This paper analyses the Socioemotional Wealth (SEW) theory to manage a better comprehension of this relatively new approach. For achieving our objective, we review previous research about SEW and gather all the given definitions of this term. We also make our own conceptualization of it. Moreover, we discuss three controversial issues related to this approach: the relationship between SEW and Emotional Value, situations that could lead to different SEW levels, and the effects of ownership and management in the SEW of a family firm. Finally, we point out the principal challenges it poses for researchers.

Este artículo se centra en la novedosa teoría de la riqueza socioemocional (Socioemotional Wealth, SEW) y trata de aunar los diversos puntos de vista que sobre la misma se han dado. Para alcanzar nuestro objetivo, se ha revisado la literatura previa sobre SEW y se han compilado las diferentes definiciones dadas hasta el momento de este término, lo que nos ha permitido realizar nuestra propia conceptualización del mismo. Además, se discuten tres cuestiones controvertidas relacionadas con este enfoque: la relación entre SEW y valor emocional, las circunstancias que pueden conducir a distintos niveles de SEW y, finalmente, los efectos que la propiedad y la gestión tienen sobre el SEW de la empresa familiar. Por último, se indican los principales desafíos que esta teoría presenta para los investigadores.

Since the seminal research of Gómez Mejia, Haynes, Núñez Nickel, Jacobson, and Moyano Fuentes (2007), there are a lot of scholars analyzing and researching on the Socioemotional Wealth (SEW) approach (Berrone, Cruz, Gómez Mejia, & Larraza Kintana, 2010; Berrone, Cruz, & Gómez Mejia, 2012; Cennamo, Berrone, Cruz, & Gomez-Mejia, 2012; Cruz, Justo, & De Castro, 2012; Detienne & Chirico, 2013; Gómez-Mejia, Cruz, Berrone, & De Castro, 2011; Stockmans, Lybaert, & Voordeckers, 2010; Vandekerkhof, Steijvers, Hendriks, & Voordeckers, 2014; Zellweger & Dehlen, 2011; Zellweger, Kellermanns, Chrisman, & Chua, 2011), which is widely accepted in the family business field. Actually, Berrone et al. (2012) consider the SEW approach as the most potential dominant paradigm in the family business field and highlight the importance of further developing it.

However, in spite of the SEW theory having great acceptance, researchers have not yet reached a consensus on what exactly SEW is, what its consequences and implications for family businesses are, and which its principal challenges are. Due to the existing divergences regarding the SEW approach, it seems interesting and necessary to delve deep into it to establish solid theoretical foundations.

Therefore, the aim of this paper is a have better comprehension of the SEW approach, and so, it is from a theoretical perspective. We postulate some ideas and discuss some questions about the SEW theory that could be a cause for debate. Moreover, some of the ideas proposed could be studied as an empirical perspective in future research.

This article contributes to current literature in several ways. First, we identify the alternative definitions given to the SEW term and we make our own conceptualization of it in order to encompass all the necessary elements that this concept comprises. Second, we also provide new steps in this relatively recent theory, by providing some contributions related to the controversial aspects of this approach. In this vein, we discuss three different issues: the relationship between SEW and Emotional Value (EV), situations that could lead to different SEW levels, and the effects of ownership and management in the SEW of a family firm. Finally, we highlight the principal challenges of this approach and highlight possible research areas related to SEW.

