Taxes on financial transactions have been especially controversial because of their potential effects on banking disintermediation. A modality of such taxes (Bank Debit Tax, BDT) was introduced in Colombia since the late nineties. Using monthly panel data from 1996 to 2014 for the major depository institutions, this paper provides evidence on the effects of the BDT on bank intermediation spread. For the total sample (thirteen banks), results suggest that nowadays the hypothetical elimination of the BDT would reduce spreads in 60 basis points, i.e. from 7.7% to levels close to 7.1%. The results do not provide clear evidence of differential impacts by bank size. Additional instruments of the financial repression as well as other determinants of banking spreads confirm the expected effects.

Los impuestos sobre las transacciones financieras han sido controversiales, especialmente por sus posibles efectos en la desintermediación bancaria. Desde finales de los años noventa se introdujo en Colombia una modalidad de estos impuestos (el Gravamen sobre los Movimientos Financiaros [GMF]). Utilizando datos mensuales desde 1996 a 2014 para los principales bancos del sistema, este documento provee evidencia sobre los efectos del GMF en los márgenes de intermediación. Para la muestra total (trece bancos), los resultados sugieren que la hipotética eliminación del GMF reduciría los márgenes hoy en día en 60 puntos básicos, es decir, del 7,7% a niveles cercanos al 7,1%. Los resultados no ofrecen evidencia clara de impactos diferenciales por tamaño del banco. El trabajo también confirma los efectos esperados de los otros instrumentos de la represión financiera y de los otros determinantes de los márgenes identificados por la literatura.

As some other Latin American Countries (LAC), Colombia adopted a financial transaction tax since the end of the last century. This tax, levied on bank debits, henceforth BDT or 4x1000, as it is commonly known, has been controversial and subject of many adjustments. It has been amended in the last eight tax reforms, after its establishment in November 1998 as a provisional contribution to alleviate the financial system crisis. The BDT has gone from temporary to permanent; its rates have been unified and increased; the tax basis has been readjusted several times; its gradual removal has been rescheduled three times; and, finally, the revenue collected has changed its purpose four times: to address the financial system crisis in 1999, for reconstruction in the aftermath of a 1999 earthquake, to fund the rainy season emergency during 2011 and to confront the agricultural sector crisis in 2013.

The main criticisms regarding the 4x1000 arise from the inefficiencies it may be generating in the financial intermediation market. On the one hand, it can increase the cost of financial repression faced by banks due to government regulation and, thereby, it could affect interest rates on deposits and loans. On the other hand, the tax represents an additional transaction cost for customers, therefore discouraging the use of bank services. The eventual increase in banking spreads as well as the higher transaction costs for the customers end up generating financial disintermediation. Additional critiques to the BDT are associated with the creation of incentives to informality and illegal activities, and changes in the usage of different means of payment.

The key objective of the majority of the financial transaction taxes adopted at the end of the nineties was to raise public revenue. In particular, revenue from the Latin American bank debit taxes has varied widely, but has typically been around 1% of the GDP. In Colombia, the 4x1000 has become one of the easiest taxes to collect and represents a non-negligible source of government funding (currently 6% of the tax revenues or 0.8% of the GDP, CEECT, 2015). A drop in productivity recorded over the last decade (from 25% to 15% between 2000 and 2009) was corrected mainly by the tax reform of 2010. Currently, the productivity of this tax has regained the levels seen 15 years ago. Finding new resources to replace those coming from 4x1000 is difficult, especially because of the falling oil revenues (MHCP, 2015). The eventual abolition of the BDT would require around a three-percentage point increase of the added value tax. Hence, its elimination remains uncertain.

Literature on financial transaction taxes is ample. Interestingly, the majority of papers were published in the subsequent years to their adoption. LAC like Argentina, Bolivia, Brazil, Ecuador, Peru, and Venezuela introduced financial transaction taxes at the beginning of this century, though some have already repealed them (Brazil, Ecuador and Venezuela). The pioneering papers characterized the taxes approved in each country and analyzed their collection and productivity. In addition, the introduction of this kind of taxes was associated with some stylized facts in the means of payment, clearing checks and monetary and financial aggregates (Arbeláez, Burman, & Zuluaga, 2006; Baca Campodonico, De Mello, & Kirilenko, 2006; Coelho, Ebrill, & Summers, 2001; Lozano & Ramos, 2000). Subsequent papers have tried to capture the expected effects of these taxes on financial disintermediation (Hernández & Zea, 2006), on the demand for cash, and on the substitution between financial instruments issued by banks (Giraldo & Buckles, 2011). The loss of efficiency caused by these taxes has been evaluated in diverse contexts (Kirilenko & Summers, 2003) and has been compared with the inefficiencies arising from other taxes (Suescun, 2004).

The BDT in Colombia is paid by depositors when they make withdrawals from their sight bank deposits. However, in the case of term deposits (CDs), banks must pay the BDT on the liquidation of these deposits. This imposes a cost on banks that could be finally reflected in interest rate spreads (lower interest rates on deposits and/or higher interest rates on lending). In this note, we assess the effects of BDT on these spreads. The analysis is carried out on the basis of monthly panel data for the majority of banks, taken from their balance sheets for the period between 1996 and 2014. The estimation controls for additional instruments of financial repression as well as other key factors identified in the banking literature as interest spread determinants. Unlike previous studies (Galindo & Majnoni, 2006; Medellín & Díaz, 2013; Salazar, 2005), in this paper we identify the isolated impact of BDT on spreads for the aggregate banking system and for banks grouped according to their size. Following this introduction, we describe the model and data in Section 2, in Section 3 we present and analyze results and, in Section 4, some conclusions are drawn.

