This paper discusses the potential effects of R&D public subsidies on a strategic issue for companies, the decision to combine internal and external R&D expenditure. Analyzing some arguments discussed in the management literature, it is assessed whether public intervention by granting R&D subsidies influences the composition of R&D expenditure. To do this, we analyze the data from the Survey on Business Strategies for the period 1991–2008. Results confirm that the public funding of R&D expenditure through subsidies have a positive impact on internal R&D and especially in the decision to conduct R&D internally and externally simultaneously.

Public subsidies are, together with tax incentives, one of the most used tools for technology policy to stimulate R&D private expenditure. Its theoretical justification is based on the logic of market failures which argues that in the absence of Government intervention, incomplete appropriability of innovation benefits and difficulties in financing R&D generate a level of expenditure on R&D below the social optimum (Hall, 2002).

In order to confirm the effectiveness of this policy, the literature that evaluates the impact of R&D subsidies has grown steadily in recent years by providing a broad base of documentation to assess the impact of R&D public subsidies (Almus & Czarnitzki, 2003; Blanes & Busom, 2004; Busom, 2000; Czarnitzki, 2006; Czarnitzki & Licht, 2006; Duguet, 2004; García Quevedo & Afcha, 2009; González & Pazó, 2008; Herrera & Heijs, 2007; Lach, 2002).

Traditionally, one of the criteria used in the technology policy evaluation to assess additionality of subsidies, has been increasing private R&D expenditure. However, consideration of this variable as an indicator of innovative efforts made by the company ignores the composition of R&D expenditure which, far from being homogeneous, includes elements enforced by different factors. This expenditure presents a heterogeneous composition widely recognized in the management literature (Arora & Gambardella, 1990; Teece, 1986; Granstrand & Pavitt, 1997; Narula, 2001; Pisano, 1990), which has not received enough attention from the evaluation point of view of technology policy, although it may reveal information that could help to improve the design of it.

Expenditure decisions on internal and external R&D are conditioned by a variety of economic, technological and organizational factors as well as their interaction with various agents in the innovation system. As a central part of this system, public sector can create through subsidies, soft loans or tax incentives, mechanisms to influence directly over decisions of companies to improve their innovation processes.

This paper addresses the effect of direct subsidies analyzing their impact on the decision of R&D expenditure in terms of its internal and external composition. The leading hypothesis argues that public subsidies affect the composition, implicitly favoring the combination of internal and external R&D expenditure. Therefore, it influences the innovative performance of the company. This is based on several reasons.

On the one hand, some of the recent empirical literature analyzes the impact of subsidies on the cooperation agreements in companies. For the specific case of Spain, this literature suggests that the percentage of subsidized companies involved in this type of agreement is higher than unsubsidized companies (Afcha, 2011; Busom & Fernández-Ribas, 2008). Furthermore, the receiving of public support enables companies somehow to prove financial viability, and quality of scientific and technical R&D activities of the companies. It reduces uncertainty and helps to correct information asymmetries that hinder the company access to external financing and marketing of its products in the technology market (Hall & Lerner, 2010).

Its main contribution lies, therefore, in complementing existing evaluation studies regarding additional financial R&D subsidies, with relevant information on R&D type generated from the grant receiving. Thus, the analysis of the composition of R&D expenditure presented in this article, involves a more qualitative examination. It allows an advance in the understanding of mechanisms that underlie the improvements of innovative results of subsidized companies.

To analyze this effect, we propose the use of a Multinomial Logit Model that allows exploring the decisions made by the company in accordance with the allocation of R&D resources. This model will allow assessing the influence of different types of public funding on decisions regarding internal – external R&D expenditure. Also, it will allow assessing both types: R&D expenditure as well as not expenditure at all on R&D.

2Literature reviewEconomic literature identifies several arguments to explain why companies conduct internal and external R&D activities. At the theoretical level, the theory of transaction costs (Coase, 1937; Williamson, 1989) argues that outsourcing R&D activities makes sense, if and only if, the assumption of such activities minimizes the number of transactions necessary to reach R&D investment planned by the company. This condition implies that the acquisition of external knowledge will only take place if there is a complementary resource base and a high level of specificity between the contracting company and the contractor in order to facilitate the transfer of knowledge.

Supported by this theoretical perspective, Audretsch et al. (1996) analyzed the choice between domestic and foreign R&D investment in the Manufacturing sector. Their results indicate that external knowledge acquisition is more likely in those companies that have a higher level of specific assets for the acquisition and assimilation of foreign technology (measured by the level of human capital formation). Additionally, their findings highlight the importance of technological opportunities in the acquisition of external knowledge, finding that both types of R&D (internal and external) are complementary in the case of industrial sectors with high-technology intensity and, they also tend to be substitutes in low-technology sectors.