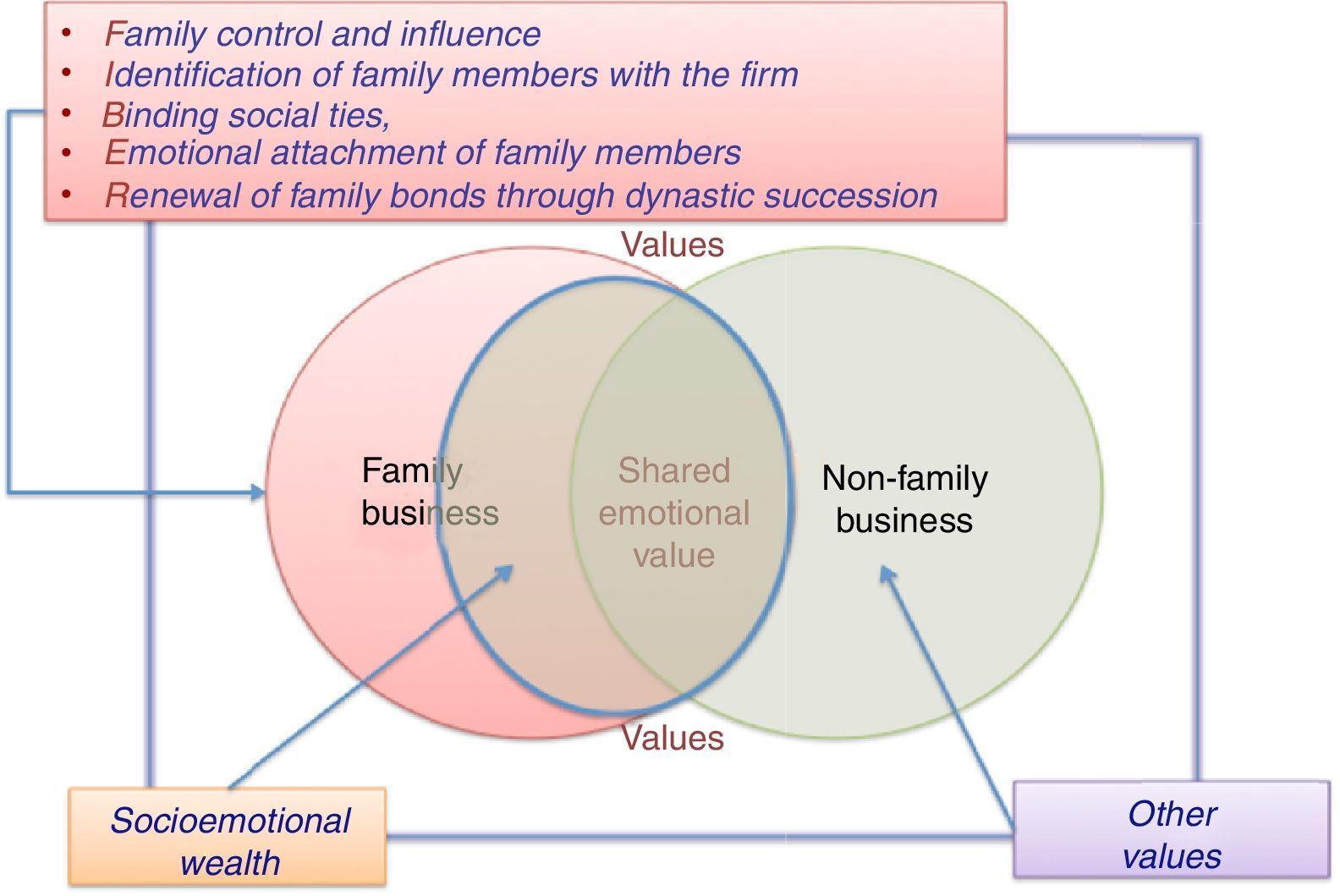

Thus, regarding the relation between SEW and EV, we identify the necessity for distinguishing between these two concepts. Although some authors (Astrachan & Jaskiewicz, 2008; Zellweger & Astrachan, 2008) treat them as equivalent, they are not exactly the same. So, this article analyzes the interconnection between EV and SEW.

With regard to situations that can lead to major or lower SEW levels, we discuss a few authors’ assumptions and simplify their postulations by arguing that there are no different types of SEW. Instead, we mention that there are positive emotions, situations, and relationships that lead to a major SEW, and negative ones that lead to a lower SEW.

Finally, we make a distinction between ownership and management to explain SEW variations along time.

The remainder of this article is structured as follows. The following section describes previous literature regarding the SEW approach, to look for a definition of this term. After that, three controversial issues related to SEW are analyzed. Next, the main challenges that this theory presents are discussed. Finally, the last section comprises the discussion and conclusions.

The Socioemotional Wealth in current literature: looking for a definitionDifferent articles have been developed recently linking the SEW approach with diverse knowledge areas: business management (Goel, Voordeckers, Van Gils, & Van den Heuvel, 2013; Sciascia & Mazzola, 2008; Stockmans et al., 2010), diversification (Gómez Mejia et al., 2007; Gomez-Mejia, Makri, & Kintana, 2010), corporate social responsibility (Berrone et al., 2010; Cruz, Larraza-Kintana, Garcés-Galdeano, & Berrone, 2014; Deephouse & Jaskiewicz, 2013), business valuation (Astrachan & Jaskiewicz, 2008; Zellweger & Astrachan, 2008; Zellweger & Dehlen, 2011), stakeholders (Cennamo et al., 2012), and performance (Cruz et al., 2012; Naldi, Cennamo, Corbetta, & Gomez-Mejia, 2013; Pazzaglia, Mengoli, & Sapienza, 2013; Schepers, Voordeckers, Steijvers, & Laveren, 2013; Sciascia & Mazzola, 2008), among others. Nevertheless, despite different subjects having been put in relation with SEW, there is no universally accepted definition of this concept. So, do scholars know what really SEW is? To solve this issue, we have reviewed the main articles that provide a definition of this concept in the following paragraphs.

The first research that deals with the Socioemotional Wealth (SEW) term is the one by Gómez Mejia et al. (2007). In this article, by SEW they refer to non-financial aspects of the firm that meet the family's affective needs, such as identity, the ability to exercise family influence, and the perpetuation of the family dynasty. This definition is not only considered the seminal one but also the most important conceptualization of SEW that has ever been made, since this article has been used as reference by most of the subsequent studies.