2Methodology2.1The modelWe start with a simple model for a representative bank j whose objective is to maximize profits (πj) at each point in time t. We omit the time subscripts for simplicity. The bank produces loans (Lj) using as inputs deposits (Dj) and labor (Nj). Revenues for bank j come from the remuneration of its productive loans (δjiL,jLj, where δj∈[0, 1] is the share of productive loans), while its costs are associated with the remuneration of deposits (iD,jDj) and labor Cj(Lj, Dj), which in turn depends on the volume of loans and deposits. Interest rates on loans and deposits are denoted by iL and iD, respectively.

We disaggregate deposits into term deposits (CDj) and other deposits (ODj). A share of these deposits (ECD and EOD) is required by the central bank as compulsory reserves while the rest (1−ECD and 1−EOD) is available to be lent by banks. The representative bank faces additional costs generated by financial repression; in particular, we stress here those derived from the financial transaction tax on the liquidation of CDs. The problem for a bank which chooses between the two types of deposits is given by:

where α is the share of CDs that reach its maturity date and are withdrawn each period and τ the financial transaction tax of flat rate (of 0.4%, hence its name 4x1000). From the two first order conditions derived from (1), we retake only the first ∂πj∂CDj=0,Note that left side of (2) represents the banking spread defined as the difference between the interest rate received from loans and the interest rate paid on CDs. Clearly, the interest rate spreads will be positively affected by the financial transaction tax as long as αj(iCD,j+1)δj(1−ECD)>0.We want to emphasize some potential alternatives employed by banks to compensate, via interest rates, the cost generated by the financial transaction tax. Following (1) and (2), the bank j may react by increasing the loan interest rates and/or by reducing the interest rates on deposits, both on CD's and/or on other deposits. For this decision, banks should take into account, among others, the price elasticity of each one. In practice, either option should ultimately influence the banking margins, as it will be examined below.

In order to run the estimations, the reduced form of the model is used to guide the econometric specification with some extensions. Firstly, we include additional sources of financial repression, which could result costly for banks in Colombia; secondly, we introduce further key factors in the determination of margins identified by literature; and, thirdly, we use the banking margins based on total deposits instead of the ones based on term deposits because of data availability. Regarding additional sources of financial repression we add three of the most recognized in the Colombian financial system; i.e., the so-called forced investments (IFj) in agricultural development securities; the required reserves by the central bank on all deposits (Ej) and the equity requirements (RCj) enforced by macro-prudential regulation.

Concerning the second point, we incorporate at least two additional factors identified in the literature. On the one hand, credit risk measures are included, given that riskier loans imply higher interest rates charged by banks. Barajas, Steiner, and Salazar (1999) provide evidence on the importance of risk exposure in the banking margins formation in Colombia. On the other hand, the fees (commissions) charged by intermediaries by the services they provide are also taken into account, since under certain circumstances they could be a source of income that complements or even replaces income from interest on loans. Estrada, González, and Hinojosa (2006) explore the importance of this factor in the margin formation of the Colombian financial system.

With the above-mentioned considerations, the econometric specification that we use is the following:

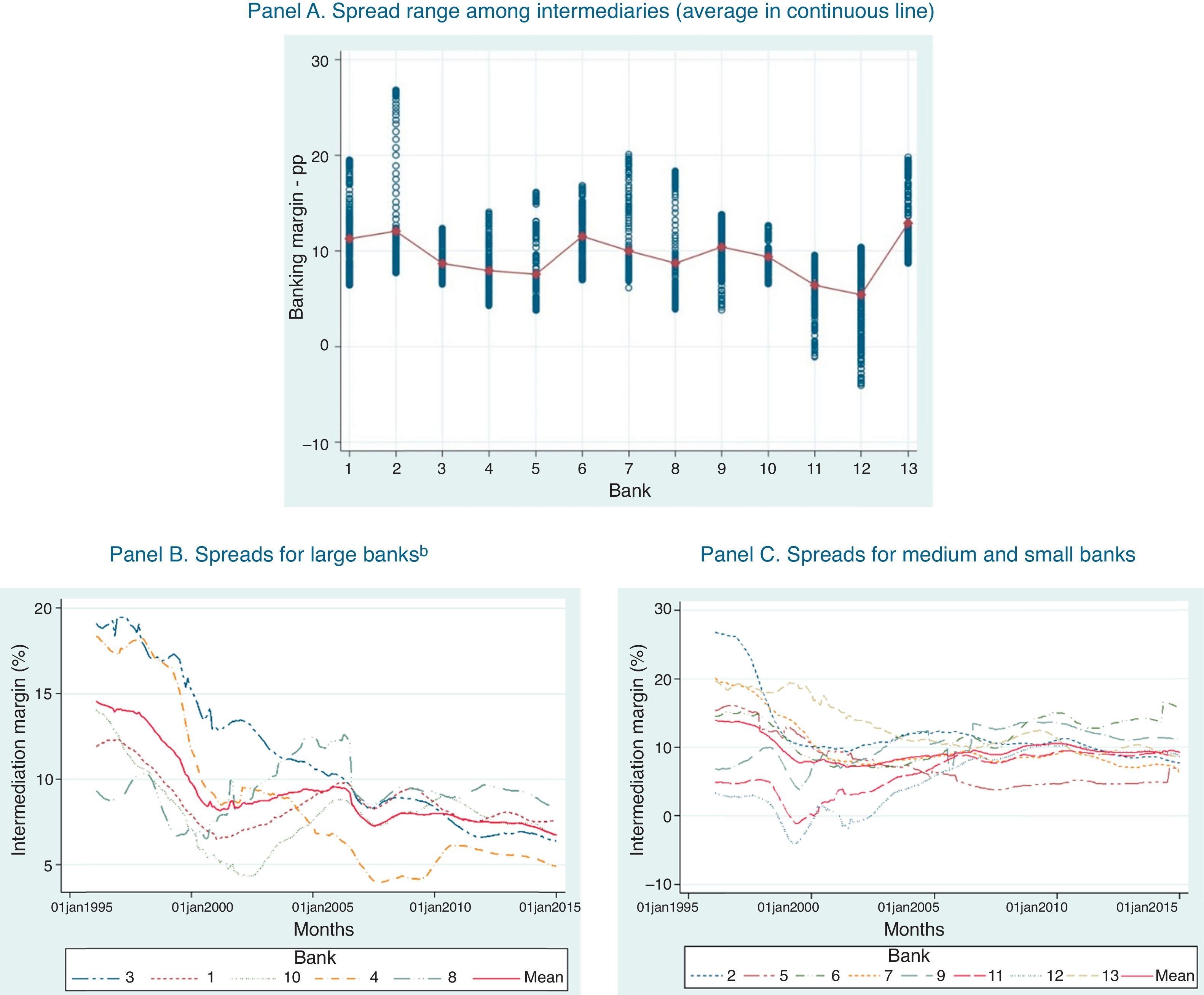

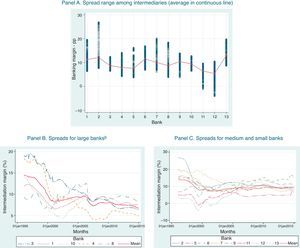

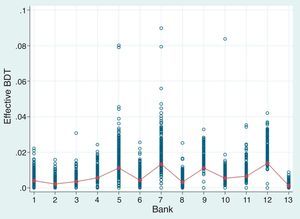

where xj is a vector of controls at the level of each intermediary (risks and commissions), and μ and λ represent the fixed effects at bank and time (month) level, respectively. The financial repression cost due to BDT is captured by τγj where γj is the tax base. The explanatory variables are lagged one period in order to avoid endogeneity problems. The fixed-month effect (λ) captures especially seasonal events or macroeconomic episodes that could affect the margin of banks altogether.2.2The dataOur sample involves thirteen banks which are the biggest in terms of their asset value within the banking system (about two-thirds). The data is coherent through time, meaning that it takes into account mergers and acquisitions of financial institutions reported in the last 20 years. Information for intermediaries comes from their monthly balance sheets covering the period 1996.01–2014.12. Interest rates are calculated as the ratio between remuneration (payments) on loans (deposits) of twelve consecutive months and the corresponding average stock of loans (deposits). Therefore, spreads are defined as the difference between the annual average effective interest rates on loans and deposits. Fig. 1 shows the interest rates spreads for the set of thirteen banks ordered randomly and without identifying them to keep confidentiality. The continuous line in Panel A links the average margins across intermediaries while Panels B and C illustrate the dynamic through time of such margins for each bank grouped into large, and medium and small banks, respectively.

Banking spreads: 1996–2014.a

aThe sample covers 13 intermediaries which explain approximately two-thirds of the overall assets of the banking system.

bLarge banks represent 67%, on average, of the total assets of the sample while the others (medium and small banks) represent the remaining.

Source: Calculations by the authors.

Note: these figures are available in colour in the electronic version of the article.

Three facts can be highlighted from this data. Firstly, there is an ample divergence in the spreads range of banks along the period (the bank labeled with No. 2 presents the largest range (19pp) while the bank No. 3 the lowest (6pp)). Secondly, there is a clear downward trend in the margins of the large banks (five banks which explain jointly 67% of the assets), which went from 15% (on average) at the middle of the nineties to 7% at the end the period. This trend is less clear for an important group of medium and small intermediaries (Panel C). Finally, there is a slight convergence in the interest rate spreads, especially among large banks, meaning that the dispersion among them was larger at the beginning of the period with respect to the end.

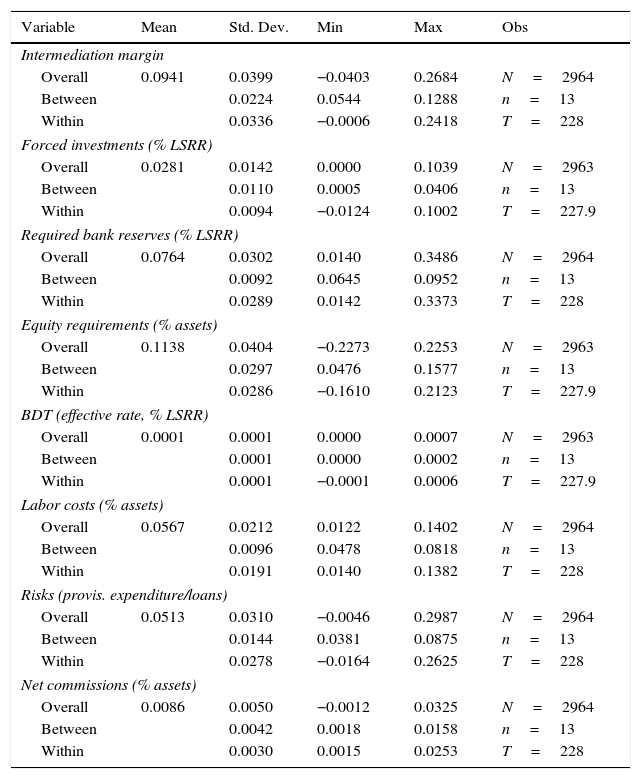

Concerning the explanatory variables and according to empirical literature, most of them must be incorporated in terms of (total) liabilities or assets of each bank; i.e. in our specification it implies to define the following ratios: forced investment to liabilities; reserve requirements to liabilities; equity requirements to assets; labor costs to assets; net commissions to assets; and expenditures in provisions (as a risk measure) to loans. Annex 1 summarizes the descriptive statistics of the variables included in the estimates.

