This study employs resource advantage theory to identify how beef cattle value chain actors’ resources are translated into the positional advantage and how that then affects their financial performance in an emerging country context. The study tested was designed to understand if: (1) the resources of beef cattle value chain actors are positively related to positional advantage; and (2) positional advantage is positively related to the financial performance of the actors within the value chain. The unit of analysis in this study is a single beef cattle value chain. One hundred and ninety value chain actors were interviewed and the findings appear to indicate that chain actors’ resources are an antecedent to positional advantage in the marketplace and that this market advantage is an antecedent to the superior financial performance of beef cattle value chain.

Este estudio emplea la teoría de la ventaja de recursos para identificar cómo los recursos de los actores de la cadena de valor del ganado vacuno se traducen en la ventaja posicional y cómo afecta entonces su desempeño financiero en el contexto de un país emergente. El estudio probado fue diseñado para comprender si: (1) los recursos de los actores de la cadena de valor del ganado vacuno están positivamente relacionados con la ventaja posicional; Y (2) la ventaja posicional está positivamente relacionada con el desempeño financiero de los actores dentro de la cadena de valor. La unidad de análisis en este estudio es una sola cadena de valor de ganado vacuno. Se entrevistaron a ciento noventa actores de la cadena de valor y los hallazgos parecen indicar que los recursos de los actores de la cadena son antecedentes de la ventaja posicional en el mercado y que estas ventajas de mercado son antecedentes del desempeño financiero superior de la cadena de valor del ganado vacuno.

Positional advantage is gained by exploiting resources and capabilities to create superior performance (Day & Wensley, 1988). Positional advantage mediates the affiliation between competitive advantage and venture performance (Martin, Javalgi, & Cavusgil, 2016); and between market orientation and new product performance (Hao, Guo, Wang, & Saran, 2014). The construct of positional advantage, gained by a superior market orientation, and the capacity to learn about, innovate and exploit entrepreneurial opportunities positively affects business performance (Hult & Ketchen, 2001; Hunt & Lambe, 2000; Micheels & Gow, 2012). Research on positional advantage in agribusinesses in transitional nations and emerging economies is scant (Micheels & Gow, 2012). Ellis (2005) identified this research gap when he suggested that it would be useful to conduct market orientation and positional advantage studies in transitional developing countries,1 where firms engage in marketing research to offer better prices, delivery times, and customer services compared to rivals to achieve the better performance in the marketplace. Further, Bathgate, Omar, Nwankwo, and Zhang (2006) and Sheth (2011) have questioned the application of the market orientation concept in transitional and developing economies. Notwithstanding, a substantial body of research reveals the relationship between resource, positional advantage and business performance in agricultural production (Grunert et al., 2005; Johnson, Dibrell, & Hansen, 2009; Ross & Westgren, 2009), but there has been a lack of empirical application of resource advantage theory in agribusiness research.

Vietnam in 1986 transitioned from a centrally-planned to a market-driven economy where open market trade policies have greatly increased competitive pressures in the marketplace (Beresford, 2008). The competition occurs between state companies versus private ones and domestic versus imported products. Likewise, Vietnam's recent membership admission to the WTO in 2007 has created both new opportunities for entrepreneurial exporters and threats to firms that had previously prospered in Vietnam's domesticated markets (e.g. for a discussion of domesticated markets see Arndt, 1979). Accordingly, Vietnam provides a suitable context to conduct a study on positional advantage in a transitional economy. Prior to 1986 the sector operated with stable prices and planned production. However, domestic beef farmers now operate in a relatively hostile and dynamic market environment with a high degree of competition and a shortage of profitable opportunities (Covin & Slevin, 1989). Within the economic sectors of Vietnam, beef cattle production is an important industry in the livestock sub-sector occupying 27% of agricultural GDP (Pham, Smith, & Pham, 2015). Indeed, the number of imported cattle to Vietnam increased by 35% from 2007 to 2015 leading to increased competition between domestic and imported beef cattle from neighboring countries and Australia. Therefore, Vietnamese beef cattle production, historically dominated by small-scale production may find it difficult to achieve superior performance.

This paper surveys members of a beef cattle value chain in Vietnam's Central Highlands to examine the translation of value chain actor's resources into positional advantage and financial performance in an emerging country. Using structural equation modeling techniques, the paper estimates a path model to explore how resources are linked to positional advantage and ultimately financial performance. This study attempts to contribute to the literature in two ways. Firstly, there have been few studies employing resource, market orientation, positional advantage and business performance theory in the context of agri-food value chains in a transitional developing country. Secondly, the study contributes to the debate on the relationship between positional advantage and business performance. This paper is structured as follows: firstly, the literature on resource advantage, the capabilities of positional advantage and financial performance is briefly reviewed, and then our theoretical model and hypotheses are presented. The following sections describe the research design including data collection, analysis, and findings. The final two sections discuss our findings and their implications.

Literature reviewThe current Vietnamese beef cattle sectorAgriculture contributes up to 18% Vietnamese GDP, in which beef cattle production contributes up to 27% GDP of agricultural sector, and is a source of livelihood of more than 35% of people in rural area (Pham et al., 2015). The demand of beef consumption has increased during the last two decades because of the rapid growth of population, the development of tourism, and changes in the tastes and preferences of consumers (Karimov et al., 2016). These stimuli are driving demand for beef in Vietnam. However, domestic beef supply does not meet domestic demand (Karimov et al., 2016; Thu, Moritaka, & Fukuda, 2016). Vietnam has about five million head of cattle and its beef production equals around 300,000 tons (Karimov et al., 2016). The cattle production system is characterized by small-scale beef farms, limitations in feed production, nutrition and animal health practices and traditional marketing practices which are inefficient, opportunistic and exploitative. Therefore, domestic beef cattle production only supplies 70% of beef demand. To satisfy this increase in the demand for beef, the Vietnamese Government allows the importation of live cattle, frozen beef cuts, and to a lesser extent, fresh beef from other countries, largely from Australia. For this reason, the competitiveness of beef cattle value chain actors has been a focus for Vietnamese Official Development Assistance in recent years. This research was conducted as part of doctoral studies which formed a component of a much larger Project sponsored by the Australian Centre for International Agricultural Research. The strategy literature indicated that cost leadership and differentiation lead to the sustainability of competitive advantage (Micheels & Gow, 2012). However, a cost leadership strategy may not be useful for beef cattle smallholders in Vietnam, because of institutional and social constraints. Due to the limited land area and fodder availability, the scale of production is approximately five cattle per Vietnamese household (Herold & Zárate, 2010). Differentiation of beef cattle production may provide smallholders and other actors in the value chain the opportunity to profitably create competitive advantage through enhancing product quality (e.g. Karimov et al., 2016; Khanh, Stur, Ha, & Duncan, 2009).

