This paper tests the existence of market discipline in the Latin American banking system using a variety of methods. It re-examines traditional tests on depositor discipline, controlling banks’ internal capital demand. In addition, it explores whether borrowers discipline bank risk-taking. This new hypothesis points out that low-quality banks issue fewer loans and charge lower interests rates. Contrary to the general view, our findings suggest weak presence of market discipline. These results are robust to different indicators of the key explanatory variables and econometric methods. For policymakers, this implies a necessity to restore market discipline following the Basel Accord.

During the 1990s and 2000s most of the empirical literature found evidence in favor of the presence of market discipline in the banking sector, particularly in developed countries (Flannery, 1998; Flannery and Nikolova, 2004). This evidence supports the recommendations of the Basel Committee, specifically the Third Pillar in Basel III on disclosure policy to provide adequate information about bank risk to private economic agents, who, through market forces, can penalize banks for excessive risk taking. As a result, banks would moderate their risky behavior (Ayadi, 2013; Basel Committee on Banking Supervision, 2011, 2006).

Since 2007, banking crises and bank bailouts in the USA and Europe have generated a new wave of research on market discipline (Belkhir, 2013; Ben-David et al., in press; Berger and Turk-Ariss, 2014; Beyhaghi et al., 2013; Dumontaux and Pop, 2013; Hasan et al., 2014; Nguyen, 2013; Tovar-García, 2016a,b, 2014). Arguably, because of a tradeoff between safety nets and market discipline (Demirgüç-Kunt and Huizinga, 2004), neither regulators nor market agents were able to prevent the recent failure of large banks, making visible the implicit policies of too-big-to-fail, too-important-to-fail, too-interconnected-to-fail, and suggesting a future where banks may be too-big-to-save (Balasubramnian and Cyree, 2014; Demirgüç-Kunt and Huizinga, 2013). It is still not clear if market discipline exists, under which conditions, and if it has been tested correctly, in particular, if internal capital markets were not taken into account (Ben-David et al., in press). Nevertheless, market discipline is still considered a key instrument to achieve financial stability, and a complement to regulatory discipline, as the new Basel Accord points out.

From the 1980s to the first years of the 2000s several banking crises considerably affected Latin American economies. Consequently, the Latin American banking systems are following the Basel recommendations (since 2009 Argentina, Brazil, and Mexico are members of the Basel Committee), and have been receiving important investments from foreign banks, in a merger and acquisition process, particularly from Spain, the USA, and United Kingdom, resulting in a process of growth of the industry, but with bank concentration (CEPAL, 2012). Under these conditions, this research is motivated by the following question: does market discipline exist in the Latin American banking system?

In general, there are mixed results about the presence of discipline induced by depositors in Latin American countries (Tovar-García, 2014). During the 1980s and 1990s, Martinez-Peria and Schmukler (2001) found evidence of depositor discipline in Argentina, Chile, and Mexico. This evidence is stronger in the post-crisis period, and despite implicit deposit insurance schemes, indicating that depositors do not trust government involvement. On the contrary, Tovar-García (2014) found weak evidence of market discipline in Mexico during the period 2008–2012. In spite of the explicit deposit insurance system, which should motivate monitoring activities by private agents. Moreover, banks’ internal capital demand appears to influence interest rates on deposits and their growth rates, suggesting that previous results could be biased.

While numerous studies have been carried out on the liability side of market discipline, induced by creditors of the bank, the asset side market discipline effect has been little studied (Allen et al., 2011; Kim et al., 2005; Tovar-García, 2012; Tovar-García and Kozubekova, 2016). Borrowers can also monitor bank risk taking, because they prefer banks with high capital ratios and asset quality (quality of bank loans). In Mexico, Tovar-García (2012) found evidence in favor of this hypothesis, but the seven largest banks controlling around 80% of the market can elude this kind of discipline.

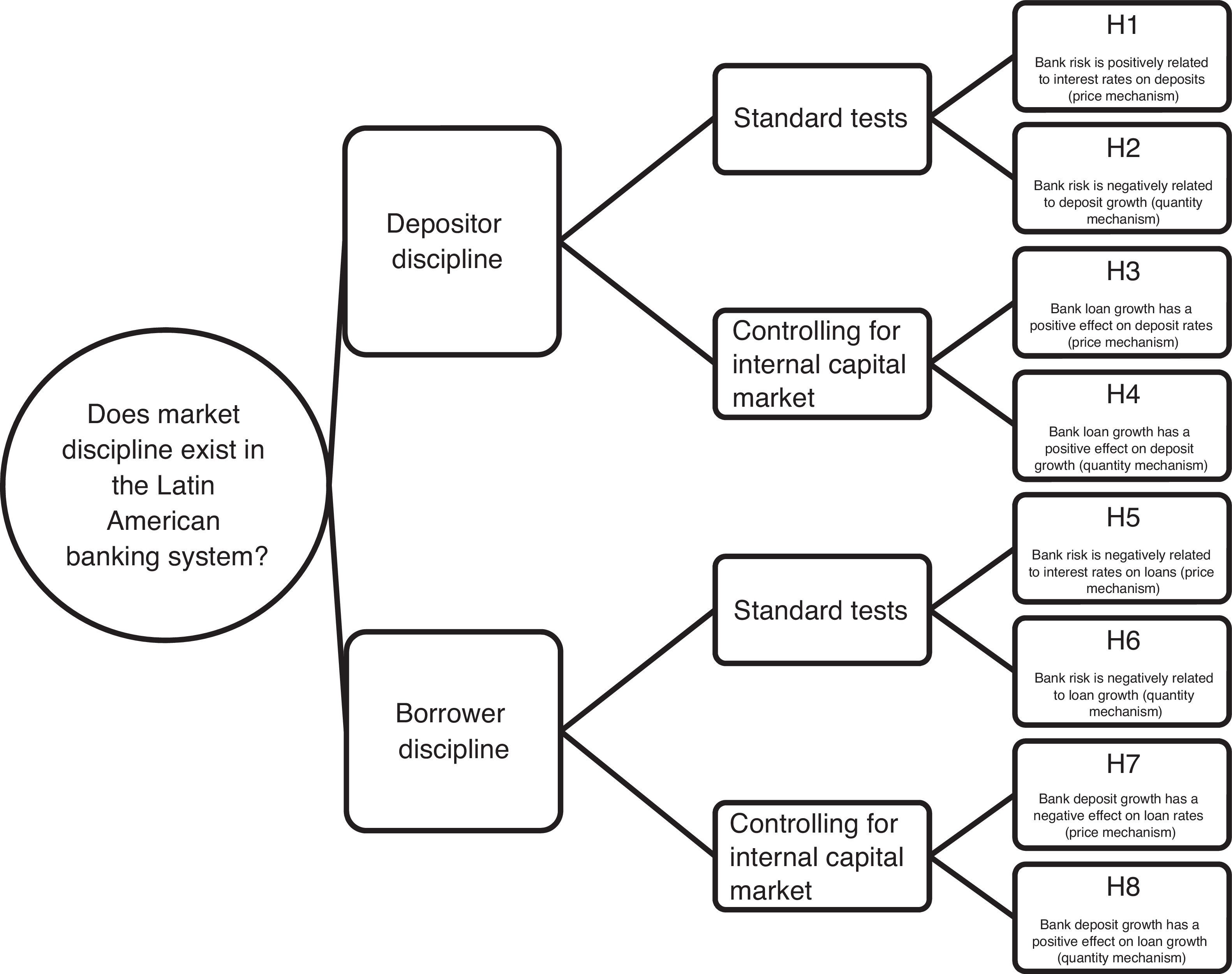

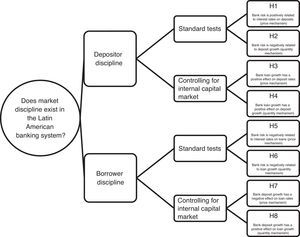

This article studies the discipline induced by depositors (testing four hypotheses H1–H4) and borrowers (testing other four hypotheses H5–H8) using panel data from 95 banks in 12 Latin American countries during the years 2008–2012. Under the conditions of the global financial crisis, which should motivate the monitoring activities of the banking economic agents (Martinez-Peria and Schmukler, 2001). Our contributions to the literature are threefold. First, we reevaluate the traditional tests of market discipline under the current conditions of the Latin American banking system, where most of the countries have limited deposit insurance schemes. Second, we test market discipline from the asset side, which has been little studied. Third, we test the internal capital market hypothesis, which allows to control the demand effect on deposit rates (and deposit growth), and the supply effect on loan rates (and loan growth), which have been forgotten in the empirical literature.

We use dynamic panel models and the SYS GMM estimator (Blundell and Bond, 1998). Contrary to previous findings, interest rates on deposits and loans, and their growth rates, are determined principally by macroeconomic conditions and weakly by bank fundamentals. These results hold after a number of robustness tests with different indicators of bank fundamentals, and fixed and random effects regression models.

The paper proceeds as follows. Section 2 presents the framework and the working hypotheses. Section 3 describes the data and variables used in this study. Section 4 outlines the empirical strategy and presents the results. Section 5 concludes.

2Theoretical framework and hypotheses developmentMarket discipline is a mechanism where private economic agents (including borrowers) make market decisions to penalize banks because of their excessive risk taking. There is an inverse relationship between bank risk and the wellbeing of creditors and debtors of banks. As a result, the bank should modify its risky behavior. We assume that these private economic agents have the ability to monitor banks and the capability to influence bank actions (Flannery, 2001).1 Note that small economic agents, in particular small depositors, usually with low levels of financial education and with incentives for free-rider behavior do not care about bank fundamentals to make decisions, but the market share of this kind of agents is typically small. On the contrary, the largest economic agents, well educated, can interpret and respond to banking indicators (Márquez, 2011).

The well known model of supply and demand is useful to understand the concept of market discipline. A depositor (supply side) will find the excessive risk taking of his/her bank as a situation that increases his/her costs. As a result, the depositor will require a higher interest rate on his/her deposits and/or he/she will withdraw his/her resources. That is, the supply curve of deposits shifts leftward. Borrowers should demonstrate a similar behavior shifting the demand curve of loans.

Thus, to answer whether market discipline exist in Latin America, this research examines two markets: the market of deposits and the market of loans (testing depositor discipline and borrower discipline). For this purpose, up to eight hypotheses are tested. H1 and H2 are traditional tests of depositor discipline and H3 and H4 extend these standard tests controlling for demand-side effects (the internal capital market hypothesis). Similarly, H5 and H6 are standard tests of borrower discipline and H7 and H8 extend these tests controlling for supply-side effects (internal capital markets). See Fig. 1.

2.1Depositor disciplineTraditional tests for the existence of discipline induced by depositors verify the following hypotheses:H1 Bank risk is positively related to interest rates on deposits (price-based mechanism of market discipline). Bank risk is negatively related to deposit growth (quantity-based mechanism of market discipline).2

In the second traditional test (H2), note the use of deposit growth instead of the absolute amount, to avoid biases from bank characteristics as size and business orientation (Hasan et al., 2013; Tovar-García, 2014).

