This paper investigates whether and to what extent individual firms improve their innovation from behaving as brokers connecting other actors in the Spanish ceramic tile cluster. The effects of the brokerage roles are analyzed for different innovation levels by means of quantile regressions. Finally, we speculate about the indirect and interactive effects of the distinct individual organization attributes and these benefits. Results show that brokerage activities unevenly influence the broker's innovative performance. In addition, the intensity of the impact varies for different innovation levels and the firm's absorptive capacity moderate the final effect of acting as a broker.

The growing interest in the territorial contexts shown by different economic disciplines has led to a major increase in the amount of research devoted to industrial clusters (Henry and Pinch, 2001; Tavassoli and Tsagdis, 2014). Within this vast body of literature, some authors have identified clusters as the network model in order to map and study the actors and the interactions that take place there (Branston et al., 2005; Boschma and Ter Wal, 2007; Parrilli and Sacchetti, 2008).

Our paper focuses on the network structure and the place individual actors occupy in the global network (see Borgatti and Foster, 2003; Provan et al., 2007; Phelps et al., 2012). As several scholars argued, the position that a firm occupies in the network might condition its ability to access external knowledge, create new value and, consequently, to achieve economic goals, including innovation, on which we focus (e.g. Coleman, 1990; Tsai and Ghoshal, 1998).

More specifically, a rapidly developing part of this literature is focused on knowledge brokers as intermediary actors (Cumbers et al., 2003; Bathelt and Gräf, 2008). One particular line of this literature extended brokerage research by distinguishing different roles as set out in the seminal proposal by Gould and Fernandez (1989). In our case, we consider two categories of broker roles, namely the coordinator and the liaison. These represent the typologies that develop horizontal and vertical relations inside the cluster, respectively, and we expect them to have uneven implications for innovation, as they are different in nature.

In spite of previous advances in the analysis of the knowledge exchanges among network actors, there are still some relevant research questions to be properly addressed.

In fact, considering the cluster networks literature, brokerage roles have been only partially considered. For instance, the gatekeeper's role has been analyzed by Giuliani (2007) and Morrison (2008), among others. In all cases, however, the authors analyzed the links between internal and external actors of the cluster. Conversely, within the context of geographical clusters, different industrial activities of the cluster value system or filière can be identified as classes or subgroups of actors and intermediations among them represent vertical and horizontal relationships inside the cluster. Triads formed by a firm acting as a bridge between two others create different contexts with distinct goals and exchanged information. As far as relationships involve the share of information and knowledge, these might play an important role in innovation performance. However, only few papers such as Boari et al. (2016) or Belso-Martínez et al. (2015) have addressed this issue, finding a positive impact of brokerage on innovation.

Whereas these contributions represent an interesting point of departure, much more research is needed in some directions. For example, it should be taken into account that firms in the cluster are different, also in terms of innovative performance. Similarly to Ebersberger et al. (2010) for the case of R&D investment and innovation, this heterogeneity might lead to nonlinear patterns and a varying capability to benefit from brokerage activities. Other contributions in related literature such as Stock et al. (2001), Berman et al. (2002), Coad and Rao (2006) and Molina-Morales and Martínez-Fernández (2009) also give support to nonlinear relationships.

The literature on brokerage so far has completely disregarded this issue, and this may lead to non-appropriate brokerage strategies in some firms. This paper attempts to fill this gap in the literature. Our research question is whether, and if so, to what extent individual firms improve their innovation by behaving as brokers (identified as coordinator and liaison) that connect other actors in the corresponding cluster network. However, the key contribution of this paper to the existent literature is to address the issue of parameter heterogeneity for companies at different level of innovation, running both OLS and quantile regressions. In case heterogeneous effects are found, the benefits from acting as a broker would be uneven for companies with different innovation levels, and this would provide useful information for a more specific and accurate design of firms’ brokerage strategy.

We focus on the specific case of the Spanish ceramic tile cluster, where knowledge creation is conditional on intra-cluster relations (Arikan and Schilling, 2011). In order to compute the values of the brokerage activities, we collected data from questionnaires completed by 166 firms and applied Social Network Analysis (SNA).

The paper is structured as follows. First, we present the outlines and the conceptual framework, and define the research questions. We then explain the methodology applied and the operationalization of the concepts, and finally results, conclusions, and their potential implications are discussed.

Theoretical frameworkKnowledge brokers in clustersTriads formed by a firm acting as a bridge between two others create different contexts with different goals and exchanged information. Brokerage, as an activity, is defined as a process by which intermediary actors facilitate transactions among other actors lacking access to or trust in one another (Marsden, 1982). Some researchers hold that brokers as intermediaries serve as go-betweens for potential exchange partners who are otherwise disconnected. Intermediaries bridge the social gaps in a network by linking persons who have complementary interests or by transferring information and so on (Aldrich and Zimmer, 1986).

The notion of knowledge brokers and their implications for clustered firms have already been the focus of the literature in this field. The concepts of brokerage and technological gatekeepers were transferred to the spatial context by Giuliani and Bell (2005), Graf (2011) or Morrison (2008). These authors emphasized that in contexts like geographical clusters, rather than all firms being tied to one another, each one can maintain a single connection with the other actors, such as supporting organizations specialized in providing access to information about potential exchange partners.

Being located in the middle of a transaction, as happens to brokers, can be beneficial for the knowledge contribution that fosters a firm's innovative capacity (Becker, 1970; Galunic and Rodan, 1998; Uzzi and Spiro, 2005; Boari and Riboldazzi, 2010). In this brokerage literature one particular extension distinguishes different roles, as proposed by the seminal work by Gould and Fernandez (1989). These authors analytically distinguished up to five different brokerage roles, arguing that a number of qualitatively different mediation structures emerge when actors in transaction networks are differentiated into subgroups. Consequently, the brokerage roles classification proposed by Gould and Fernandez (1989) is very sensible to “the possibility that actors in a social structure are differentiated with regard to activities or interests, so that exchanges between some actors differ in meaning from exchanges between other actors. An obvious way to take such differentiation into account is to partition a system into a set of mutually exclusive (nonoverlapping) classes or subgroups of actors” (Gould and Fernandez, 1989: p. 91). In the case of industrial clusters, this partition can be made by separating companies in different industrial activities embedded in the cluster value system. This type of partition allows also identifying vertical and horizontal relationships that have received most attention in the clusters literature (Schmitz, 2000; Maskell, 2001; Mesquita and Lazzarini, 2008). Vertical relationships in clusters are often maintained between business partners and collaborators that perform complementary activities while horizontal relationships involve rivals and competitors (Maskell, 2001).