Resource advantage theoryThis study employs resource advantage (hereafter R-A) theory to identify how actors in a beef cattle value chain in an emerging country utilize their assortment of resources to produce positional advantage, which then results in financial performance. R-A theory was developed to advance marketing theory through positing the interaction between resources and the exchange process in competitive markets (Hunt, 2010, 2013, 2015). R-A can be considered as the combination of business strategy when it integrates industry-based, resource-based, competence-based theory and contributing to marketing's literature through the form of market orientation (Hunt & Lambe, 2000). As will be shown, both R-A theory and industry-based theory agree that firm's objective is superior performance which caused by the marketplace position and affected by external factors such as competitors, customers, and suppliers. The R-A viewed that the comparative advantage of resource results in the advantage of position in marketplace, which then enhances the superior financial performance and conversely (Hunt & Morgan, 1997). This point of view under R-A theory supported to Porter's (1991) to explain why firms outperform to others in value chain performance due to the comparative advantage in resources. With regard to resource-based theory, R-A theory agrees that firm's resources, which are heterogeneity and imperfect mobility, enable to effectively and efficiently produce offering product to market segments (Barney, 1991, 2001; Hunt & Lambe, 2000; Hunt & Morgan, 1997). Both competence-based theory and R-A theory stated that competition is disequilibrium provoking and organizational learning essential to organizational competence, which can create and leverage new knowledge within and across organizations (Hunt, 2000; Hunt & Lambe, 2000).