Most of the empirical literature has forgotten that the demand side forces (bank's internal capital market) can determine the interest rates on deposits (and the growth of deposit volumes). Since less risky banks (i.e., banks with more solvency) are more solid, they can pay higher interest rates in order to damage their competitors. In other words, the higher interest rate may be a result of a shift of the demand curve to the right (or the smaller quantity of deposits may be a result of a shift of the demand curve to the left).

Ben-David et al. (in press) point out that loan growth is a key variable to approach the demand side effect on deposit rates. As a result of an increase in the demand for loans (loan growth), the bank will look for more deposits, and one way to attract them is to offer higher interest rates. Analogously, a reduction in the demand for loans will cause a reduction in the demand for deposits, and vice versa. To test this demand side effect on deposits the following hypotheses are verified:H3 Bank loan growth has a positive effect on deposit rates (price-based mechanism of market discipline). Bank loan growth has a positive effect on deposit growth (quantity-based mechanism of market discipline).

Ben-David et al. (in press) did not find evidence of discipline induced by depositors in the USA. In their empirical tests, capital ratios (as a key indicator of bank risk) do not determine interest rates on deposits. On the contrary, loan growth (a key indicator of banks’ internal capital demand) is the main variable determining deposit rates. In other words, demand side forces determine deposit rates (and deposit growth). In the Mexican case, Tovar-García (2014) also uses loan growth as a key control variable, in general the findings do not suggest the existence of market discipline, and loan growth enters in some regressions with the expected sign and statistical significance. However, the demand side effect is not as clear and robust as in the American case.

2.2Borrower disciplineBorrowers also respond to bank fundamentals and bank risk, in particular to capital ratios and asset quality. They prefer high-quality banks to signal their creditworthiness to other stakeholders (certification-signaling motive) and to obtain and extend credit lines and new loans (refinancing-solvency motive). Consequently, borrowers monitor banks3 and are willing to pay higher interest rates to high-quality banks, accordingly, they can discipline banks (Allen et al., 2011; Kim et al., 2005; Tovar-García, 2014).

Based on the demand and supply model, a borrower (demand side) will find the excessive risk taking of his/her bank as a situation that diminishes his/her wellbeing. Subsequently, the borrower will pay a lower interest rate on loan, and/or he/she will demand a smaller quantity of loan. That is, the demand curve for loans shifts leftward.

To test the existence of discipline induced by borrowers the following hypotheses are verified:H5 Bank risk is negatively related to interest rates on loans (price-based mechanism of market discipline). Bank risk is negatively related to loan growth (quantity-based mechanism of market discipline).

Of course, the bank's internal capital supply can determine the interest rates on loans (and the growth of loan volumes). That is, the lower interest rate may be a result of a shift of the supply curve to the right (or the smaller quantity of loan may be a result of a shift of the supply curve to the left).

Deposit growth can work as a key variable controlling the supply side effects on loan rates (and volumes). As a result of an increase in the supply of deposits (deposit growth), the bank will try to lend more money, and one way of doing this is by accepting lower interest rates on loans. Similarly, a reduction in the supply of deposits will weaken the credit activity of the bank, and vice versa. To test this supply side effect on loans the following hypotheses are verified:H7 Bank deposit growth has a negative effect on loan rates (price-based mechanism of market discipline). Bank deposit growth has a positive effect on loan growth (quantity-based mechanism of market discipline).

In our hypotheses, supply and demand forces can drive the effects on the dependent variables (prices and quantities), and there are many factors impacting them, as strategic decisions by bank management, for instance, expanded operating hours, expanded online banking technology, construction of new branches, etc. It is worth noticing that data limitations and endogeneity concerns (double causality) do not allow the simultaneous calculations of supply and demand curves. Consequently, since the work of Park (1995) evidence from reduced-form equations is practically the rule in the empirical literature. This research is particularly controlling the demand side effects on H1 and H2 through H3 and H4, and controlling the supply side effects on H5 and H6 through H7 and H8.4

2.3A brief comments on previous empirical findingsAs mentioned in the introduction, the empirical evidence about depositor discipline is substantial, Berger and Turk-Ariss (2014), Hasan et al. (2013), and Tovar-García (2014) present a review of the literature in developed, emerging markets, and in Latin American countries, respectively.

In Latin America, recent findings suggest that market discipline is weak, because it is not exerted by small depositors (Márquez, 2011), and the government involvement has won credibility, including an implicit too-big-to-fail policy (de Mendonça and Villela Loures, 2009; Romera and Tabak, 2010; Tovar-García, 2015, 2014). That is, the largest banks can evade market discipline, and the deposit insurance has weakened depositor discipline (Demirgüç-Kunt and Huizinga, 2004). Arguably, the recent bailouts in developed countries contribute to a general perception that bank losses (bank crises) should be socialized,5 then, there is always a positive relationship between the expected profits of banks’ creditors and bank risk.6 In addition, the empirical literature considering the banks’ internal capital markets is negligible. Consequently, previous findings could be biased, as it is suggested in the American and Mexican cases (Ben-David et al., in press; Tovar-García, 2014).

In comparison with the liability side, there are a few studies directly testing the asset side of market discipline.7Kim et al. (2005) present a theoretical model and empirical evidence in favor of this hypothesis in the Norwegian case. Borrowers discipline banks to avoid losses, selecting banks with asset quality to signal their creditworthiness to other stakeholders (signaling motive). In Russia, Tovar-García (2013) uses discriminant analysis and points out that the interest rate on loans discriminates between high quality banks (high capital ratio) and low quality banks (low capital ratio) in favor of the asset side market discipline effect. That is, Russian borrowers are willing to pay higher interest rates to solvent banks because of future necessities of credit (refinancing motive). In Kyrgyzstan, the empirical evidence also suggests the presence of borrower discipline (Tovar-García and Kozubekova, 2016). In 2010, the state could not rescue the largest Kyrgyz bank, indicating that there are banks too-big-to-save. As a result, in this country, the evidence suggests that the banking economic agents actually monitor the risk taking of their banks. Tovar-García (2012) found evidence of refinancing and signaling motives in the Mexican case, but the largest and retail banks can keep away from the borrower discipline.

It is worth noticing that market discipline can also be induced by other banks (Furfine, 2001; Tovar-García, 2016a,b) and principally by subordinated debt holders (de Mendonça and Villela Loures, 2009; Lang and Robertson, 2002; Tovar-García, 2015). Nevertheless, due to data limitations and small stock markets in Latin America these hypotheses will not be tested here. In addition, note that in Latin America the deposit market is the major source of banking founds. According to CEPAL (2012), in contrast with European and American banks, the ratio of deposits to total liabilities in Latin American banks is high, about 50%. The exclusion of Brazilian banks makes this percentage even higher. Moreover, this ratio is slightly higher in the case of foreign banks, and this is a fact since the beginning of the banking merger or acquisition. Actually, the majority of loans are financed by local deposits in domestic and subsidiary banks.

3DataThe data employed in this research are taken from Bankscope and World Bank, World Development Indicators (WDI). The original bank data set covers the period 2006–2013 (annual observations). Nevertheless, there are a few observations for years 2006, 2007, and 2013, consequently, the period under analysis is 2008–2012.

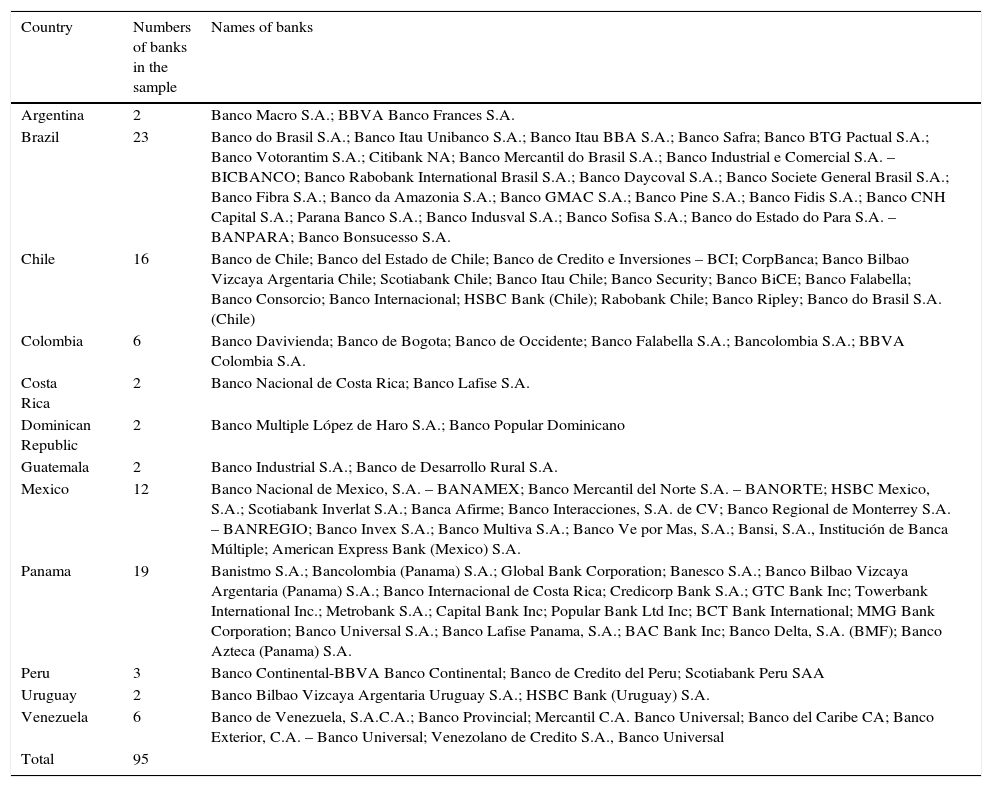

According to Bankscope, nowadays, there are 537 banks classified as commercial banks in the 12 countries under study. Nevertheless, bank data are incomplete for many key indicators and banks, and several extreme values (outliers) were removed from the data set. Bank-level data often present recording or reporting errors, in particular for Bankscope data many of the entries are from tiny local offices of large foreign banks and may reflect intrabank transfers responding to cross-border tax incentives or other unrepresentative factors. Consequently, the data were filtered and the baseline sample covers 95 commercial banks, several of them are considered big banks in their respective countries. Thus, the sample includes around 18% of the population of banks, and it is potentially affected by a selection bias, but it is reasonably representative in terms of the banking industry because of the bank concentration of Latin America (see Table A1 in the appendix).

Note that the crises in the USA and Europe affected the GDP growth rates of Latin American countries, particularly in the year 2009. In that year, Mexico was the country with the lowest rate −4.7%, Chile −1.03%, Costa Rica −1.02%, and Brazil −0.3%. Argentina, Colombia, Dominican Republic, Guatemala, Panama, Peru, and Uruguay had positives rates during the period of analysis, but their GDP rates were negatively affected by the global crisis. Martinez-Peria and Schmukler (2001) point out that depositors are particular sensitive to bank risk in the aftermath of the crises.