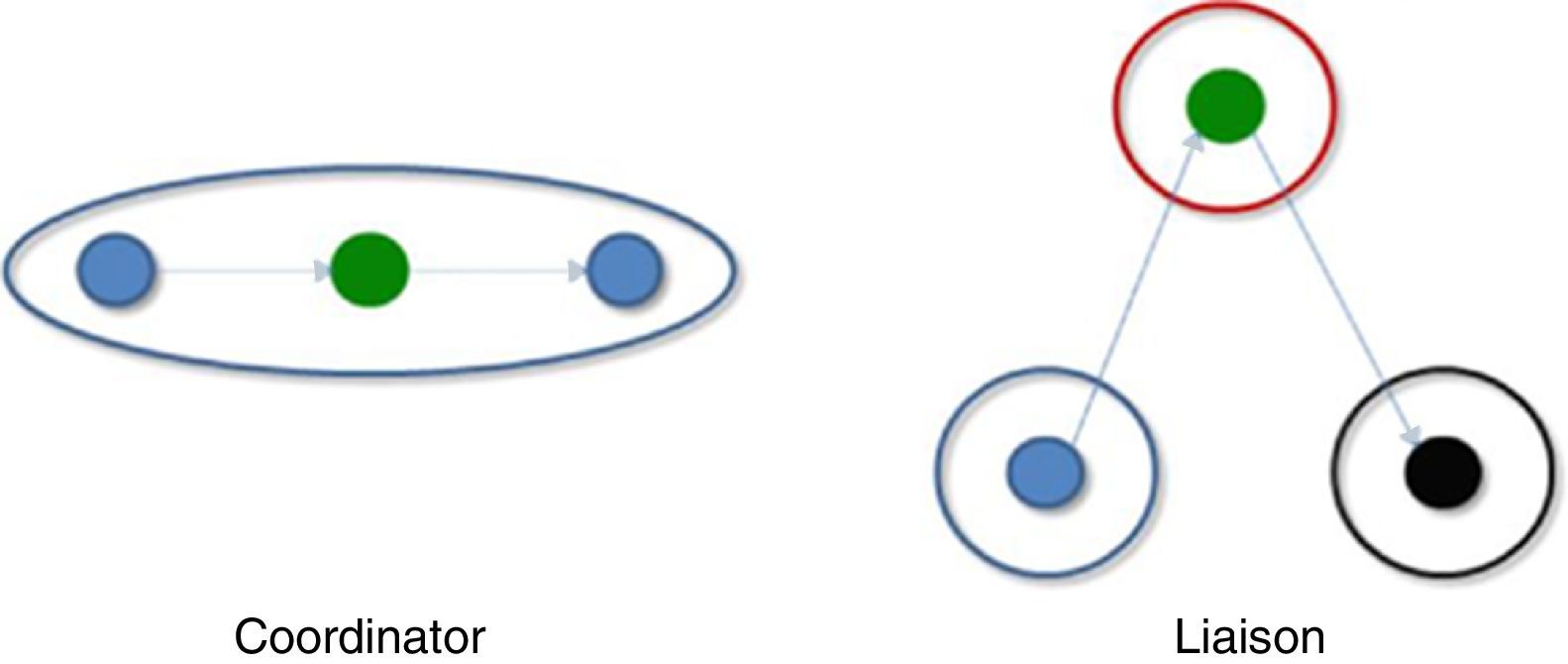

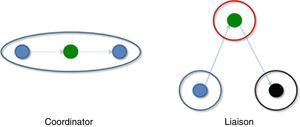

Each role has a distinct complexity and therefore must be treated differently to accommodate contexts and goals (Graf and Kruger, 2011). Under the industrial cluster framework and considering a partition of the social structure according to the position of the actors in the cluster value system, we focus on two particular roles: coordinator and liaison. These two roles are the best representatives of vertical and horizontal relationships in the aforementioned context. In the case of the coordinator, the broker connects only with firms in the same position in the value system, that is, this role has horizontal ties with rival firms. On the other hand, in the liaison role, the broker is an outsider with respect to both the initiator and the receiver of the brokerage relationship (Gould and Fernandez, 1989), involving vertical ties between firms and customers or suppliers (Fig. 1).

There is a different theoretical reasoning underlying horizontal and vertical ties, the nature of the information transmitted is also different and, in consequence, the implications of brokerage roles for innovation are expected to differ. However, instead of proposing a hypothesis discriminating between the two roles we have opted for formulating two separated hypotheses.

HypothesesEffects of acting as a liaison broker on the innovation of clustered firmsWithin the context of our research, the liaison role connects actors located at different phases of the production process in a triad where all the actors belong to different industrial activities. Previous literature has provided a great deal of evidence on the effect of vertical relations, with suppliers and customers, on the competitiveness and innovation of cluster firms. The ability to interact with suppliers accelerates the firm's access to and transfer of knowledge with relevant effects on company growth and innovativeness (Lorenzoni and Lipparini, 1999). Relations between firms and customers favour the potential for new innovative combinations and for reducing the phases of the innovation process (Von Hippel, 1977; Yli-Renko et al., 2001). In addition, it is argued that firms improve product-development coordination by interacting heavily with their suppliers (Dyer and Nobeoka, 2000).

Particularly, within the context of clusters, firm–supplier relationships are more widespread and considered more important as far as the transfer of technical knowledge is concerned. The existing firm–supplier relationships within the cluster may foster flows of technical knowledge that are supported by the lack of fear of unintended imitation by competitors, which usually characterizes horizontal ties (Boschma and Ter Wal, 2007).

From a relational perspective, liaison is focused on diversity of knowledge sources. Brokers create value in different ways, namely by identifying different interests and difficulties, by transferring best practices, and by appreciating possible contributions that can arise from combining elements from different groups. Empirical research shows that the most important factor for innovation is how diverse and even contradictory the intermediated information and its possible interpretation (Burt, 2004), based on the idea that the same information can be valuable in one group and useless in another.

We have reported some previous papers addressing to this issue as, for instance Belso-Martínez et al. (2015) or Molina-Morales et al. (2016), who proved a significant association between brokerage roles and innovation performance. In consequence, we expect brokers playing a liaison role will have a potential positive effect on the innovation of clustered firms by intermediating between different industrial activities involved in different technologies/markets. However, in this paper, we aim to go further and we speculate about a variation on this effect across the different levels of innovation achieved by the firm. Rather than a more simplistic contribution to explain the average effects on the innovation of the role, we address the potential heterogeneity in the estimated effects in other parts of the innovation distribution, i.e., different quantiles, which is otherwise overlooked. The point is that firms differ in their innovation level, and it is likely that adopting the brokerage roles that we consider has different effects for low and highly innovative companies, as have been found for other innovation determinants as R&D expenditures (see Ebersberger et al., 2010). For example, it can be argued that low innovative firms lack the necessary structure to exploit the benefits from brokerage. When innovation activities are occasional and sparse, being a broker may have a weak impact on innovation. Yet, once a company is involved in innovation processes more systematically, it can likely benefit further from brokerage. These benefits, however, are expected to decline at some point since, similarly to other innovation determinants, brokerage may be subject to diminishing returns. Accordingly, we speculate that the impact of brokerage reduces for companies that are already highly innovative, giving rise to an inverted U-shaped curve. Shedding light on this issue would have significant consequences for the innovation strategies of clustered firms.

Nevertheless, the literature on brokerage is very recent, and we found support for our proposition in similar examples as that by Ebersberger et al. (2010) regarding R&D investment. There are also studies from other branches of the literature, but with some similarities in the theoretical reasoning, as for example Peiró-Palomino and Tortosa-Ausina (2013) for the case of social trust and economic development. Considering the innovation field in a broader sense, inverted U-shaped curves are common (see, for instance, Stock et al., 2001; Berman et al., 2002; McFadyen and Cannella, 2004). However, whereas we consider that these related papers might give support to the idea of nonlinear effects of brokerage on innovation, we cannot hypothesize a particular functional form with the current state of knowledge. Then, our hypothesis can be expressed in a formal way as follows:H1 The brokerage role of liaison will likely have a nonlinear relation with the innovation performance of the clustered firm depending on its innovation level.

Differently to what happens with vertical relations, the impact of horizontal relations on innovation has received little attention. In fact some authors have argued that, if present, horizontal ties are less important than vertical ones (Tomlinson, 2010). Apparently, by intermediating between rival firms, coordinators have the lowest chance of accessing and exploiting knowledge related to innovation. However, in spite of the possible redundancy of the accessed knowledge, when coordinators interact with their competitors, firms benefit in different ways and learn useful lessons. This is particularly predictable in a cluster, where closeness between competitors encourages the sharing of high quality ideas and resources, as authors like Boari et al. (2003) have observed.

The particular conditions under which firms operate make clustered firms compete more intensely than companies that are not located in these spatial agglomerations (Becattini, 1990; Dei Ottati, 1994). Porter, for example, considers that location amplifies domestic rivalry, which becomes a key factor for competitive advantage, since this rivalry, among other things, pressures companies to be more efficient (Porter, 1990, 1998; Porter et al., 2000). Spatial closeness to rival firms can increase the richness and depth of the information exchanged; in fact, local competition facilitates the adoption and transfer of best practices within an industry (Piore and Sabel, 1984).

In conclusion, and similarly to the liaison's hypothesis argument, we expect brokers playing a coordinator role to benefit in terms of innovation performance, by intermediating between different firms involved in the same technologies/markets. Following the arguments we proposed in the previous hypothesis, considering only the average effect of the potential influence of coordinator activities on innovation is far from providing a complete understanding on their actual effects. In consequence, we aim to investigate how the potential effect varies at different levels of innovation achieved by clustered firms. Analogously to the liaison role, we expect the role of coordination to be significant and nonlinearly related to innovation over the entire range of innovation quantiles. Accordingly, our hypothesis can be defined as follows:H2 The brokerage role of coordinator will likely have a nonlinear relation with the innovation performance of the clustered firm depending on its innovation level.

Although in the previous sections we focused on the organization's external relations, this exclusive attention to network structure obscures the role of the many intrinsic organizational characteristics that also influence the firm's innovative capabilities. Previous research emphasizes the relevancy of the firm-specific factors in order to enhance a firm's outcomes (Barney, 1991; Grant, 1991). In fact, network structure influences firm outcomes, but these effects may be contingent on the focal firm's capabilities (Zaheer and Bell, 2005). The focal firm's attributes are likely to be an important source of variance in firm performance (Zaheer and Bell, 2005). As Adler and Kwon (2002) pointed out, firm-specific capacities can act as complementary resources. Internal characteristics (such as a strong R&D team, internal organizational structures, and organizational culture) might make the firm more innovative than its competitors.

Particularly, innovativeness is closely related to R&D efforts as an indicator of absorptive capacity, which is defined as the capability of the firm to use and exploit knowledge obtained from external sources (Cohen and Levinthal, 1990, 1994). Hence, the absorptive capacity implies the recognition of valuable external knowledge and its corresponding assimilation in such a manner that enables a commercial end (Escribano et al., 2009). In fact, many authors suggested two main roles of absorptive capacity and its relation with external knowledge. On the one hand, absorptive capacity amplifies the amount of available external knowledge flows. On the other, the benefits of these identified knowledge flows depend mostly on the amount of absorptive capacity (Cohen and Levinthal, 1989; Arora and Gambardella, 1994; Zahra and George, 2002). Consequently, the first role is often referred to as the potential absorptive capacity while the second one is labelled as realized absorptive capacity (Escribano et al., 2009).