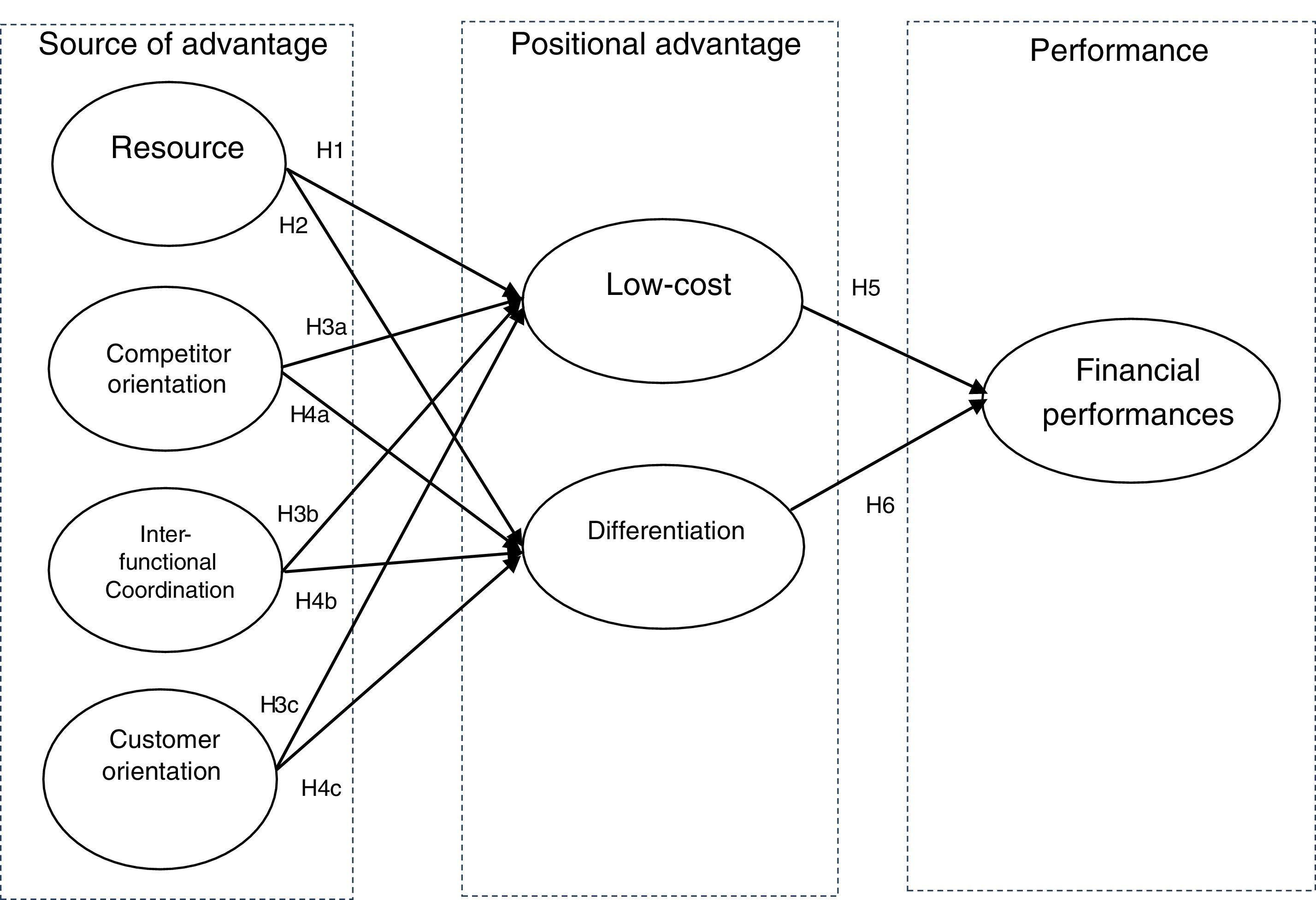

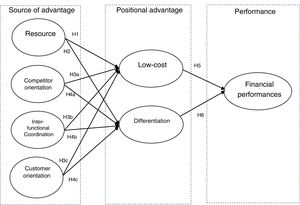

The theoretical framework (Fig. 1) in this paper is modified from “a schematic of the R-A theory of competition” developed by Hunt (1995, p. 318). R-A theory concentrates on the importance of resources comprising tangible and intangible assets, which enable the efficient and effective production of the value offering for economically attractive market segments. They consist of heterogeneous physical, financial, legal, human, organizational, informational, and relational assets. Firms achieve advantage by offering a product that provides superior value to customers and/or low cost based production compared to the competitors (Hunt & Morgan, 1995).

Positional advantageA firm managers’ expectation is to improve the performance for the least expenditure. To do so, firms need to identify required skills and resources to optimize current position and future performance, which then allocates resources toward high leverage activities. The conversion of resources and skills into positional advantage has been identified as the structural “drivers” of cost and differentiation advantage (Porter, 1985), and the combination of these drivers creates customer value. Cost advantage is driven by factors such as the economies of scale, learning and knowledge externalities, capacity utilization patterns, and the strategic alignment of vertically linked activities throughout the chain. Analogously, differentiation reflects the translation of superior skills and resources into activities to increase the customer’ perceptions of the product's benefit. Therefore, they are willing to pay a premium which must be higher than the added cost of superior product performance (Porter, 1991). The drivers of differentiation are the selection of policies to perform activities such as advertising, skills, and labor, coordination within the chain, timing to achieve the first-mover advantage and the location (Hult & Ketchen, 2001).

A firm can attain product or service differentiation when customers consistently recognize its offerings as superior to its competitors, and a firm can achieve cost leadership when its operational cost is lower than competitors (Porter, 1991). When a firm employs a differentiation strategy, customers receive the added value in products/services compared to those of competitors (Zhou, Brown, & Dev, 2009). Such a strategy comprises two dimensions: product or services advantage, the former relates to superior qualities, package, and design of a product, while the latter relates to services such as delivery and warranty (Morgan, Kaleka, & Katsikeas, 2004). Differentiation can be in various forms such as service differentiation, technical differentiation, and product differentiation (Kaleka & Berthon, 2006).

Low cost is a component of positional advantage (Langerak, 2003; Micheels & Gow, 2012; Vytlacil, 2011). The concept is achieved through the performance of activities in a value chain at low cost, but providing a parity product compared to the competitors. According to Narver and Slater (1990), firms achieve superior performance through low-cost when customers perceive that they purchase parity products which have low total acquisition and usage costs; hence the desirable profit margins of firms are still maintained. To apply R-A theory in the context of agribusiness value chain in a transitional developing country, this paper hypothesizes that:H1 The resources of beef cattle value chain actors have a positive relationship with low-cost. The resources of beef cattle value chain actors have a positive relationship with differentiation.

Marketing literature classifies the source of advantage into two groups: firstly, distinctive personal capabilities or skills and, secondly, the tangible assets or resources required for advantage (Day & Wensley, 1988), while Hunt and Morgan (1995) considered market orientation as a firm's resource. Market orientation is neither a skill nor a tangible asset, hence this concept does not affect competitive advantage. However, because this paper employs R-A theory in which the resource advantage comprises both tangible and intangible assets, then market orientation can be seen as an intangible resource. It is argued that market orientation contributes to comparative advantage and hence enables the positional advantage of a firm in the marketplace (Hunt & Morgan, 1995). Market orientation stresses the essential nature of employing and acting on customer and competitor information. The concept enables firms to formulate strategies to more effectively produce a market offering compared to competitors (Glazer, 1991).

Market orientation has been conceived at the heart of marketing theory, in which market-oriented organizations aim to meet their customer requirements through organizing activities around customer's needs (Levitt, 1960). Based on theoretical and empirical studies of Day and Wensley (1988), Deshpande and Webster (1989) and Shapiro (1988), market orientation was conceptualized in papers of Kohli and Jaworski (1990) as the three behavioral components: market intelligence generation, intelligence dissemination, and responsiveness. Narver and Slater (1990) on the other hand, conceptualized market orientation as three dimensions including, customer orientation, competitive orientation, and inter-functional coordination.

The study employs the Narver and Slater (1990) conceptualization of market orientation concept which has been used in previous studies pertaining to agricultural marketing (Micheels & Gow, 2008, 2009, 2011, 2012), food processing (Johnson et al., 2009), and developing countries (Hau, Evangelista, & Thuy, 2013). The Narver and Slater (1990) scale is used to measure each value chain actor's customer orientation and competitor orientation, and then disseminating these customer and competitor insights throughout the value chain to create a superior value proposition for the customer. While market orientation is concerned as the heart of marketing studies, its role in examining business performance is placed in the broader context of strategic business management. This means that the relationship between market orientation and business performance still remains to be determined and hence, this study addresses that gap.

Market orientation has been confirmed to be an essential resource in various contexts, including agriculture. Grunert et al. (2005) in four case studies of agribusiness and fisheries value chains indicated that market orientation has a significant effect on chain performance. A market orientation enables firms to explore how they may optimize value creation by delivering a differentiated product. Purcell and Hudson (2003) indicated that vertical alliances in beef value chain enable cattle producers in a chain to multiply their benefit by creating premiums in the marketplace which enable the high degree of input required to produce a differentiated product. Similarly, Wachenheim and Singley (1999) show that successful branded products are based on the sharing information on customer demand and sharing incentives with the chain participants who help create the added value for the customer.