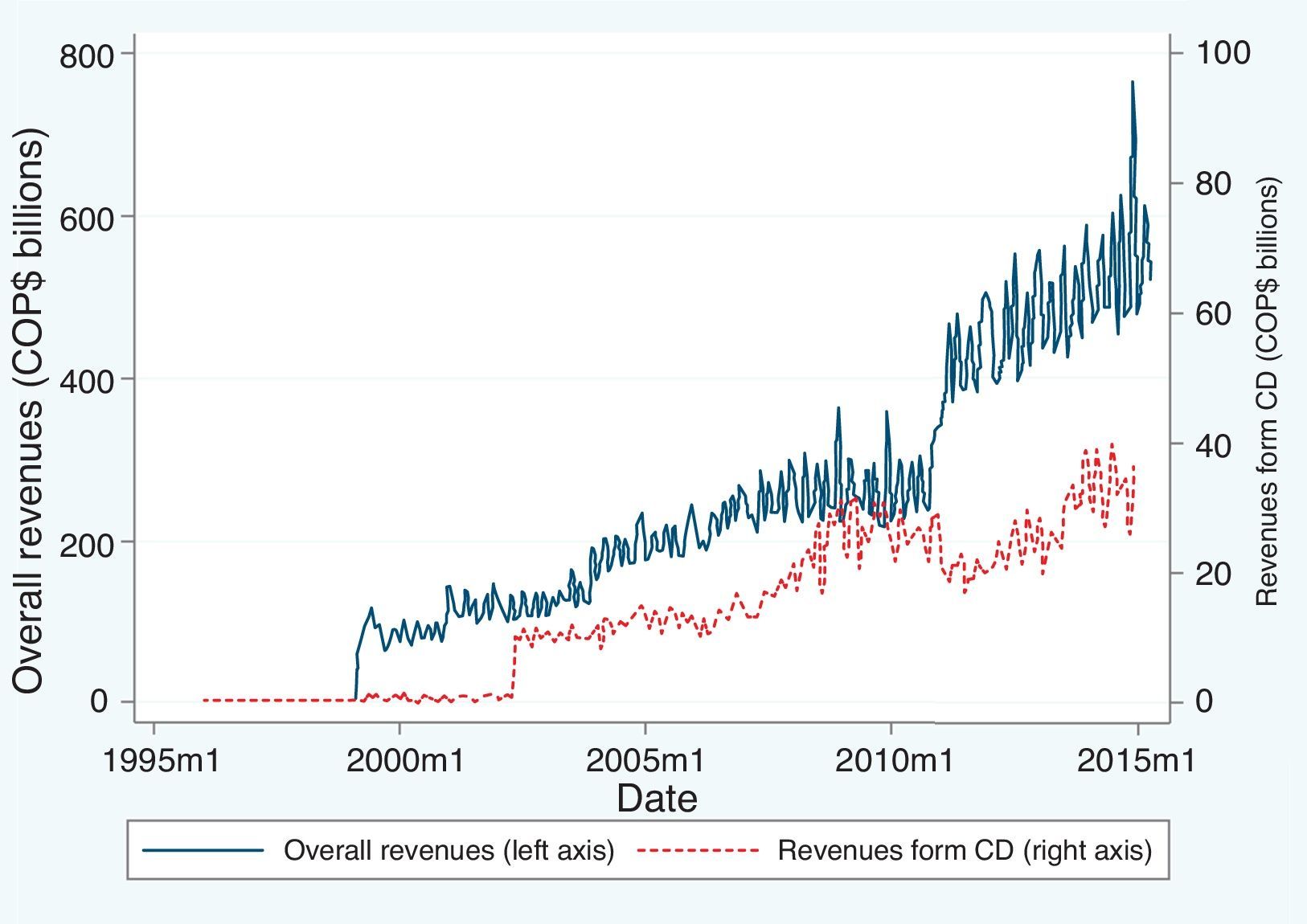

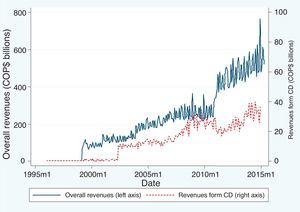

Regarding the BDT it is necessary to remark two aspects. The first is related to the revenue collected, since it has undergone numerous adjustments. Fig. 2 highlights the leap it took at early 2011, which seems to be associated with the measures undertaken by the government on operations that were used to avoid the tax (Tax Reform No. 1430 of 2010).1 So, the average monthly revenues from BDT went from COP$258 billion in the first half of 2010 to COP$406 billion in the same period of 2011 (an increase of 58%). This dynamic allowed recovering the revenue productivity from 15% to 20% between these two years.2 Even though the overall revenue collected by BDT could suggest an apparent structural change in 2011, Fig. 2 also shows no clear evidence of changes in BDT revenues collected by CDs. Based on the latter evidence, we do not consider necessary to include this structural change in econometric exercises.3