The literature is inconclusive on the effect between absorptive capacity (or R&D effort) and brokerage activity. However, there is an extensive literature, particularly on clusters, showing the existence of a joint additional positive effect of individual absorptive capacity and cluster interactions (brokerage). In fact, most of the research on absorptive capacity highlights the high degree of complementarity between external information availability and internal resources aimed at its appropriation (Cohen and Levinthal, 1990; Pennings and Harianto, 1992; Lane et al., 2001; Shipilov, 2009). This joint effect increases the firm's knowledge and, consequently, its value creation and innovation. Some examples in this regard are Expósito-Langa et al. (2015), Molina-Morales and Expósito-Langa (2012) or Escribano et al. (2009). In spite of the above argumentation, some recent body of research remarks that it is also possible to find a partial substitution effect between internal R&D efforts and external information sources such as brokerage activities. Intuitively, we might argue that a company can acquire knowledge investing in R&D (absorptive capacity) or, alternatively, interacting with other cluster actors (brokerage). However, some overlapping effects between the potential absorptive capacity and brokerage activities might occur. Consequently, the absorptive capacity can be at some point partially substituted or complemented by brokerage activities, depending on the degree of overlapping (Shipilov, 2009).

Despite these findings, some authors point to the fact that networks of collaboration between cluster companies require the participation of many organizational aspects (Lane and Lubatkin, 1998; Laursen and Salter, 2006). In the case of external collaborative relationships, like brokerage, these interactions imply the destination of internal resources into activities such as compiling knowledge from the initiator of the brokerage relationship or sending it to the receiver (Lam, 1998). In order to monitor the progress, managers involved in innovative processes need to pay attention to several questions regarding the composition of their teams and the amount of effort dedicated to internal and external activities (Ebersberger and Herstad, 2011). As investments in R&D grow, there is an increasing pressure in capitalizing the efforts and more sensitivity on potential intellectual property rights conflicts with collaborators. This leads to a certain reticence or barriers on external interactions in order to avoid uncontrolled spillovers (Ebersberger and Herstad, 2011). In this line, authors such as Chesbrough (2003) argued that strong orientations to internal R&D activities may lead to closed innovative processes. Despite all the above considerations, it must be said that very few empirical evidences support these arguments (Laursen and Salter, 2006; Ebersberger and Herstad, 2011).

Considering the two roles which are the focus of this paper, we expect the absorptive capacity of the individual firm to act as a moderator in the causal relation between the liaison and coordinator roles and innovation performance. This moderation, following the majority of the literature on the topic, is expected to be positive, assuming the complementarity between brokerage activities and absorptive capacity. In consequence, we formulate the following hypothesis:H3 The absorptive capacity of clustered firms moderates positively the effect of the brokerage activities on innovative performance.

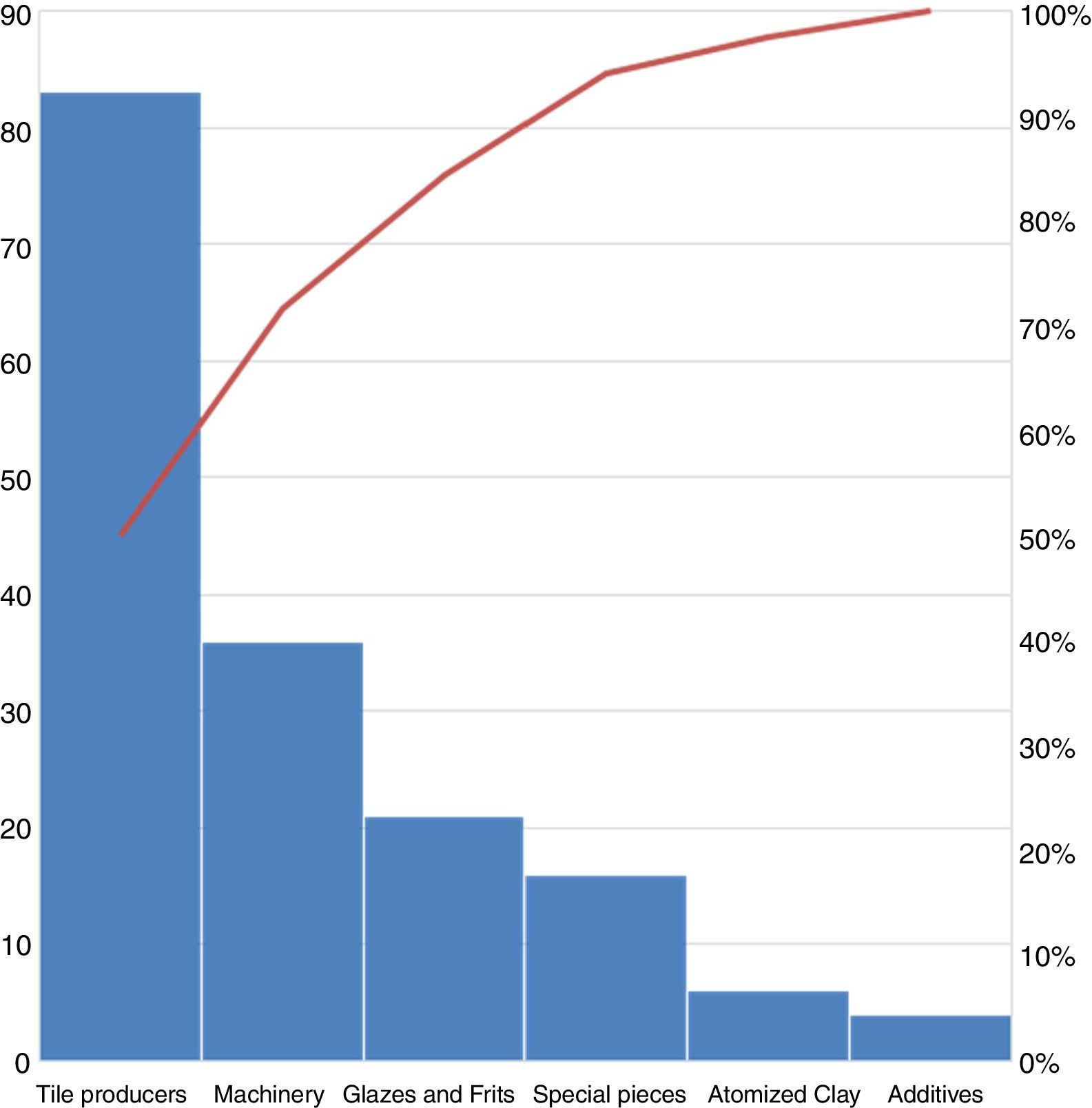

To carry out this research we focused our analysis on the Spanish ceramic cluster (Molina-Morales and Martínez-Fernández, 2004; Picazo-Tadeo and García-Reche, 2007). This cluster is located in the province of Castelló and has a radius of about 20km. This geographical area accounts for more than 90% of the Spanish tile production. In addition to the manufacture of wall and floor tiles, there are also other industrial activities in the area such as production of decorative pieces, chemical additives, glazes and frits, machinery and atomized clay, among others. In addition, a group of institutions provides services and support to the entire cluster. Examples of these institutions are the local university, research institutes, policy agents, business associations, etc. Globally, the production of ceramic tiles is still growing, mainly in industrial cluster-type concentrations. In this global context Spain is one of the most important producers, together with countries like China, Italy and Brazil.

The Spanish ceramic cluster is characterized by technological overlaps, specialization, and an abundance of small and medium enterprises (Molina-Morales, 2002). It is a very dynamic cluster in terms of technological advances, which are applied mainly in improving processes and products (Flor and Oltra, 2004; Oliver et al., 2008). The transmission of knowledge is also very intensive, in addition to business creation, mobility of workers, and the abundance of communication channels (Albors, 2002). This set of features, together with a specific cluster technology, generates a common perception of the market (Molina-Morales, 2002). In fact, within this group of companies, the link between tile producers and suppliers of glazes and frits plays a very important role (Hervas-Oliver, 2004). This relationship provides one of the main competitive advantages of the cluster as a whole. In terms of innovation, the exploitative type characterizes this cluster, given that the cluster is in a mature stage of development. The dense relational structure and strong ties favour the existence of this innovative model. In this context, suppliers work with many clients, thus paving the way for the presence of knowledge spillovers. This allows the dissemination of information and knowledge resources within the cluster internal market.

Previous literature has identified and analyzed the Spanish ceramic cluster in works such as Boix and Galletto (2006), Giner and Santa María (2002) and Ybarra (1991), among others. It is a cluster which follows the archetype of Arikan and Schilling (2011), with the presence of considerable coordination and scarce centralization. The coordination effort is crucial in this cluster due to the technological complexity of the production process, which fosters the specialization of firms in different industrial activities (Albors, 2002; Molina-Morales, 2002). These firms end up engaging in a large relational conglomerate with other specialized firms in order to deliver the final ceramic products. Furthermore, no firm is large or powerful enough to control the cluster even though some firms can become sizeable enterprises. Firms that belong to this archetype of cluster do not only benefit from the common externalities of this industrial context but also present better rates of knowledge creation “entirely conditional upon the nature of intra-district relationships” (Arikan and Schilling, 2011). In short, in the Spanish ceramic cluster the key drivers of knowledge flows are network relationships and knowledge brokers, because knowledge is created under the necessity of an intense coordination (Albors, 2002; Molina-Morales, 2002).

