The aim of this paper is to analyze the diversification decision in Mergers and Acquisitions (M&As) and how this decision is valued by acquiring shareholders, considering the influence of the legal and institutional environment. Using a sample of 447 M&As announced by European firms, which acquire a target in any country in the world over the period 2002–2007, we find that the weak legal and institutional environment in the bidder country has a positive impact on the diversification decision. After controlling the diversification endogeneity, we observe that acquiring shareholders value diversified M&As negatively in countries with strong legal and institutional environment. This result indicates that the benefits of the internal capital market effect dominate the agency conflicts’ effect. We also observe that acquiring firms with concentrated ownership structures value diversified M&As negatively in countries with strong legal and institutional environment.

The aim of this paper is to analyze if the product diversification decision in Mergers and Acquisitions (M&As) and its valuation by acquiring shareholders are explained by the legal and institutional environment.

From the point of view of the agency theory, managers may undertake an M&A in a different industry to build corporate empires at the expense of shareholders’ wealth, in order to obtain higher compensation and personal prestige (Jensen, 1986; Jensen and Murphy, 1990; Mock et al., 1990), to reduce their personal risk, which is linked to the firm risk (Amihud and Lev, 1999), or to entrench (Shleifer and Vishny, 1989). Diversified firms may transfer resources from large divisions with good investment opportunities to small divisions with poor opportunities, reducing the firm value (Rajan et al., 2000; Doukas and Kan, 2008). Information asymmetries between central managers and divisional managers will also lead to higher operating costs because of the incentives for rent-seeking by managers within the firm (Scharfstein and Stein, 2000; Aggarwal and Samwick, 2003).

With regard to diversification advantages, the transaction cost theory establishes that the diversification generates value to the firm because of the internal capital markets promoted. It may provide firms’ gains due to effective capital allocating within the firm (Willianson, 1975; Harris and Ravis, 1996). The firm avoids the transaction costs associated with issuing securities to the public, as well as the costs of overcoming information asymmetries encountered when selling securities in the capital market. In this sense, diversified firms are more able to overcome market imperfections such as capital, labor, or product market failures than undiversified firms (Khanna and Palepu, 1997, 2000; Chang and Hong, 2002). Furthermore, firm diversification increases the debt capacity (Lewellen, 1971), reduces the firm risk (Comment and Jarrell, 1995) and increases the market power (Tirole, 1995).

The creation of an internal capital market in diversified firms may be more valuable in countries with less developed capital markets, where it is more costly to raise external capital (Fauver et al., 2003). However, the agency problems between managers and shareholders may also be higher in these countries, determining a higher diversification cost in less developed capital market countries (Johnson et al., 2000; Lins, 2003). According to these arguments, the net effect of the diversification on the firm value in countries with less developed capital markets is an empirical question.

Besides, the ownership structure of the firms may also vary across countries (La Porta et al., 1999). Large shareholders may prefer to diversify to reduce their own risk, though it does not benefit minority shareholders (Shleifer and Vishny, 1989). On the contrary, large shareholders may prefer to monitor managers, avoiding destroying value M&As (Lins and Servaes, 1999; Chen and Ho, 2000).

Both the decision of undertaking a diversified M&A and the effect of this decision on the firm value may be influenced by the legal and institutional environment. But, the analysis of the legal and institutional environment on the diversification decision is scarce. This paper contributes to the diversification decision studies taken into account the possible influence of the legal and institutional environment on this decision.

We propose the following research questions: (i) Are diversified M&As more likely in countries with less investor protection and less developed capital markets? (ii) How do European acquiring shareholders value diversified M&As in different legal and institutional environments? (iii) Does the acquiring ownership structure influence the M&A diversification decision and its valuation by acquiring shareholders? To test these questions, we analyze the M&As announced by European firms over the period 2002–2007, being the target firms worldwide.

Our main findings show that the stronger legal and institutional environment in the host country (bidder country) negatively influences the likelihood to undertake a diversified M&A. After controlling the endogeneity of the diversification decision, we observe that diversified M&As are valued negatively in countries with strong legal and institutional environment by acquiring shareholders. This result is in line with Fauver et al. (2003) about the higher benefits of the internal capital markets in countries with weak legal and institutional environment. This effect is maintained when we control for the ownership concentration of the acquiring firm.

The paper is organized as follows: in Section 2, we present the related literature; in Section 3, we describe the data and methodology used in the study, as well as the results of the M&A diversification decision and the acquiring shareholder valuation; and, in Section 4, we present the conclusions.

2Related literatureThe controversial empirical evidence about the product diversification strategy on the firm value is spread. This strategy may increase the agency costs due to more firm complexity and rent-seeking division managers’ behavior. On the contrary, the product diversification may benefit firms, when they have difficulties to obtain external capital, given that it favors internal capital markets.

The majority of the studies indicate that the diversified US firms trade with a discount relative to single segment firms (Lang and Stulz, 1994; Berger and Ofek, 1995). Lins and Servaes (2002) find the same results for seven emerging markets, and Lins and Servaes (1999) support this result for diversified firms in Japan and the United Kingdom, but they do not find empirical evidence for Germany. These studies analyze the value of diversified firms relative to single-segment firms. The value discount associated with the diversification observed in these studies is related to the higher agency costs in diversified firms, as a consequence of their more complex organizational structure.

The diversified M&As may also be associated with self-manager's interests, if they pursue to secure their firm position and firm's survival (Jensen and Meckling, 1976). Managers in firms with free cash flow may use the diversified M&A to over invest (Jensen, 1986). Alternatively, although diversified firms do not have free cash flow, their managers may transfer resources from large divisions with good investment opportunities to small divisions with poor ones, making the internal capital market inefficient in the allocation of resources between divisions and reducing the firm's value (Rajan et al., 2000; Doukas and Kan, 2008). Information asymmetries between central managers and divisional managers may also lead to higher operating costs, because of higher managers incentives for rent-seeking within the firm (Scharfstein and Stein, 2000; Aggarwal and Samwick, 2003). These costs would provoke that the diversification decision will destroy firm value. Then, a negative acquiring shareholder valuation will be expected when announcing diversified M&As.

On the contrary, other studies consider the diversification decision to be endogenous. The diversification influence on the firm's value may be capturing the effect of firm characteristics on the diversification decision. Some firm characteristics may lead some firms to generate more value from the diversification decision than other firms (Campa and Kedia, 2002; Graham et al., 2001; Villalonga, 2004b). Firms with poor performance and lower internal growth opportunities may choose to diversify. Then, the discount on the firm value after the diversification would not be associated with this decision, but related to those firm characteristics.

Other studies show the benefits from the diversification strategy. The transaction cost theory states that firms with capital constraints may benefit from establishing internal capital markets through diversified investments, and that they are capable of effectively allocating resources within the firm (Mansi and Reeb, 2002). Taking it into account, we would expect a positive acquiring shareholder valuation of diversified M&As.

2.1The legal and institutional environmentThe access to external capital depends on the capital markets development and on the country and firms capacity to attract foreign capital. The legal and institutional environment may also influence the availability and cost of the external capital (La Porta et al., 1998). More investor protection and more capital market development in a country reduce the firms’ costs of raising external capital.

Emerging countries have markets with more asymmetric information and agency problems, derived from the lack of disclosure information and weak corporate governance and control systems. Also, the less developed intermediary institutions makes it costly to acquire inputs, such as financial resources, technology and management talent (Khanna and Palepu, 2000). It increases the cost of accessing to the external capital markets. Then, weak legal and institutional environments may promote firms to undertake diversified M&As to generate an internal capital market, and then overcome the difficulties to access to the external capital markets. In addition to this, the higher agency costs and asymmetric information between managers and shareholders in countries with weak investor protection, may also promote diversified M&As because of the managers’ incentives for rent-seeking. Therefore, we propose the following hypothesis:Hypothesis 1 Diversified M&As will be more likely in countries with weak legal and institutional environments.

The benefits of diversification related to the internal capital market may be higher in countries where the capital markets are less developed and the investor protection is lower. In these countries, it is costly to raise external funds (Fauver et al., 2003). Therefore, the internal capital market will make less necessary to obtain funds in the external capital markets.

However, firms in markets with weak legal and institutional environments have less disclosure requirements, weak corporate governance mechanisms and poorly developed corporate control markets (La Porta et al., 1997, 1998). Then, the diversification decision may be associated with more agency problems between managers and shareholders and inefficient resource allocation within the firm. Thus, the diversification decision will be valued by acquiring shareholders negatively.