Gómez Mejia et al. (2007) proved that family firms could be risk willing and risk averse at the same time, depending on two types of risk: performance hazard risk and venturing risk. These authors challenge the prevalent notion that family firms are more risk averse than publicly owned firms. They identify SEW in family firms in a variety of related forms, such as perpetuating family name, values, control, and employment; need for belonging, affect, and intimacy; preservation of family firm social capital; ability to exercise authority; preservation of the family dynasty; continuous with the family lifestyle; and, the fulfillment of family obligations based on blood ties rather than on strict criteria of competence and the opportunity to be altruistic to family members.

On the other hand, there are some authors (Astrachan & Jaskiewicz, 2008; Zellweger & Astrachan, 2008) who equate the concepts of SEW and Emotional Value (EV). They define EV as that part of willingness to accept unexplained by the financial value of the ownership stake and the private financial benefits of control accruing to the owners. So, according to these authors, SEW could be defined in the same way.

If we specifically refer to the SEW concept, the next article that deals with it is the one by Berrone et al. (2010). By using a dataset of 194 U.S. firms, these authors explain that family firms pollute less than nonfamily ones at the local level, in order to preserve their SEW. In this context, they define SEW as the stock of affect-related value that the family has invested in the firm. Nevertheless, they do not delve deep into the concept, and when they refer to it, they make reference to Gómez Mejia et al. (2007).

Zellweger and Dehlen (2011) proposed a model that suggests that affect from ownership exerts influence on value perception and on SEW through three features: target, personal, and situational. These authors, following prospect theory, behavioral theory of the firm, and behavioral agency model, conceptualized SEW as the absolute difference between an owner's subjective value assessment and the objective market value for the ownership stake of a firm. Moreover, they make reference to the SEW definition given by Astrachan and Jaskiewicz (2008) and by Zellweger and Astrachan (2008), who define it as that part of a business value (as perceived by the owner) that is unexplained by financial considerations.

Berrone et al. (2012) identify SEW as the most important differentiator of family firms. They argue that SEW is an exclusive aspect for family business and find in this concept the distinctive behavior of these types of firms. They postulate that socioemotional endowment is conceptualized in broad terms to capture the stock of affect-related value that a family derives from its controlling position in a particular firm. These authors highlight not only the advantages but also the challenges of the SEW approach, specifically in its methodological application. They contribute to current literature by identifying five major SEW dimensions: Family control and influence, Identification of family members with the firm, Binding social ties, Emotional attachment of family members, and Renewal of family bonds to the firm through dynastic succession, and label them as FIBER. They also propose a set of items to try to measure different SEW dimensions. They finish their paper with a set of questions for future research.

Finally, Cruz et al. (2012), using a dataset of 392 micro and small enterprises in the Dominican Republic, and by combining the embeddedness and the SEW perspective, empirically show that family employment increases sales but decreases profitability measured by ROA. But, the main thing is that these authors give their own definition of SEW by suggesting that it represents an “affective endowment” that is intrinsically attached to kinship ties so that its presence affects the performance of firms.

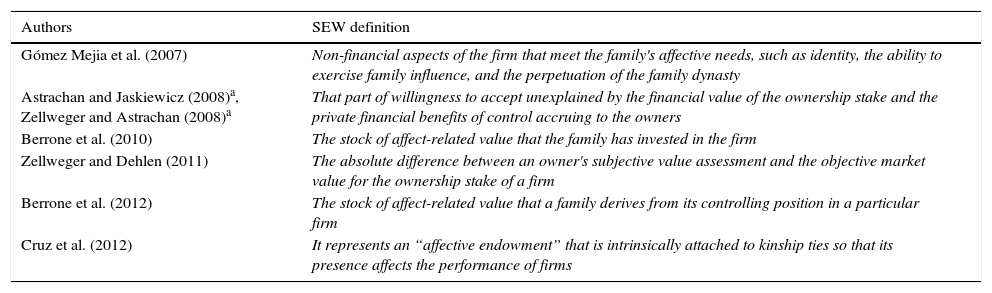

As can be seen, despite being widely used in the family business field, the SEW term presents diverse acceptations. In fact, different definitions are given by the same authors. This might be surprising at first, but also comprehensible. This means that, as this field of study advances, authors can add more details and information to previous definitions in order to make them more consistent. So, Table 1 summarizes the main definitions that have been made so far of the SEW concept, according to previous articles.