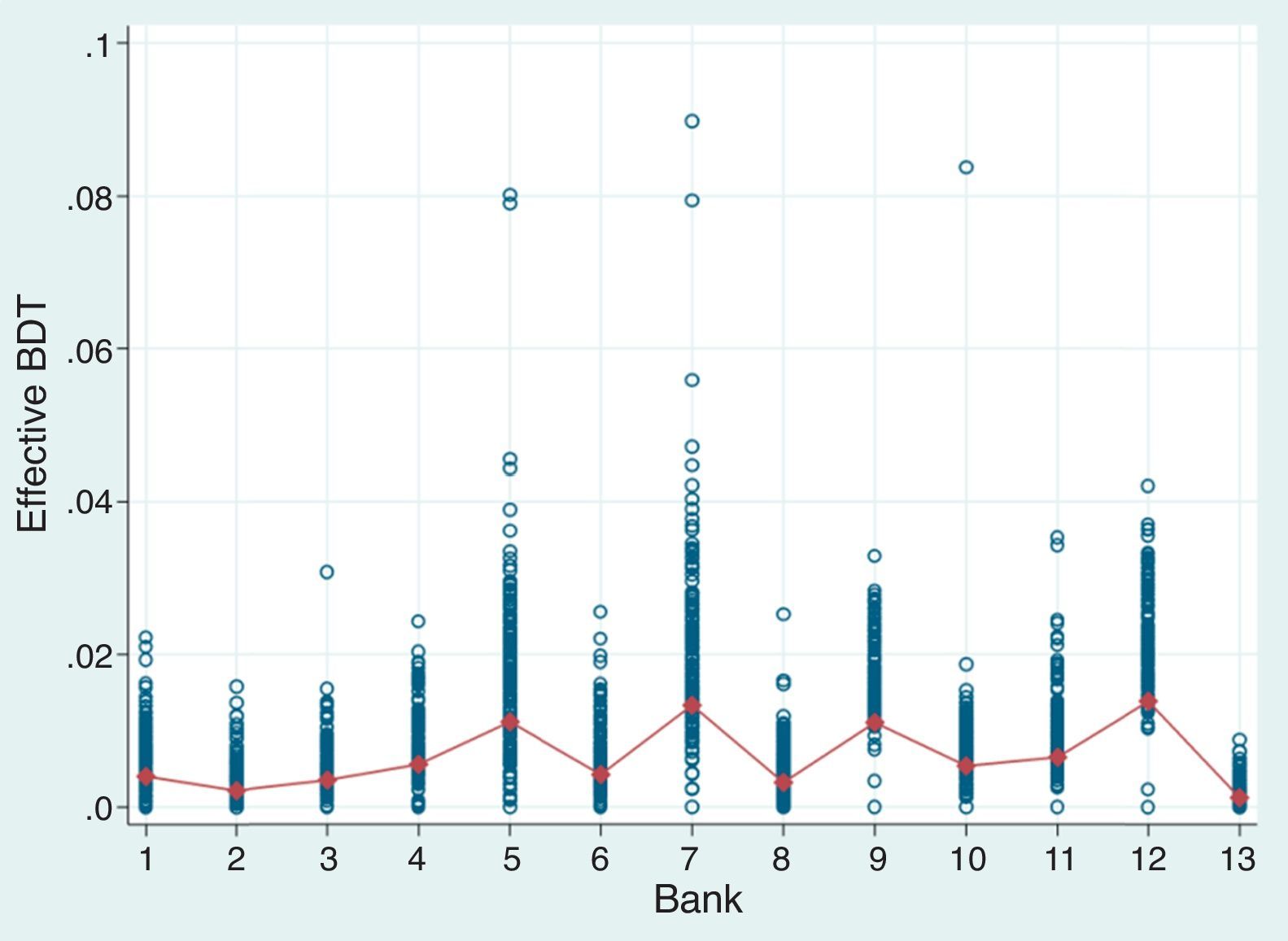

The second relates to the tax burden assumed by each bank, which is not so evident nor is available in the data sets at hand. The DIAN (Agency of National Taxes and Customs) does not provide that information for confidentiality reasons. As noted in (3), the tax burden of BDT is given by τγj, where τ is the flat tax rate and γj is a tax base that differs between intermediaries. Indeed, the tax base should correspond to the value of CDs (as percentage of liabilities subject to reserve requirements, LSRR) that are reimbursed in each period. Consequently, we infer γj using information on the monthly stock of CDs and the new issues of this kind of deposits. This measurement strategy of γj is quite different with regard to the one designed by Galindo and Majnoni (2006).

The reason why the BDT would affect the banking cost and, therefore, their margins, ultimately has to do with the Law 788 of 2002, which established that the tax burden on liquidation of CDs should be assumed by the entity issuing the term deposits. In this regard, the cost of BDT is not only supported by customers, but also by intermediaries. Fig. 3 shows our estimates of tax burden (effective) of BDT for each of the thirteen intermediaries that correspond to τγj as proportion of liabilities subject to reserve requirements.4

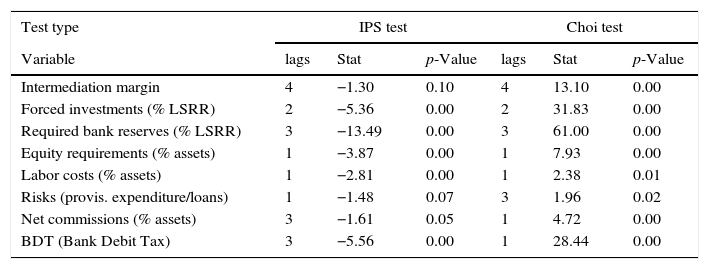

3ResultsEq. (3) is estimated by OLS panel data using robust standard errors clustered by bank.5 Making use of test of Im, Pesaran, and Shin (2003) and Choi (2001), the existence of unit root can be ruled out in both the dependent variable and the residuals of the estimated models (Annex 2). Hence we will assume the process is stationary. The data allow us to run estimates for all banks as well as for groups according to the size of their assets (large banks and medium and small ones). The BDT variable takes positive values from January 2003 through the end of the sample, on the basis that ever since the banks were obliged to pay this tax, while tax payments were zero before.