We have few time observations to try to divide the sample and to test the effects in the pre-crisis and post-crisis periods, but it is possible to assume that in Latin America the global financial crisis increased market discipline because of awareness of bank risks and bank failures in developed countries, and the media coverage of these topics. However, Tovar-García (2014) found weak evidence of depositor discipline in the Mexican case during the same period (with quarterly observations), and recent findings in the American case suggest that depositor discipline decreases during the crisis, excluding small banks (Berger and Turk-Ariss, 2014). In addition, there is cross-country evidence suggesting that, on average, market discipline weakens after a banking crisis (Cubillas et al., 2012).

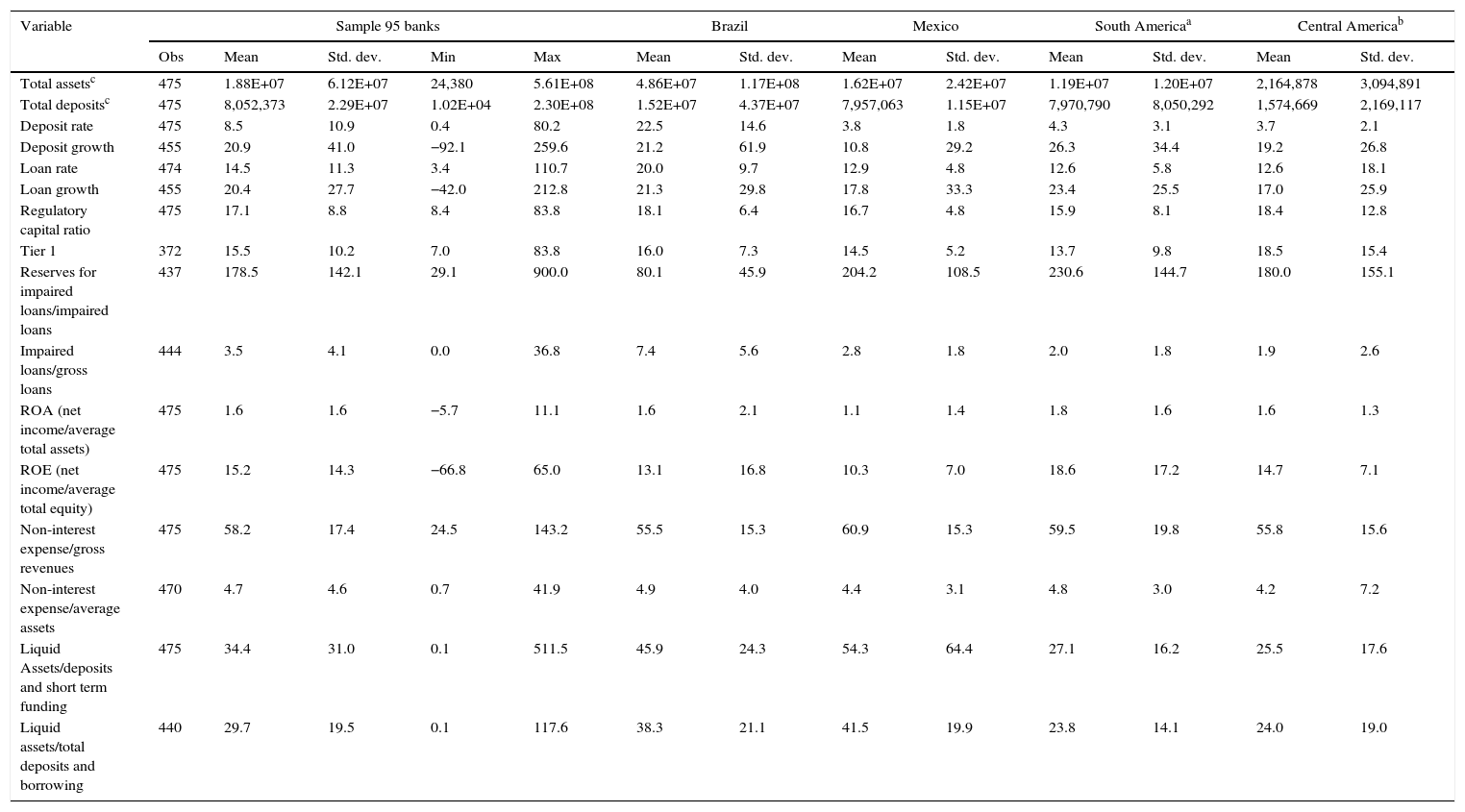

3.1Dependent variables: interest rates and growth ratesFollowing the empirical literature, to test the price-based discipline mechanism in the deposit market (liability side) we use as dependent variable an implicit interest rate: interest expense on customer deposits divided by average customer deposits (deposit rate). Its mean is 8.5% and its standard deviation is 10.9% (see Table 1). The highest rate corresponds to Banco Rabobank International Brasil S.A. (80.2% in the year 2012). On average, the Brazilian banks have the highest rates (22.5%). In comparison with Brazil the rest of banks in the countries under study have low deposit rates. The mean deposit rate of Mexican banks is 3.8%, in South America without Brazil 4.3%, and in Central America 3.7%. The lowest rate corresponds to MMG Bank Corporation in Panama (0.4% in the year 2012).

Summary statistics.

| Variable | Sample 95 banks | Brazil | Mexico | South Americaa | Central Americab | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Obs | Mean | Std. dev. | Min | Max | Mean | Std. dev. | Mean | Std. dev. | Mean | Std. dev. | Mean | Std. dev. | |

| Total assetsc | 475 | 1.88E+07 | 6.12E+07 | 24,380 | 5.61E+08 | 4.86E+07 | 1.17E+08 | 1.62E+07 | 2.42E+07 | 1.19E+07 | 1.20E+07 | 2,164,878 | 3,094,891 |

| Total depositsc | 475 | 8,052,373 | 2.29E+07 | 1.02E+04 | 2.30E+08 | 1.52E+07 | 4.37E+07 | 7,957,063 | 1.15E+07 | 7,970,790 | 8,050,292 | 1,574,669 | 2,169,117 |

| Deposit rate | 475 | 8.5 | 10.9 | 0.4 | 80.2 | 22.5 | 14.6 | 3.8 | 1.8 | 4.3 | 3.1 | 3.7 | 2.1 |

| Deposit growth | 455 | 20.9 | 41.0 | −92.1 | 259.6 | 21.2 | 61.9 | 10.8 | 29.2 | 26.3 | 34.4 | 19.2 | 26.8 |

| Loan rate | 474 | 14.5 | 11.3 | 3.4 | 110.7 | 20.0 | 9.7 | 12.9 | 4.8 | 12.6 | 5.8 | 12.6 | 18.1 |

| Loan growth | 455 | 20.4 | 27.7 | −42.0 | 212.8 | 21.3 | 29.8 | 17.8 | 33.3 | 23.4 | 25.5 | 17.0 | 25.9 |

| Regulatory capital ratio | 475 | 17.1 | 8.8 | 8.4 | 83.8 | 18.1 | 6.4 | 16.7 | 4.8 | 15.9 | 8.1 | 18.4 | 12.8 |

| Tier 1 | 372 | 15.5 | 10.2 | 7.0 | 83.8 | 16.0 | 7.3 | 14.5 | 5.2 | 13.7 | 9.8 | 18.5 | 15.4 |

| Reserves for impaired loans/impaired loans | 437 | 178.5 | 142.1 | 29.1 | 900.0 | 80.1 | 45.9 | 204.2 | 108.5 | 230.6 | 144.7 | 180.0 | 155.1 |

| Impaired loans/gross loans | 444 | 3.5 | 4.1 | 0.0 | 36.8 | 7.4 | 5.6 | 2.8 | 1.8 | 2.0 | 1.8 | 1.9 | 2.6 |

| ROA (net income/average total assets) | 475 | 1.6 | 1.6 | −5.7 | 11.1 | 1.6 | 2.1 | 1.1 | 1.4 | 1.8 | 1.6 | 1.6 | 1.3 |

| ROE (net income/average total equity) | 475 | 15.2 | 14.3 | −66.8 | 65.0 | 13.1 | 16.8 | 10.3 | 7.0 | 18.6 | 17.2 | 14.7 | 7.1 |

| Non-interest expense/gross revenues | 475 | 58.2 | 17.4 | 24.5 | 143.2 | 55.5 | 15.3 | 60.9 | 15.3 | 59.5 | 19.8 | 55.8 | 15.6 |

| Non-interest expense/average assets | 470 | 4.7 | 4.6 | 0.7 | 41.9 | 4.9 | 4.0 | 4.4 | 3.1 | 4.8 | 3.0 | 4.2 | 7.2 |

| Liquid Assets/deposits and short term funding | 475 | 34.4 | 31.0 | 0.1 | 511.5 | 45.9 | 24.3 | 54.3 | 64.4 | 27.1 | 16.2 | 25.5 | 17.6 |

| Liquid assets/total deposits and borrowing | 440 | 29.7 | 19.5 | 0.1 | 117.6 | 38.3 | 21.1 | 41.5 | 19.9 | 23.8 | 14.1 | 24.0 | 19.0 |

Notes: This table presents the descriptive statistics on bank variables for the full sample and subsamples by country or group of countries. The sample period starts in the year 2008 and ends in the year 2012. Author's calculations using Bankscope data.

To test the market discipline asset side effect we use as dependent variable other implicit interest rate: interest income on loans divided by average gross loans (loan rate). Its mean is 14.5% and its standard deviation is 11.3%. The highest loan rate corresponds to Banco Azteca in Panama (110.7% in the year 2012) and the lowest rate corresponds to Banco do Brasil in Chile (3.4% in the year 2011). However, once more Brazilian banks have the highest rates (on average 20.0%), the mean of loan rate in the rest of banks is around 12.6%.

Note that these implicit interest rates differ from the typical interest rates announced by banks to the public. Consequently, some minimum and maximum figures seem to be very low or high, as the mentioned deposit rates of 0.4% and 80.2%, or the loan rates of 3.4% and 110.7%. When we removed outliers, we reviewed that these figures are not spuriously generated, comparing them with values in other periods, checking missing (or extra) zero in one component of the ratio, and sharp reductions in the volume of deposits (or loans) near the end of the reporting period.8

To test the quantity-based discipline mechanism in the deposit market we use as dependent variable the deposit growth ratio: deposits in yeart divided by deposits in yeart−1 as percentage (deposit growth). Its mean is 20.9% and its standard deviation is 41.0%. The highest ratio corresponds to Banco Itau BBA in Brazil (259.6% in the year 2008), and the lowest ratio corresponds to American Express Bank in Mexico (−92.1% in the year 2012). On average, the banks in South America (without Brazil) have the highest deposit growth rates (26.3%), and the Mexican banks are around 10% under the mean of the other banks in the sample.

Similarly, to test the asset side effect we use the loan growth rate (loan growth), its mean is 20.4% and its standard deviation is 27.7%. The highest rate corresponds to Banco Multiva in Mexico (212.8% in the year 2008), and the lowest rate corresponds to Banco Consorcio in Chile (−42.0%). The North and Central American banks have rates slightly below the average rates in South America, including Brazil.