SEW definitions.

| Authors | SEW definition |

|---|---|

| Gómez Mejia et al. (2007) | Non-financial aspects of the firm that meet the family's affective needs, such as identity, the ability to exercise family influence, and the perpetuation of the family dynasty |

| Astrachan and Jaskiewicz (2008)a, Zellweger and Astrachan (2008)a | That part of willingness to accept unexplained by the financial value of the ownership stake and the private financial benefits of control accruing to the owners |

| Berrone et al. (2010) | The stock of affect-related value that the family has invested in the firm |

| Zellweger and Dehlen (2011) | The absolute difference between an owner's subjective value assessment and the objective market value for the ownership stake of a firm |

| Berrone et al. (2012) | The stock of affect-related value that a family derives from its controlling position in a particular firm |

| Cruz et al. (2012) | It represents an “affective endowment” that is intrinsically attached to kinship ties so that its presence affects the performance of firms |

In our point of view and as Berrone et al. (2010) suggest, the SEW constitutes something intrinsic to family firms. Consequently, an adequate definition of it should note this characteristic. Nevertheless, previous research has partially neglected this essential feature. In this vein, it is necessary to go further and to propose a definition of SEW that compiles all the attributes mentioned in previous research. So, SEW could be defined as, “The intrinsic and inextricable emotional endowment that all family businesses have, i.e. the set of feelings, emotions, relationships and binding ties between members of the business family.”

This concept explains that SEW is an “emotional endowment,” and thus, very close to psychology. With this definition, we want to highlight that SEW is “intrinsic and inextricable” of family firms, that is, it is characteristic, inseparable, and indissoluble of family firms.

Controversial questions related to SEWSEW and Emotional ValueAn important issue, which requires more attention, is the one concerning the differences between SEW and Emotional Value (EV), because some authors treat them as synonyms (Astrachan & Jaskiewicz, 2008; Zellweger & Astrachan, 2008; Zellweger & Dehlen, 2011) despite they being not exactly the same.

As we said in the previous section, the SEW is an unique characteristic of family businesses, because, although nonfamily principals and managers might experience some of this, “the value of socioemotional wealth to the family is more intrinsic, its preservation becomes an end in itself, and it is anchored at a deep psychological level among family owners whose identity is inextricably tied to the organization” (Berrone et al., 2010: 87). On the other hand, the EV is common for family and nonfamily firms, because it implies emotions and all types of firms have an emotional endowment to the extent that they are run by people, and all people have feelings.

So, it can be assumed that all businesses (familiar or nonfamiliar) are going to have an emotional component. Nevertheless, this component will be a lot more important in family firms because of the relationships between their members. Indeed, these relations among their members are what will determine the difference between SEW and EV. Thereby, it is quite important to distinguish between both of them. We assume that when we talk about SEW, we are referring exclusively to family firms, while when we talk about EV, we are referring to family or nonfamily ones. That is, SEW encompasses EV, but not vice versa.

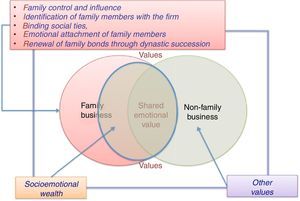

Fig. 1 shows family and nonfamily firms values’ composition. As can be seen, both types of businesses have the common feature of having an emotional component that we call EV. Furthermore, family businesses have a Socioemotional Wealth endowment that encompasses the Emotional Value plus many other emotional components that are related to family relations, such as family members’ relationships or emotional attachment between family members. In any case, all this “overvalued” that SEW has above EV is explained by the family component of these firms. And namely, this is the reason why SEW is unique for family businesses and cannot be extrapolated to nonfamily firms.

The ideas explained above are easier to understand if we think about the SEW dimensions proposed by Berrone et al. (2012), which they label as FIBER that stands for the following: family control and influence, identification of family members with the firm, binding social ties, emotional attachment of family members, and renewal of family bonds to the firm through dynastic succession. These dimensions are exclusive for family businesses insofar that all of them make reference to family firm members and their entailment to the business. Thus, it makes no sense to talk about these dimensions for nonfamily businesses. For example, it cannot be asked in a nonfamily firm if the owner is worried about lending the firm to the next generation, because this will not be a goal for him or her. On the other hand, a family firm owner could be asked if he or she wanted to pass the business to his or her descendants. Hence, definitely there are some emotions and feelings that are inherent to the business family, and thereby, to the family firm. In short, SEW implies EV but not conversely. So, this means that it is compulsory to differentiate between the SEW and the EV.

Moreover, we do not only give a new step by differentiating between SEW and EV, we also give a definition for each of these concepts. So, in the previous section, we defined SEW as “the intrinsic and inextricably emotional endowment that all family businesses have,” while EV could be defined as “the affective value derived from interpersonal relationships in a business.” Thereby,

- •

EV is the emotional endowment derived from interpersonal relationships in all types of firms and it is an extrinsic value (Zimmerman, 2008) also known as instrumental value or derived value. This means that this value is derivative of something associated, namely of the personal relations that occur in firms.