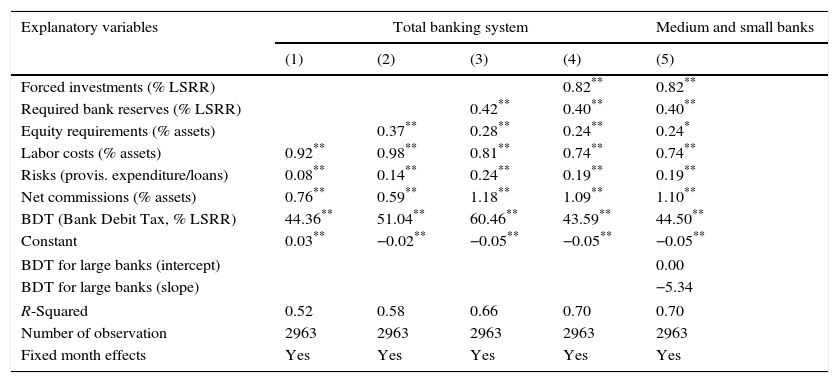

Table 1 summarizes the results. In columns (1)–(4) the estimates for the aggregate banking system (thirteen banks) are presented, initially leaving aside all components of financial repression (column (1)) and then adding them one at a time (columns (2) and (3)) to check the robustness of the BDT parameter. Column (4) represents the most complete specification of the model (the benchmark model) and the one that will be used to interpret our results.

Results of the estimated models (dependent variable: interest rate spreads).

| Explanatory variables | Total banking system | Medium and small banks | |||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Forced investments (% LSRR) | 0.82** | 0.82** | |||

| Required bank reserves (% LSRR) | 0.42** | 0.40** | 0.40** | ||

| Equity requirements (% assets) | 0.37** | 0.28** | 0.24** | 0.24* | |

| Labor costs (% assets) | 0.92** | 0.98** | 0.81** | 0.74** | 0.74** |

| Risks (provis. expenditure/loans) | 0.08** | 0.14** | 0.24** | 0.19** | 0.19** |

| Net commissions (% assets) | 0.76** | 0.59** | 1.18** | 1.09** | 1.10** |

| BDT (Bank Debit Tax, % LSRR) | 44.36** | 51.04** | 60.46** | 43.59** | 44.50** |

| Constant | 0.03** | −0.02** | −0.05** | −0.05** | −0.05** |

| BDT for large banks (intercept) | 0.00 | ||||

| BDT for large banks (slope) | −5.34 | ||||

| R-Squared | 0.52 | 0.58 | 0.66 | 0.70 | 0.70 |

| Number of observation | 2963 | 2963 | 2963 | 2963 | 2963 |

| Fixed month effects | Yes | Yes | Yes | Yes | Yes |

Panel data estimation with robust standard errors clustered at bank level (Arellano, 2003, chap. 2).

LSRR: liabilities subject to reserve requirements.

Column (5), in turn, shows the results, grouping banks according to their size. The empirical strategy is to include a dummy variable set to zero for small and medium banks and equal to the BDT variable for large banks (five entities). This allows us to derive the differential impact on the margins of large banks. The corresponding effect on large banks margins is deduced, thereafter, taking into account the last two rows of the column (5). The signs we obtain are the expected and the parameters are statistically significant and robust across estimates. The goodness of fit (R2) of the benchmark model is 70%, which is satisfactory in this type of exercises.

The size of the coefficients of forced investments, required bank reserves and equity requirements (β3=0.82, β4=0.40 and β5=0.24 of Eq. (3), respectively) suggests that their costs are not negligible and there are no differences by size of banks. Results also confirm that the level of bank efficiency (β2=0.74 of Eq. (3)), as measured by labor costs, matters in spread setting, so that greater inefficiency (higher labor costs) implies setting higher spreads. Findings for control variables included in vector xj confirm what is conventionally recognized by empirical literature: The positive impact of the riskier credits on lending interest rate (and thus on margins) and the use of commissions as a complementary (instead of substitute) source of income for banks (Barajas et al., 1999; Estrada et al., 2006; Galindo & Majnoni, 2006).

The impact of the BDT on intermediation spreads reveals novel details. On the one hand, the expected sign and statistical significance of the parameters are confirmed through all estimates (five in all), corroborating its robustness. Like other forms of financial repression, this tax is onerous; therefore, banks partially or totally transfer this cost to the interest rates of loans and/or deposits.6 On the other, there is not clear evidence of a differential impact on spreads between small, medium and large banks. That is because the parameters for large banks in the last two lines of column (5) are not statistically different from zero.

To illustrate our findings, we consider the estimated model for the banking system as a whole (column (4)). Given the historical average ratio of 0.04 (γj) between the reimbursed value of CDs and the total liabilities subject to reserve requirements (LSRRj), which is a usual figure for a typical bank, the BDT parameter of 43.59 implies that the banking spread increases by about 0.00174 per each tax rate point (43.59×0.04×0.001). Due to the fact that the tax rate has been four points, this parameter suggests that historically the BDT has increased the margins, on average, 0.00697 (equivalent to 70 basis points). Finally, using these results to assess the current impact of a hypothetical abolition of the BDT (i.e., employing the latest information of 2014, with γj=0.035), we conclude that nowadays the intermediation spreads could be reduced in 61 basis points (from 7.7% to levels close to 7.1%).

4ConclusionsBased on monthly data from 1996 to 2014 for the thirteen largest banks in Colombia, this paper provided evidence of the effects of BDT on the interest rates spreads. The effects were valued for the banking system as whole and for grouped intermediaries according to their asset size. The exercise introduced controls for additional instruments of the financial repression as well as the most relevant factors in spread setting, as identified in the literature.

The results illustrate that traditional mechanisms of financial repression (forced investments in TDAs, required reserves and capital requirements) affect interest rate margins in the expected direction and parameters do not vary substantially by including an ample set of control variables. The level of efficiency of banks (measured by labor costs) matters in spread setting, so that the greater the inefficiency (higher labor costs) the higher the spreads. Additionally, we found that credit risk and commissions charged by banks for their various services seem to have significant effects in the expected direction.