The findings of Arora and Gambardella (1990, 1994) for the biotechnology sector, coincide with those in Audretsch et al. (1996) and with other empirical studies (Watkins & Paff, 2009) when pointing out that the complement of internal and external R&D activities occurs especially in sectors characterized by complexity and rapid technological change and shows that in such sectors, the learning effect generated by conducting internal R&D plays a decisive role in the assimilation of information provided by outside sources.

In the same approach, Martín de Castro et al. (2009) analyzed for the case of the biotechnology industry in Spain, the importance of reputation in the formation of strategic alliances. Their results confirm, in a way, the importance of internal capacity of the company to absorb external knowledge that involves the creation of alliances with other companies. Specifically, the authors include variables such as innovation and the ability to keep talented staff, as key elements to establish successful cooperation agreements with other companies.

The absorptive capacity hypothesis raised by Cohen and Levinthal (1989) has been accepted frequently to explain how the effort or intensity of internal R&D expenditure positively influences the use of external knowledge sources. This influence appears to be conditioned to the type of partner when establishing external relations, in the case of cooperation agreements (Belderbos et al., 2004; Fritsch & Lukas, 2001) as well as the number of external relations established by companies and the type of external relations (outsourcing or partnership). Dhont-Peltrault and Pfister (2011) conclude that companies that highly support R&D are increasingly turning to outsourcing, as a way to reduce transaction costs. And those external relations are more frequent when the company uses more generic or standardized technology in its production process.

Along the same perspective, other studies show that implementation of internal and external R&D activities generates positive effects on company performance as a result of the complement between the two types of R&D. In this sense, the interaction between domestic R&D expenditure and the use of external sources of knowledge has proven to be particularly a favorable combination for business (Veugelers, 1997; Becker & Dietz, 2004; Schmiedeberg, 2008).

Similarly, the decision between internal and external R&D has important implications in economic terms and market power. The incursion in R&D internal activities means to the company high early costs and some cases irreversible ones and largely recurring (Atuahene-Gima, 1992; Hall, 2002; Narula, 2001; Watkins & Paff, 2009). In this sense, Roper and Love (2002) explain the decision between internal and external R&D by analyzing production cost of internal innovations. Implicitly, they assume that firms adopt the use of external R&D when the cost of producing innovations in this way is less than the adoption of internal R&D. Their results allow identifying key elements in making R&D activities internally, such as: the generation of economies of scale in innovation production, the size of the company, the plant capacity or level of standardization of production.

In contrast, the alternative to acquire external R&D means less economic effort, it is, a priori, safer (the hiring company pays for the use of a license, or assumes a venture with other partners in the development of a project), and it poses a risk of a different nature, derived from the threat of competition. The company that hires external R&D not always has the necessary contractual mechanisms to control property rights arising from the contract activity which, in highly concentrated markets, could result in the loss of market share or the exclusivity on the sale of a new product.

The literature identifies appropriability conditions as a key element in the decision of internal and external R&D (Atuahene-Gima, 1992; Roper & Love, 2002). These studies highlight the importance of appropriability conditions as key determinants in the decision to invest in R&D, arguing that the higher the concentration of market power is, the more reluctant the company will be to hire external sources for the development of their R&D projects or to buy licenses already developed, due to the risk to suffer imitations or being unable to exploit properly the innovations on which companies do not have complete property rights.

In any case, the choice between the two sources of knowledge should not be considered as a choice of discrete nature (Beneito, 2003), as companies can and do combine internal and external R&D. In this sense, the incentives generated by the public sector may be crucial.

2.1Impact of R&D subsidies on the decision of internal–external R&D expenditureDuring the last few years, the promotion of R&D projects has pursued as objective, besides the increase in private R&D expenditure, the improvement of the interaction of actors in the innovation system (Aerts & Czarniztki, 2004; Fier et al., 2006; Busom & Fernández-Ribas, 2008; Schmiedeberg, 2008). This line of action aims to improve the dissemination and transfer of knowledge and the promotion of the learning process among companies, universities and technology centers (Autio et al., 2008).

These elements, coupled with the increasing complexity of the innovation process, create incentives that induce companies to include in their technology strategy, the use of external sources of knowledge (Cassiman & Veugelers, 2002; Rigby & Zook, 2002; Cassiman & Veugelers, 2006). Recent work has analyzed how public subsidies stimulate this interaction. Busom and Fernández-Ribas (2008), for instance, conclude arguing that subsidies have a positive effect on the establishment of cooperation agreements in the autonomous community of Catalonia, Spain. Their results show that subsidy encourages positively toward cooperation with customers and suppliers, as well as universities and research centers. Similar results are found by Afcha (2011) for the case of central and regional subsidies in Spain.

It should be point out that, recent work that analyzes the decision of public agencies regarding the granting of subsidies reveal that indeed, both the expenditure intensity on R&D and the collaboration with scientific institutions, are factors that influence significantly in the decision of these agencies for granting R&D subsidies (Huergo & Trenado, 2010). This indicates that direct public funding positively stimulates both R&D domestic expenditure and, the acquisition of external knowledge.

