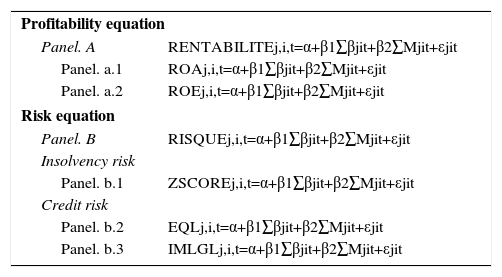

Panel data are used to measure the strength of IBs. Two evaluation levels are possible: the first gives direct insight into the bank's ability to generate profits and the second determines the ability of a bank to manage and mitigate incurred risks. The robustness of results is ensured by using a set of financial indicators to measure profitability (ROA and ROE) of IBs and their risk (IMLGL, EQL and Z-score). Applying each ratio on profitability and risk, five multiple linear models are estimated. These regressions are summarized in Table 4.

The different models explaining strength in terms of profitability-risk.

| Profitability equation | |

| Panel. A | RENTABILITEj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

| Panel. a.1 | ROAj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

| Panel. a.2 | ROEj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

| Risk equation | |

| Panel. B | RISQUEj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

| Insolvency risk | |

| Panel. b.1 | ZSCOREj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

| Credit risk | |

| Panel. b.2 | EQLj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

| Panel. b.3 | IMLGLj,i,t=α+β1∑βjit+β2∑Mjit+εjit |

where “i”, “j” and “t” indicate successively banks (i=1, 2, 3, …, 78), countries (j=1, 2, 3, …, 12), and period (t=2004, 2005, …, 2013). β, denotes the to-be-estimated model's parameters; ∑βjit, a vector of microeconomic variables; ∑Mjit, a vector of macroeconomic variables; εjit, random or error term.

Unlike a dynamic panel GMM, traditional econometric methods (OLS, fixed effect and generalized effect) do not avoid the endogeneity problem arising from a causal relationship between the independent and dependent variables due to lagged dependent variables. To solve this problem, the generalized moment method (GMM) is used as a generic tool to estimate a statistical model's parameters. GMM was proposed by Arellano and Bond (1991) and developed by Arellano and Bover (1995) and Blundell and Bond (1998) to solve the endogeneity problem in the independent variables using a series of instrumental variables generated by lagged variables (simultaneity bias problem of reverse causality and possible omitted variables).

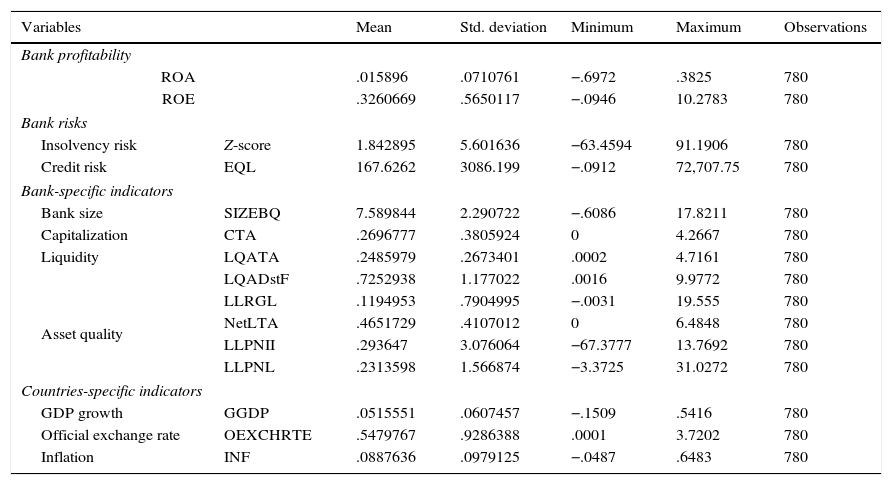

4The results and interpretations4.1Descriptive statisticsA descriptive analysis of the data is presented in Table 5. The results indicate that during the study period, the mean values of IBs’ profitability ratios are important. These institutions also have low credit and insolvency risks. On the micro level, IBs possess important levels of liquidity, capital and quality of major assets. As macro-economic variables, GGDP, OEXCHRATE and INF respectively have average values of 0.0515551, 0.5479767 and 0.0887636. The OEXCHRATE has a higher standard deviation than INF and GGDP.