Therefore, the influence of the diversification decision on acquiring shareholder valuation in weak legal and institutional environments will depend on which of these effects dominate. The effect of the ownership concentration may be more intense in countries with weak legal and institutional environment due to the less investor protection. So, we establish the following hypothesis:Hypothesis 2 Acquiring shareholders will value diversified M&As positively (negatively) when the acquiring firm belongs to a country with weak legal and institutional environment.

The acquiring ownership structure may influence M&A decision about diversification, as well as acquiring shareholders’ valuation, given the ownership structure relationship with firm agency costs.

Shareholders’ valuation of the M&A diversification decision may be different depending on the acquiring firm ownership, which usually varies across countries (La Porta et al., 1999; Claessens et al., 2002; Fauver et al., 2004). Diversification decision may allow large shareholders to reduce the risks associated with their firm-specific investments. Risk reduction not necessarily benefits small shareholders, given that their wealth may be diversified (Shleifer and Vishny, 1989). On the contrary, firms with insider ownership have fewer manager–stockholder agency conflicts, being less probable that unrelated M&A, which destroy value for shareholders, is decided (Amihud and Lev, 1981; Denis et al., 1997). Then, higher ownership concentration may determine a positive valuation of the diversification decision (Lins and Servaes, 1999). Therefore, large shareholders will face a trade-off between the risk reduction and the value generation for the remaining shareholders (Jensen and Meckling, 1976; Fama and Jensen, 1983; Demsetz and Lehn, 1985; Shleifer and Vishny, 1997). We establish the following hypothesis to test which of these preferences dominate:Hypothesis 3 Acquiring shareholders will value diversified M&As positively (negatively) when acquiring firms have high levels of ownership concentration in weak legal and institutional environments.

The database to test the above hypotheses comprises the listed European firms which announced an M&A during the 2002–2007 period, with the target firms being listed or unlisted in any country in the world.

We obtained this dataset from the Thomson One Banker Merger & Acquisitions Database, DataStream, Amadeus and Lexis Nexis. The sample is made according to the following criteria: (i) all M&As announced by a European listed company for the period 2002–2007, which have been completed to date; (ii) both domestic and cross-border transactions are considered; (iii) target firms may be listed or unlisted in any part of the world; (iv) the transaction involves a change in firm control; (v) firms do not belong to the financial sector (SIC code from 6000 to 6999); (vi) the acquiring firm does not announce more than one transaction in the event window, (−20, +20); (vii) the beta parameter of the market model is significant at the 95% confidence level; (viii) acquiring-firm ownership data are available at the end of the year prior to the deal.

The final sample of M&A announcements consists of 447 transactions, involving firms in 36 countries.

We consider diversified M&A when the acquiring firm buys a firm in a new unrelated line of the core business and non-diversified M&As otherwise. The unrelated business is that which differ from the main line of business of the acquiring firms in the two first digits of the SIC code (Berger and Ofek, 1996; Campa and Kedia, 2002, among others). 140 diversified M&As and 307 non-diversified M&A compose our sample.

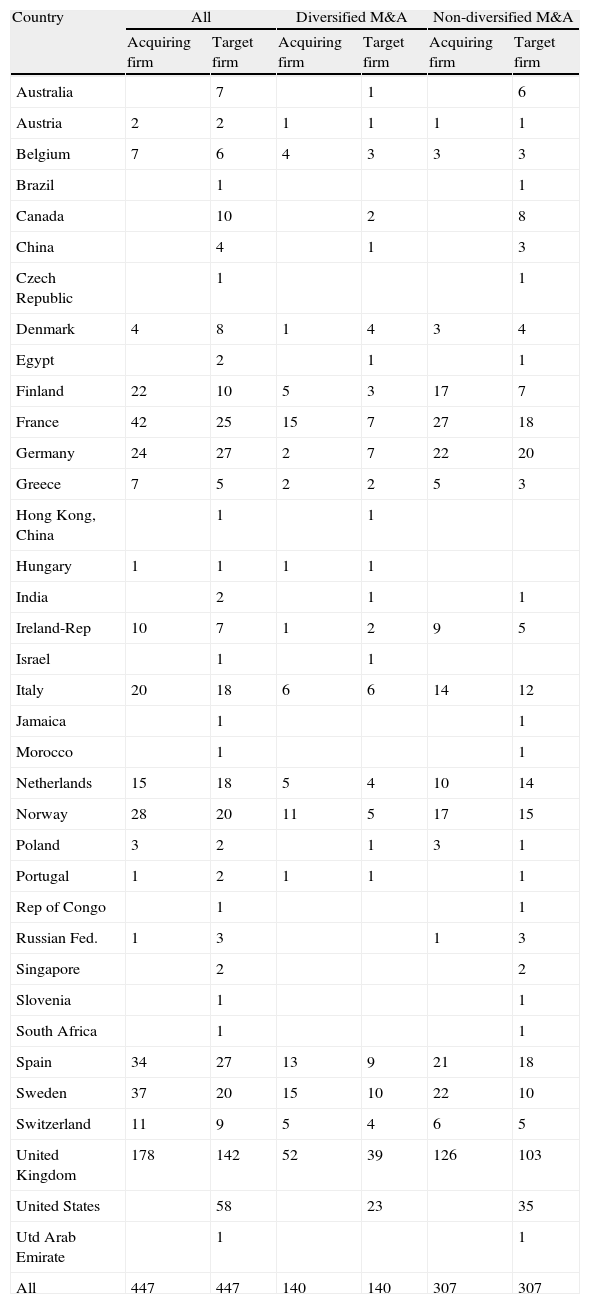

Table 1 shows M&A distribution according to the geographical area of both the acquiring and the target firms, distinguishing between diversified and non-diversified M&As. 40% of all operations are announced by firms from the United Kingdom. We observe that acquiring and target firms from United Kingdom, that is to say, a country with strong legal and institutional environment, are less involved in diversified M&As.

Geographical distribution of the mergers and acquisitions (M&As).

| Country | All | Diversified M&A | Non-diversified M&A | |||

| Acquiring firm | Target firm | Acquiring firm | Target firm | Acquiring firm | Target firm | |

| Australia | 7 | 1 | 6 | |||

| Austria | 2 | 2 | 1 | 1 | 1 | 1 |

| Belgium | 7 | 6 | 4 | 3 | 3 | 3 |

| Brazil | 1 | 1 | ||||

| Canada | 10 | 2 | 8 | |||

| China | 4 | 1 | 3 | |||

| Czech Republic | 1 | 1 | ||||

| Denmark | 4 | 8 | 1 | 4 | 3 | 4 |

| Egypt | 2 | 1 | 1 | |||

| Finland | 22 | 10 | 5 | 3 | 17 | 7 |

| France | 42 | 25 | 15 | 7 | 27 | 18 |

| Germany | 24 | 27 | 2 | 7 | 22 | 20 |

| Greece | 7 | 5 | 2 | 2 | 5 | 3 |

| Hong Kong, China | 1 | 1 | ||||

| Hungary | 1 | 1 | 1 | 1 | ||

| India | 2 | 1 | 1 | |||

| Ireland-Rep | 10 | 7 | 1 | 2 | 9 | 5 |

| Israel | 1 | 1 | ||||

| Italy | 20 | 18 | 6 | 6 | 14 | 12 |

| Jamaica | 1 | 1 | ||||

| Morocco | 1 | 1 | ||||

| Netherlands | 15 | 18 | 5 | 4 | 10 | 14 |

| Norway | 28 | 20 | 11 | 5 | 17 | 15 |

| Poland | 3 | 2 | 1 | 3 | 1 | |

| Portugal | 1 | 2 | 1 | 1 | 1 | |

| Rep of Congo | 1 | 1 | ||||

| Russian Fed. | 1 | 3 | 1 | 3 | ||

| Singapore | 2 | 2 | ||||

| Slovenia | 1 | 1 | ||||

| South Africa | 1 | 1 | ||||

| Spain | 34 | 27 | 13 | 9 | 21 | 18 |

| Sweden | 37 | 20 | 15 | 10 | 22 | 10 |

| Switzerland | 11 | 9 | 5 | 4 | 6 | 5 |

| United Kingdom | 178 | 142 | 52 | 39 | 126 | 103 |

| United States | 58 | 23 | 35 | |||

| Utd Arab Emirate | 1 | 1 | ||||

| All | 447 | 447 | 140 | 140 | 307 | 307 |

Sample includes 447 M&A deals announced by European listed firms (2002–2007). We classify: 140 diversified M&As and 307 non-diversified M&As. Acquiring firms belong to European countries and target firms are worldwide.

