This research studies whether Executive MBA student's participation in a business strategy simulation course significantly impacts on self-perceptions of their strategic competencies and decision style, which involves crossing psychological and strategy fields, and aims to contribute to the development of theoretical management and educational insights. The obtained results on students’ self-perception of their improvement on strategic competencies suggest that the simulation has a positive value for students and contributes both to their engagement in the MBA program and to their knowledge. However, decision-making styles do not change as a result of the simulation, with the exception of the analytical component, which is reinforced. Thus, we concluded that although students’ knowledge and strategic competencies could be expanded with a business strategy simulation, their decision-making style is not significantly influenced by practice. Consequently, we suggest that it is possible to antecipate one reaction to a future situation, when managers’ decision-making style is known in advance, which in turn validates the statement that “nothing is so theoretical as good practice”.

Este estudio investiga si la participación de los alumnos de un programa de MBA para Ejecutivos en un curso de simulación estratégica de negocios tiene impactos significativos en la percepción propia de sus competencias estratégicas y en su estilo de toma de decisiones, lo que implica combinar los dominios de la psicología y de la estrategia, intentando contribuir en el desarrollo de nuevas ideas teóricas sobre la gestión y la educación. Los resultados obtenidos sobre la autopercepción del alumno de sus mejorías en las competencias estratégicas sugieren que la simulación ha tenido un valor positivo para los alumnos y contribuye a mejorar su participación en el programa de MBA, así como su conocimiento. Además, los estilos de toma de decisiones no cambian como resultado de la simulación, con la excepción de la componente analítica, que es reforzada. De este modo, se concluye que mientras el conocimiento y las competencias estratégicas de los alumnos puedan ampliarse con una simulación estratégica de negocios, el estilo de toma de decisiones no es significativamente influenciado por su práctica. Consecuentemente, se sugiere que es posible anticipar una reacción a una situación futura, cuando el estilo de toma de decisiones de los directivos es ya conocido.

“A teoria não é senão uma teoria da prática, e a prática não é senão a prática de uma teoria.” (theory is nothing but a theory of practice, and practice is nothing but the practice of theory)

The experiential learning theory (ELT) advocates that individuals learn – intentionally or not – from their experiences (Kolb, 1984), and simulations help participants to learn from their experiences (Russ & Drury-Grogan, 2013). The ELT posits that the learning cycle includes four modes: experiencing, reflecting, thinking, and acting, which corresponds to a dynamic cycle that translates the value of being mindful of one's own direct, immediate experience, observing and reflecting upon the experience and thinking and conceptualizing (Peterson, DeCato, & Kolb, 2015).

Running the business strategy simulation among Executive MBA students is similar to realizing an experiment on the real-life practice (behavior) of business managers. Moreover, this is a kind of laboratory experiment that can be run to assessing either student's capacity to apply theoretical concepts in practice and the improvement in their understanding of the theory and practice of business strategy.

During the final trimester of the Executive MBA program of the Faculty of Economics of the University of Coimbra a simulation course is offered as an elective course, and the chosen simulation is “The Business Strategy Game: Competing in a Global Marketplace”, which will be referred hereafter as BSG.

In this context, the aim of this study is to analyze whether Executive MBA student's participation in a business strategy simulation course significantly impacts on self-perceptions of their strategic competencies and decision style.

The rest of this paper is structured as follows. In the next section we present the background. Then, we describe the research design; the results are presented and discussed, and finally, we summarize the main conclusions.

BackgroundPast research compared simulation-based methods with case-based methods and concluded that the former produces significantly larger gains in student's self-efficacy (Tompson & Dass, 2000), although both contribute to students’ understanding of real strategic challenges. Also, previous research explored the role of simulation case studies in enterprise education, their effectiveness, and their relationship to traditional forms of classroom-based approaches to experiential learning (Tunstall & Martin Lynch, 2010). In fact, the literature is extensive in describing the effects that simulation-based methods might have on motivation (e.g., Garris, Ahlers, & Driskell, 2002).

The literature describes strategy formulation as a complex activity that involves scanning, sense making, and decision-making (Narayanan, Zane, & Kemmerer, 2011). Based on business strategy theory (e.g., Johnson & Scholes, 2013; Wheelen, Hunger, Hoffman, & Bamford, 2015), we can consider that strategy formulation involves detecting environmental opportunities and threats, assessing organization capabilities, establishing company objectives, determining a competitive strategy, developing a strategic direction, preparing operating projections, and understanding the consequences of the decisions made. Furthermore, it is important to stress that the strategic decision-making process involves exchange of information between the members, and the way in which information is exchanged, processed and acted upon has a pivotal role (Parayitam & Dooley, 2009).