Descriptive statistics.

| Variables | Mean | Std. deviation | Minimum | Maximum | Observations | |

|---|---|---|---|---|---|---|

| Bank profitability | ||||||

| ROA | .015896 | .0710761 | −.6972 | .3825 | 780 | |

| ROE | .3260669 | .5650117 | −.0946 | 10.2783 | 780 | |

| Bank risks | ||||||

| Insolvency risk | Z-score | 1.842895 | 5.601636 | −63.4594 | 91.1906 | 780 |

| Credit risk | EQL | 167.6262 | 3086.199 | −.0912 | 72,707.75 | 780 |

| Bank-specific indicators | ||||||

| Bank size | SIZEBQ | 7.589844 | 2.290722 | −.6086 | 17.8211 | 780 |

| Capitalization | CTA | .2696777 | .3805924 | 0 | 4.2667 | 780 |

| Liquidity | LQATA | .2485979 | .2673401 | .0002 | 4.7161 | 780 |

| LQADstF | .7252938 | 1.177022 | .0016 | 9.9772 | 780 | |

| Asset quality | LLRGL | .1194953 | .7904995 | −.0031 | 19.555 | 780 |

| NetLTA | .4651729 | .4107012 | 0 | 6.4848 | 780 | |

| LLPNII | .293647 | 3.076064 | −67.3777 | 13.7692 | 780 | |

| LLPNL | .2313598 | 1.566874 | −3.3725 | 31.0272 | 780 | |

| Countries-specific indicators | ||||||

| GDP growth | GGDP | .0515551 | .0607457 | −.1509 | .5416 | 780 |

| Official exchange rate | OEXCHRTE | .5479767 | .9286388 | .0001 | 3.7202 | 780 |

| Inflation | INF | .0887636 | .0979125 | −.0487 | .6483 | 780 |

The estimation of the multiple regression models requires the absence of multicollinearity between the variables. A multicollinearity problem arises when two independent variables are highly correlated. Kervin (1992) states that a serious multicollinearity problem arises when exceeding the limit of 0.7. Referring to Kervin (1992), the results show that all correlation coefficients are below 0.7. The absence of multicollinearity in all the models defined above is concluded.