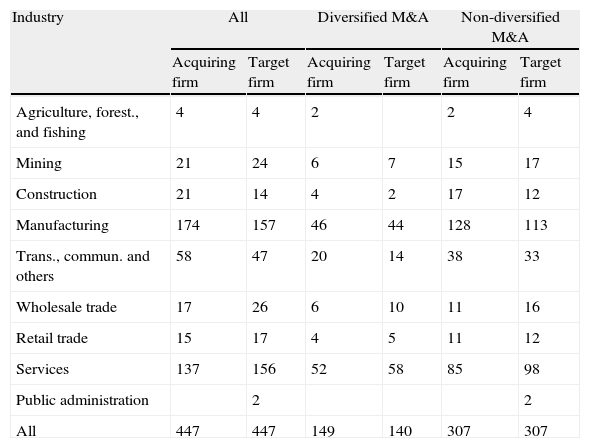

Table 2 presents the M&A distribution according to the industry of both the acquiring and the target firms, distinguishing between diversified and non-diversified M&As. Manufacturing and services represent the sectors with more M&As. The proportion of diversified M&As is lower in all sectors, in comparison with non-diversified M&As in each sector.

Industrial distribution of the mergers and acquisitions (M&As).

| Industry | All | Diversified M&A | Non-diversified M&A | |||

| Acquiring firm | Target firm | Acquiring firm | Target firm | Acquiring firm | Target firm | |

| Agriculture, forest., and fishing | 4 | 4 | 2 | 2 | 4 | |

| Mining | 21 | 24 | 6 | 7 | 15 | 17 |

| Construction | 21 | 14 | 4 | 2 | 17 | 12 |

| Manufacturing | 174 | 157 | 46 | 44 | 128 | 113 |

| Trans., commun. and others | 58 | 47 | 20 | 14 | 38 | 33 |

| Wholesale trade | 17 | 26 | 6 | 10 | 11 | 16 |

| Retail trade | 15 | 17 | 4 | 5 | 11 | 12 |

| Services | 137 | 156 | 52 | 58 | 85 | 98 |

| Public administration | 2 | 2 | ||||

| All | 447 | 447 | 149 | 140 | 307 | 307 |

Sample includes 447 M&A deals announced by European listed firms (2002–2007). We distinguish: 140 diversified M&As and 307 non-diversified M&As.

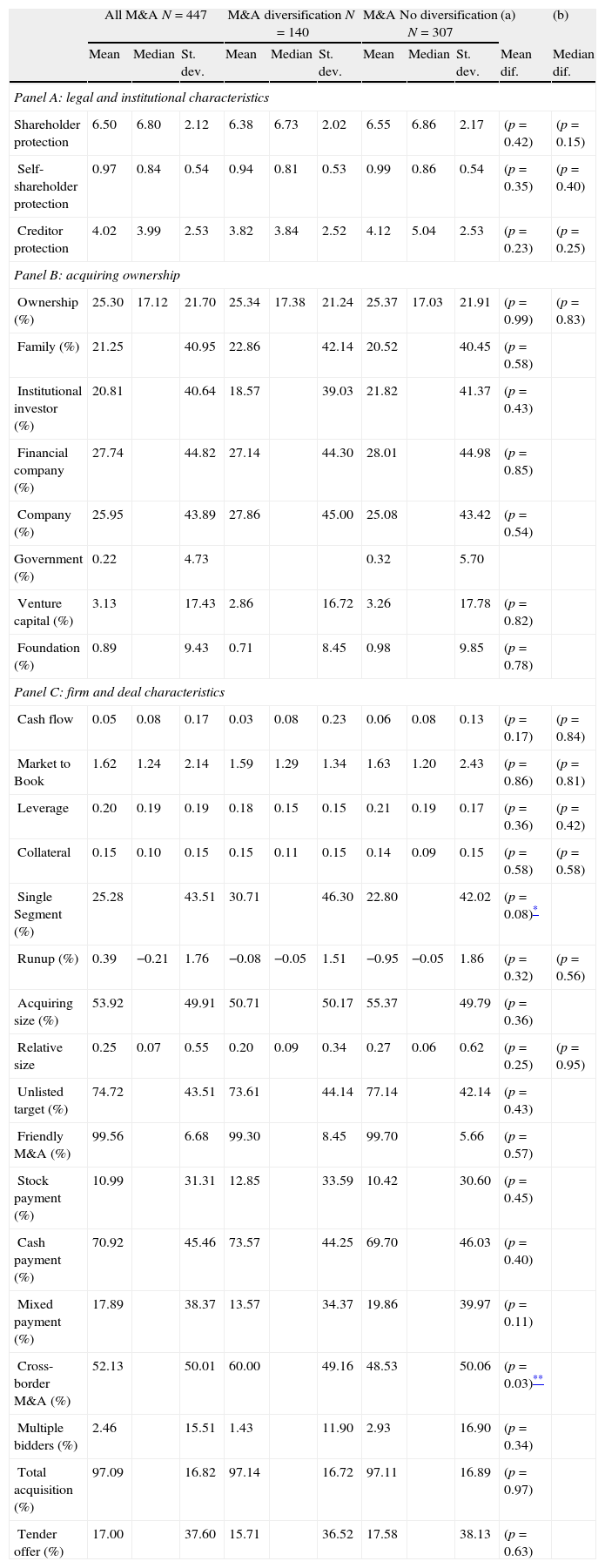

Table 3 summarizes the descriptive statistics of the legal and institutional environment, acquiring ownership structure, and the deal and firm characteristics, distinguishing diversified and non-diversified M&As. We observe that there are more diversified M&As when the acquiring firms are in a single segment, than when acquiring firm is already diversified before the M&A. This difference is statistically significant. This result indicates that single segment firms prefer to enter a new business when they make an M&A (Lin and Su, 2008). Also, acquiring firms make more diversified M&As outside of the host country. The cross-border M&As in unrelated business represent 58.74% of the cross-border deals, being 48.72% in related business. This difference is statistically significant. This result agrees with the complementary of industrial and global diversification (Denis et al., 2002).

Descriptive statistics.

| All M&A N=447 | M&A diversification N=140 | M&A No diversification N=307 | (a) | (b) | |||||||

| Mean | Median | St. dev. | Mean | Median | St. dev. | Mean | Median | St. dev. | Mean dif. | Median dif. | |

| Panel A: legal and institutional characteristics | |||||||||||

| Shareholder protection | 6.50 | 6.80 | 2.12 | 6.38 | 6.73 | 2.02 | 6.55 | 6.86 | 2.17 | (p=0.42) | (p=0.15) |

| Self- shareholder protection | 0.97 | 0.84 | 0.54 | 0.94 | 0.81 | 0.53 | 0.99 | 0.86 | 0.54 | (p=0.35) | (p=0.40) |

| Creditor protection | 4.02 | 3.99 | 2.53 | 3.82 | 3.84 | 2.52 | 4.12 | 5.04 | 2.53 | (p=0.23) | (p=0.25) |

| Panel B: acquiring ownership | |||||||||||

| Ownership (%) | 25.30 | 17.12 | 21.70 | 25.34 | 17.38 | 21.24 | 25.37 | 17.03 | 21.91 | (p=0.99) | (p=0.83) |

| Family (%) | 21.25 | 40.95 | 22.86 | 42.14 | 20.52 | 40.45 | (p=0.58) | ||||

| Institutional investor (%) | 20.81 | 40.64 | 18.57 | 39.03 | 21.82 | 41.37 | (p=0.43) | ||||

| Financial company (%) | 27.74 | 44.82 | 27.14 | 44.30 | 28.01 | 44.98 | (p=0.85) | ||||

| Company (%) | 25.95 | 43.89 | 27.86 | 45.00 | 25.08 | 43.42 | (p=0.54) | ||||

| Government (%) | 0.22 | 4.73 | 0.32 | 5.70 | |||||||

| Venture capital (%) | 3.13 | 17.43 | 2.86 | 16.72 | 3.26 | 17.78 | (p=0.82) | ||||

| Foundation (%) | 0.89 | 9.43 | 0.71 | 8.45 | 0.98 | 9.85 | (p=0.78) | ||||

| Panel C: firm and deal characteristics | |||||||||||

| Cash flow | 0.05 | 0.08 | 0.17 | 0.03 | 0.08 | 0.23 | 0.06 | 0.08 | 0.13 | (p=0.17) | (p=0.84) |

| Market to Book | 1.62 | 1.24 | 2.14 | 1.59 | 1.29 | 1.34 | 1.63 | 1.20 | 2.43 | (p=0.86) | (p=0.81) |

| Leverage | 0.20 | 0.19 | 0.19 | 0.18 | 0.15 | 0.15 | 0.21 | 0.19 | 0.17 | (p=0.36) | (p=0.42) |

| Collateral | 0.15 | 0.10 | 0.15 | 0.15 | 0.11 | 0.15 | 0.14 | 0.09 | 0.15 | (p=0.58) | (p=0.58) |