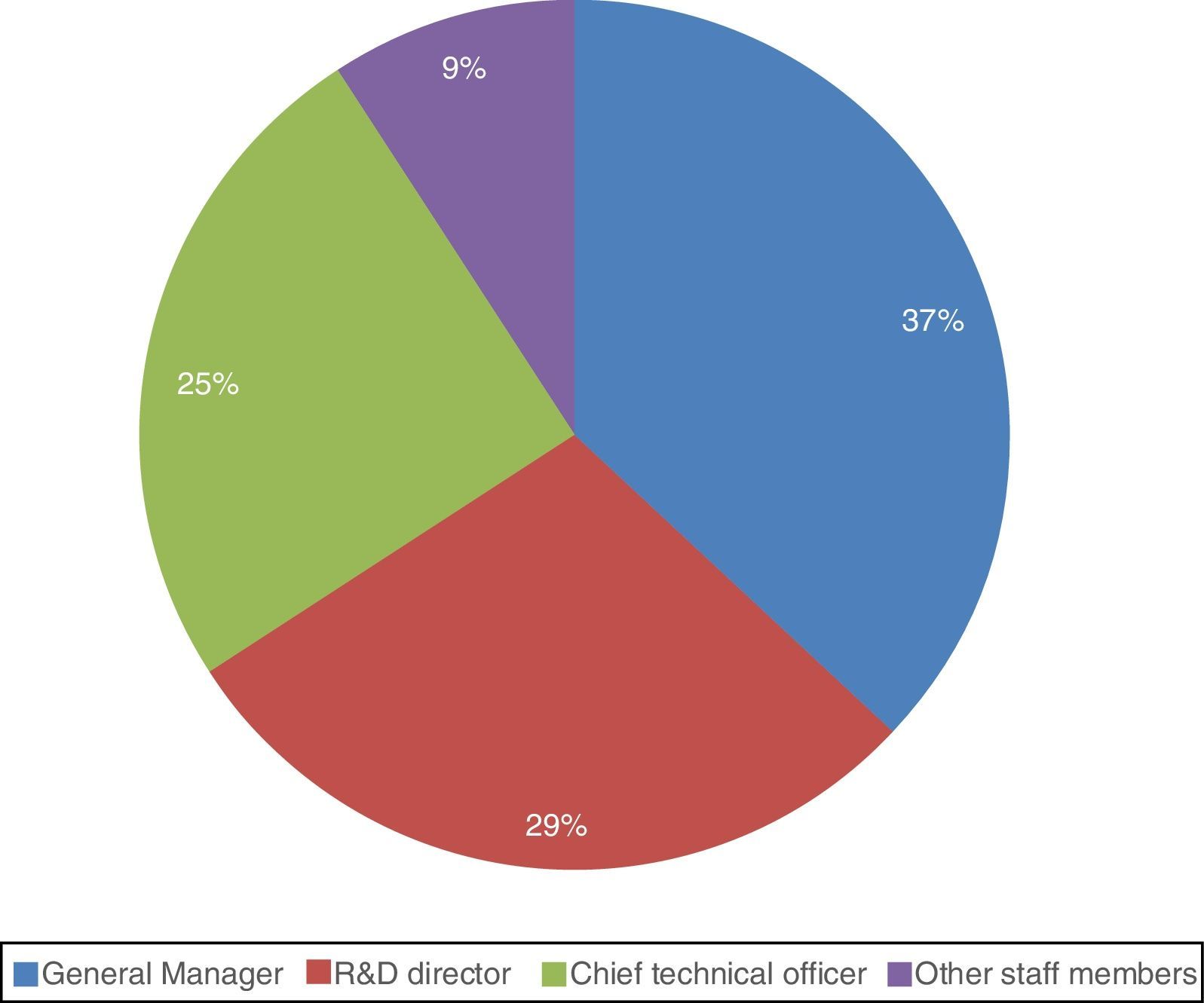

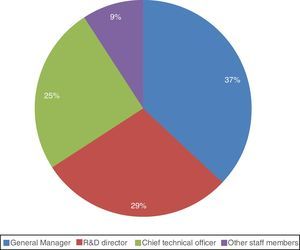

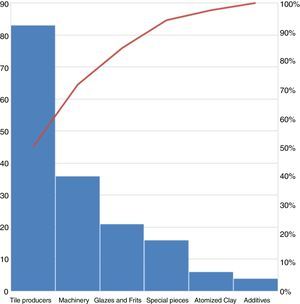

Data collection and sampleThis research work relies on primary data that has been collected at the firm level from the Spanish ceramic tile cluster. This was done through interviews, based on a structured questionnaire, with firms’ managers and engineers in charge of R&D activities or involved in managing operating and production processes. We consider this set of profiles the most adequate to answer our questionnaire since it deals with questions about diverse aspects of the relationships involving technological and business information exchanges (see Fig. 2). The survey was conducted between February 2011 and July 2011 and the targeted firms were all involved in the different cluster activities, such as the manufacture of wall and floor tiles, decorative pieces, chemical additives, glazes and frits, machinery, and atomized clay. We were able to gather 166 complete questionnaires from a universe of 238 companies in the cluster, which accounts for 69.5% of the total number of firms, a response rate that is similar to what is often obtained by network researchers (Stork and Richards, 1992). Additionally, we made sure that we are not missing the most relevant actors in the tile cluster asking some experts and contrasting with secondary sources like the SABI database. In any case, and to avoid problems of representativeness in our network analysis, we ended up restricting our attention to the subset of actors for whom network information was complete.

Given the fact that this research work deals with brokerage roles, we had to divide our network into non-overlapping classes or subgroups. In the case of the ceramic cluster, we considered the different productive activities of the whole value system or filière as classes or subgroups of actors. The distribution of these industrial activities is reported in Fig. 3, where the red line represents the cumulative percentage of firms. The contrasts among these activities and their distinctive characteristics are relevant for our analysis, since these subgroups of actors allow us to determine the brokerage activities of clustered firms.

Before computing the values of the brokerage activities, we needed to create our network, so we built questions that asked respondents about the destination and source of the technological knowledge they had access to. In order to identify relationships between companies in the cluster we used a roster recall method, where each firm was presented with a list (roster) of other firms in the cluster and there were blank spaces which could be used to give the name of other firms not included on the roster. Specifically, respondents were asked the following two questions: Question 1: As a receiver, if your company needs to solve some technical problem or receive some help in this area, which of the firms and organizations from the roster has it had some kind of relationship with in the last three years? Question 2: As a source, which of the firms mentioned on the roster have benefited from your help about diverse aspects of technical knowledge during the last three years? Technical information includes aspects such as: production techniques, product applications, chemical additives, raw materials, characteristics and performance of machinery and technology, glaze applications, new technologies, and so forth.

Once all the relational data had been collected, we contrasted the information, since the opinions from one actor to another were different in some cases. These differences specifically affect the recognition of particular relationships and the evaluation of the relative importance for each of the firms involved. To resolve such conflicts we have taken the receiver opinion as the prevailing one because we believe it is the best placed to both prove and evaluate the existence and the importance of a relationship.

Analysis techniquesThis research work relies mainly on two analysis techniques. On the one hand, we have used the Social Network Analysis (SNA) methodology to identify the relationships among companies and evaluate their brokerage activity. On the other, and once the network indicators had been calculated, we made use of quantile regression to test our theoretical framework and hypotheses.

Social network analysis. SNA consists in identifying the relationships between individuals, groups, organizations, institutions or, ultimately, between different entities capable of processing information or knowledge (Hanneman and Riddle, 2001). This methodology is particularly well suited to studies about business networks in industrial clusters (Boschma and Ter Wal, 2007; Borgatti et al., 2009; Graf, 2011). As mentioned before, we made use of SNA to calculate the brokerage roles of each firm. In order to perform these calculations we resorted to the UCINET software application (Borgatti et al., 2002), after building a (166×166) network matrix with all the relational data.

Quantile regression. Quantile regression was initially introduced by Koenker and Bassett (1978), although its generalization in the economic sphere is still relatively new. These methods are still yet to come to the cluster literature in general and to the influence of brokerage roles inside the cluster in particular. In this literature, ordinary least squares (OLS) regressions still dominate. Nonetheless, it is well known that OLS regressions face a series of shortcomings. For instance, they only contribute to explain the average effects on the dependent variable, while potential heterogeneity in the estimated effects in other parts of the distribution of the response variable is completely overlooked.

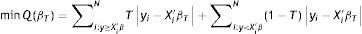

However, firms show important disparities in terms of innovation. Then, focusing only on the average effect of the potential influence of the brokerage activities on innovation activities might be a valuable result, yet it is far from providing a complete understanding on how they actually affect innovation. In this respect, the application of quantile regression methods might be appealing, since they are particularly robust to the existence of outliers driving the average estimated coefficient. The formal notation is provided in the seminal paper by Koenker and Bassett (1978). Each βˆT parameter is estimated by minimizing the absolute sum of the residuals. It is expressed as follows:

where T, lying in the interval [0, 1] refers to a specific quantile. Eq. (1) is not differentiable and a linear programming problem is solved to be optimized. Each βˆT is asymptotically distributed as N→(0, ΩT), where ΩT is the variance–covariance matrix of βˆT for a given T. In order to compute the fit, the algorithm used is that proposed by Barrodale and Roberts (1974) (see also Koenker and d’Orey, 1987). Among the different alternatives to compute standard deviations, we chose the Hall–Sheather bandwidth rule, although the discrepancies among competing methods are slight (see Koenker and Hallock, 2001, for further details).The estimation of Eq. (1) provides results for different quantiles T. Low and high innovative firms correspond to low and high quantiles, respectively. Therefore, the methodology is able to provide different estimated slopes (beta parameters) for the different quantiles, allowing for heterogeneous effects across them and thus providing a particular estimated effect for different innovation levels. It is worth mentioning that this is not comparable to run separate OLS regressions for each quantile. From Eq. (1) it is easily observable that quantile regression takes always into account the whole distribution and the full sample. For example, when T=0.2, the estimation process it is also considering the rest of the sample, i.e., (1−T)=0.8. All the estimations were performed using the quantreg package for R.