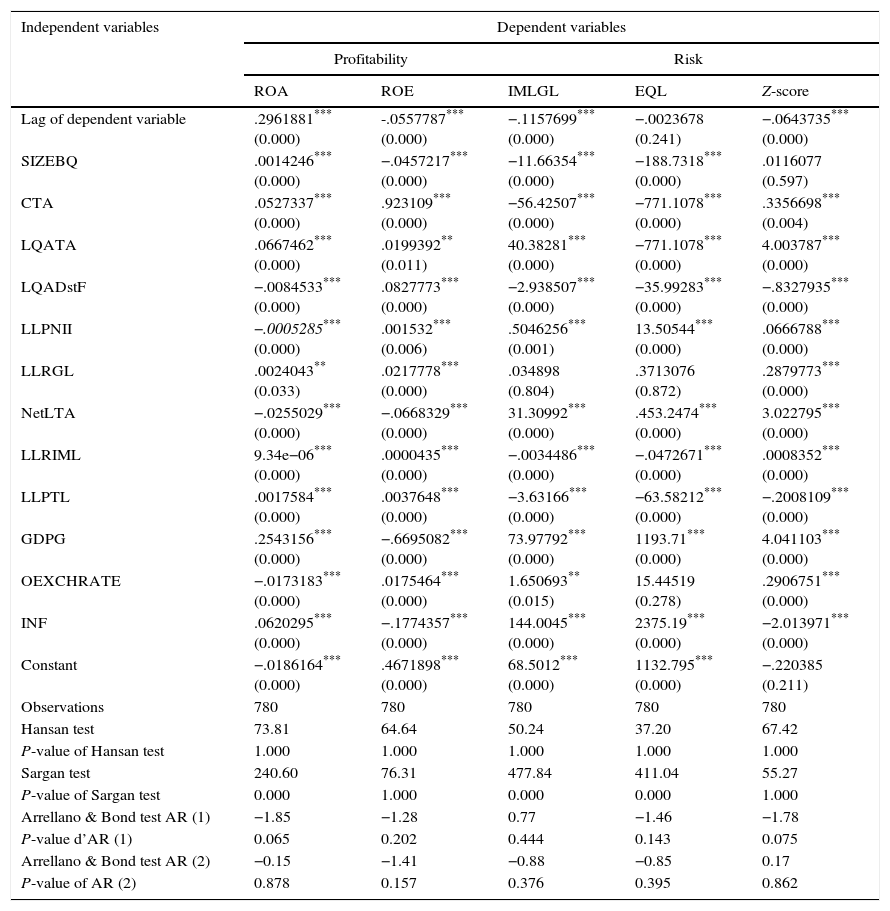

4.2Models estimation and interpretation of resultsThe results of the five models are shown in Table 6. The null hypothesis H0 on the validity of the instruments is not rejected (the probabilities of Hansan statistic are greater than 5%, indicating that the instruments are exogenous together). In addition, there is no order 2 serial autocorrelation (the probabilities of Arellano & Bond test AR (2) are greater than 5%). This indicates that the GMM system model is consistent and has a good specification of instruments without heteroscedasticity or autocorrelation problems.

The GMM method.

| Independent variables | Dependent variables | ||||

|---|---|---|---|---|---|

| Profitability | Risk | ||||

| ROA | ROE | IMLGL | EQL | Z-score | |

| Lag of dependent variable | .2961881*** (0.000) | -.0557787*** (0.000) | −.1157699*** (0.000) | −.0023678 (0.241) | −.0643735*** (0.000) |

| SIZEBQ | .0014246*** (0.000) | −.0457217*** (0.000) | −11.66354*** (0.000) | −188.7318*** (0.000) | .0116077 (0.597) |

| CTA | .0527337*** (0.000) | .923109*** (0.000) | −56.42507*** (0.000) | −771.1078*** (0.000) | .3356698*** (0.004) |

| LQATA | .0667462*** (0.000) | .0199392** (0.011) | 40.38281*** (0.000) | −771.1078*** (0.000) | 4.003787*** (0.000) |

| LQADstF | −.0084533*** (0.000) | .0827773*** (0.000) | −2.938507*** (0.000) | −35.99283*** (0.000) | −.8327935*** (0.000) |

| LLPNII | −.0005285*** (0.000) | .001532*** (0.006) | .5046256*** (0.001) | 13.50544*** (0.000) | .0666788*** (0.000) |

| LLRGL | .0024043** (0.033) | .0217778*** (0.000) | .034898 (0.804) | .3713076 (0.872) | .2879773*** (0.000) |

| NetLTA | −.0255029*** (0.000) | −.0668329*** (0.000) | 31.30992*** (0.000) | .453.2474*** (0.000) | 3.022795*** (0.000) |

| LLRIML | 9.34e−06*** (0.000) | .0000435*** (0.000) | −.0034486*** (0.000) | −.0472671*** (0.000) | .0008352*** (0.000) |

| LLPTL | .0017584*** (0.000) | .0037648*** (0.000) | −3.63166*** (0.000) | −63.58212*** (0.000) | −.2008109*** (0.000) |

| GDPG | .2543156*** (0.000) | −.6695082*** (0.000) | 73.97792*** (0.000) | 1193.71*** (0.000) | 4.041103*** (0.000) |

| OEXCHRATE | −.0173183*** (0.000) | .0175464*** (0.000) | 1.650693** (0.015) | 15.44519 (0.278) | .2906751*** (0.000) |

| INF | .0620295*** (0.000) | −.1774357*** (0.000) | 144.0045*** (0.000) | 2375.19*** (0.000) | −2.013971*** (0.000) |

| Constant | −.0186164*** (0.000) | .4671898*** (0.000) | 68.5012*** (0.000) | 1132.795*** (0.000) | −.220385 (0.211) |