Regarding the execution of the designed strategy one has to organize the strategy implementation procedures, the structure of the organization, the systems of the organization, conduct resource allocation, and understand functional interaction flows (e.g., Johnson & Scholes, 2013; Wheelen et al., 2015). Moreover, the strategy literature portrays that strategy implementation is composed of sense giving, sense making, and issue selling (Narayanan et al., 2011).

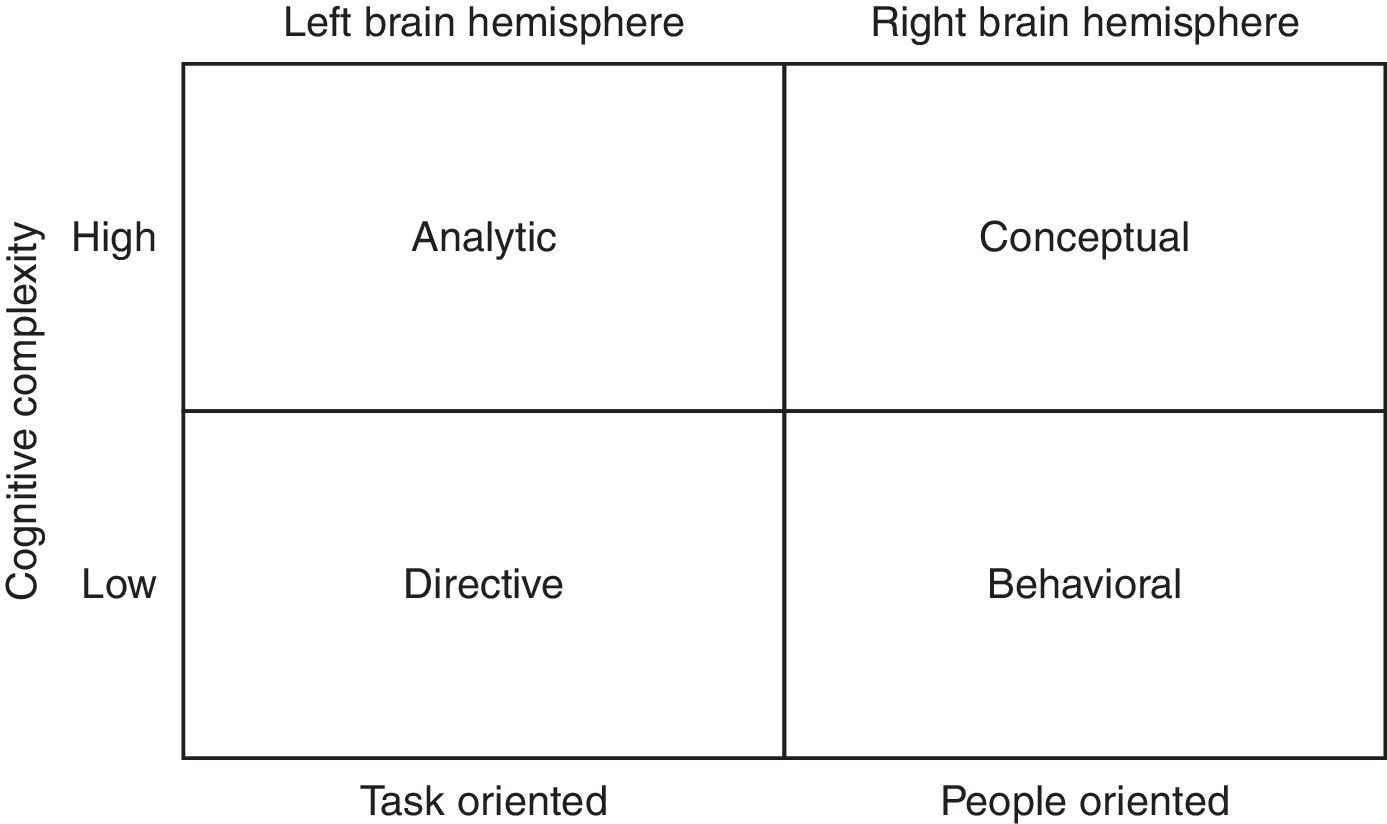

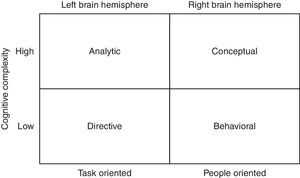

Furthermore, decision-making is a crucial activity for managers and the existence of different decision-making approaches has been recognized a long time ago (Martinsons & Davison, 2007), and it is possible to predict how an individual will react to different situations when knowing his or her decision style pattern (Rowe & Boulgarides, 1994). The typology proposed by Rowe and Boulgarides (1994) includes four forces (directive, analytical, conceptual, and behavioral) as presented in Fig. 1.