- •

SEW is the overemotional endowment in family firms due to family members’ relationships and can be classified as an intrinsic value (Zimmerman, 2008) of this type of firms. It is not derivative; it is inherent to family businesses.

The dynamics of family controlled firms has been deeply studied for years (Auken & Van Werbel, 2006; Chirico & Nordqvist, 2010). Authors usually distinguish between advantages and disadvantages of family businesses (Chrisman, Steier, & Chua, 2006; Habbershon & Williams, 1999; Kets de Vries, 1993). These pros and cons are linked with the dynamics of the businesses and, particularly with their owners’ behavioral decisions. Moreover, family firms owners’ attitudes shape the emotional endowment of family firms, and thereby their SEW. So, emotions occupy an essential place in the family business field. In this vein, Kets de Vries (1993) cites as positive emotions of family firms the desire for firm's continuity, greater resilience in hard times, and family pride of continuity leadership, among others. On the other hand, as bad sensations of this type of firms, he mentions nepotism, confusing organization, and paternalistic rules.

Understanding SEW as the intrinsic and inextricable emotional endowment that all family businesses have, it can be considered that it is conformed by positive and no so positive emotions. Nevertheless, in the first research about this topic, SEW was conceptualized as a positive emotional endowment (Gómez Mejia et al., 2007). According to this article, SEW can be identified in family firms in a variety of related forms, such as perpetuating family name, values, control, and employment; need for belonging, affect, and intimacy; preservation of family firm social capital; ability to exercise authority; preservation of the family dynasty; continuous with the family lifestyle; the fulfillment of family obligations based on blood ties rather than on strict criteria of competence and the opportunity to be altruistic to family members. Cennamo et al. (2012) and Berrone et al. (2010) also only consider positive dimensions of SEW.

However, there are emotions and feelings that cannot be understood as positive, like stress, conflicts with nonfamily relatives, specifically brothers and sisters-in-law, siblings’ rivalry, the mixture of family and business’ problems, etc.

Regarding these “no so positive” emotional aspects, some authors have written different articles about what they call “dark side” of SEW (Kellermanns, Eddleston, & Zellweger, 2012) or about the positive and negative SEW valences (Zellweger & Dehlen, 2011).

In this regard, Kellermanns et al. (2012) argue that if family firms’ owners take SEW as the main frame of reference, they could jeopardize both firm survival and its contributions to stakeholders. They make reference to the term “valence” that was first defined by Feldman Barrett (1996) to categorize emotions, distinguishing between SEW dimensions that could be positively and negatively valenced. These authors also postulate that family control and strong family identification can cause family members a dependence feeling to the firm. Moreover, they assume that SEW dimensions with negative valences will reduce family members’ arrangement of performing proactive stakeholders engagement.

Zellweger and Dehlen (2011) also differentiate between positive and negative SEW valences in the context of firm valuation, and argue that in both cases this differentiation has consequences in the subjective valuation process that family business owners make. So they extrapolate valences to firms’ valuation processes. On the one hand, positive valence indicates that continued investing in that firm is the best option. And on the other hand, negative valence indicates a preference to leave and to sell the firm.

Miller and Le Breton-Miller (2014) make a different assumption. They argue that there are two types of SEW priorities: restricted and extended. They postulate that restricted SEW is centered in family priorities and could run counter to the firm and the interests of nonfamily stakeholders. By contrast, extended SEW would be centered on the long run and on the family, the business and on all its stakeholders at the same time.

Actually, all the above research analyzes the same issue, although distinct authors call it differently: positive and negative SEW valences (Kellermanns et al., 2012; Zellweger & Dehlen, 2011), or restricted and extended SEW (Miller & Le Breton-Miller, 2014). Indeed, they are referring to different forms of categorizing the same thing, that is, the good and not so good emotions and relations in family firms that shape SEW, and that lead to different levels of this emotional endowment.

It is possible to assume that there are no different types of SEW. It is simpler than this. There are positive emotions, situations, and relationships that lead to a major SEW, and negative ones that lead to a lower SEW. What is important is to identify what aspects or situations lead to different SEW levels. Thereby, it is necessary to distinguish between positive and negative (or no so positive) situations that can lead to higher or lower SEW.

Moreover, it is imperative to highlight that wealth could be major or lower, but not negative. Thus, SEW will always have positive values. This is easier to understand if we think in the SEW dimensions proposed by Berrone et al. (2012). If a dimension does not exist, it would take the value zero but it would not be negative.

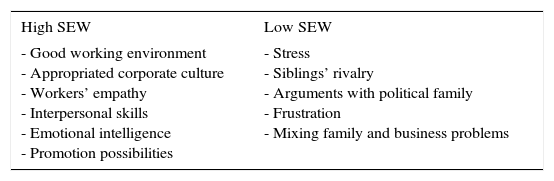

Table 2 shows different situations in family firms that lead to different SEW levels.