| Single Segment (%) | 25.28 | 43.51 | 30.71 | 46.30 | 22.80 | 42.02 | (p=0.08)* | ||||

| Runup (%) | 0.39 | −0.21 | 1.76 | −0.08 | −0.05 | 1.51 | −0.95 | −0.05 | 1.86 | (p=0.32) | (p=0.56) |

| Acquiring size (%) | 53.92 | 49.91 | 50.71 | 50.17 | 55.37 | 49.79 | (p=0.36) | ||||

| Relative size | 0.25 | 0.07 | 0.55 | 0.20 | 0.09 | 0.34 | 0.27 | 0.06 | 0.62 | (p=0.25) | (p=0.95) |

| Unlisted target (%) | 74.72 | 43.51 | 73.61 | 44.14 | 77.14 | 42.14 | (p=0.43) | ||||

| Friendly M&A (%) | 99.56 | 6.68 | 99.30 | 8.45 | 99.70 | 5.66 | (p=0.57) | ||||

| Stock payment (%) | 10.99 | 31.31 | 12.85 | 33.59 | 10.42 | 30.60 | (p=0.45) | ||||

| Cash payment (%) | 70.92 | 45.46 | 73.57 | 44.25 | 69.70 | 46.03 | (p=0.40) | ||||

| Mixed payment (%) | 17.89 | 38.37 | 13.57 | 34.37 | 19.86 | 39.97 | (p=0.11) | ||||

| Cross-border M&A (%) | 52.13 | 50.01 | 60.00 | 49.16 | 48.53 | 50.06 | (p=0.03)** | ||||

| Multiple bidders (%) | 2.46 | 15.51 | 1.43 | 11.90 | 2.93 | 16.90 | (p=0.34) | ||||

| Total acquisition (%) | 97.09 | 16.82 | 97.14 | 16.72 | 97.11 | 16.89 | (p=0.97) | ||||

| Tender offer (%) | 17.00 | 37.60 | 15.71 | 36.52 | 17.58 | 38.13 | (p=0.63) | ||||

Sample of 447 M&A announcements by European listed firms, target firms being listed and non-listed firms worldwide, for completed transactions between 2002 and 2007.

In this section, we examine the acquiring shareholder valuation of M&A announcements, following the event study methodology.

We obtain the M&A announcement dates from Thomson One Banker and Lexis Nexis. We calculate the abnormal return for each announcement (AR) in the event window (−20, +20) as the difference between daily returns and expected returns, estimated in the period (−200, −21) before the announcement date, according to the market model. Datastream provides the daily return index for each firm, adjusted by dividends and splits. We follow the method of Dodd and Warner (1983), as well as Corrado (1989) for small sample sizes, in order to verify significant daily abnormal returns (AR) and cumulative abnormal returns (CAR), around the M&A announcement.

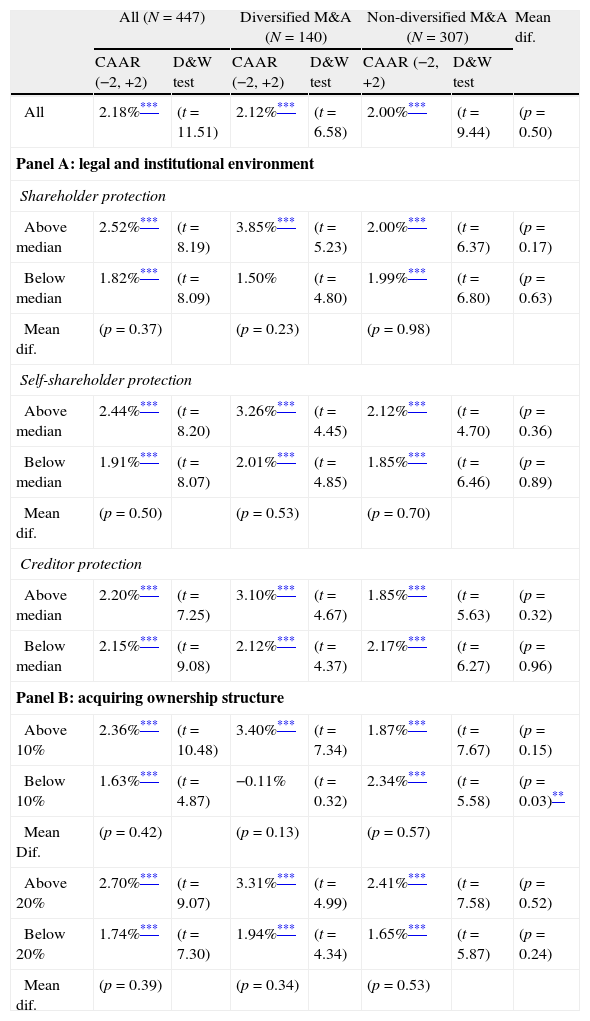

Table 4 shows the cumulative average abnormal return (CAAR) for acquiring-firm shareholders around the announcement of the M&A, comparing diversified and non-diversified deals. The abnormal return for bidder firm shareholders on the day of the merger or acquisition transaction announcement (t=0) is 0.93% for the entire set of firms. The CAAR for the whole sample is 2.13%, in the interval (−2, +2), and statistically significant. Therefore, acquiring-firm shareholder valuation of M&A announcement is positive for the entire set of public firms in Europe. There are no significant differences in the CAAR between diversified and non-diversified deals.

Cumulative average abnormal return (CAAR) for the acquiring firm around the M&A announcement.

| All (N=447) | Diversified M&A (N=140) | Non-diversified M&A (N=307) | Mean dif. | ||||

| CAAR (−2, +2) | D&W test | CAAR (−2, +2) | D&W test | CAAR (−2, +2) | D&W test | ||

| All | 2.18%*** | (t=11.51) | 2.12%*** | (t=6.58) | 2.00%*** | (t=9.44) | (p=0.50) |

| Panel A: legal and institutional environment | |||||||

| Shareholder protection | |||||||

| Above median | 2.52%*** | (t=8.19) | 3.85%*** | (t=5.23) | 2.00%*** | (t=6.37) | (p=0.17) |

| Below median | 1.82%*** | (t=8.09) | 1.50% | (t=4.80) | 1.99%*** | (t=6.80) | (p=0.63) |

| Mean dif. | (p=0.37) | (p=0.23) | (p=0.98) | ||||

| Self-shareholder protection | |||||||

| Above median | 2.44%*** | (t=8.20) | 3.26%*** | (t=4.45) | 2.12%*** | (t=4.70) | (p=0.36) |

| Below median | 1.91%*** | (t=8.07) | 2.01%*** | (t=4.85) | 1.85%*** | (t=6.46) | (p=0.89) |

| Mean dif. | (p=0.50) | (p=0.53) | (p=0.70) | ||||

| Creditor protection | |||||||

| Above median | 2.20%*** | (t=7.25) | 3.10%*** | (t=4.67) | 1.85%*** | (t=5.63) | (p=0.32) |

| Below median | 2.15%*** | (t=9.08) | 2.12%*** | (t=4.37) | 2.17%*** | (t=6.27) | (p=0.96) |

| Panel B: acquiring ownership structure | |||||||

| Above 10% | 2.36%*** | (t=10.48) | 3.40%*** | (t=7.34) | 1.87%*** | (t=7.67) | (p=0.15) |

| Below 10% | 1.63%*** | (t=4.87) | −0.11% | (t=0.32) | 2.34%*** | (t=5.58) | (p=0.03)** |

| Mean Dif. | (p=0.42) | (p=0.13) | (p=0.57) | ||||

| Above 20% | 2.70%*** | (t=9.07) | 3.31%*** | (t=4.99) | 2.41%*** | (t=7.58) | (p=0.52) |

| Below 20% | 1.74%*** | (t=7.30) | 1.94%*** | (t=4.34) | 1.65%*** | (t=5.87) | (p=0.24) |

| Mean dif. | (p=0.39) | (p=0.34) | (p=0.53) | ||||

Sample includes 447 M&A deals announced by European listed firms (2002–2007). We distinguish: 140 diversified M&As and 307 non-diversified M&As. Dodd and Warner T-test (1983) and the Corrado non-parametric test (1989) in parentheses.

We also divide the sample into two-subsample according to the legal and institutional environment and acquiring ownership structure.