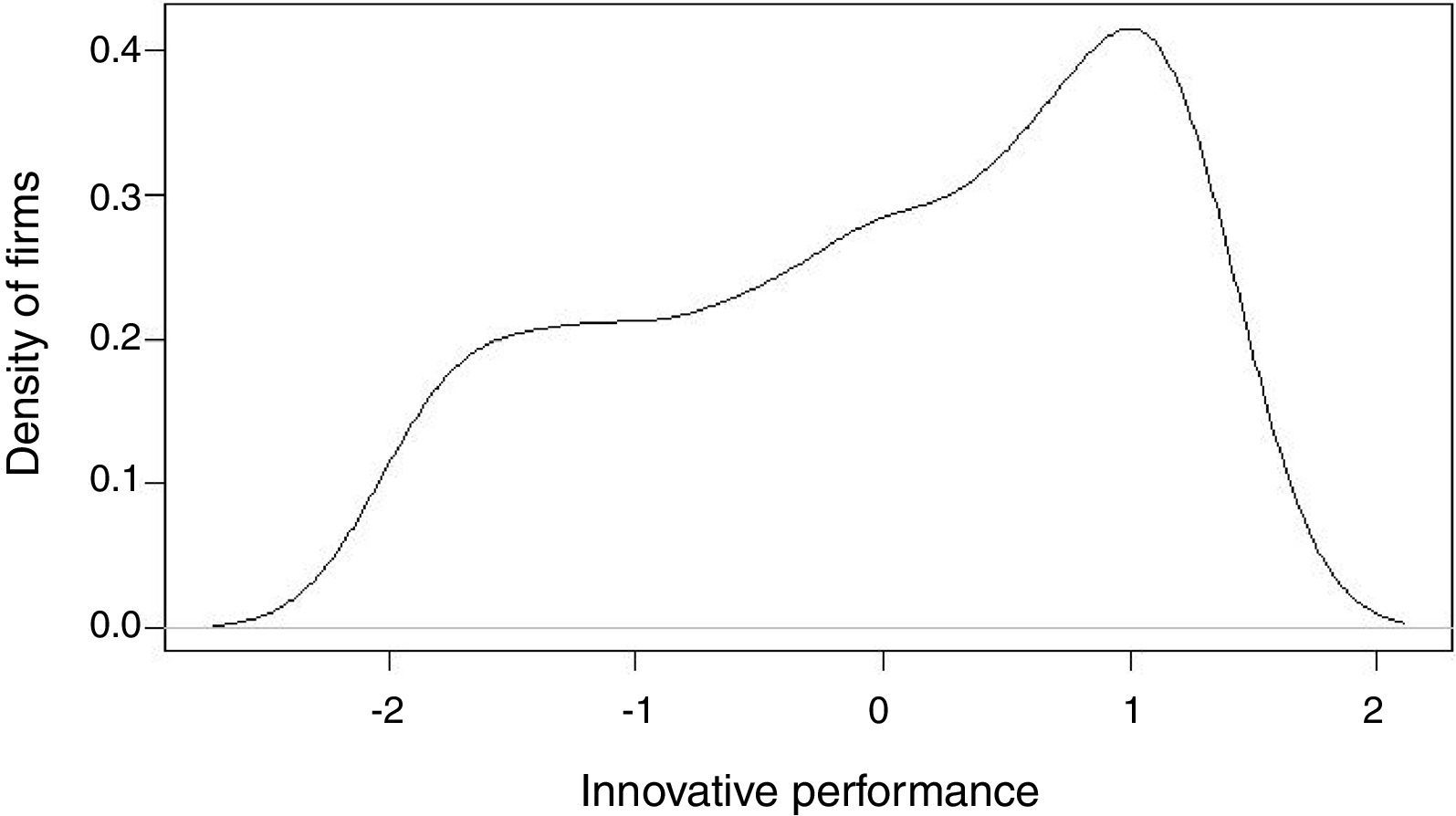

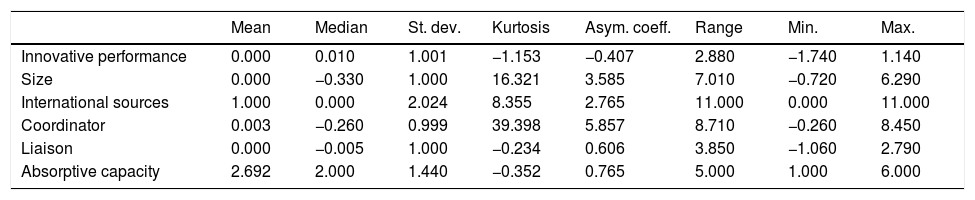

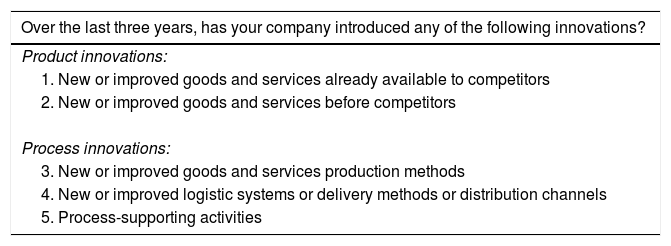

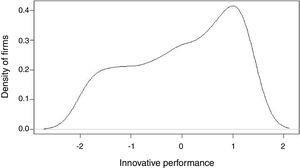

VariablesDependent variable: Innovative performance. To calculate the dependent variable we have built an indicator from five items in our survey. These items focus on aspects related with product and process innovations (see Appendix 1). As already suggested in the literature about the ceramic sector, product and process innovations have a clear technological component within this particular industry (Albors, 2002; Flor and Oltra, 2004). With these five items we then conducted a factor analysis that allows us to work with a single representative value of the innovative performance for each company (Cronbach's alpha=0.780; KMO=0.784). The main descriptive statistics for the computed scores via factor analysis are reported in Table 1, whereas the more informative Fig. 4 displays its kernel distribution. The latter shows that a main mode locates around of the unity. Despite the rest of the scores are more homogeneously distributed (only a small second mode is observed around the score −1.5), the density departs from normality, which make less suitable relaying on estimations focusing only on the average, as results can be very different for the companies located in the tails.

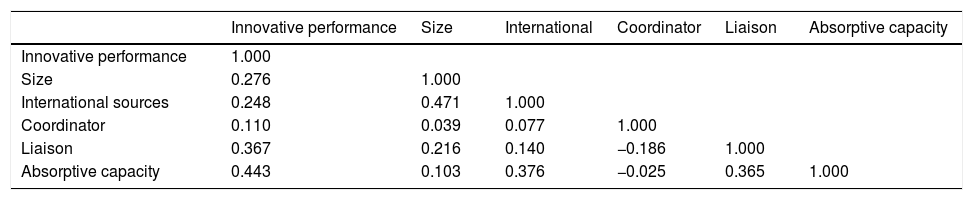

Descriptive statistics.

| Mean | Median | St. dev. | Kurtosis | Asym. coeff. | Range | Min. | Max. | |

|---|---|---|---|---|---|---|---|---|

| Innovative performance | 0.000 | 0.010 | 1.001 | −1.153 | −0.407 | 2.880 | −1.740 | 1.140 |

| Size | 0.000 | −0.330 | 1.000 | 16.321 | 3.585 | 7.010 | −0.720 | 6.290 |

| International sources | 1.000 | 0.000 | 2.024 | 8.355 | 2.765 | 11.000 | 0.000 | 11.000 |

| Coordinator | 0.003 | −0.260 | 0.999 | 39.398 | 5.857 | 8.710 | −0.260 | 8.450 |

| Liaison | 0.000 | −0.005 | 1.000 | −0.234 | 0.606 | 3.850 | −1.060 | 2.790 |

| Absorptive capacity | 2.692 | 2.000 | 1.440 | −0.352 | 0.765 | 5.000 | 1.000 | 6.000 |

Independent variable. Brokerage roles: coordinator and liaison. As independent variables in our model, we chose two intermediary roles: Coordinator and Liaison. As already mentioned in the theoretical framework, the conceptualization of these two roles is based on the seminal proposal by Gould and Fernandez (1989). In this conceptualization, the coordinator role involves brokerage transactions where all the members belong to the same subgroup corresponding, in our case, to companies that perform the same industrial activity in the cluster value system. Conversely, the liaison role involves brokerage transactions where all the triad members belong to different subgroups corresponding, in our case, to companies that perform different industrial activities in the cluster value system. Consequently, the coordinator role represents horizontal relationships inside the cluster while the liaison role is associated with vertical relationships.