Several empirical papers examine the relationship between market orientation and positional advantage. However, the difference in applying theories leads to differences in identifying market orientation in relation to positional advantage. Based on resource-based view theory, Hult and Ketchen (2001) developed a framework for first-order indicators including market orientation, entrepreneurship, innovativeness, and organizational learnings, positional advantage, and firm performance. The authors stated that those four dimensions “…can collectively contribute to the creation of a unique resource…” (Hult & Ketchen, 2001, p. 900). The study concluded that the intangible construct of positional advantage has a positive effect on the performance of firms through market orientation, entrepreneurship, innovativeness and organizational learning. Similarly, Micheels and Gow (2012) confirmed that market orientation together with other capabilities such as innovativeness, cost focus, organizational learning, and entrepreneurship are positive indicators of positional advantage. By contrast, based on the resource advantage theory, other researchers consider market orientation as a resource that creates a comparative advantage, hence improving the positional advantage. In particular, Langerak (2003) and Vytlacil (2011) indicate how market orientation including customer orientation, competitor orientation, and inter-functional coordination contributes to differentiation and low-cost in the electronic industry, industrial automation, and laboratory and medical technology. The findings of these two research projects stated that customer orientation and inter-functional coordination positively affect differentiation and cost advantage, respectively, while competitor orientation has no significant relationship with both differentiation, and cost advantage. Their structural equation model also indicates that firm performance is achieved through differentiation (Langerak, 2003; Vytlacil, 2011) and cost advantage (Vytlacil, 2011).

Further, Verhees and Meulenberg (2004) indicate that a market orientation can increase performance within the context of food and agriculture, however, this appears to be qualified by other research which indicates that market orientation itself cannot solely improve the performance (Hult & Ketchen, 2001; Langerak, 2003; Pelham, 2000). In particular, Hult and Ketchen (2001) confirm that market orientation was only one of the factors influencing positional advantage, the others being entrepreneurship, innovativeness, and organizational learning. Similarly, Micheels and Gow (2012) show that market orientation combines with other capabilities: entrepreneurship, innovativeness, and cost focus to increase firm performance, thus supporting Hult and Ketchen's (2001) view. Indeed, a market-oriented firm may recognize the customer needs, but this alone does not create customer value. Indeed, after generating market information, firm managers need to leverage it through innovativeness and entrepreneurship into strategy formulation and implementation to develop a positional advantage in a competitive marketplace (Homburg, Krohmer, & Workman, 2004). Many previous studies indicate the positive relationship between market orientation, innovation, and performance (Baker & Sinkula, 1999; Homburg, Workman, & Krohmer, 1999; Langerak, 2003; Menguc & Auh, 2006; Ross & Westgren, 2009). Because this paper is applying the R-A theory to this problem, our hypotheses are:H3 (a) Competitor orientation, (b) inter-functional coordination, and (c) customer orientation of beef cattle value chain actors have a positive relationship with low-cost. (a) Competitor orientation, (b) inter-functional coordination, (c) customer orientation of beef cattle value chain actors have a positive relationship with differentiation.

A firm achieving the positional advantage is a prerequisite to obtain superior performance (Ahmadi, O’Cass, & Miles, 2013; Day & Wensley, 1988). As this study investigates positional advantage comprised of market orientation, innovation, low-cost, and differentiation, each capability is related to financial value chain performance in terms of profitability, return on assets, return on sales, or return on investment.

To translate differentiation into the financial performance, firms apply innovation and marketing strategies to improve customers’ perception of product value (Morgan & Hunt, 1994). Product innovation facilitates firms to outperform their competitors, penetrate existing markets, and/or expand into new markets (Menguc, Auh, & Shih, 2007). Marketing strategies also strengthen the relationship between customers and brands, connect customers with firms (Day, 1994) and contribute to the firm's growth through expanding market share and sales in both existing and new markets. Moreover, Cao and Gruca (2005) and Menguc et al. (2007) show that firms marketing strategy translates into financial efficiency when they manage customer relationships, identify their target customers, and conduct advanced market research.

Cost leadership in positional advantage requires a focus on operational efficiencies which are achievable when firms have more skills in controlling cost drivers compared to the competitors, and when they identify innovative ways to minimize costs that cannot be imitated by competitors. As Porter (1985, p. 97) states “cost advantage leads to superior performance if the firm provides an acceptable level of value to the buyer so that its cost advantage is not nullified by the need to charge a lower price than competitors”. Thus, cost reduction strategies have to combine with quality improvement and improvements in operational efficiencies, rather than simply to attempt reductions generally. Therefore, these hypotheses state:H5 There is a positive relationship between the low-cost of a firm and its financial performance. There is a positive relationship between the differentiation of a firm and its financial performance.

The unit of analysis for this study is a single agri-food value chain system in a transitional developing country context. At some levels in traditional value chains, there are very few actors (e.g. collectors/aggregators or traders) and there is a paucity of formal information available on chain participants to assist research design. Hence ‘non-probability’ or ‘purposeful’ sampling is the most appropriate sampling technique to employ in order to collect the richness of the information needed to illuminate the phenomenon being studied. Thus, the frame was ‘stratified’ by the structure of the chain and its various levels of chain actors, farmers, collectors (sometimes also called ‘aggregators’ or ‘traders’), slaughterhouses, and retailers, with a purposeful sample being selected from each stratum (Onwuegbuzie & Leech, 2007).