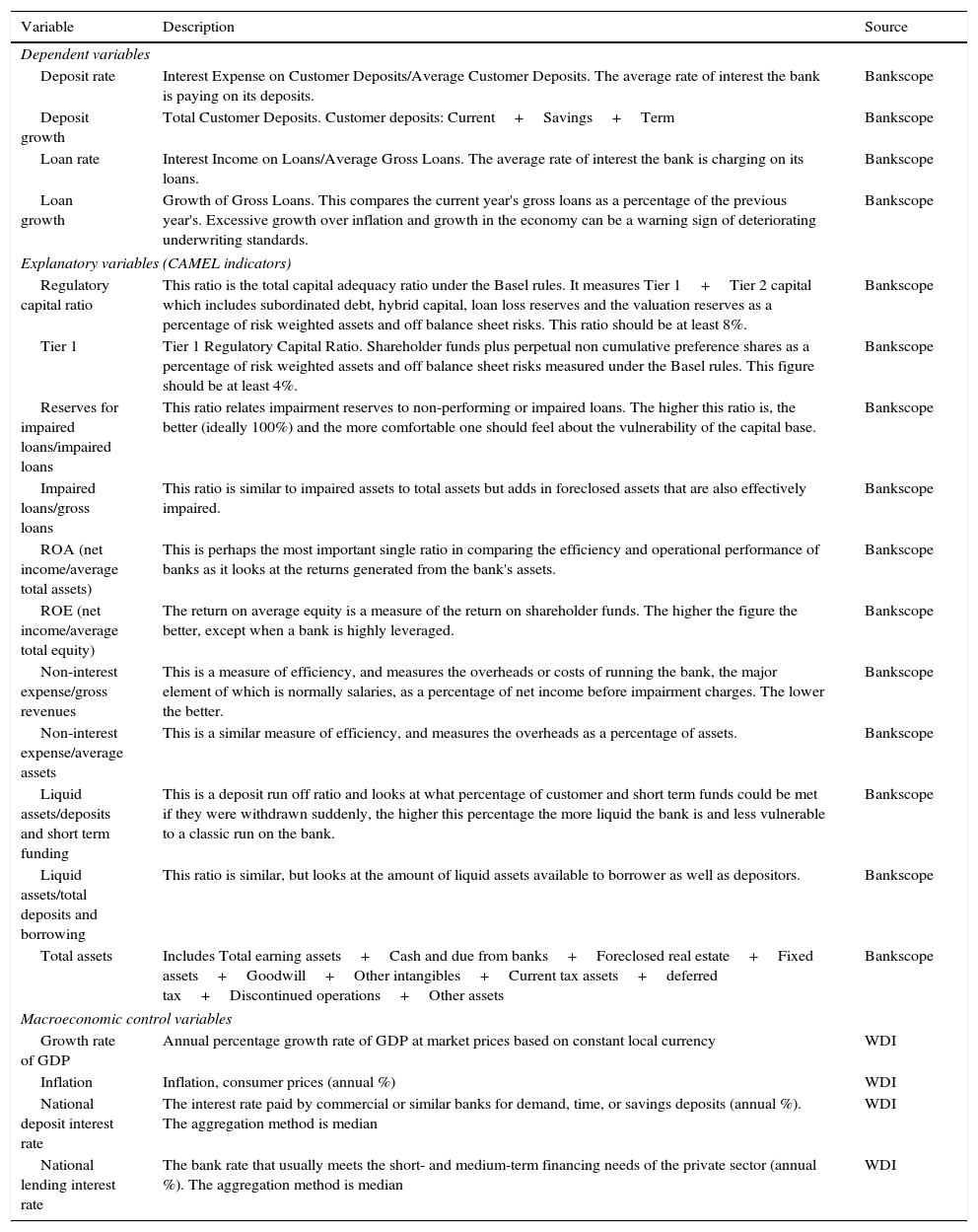

3.2Explanatory variables: bank fundamentalsTo test market discipline the main independent variables are bank fundamentals (as key indicators of bank risk).9 Bank ratings (Fitch, Moody's, and Standard and Poor's) are common indicators of bank risk, but these ratings are available only for a few Latin American banks, extremely affecting the representativeness of the sample. Moreover, these ratings have been seriously criticized for their shortcomings forecasting the last financial and banking crisis. Consequently, this research is based on several CAMEL indicators (capital adequacy, asset quality, management quality, earnings and liquidity), which have been extensively employed in the empirical literature. Table A2 in the appendix summarizes these indicators and their theoretical implications.

Table 1 contains summary statistics on bank variables, for the full sample (95 banks) and subsamples of banks in South America (excluding Brazil) and Central America (excluding Mexico). The mean of total assets is 18,800 million US dollars, and its standard deviation is 61,200. Consequently, the bank sample includes small and large banks, where the smallest bank is Banco Azteca in Panama with 45,553 thousands US dollars (total assets in 2012), and the largest bank is Banco do Brasil with 561,103 million US dollars (total assets in 2012). By total assets, the largest banks are in Brazil and the smallest ones in Central America. In the next section, we use the natural logarithm of total assets to control the bank size effect.10

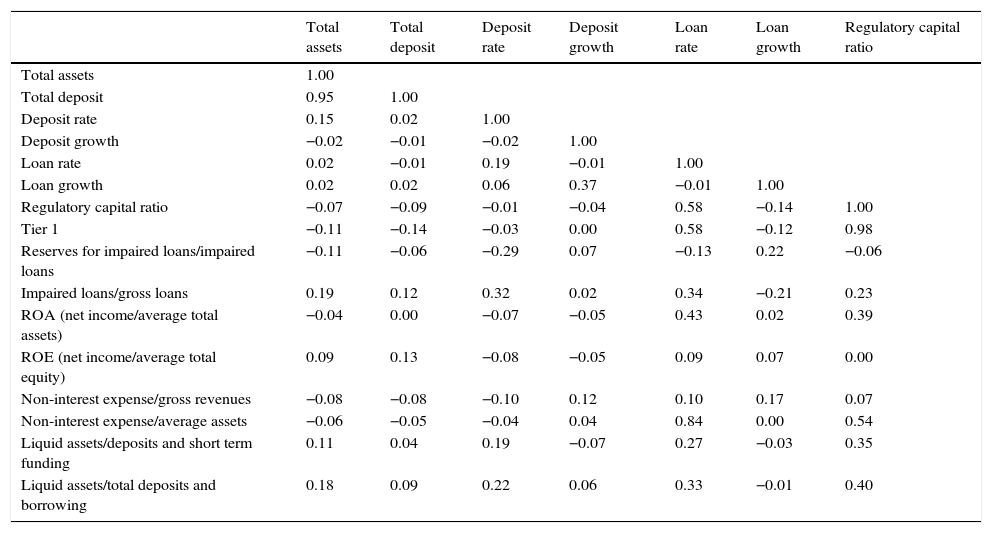

On average, the regulatory capital ratio (Tier 1+Tier 2) equals 17.1%, the standard deviation is 8.8%. The minimal value is 8.4% (Banco Lafise Panama) and the maximum is 83.8% (Banco Azteca in Panama), both in the year 2008. To approach the capital adequacy we also use Tier 1, its mean is 15.5% and its standard deviation is 10.2%. The correlation coefficient between them is 0.98 (see Table A3 in the appendix).

Asset quality is measured with two indicators. First, the ratio reserves for impaired loans to impaired loans, its mean is 178.5% and the standard deviation is 142.1%. Second, the ratio impaired loans to gross loans, its mean is 3.5% and the standard deviation is 4.1%. There are a few banks with very high (or very low) percents in these indicators, for example, Banco Multiple López de Haro in Domincan Republic has 900% in the ratio reserves for impaired loans to impaired loans, and 0.28% in the ratio impaired loans to gross loans (in the year 2008). These figures are not recording errors, and we decide to include them in the baseline sample (later, we excluded them, for robustness checks). The correlation between these indicators is −0.44.

To approach profitability we use the typical indicators ROA and ROE (returns on assets and equity), their means are 1.6% and 15.2%, and their standard deviations are 1.6% and 14.3%, respectively. The Brazilian banks have the highest losses, for example, Banco CNH Capital (ROA equals −5.7% in 2009) and Banco Societe General Brasil (ROA equals −4.6% and ROE equals −66.8 in 2012). However, on average, the Mexican banks are in the worst position. The correlation coefficient between ROA and ROE is 0.79.

Management quality is measured with two indicators. First, non-interest expense divided by gross revenues. Second, non-interest expense divided by average assets. Their correlation coefficient is 0.26, their means are 58.2% and 4.7%, and their standard deviations are 17.4% and 4.6%, respectively.

Liquidity is measured with two indicators. First, liquid assets divided by deposits and short term funding. Second, liquid assets divided by total deposits and borrowing. Their correlation coefficient is 0.71, their means are 34.4% and 29.7%, and their standard deviations are 31.0% and 19.5%, respectively.

As we can expect, there are several high correlations among CAMEL indicators (see Table A3 in the appendix), consequently, in the next section, under the regression analysis, these variables are included taking into account multicollinearity concerns.

4Empirical strategyDue to endogeneity concerns, and autoregressive characteristics of the dependent variables, recent empirical studies (using panel data) propose regression analysis using the dynamic generalized method of moments (DIF GMM or SYS GMM estimators) to test the market discipline hypothesis (Tovar-García, 2014).

The number of time-series observations in our case is moderately small. Therefore, to obtain consistent and unbiased estimates of the relationship between indicators of the mechanism of market discipline (price and quantity) and bank risk, the literature suggests to use the SYS GMM estimator (Blundell and Bond, 1998). In this research the number of cross sectional observations is 95, smaller than the number of observations used by Blundell and Bond (1998) to develop their method (where N=100, 200 and 500).

This method uses the lagged dependent variable as regressor, and the regressors instrumented by themselves with their lagged levels and first differences. If the model is not subject to serial correlation (in particular of second order) and the instruments are valid, then the estimator ensures efficiency and consistency. In addition, we checked stationarity, and our variables do not have unit roots.

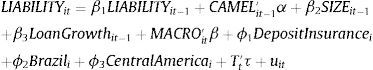

4.1Liability side of market discipline and the internal capital demand hypothesisThe baseline empirical model to test the liability side market discipline effect is given by Eq. (1):

where LIABILITY includes as dependent variables deposit rate and deposit growth to test the price and quantity mechanisms of market discipline, respectively. The model includes as independent variable loan growth to test the effect of the banks’ internal capital demand on deposit rate, and on deposit growth (H3 and H4).CAMEL indicators (bank fundamentals) approach bank risk. These indicators are entered with one lag to account for the delay in obtaining the relevant information by economic agents. SIZE is the log of total assets controlling bank size. MACRO consists of macroeconomic variables, we use the growth rate of GDP and inflation as general indicators of economic stability, and a national deposit interest rate (median) to control the general performance of the deposit market (see Table A2 in the appendix). Deposit Insurance is a dummy variable coded 1 for countries with an explicit deposit insurance scheme, and 0 otherwise (for Panama and Costa Rica with implicit deposit insurance). Brazil is a dummy variable coded 1 for Brazilian banks, and 0 otherwise, and Central America is a dummy variable coded 1 for banks in Costa Rica, Guatemala, and Panama, and 0 otherwise. In comparison with other Latin American banks in the sample, the Brazilian and Central American banks show different bank characteristics (see Table 1), besides Brazil contributes to the sample with 24% of the banks. Evidently, the banks are heterogeneous, and country banking legislation may affect some variables, yet these dummy variables control these effects.11T is time dummy variables controlling effects of unspecified market conditions.