More recently, Gelabert et al. (2009) analyze the interaction between R&D public funding and the degree of appropriability of the companies on the benefits of their innovations. Their results show that R&D public subsidies have a greater impact on R&D domestic expenditure than those companies that have a lower level of appropriability of benefits. This result suggests that subsidies would be fulfilling their proper role correcting market failures.

In summary, the literature review leads to the conclusion that the decision of internal–external R&D expenditure is not a trivial decision and the public sector may have an influence on this decision. Therefore, the analysis of the composition of R&D expenditure in response to receiving a subsidy, it is relevant for a better understanding of the effect of technology policy.

3Data description and methodologyThe data used correspond to the Survey of Business Strategies Survey (henceforth ESEE, by its Spanish acronym) for the period 1991–2008. This survey provides a comprehensive panel data on different areas of business strategy that allows deepening both, decision process of the company, and induced changes in the wake of those decisions. The sample includes 15,646 observations for 2007 manufacturing companies with more than 10 employees and R&D positive expenditure in the period 1991–2008 for at least one year.

Unlike some innovation surveys, the ESEE survey as being a business strategy survey provides data on various areas of the company. This represents an important advantage since, as indicated above, the constraints on the choice between internal–external R&D belong to various fields. In addition, the complexity of the interaction between R&D subsidies and the changes in the composition of R&D expenditure require the observation of different variables.

It should be noted that empirical analysis focuses on the composition of expenditure of the company. Therefore, the internal R&D variable refers to the cost to finance R&D activities carried out within the company, while the external R&D makes reference to hiring R&D activities out of the company. To attain this decision, the ESEE survey asks to the surveyed companies if they conducted or contracted R&D activities during the financial year. Specifically, the companies surveyed must choose among the following four possible situations:

- (i)

The company has not conducted or contracted R&D activities.

- (ii)

The company conducts internally R&D activities but has not external R&D.

- (iii)

The company has conducted R&D activities but not internal R&D, and finally

- (iv)

The company has conducted internal and external R&D activities.

Given the nature of the dependent variable to be analyzed, it is considered that the Multinomial Logit Model is the most appropriate. The implementation of this model allows analyzing the influence of various factors that affect the composition of R&D expenditure of the company over the time. Thus, for each company i (i=1, 2, …, n) a decision on the composition of R&D expenditure can be expressed as:

where AIDij represents the type of R&D chosen by the company, and the set of options j=1, 2, 3, 4 indicate if the company decides not to carry out any R&D activities, or conduct only external R&D only internal R&D or internal and external R&D, respectively.Since the data have a panel structure, it is necessary to consider that the observations available for each company can be correlated with each other. Thus, we have proceeded to estimate the robust standard errors clustered around each company, which allows this interdependence and conduct the estimation properly (see Long & Freese, 2006).

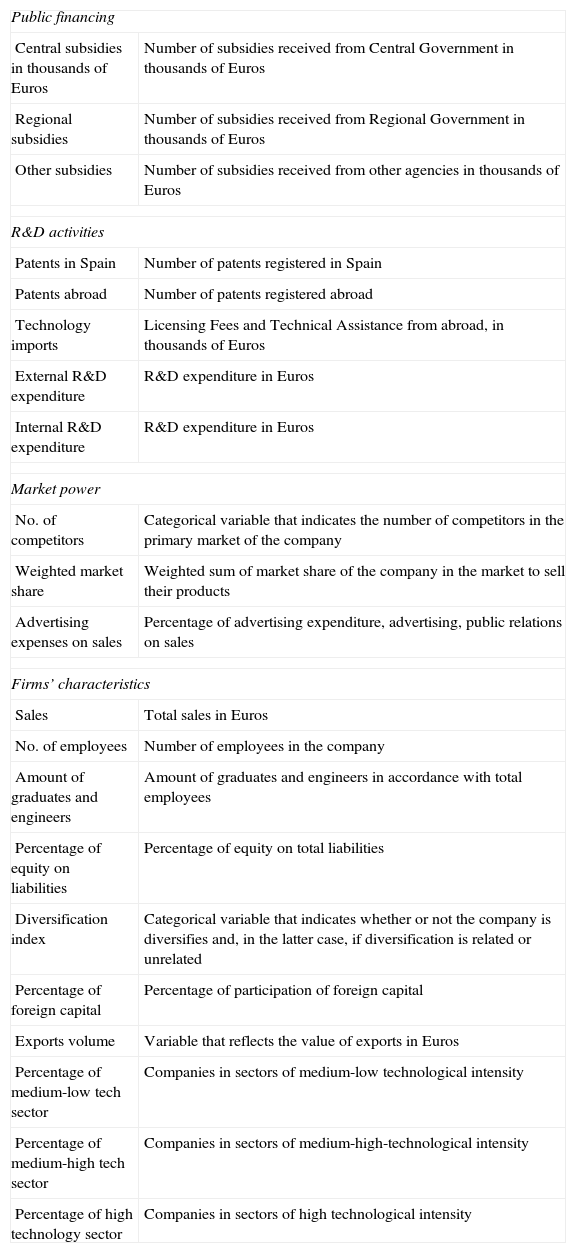

The independent variables used in the estimation of the model are shown in Table 1. To facilitate interpretation of the data, the variables have been grouped into four (4) categories: Public funding, R&D activities, Market power and Firms’ characteristics.