Surveys were administered to a non-random, purposeful sample of 190 actors including 134 smallholders, 4 collectors, 2 slaughterhouses, 20 wholesalers, and 30 retailers who involve beef cattle value chain the Central Highlands of Vietnam. The respondents were requested to undertake the survey by using a snowball process. There are five collectors at the district level, of which one collector who supplies beef cattle to the city. The rest are small collectors mainly supplying beef cattle for the district's slaughterhouse. The district collector was requested to identify collectors at commune level and the collection areas which daily provide a high percentage of beef cattle. Three out of six commune collector were selected from this stage. Based on a list of 250 smallholders provided by the commune authority, 180 smallholders, who sell beef cattle to the three selected commune collectors, were selected. However, 30 smallholders were removed from this list for reasons that included: (1) they had migrated to the city; (2) they changed their production model to a cow-calf raising operation, or (3) they were not of sufficient scale of production. Within 150 selected smallholders, 16 smallholders were not available at the time of survey; therefore, only 134 smallholders were involved in this process. The district collectors also helped to identify two slaughterhouses, and then 20 wholesalers who buy beef from these slaughterhouses were subsequently identified. The wholesalers helped to identify the markets where they supply retailers. A list of 60 retailers at two central markets in the city was provided by the government's Market Management Board. However, 20 retailers were removed from this list as they had not bought beef from the wholesalers linked to this chain; therefore 40 retailers at the two central markets in the city were selected to undertake the survey. During the survey, 10 out of 40 retailers opted out of this survey because they did not have the time to answer the questions.

Measures development and pre-testingA pool of items was generated for measuring each of the study's constructs based on a literature search. Those items were then pre-tested in two distinct stages: (1) face-to-face interviews with five academics, who have experiences in relevant research on market orientation, value chain, beef cattle production in Vietnam; and (2) face-to-face interviews with twenty different beef cattle value chain actors. At each stage, interviewees were asked to identify any problems they encountered. Items, which were identified as problematic, were revised or removed from the questionnaires, and new items were developed.

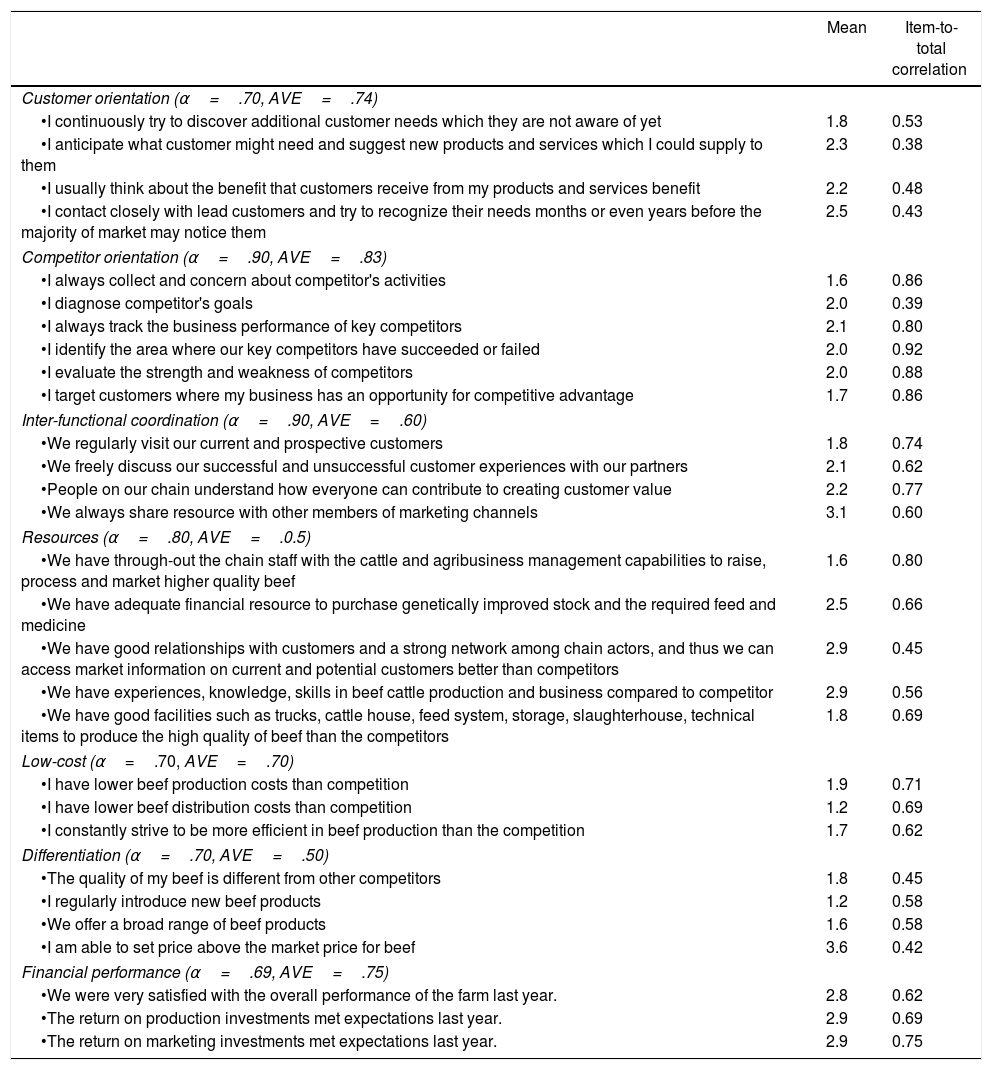

The measurement scales employed in this paper are presented in Table 1, in which some items are included to identify the context of beef cattle value chain. Measurement of items using the five-point Likert scales ranging from 1=“Not at all”, 2=“A little bit”, 3=“Somewhat”, 4=“Quite well”, and 5=“Very well”. Local experts in beef cattle production include successful smallholders, local extension agents, beef cattle ‘collectors’.