| Observations | 780 | 780 | 780 | 780 | 780 |

| Hansan test | 73.81 | 64.64 | 50.24 | 37.20 | 67.42 |

| P-value of Hansan test | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Sargan test | 240.60 | 76.31 | 477.84 | 411.04 | 55.27 |

| P-value of Sargan test | 0.000 | 1.000 | 0.000 | 0.000 | 1.000 |

| Arrellano & Bond test AR (1) | −1.85 | −1.28 | 0.77 | −1.46 | −1.78 |

| P-value d’AR (1) | 0.065 | 0.202 | 0.444 | 0.143 | 0.075 |

| Arrellano & Bond test AR (2) | −0.15 | −1.41 | −0.88 | −0.85 | 0.17 |

| P-value of AR (2) | 0.878 | 0.157 | 0.376 | 0.395 | 0.862 |

* Significant at 10%.

A general reading of the results of Table 6 indicates that all variables are statistically significant, except for the LLRGL variable (Models 3 and 4), SIZEBQ (Model 5) and OEXCHRATE (Model 4).

In particular, the variable size (SIZEBQ) affects positively and very significantly the profitability of IBs. Increasing bank size (higher total assets) leads to higher profitability.

Hasan and Dridi (2010), Zeitoun (2012), Muda, Shaharuddin, and Embaya (2013) and Rashid and Jabeen (2016) found similar results. However, credit risk and its effects are negative and highly significant compared to the results obtained by Cihák and Hesse (2008). This can be explained by the fact that the strong presence of IBs in different activities facilitates the adjustment of their credit risk monitoring and results in better diversification and risk absorption. The latter is illustrated by the positive yet not significant relationship with insolvency risk. This reflects a low insolvency probability and therefore high stability for IBs. Here the results seem to be consistent with the results of Fayed (2013) and Rajhi and Hassairi (2013) who found similar correlation.

As mentioned by Sufian and Mohamad Noor (2009), Akhtar et al. (2011), Choong et al. (2012), Onakoya and Onakoya (2013), Beck et al. (2013) and Ramlan and Adnan (2016), bank capitalization has a positive and a very significant effect on profitability. In terms of risk, capitalization negatively and very significantly correlates with credit risk. This implies that IBs capitalization decisions are primarily based on risk reduction. This relationship is not surprising as it refers to the principle of prohibition of interest in Islam. IBs are not allowed to borrow money from other banks nor from a last resort bank. The Z-score is positively yet not significantly affected by capital. Thus, a sufficient level of capital makes for a better protection against banking crises. In light of these results, it seems that capital adequacy is a safety valve and a guarantee of bank profitability and stability. Therefore, the bank should maintain a minimum capital to ensure sufficient funds against unexpected losses and negative shocks.

Except for the correlation between LQADstF and ROA, all the variables explaining the profitability-liquidity ratio are positively and significantly related. Thus, a better liquidity position maximizes the gains of IBs. This is similar to the findings of Wasiuzzaman and Tarmizi (2010), Zeitoun (2012) and Beck et al. (2013). At the level of credit risk, the latter is very significantly and negatively affected by the two liquidity measures, except for the relationship LQATA and IMLGL. The result in this study indicates that the more fluid the bank, the lower its credit risk and therefore the more it resists a liquidity crisis period. However, when it comes to insolvency risk, the relationship is not clear since the LQADstF ratio affects negatively and very significantly the Z-score. However, the relationship is positive and highly significant when liquidity is measured by LQATA. This positive finding has already been validated by numerous studies namely that of Rajhi and Hassairi (2013).

Asset quality of the bank is also another internal indicator that determines profitability and risk of IBs. Profitability-wise, assets quality is in good standing since the LLRGL, LLRIML and LLPNL variables measuring this quality act positively and very significantly on ROA and ROE. Similar results were obtained by Kosmidou et al. (2005), Beck et al. (2013) and Ftiti et al. (2013). However, this conclusion is not always correct because the NetLTA and LLPNII variables act negatively and very significantly on profitability except for LLPNII and ROE. As for credit risk, it positively correlates with the LLPNII, LLRGL and NetLTA ratios. This replicates the conclusion of Fayed (2013) indicating that assets quality of IBs is worse. However, we found a negative relationship when asset quality is measured by the LLRIML and LLPNL ratios. As for insolvency risk, the determinants of asset quality significantly and positively influence insolvency risk except for the LLPNL ratio. This means that IBs hold a better asset quality that contributes to their stability.