Grant subsidies independent variables.

| Public financing | |

| Central subsidies in thousands of Euros | Number of subsidies received from Central Government in thousands of Euros |

| Regional subsidies | Number of subsidies received from Regional Government in thousands of Euros |

| Other subsidies | Number of subsidies received from other agencies in thousands of Euros |

| R&D activities | |

| Patents in Spain | Number of patents registered in Spain |

| Patents abroad | Number of patents registered abroad |

| Technology imports | Licensing Fees and Technical Assistance from abroad, in thousands of Euros |

| External R&D expenditure | R&D expenditure in Euros |

| Internal R&D expenditure | R&D expenditure in Euros |

| Market power | |

| No. of competitors | Categorical variable that indicates the number of competitors in the primary market of the company |

| Weighted market share | Weighted sum of market share of the company in the market to sell their products |

| Advertising expenses on sales | Percentage of advertising expenditure, advertising, public relations on sales |

| Firms’ characteristics | |

| Sales | Total sales in Euros |

| No. of employees | Number of employees in the company |

| Amount of graduates and engineers | Amount of graduates and engineers in accordance with total employees |

| Percentage of equity on liabilities | Percentage of equity on total liabilities |

| Diversification index | Categorical variable that indicates whether or not the company is diversifies and, in the latter case, if diversification is related or unrelated |

| Percentage of foreign capital | Percentage of participation of foreign capital |

| Exports volume | Variable that reflects the value of exports in Euros |

| Percentage of medium-low tech sector | Companies in sectors of medium-low technological intensity |

| Percentage of medium-high tech sector | Companies in sectors of medium-high-technological intensity |

| Percentage of high technology sector | Companies in sectors of high technological intensity |

Each of these categories gathers variables used previously in the literature on the analysis of internal–external R&D decisions. First, Public funding is the focus of our analysis and, therefore, it is expected to have a significant effect on the composition of R&D expenditure. Following recent literature about R&D subsidies evaluation, there are three different sources of public funding, grants from Central Government, Regional Governments, and other agencies (Czarnitzki & Lopes-Bento, 2011; Fernández-Ribas, 2009, García Quevedo & Afcha, 2009).

Conducting R&D activities means companies should pay additional costs, primarily, for the initial investment required to engage in these activities internally (Hall & Lerner, 2010). Thus, the variables included in the category of R&D activities, try to capture the degree of linkage of companies to R&D activities. The number of patents registered in Spain and abroad, the license fee, the technical assistance from abroad, and the cost of internal–external R&D during the previous year are the variables considered in this section.

The inclusion of lagged variables in a year of internal–external R&D expenditure is to control the persistence of R&D. Thus, both are expected to have a positive effect on the decision of internal and external expenditure respectively.

Additionally, and to complement the analysis of the variables that have a direct impact on the composition of R&D expenditure, these are considered variables related to market power and firms’ specific characteristics.

In highly concentrated markets, using external R&D can be a greater risk on the appropriability of innovations and therefore the internal R&D is preferred as a source of knowledge acquisition in the presence of few competitors (and Atuahene-Gima, 1992; Roper & Love, 2002). Furthermore, market structures characterized by intense competition can lead the company to develop internal R&D as a source of competitive advantage (Beneito, 2003; Baumol, 2002), a fact that would lead to a situation in contrast to the previously exposed. In other words, a larger number of companies lead to higher domestic R&D expenditure. The following variables: number of competitors, weighted market share and advertising expenses on sales included in the Market Power section has been included to analyze this point.

Finally, it includes a number of variables related to firms’ characteristics such as size, the percentage of foreign capital, diversification of products, level of debt, amount of engineers and graduates and the technological intensity the company has.