We consider that a firm belongs to a country with strong (weak) legal and institutional environment when the index of this country used to proxy the quality of the legal and institutional environment is above (or below) the median of the sample. We consider the following indexes: (i) Shareholder protection, which is calculated multiplying the revised anti-director index calculated for 2003 (Djankov et al., 2008) by a measure of the legal efficiency (rule of law, which rates the law-and-order tradition, Kaufmann et al., 2007), following Rossi and Volpin (2004). The revised anti-director index in Djankov et al. (2008) covers 72 countries and addresses some of the concerns about the ambiguity in the definition of the index components and the mistakes in coding. (ii) We also use the anti-self dealing index to proxy the minority shareholder protection tunneling risk by the large shareholders, defined by Djankov et al. (2008). This variable is named Self-shareholder protection. (iii) Creditor protection, which multiplies the creditor rights index calculated for 2003 defined by Djankov et al. (2008), a proxy for the possibility of debt financing, by the measure of legal efficiency (rule of law). We do not find significant differences between diversified and non-diversified M&As in different legal and institutional environments.

Regarding the acquiring ownership structure, we classify acquiring firms in above or below 10%, or 20%, of ownership hold by the largest shareholder, following Fauver et al. (2003). We only find significant differences between diversified and non-diversified M&As when the large shareholder of the acquiring firm hold less than 10% of the control rights. The abnormal return is lower for diversified firms (−0.11%) than non-diversified ones (2.34%) when the large shareholder of the acquiring firm hold less than 10% of the control rights. This result shows that lower levels of control rights destroy value in diversified M&As.

3.3Probability of diversified M&AsIn this section, we examine the effect of the legal and institutional environment on the diversification decision in M&As. According to the first hypothesis, we expect a negative influence of the strong legal and institutional environment in the acquiring country on the diversification decision. Agency conflicts and the generation of internal capital markets may favor diversification in countries with less investor protection and less developed capital markets, namely, countries with higher cost of external financing.

Although previous studies analyze the determinants of the diversification decision in the firm (Campa and Kedia, 2002; Villalonga, 2004), however, they do not take into account the effect of the legal and institutional environment on this decision. This paper contributes considering this aspect, that is to say, the possible influence of the legal and institutional characteristics on the diversification decision in M&A deals.

We propose a probit model to analyze if the legal and institutional environment influences the likelihood to undertake a diversified M&A. Firms in countries with a weak legal and institutional environment may prefer to undertake a diversified M&A in order to create an internal capital market, which allows firms to solve their difficulties to access the external capital markets. Besides, the lower investor protection in these countries may encourage managers to undertake diversified M&As, creating empire buildings, increasing the compensation or reducing their risk position (Jensen, 1986; Amihud and Lev, 1999; Jensen and Murphy, 1990; Mock et al., 1990; Scharfstein and Stein, 2000; Aggarwal and Samwick, 2003).

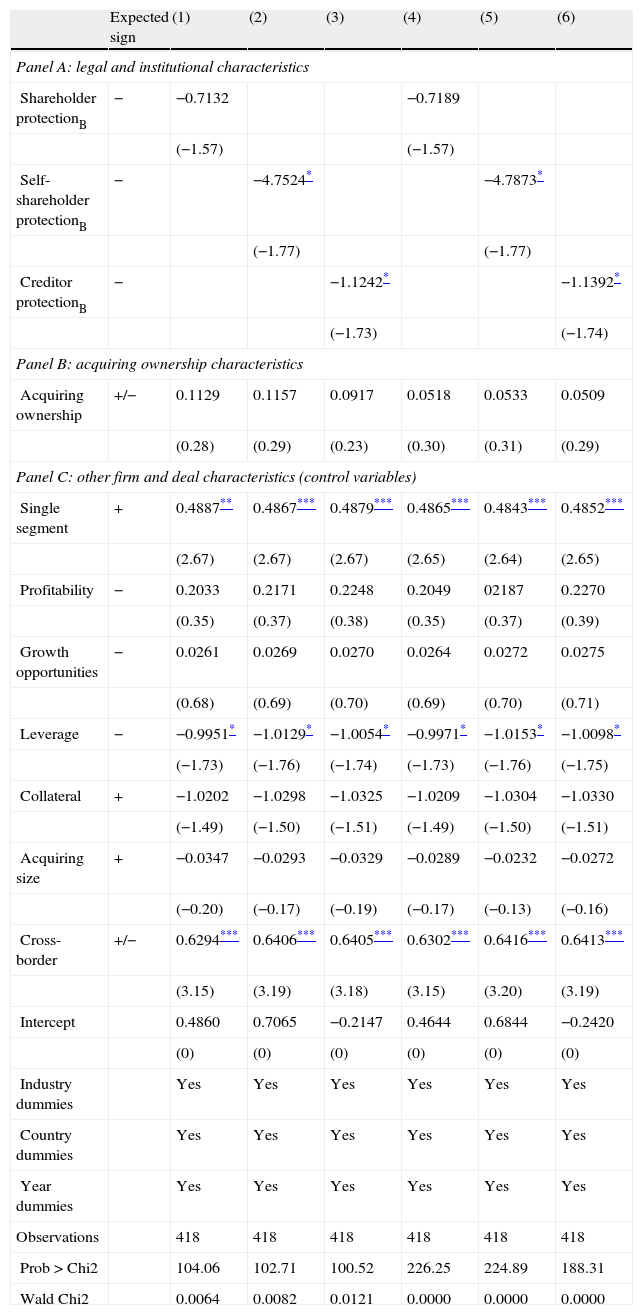

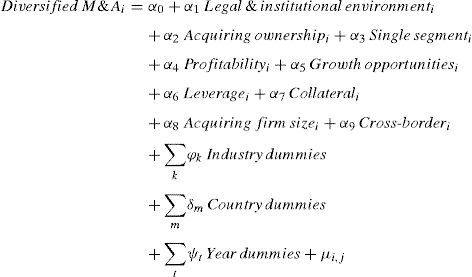

The model to analyze the diversified M&A decision is as follows:

- -

The dependent variable is Diversified M&Asi, a dummy variable which takes the value of 1 when the acquiring firm buys a firm in a new unrelated line of the core business. We consider unrelated business acquisitions when the main line of business for both firms does not have the same first two digits of the industrial SIC code (Berger and Ofek, 1996; Campa and Kedia, 2002, among others). In addition to this, we also check that any non-core business of the acquiring firm is equal to the target business, in order to assure that the acquiring firm enters a new business.

- -

Legal & institutional environmenti is a vector variable which includes the characteristics of the legal and institutional environment of the acquiring firm countries. La Porta et al. (1998), among others, show that the capital market developed is positively correlated with the investor protection and the quality of institutions. We consider alternative measures to proxy the quality of the legal and institutional environment, defined in the previous section: (i) Shareholder protection; (ii) Self-shareholder protection; (iii) Creditor protection. We include these measures alternatively because of their correlation. We expect a negative effect of this variable on the diversified M&A decision, since firms in countries with strong legal and institutional environment have lower cost of external capital (La Porta et al., 1998), so the creation of an internal capital market being less necessary. The asymmetric information and agency problems are also lower, reducing rent-seeking managerial behavior.

- -

Acquiring ownershipi is the percentage of ownership held by the largest shareholder in the acquiring firm. It also represents the percentage of control rights (Source: Amadeus). Alternatively, we include a dummy variable that takes the value 1 when the largest shareholder held more than 20% of the ownership and 0 otherwise. We also identify the identity of the largest shareholders and classify them as: (i) Family, when the largest shareholder is an individual or a family; (ii) Institutional investor, when the largest shareholder is a mutual fund or a pension fund; (iii) Financial company, when the largest shareholder is a bank or another financial entity; (iv) Company, when the largest shareholder is a private or public firm; (v) Governments, when the largest shareholder is a public entity; (vi) Venture capital, when the largest shareholder is a venture capital firm; (vii) Foundation, when the large shareholder is a foundation. Shareholders with high percentage of ownership are expected to undertake more diversified acquisitions, in order to reduce their idiosyncratic risk (Amihud and Lev, 1981). On the contrary, concentrated ownership may provide incentives to monitor managers, reducing the likelihood to undertake diversified M&As that destroy value for shareholders (Lins and Servaes, 1999; Chen and Ho, 2000).

- -

Single Segmenti is a dummy variable, which takes the value of 1 when the acquiring firm is a single segment firm. We expect that firms in a single segment diversify to reduce the firm risk from being in a single business (Lin and Su, 2008). We include this variable as an instrument.