Reliability of constructs.

| Mean | Item-to-total correlation | |

|---|---|---|

| Customer orientation (α=.70, AVE=.74) | ||

| •I continuously try to discover additional customer needs which they are not aware of yet | 1.8 | 0.53 |

| •I anticipate what customer might need and suggest new products and services which I could supply to them | 2.3 | 0.38 |

| •I usually think about the benefit that customers receive from my products and services benefit | 2.2 | 0.48 |

| •I contact closely with lead customers and try to recognize their needs months or even years before the majority of market may notice them | 2.5 | 0.43 |

| Competitor orientation (α=.90, AVE=.83) | ||

| •I always collect and concern about competitor's activities | 1.6 | 0.86 |

| •I diagnose competitor's goals | 2.0 | 0.39 |

| •I always track the business performance of key competitors | 2.1 | 0.80 |

| •I identify the area where our key competitors have succeeded or failed | 2.0 | 0.92 |

| •I evaluate the strength and weakness of competitors | 2.0 | 0.88 |

| •I target customers where my business has an opportunity for competitive advantage | 1.7 | 0.86 |

| Inter-functional coordination (α=.90, AVE=.60) | ||

| •We regularly visit our current and prospective customers | 1.8 | 0.74 |

| •We freely discuss our successful and unsuccessful customer experiences with our partners | 2.1 | 0.62 |

| •People on our chain understand how everyone can contribute to creating customer value | 2.2 | 0.77 |

| •We always share resource with other members of marketing channels | 3.1 | 0.60 |

| Resources (α=.80, AVE=.0.5) | ||

| •We have through-out the chain staff with the cattle and agribusiness management capabilities to raise, process and market higher quality beef | 1.6 | 0.80 |

| •We have adequate financial resource to purchase genetically improved stock and the required feed and medicine | 2.5 | 0.66 |

| •We have good relationships with customers and a strong network among chain actors, and thus we can access market information on current and potential customers better than competitors | 2.9 | 0.45 |

| •We have experiences, knowledge, skills in beef cattle production and business compared to competitor | 2.9 | 0.56 |

| •We have good facilities such as trucks, cattle house, feed system, storage, slaughterhouse, technical items to produce the high quality of beef than the competitors | 1.8 | 0.69 |

| Low-cost (α=.70, AVE=.70) | ||

| •I have lower beef production costs than competition | 1.9 | 0.71 |

| •I have lower beef distribution costs than competition | 1.2 | 0.69 |

| •I constantly strive to be more efficient in beef production than the competition | 1.7 | 0.62 |

| Differentiation (α=.70, AVE=.50) | ||

| •The quality of my beef is different from other competitors | 1.8 | 0.45 |

| •I regularly introduce new beef products | 1.2 | 0.58 |

| •We offer a broad range of beef products | 1.6 | 0.58 |

| •I am able to set price above the market price for beef | 3.6 | 0.42 |

| Financial performance (α=.69, AVE=.75) | ||

| •We were very satisfied with the overall performance of the farm last year. | 2.8 | 0.62 |

| •The return on production investments met expectations last year. | 2.9 | 0.69 |

| •The return on marketing investments met expectations last year. | 2.9 | 0.75 |

All data were analyzed using exploratory data analysis (EDA) to determine the out-of-range values, missing values, outliers, and normality. The kurtosis and skewness of indicators were within the acceptable limits. It suggested that items should be dropped from the scales if the correlation is low. While there is not an agreement of cut-off for low items in total correlations, this study applied a cut-off for low items from 0.3 to 0.5 as in several related studies (see Delgado-Ballester, 2004; Hurley & Hult, 1998; Im & Workman, 2004; Narver & Slater, 1990).

To measure the internal consistency among the items, reliability analysis was employed in which the Cronbach alpha is indicated in Table 1. Findings show that most of the Cronbach alpha values are greater than 0.70 indicating the outstanding the consistency among items (Nunnally, 1978). Indeed, the Cronbach alphas of constructs are from 0.685 to 0.92. The construct of financial chain performance 0.685 is minimally acceptable for the context and nature of this exploratory study (Nunnally, 1978).

To valid the construct, confirmatory factor analysis (CFA) was employed to analyze the full measurement model. Model fit indices includes the goodness of fit index (GFI), the incremental fit index (IFI), the Tucker–Lewis index (TLI), the root mean squared error of approximation (RMSEA), and the chi-square index divided by degrees of freedom (df). The data fit the model reasonably well as the GFI=0.80, IFI=0.90, TLI=0.87, RMSEA=0.09, and CMIN/df=2.6. The convergent validity was examined by the Average Variance Extracted (AVE), which is from 0.5 to 0.78 greater than the cut-off at 0.5; hence all items in measurement model are statistically significant.

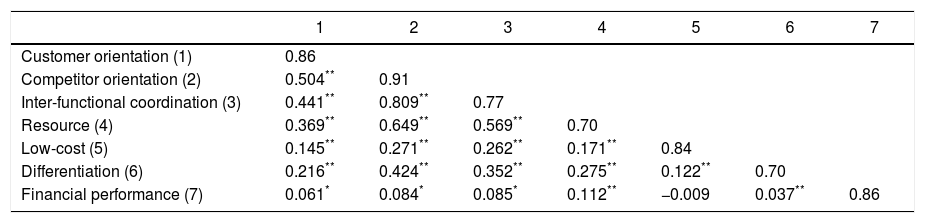

Discriminant validity was used to measure the extent to which latent factors are distinct and uncorrelated to ensure that one latent variable is not highly correlated with others. A high correlation between two latent variables means that this latent variable is explained better by another variable from a different factor than its observed variables. According to Fornell and Larcker (1981), discriminant validity is observed through the comparison between the square roots of the average variance extracted and the correlation between latent variables. The result indicates that the square root of average variance extracted of all latent variables is greater than the correlation between latent variables; hence the discriminant validity is achieved (Table 2).