To calculate both roles we used the Gould and Fernandez (1989) Brokerage Roles algorithm included in the UCINET (Borgatti et al., 2002) software package. This procedure allows us to measure the degree to which each firm behaves as each role. Essentially, an actor j exerts a specific brokerage role, between actors i and k, when the condition ijk is met and the characteristics of that specific role apply. UCINET (Borgatti et al., 2002) provides two types of brokerage measures. On the one hand, the software can compute the number of times that the aforementioned conditions are met in order to obtain a total individual brokerage score (or unweighted). On the other hand, the algorithm is also able to compute a relative brokerage measure (or weighted) dividing the individual brokerage score in our network by the estimated one obtained in a random network with the same number of actors and subgroups than the network under study. This approach allows us to know whether brokerage values in the network are relevant or not. According to the relative measure of brokerage, we can have an idea of the importance of the brokerage values in each case. Thus, the relative brokerages of each role were the independent variables in our regression.

Independent variable. Absorptive capacity. Another independent variable in our model is absorptive capacity. Here we have followed the same approach as authors like Cohen and Levinthal (1990) or Tsai (2001). In our case, we have computed the absorptive capacity value by dividing the R&D expenditure by the total revenue of each company represented as a percentage.

Control variable. International sources of knowledge. We have introduced this control variable in our model because we consider that those actors that receive knowledge resources from outside the cluster are likely to be in a better situation to feed it to the rest of the actors inside the cluster. In our survey we asked about knowledge acquisition from international sources that do not belong to the cluster, as some recent research has already done (Bathelt et al., 2004; Owen-Smith and Powell, 2004). Among the possible external and international sources of knowledge, we considered: universities, technological centres, other groups of firms, customers, suppliers, consultants, public research centres, research, etc. Specifically, our questionnaire contemplated this type of information in questions like: Question 3: Among these sources of knowledge, could you indicate or mark those that have transferred technical knowledge or have collaborated with your firm? Please indicate the geographical location of the source of knowledge in each case by marking the identified sources on one of these possible values: 1=local or inside the cluster, 2=national and outside the cluster, 3=European Union and 4=other international origins.

To obtain the variable, we only have to compute the simple sum of the external linkages with sources with international origins.

Control variable. Size. The second control variable included in our model is the firms’ size. Size and innovation has been associated in the literature in research works like Ács and Audretsch (1991) or Mowery et al. (1996). The argument behind this association relies on the fact that larger companies have more capacity to gather, acquire and/or generate knowledge, which leads to a greater innovative capacity (Tsai and Ghoshal, 1998). To calculate a value for this variable, we ran a factor analysis that included three size-related items like: (1) number of employees, (2) total assets, and (3) total revenues.

The main descriptive statistics for all the variables included in the analysis are reported in Table 1 and a correlation matrix is provided in the Appendix 2.

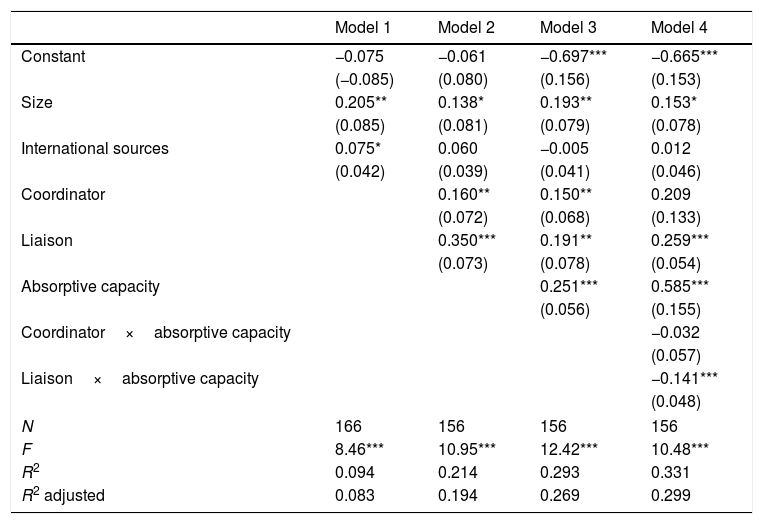

ResultsOLS regressionsResults for the OLS regressions are provided in Table 2. Model 1 includes only the control variables. The results suggest that both the size of the company and international knowledge transfer activities are related to higher innovation. In Model 2, the variables of interest, namely the brokerage roles, are introduced. The results show that brokerage activities foster innovation. Both the roles of coordinator (horizontal relationships) and liaison (vertical relationships) are significant predictors of innovation, at least on average, and the control variable capturing international knowledge transfer activities loses significance. Model 3 incorporates the absorptive capacity of the firm, measured as R&D effort, which might act as a moderator variable, as argued in our theoretical framework. This variable is also positive and significant and the rest of the results for the other variables remain qualitatively unaltered.

OLS regressions.

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Constant | −0.075 | −0.061 | −0.697*** | −0.665*** |

| (−0.085) | (0.080) | (0.156) | (0.153) | |

| Size | 0.205** | 0.138* | 0.193** | 0.153* |

| (0.085) | (0.081) | (0.079) | (0.078) | |

| International sources | 0.075* | 0.060 | −0.005 | 0.012 |

| (0.042) | (0.039) | (0.041) | (0.046) | |

| Coordinator | 0.160** | 0.150** | 0.209 | |

| (0.072) | (0.068) | (0.133) | ||

| Liaison | 0.350*** | 0.191** | 0.259*** | |

| (0.073) | (0.078) | (0.054) | ||

| Absorptive capacity | 0.251*** | 0.585*** | ||

| (0.056) | (0.155) | |||

| Coordinator×absorptive capacity | −0.032 | |||

| (0.057) | ||||

| Liaison×absorptive capacity | −0.141*** | |||

| (0.048) | ||||

| N | 166 | 156 | 156 | 156 |

| F | 8.46*** | 10.95*** | 12.42*** | 10.48*** |

| R2 | 0.094 | 0.214 | 0.293 | 0.331 |

| R2 adjusted | 0.083 | 0.194 | 0.269 | 0.299 |

*, **, and *** denote 10%, 5% and 1% statistical significance, respectively.

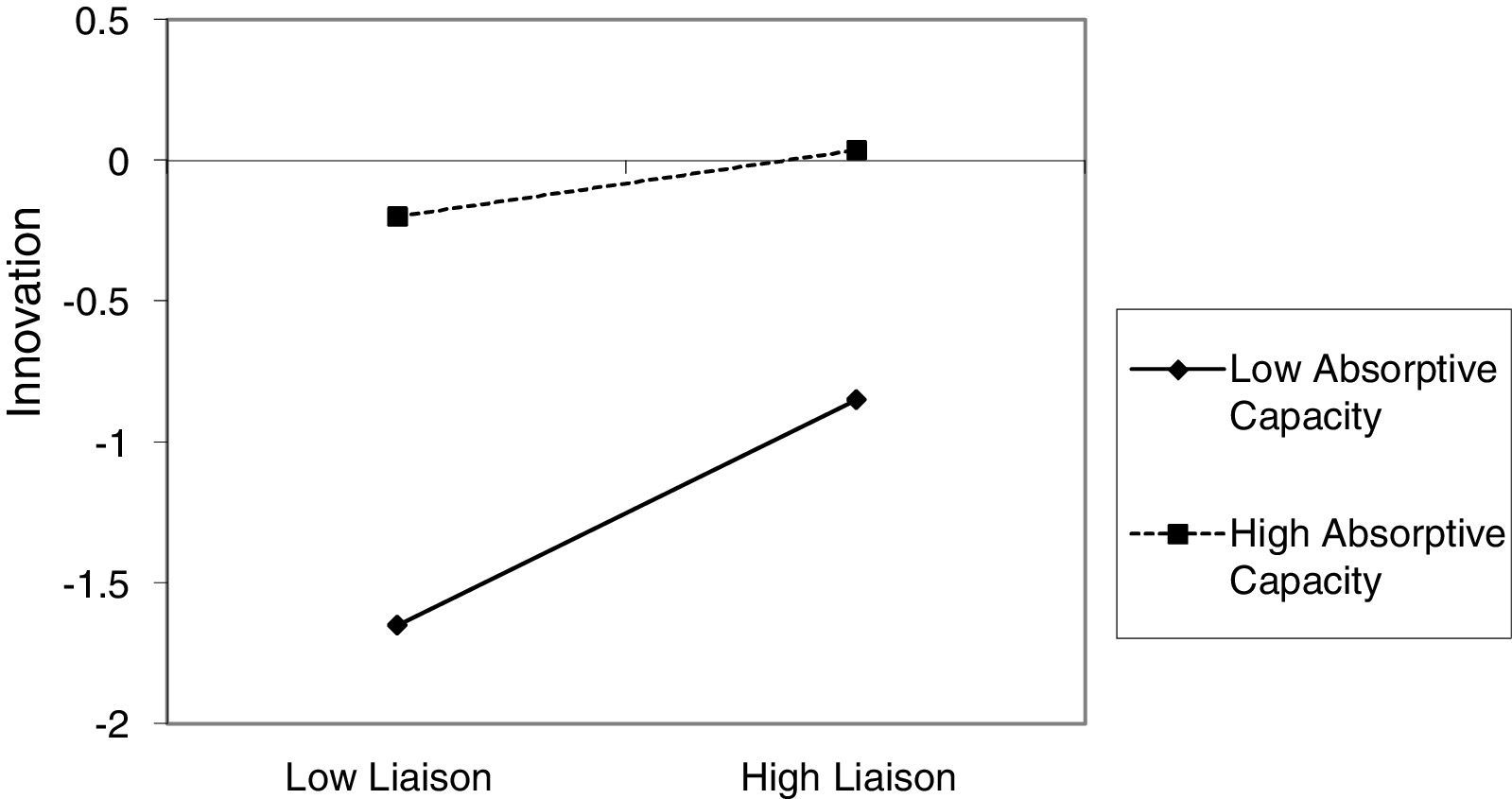

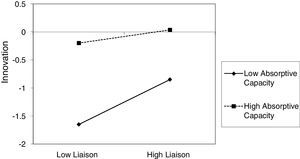

Finally, the most comprehensive Model 4 assesses the likely existence of moderation effects between absorptive capacity and brokerage roles by including interaction terms. For both interactions, the estimated coefficient is negative, thus suggesting that the absorptive capacity exhibits some moderation effect. However, this interaction is only significant for the case of liaison. The estimation shows that when the interaction is considered, the coordinator role loses significance and its interaction with the absorptive capacity is non-significant as well. The contrary holds for liaison links. The brokerage variable is still significant when the interaction is accounted for as well as the latter. As already commented, its negative sign suggests that a firm's absorptive capacity moderates the role of liaison relationships.