In fact, cognitive psychology has examined an individual's ability to extract a number of dimensions from data or examined their ability to utilize different constructs to evaluate information (Bouldgarides & Rowe, 1983). The decision style model is based on how people think and what is important to them, and a link between the decision styles and individual needs can be established. In short: (i) directive decision makers are driven primary by the need for power; (ii) analytical decision makers look for new challenges in order to fulfill their need for achievement; (iii) conceptual decision makers are also looking for achievement, but they tend to value extrinsic rewards, such as praise, recognition, and independence; and (iv) behavioral decision makers focused mostly on fulfilling their need for affiliation (Martinsons & Davison, 2007).

The integration of behavioral theory and cognitive psychology on strategy process research has been growing (Thomas & Ladwig, 2015). For example, past research suggested that competence-based trust seems to be more important than relationship-based trust in strategic decision-making (Parayitam & Dooley, 2009). Thus, the cognitive dimensions of the strategy process should not be forgotten to better understand it.

Research designThe challengeBSG is an online exercise performed in the classes where students are asked to manage an athletic footwear company in competition against companies run by other class members in a global marketplace. There are four markets worldwide (North America, Europe-Africa, Asia-Pacific, and Latin America) and each region has three market segments (internet segment, wholesale segment, and private-label segment). Each team (company) has to make decisions relating to: (i) corporate social responsibility and citizenship, (ii) plant capacity additions/sales/upgrades, (iii) production of branded and private-label footwear, (iv) worker compensation and training, (v) shipping and warehouse operations, (vi) pricing and marketing, (vii) celebrity endorsement contracts, and (viii) financing of company operations.

The intent of the BSG is to involve participants in crafting and executing a strategy for a virtual company and it was created as a complement of the book “Crafting and Executing Strategy: The Quest for Competitive Advantage (Thompson et al., 2013). Company co-managers are held accountable for their decision-making, and they make as many as 53 types of decisions each period. The company's performance is scored on the basis of earnings per share, return on equity investment, stock price, credit rating, and image rating. Thus, the challenge for each company's management is to formulate and implement a competitive strategy that produces good outcomes on the five measures.

Sample and measurement instrumentA survey was applied to Executive MBA students of the University of Coimbra, registered on the course of Strategic Management Simulation in the academic year 2014/2015. The data was gathered in the end of the simulation, on July 2015. From the 37 questionnaires that were sent, we obtained 22 answers.

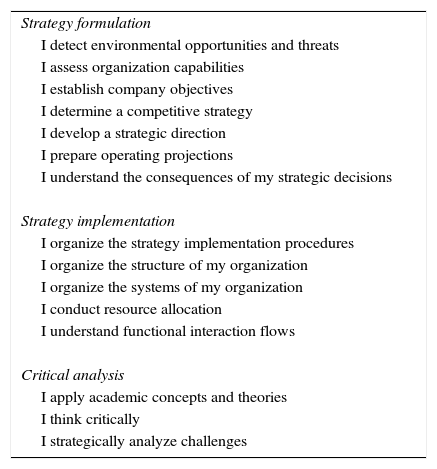

The measurement instrument included two parts, one related to strategy competencies and another related to the decision style. The items for the first part were developed based on widely accepted strategy theory components, considering both the strategy formulation and the strategy implementation, which fit the categories reflected on the BSG. Additionally, we included a third construct, critical analysis, and we use the scale proposed by Russ and Drury-Grogan (2013), as shown in Table 1.