Situations that lead to high or low SEW.

| High SEW | Low SEW |

|---|---|

| - Good working environment - Appropriated corporate culture - Workers’ empathy - Interpersonal skills - Emotional intelligence - Promotion possibilities | - Stress - Siblings’ rivalry - Arguments with political family - Frustration - Mixing family and business problems |

It is firmly rooted that family firms pursue more nonfinancial goals than nonfamily firms (Chrisman, Chua, & Litz, 2003). Specifically, family firms pay major attention to noneconomic objectives related to the family itself (Westhead & Howorth, 2007).

This is closely related with the SEW issue, to the extent that it is supposed that a major SEW would imply a major emotional importance in the decision-making process. Thereby, it is interesting to analyze if SEW varies along time. Because if SEW changes along time, different decisions would be made depending on the importance given to the emotional component of the family firm. Some authors have dealt with the question of emotional considerations’ variations along time (Gómez Mejia et al., 2007; Westhead, 2003; Zellweger et al., 2011). So, it could be assumed that emotional perceptions, and therefore SEW, change along time.

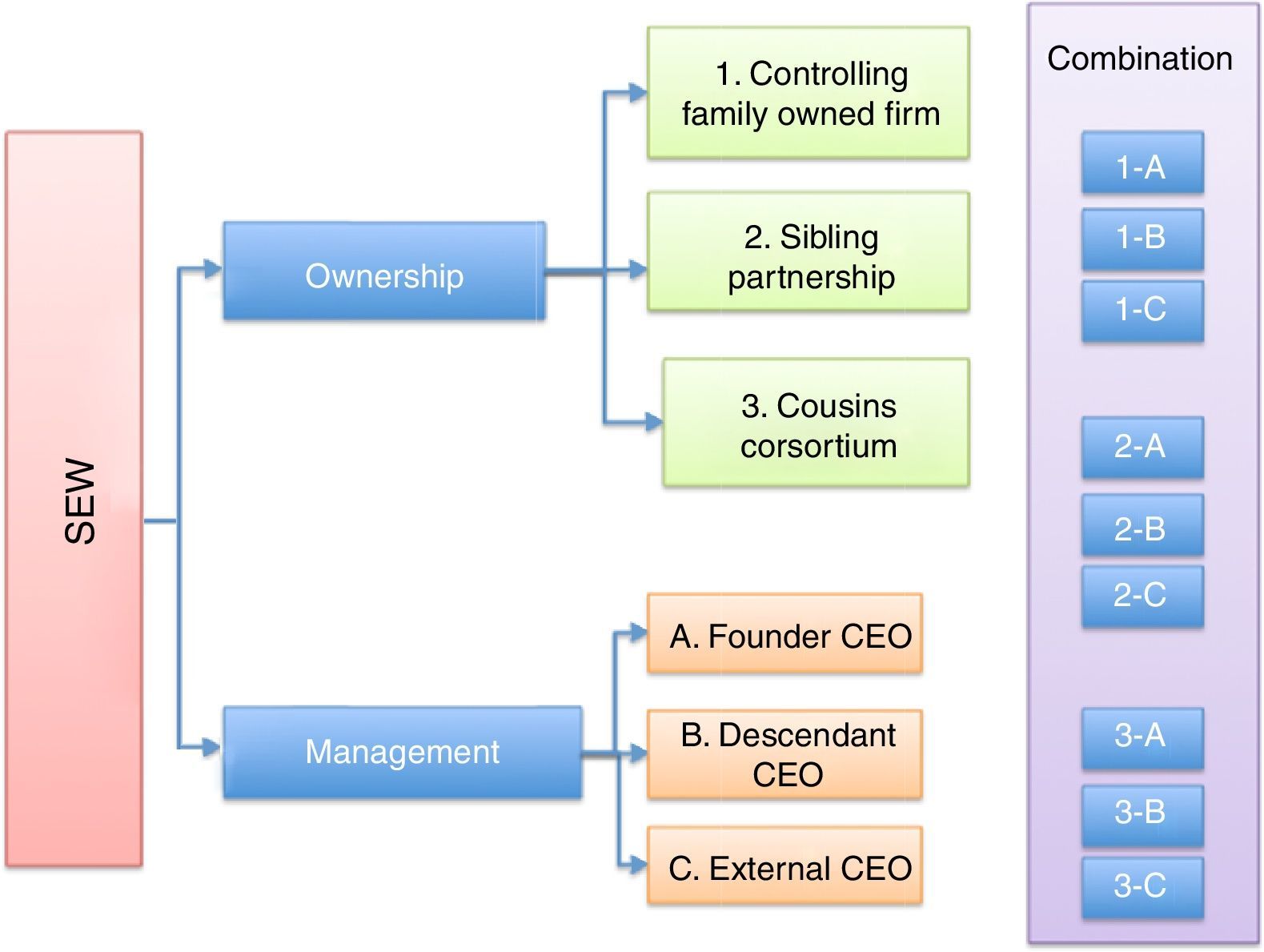

Nevertheless, in all the articles mentioned above, there is no distinction between ownership and management, and authors mix both concepts when they talk about SEW. For example, Gómez Mejia et al. (2007) postulate that “losses in socioemotional wealth should weigh less heavily on a family firm's willingness to give up control as it moves from stage one [founding-family owned and managed firms] through stage three [extended-family owned, professionally managed firms].”