We found novel estimates regarding the impact of BDT on intermediation margins of banks. On the one side, results indicate that this tax became costly for banks, so they ended up transferring (partially or fully) this cost to the lending or deposit interest rates. In particular, the BDT increased intermediation margins by about 70 basis points on average for the banking system as whole. The evidence also confirms the double mechanism employed by banks to compensate the cost generated by the BDT, that is, via higher interest rates on loans and/or lower interest rates on deposits. On the other side, there is no clear evidence of a differential impact on spreads between small, medium and large banks. Taking as reference the effective average spread recorded for the banking system in 2014 (7.7%), our results imply that nowadays the hypothetical elimination of the BDT would reduce margins to levels close to 7.1%.

Conflict of interestsThe author declares that they have no conflict of interest.

| Variable | Mean | Std. Dev. | Min | Max | Obs |

|---|---|---|---|---|---|

| Intermediation margin | |||||

| Overall | 0.0941 | 0.0399 | −0.0403 | 0.2684 | N=2964 |

| Between | 0.0224 | 0.0544 | 0.1288 | n=13 | |

| Within | 0.0336 | −0.0006 | 0.2418 | T=228 | |

| Forced investments (% LSRR) | |||||

| Overall | 0.0281 | 0.0142 | 0.0000 | 0.1039 | N=2963 |

| Between | 0.0110 | 0.0005 | 0.0406 | n=13 | |

| Within | 0.0094 | −0.0124 | 0.1002 | T=227.9 | |

| Required bank reserves (% LSRR) | |||||

| Overall | 0.0764 | 0.0302 | 0.0140 | 0.3486 | N=2964 |

| Between | 0.0092 | 0.0645 | 0.0952 | n=13 | |

| Within | 0.0289 | 0.0142 | 0.3373 | T=228 | |

| Equity requirements (% assets) | |||||

| Overall | 0.1138 | 0.0404 | −0.2273 | 0.2253 | N=2963 |

| Between | 0.0297 | 0.0476 | 0.1577 | n=13 | |

| Within | 0.0286 | −0.1610 | 0.2123 | T=227.9 | |

| BDT (effective rate, % LSRR) | |||||

| Overall | 0.0001 | 0.0001 | 0.0000 | 0.0007 | N=2963 |

| Between | 0.0001 | 0.0000 | 0.0002 | n=13 | |

| Within | 0.0001 | −0.0001 | 0.0006 | T=227.9 | |

| Labor costs (% assets) | |||||

| Overall | 0.0567 | 0.0212 | 0.0122 | 0.1402 | N=2964 |

| Between | 0.0096 | 0.0478 | 0.0818 | n=13 | |

| Within | 0.0191 | 0.0140 | 0.1382 | T=228 | |

| Risks (provis. expenditure/loans) | |||||

| Overall | 0.0513 | 0.0310 | −0.0046 | 0.2987 | N=2964 |

| Between | 0.0144 | 0.0381 | 0.0875 | n=13 | |

| Within | 0.0278 | −0.0164 | 0.2625 | T=228 | |

| Net commissions (% assets) | |||||

| Overall | 0.0086 | 0.0050 | −0.0012 | 0.0325 | N=2964 |

| Between | 0.0042 | 0.0018 | 0.0158 | n=13 | |

| Within | 0.0030 | 0.0015 | 0.0253 | T=228 | |

| Test type | IPS test | Choi test | ||||

|---|---|---|---|---|---|---|

| Variable | lags | Stat | p-Value | lags | Stat | p-Value |

| Intermediation margin | 4 | −1.30 | 0.10 | 4 | 13.10 | 0.00 |

| Forced investments (% LSRR) | 2 | −5.36 | 0.00 | 2 | 31.83 | 0.00 |

| Required bank reserves (% LSRR) | 3 | −13.49 | 0.00 | 3 | 61.00 | 0.00 |

| Equity requirements (% assets) | 1 | −3.87 | 0.00 | 1 | 7.93 | 0.00 |

| Labor costs (% assets) | 1 | −2.81 | 0.00 | 1 | 2.38 | 0.01 |

| Risks (provis. expenditure/loans) | 1 | −1.48 | 0.07 | 3 | 1.96 | 0.02 |

| Net commissions (% assets) | 3 | −1.61 | 0.05 | 1 | 4.72 | 0.00 |

| BDT (Bank Debit Tax) | 3 | −5.56 | 0.00 | 1 | 28.44 | 0.00 |

For both test the null hypothesis is that all the panels contain a unit root. Optimal lag-lengths are chosen by BIC criteria.

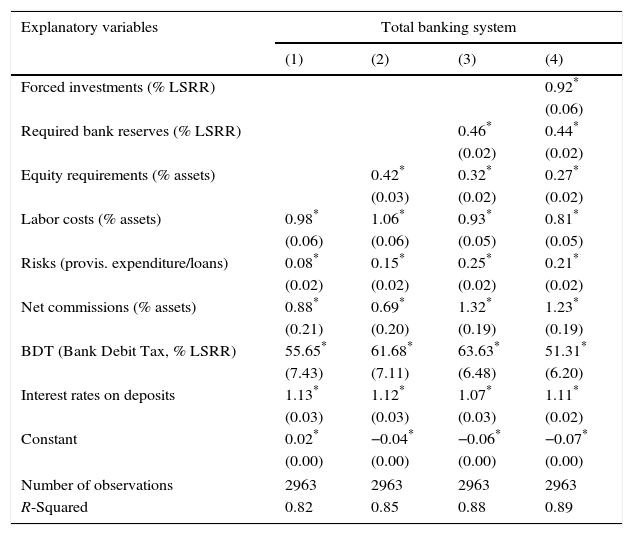

Dependent variable: interest rate on loans

| Explanatory variables | Total banking system | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Forced investments (% LSRR) | 0.92* | |||