Discriminant validity.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

|---|---|---|---|---|---|---|---|

| Customer orientation (1) | 0.86 | ||||||

| Competitor orientation (2) | 0.504** | 0.91 | |||||

| Inter-functional coordination (3) | 0.441** | 0.809** | 0.77 | ||||

| Resource (4) | 0.369** | 0.649** | 0.569** | 0.70 | |||

| Low-cost (5) | 0.145** | 0.271** | 0.262** | 0.171** | 0.84 | ||

| Differentiation (6) | 0.216** | 0.424** | 0.352** | 0.275** | 0.122** | 0.70 | |

| Financial performance (7) | 0.061* | 0.084* | 0.085* | 0.112** | −0.009 | 0.037** | 0.86 |

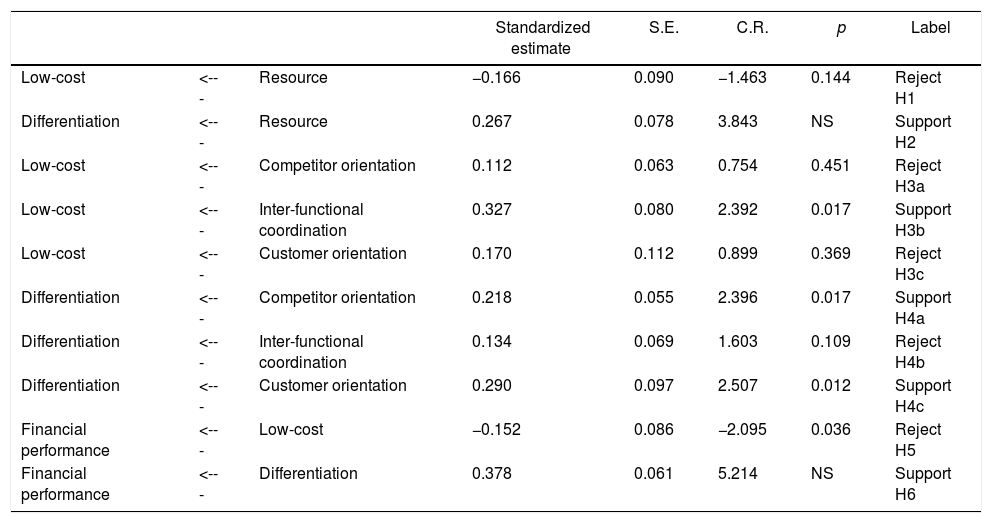

Testing of the hypotheses was conducted through structural equation model after computing latent variables to become observed variable (Micheels & Gow, 2012). Model fit was analyzed using the Goodness of Fit Index (GFI), the Incremental Fit Index (IFI), and the Tucker–Lewis index (TLI) along with the root mean squared error of approximation (RMSEA) and the CMIN (χ2) divided by degrees of freedom (df). The data seem to fit the model reasonably well as the, GFI=0.982, IFI=0.994, TLI=0.980, RMSEA=0.075, and CMIN/df=2.06, all indicating the model fits the data well.

The result shows that there are significant relationships between customer orientation (beta=0.29, p<0.05) and differentiation, and competitor orientation (beta=0.218, p<0.05) and differentiation, hence the hypothesis H4c and H4a are supported, However, the relationship between customer orientation, competitor orientation and low-cost (p>0.05) is not significant. Similarly, the relationship between d inter-functional coordination and differentiation is not significant (p>0.05). The resource has a positive effect on differentiation (beta=0.27; p<0.05), whereas there is no effect on low-cost (p>0.05).

The result also indicates that there is significant positive effect of differentiation on financial chain performance; hence a hypothesis H6 is supported. This concludes that one unit increase in differentiation leads to 0.378 unit increase in financial performance, respectively (p<0.05), while there is negative relationship between low-cost and financial performance (beta=−0.15, p<0.05) (Table 3).

Regression weights.

| Standardized estimate | S.E. | C.R. | p | Label | |||

|---|---|---|---|---|---|---|---|

| Low-cost | <--- | Resource | −0.166 | 0.090 | −1.463 | 0.144 | Reject H1 |

| Differentiation | <--- | Resource | 0.267 | 0.078 | 3.843 | NS | Support H2 |

| Low-cost | <--- | Competitor orientation | 0.112 | 0.063 | 0.754 | 0.451 | Reject H3a |

| Low-cost | <--- | Inter-functional coordination | 0.327 | 0.080 | 2.392 | 0.017 | Support H3b |

| Low-cost | <--- | Customer orientation | 0.170 | 0.112 | 0.899 | 0.369 | Reject H3c |

| Differentiation | <--- | Competitor orientation | 0.218 | 0.055 | 2.396 | 0.017 | Support H4a |

| Differentiation | <--- | Inter-functional coordination | 0.134 | 0.069 | 1.603 | 0.109 | Reject H4b |

| Differentiation | <--- | Customer orientation | 0.290 | 0.097 | 2.507 | 0.012 | Support H4c |

| Financial performance | <--- | Low-cost | −0.152 | 0.086 | −2.095 | 0.036 | Reject H5 |

| Financial performance | <--- | Differentiation | 0.378 | 0.061 | 5.214 | NS | Support H6 |

The objective of this study was to examine the relationship between resource, positional advantage, and financial performance while extending previous research about positional advantage components in agribusiness value chain in emerging country. Utilizing data from a survey of 190 actors in a single beef cattle value chain, a SEM of hypothesized relationships was developed and tested. This study expands the work of Langerak (2003, p. 110) who stated that “Future research should consider also including other sources of advantage (i.e., both resources and skills)” and its effect on positional advantage. Findings contribute some worthy contributions in terms of theory and practice for a transitional developing economy.

Market orientation and positional advantageIn transitional developing economies, such as Vietnam, market orientation plays an extremely important role in creating competitive advantage and is an effective tool for improving business performance (Hau et al., 2013; Long, 2013; O’Cass & Ngo, 2011). The findings in this research confirm that market orientation is a means for smallholders to enhance the positional advantage in the market place and this is consistent with Hunt and Morgan (1995) in a developed country context.