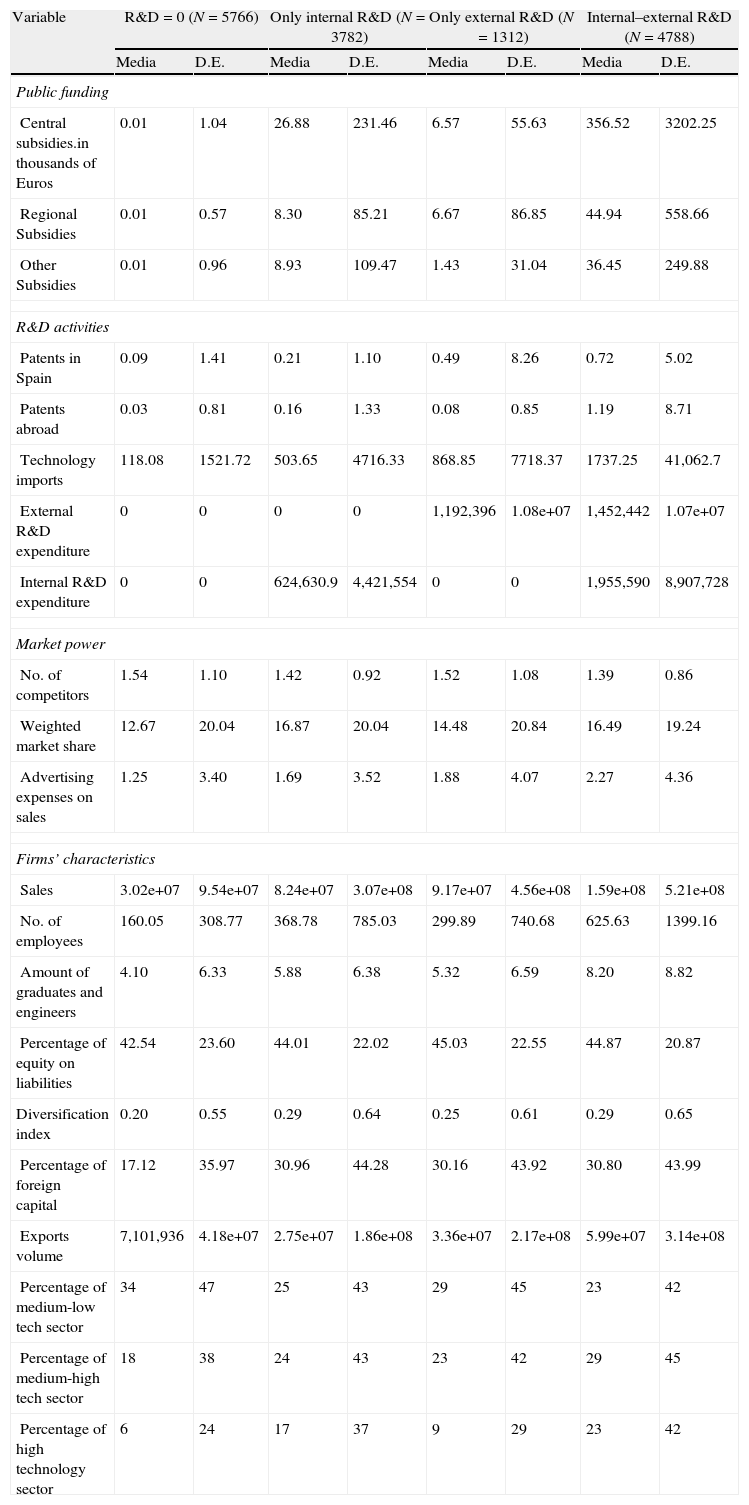

3.1Descriptive statisticsTable 2 shows the descriptive statistics of the independent variables included in the analysis, depending on the type of innovation chosen by the company. In relation to public funding, it highlights on the one hand the differences in the amounts of subsidies granted by various levels of Government, especially central subsidies the most substantial ones. On the other hand, it could be noted that for all three types of subsidies, the amount received by the companies that conduct both types of R&D is greater than the one received by companies that conduct only internal or external R&D, respectively. For R&D activities, again, the performance of companies operating mixed R&D activities, it stands out above the R&D performance of companies that only conduct internal or external activities. In fact, the descriptive statistics for companies that conduct both types of R&D show, in general, larger companies in terms of number of employees and sales, with greater market power and a more widespread presence in high and medium-high technology sectors.

Descriptive statistics.

| Variable | R&D=0 (N=5766) | Only internal R&D (N=3782) | Only external R&D (N=1312) | Internal–external R&D (N=4788) | ||||

| Media | D.E. | Media | D.E. | Media | D.E. | Media | D.E. | |

| Public funding | ||||||||

| Central subsidies.in thousands of Euros | 0.01 | 1.04 | 26.88 | 231.46 | 6.57 | 55.63 | 356.52 | 3202.25 |

| Regional Subsidies | 0.01 | 0.57 | 8.30 | 85.21 | 6.67 | 86.85 | 44.94 | 558.66 |

| Other Subsidies | 0.01 | 0.96 | 8.93 | 109.47 | 1.43 | 31.04 | 36.45 | 249.88 |