Strategy competencies.

| Strategy formulation |

| I detect environmental opportunities and threats |

| I assess organization capabilities |

| I establish company objectives |

| I determine a competitive strategy |

| I develop a strategic direction |

| I prepare operating projections |

| I understand the consequences of my strategic decisions |

| Strategy implementation |

| I organize the strategy implementation procedures |

| I organize the structure of my organization |

| I organize the systems of my organization |

| I conduct resource allocation |

| I understand functional interaction flows |

| Critical analysis |

| I apply academic concepts and theories |

| I think critically |

| I strategically analyze challenges |

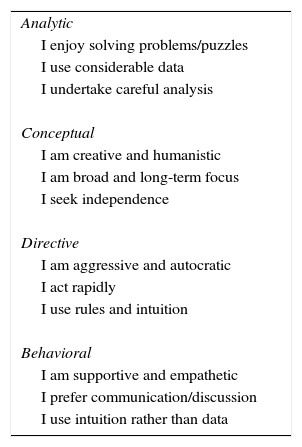

Regarding decision style, the scales used were based on the decision style model presented by Martinsons and Davison (2007), which was adapted from Rowe and Boulgarides (1994), as shown in Table 2.

Decision styles.

| Analytic |

| I enjoy solving problems/puzzles |

| I use considerable data |

| I undertake careful analysis |

| Conceptual |

| I am creative and humanistic |

| I am broad and long-term focus |

| I seek independence |

| Directive |

| I am aggressive and autocratic |

| I act rapidly |

| I use rules and intuition |

| Behavioral |

| I am supportive and empathetic |

| I prefer communication/discussion |

| I use intuition rather than data |

Students were asked to rate each item, before and after the simulation, on a 7-point Likert type scale ranging from 1 (strongly disagree) to 7 (strongly agree). Then, ANOVA tests were conducted to assess statistically significant differences between their self-perceptions of the impact of the simulation.

MethodologyIn the data analysis we used the analysis of variance (ANOVA). The theoretical assumptions for its application were verified. The ANOVA model used in the study is classified as a single factor experiment (One-Way Anova), whose mathematical representation, according to Hicks (1982), is the following:

where Yij represents the ith observations (i=1, 2, …, nj) on the jth treatment (j=1, 2 levels), τj represents the effect of jth treatment, with j=1, 2 (before and after Executive MBA student's participation in a business strategy simulation course), μ is the common effect for the whole experiment, and ¿ij represents the random error present in the ith observation on the jth treatment, which is usually considered a normally and independently distributed random effect whose mean value is zero and whose variance is the same for all treatments or levels.The mathematically hypothesis to be tested are the following:

The statistic F will be used in this test for a 5% significance level. A significant F statistic will indicate there are differences in strategic competencies/decision-making style before and after Executive MBA students’ participation in a business strategy simulation course, i.e. hypothesis to be tested can be written as follows:H1a There are differences in students’ strategic formulation competencies before and after the participation in the BSG simulation. There are differences in students’ strategic implementation competencies before and after the participation in the BSG simulation. There are differences in students’ critical analysis competencies before and after the participation in the BSG simulation. There are differences in students’ analytical decision-making style before and after the participation in the BSG simulation. There are differences in students’ conceptual decision-making style before and after the participation in the BSG simulation. There are differences in students’ directive decision-making style before and after the participation in the BSG simulation. There are differences in students’ behavioral decision-making style before and after the participation in the BSG simulation.

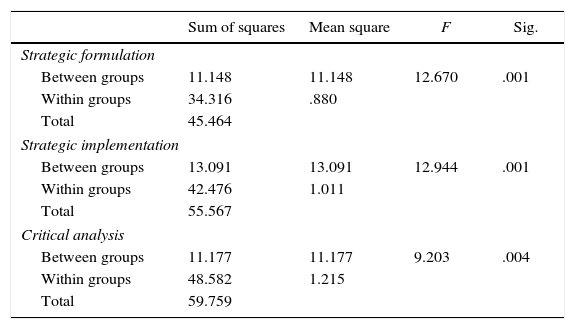

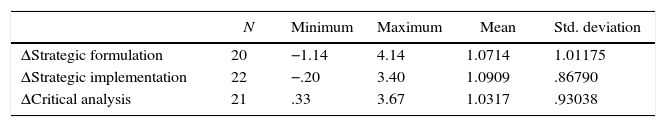

The results of the ANOVA tests on each item of the strategic competencies scale show that there was a significant improvement in all of them, meaning that students perceived an improvement on their strategic skills as a result of the simulation. However, our scale for the strategic competencies consists of three components, so we also check their unidimensionality and validate the proposed scales, which constitutes another contribute of this research. Then, we tested the differences in each component mean, as presented in Table 3, and found statistically significant differences in all of them (the hypothesis H1a–H1c are confirmed). Moreover, the results show that the most important differences were perceived on the strategic implementation and strategic formulation competencies, rather than on critical analysis (Table 4). This result was expected since the focus of the simulation is business strategy.