The results indicate that customer orientation and competitor orientation have a positive relationship with product differentiation (Langerak, 2003; Vytlacil, 2011). It reveals that knowledge and understanding about target customers and competitors facilitate behaviors to deploy sufficient resources to achieve differentiation compared to the competitors (Langerak, 2003). Thus, it can be inferred that actors in beef cattle value chains in Vietnam should focus on obtaining knowledge and understanding about current and potential customers as well as their competitors to differentiate their products from their competitors. Further, the beef cattle value chain actors need to be sensitive and responsive not only to expressed but also the latent needs of customer, as well as the capabilities and plans of competitors (Jaworski & Kohli, 1993). The results also suggest that related agribusiness policy makers need to facilitate smallholder access to market information about customer needs and understanding about the capabilities of their competitors to enhance customer perceptions and their competitive position in the marketplace.

The results also show that inter-functional coordination has no significant effect on differentiation. This is consistent with Narver and Slater (1990) who stated that customer and competitor orientation are two pre-conditions to achieve differentiation, and inter-functional coordination is considered as the facilitator between businesses to obtain the differentiation.

Further, inter-functional coordination has a significant relationship with cost-efficiency but there is no relationship between competitor orientation and cost efficiency (Langerak, 2003; Vytlacil, 2011). This can be explained that a low-cost strategy is an internal activity depending on the scale of economic activity, the volume of production, and scope; whereas competitor orientation is externally focused on the issues of competitors. It also raises a question for future studies of positional advantage about whether competitor orientation should be encouraged to obtain positional advantage through the low-cost. This finding that there is a positive relationship between inter-functional coordination and low-cost strategy suggests that to achieve efficiency in cost, smallholders in beef cattle value chains need to collaborate to facilitate coordination to improve cost management.

The study also contributes to the on-going debate about the relationship between market orientation and business performance. Some studies have found no effect of market orientation on business performance (Hao et al., 2014; Johnson et al., 2009), while others support the positive relation between these two concepts (Langerak, 2003; Martin et al., 2016). Ellis (2006) suggested that the reason is that market orientation is influenced by the culture, economic, and institutions of the countries being studied. Although not clearly tested in this study, it is believed that market orientation affects the financial performance of beef cattle value chains through positional advantage. Two dimensions of market orientation: customer orientation and inter-functional coordination were found to be important in producing a differentiated product compared to competitors, hence leading to superior financial performance.

Leveraging resources into positional advantage in beef cattle value chainsThe findings in this study indicate that skills and resources have leveraged into positional advantage to improve the performance of the beef cattle value chain. This is consistent with the suggestion by Day and Wensley (1988) that to achieve the greatest improvement of performance, firms need to identify and allocate the key skills and resources required to optimize their positional advantage. It is also similar to Ahmadi et al. (2013), in that the study supports the importance of examining the simultaneous leverage of both resources and skills to develop and launch business activities at the operational level.

Positional advantage and financial performanceThe capabilities of the positional advantage framework in this study are based on the work of Hult and Ketchen (2001), Micheels and Gow (2012), and adapt that of Day and Wensley (1988) by including the importance of low-cost and differentiation. Our results show differentiation to be the most important capability smallholder can use to leverage his positional advantage into financial performance. In highly competitive markets such as agriculture production, smallholders that produce tangible differences in their beef cattle from those of others may be able to outperform their competitors if they align with what customers’ value. This corroborates the suggestion of Narver and Slater (1990) that for commodity and non-commodity business, differentiation in many forms such as brand image, customer services, product features, supplier networks, and technology is an attempt to create business demand. It is also consistent with Porter's (1985) suggestion that differentiation can enhance the competitive capacity of firms.

The findings of this study are in line with other previous studies such as Micheels and Gow (2012) and Leuschner, Rogers, and Charvet (2013) when it indicates that low-cost has no significant relationship with performance. In this study, the beef value chain actors have few options for reducing cost because breeding is 80% of total production costs (Viet, 2013). In this instance, reducing the veterinary inputs would lead to the reduction of the quality of the beef cattle produced. Accordingly, value chain actors in these beef cattle value chains have not practiced a low-cost strategy to improve the financial performance.

Limitations and implicationThe present study has some limitations. The survey involves a range of value chain actors such as farmers, collectors, slaughterhouse, wholesalers, and retailers while ignoring the effect of other stakeholders in farmers’ networks. It would be interesting to expand respondents such as extension agents, local governmental staff, and policy makers who also may affect the resources, market orientation and competitive advantage of smallholders, consequently impacting financial performance of the value chain. Therefore, future studies should consider the effect of these networked actors in supporting smallholders to improve their beef cattle value chain.

Findings indicate that market orientation and resources of value chain actors are an antecedent to positional advantage. This suggests that to improve beef cattle value chain financial performance, customer and competitive orientations, as well as inter-functional coordination should be encouraged amongst smallholders, collectors, slaughterhouse, wholesalers, and retailers. To do that, value chain actors should be encouraged to engage in coordinating supply and increasing their capacity to access information on customers, competitors, and have contact with other actors across the chain. This study applied the work of Hunt and Morgan (1995) to value chain actors in an agricultural context of emerging country. This study confirms that market orientation is a resource of value chain actors that combines with other tangible and intangible resources to develop positional advantage, and then improve financial performance throughout the chain. Increasing market orientation and positional advantage is an essential goal if the value chain actors are going to continue to deliver value-added products, and services (Micheels & Gow, 2009). To do that, value chain actors must communicate with parties downstream in the chain to identify the potential sources of value creation. To develop positional advantage, it is important that beef value chain actors have access to pertinent market information. This is especially for chain actors having little contact with other parties downstream of the value chain (Micheels & Gow, 2009). In order to acquire reliable market information, smallholders need to establish linkages with collectors, slaughterhouse, wholesalers, and retailers at other downstream chain segments to gather information which they can then apply to formulate or conduct their business strategy based on their resources.