The statistical hypotheses point out that deposit rate is higher for banks reporting low-quality bank fundamentals (higher bank risk). It depends inversely upon the level of regulatory capital ratio, Tier 1, reserves for impaired loans/impaired loans, ROA, ROE, liquid assets/deposits and short term funding, and liquid assets/total deposits and borrowing, and positively upon the level of impaired loans/gross loans, non-interest expense/gross revenues, and non-interest expense/average assets.

On the contrary, deposit growth depends positively upon the level of regulatory capital ratio, Tier 1, reserves for impaired loans/impaired loans, ROA, ROE, liquid assets/deposits and short term funding, and liquid assets/total deposits and borrowing, and inversely upon the level of impaired loans/gross loans, non-interest expense/gross revenues, and non-interest expense/average assets.

Due to multicollinearity concerns, these variables are entered with caution, and we run several regressions interchanging these CAMEL indicators, thus we can check robustness to different indicators of bank fundamentals.

We expect a positive relationship between the dependent variables and loan growth, which is interpreted as evidence in favor of the internal capital demand hypothesis (H3 and H4). We run regressions including and excluding loan growth, exploring if this hypothesis (this demand side effect) has an impact on the role of bank risk for market discipline (H1 and H2).

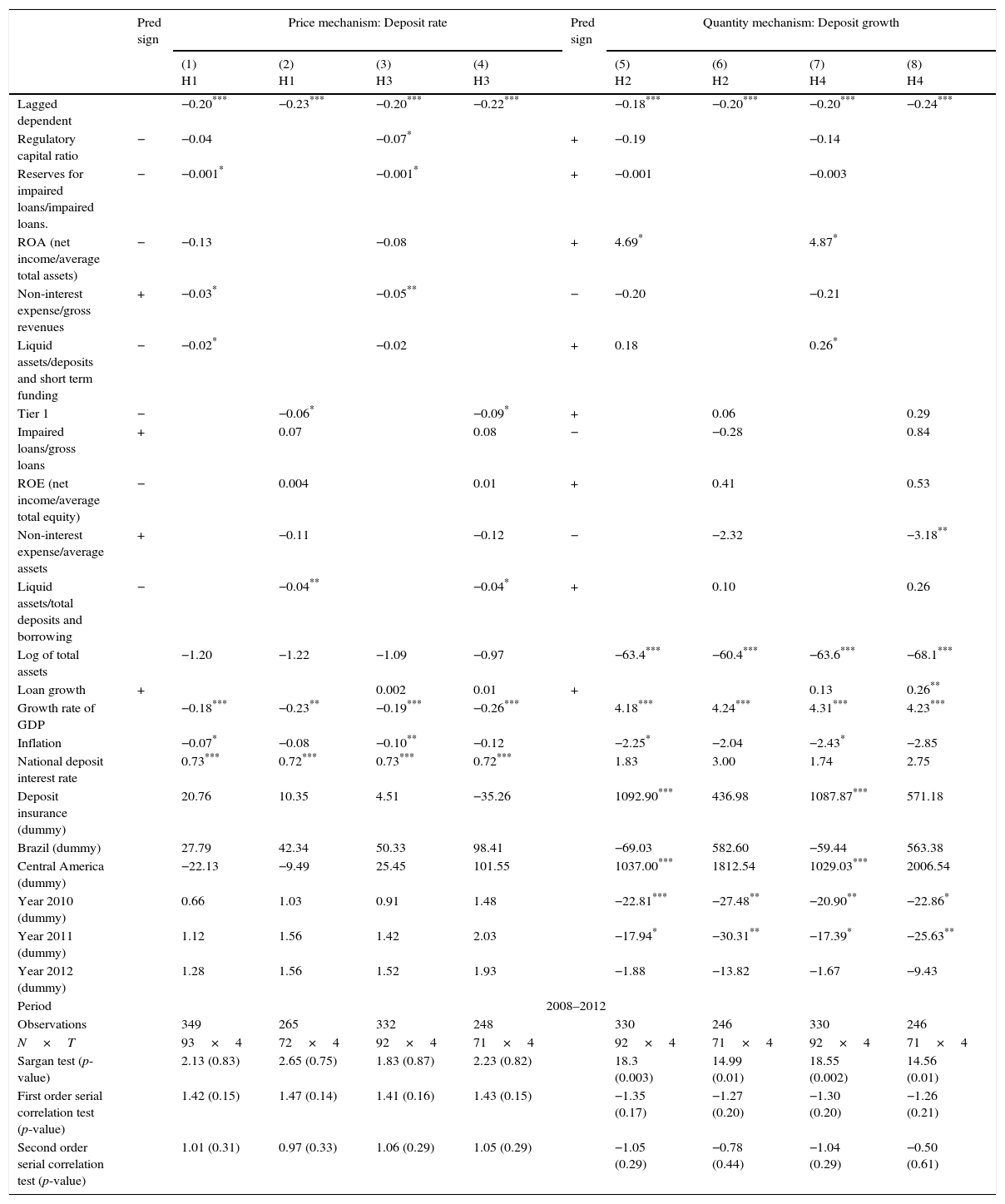

The main results are reported in Table 2. Note that the dynamic model is well justified; the dependent variables as regressors show statistical significance. The SYS GMM estimations are not subject to serial correlation (of first and second order) and the instruments used to test the price mechanism are valid according to the Sargan test.12

Liability side of market discipline and banks’ internal capital demand.

| Pred sign | Price mechanism: Deposit rate | Pred sign | Quantity mechanism: Deposit growth | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) H1 | (2) H1 | (3) H3 | (4) H3 | (5) H2 | (6) H2 | (7) H4 | (8) H4 | |||

| Lagged dependent | −0.20*** | −0.23*** | −0.20*** | −0.22*** | −0.18*** | −0.20*** | −0.20*** | −0.24*** | ||

| Regulatory capital ratio | − | −0.04 | −0.07* | + | −0.19 | −0.14 | ||||

| Reserves for impaired loans/impaired loans. | − | −0.001* | −0.001* | + | −0.001 | −0.003 | ||||

| ROA (net income/average total assets) | − | −0.13 | −0.08 | + | 4.69* | 4.87* | ||||

| Non-interest expense/gross revenues | + | −0.03* | −0.05** | − | −0.20 | −0.21 | ||||

| Liquid assets/deposits and short term funding | − | −0.02* | −0.02 | + | 0.18 | 0.26* | ||||

| Tier 1 | − | −0.06* | −0.09* | + | 0.06 | 0.29 | ||||

| Impaired loans/gross loans | + | 0.07 | 0.08 | − | −0.28 | 0.84 | ||||

| ROE (net income/average total equity) | − | 0.004 | 0.01 | + | 0.41 | 0.53 | ||||

| Non-interest expense/average assets | + | −0.11 | −0.12 | − | −2.32 | −3.18** | ||||

| Liquid assets/total deposits and borrowing | − | −0.04** | −0.04* | + | 0.10 | 0.26 | ||||

| Log of total assets | −1.20 | −1.22 | −1.09 | −0.97 | −63.4*** | −60.4*** | −63.6*** | −68.1*** | ||

| Loan growth | + | 0.002 | 0.01 | + | 0.13 | 0.26** | ||||

| Growth rate of GDP | −0.18*** | −0.23** | −0.19*** | −0.26*** | 4.18*** | 4.24*** | 4.31*** | 4.23*** | ||

| Inflation | −0.07* | −0.08 | −0.10** | −0.12 | −2.25* | −2.04 | −2.43* | −2.85 | ||

| National deposit interest rate | 0.73*** | 0.72*** | 0.73*** | 0.72*** | 1.83 | 3.00 | 1.74 | 2.75 | ||

| Deposit insurance (dummy) | 20.76 | 10.35 | 4.51 | −35.26 | 1092.90*** | 436.98 | 1087.87*** | 571.18 | ||

| Brazil (dummy) | 27.79 | 42.34 | 50.33 | 98.41 | −69.03 | 582.60 | −59.44 | 563.38 | ||

| Central America (dummy) | −22.13 | −9.49 | 25.45 | 101.55 | 1037.00*** | 1812.54 | 1029.03*** | 2006.54 | ||

| Year 2010 (dummy) | 0.66 | 1.03 | 0.91 | 1.48 | −22.81*** | −27.48** | −20.90** | −22.86* | ||

| Year 2011 (dummy) | 1.12 | 1.56 | 1.42 | 2.03 | −17.94* | −30.31** | −17.39* | −25.63** | ||

| Year 2012 (dummy) | 1.28 | 1.56 | 1.52 | 1.93 | −1.88 | −13.82 | −1.67 | −9.43 | ||

| Period | 2008–2012 | |||||||||

| Observations | 349 | 265 | 332 | 248 | 330 | 246 | 330 | 246 | ||

| N×T | 93×4 | 72×4 | 92×4 | 71×4 | 92×4 | 71×4 | 92×4 | 71×4 | ||

| Sargan test (p-value) | 2.13 (0.83) | 2.65 (0.75) | 1.83 (0.87) | 2.23 (0.82) | 18.3 (0.003) | 14.99 (0.01) | 18.55 (0.002) | 14.56 (0.01) | ||

| First order serial correlation test (p-value) | 1.42 (0.15) | 1.47 (0.14) | 1.41 (0.16) | 1.43 (0.15) | −1.35 (0.17) | −1.27 (0.20) | −1.30 (0.20) | −1.26 (0.21) | ||

| Second order serial correlation test (p-value) | 1.01 (0.31) | 0.97 (0.33) | 1.06 (0.29) | 1.05 (0.29) | −1.05 (0.29) | −0.78 (0.44) | −1.04 (0.29) | −0.50 (0.61) | ||

Notes: This table presents the results of the estimated regressions using the dynamic SYS GMM estimator (Blundell and Bond, 1998), two-step estimation. The explanatory variables entered with a one period lag. Independent variables are in rows, and the dependent variables are deposit rate and deposit growth in columns (read the regressions vertically). The sample includes annual data on 95 commercial banks from 12 Latin American countries over the period 2008–2012. Data are collected from Bankscope.