Following previous studies, we also include firm characteristics as possible determinants of M&A diversification decision:

- -

Profitabilityi is defined as the EBITDA over total assets at the end of the year before the announcement. Firms with poor profitability in their industry are more likely to diversify in order to increase their profits through other business. We expect a negative effect of the profitability on the diversification decision (Berger and Ofek, 1995; Campa and Kedia, 2002; Villalonga, 2004a,b; Doukas and Kan, 2008);

- -

Growth opportunitiesi (Market to Book ratio), defined as the ratio of equity market value plus debt book value over the total assets of the acquiring firm (Villalonga, 2004). The growth perspective establishes that firms diversify into unrelated lines of business when they have poor performance and lower internal growth opportunities. In this sense, we expect a negative impact of the growth opportunities on the decision to diversify;

- -

Leveragei, defined as total debt over the total assets. Debt is taken to capture the monitoring effect of external capital market on managers (Jensen, 1986). Bidder with high levels of debt is less likely to undertake unrelated diversified acquisitions motivated by managerial opportunism. Therefore, we expect a negative sign of this variable on the diversification decision.

- -

Collaterali is defined as total tangible assets over the total assets. Firms with more tangible assets prefer to diversify (Morck and Yeung, 1998);

- -

Acquiring firm sizei is defined as having a value of 1 if the firm falls within the first quartile of market capitalization at the end of the semester prior to the transaction announcement (Moeller et al., 2004). Alternatively, we consider the log of the total assets (Berger and Ofek, 1995; Campa and Kedia, 2002; Villalonga, 2004a,b). Higher size provides firms with more resources, increasing their capacity to diversify. Thus, we expect a positive effect of the acquiring firm size on the diversification decision;

- -

Cross-borderi is defined as a dummy variable, which takes the value of 1 if the M&A is cross-border, and zero otherwise. Integration of global economies has changed the relative costs and benefits of industrial and global diversification. Opening markets may increase global diversification. However, global competition may force firms to focus on their core business. Thus, the global diversification may substitute the industrial diversification. Then, we would expect a negative effect of cross-border M&A on the industrial diversification decision. Otherwise, if the global diversification complements the industrial diversification, we would expect a positive sign of this variable (Denis et al., 2002).

We also include industry, country and year dummies to control these fixed effects.

Table 5 shows the results of the probit model estimation, where the dependent variable is the probability of acquiring firms making a diversified M&A. In order to test our first hypothesis, in relation to the influence of the legal and institutional environment on the M&A diversification decision, we include as explanatory variable the legal and institutional characteristics of the acquiring firm country.

The diversification M&A determinants.

| Expected sign | (1) | (2) | (3) | (4) | (5) | (6) | |

| Panel A: legal and institutional characteristics | |||||||

| Shareholder protectionB | − | −0.7132 | −0.7189 | ||||

| (−1.57) | (−1.57) | ||||||

| Self-shareholder protectionB | − | −4.7524* | −4.7873* | ||||

| (−1.77) | (−1.77) | ||||||

| Creditor protectionB | − | −1.1242* | −1.1392* | ||||

| (−1.73) | (−1.74) | ||||||

| Panel B: acquiring ownership characteristics | |||||||

| Acquiring ownership | +/− | 0.1129 | 0.1157 | 0.0917 | 0.0518 | 0.0533 | 0.0509 |

| (0.28) | (0.29) | (0.23) | (0.30) | (0.31) | (0.29) | ||

| Panel C: other firm and deal characteristics (control variables) | |||||||

| Single segment | + | 0.4887** | 0.4867*** | 0.4879*** | 0.4865*** | 0.4843*** | 0.4852*** |

| (2.67) | (2.67) | (2.67) | (2.65) | (2.64) | (2.65) | ||

| Profitability | − | 0.2033 | 0.2171 | 0.2248 | 0.2049 | 02187 | 0.2270 |

| (0.35) | (0.37) | (0.38) | (0.35) | (0.37) | (0.39) | ||

| Growth opportunities | − | 0.0261 | 0.0269 | 0.0270 | 0.0264 | 0.0272 | 0.0275 |

| (0.68) | (0.69) | (0.70) | (0.69) | (0.70) | (0.71) | ||

| Leverage | − | −0.9951* | −1.0129* | −1.0054* | −0.9971* | −1.0153* | −1.0098* |

| (−1.73) | (−1.76) | (−1.74) | (−1.73) | (−1.76) | (−1.75) | ||

| Collateral | + | −1.0202 | −1.0298 | −1.0325 | −1.0209 | −1.0304 | −1.0330 |

| (−1.49) | (−1.50) | (−1.51) | (−1.49) | (−1.50) | (−1.51) | ||

| Acquiring size | + | −0.0347 | −0.0293 | −0.0329 | −0.0289 | −0.0232 | −0.0272 |

| (−0.20) | (−0.17) | (−0.19) | (−0.17) | (−0.13) | (−0.16) | ||

| Cross-border | +/− | 0.6294*** | 0.6406*** | 0.6405*** | 0.6302*** | 0.6416*** | 0.6413*** |

| (3.15) | (3.19) | (3.18) | (3.15) | (3.20) | (3.19) | ||

| Intercept | 0.4860 | 0.7065 | −0.2147 | 0.4644 | 0.6844 | −0.2420 | |

| (0) | (0) | (0) | (0) | (0) | (0) | ||

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | |

| Country dummies | Yes | Yes | Yes | Yes | Yes | Yes | |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | |

| Observations | 418 | 418 | 418 | 418 | 418 | 418 | |

| Prob>Chi2 | 104.06 | 102.71 | 100.52 | 226.25 | 224.89 | 188.31 | |

| Wald Chi2 | 0.0064 | 0.0082 | 0.0121 | 0.0000 | 0.0000 | 0.0000 | |

Sample includes 447 M&A deals announced by European listed firms (2002–2007). Dependent variable: the probability that an acquiring firm buy a firm in an unrelated business (different first two-digit SIC code following Berger and Ofek (1995, 1996)). Explanatory variables: legal and institutional environment, acquiring ownership structure firm, and firm and transaction characteristics as control variables. T-statistics in parentheses below the coefficients are based on robust estimation of standard errors.

Models 2 and 3 show that strong minority shareholder protection and creditor protection in the bidder firm country has a negative influence on the M&A diversification decision. This result supports our first hypothesis about the higher likelihood of undertaking diversified M&As when the country is characterized by lower investor protection, and less developed capital markets. These legal and institutional characteristics increase the costs of external funds, the asymmetric information, and agency problems for acquiring firms.

As regards the firm and transaction characteristics, firms in a single segment influence the M&A diversification decision positively. These firms are more likely to enter a new business to reduce firm risk (Lin and Su, 2008). More leverage reduces the probability of buying a firm in another industry. This result is in accordance with leverage effect reducing agency conflicts. Cross-border M&A is also positively related to the M&A diversification decision, in agreement with the utility of international diversification to promote product diversification. This result is in line with Denis et al. (2002). Then, the industrial diversification and the global diversification seem to be complementary rather than substitutive.

In non-reported models we repeat the estimations including the identity of the largest shareholder. The results indicate that the identity of the largest shareholder does not influence the diversified M&A decision.

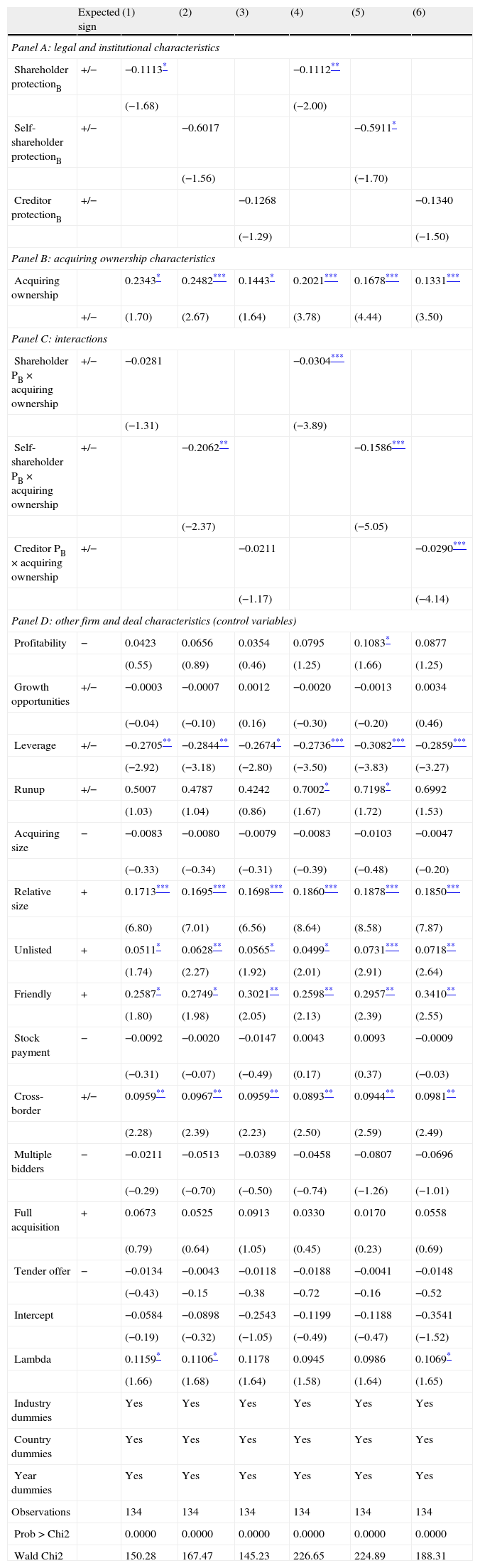

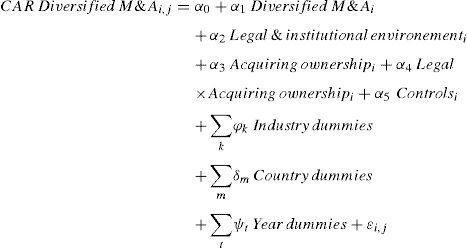

3.4Acquiring-firm shareholders’ performanceNow, we focus on the analysis of the acquiring shareholder valuation determinants, controlling the possible endogenity of the diversification decision. We also analyze if the diversification effect on acquiring shareholder valuation vary depending on the acquiring ownership structure and the legal and institutional environment. We include other transaction and firm characteristics as control variables.