| (0.06) | ||||

| Required bank reserves (% LSRR) | 0.46* | 0.44* | ||

| (0.02) | (0.02) | |||

| Equity requirements (% assets) | 0.42* | 0.32* | 0.27* | |

| (0.03) | (0.02) | (0.02) | ||

| Labor costs (% assets) | 0.98* | 1.06* | 0.93* | 0.81* |

| (0.06) | (0.06) | (0.05) | (0.05) | |

| Risks (provis. expenditure/loans) | 0.08* | 0.15* | 0.25* | 0.21* |

| (0.02) | (0.02) | (0.02) | (0.02) | |

| Net commissions (% assets) | 0.88* | 0.69* | 1.32* | 1.23* |

| (0.21) | (0.20) | (0.19) | (0.19) | |

| BDT (Bank Debit Tax, % LSRR) | 55.65* | 61.68* | 63.63* | 51.31* |

| (7.43) | (7.11) | (6.48) | (6.20) | |

| Interest rates on deposits | 1.13* | 1.12* | 1.07* | 1.11* |

| (0.03) | (0.03) | (0.03) | (0.02) | |

| Constant | 0.02* | −0.04* | −0.06* | −0.07* |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Number of observations | 2963 | 2963 | 2963 | 2963 |

| R-Squared | 0.82 | 0.85 | 0.88 | 0.89 |

Robust standard errors in parentheses.

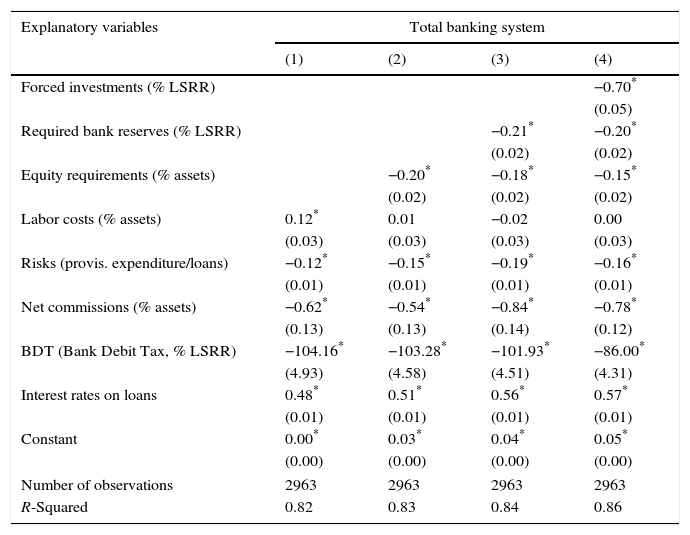

Dependent variable: interest rate on deposits

| Explanatory variables | Total banking system | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Forced investments (% LSRR) | −0.70* | |||

| (0.05) | ||||

| Required bank reserves (% LSRR) | −0.21* | −0.20* | ||

| (0.02) | (0.02) | |||

| Equity requirements (% assets) | −0.20* | −0.18* | −0.15* | |

| (0.02) | (0.02) | (0.02) | ||

| Labor costs (% assets) | 0.12* | 0.01 | −0.02 | 0.00 |

| (0.03) | (0.03) | (0.03) | (0.03) | |

| Risks (provis. expenditure/loans) | −0.12* | −0.15* | −0.19* | −0.16* |

| (0.01) | (0.01) | (0.01) | (0.01) | |

| Net commissions (% assets) | −0.62* | −0.54* | −0.84* | −0.78* |

| (0.13) | (0.13) | (0.14) | (0.12) | |

| BDT (Bank Debit Tax, % LSRR) | −104.16* | −103.28* | −101.93* | −86.00* |

| (4.93) | (4.58) | (4.51) | (4.31) | |

| Interest rates on loans | 0.48* | 0.51* | 0.56* | 0.57* |

| (0.01) | (0.01) | (0.01) | (0.01) | |

| Constant | 0.00* | 0.03* | 0.04* | 0.05* |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| Number of observations | 2963 | 2963 | 2963 | 2963 |

| R-Squared | 0.82 | 0.83 | 0.84 | 0.86 |

Robust standard errors in parentheses.

The authors would like to express their gratitude to Lina Maria Ramirez and Diana Ricciulli for their valuable research assistance and Luisa Silva for providing information. The authors also express their gratitude to the two anonymous referees for their valuable comments and suggestions. The opinions and conclusions expressed in this paper are those of the authors and do not compromise the Banco de la República or its Board of Directors.

In particular, Articles 4 and 5 of this tax reform included transaction payment to third parties for concepts such as payroll, services, suppliers, purchase of goods, etc. The Reform did not make any BDT adjustment related to the CD operations.

Productivity is calculated as the ratio between revenue (as percentage of GDP) and the tax rate, in points per thousand.

In fact, when we included a dummy variable as control to assess the effect of an “apparent” change of regime in the BDT, the parameter estimated turned out statistically nonsignificant.

We use liabilities subject to reserve requirements instead of term deposits for the BDT-tax burden definition to keep coherence with our endogenous variable (margins based on total deposits).

See Wooldridge (2013, chap. 13–14) and Arellano (2003) for the advantages of this technique.

To assess the alternatives employed by banks to compensate, via interest rates, the cost generated by the BDT, we estimate the models (1)–(4) using as dependent variable the interest rates on loans and deposits, alternatively. The results are presented in Annex 3 and confirm what we expected. The BDT impact on loans interest rates is positive and statistical significant as well as the remaining instruments of financial repression. In contrast, the BDT impact on deposit interest rates is negative and slightly bigger meaning that a larger cost generated by the BDT led to reduce the interest rates payed to depositors.