In general, the bank fundamentals show mixed and no robust effects on deposit rate (see columns 1–4 in Table 2). The indicators of capital adequacy and liquidity are negatively linked to deposit rate, in accordance with the market discipline hypothesis. That is, banks with higher values in these indicators pay lower interest rates on deposits. However, this result is not robust, note that regulatory capital ratio is not statistically significant in the first regression (column 1 in Table 2), and liquid assets/deposits and short term funding is not statistically significant in the third regression (column 3 in Table 2).

Similarly, the effects of the indicators of asset quality are not robust. The coefficients related to the ratio reserves for impaired loans to impaired loans are negative and significant, as the market discipline hypothesis predicts, but impaired loans/gross loans is not significant. Consequently, it is not possible to support the expected effect from asset quality.

The ratio non-interest expense to gross revenues shows evidence against the market discipline hypothesis, suggesting that banks with low efficiency pay lower interest rates on deposits. However, this result is not robust; non-interest expense/average assets is not significant. ROA and ROE are non-significant, too.

We do not find evidence in favor of the internal capital demand hypothesis in the price-based mechanism (H3). The coefficients related to loan growth are not statistically significant (see columns 3 and 4 in Table 2).

The bank size does not explain the interest rate on deposits (the coefficients related to log of total assets are not statistically significant). The time dummies, the dummy for deposit insurance, and the dummy variables for Brazilian and Central American banks do not show significance.

The findings suggest that the most robust and relevant factors explaining interest rates on deposits are the macroeconomic variables, in particular the growth rate of GDP and the national deposit interest rate. In other words, the interest rates on deposits follow the general trend of the economy.

With respect to the results of the quantity mechanism, we find a few significant coefficients and the effects of banks fundamentals on deposit growth are not robust (see columns 5–8 in Table 2). ROA has a positive effect on deposit growth, in favor of the market discipline hypothesis, but ROE is not statistically significant. Similarly, the indicators of liquidity and management quality show weak evidence in favor of the market discipline hypothesis because liquid assets/deposits and short term funding and non-interest expense/average assets present the expected sign and significance only in one of the four regressions.

There is no robust evidence in favor of the internal capital demand hypothesis (H4). Loan growth has a positive effect on deposit growth only in one of the two regressions (see columns 7 and 8 in Table 2).

On the contrary, bank size has a robust negative effect on deposit growth, that is, the deposit growth rate of large banks is smaller. The dummy variables for deposit insurance and Central American banks have some significant coefficients, but they are not robust. It is not possible to support that deposit growth is higher in countries with explicit deposit insurance systems, and in banks located in Central America.

The time dummies for year 2010 and 2011 have a negative effect on deposit growth, following the general trend of the global financial crisis. The growth rate of GDP has a positive and robust effect on deposit growth, supporting the previous finding in the price mechanism about the relevance of the macroeconomic conditions to explain the deposit market performance.

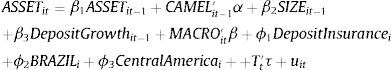

4.2Asset side of market discipline and the internal capital supply hypothesisSimilarly, the baseline empirical model to test the asset side market discipline effect is given by Eq. (2):

where ASSET includes as dependent variables loan rate and loan growth, to test the price and quantity mechanisms, respectively. Deposit growth tests the effect of the banks’ internal capital supply (H7 and H8), controlling changes in loan rate and loan growth that could be a result of the supply side.As in Eq. (1), CAMEL indicators enter with one lag, and the variables SIZE, MACRO,13 Deposit Insurance, Brazil, Central America, and T have similar functions.

The statistical hypotheses point out that loan rate and loan growth are higher for banks reporting high-quality bank fundamentals (low bank risk), particularly high capital ratios (refinancing motive) and asset quality (signaling motive). Thus, loan rate and loan growth depend positively upon the level of regulatory capital ratio, Tier 1, reserves for impaired loans/impaired loans, ROA, ROE, liquid assets/deposits and short term funding, and liquid assets/total deposits and borrowing, and inversely upon the level of impaired loans/gross loans, non-interest expense/gross revenues, and non-interest expense/average assets. Once more, because of multicollinearity concerns, these variables are entered with caution, and we interchange them to check robustness.

In addition, we expect a negative relationship between deposit growth and loan rate, and a positive relationship between deposit growth and loan growth. This is interpreted as evidence in favor of the internal capital supply hypothesis (H7 and H8). We run regressions including and excluding the deposit growth, exploring if this hypothesis, this supply side effect, has an impact on the market discipline hypothesis.

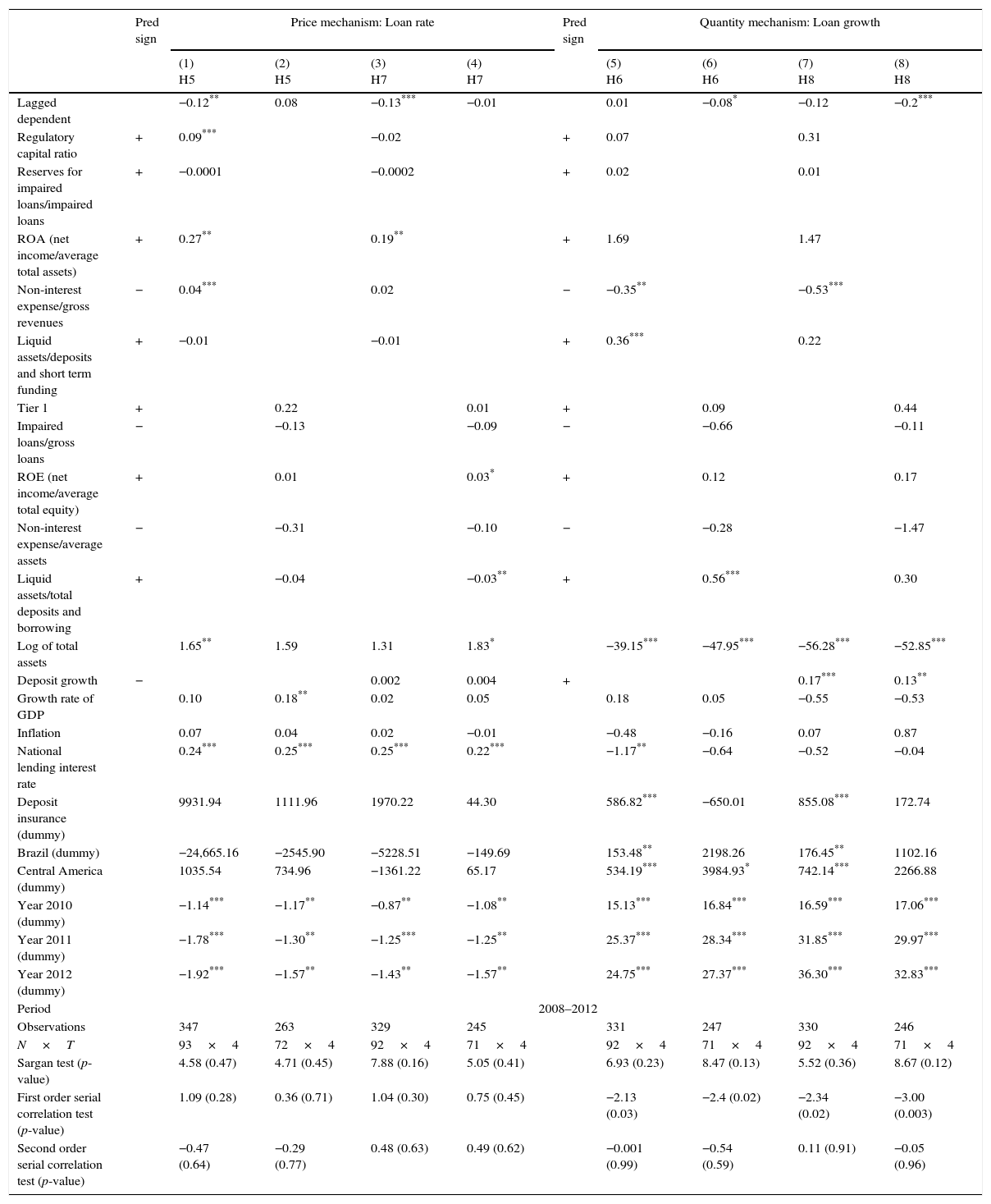

The main results are reported in Table 3. The SYS GMM estimations pass the serial correlation tests, particularly of order two, and the used instruments are valid according to the Sargan test.

Asset side of market discipline and banks’ internal capital supply.

| Pred sign | Price mechanism: Loan rate | Pred sign | Quantity mechanism: Loan growth | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) H5 | (2) H5 | (3) H7 | (4) H7 | (5) H6 | (6) H6 | (7) H8 | (8) H8 | |||

| Lagged dependent | −0.12** | 0.08 | −0.13*** | −0.01 | 0.01 | −0.08* | −0.12 | −0.2*** | ||

| Regulatory capital ratio | + | 0.09*** | −0.02 | + | 0.07 | 0.31 | ||||

| Reserves for impaired loans/impaired loans | + | −0.0001 | −0.0002 | + | 0.02 | 0.01 | ||||

| ROA (net income/average total assets) | + | 0.27** | 0.19** | + | 1.69 | 1.47 | ||||

| Non-interest expense/gross revenues | − | 0.04*** | 0.02 | − | −0.35** | −0.53*** | ||||

| Liquid assets/deposits and short term funding | + | −0.01 | −0.01 | + | 0.36*** | 0.22 | ||||

| Tier 1 | + | 0.22 | 0.01 | + | 0.09 | 0.44 | ||||

| Impaired loans/gross loans | − | −0.13 | −0.09 | − | −0.66 | −0.11 | ||||

| ROE (net income/average total equity) | + | 0.01 | 0.03* | + | 0.12 | 0.17 | ||||

| Non-interest expense/average assets | − | −0.31 | −0.10 | − | −0.28 | −1.47 | ||||

| Liquid assets/total deposits and borrowing | + | −0.04 | −0.03** | + | 0.56*** | 0.30 | ||||

| Log of total assets | 1.65** | 1.59 | 1.31 | 1.83* | −39.15*** | −47.95*** | −56.28*** | −52.85*** | ||

| Deposit growth | − | 0.002 | 0.004 | + | 0.17*** | 0.13** | ||||

| Growth rate of GDP | 0.10 | 0.18** | 0.02 | 0.05 | 0.18 | 0.05 | −0.55 | −0.53 | ||

| Inflation | 0.07 | 0.04 | 0.02 | −0.01 | −0.48 | −0.16 | 0.07 | 0.87 | ||

| National lending interest rate | 0.24*** | 0.25*** | 0.25*** | 0.22*** | −1.17** | −0.64 | −0.52 | −0.04 | ||

| Deposit insurance (dummy) | 9931.94 | 1111.96 | 1970.22 | 44.30 | 586.82*** | −650.01 | 855.08*** | 172.74 | ||

| Brazil (dummy) | −24,665.16 | −2545.90 | −5228.51 | −149.69 | 153.48** | 2198.26 | 176.45** | 1102.16 | ||

| Central America (dummy) | 1035.54 | 734.96 | −1361.22 | 65.17 | 534.19*** | 3984.93* | 742.14*** | 2266.88 | ||

| Year 2010 (dummy) | −1.14*** | −1.17** | −0.87** | −1.08** | 15.13*** | 16.84*** | 16.59*** | 17.06*** | ||

| Year 2011 (dummy) | −1.78*** | −1.30** | −1.25*** | −1.25** | 25.37*** | 28.34*** | 31.85*** | 29.97*** | ||

| Year 2012 (dummy) | −1.92*** | −1.57** | −1.43** | −1.57** | 24.75*** | 27.37*** | 36.30*** | 32.83*** | ||

| Period | 2008–2012 | |||||||||

| Observations | 347 | 263 | 329 | 245 | 331 | 247 | 330 | 246 | ||

| N×T | 93×4 | 72×4 | 92×4 | 71×4 | 92×4 | 71×4 | 92×4 | 71×4 | ||

| Sargan test (p-value) | 4.58 (0.47) | 4.71 (0.45) | 7.88 (0.16) | 5.05 (0.41) | 6.93 (0.23) | 8.47 (0.13) | 5.52 (0.36) | 8.67 (0.12) | ||

| First order serial correlation test (p-value) | 1.09 (0.28) | 0.36 (0.71) | 1.04 (0.30) | 0.75 (0.45) | −2.13 (0.03) | −2.4 (0.02) | −2.34 (0.02) | −3.00 (0.003) | ||

| Second order serial correlation test (p-value) | −0.47 (0.64) | −0.29 (0.77) | 0.48 (0.63) | 0.49 (0.62) | −0.001 (0.99) | −0.54 (0.59) | 0.11 (0.91) | −0.05 (0.96) | ||