The analysis of the endogeneity problem requires to identify variables that affect the M&A diversification decision while being uncorrelated with firm value. In order to control the possible diversification endogeneity, we use the probability of diversifying as an instrument for diversified status, when evaluating the effect on the acquiring shareholder valuation. We follow the Heckman's two-stages least squares methodology (2SLS) to analyze the determinants of the acquiring shareholder valuation when firms undertake a diversified M&A (Heckman, 1979).

The specification of the model to test the hypotheses is as follows:

The dependent variable is the cumulative abnormal return (CARi), estimated 5 days (−2, +2) around the announcement date.

The explanatory variables are the following ones:

- -

Legal & institutional environmenti is a vector variable which includes the characteristics of the legal and institutional environment of the acquiring firms. We use the same variables defined in Section 3.2, which are: (i) Shareholder protection; (ii) Self-shareholder protection; (iii) Creditor protection. More investor protection and capital market development may reduce the managerial opportunism when they undertake strategic decisions, such as M&As. Therefore, the acquiring shareholder valuation, associated with less asymmetric information and agency problems in countries with strong legal and institutional environment, will be positive. However, strong legal and institutional environments may reduce the benefits of the diversification decision. In this case, the acquiring shareholder valuation will be negative. This variable allows us to test if the diversification effect varies depending on the legal and institutional environment, as we established in Hypothesis 2.

- -

Acquiring ownershipi is the percentage of ownership held by the largest shareholders in the acquiring firm (defined in the previous section). This percentage also represents the control rights held (Source: Amadeus). We identify the identity of the largest shareholder, classified as: (i) Family; (ii) Institutional investor; (iii) Financial company; (iv) Company; (v) Government; (vi) Venture capital; (vii) Foundation. The largest shareholders may prefer to diversify in order to reduce their risk, though it destroys value for minority shareholders. On the contrary, firms with high level of ownership may have less agency problems, and they may avoid undertaking diversified M&As, which destroy value for shareholders.

- -

Legal & institutional environment×Acquiring ownershipi is the interaction term between the legal and institutional environment and acquiring ownership variable. Large shareholders may prefer to diversify in order to reduce their risk, though it destroys value for minority shareholders. On the contrary, firms with high level of ownership may have less agency problems, and they may avoid undertaking diversified M&As, which destroy value for shareholders. The effect of the ownership concentration may be more intense in countries with a weak legal and institutional environment due to less investor protection.

- -

Controlsi is a vector variable which incorporates both firms’ and transaction characteristics that previous studies consider. It includes the following variables:

- •

Profitability, defined as Ebitda between total acquiring firm assets, which proxies the managerial opportunism. Jensen (1986) free cash flow hypothesis predicts that managers at firms with more free cash flow have more resources to engage in empire building acquisitions. We expect a negative effect of the profitability on the acquiring return;

- •

Growth opportunities (Market to Book ratio), defined as the ratio of the equity market value plus debt book value over the acquiring firm total assets. The expected effect of this variable is ambiguous, since higher market-to-book may proxy more acquiring firm growth opportunities, or that they are overvalued (Moeller et al., 2004);

- •

Leverage, defined as total debt over the total assets. Higher debt levels act as a corporate governance mechanism, given that it reduces the future free cash flow, and limits the managerial discretion (Masulis et al., 2007; Martynova and Renneboog, 2011). Otherwise, high leverage may reduce the growth opportunities of the firm (Denis et al., 2002);

- •

Runup, as the CAAR of the acquiring firm 40 days before the deal, in the interval (−60, −2), in order to control information leakage. Part of the valuation effect of takeovers could be already incorporated in the stock price prior to the M&A announcement (Martynova and Renneboog, 2011);

- •

Acquiring firm size, which has a value of 1 if the firm falls within the first quartile of market capitalization, at the end of the semester prior to the transaction announcement, and 0 otherwise. Alternatively, we consider the log total assets at the end of the year before the deal. We expect that large firms have more agency problems, which favor worse acquisitions than their smaller counterparts (Roll, 1986);

- •

Relative size of the target firm, calculated as the logarithm of the transaction value divided by acquiring firm market value four days before the transaction. Higher size of the target firm may reduce the asymmetric information, although it may provoke more integration costs (Asquith et al., 1983; Aggarwal et al., 1992). Therefore, the expected effect is not clear;

- •

Target firm unlisted, which has a value of 1 if the target firm is not listed on the stock market, and 0 otherwise. Listed target firms may increase the M&A cost, because more bid competition, in comparison with unlisted firm bids, is expected. This higher competition is also associated with the free-rider problem in target firms (Grossman and Hart, 1980). Therefore we expect a positive impact of this variable on the acquiring return;

- •

Acquirer attitude regarding the takeover, which has a value of 1 if it is friendly, and 0 when it is hostile. Hostile takeovers may raise the price paid in an M&A. A negative bidder shareholder valuation is expected in hostile deals (Campa and Hernando, 2004);

- •

Method of payment, which has a value of 1 if financing is exclusively in stocks, and 0 otherwise. Managers may prefer to pay with stocks when the firm is overvalued. We expect a negative effect associated with this overvaluation signal (Myers and Majluf, 1984);

- •

Cross-borderi is defined as a dummy variable if the bidder and the target firm country are different. We expect an ambiguous effect. The internationalization perspective predicts a positive return from cross-border acquisitions, associated with gains from geographical diversification when firms seek synergies from their intangible assets (Eun et al., 1996). However, other studies consider a negative effect on return for cross-border acquisitions, due to more asymmetric information problems valuing foreign targets (Moeller and Shilingemann, 2005);

- •

Multiple bidders, which is a dummy variable that equals 1 when there are many bidders. We expect a negative effect associated with more competition in the bid (Moeller et al., 2004), because the “winner” bidder firm may have to pay a higher price for the target firm;

- •

Full acquisition, which is a dummy variable that equals 1 if the bidder fully acquires the target and hence holds a hundred percentage of the share capital after completion of the deal, and equals zero otherwise. The full acquisition limits the use of acquisitions to transfer wealth from the target's minority shareholders to themselves (La Porta et al., 1999; Martynova and Renneboog, 2011). Therefore, a positive effect on the bidder shareholder is expected;

- •

Tender offer, which is equal to 1 if the bid is a tender offer. We expect a negative effect associated with the reluctance of managers to sell the firm (Moeller et al., 2004).

- •

We also include industry, country and year dummies to control these fixed effects.

Once we estimated diversified M&A determinants (Section 3.3), Table 6 presents the estimations of acquiring shareholder valuation determinants.