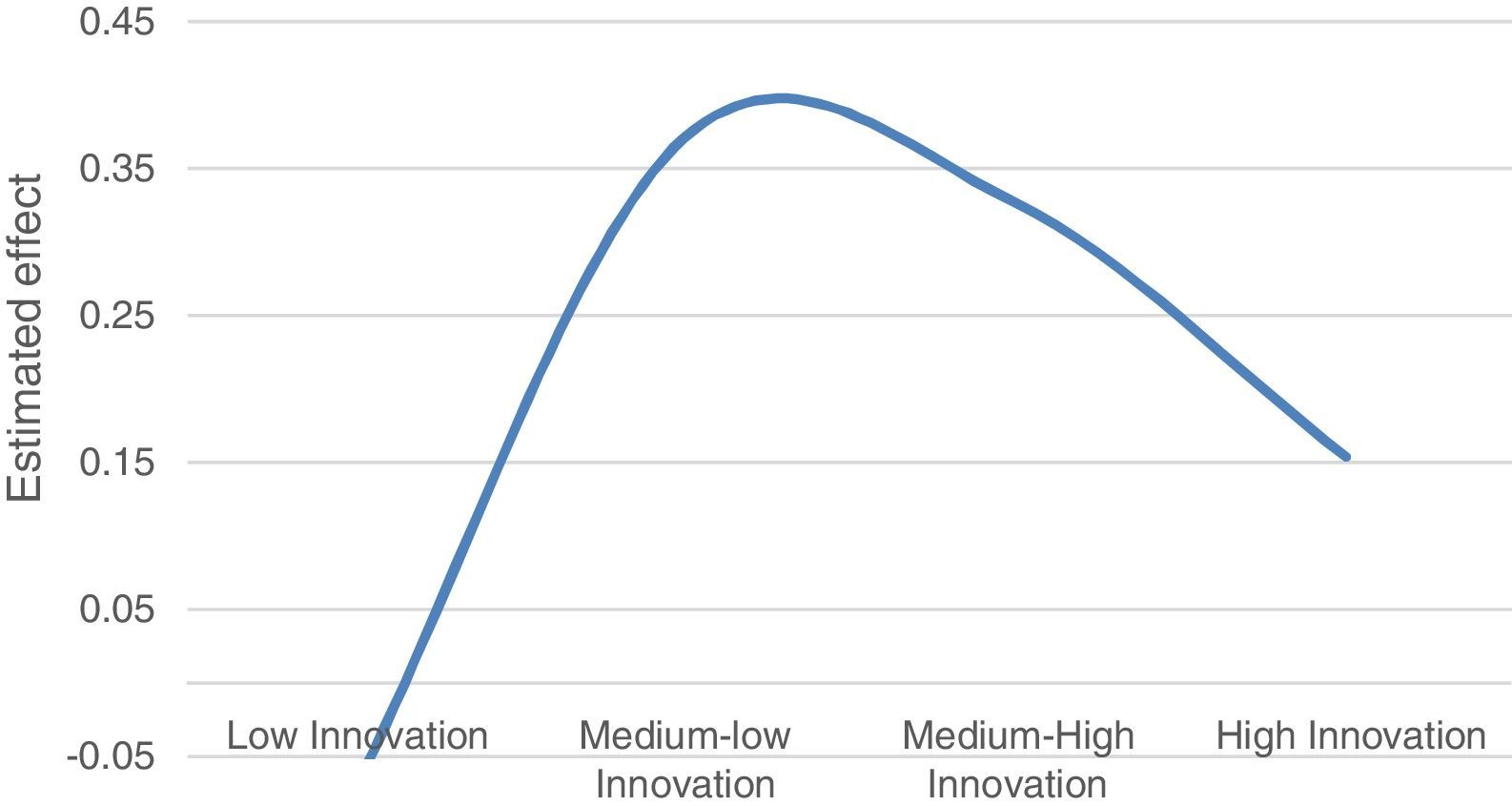

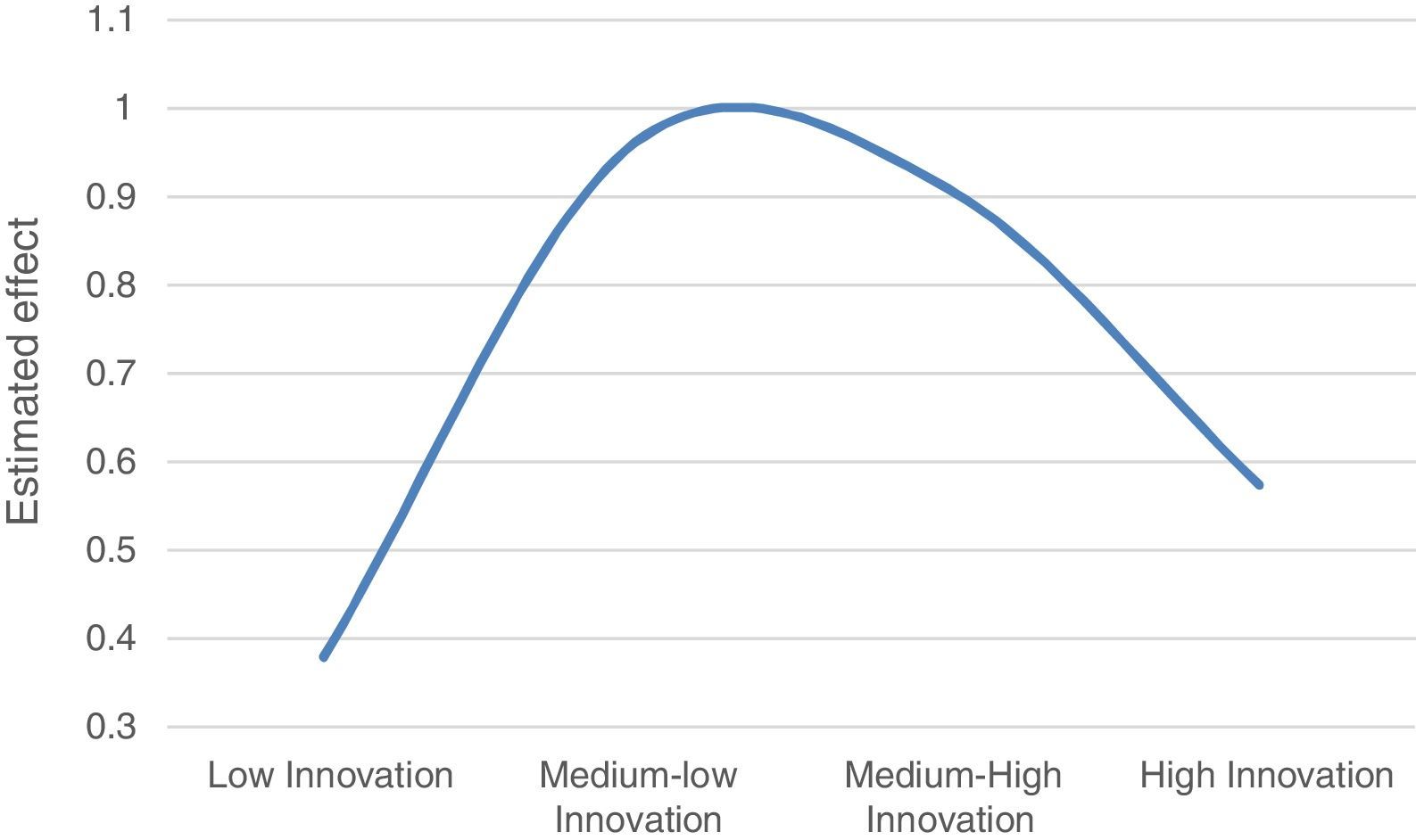

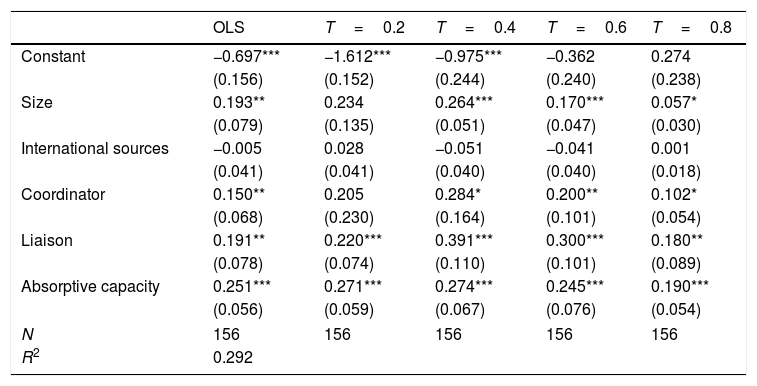

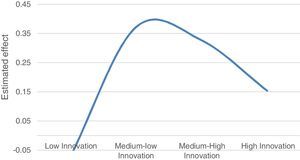

Quantile regressionsThis section reports quantile regression results. In order to save space, only those for the more comprehensive Models 3 and 4 are provided. Table 3 reports the results for Model 3. In order to make comparisons easier, in the first column we provide the results for the OLS regression, while the subsequent columns contain the results for different selected quantiles (T), considering from low innovative (T=0.2) to high innovative firms (T=0.8). Focusing on the role of coordinator, we can observe that, while on average (first column) its effects are significant, they are not relevant for the lowest quantiles (low innovation levels). The effect becomes significant for low-middle innovation levels (T=0.4), and the estimated coefficient becomes higher. However, although still significant, the coefficient follows a downward trend for relatively high levels of innovation. When analysing the liaison role, we can observe a similar pattern. In this case, however, the brokerage role is significant for the whole range of innovation quantiles. Similarly, to the coordinator role, the coefficient draws an inverted U-shaped curve, thus suggesting that the most prominent effects of the liaison activities take place in firms with middle innovation levels. Regarding absorptive capacity, the coefficient is comparatively more stable across quantiles, similar to that found in the OLS estimation, although its magnitude decreases slightly for the highest quantiles.

Quantile regression, Model 3.

| OLS | T=0.2 | T=0.4 | T=0.6 | T=0.8 | |

|---|---|---|---|---|---|

| Constant | −0.697*** | −1.612*** | −0.975*** | −0.362 | 0.274 |

| (0.156) | (0.152) | (0.244) | (0.240) | (0.238) | |

| Size | 0.193** | 0.234 | 0.264*** | 0.170*** | 0.057* |

| (0.079) | (0.135) | (0.051) | (0.047) | (0.030) | |

| International sources | −0.005 | 0.028 | −0.051 | −0.041 | 0.001 |

| (0.041) | (0.041) | (0.040) | (0.040) | (0.018) | |

| Coordinator | 0.150** | 0.205 | 0.284* | 0.200** | 0.102* |

| (0.068) | (0.230) | (0.164) | (0.101) | (0.054) | |

| Liaison | 0.191** | 0.220*** | 0.391*** | 0.300*** | 0.180** |

| (0.078) | (0.074) | (0.110) | (0.101) | (0.089) | |

| Absorptive capacity | 0.251*** | 0.271*** | 0.274*** | 0.245*** | 0.190*** |

| (0.056) | (0.059) | (0.067) | (0.076) | (0.054) | |

| N | 156 | 156 | 156 | 156 | 156 |

| R2 | 0.292 | ||||

Standard errors are in parentheses. *, **, and *** denote 10%, 5% and 1% statistical significance, respectively. From columns 3–6, the reported results correspond to particular quantiles (0.2, 0.3, 0.6 and 0.8) of the dependent variable, all yielded by a single estimation of Model 3.

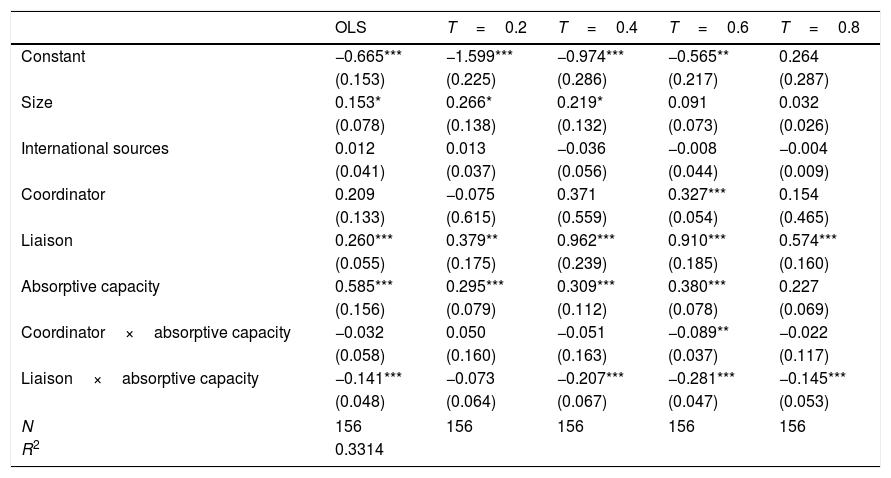

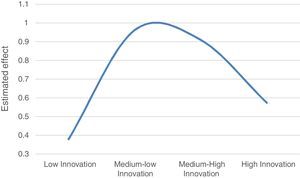

Finally, we consider the results for Model 4, which includes interaction terms between the absorptive capacity and the brokerage roles. The results, provided in Table 4, suggest some notable differences from those of Model 3. In particular, focusing on the brokerage roles, the coordinator role appears to be significant for the middle-high levels of innovation (T=0.6). Its coefficient is even negative for the lowest innovation levels, reaches its maximum for T=0.4 (although non-significant in both cases) and then decreases until the T=0.8, when the coefficient becomes non-significant again. Nevertheless, the liaison role is always significant and the inverted U-shaped curve is even more clearly defined. Figs. 5 and 6 display these nonlinear trends, alongside the different levels of the dependent variable, for both roles. The interaction terms with the firm's absorptive capacity are both negative, indicating that the moderation effect is persistent across quantiles. However, significance is found only for the liaison role, (with the exception of the T=0.6 for the case of the coordinator).