Notes: This table presents the results of the estimated regressions using the dynamic SYS GMM estimator (Blundell and Bond, 1998), two-step estimation. The explanatory variables entered with a one period lag. Independent variables are in rows, and the dependent variables are loan rate and loan growth in columns (read the regressions vertically). The sample includes annual data on 95 commercial banks from 12 Latin American countries over the period 2008–2012. Data are collected from Bankscope.

In the price mechanism, the bank fundamentals do not show robust effects on loan rate (see columns 1–4 in Table 3). The evidence is not enough robust to support the refinancing motive (this suggests that capital adequacy is positively linked to loan rate). In our results, only in one regression capital regulatory ratio has a significant and positive coefficient (column 1), and Tier 1 is not statistically significant. It is interesting to note that ROA and ROE present significant and positive coefficients, suggesting that banks with high earnings charge higher interest rates on loans. Probably the refinancing motive of borrowers is based on these indicators, in place of capital ratios. However, the evidence is not robust; ROE is not statistically significant in one regression (column 2).

There is no evidence in favor of the signaling motive, which suggests that asset quality is positively linked to loan rate. The coefficients related to reserves for impaired loans/impaired loans and impaired loans/gross loans are not statistically significant.

Other bank fundamentals do not show robust effects, including bank size, which is positive and statistically significant in two of the four regressions, weakly suggesting that large banks charge higher interact rates on loans.

In the price mechanism, we do not find evidence in favor of the internal capital supply hypothesis (H7). The coefficients related to deposit growth are not statistically significant (see columns 3 and 4 in Table 3).

The dummy for deposit insurance and the dummy variables for Brazilian and Central American banks do not show significance. Among macroeconomic variables, we can see a robust positive effect of the national lending interest rate on loan rate, and the times dummies also show a robust negative effect on loan rate, suggesting that loan rate follows the general conditions of the economy.

With respect to the results of the quantity mechanism, we find a few significant coefficients and the effects of banks fundamentals on loan growth are not robust (see columns 5–8 in Table 3). There is no evidence in favor of the refinancing or signaling motives, that is, the indicators of capital adequacy and asset quality are not statistically significant. Other banks fundamentals do not present robust effects on loan growth.

On the contrary, there is a robust effect of bank size on loan growth. The coefficients related to log of total assets are negative and statistically significant, suggesting that the loan growth rate of large banks is smaller.

There is robust evidence in favor of the internal capital supply hypothesis (H8). Deposit growth has a positive effect on loan growth in both regressions where the indicator is included (see columns 7 and 8 in Table 3).

The time dummy variables have a robust, positive, and significant effect on loan growth. Therefore, loan growth follows a general trend. The other dummy variables do not present robust effects.

As additional robustness checks, we estimated Eqs. (1) and (2) using robust standard errors, using a logarithmic transformation of dependent and independent variables, and the results are very similar to those reported in Tables 2 and 3. However, using logarithms the regressions usually do not pass the correlation tests and the Sargan test. The equations also were estimated using fixed and random effects regression models. Thinking that our sample could still includes outliers, we limited the values of independent and dependent variables, for instance, we used a sample limiting the values on the implicit interest rates and growth rates, including exclusively deposit rates between 1% and 30%, and loan rates between 5% and 40%, and deposit growth between −50% and 100%, and loan growth between −30% and 60%, the main findings remain qualitatively the same. These results are not shown in tables to conserve space.

To sum up, in Latin America during the years 2008–2012, our findings suggest evidence, which is weak and not robust, that bank risk is positively related to interest rates on deposits (H1), and negatively related to deposit growth (H2). Park and Peristiani (1998) and Park (1995) argue that in presence of imperfect information the price mechanism of market discipline might be biased, as we can expect is the case in Latin American countries (Goday et al., 2005). However, in our analysis, the quantity mechanism presents weaker evidence than the price mechanism.

There is no evidence that bank loan growth has a positive effect on deposit rates (H3), and there is no robust evidence that bank loan growth has a positive effect on deposit growth (H4). Contrary to the American case (Ben-David et al., in press), the demand side effect on deposit rate is not relevant, and loan growth is not affecting the impact of bank fundamentals on deposit rates (which already are showing mixed effects).

There is weak and no robust evidence (particularly considering capital ratios and asset quality) that bank risk is negatively related to interest rates on loans (H5) and to loan growth (H6).

Finally, there is no evidence of a negative effect of deposit growth on loan rates (H7), but there is robust evidence of a positive effect of deposit growth on loan growth (H8). Consequently, through quantity mechanism, our findings support the internal capital supply hypothesis. Nevertheless, the supply side is not affecting the impact of bank fundamentals (in particular of capital ratios and asset quality) on loan growth (which already shows non-significant effects).

Previous findings suggest that the largest banks do not face market discipline. In our results, bank size impacts negatively deposit growth and loan growth, probably because of the scale of business in large banks. However, it is important to recognize that our sample consist of many large banks (information for small banks is poor), and this may bias the bank size effect.

In general, only the macroeconomic variables (in particular the growth rate of GDP and the national deposit and lending interest rates) and the time dummies present robust effects on the interest rates and growth rates.

5ConclusionIn banking markets, the responses of private agents to bank risk (market discipline) are considered key actions to achieve a stable financial system. Therefore, the Basel Committee proposes a disclosure policy (the Third Pillar in Basel III) to facilitate the monitoring activities of banks’ creditors. In addition, there is theoretical and empirical evidence suggesting that this disclosure policy can benefit borrowers, who can also monitor the risk taking of their banks, and discipline them. Borrowers prefer high-quality banks, particularly with higher capital ratios and asset quality because of refinancing and signaling motives (Allen et al., 2011; Kim et al., 2005; Tovar-García, 2012).

This research tested the discipline induced by depositors and borrowers, controlling effects from banks’ internal capital markets. Using a sample of 95 banks in 12 Latin American countries during the years 2008–2012, and based on the SYS GMM estimator (Blundell and Bond, 1998), our findings suggest weak evidence in favor of the market discipline hypothesis. In addition, the role of banks’ internal capital markets shaping interest rates on deposits and loans (price mechanism) and their growth rates (quantity mechanism) is weak. The macroeconomic variables, particularly the growth rate of GDP and the national deposit and lending interest rates, and time dummies are the only variables showing robust and significant effects on prices and quantities in deposit and loan markets. In other words, the general trend of the economy was the key variable.

Currently, most Latin American countries have explicit deposit insurance systems (Panama and Costa Rica have implicit deposit insurance). In principle, the defined government involvement should motivate the monitoring activities of private agents (Demirgüç-Kunt and Huizinga, 2004). Nevertheless, in Latin America our findings do no suggest a relevant difference between implicit and explicit deposit insurance systems. Arguably, the recent bank bailouts and general policies to increase the amount of deposit insurance in Europe and the USA produce a global signal that bank crises should be socialized, particularly in the case of too-big-to-fail banks. Consequently, the main task of Latin American policymakers is to restore market discipline. It is necessary to remind private agents that they also have relevant functions to achieve soundness in banking systems.

This work predominantly has data limitations, and future research for Latin America should explore the hypotheses using country case studies, and more than accounting information.

Countries and bank sample.

| Country | Numbers of banks in the sample | Names of banks |

|---|---|---|

| Argentina | 2 | Banco Macro S.A.; BBVA Banco Frances S.A. |

| Brazil | 23 | Banco do Brasil S.A.; Banco Itau Unibanco S.A.; Banco Itau BBA S.A.; Banco Safra; Banco BTG Pactual S.A.; Banco Votorantim S.A.; Citibank NA; Banco Mercantil do Brasil S.A.; Banco Industrial e Comercial S.A. – BICBANCO; Banco Rabobank International Brasil S.A.; Banco Daycoval S.A.; Banco Societe General Brasil S.A.; Banco Fibra S.A.; Banco da Amazonia S.A.; Banco GMAC S.A.; Banco Pine S.A.; Banco Fidis S.A.; Banco CNH Capital S.A.; Parana Banco S.A.; Banco Indusval S.A.; Banco Sofisa S.A.; Banco do Estado do Para S.A. – BANPARA; Banco Bonsucesso S.A. |

| Chile | 16 | Banco de Chile; Banco del Estado de Chile; Banco de Credito e Inversiones – BCI; CorpBanca; Banco Bilbao Vizcaya Argentaria Chile; Scotiabank Chile; Banco Itau Chile; Banco Security; Banco BiCE; Banco Falabella; Banco Consorcio; Banco Internacional; HSBC Bank (Chile); Rabobank Chile; Banco Ripley; Banco do Brasil S.A. (Chile) |

| Colombia | 6 | Banco Davivienda; Banco de Bogota; Banco de Occidente; Banco Falabella S.A.; Bancolombia S.A.; BBVA Colombia S.A. |

| Costa Rica | 2 | Banco Nacional de Costa Rica; Banco Lafise S.A. |

| Dominican Republic | 2 | Banco Multiple López de Haro S.A.; Banco Popular Dominicano |

| Guatemala | 2 | Banco Industrial S.A.; Banco de Desarrollo Rural S.A. |

| Mexico | 12 | Banco Nacional de Mexico, S.A. – BANAMEX; Banco Mercantil del Norte S.A. – BANORTE; HSBC Mexico, S.A.; Scotiabank Inverlat S.A.; Banca Afirme; Banco Interacciones, S.A. de CV; Banco Regional de Monterrey S.A. – BANREGIO; Banco Invex S.A.; Banco Multiva S.A.; Banco Ve por Mas, S.A.; Bansi, S.A., Institución de Banca Múltiple; American Express Bank (Mexico) S.A. |

| Panama | 19 | Banistmo S.A.; Bancolombia (Panama) S.A.; Global Bank Corporation; Banesco S.A.; Banco Bilbao Vizcaya Argentaria (Panama) S.A.; Banco Internacional de Costa Rica; Credicorp Bank S.A.; GTC Bank Inc; Towerbank International Inc.; Metrobank S.A.; Capital Bank Inc; Popular Bank Ltd Inc; BCT Bank International; MMG Bank Corporation; Banco Universal S.A.; Banco Lafise Panama, S.A.; BAC Bank Inc; Banco Delta, S.A. (BMF); Banco Azteca (Panama) S.A. |

| Peru | 3 | Banco Continental-BBVA Banco Continental; Banco de Credito del Peru; Scotiabank Peru SAA |

| Uruguay | 2 | Banco Bilbao Vizcaya Argentaria Uruguay S.A.; HSBC Bank (Uruguay) S.A. |

| Venezuela | 6 | Banco de Venezuela, S.A.C.A.; Banco Provincial; Mercantil C.A. Banco Universal; Banco del Caribe CA; Banco Exterior, C.A. – Banco Universal; Venezolano de Credito S.A., Banco Universal |

| Total | 95 |

Variable description and data sources.