The results obtained on the relationship between profitability, risk (insolvency and credit risks) of IBs and the different bank-specific variables seem to validate our three hypotheses.

On the macroeconomic level, the official exchange rate, inflation and GDP growth tend to influence positively and very significantly credit and insolvency risks with the exception of inflation-insolvency risk. Fayed (2013), Rajhi and Hassairi (2013) and Mat Rahim and Zakaria (2013) found similar results. The positive relationship between OEXCHRATE and the Z-score is different from that found by Rajhi and Hassairi (2013) and Bourkhis and Nabi (2013). Indeed, the INF variable should have a negative impact on credit risk as uncertainty makes banks more conservative and cautious, but this has not been confirmed by the positive relationship in this study. On the other hand, unlike the signs of the relationship between the OEXCHRTE and profitability ratios, GGDP affects positively and very significantly ROA, which means that an increase in GDP of a country improves performance of banks operating in that country. This is consistent with the work of Srairi (2009), Wasiuzzaman and Tarmizi (2010), Choong et al. (2012), Zeitoun (2012) and Muda et al. (2013). However, there is a negative and a highly significant relationship when profitability is measured by ROE. The same interpretation applies when we consider the inflation variable. The positive and significant effect on ROA at the 1% level confirms the results of Delis and Papanikolaou (2009) and Wasiuzzaman and Tarmizi (2010) who found a positive correlation. Their results indicate that with inflation, bank profitability increases more than its costs. However, it has had a negative and a significant effect on ROE at the 1% level. Significance of the relationship between the different external determinants and the dependent variables confirm once more the initial three hypotheses.

5Conclusion and implicationsThe purpose of this study is to examine whether an interest-free financial system could be an alternative to the traditional final system or a financial supplement with some limitations. To address this issue, a series of micro and macroeconomic indicators are combined to explain the strength of IBs in terms of profitability measured by the two ROA and ROE ratios, and risk measured by credit risk (IMLGL and EQL) and insolvency risk (Z-score).

Consistent with previous results, the different internal and external determinants significantly affect the two measures of profitability of IBs at the 5% and 10% levels. The same is true for credit and insolvency risks.

The results indicate that bank size and capital are key indicators of increased profitability and stability of IBs and reduce their credit risk. It also seems that measures of liquidity often positively affect profitability and bank stability, yet negatively affect credit risk except for a few ratios. As for measures of asset quality, the results are inconclusive. Moreover, it is noted that the macroeconomic variables, except for inflation, are external indicators that favor the stability of IBs. This is not the case for credit risk where the ratio is still unfavorable. However, a clear relationship between profitability and the three external variables has not been found.

The results obtained in this study lead to the conclusion that the Islamic financial system cannot be a substitute to the traditional system, but rather a financial supplement to the conventional system.

The present study identified several factors that may eventually help bank managers to improve the financial outlook of their firms by controlling profitability and risk. It also helps them understand how macroeconomic indicators affect this pair in the banking sector. Managers of IBs can focus their attention on assets quality to improve profitability of these banks and minimize their risk level.

Finally, the survival and sustainability of IBs can be issues of concern. Indeed, Islamic finance takes its strength from investments coming from sovereign funds obtained on oil earnings because of the exuberant increase in oil prices that has reached 150 dollars for the barrel and has led oil-producing Islamic countries to place funds in IBs. Nevertheless, given the fall in oil prices and the wars raged by some Gulf countries in addition to the Saudi-Iran conflict, there is a loss in deposits growth on the one hand, and a slackening of the public finances of the oil-producing countries on the other. This manifested itself in a massive withdrawal of liquidity from the banking system and in particular from IBs. This concern stems essentially from the fact that in 2015, in the GCC countries, conventional bond emissions increased by 140% to reach 58billion dollars, while the sukuk decreased by 22% reaching 18billion dollars (according to Standard & Poor's).