| R&D activities | ||||||||

| Patents in Spain | 0.09 | 1.41 | 0.21 | 1.10 | 0.49 | 8.26 | 0.72 | 5.02 |

| Patents abroad | 0.03 | 0.81 | 0.16 | 1.33 | 0.08 | 0.85 | 1.19 | 8.71 |

| Technology imports | 118.08 | 1521.72 | 503.65 | 4716.33 | 868.85 | 7718.37 | 1737.25 | 41,062.7 |

| External R&D expenditure | 0 | 0 | 0 | 0 | 1,192,396 | 1.08e+07 | 1,452,442 | 1.07e+07 |

| Internal R&D expenditure | 0 | 0 | 624,630.9 | 4,421,554 | 0 | 0 | 1,955,590 | 8,907,728 |

| Market power | ||||||||

| No. of competitors | 1.54 | 1.10 | 1.42 | 0.92 | 1.52 | 1.08 | 1.39 | 0.86 |

| Weighted market share | 12.67 | 20.04 | 16.87 | 20.04 | 14.48 | 20.84 | 16.49 | 19.24 |

| Advertising expenses on sales | 1.25 | 3.40 | 1.69 | 3.52 | 1.88 | 4.07 | 2.27 | 4.36 |

| Firms’ characteristics | ||||||||

| Sales | 3.02e+07 | 9.54e+07 | 8.24e+07 | 3.07e+08 | 9.17e+07 | 4.56e+08 | 1.59e+08 | 5.21e+08 |

| No. of employees | 160.05 | 308.77 | 368.78 | 785.03 | 299.89 | 740.68 | 625.63 | 1399.16 |

| Amount of graduates and engineers | 4.10 | 6.33 | 5.88 | 6.38 | 5.32 | 6.59 | 8.20 | 8.82 |

| Percentage of equity on liabilities | 42.54 | 23.60 | 44.01 | 22.02 | 45.03 | 22.55 | 44.87 | 20.87 |

| Diversification index | 0.20 | 0.55 | 0.29 | 0.64 | 0.25 | 0.61 | 0.29 | 0.65 |

| Percentage of foreign capital | 17.12 | 35.97 | 30.96 | 44.28 | 30.16 | 43.92 | 30.80 | 43.99 |

| Exports volume | 7,101,936 | 4.18e+07 | 2.75e+07 | 1.86e+08 | 3.36e+07 | 2.17e+08 | 5.99e+07 | 3.14e+08 |

| Percentage of medium-low tech sector | 34 | 47 | 25 | 43 | 29 | 45 | 23 | 42 |

| Percentage of medium-high tech sector | 18 | 38 | 24 | 43 | 23 | 42 | 29 | 45 |