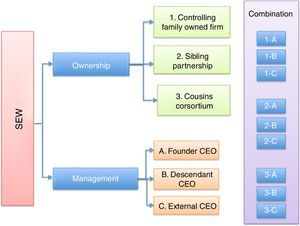

This nondifferentiation could lead to mistakes, to the extent that ownership and management might not be in the same hands. We mean that it may happen for example if the firm's ownership was in hands of the first generation, and by contrast, control was held by subsequent generations. In these cases, there will be controversial factors to determine the firm SEW, because some of them (the ones related to ownership) will increase this wealth, and others (the ones related to management) will move in the opposite direction. And conversely, that is, the firm's ownership could be in subsequent generations and the firm's control could be in the founder's hands. The main thing, in our opinion, is to consider all the different possible combinations of ownership and management.

So, SEW variations over time should be analyzed, since there might be a double perspective: ownership and management. Ownership is understood as participations’ possession and management is understood as power of leadership.

Thereby, it is quite important to make this distinction to delve deep into this issue and to clarify it. For example, Le Breton-Miller and Miller (2013) make reference to ownership and management, as different aspects. Nevertheless, they consider that founder firms are founded, owned, and run, postfounder family firms are family owned and run, and cousin consortia have dispersed family ownership and sometimes are nonfamily managed. So, these authors do not analyze the different possibilities that result from mixing different combinations of ownership and management stages.

Regarding family firms’ ownership, it had been demonstrated that first-generation family firms are more concerned with emotional goals than next generation ones (Westhead, 2003), and thereby their SEW is higher (Gómez Mejia et al., 2007). So, when the founding family controls the firm, the emotional endowment of that firm is deeper (Schulze, Lubatkin, & Dino, 2003). Stockmans et al. (2010) also postulate that when successive generations enter the family firm, businesses objectives become as important as emotional objectives, downplaying familiar considerations.

So, it has been empirically proved that SEW is related to the ownership's stage (Gómez Mejia et al., 2007). But, does SEW change with business management?

If we talk about management, we are referring to the decision-making process, and thereby to the CEO. So, it is very important to identify who the CEO is, and which his or her value perceptions are. Regarding family firm's management, Villalonga and Amit (2006) distinguish between the CEO's generation. That is, they identify founder CEOs, descendant CEOs, and external CEOs. These authors postulate that founder CEOs create value for family firms, while the other CEOs do not. Moreover, Chrisman, Chua, and Litz (2004) add that founder CEOs could pursue other than financial goals.

So, according to these authors’ postulations (Chrisman et al., 2004; Villalonga & Amit, 2006), we argue that the CEO's stage in a family firm is linked with the amount of SEW that it presents.

In short, the amount of SEW in a family firm changes along time and depends on two factors: ownership and management. Both of them influence the emotional endowment, and although their connection with SEW is very similar, they are not exactly the same. So, SEW could vary due to ownership factors and/or due to management factors, as expressed in Fig. 2. The combination of these factors might lead to very different results.

ChallengesStarting from the idea that differences exist among family firms and family owners, heterogeneity can be assumed among family firms and also among their owners (Melin & Nordqvist, 2007). Two equal family businesses do not exist. Each family business has different behaviors and organizational characteristics (Berrone et al., 2012). Even having similar characteristics regarding profitability, leverage, target market and clients, or form of management, two family firms are completely different. This fact means that results from one family business cannot be generalized to another, as these would not be equivalent.

Therefore, we start from a heterogeneous group of companies. However, despite the discrepancies in the literature regarding the conceptualization of family firm, due to the nonexistence of a universally accepted definition of family business (Astrachan & Shanker, 2003; Astrachan, Klein, & Smyrnios, 2002; Litz, 1995), there is some unanimity in qualifying a business as familiar or nonfamiliar. Mainly, the analyzed characteristics to classify a business as a familiar one are ownership, control, and the desire of business continuity along time (Vallejo Martos, 2005).

Considering that we start from a diverse group of businesses, the challenge is even greater when once assumed that we are working with a heterogeneous group of family businesses, we move to the Socioemotional Wealth that they present. In this regard, it can be said that the SEW is an intangible element, which is not visible, but nevertheless, it is perfectly perceptible in the corporate environment and culture.