ANOVA strategic competencies.

| Sum of squares | Mean square | F | Sig. | |

|---|---|---|---|---|

| Strategic formulation | ||||

| Between groups | 11.148 | 11.148 | 12.670 | .001 |

| Within groups | 34.316 | .880 | ||

| Total | 45.464 | |||

| Strategic implementation | ||||

| Between groups | 13.091 | 13.091 | 12.944 | .001 |

| Within groups | 42.476 | 1.011 | ||

| Total | 55.567 | |||

| Critical analysis | ||||

| Between groups | 11.177 | 11.177 | 9.203 | .004 |

| Within groups | 48.582 | 1.215 | ||

| Total | 59.759 | |||

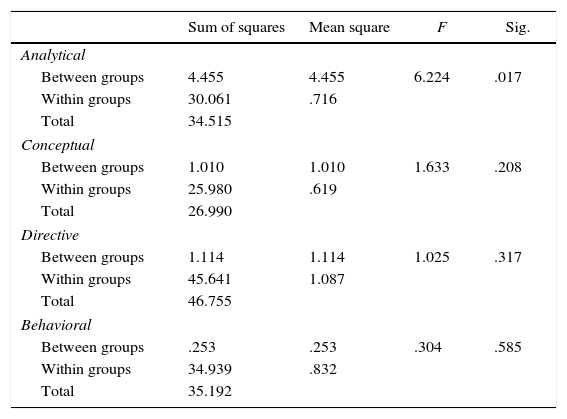

Regarding the decision-making style, as shown in Table 5, the results suggest that there are no significant differences, except in the analytical force (the hypothesis H2a is confirmed, but H2b–H2d are rejected). Therefore, we may conclude that the simulation did not change each participant decision style, but it reinforced the analytical component within their decision-making style. Considering that decision-making is influenced by values and cognitive perception, which in turn could be explained by cultural factors (Martinsons & Davison, 2007), it is not surprising that we did not find significant differences in MBA students’ decision style. On the other hand, the higher importance of the analytical component after the simulation was expected, since the BSG encourages data collection and processing, in order to enable systematically evaluation of different courses of action.

ANOVA decision-making style.

| Sum of squares | Mean square | F | Sig. | |

|---|---|---|---|---|

| Analytical | ||||

| Between groups | 4.455 | 4.455 | 6.224 | .017 |

| Within groups | 30.061 | .716 | ||

| Total | 34.515 | |||

| Conceptual | ||||

| Between groups | 1.010 | 1.010 | 1.633 | .208 |

| Within groups | 25.980 | .619 | ||

| Total | 26.990 | |||

| Directive | ||||

| Between groups | 1.114 | 1.114 | 1.025 | .317 |

| Within groups | 45.641 | 1.087 | ||

| Total | 46.755 | |||

| Behavioral | ||||

| Between groups | .253 | .253 | .304 | .585 |

| Within groups | 34.939 | .832 | ||

| Total | 35.192 | |||

The engagement of students into critical management studies is considered to be a challenge for management education (Schwarz, 2013). On the other hand, working as a team may expand one knowledge and some authors suggest that organizational learning is enhanced as more decisions are made (Bettis-Outland, 2012). The BSG simulation requires participants to conduct thorough analysis of their competitive environment and strategic position to formulate and implement business strategies. Consequently, each team (company) should make decisions on a multitude of variables, in order to pursuit competitive advantage.

The obtained results on students’ self-perception of their improvement on strategic competencies, suggest that the simulation has a positive value for students and contributes both to their engament in the MBA program and to their knowledge. Moreover, both the formulation and implemention skills appear to be developed, which shows the influence of the practice on theory understanding and application in a changing setting.

Furthermore, one important finding is that the decision-making styles do not change as a result of the simulation, with the exception of the analytical component, which is reinforced. Thus, we may conclude that although the students’ knowledge and strategic competencies could be expanded with a business strategy simulation, the decision-making style is not significantly influenced by practice, possibly because it is driven by other forces, such as cultural factors and personality. In other words, in a business environment, it will be possible to antecipate one reaction to a future situation, if we already know his or her decision-making style. In our view, this finding confirms that “nothing is so theoretical as good practice”.