| Percentage of high technology sector | 6 | 24 | 17 | 37 | 9 | 29 | 23 | 42 |

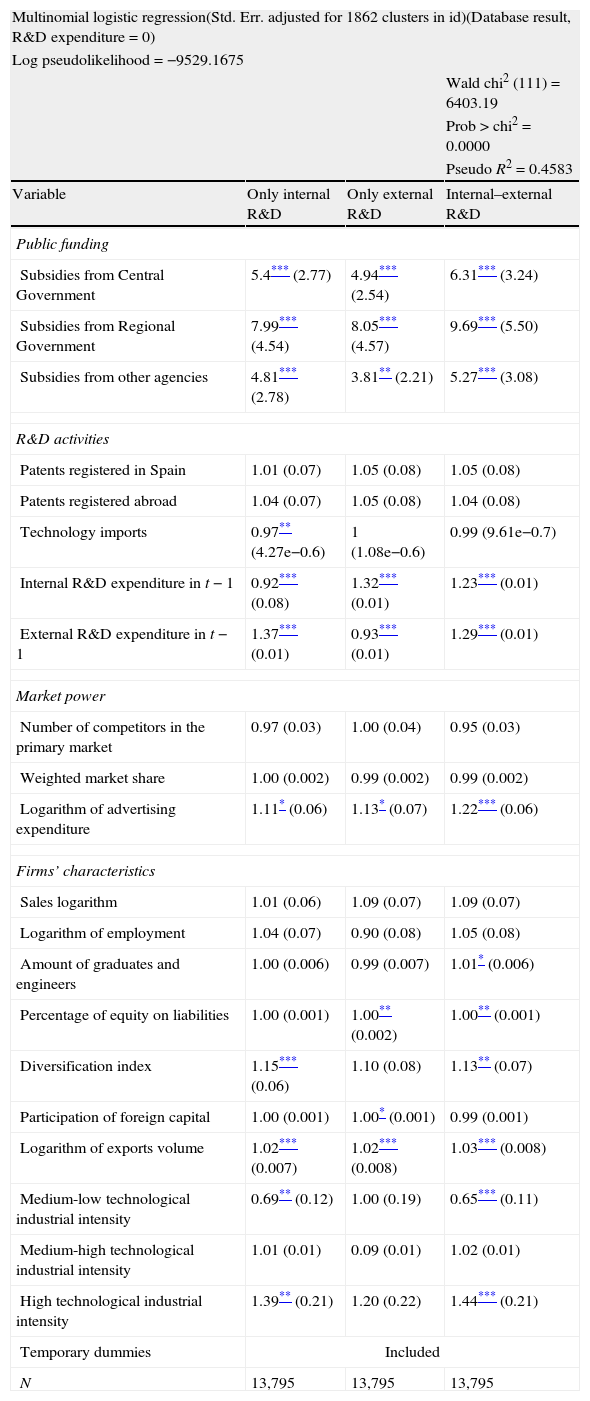

Table 3 shows the results of the Multinomial Logit Model estimation for different combinations of R&D expenditure which were analyzed. Each column compares different combinations of R&D expenditure over the option of not making any R&D expenditure.1 The sample is composed of innovative companies that perform R&D expenditure for at least one year of the analysis period. Therefore, the lack of R&D expenditure is occasional, not regular.

Multinomial logit model. Factors that affect the composition of R&D expenditure.

| Multinomial logistic regression(Std. Err. adjusted for 1862 clusters in id)(Database result, R&D expenditure=0) | |||

| Log pseudolikelihood=−9529.1675 | |||

| Wald chi2 (111)=6403.19 | |||

| Prob>chi2=0.0000 | |||

| Pseudo R2=0.4583 | |||

| Variable | Only internal R&D | Only external R&D | Internal–external R&D |

| Public funding | |||

| Subsidies from Central Government | 5.4*** (2.77) | 4.94*** (2.54) | 6.31*** (3.24) |

| Subsidies from Regional Government | 7.99*** (4.54) | 8.05*** (4.57) | 9.69*** (5.50) |

| Subsidies from other agencies | 4.81*** (2.78) | 3.81** (2.21) | 5.27*** (3.08) |

| R&D activities | |||

| Patents registered in Spain | 1.01 (0.07) | 1.05 (0.08) | 1.05 (0.08) |

| Patents registered abroad | 1.04 (0.07) | 1.05 (0.08) | 1.04 (0.08) |

| Technology imports | 0.97** (4.27e−0.6) | 1 (1.08e−0.6) | 0.99 (9.61e−0.7) |

| Internal R&D expenditure in t−1 | 0.92*** (0.08) | 1.32*** (0.01) | 1.23*** (0.01) |

| External R&D expenditure in t−1 | 1.37*** (0.01) | 0.93*** (0.01) | 1.29*** (0.01) |

| Market power | |||

| Number of competitors in the primary market | 0.97 (0.03) | 1.00 (0.04) | 0.95 (0.03) |

| Weighted market share | 1.00 (0.002) | 0.99 (0.002) | 0.99 (0.002) |

| Logarithm of advertising expenditure | 1.11* (0.06) | 1.13* (0.07) | 1.22*** (0.06) |

| Firms’ characteristics | |||

| Sales logarithm | 1.01 (0.06) | 1.09 (0.07) | 1.09 (0.07) |

| Logarithm of employment | 1.04 (0.07) | 0.90 (0.08) | 1.05 (0.08) |

| Amount of graduates and engineers | 1.00 (0.006) | 0.99 (0.007) | 1.01* (0.006) |

| Percentage of equity on liabilities | 1.00 (0.001) | 1.00** (0.002) | 1.00** (0.001) |

| Diversification index | 1.15*** (0.06) | 1.10 (0.08) | 1.13** (0.07) |

| Participation of foreign capital | 1.00 (0.001) | 1.00* (0.001) | 0.99 (0.001) |

| Logarithm of exports volume | 1.02*** (0.007) | 1.02*** (0.008) | 1.03*** (0.008) |

| Medium-low technological industrial intensity | 0.69** (0.12) | 1.00 (0.19) | 0.65*** (0.11) |

| Medium-high technological industrial intensity | 1.01 (0.01) | 0.09 (0.01) | 1.02 (0.01) |

| High technological industrial intensity | 1.39** (0.21) | 1.20 (0.22) | 1.44*** (0.21) |

| Temporary dummies | Included | ||

| N | 13,795 | 13,795 | 13,795 |

Note: The coefficients are expressed as relative risk ratios.

Results according to expectations indicate that R&D Public Subsidies encourage positively R&D expenditure. In particular, we can see that the impact of subsidies on companies that conduct internal-external R&D is higher, followed by the business effect generated on the companies that just perform internal R&D expenditure, and finally the ones that only perform external expenses.