| Variable | Description | Source |

|---|---|---|

| Dependent variables | ||

| Deposit rate | Interest Expense on Customer Deposits/Average Customer Deposits. The average rate of interest the bank is paying on its deposits. | Bankscope |

| Deposit growth | Total Customer Deposits. Customer deposits: Current+Savings+Term | Bankscope |

| Loan rate | Interest Income on Loans/Average Gross Loans. The average rate of interest the bank is charging on its loans. | Bankscope |

| Loan growth | Growth of Gross Loans. This compares the current year's gross loans as a percentage of the previous year's. Excessive growth over inflation and growth in the economy can be a warning sign of deteriorating underwriting standards. | Bankscope |

| Explanatory variables (CAMEL indicators) | ||

| Regulatory capital ratio | This ratio is the total capital adequacy ratio under the Basel rules. It measures Tier 1+Tier 2 capital which includes subordinated debt, hybrid capital, loan loss reserves and the valuation reserves as a percentage of risk weighted assets and off balance sheet risks. This ratio should be at least 8%. | Bankscope |

| Tier 1 | Tier 1 Regulatory Capital Ratio. Shareholder funds plus perpetual non cumulative preference shares as a percentage of risk weighted assets and off balance sheet risks measured under the Basel rules. This figure should be at least 4%. | Bankscope |

| Reserves for impaired loans/impaired loans | This ratio relates impairment reserves to non-performing or impaired loans. The higher this ratio is, the better (ideally 100%) and the more comfortable one should feel about the vulnerability of the capital base. | Bankscope |

| Impaired loans/gross loans | This ratio is similar to impaired assets to total assets but adds in foreclosed assets that are also effectively impaired. | Bankscope |

| ROA (net income/average total assets) | This is perhaps the most important single ratio in comparing the efficiency and operational performance of banks as it looks at the returns generated from the bank's assets. | Bankscope |

| ROE (net income/average total equity) | The return on average equity is a measure of the return on shareholder funds. The higher the figure the better, except when a bank is highly leveraged. | Bankscope |

| Non-interest expense/gross revenues | This is a measure of efficiency, and measures the overheads or costs of running the bank, the major element of which is normally salaries, as a percentage of net income before impairment charges. The lower the better. | Bankscope |

| Non-interest expense/average assets | This is a similar measure of efficiency, and measures the overheads as a percentage of assets. | Bankscope |

| Liquid assets/deposits and short term funding | This is a deposit run off ratio and looks at what percentage of customer and short term funds could be met if they were withdrawn suddenly, the higher this percentage the more liquid the bank is and less vulnerable to a classic run on the bank. | Bankscope |

| Liquid assets/total deposits and borrowing | This ratio is similar, but looks at the amount of liquid assets available to borrower as well as depositors. | Bankscope |

| Total assets | Includes Total earning assets+Cash and due from banks+Foreclosed real estate+Fixed assets+Goodwill+Other intangibles+Current tax assets+deferred tax+Discontinued operations+Other assets | Bankscope |

| Macroeconomic control variables | ||

| Growth rate of GDP | Annual percentage growth rate of GDP at market prices based on constant local currency | WDI |

| Inflation | Inflation, consumer prices (annual %) | WDI |

| National deposit interest rate | The interest rate paid by commercial or similar banks for demand, time, or savings deposits (annual %). The aggregation method is median | WDI |

| National lending interest rate | The bank rate that usually meets the short- and medium-term financing needs of the private sector (annual %). The aggregation method is median | WDI |

Correlation matrix.

| Total assets | Total deposit | Deposit rate | Deposit growth | Loan rate | Loan growth | Regulatory capital ratio | |

|---|---|---|---|---|---|---|---|

| Total assets | 1.00 | ||||||

| Total deposit | 0.95 | 1.00 | |||||

| Deposit rate | 0.15 | 0.02 | 1.00 | ||||

| Deposit growth | −0.02 | −0.01 | −0.02 | 1.00 | |||

| Loan rate | 0.02 | −0.01 | 0.19 | −0.01 | 1.00 | ||

| Loan growth | 0.02 | 0.02 | 0.06 | 0.37 | −0.01 | 1.00 | |

| Regulatory capital ratio | −0.07 | −0.09 | −0.01 | −0.04 | 0.58 | −0.14 | 1.00 |

| Tier 1 | −0.11 | −0.14 | −0.03 | 0.00 | 0.58 | −0.12 | 0.98 |

| Reserves for impaired loans/impaired loans | −0.11 | −0.06 | −0.29 | 0.07 | −0.13 | 0.22 | −0.06 |

| Impaired loans/gross loans | 0.19 | 0.12 | 0.32 | 0.02 | 0.34 | −0.21 | 0.23 |

| ROA (net income/average total assets) | −0.04 | 0.00 | −0.07 | −0.05 | 0.43 | 0.02 | 0.39 |

| ROE (net income/average total equity) | 0.09 | 0.13 | −0.08 | −0.05 | 0.09 | 0.07 | 0.00 |

| Non-interest expense/gross revenues | −0.08 | −0.08 | −0.10 | 0.12 | 0.10 | 0.17 | 0.07 |

| Non-interest expense/average assets | −0.06 | −0.05 | −0.04 | 0.04 | 0.84 | 0.00 | 0.54 |

| Liquid assets/deposits and short term funding | 0.11 | 0.04 | 0.19 | −0.07 | 0.27 | −0.03 | 0.35 |

| Liquid assets/total deposits and borrowing | 0.18 | 0.09 | 0.22 | 0.06 | 0.33 | −0.01 | 0.40 |

| Tier 1 | Reserves for impaired loans/impaired loans | Impaired loans/gross loans | ROA (net income/average total assets) | ROE (net income/average total equity) | Non-interest expense/gross revenues | Non-interest expense/average assets | |

|---|---|---|---|---|---|---|---|

| Tier 1 | 1.00 | ||||||

| Reserves for impaired loans/impaired loans | −0.05 | 1.00 | |||||

| Impaired loans/gross loans | 0.22 | −0.44 | 1.00 | ||||

| ROA (net income/average total assets) | 0.41 | 0.16 | −0.08 | 1.00 | |||

| ROE (net income/average total equity) | −0.07 | 0.28 | −0.24 | 0.79 | 1.00 | ||

| Non-interest expense/gross revenues | 0.15 | −0.02 | −0.03 | −0.41 | −0.51 | 1.00 | |

| Non-interest expense/average assets | 0.57 | −0.06 | 0.24 | 0.43 | 0.05 | 0.26 | 1.00 |

| Liquid assets/deposits and short term funding | 0.34 | −0.06 | 0.23 | 0.09 | −0.10 | 0.12 | 0.22 |

| Liquid assets/total deposits and borrowing | 0.40 | −0.09 | 0.29 | 0.02 | −0.12 | 0.15 | 0.23 |

| Liquid Assets/deposits and short term funding | Liquid assets/total deposits and borrowing | |

|---|---|---|

| Liquid assets/deposits and short term funding | 1.00 | |

| Liquid assets/total deposits and borrowing | 0.71 | 1.00 |

Notes: This table presents the Pearson correlation coefficients among the bank variables used in the multivariate analysis. The sample period starts in the year 2008 and ends in the year 2012. Author's calculations using Bankscope data.

The empirical literature is centered around tests for market monitoring. The market influence usually is omitted in the empirical research due to data limitations and endogeneity concerns.

In the literature is possible to find a third discipline mechanism: maturity-based (Goday et al., 2005; Tovar-García, 2014). Due to data limitations, we do not test this third mechanism.

As in the case of small depositors, small borrowers do not care so much about bank fundamentals and their market share usually is small. However, there is an increasing literature supporting the positive nexus between loans announcements and abnormal returns (price premiums in the stock market), suggesting that the assessment and monitor activity of the bank about the conditions of the borrower is valued by other agents (Billett et al., 1995). Therefore, large borrowers take care about the characteristics of their creditors.

In addition, the econometric method in Section 4 controls double causality concerns and specification errors, thanks to instrumental variables.

During the European banking crisis of 2008 the general reaction of European countries was to increase their deposit insurance, as the Americans did (Berger and Turk-Ariss, 2014).

Kauko (2014) presents empirical evidence suggesting that countries that employed a blanket guarantee (bank bailouts) have lower nonperforming loans/total loans ratios, that is, evidence against the moral hazard hypothesis (safety nets encourage risk taking). Nevertheless, in the regressions, countries where depositors suffered losses have higher nonperforming loans/total loans ratios.

Using a different approach, there are several studies exploring the nexus between bank fundamentals (mainly capital ratios) and loan rate (Santos and Winton, 2013), and loan growth (Berrospide and Edge, 2010).

In addition, in our specifications to check robustness, we also employed subsamples limiting the maximum and minimum values of the dependent and independent variables.

The first empirical studies on market discipline used bank fundamentals to estimate an indicator of bank failure (bank risk). However, the most recent studies use directly bank fundamentals (as indicator of bank risk) to test the market discipline hypothesis, because, in that way, it is possible to observe which particular factors (kinds of risks) are determining interest rates, and growth rates (Tovar-García, 2014).

Demirgüç-Kunt and Huizinga (2013) suggest the use of liabilities divided by GDP to control the bank size effect. Nevertheless, this research does not use this indicator to avoid multicollinearity concerns with the macroeconomic control variables, which have a relevant role in our econometric models.

Due to multicollinearity concerns, it is not possible to include dummy variables for each country.

In the case of the quantity mechanism (deposit growth as dependent variable), the regressions did not pass the Sargan test. We run different specifications, but we could not resolve this problem, consequently these results should be treated with caution.

Note that we include a national lending interest rate (median) to control the general performance of the loan market.