In any case, in this section, we point out which are the major challenges of the SEW approach that could be summarized in broad strokes into two: on the one hand, the different emotional endowment of each type of business and, on the other hand, the quantification of this emotional component.

Regarding different emotional endowment, as it is said by Zellweger and Dehlen (2011), different family firms have different emotional endowments, and thereby, different SEW. This can greatly hinder the creation of a standard model to analyze the emotional endowment of these businesses. In addition, individualized firm studies would have to be made because the results obtained for a business could not be extrapolated to another.

Moreover, we argue that not only SEW endowment differs between family business, but also SEW perceptions differ between family firms’ owners. This is even more complicated than the previous defiance, because it would be necessary to study owners’ perceptions, and this cannot be done but only at the individual level.

Therefore, the SEW issue in a firm could be analyzed as a whole, by observing the business culture and by surveying the CEO. While, if the owners’ perceptions would like to be analyzed in more detail, it would be necessary to study the individual behaviors and reactions of each of them.

The other big challenge that the SEW concept presents is its quantification. As it was said above, it is an abstract concept, and so its measurement is complicated.

Different proxies have been used to quantify SEW. The most common one has been the ownership stake in the hands of family members (Berrone et al., 2010; Gómez Mejia et al., 2007). The more the ownership is in family hands, the more is the influence of the family in firms’ decisions. So, these authors postulate that a major ownership would imply a major SEW. Another point of view has been considering family status as a measurement of SEW (Gómez-Mejia et al., 2010).

In this vein, Berrone et al. (2012) go beyond their peers. They distinguish between different SEW dimensions and proposed a set of items based on previous research to measure them. They add that the proposed items need to be tested and pass psychometric procedures. Thereby, the research of Berrone et al. (2012) could be the first step to empirically measure SEW directly. But what about financial quantification? It seems that it has to be assessed as an intangible asset, but nothing has been done up till now.

Summarizing, researchers have some challenges to improve this approach: different SEW for different businesses and its quantification. So, future research is needed to resolve these issues.

ConclusionsThe main goal pursued with this article was a major comprehension of the SEW approach.

For achieving our objective, we have first analyzed the SEW approach looking for a definition of it, starting from the seminal article of Gómez Mejia et al. (2007) to the most current ones (Miller & Le Breton-Miller, 2014; Vandekerkhof et al., 2014). We have gathered the different definitions of this term. Moreover, we have suggested a more comprehensive definition of SEW, trying to conceptualize it in the most appropriate way by compiling the attributes cited in previous research.

This paper also discusses some controversial questions regarding the SEW: the differences between SEW and Emotional Value (EV), the situations that lead to a major or a lower SEW, and SEW variations along time due to ownership and management. We also discuss two aspects that constitute the main challenges of this approach.

As we have expressed in “Controversial questions related to SEW” section, we consider it necessary to distinguish between SEW and EV. The SEW is an exclusive endowment of family firms (Berrone et al., 2010). But, emotional aspects of nonfamily firms cannot be ignored. There are people working in nonfamily firms, and people have feelings and emotions. So, there would be an emotional endowment in nonfamily firms. Thereby, SEW and EV are not the same and they have to be used as different concepts.

Otherwise, the simplification that we have made about positive and negative SEW valences (Kellermanns et al., 2012; Zellweger & Dehlen, 2011) and restricted or extended SEW (Miller & Le Breton-Miller, 2014) can lead to the search of similar goals. We mean that researchers should focus on how different situations affect the socioemotional endowment of family businesses. In this way, family firms could learn how to face these situations and how to cope with them.

Furthermore, we find out the need for distinguishing between ownership and management in order to analyze SEW variations along time. In this vein, it could be interesting to develop an empirical study to analyze the effects on SEW on different combinations of control and management.

Regarding the challenges that the SEW approach presents, we cite two as follows: the different SEW endowment of family firms and its quantification. The solutions for these challenges are not easy, and they will require further research. So, for analyzing these issues, it is necessary to make individualized studies of family firms. And namely, for the SEW quantification, we think that the proposal of Berrone et al. (2012) constitutes a first step that has laid the base to further develop the empirical part of the SEW approach.

The SEW approach is relatively new and is still in its infancy, so numerous contributions have to be made to improve it. Nevertheless, by analyzing the existing literature that deals with this concept, it could be said that research is advancing in this field. As we said before, diverse knowledge areas have been related with the SEW approach: business management and business valuation, diversification, and performance, among others. So it is true that SEW has important implications and consequences for family businesses. Thereby, SEW can be considered as the most important paradigm in the family business field (Berrone et al., 2012) and more research has to be developed to improve this theory.

The aim of this paper was to delve deep into the SEW approach to achieve major knowledge of it. We also want to encourage more research regarding the controversial questions mentioned. So, the next step should be analyze empirically the polemical issues we propose.

Conflict of interestsThe authors declare no conflict of interests.