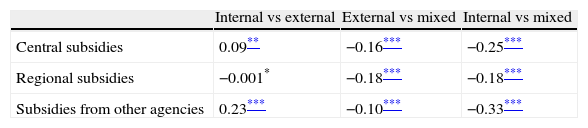

To further analyze the impact of public funding on various combinations of R&D, Table 4 compares the influence of the three kinds of subsidies on the possible composition of R&D expenditure.2 It is possible to confirm receiving R&D subsidies, favors the adoption of internal and external R&D expenditures against the decision to only spend on internal or external R&D. Finally, when comparing the adoption of performing internal R&D versus just performing external R&D, results show that receiving subsidies from central government and other organisms favors the adoption of internal R&D, while are not significant in the case of regional subsidies.

Regarding the other variables, technology imports from abroad adversely affects the possibility of only internal R&D expenditure. Furthermore, the Statistical significance of the expenditure on internal-external R&D in period t-1, confirms the persistence in the composition of R&D expenditure. It shows that to be incurred in internal-external R&D during the previous year favors the selection to only perform domestic R&D expenditure or only the external one during the current year, respectively. In contrast, having external expenses has a negative effect on the ability to perform only internal expenses and vice versa. Consistent with this result, having engaged in internal–external R&D during the previous year, influences positively on the option to do both types of expenditure simultaneously during the usual year.

Regarding the Market Power of companies, only Advertising Expenditure on sales is significant and it positively influences on the composition of R&D expenditure, especially in the case of companies’ expenditure on internal–external R&D.

The Percentage of Equity on Liabilities positively affects companies conducting external R&D and mixed R&D, while showing no significant effect on performing R&D internally. This result is consistent with expectations. Companies with fewer financial constraints are then able to bear more sunk costs involving internal R&D expenditures.

A priori, greater product of diversification would be associated with the use of generic production technologies and therefore the use of external R&D in areas where applied processes do not require a high specialization. So contrary to expectations, the variable used to measure the level of diversification of production shows a positive influence in the case of companies that only perform internal R&D expenditure, while it shows no influence in the case of those that only perform external R&D.

The degree of Internationalization of the company, as measured by the volume of exports reveals a positive and significant influence in all cases, it reflects the general trend of international markets require a rule, higher levels of competitiveness and, therefore, it would be associated to any of the efforts made in this regard.

Finally, membership in high-technology sectors favors in the case of companies that perform only internal R&D, while in the case of companies that perform internal–external R&D. Technological intensity of the sector positively affects both, high-tech sectors as well as those with medium-high technological intensity.

5ConclusionsThis paper identifies the key variables that influence the composition of R&D expenditure and its connection with R&D subsidies. For this reason, we used a Multinomial Logistic Model that allows analyzing different potential combinations of R&D expenditure of innovative companies. Only internal R&D, only external R&D, internal–external R&D and R&D expenditure equals zero.

This model allows moving the technology policy evaluation focused on the intensity of the effect of R&D subsidies, to an assessment that examines the strategic decisions of the company in the field of innovation. This analysis identifies factors that influence the company's decision regarding the allocation of internal–external R&D expenditure.

The main results show that public funding, regardless the level of Government grants, positively stimulates R&D expenditure. This effect includes both companies, the ones engaged in internal or external R&D expenditure, and the ones that perform both R&D expenditure.

Additionally, when analyzing how it affects the reception of subsidies on companies making external R&D, compared to the option of internal and mixed R&D, the results indicate that in both cases, public funding favors the adoption of internal R&D. Finally, when comparing internal R&D option to undertake joint internal and external activities, the results show that the receiving of subsidies favors joint adoption of R&D activities.

As a complement, it is possible to confirm the importance of the type of activity performed during the previous period, which is directly relevant to the activity, but opposite of the unrealized activity. In other words, those companies that perform internal R&D tend to continue performing only internal R&D, or combine both internal and external R&D, but not to perform only external R&D.

Overall, results confirm the importance of public funding. It highlights in particular the encouragement of companies to combine their expertise internally with sources of information produced by third parties through external R&D expenditure. Considering that the literature suggests complementary effects on innovative output of companies associated with interaction between internal and external R&D, especially in dynamic and high-technology sectors. These results provide a starting point for understanding the mechanisms that underlie indirect effects of R&D Public Funding.

Authors thank Jose Garcia-Quevedo by the comments received on earlier drafts of this paper. They also than the referees for helpful suggestion and comments.

Please cite this article as: Afcha S, León López G. Financiación pública de la I+D y composición del gasto empresarial en I+D. Cuad Econ Dir Empresa. 2013. http://dx.doi.org/10.1016/j.cede.2013.01.001.

The relative risk coefficients are obtained by applying the exponential function exp(bi) where bi represents the multinomial regression coefficients. These coefficients indicate the more likely the company chooses to perform some kind of R&D expenditure compared to the option of not making any R&D expenditure at all. For a detailed explanation see Long and Freese (2006).

This comparison is carried out by estimating the “likelihood ratio test” for different expenditure categories. For a detailed description of the implementation of this procedure see Long and Freese (2006, p. 177).