Effect of diversification on acquiring-firm return.

| Expected sign | (1) | (2) | (3) | (4) | (5) | (6) | |

| Panel A: legal and institutional characteristics | |||||||

| Shareholder protectionB | +/− | −0.1113* | −0.1112** | ||||

| (−1.68) | (−2.00) | ||||||

| Self-shareholder protectionB | +/− | −0.6017 | −0.5911* | ||||

| (−1.56) | (−1.70) | ||||||

| Creditor protectionB | +/− | −0.1268 | −0.1340 | ||||

| (−1.29) | (−1.50) | ||||||

| Panel B: acquiring ownership characteristics | |||||||

| Acquiring ownership | 0.2343* | 0.2482*** | 0.1443* | 0.2021*** | 0.1678*** | 0.1331*** | |

| +/− | (1.70) | (2.67) | (1.64) | (3.78) | (4.44) | (3.50) | |

| Panel C: interactions | |||||||

| Shareholder PB×acquiring ownership | +/− | −0.0281 | −0.0304*** | ||||

| (−1.31) | (−3.89) | ||||||

| Self-shareholder PB×acquiring ownership | +/− | −0.2062** | −0.1586*** | ||||

| (−2.37) | (−5.05) | ||||||

| Creditor PB×acquiring ownership | +/− | −0.0211 | −0.0290*** | ||||

| (−1.17) | (−4.14) | ||||||

| Panel D: other firm and deal characteristics (control variables) | |||||||

| Profitability | − | 0.0423 | 0.0656 | 0.0354 | 0.0795 | 0.1083* | 0.0877 |

| (0.55) | (0.89) | (0.46) | (1.25) | (1.66) | (1.25) | ||

| Growth opportunities | +/− | −0.0003 | −0.0007 | 0.0012 | −0.0020 | −0.0013 | 0.0034 |

| (−0.04) | (−0.10) | (0.16) | (−0.30) | (−0.20) | (0.46) | ||

| Leverage | +/− | −0.2705** | −0.2844** | −0.2674* | −0.2736*** | −0.3082*** | −0.2859*** |

| (−2.92) | (−3.18) | (−2.80) | (−3.50) | (−3.83) | (−3.27) | ||

| Runup | +/− | 0.5007 | 0.4787 | 0.4242 | 0.7002* | 0.7198* | 0.6992 |

| (1.03) | (1.04) | (0.86) | (1.67) | (1.72) | (1.53) | ||

| Acquiring size | − | −0.0083 | −0.0080 | −0.0079 | −0.0083 | −0.0103 | −0.0047 |

| (−0.33) | (−0.34) | (−0.31) | (−0.39) | (−0.48) | (−0.20) | ||

| Relative size | + | 0.1713*** | 0.1695*** | 0.1698*** | 0.1860*** | 0.1878*** | 0.1850*** |

| (6.80) | (7.01) | (6.56) | (8.64) | (8.58) | (7.87) | ||

| Unlisted | + | 0.0511* | 0.0628** | 0.0565* | 0.0499* | 0.0731*** | 0.0718** |

| (1.74) | (2.27) | (1.92) | (2.01) | (2.91) | (2.64) | ||

| Friendly | + | 0.2587* | 0.2749* | 0.3021** | 0.2598** | 0.2957** | 0.3410** |

| (1.80) | (1.98) | (2.05) | (2.13) | (2.39) | (2.55) | ||

| Stock payment | − | −0.0092 | −0.0020 | −0.0147 | 0.0043 | 0.0093 | −0.0009 |

| (−0.31) | (−0.07) | (−0.49) | (0.17) | (0.37) | (−0.03) | ||

| Cross-border | +/− | 0.0959** | 0.0967** | 0.0959** | 0.0893** | 0.0944** | 0.0981** |

| (2.28) | (2.39) | (2.23) | (2.50) | (2.59) | (2.49) | ||

| Multiple bidders | − | −0.0211 | −0.0513 | −0.0389 | −0.0458 | −0.0807 | −0.0696 |

| (−0.29) | (−0.70) | (−0.50) | (−0.74) | (−1.26) | (−1.01) | ||

| Full acquisition | + | 0.0673 | 0.0525 | 0.0913 | 0.0330 | 0.0170 | 0.0558 |

| (0.79) | (0.64) | (1.05) | (0.45) | (0.23) | (0.69) | ||

| Tender offer | − | −0.0134 | −0.0043 | −0.0118 | −0.0188 | −0.0041 | −0.0148 |

| (−0.43) | −0.15 | −0.38 | −0.72 | −0.16 | −0.52 | ||

| Intercept | −0.0584 | −0.0898 | −0.2543 | −0.1199 | −0.1188 | −0.3541 | |

| (−0.19) | (−0.32) | (−1.05) | (−0.49) | (−0.47) | (−1.52) | ||

| Lambda | 0.1159* | 0.1106* | 0.1178 | 0.0945 | 0.0986 | 0.1069* | |

| (1.66) | (1.68) | (1.64) | (1.58) | (1.64) | (1.65) | ||

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | |

| Country dummies | Yes | Yes | Yes | Yes | Yes | Yes | |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | |

| Observations | 134 | 134 | 134 | 134 | 134 | 134 | |

| Prob>Chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | |

| Wald Chi2 | 150.28 | 167.47 | 145.23 | 226.65 | 224.89 | 188.31 | |

Sample includes 447 M&A deals announced by European listed firms (2002–2007). Dependent variable: bidder cumulative abnormal returns from 2 days before to 2 days after the diversified M&A announcement. Explanatory variables: legal and institutional environment, acquiring ownership structure, and firm and transaction characteristics as control variables. T-statistics in parentheses below the coefficients are based on robust estimation of standard errors.

In order to test Hypotheses 2 and 3, about the influence of the weak legal and institutional environment on the diversified M&A valuation when firms have concentrated ownership structure, we include the interaction terms between the legal and institutional variables and the percentage of ownership concentration hold by the largest shareholder in the regression. Models 1–3 report these results. In models 4–6, we include the interaction term of the legal and institutional environment and acquiring ownership concentration, defined as percentage of ownership when it is more than 20%, to test our Hypothesis 3, in relation to the influence of the high concentrated ownership on diversified M&A valuation.

Acquiring shareholders value diversified M&As positively if the acquiring firm has high levels of ownership concentration. These results do support the argument about that the concentrated ownership reduces the agency conflicts. The valuation of diversified M&As is negative when the firm has high levels of ownership and is in a country with a strong legal and institutional environment. These results are in line with the benefits of the internal capital markets in countries with lower investor protection and less developed capital markets. Therefore, the benefits of the internal capital markets are higher in countries with weak legal and institutional environments.

4ConclusionThe discussion about whether or not the firm diversification creates or destroys value has been controversial in the financial literature. The studies analyze the advantages and the costs of diversification decision for firms. The majority of empirical evidence states that diversification decision destroys firms’ value because of the high agency costs for these firms (Lang and Stulz, 1994; Berger and Ofek, 1995; Servaes, 1996, among others). Others consider the diversification to be an endogenous decision, and they argue that the effect of this decision on the firm value is capturing other firms characteristics (Campa and Kedia, 2002; Graham et al., 2001; Villalonga, 2004b). Regarding the diversification advantages, other studies show that the internal capital market generated increases the diversified firms’ value (Khanna and Palepu, 1997, 2000; Chang and Hong, 2002).

Taking a sample of 447 M&As announced by European acquiring firms over the period 2002–2007, we examine the influence of the legal and institutional environment on the diversification decision in M&As and the acquiring shareholder valuation of this decision. The legal and institutional environment may be a determinant of the diversification decision, given that the cost of external capital markets, the agency problems and asymmetric information may vary across countries. Besides, the acquiring shareholders’ valuation of the diversified M&A decision may also vary depending on the legal and institutional environment. In addition, we examine if the acquiring ownership structure influences both diversified M&A decision and its valuation by acquiring shareholders. Large shareholders may prefer diversified M&As in order to get risk reduction, though it destroys value for minority shareholders.

We find that European firms prefer to undertake acquisitions in unrelated business when they belong to countries with weak legal and institutional environments. This result agrees with that firms diversify to create internal capital markets when the external capital markets are costly. We do not find evidence about the influence of the acquiring ownership structure on this decision. More leverage in the acquiring firm increases the managerial monitor, and it may reduce the incentive to acquire firms in unrelated businesses. Single segment firms tend to acquire firms in different industries to diversify risk. We also observe that the geographical diversification complements the industrial diversification.

After controlling the endogeneity of the diversification decision, we observe that a strong legal and institutional environment in the acquiring country influences the acquiring shareholders valuation in diversified M&As negatively. These results indicate that the benefits of the diversification overcome the costs in countries with weak legal and institutional environment. This result supports the transaction cost theory. Our results are in line with Campa and Kedia (2002), Graham et al. (2001) and Villalonga (2004), when they indicate that the endogenity of the diversification decision may explain the controversial results of previous studies. We also find that the agency costs effect exists, but it is dominated by the internal capital markets goal, in firms with concentrated ownership structures.

We thank participants at the International Risk Management Conference in Amsterdam (2011), the International Finance and Banking Society Conference (IFABS) in Rome (2011), and the ACEDE Conference in Barcelona (2011) for their helpful comments and suggestions. Financial support from the Spanish Science and Innovation Ministry (MICINN-09-ECO2009-11758) is gratefully acknowledged. Isabel Feito also acknowledges the financial support of the Fundación para el Fomento en Asturias de la Investigación Científica Aplicada y la Tecnología (FICYT).