Quantile regression, Model 4.

| OLS | T=0.2 | T=0.4 | T=0.6 | T=0.8 | |

|---|---|---|---|---|---|

| Constant | −0.665*** | −1.599*** | −0.974*** | −0.565** | 0.264 |

| (0.153) | (0.225) | (0.286) | (0.217) | (0.287) | |

| Size | 0.153* | 0.266* | 0.219* | 0.091 | 0.032 |

| (0.078) | (0.138) | (0.132) | (0.073) | (0.026) | |

| International sources | 0.012 | 0.013 | −0.036 | −0.008 | −0.004 |

| (0.041) | (0.037) | (0.056) | (0.044) | (0.009) | |

| Coordinator | 0.209 | −0.075 | 0.371 | 0.327*** | 0.154 |

| (0.133) | (0.615) | (0.559) | (0.054) | (0.465) | |

| Liaison | 0.260*** | 0.379** | 0.962*** | 0.910*** | 0.574*** |

| (0.055) | (0.175) | (0.239) | (0.185) | (0.160) | |

| Absorptive capacity | 0.585*** | 0.295*** | 0.309*** | 0.380*** | 0.227 |

| (0.156) | (0.079) | (0.112) | (0.078) | (0.069) | |

| Coordinator×absorptive capacity | −0.032 | 0.050 | −0.051 | −0.089** | −0.022 |

| (0.058) | (0.160) | (0.163) | (0.037) | (0.117) | |

| Liaison×absorptive capacity | −0.141*** | −0.073 | −0.207*** | −0.281*** | −0.145*** |

| (0.048) | (0.064) | (0.067) | (0.047) | (0.053) | |

| N | 156 | 156 | 156 | 156 | 156 |

| R2 | 0.3314 | ||||

Standard errors are in parentheses. *, **, and *** denote 10%, 5% and 1% statistical significance, respectively. From columns 3–6, the reported results correspond to particular quantiles (0.2, 0.4, 0.6 and 0.8) of the dependent variable, all yielded by a single estimation of Model 4.

In any case, the quantile estimations have shown that by focusing only on the average effect provided by the OLS estimation, we are not able to fully explain how the brokerage activities actually affect innovation.

DiscussionIn this section, we discuss the results and the accomplishment of the hypotheses. Considering the first one, focused on the liaison role, an inverted U-shaped relationship is found when comparing the coefficients against the firms’ innovation level, indicating that companies with middle levels of innovation benefit with more intensity from the liaison links. In all cases, though, the liaison role is significant, so that vertical relationships, normally characterized by non-redundant information, are indeed useful for the development of new ideas. As we have argued along the paper, the literature provides many examples in related theoretical contexts predicting this particular shape for the relationship. For instance, Berman et al. (2002) looked at how shared experience affected performance whereas McFadyen and Cannella (2004) examined the influence of the number of exchange partners on the amount of knowledge that a person creates. In clusters, the existence of systemic capacities may generate redundancies with respect to those developed internally by firms. In this vein, a recent study by Molina-Morales and Martínez-Fernández (2009) provided strong evidence that intensity of relations on innovation performance in cluster firms can be described using an inverted U-shaped function. Finally, the same inverted pattern between external knowledge orientation and product innovation is also found in Ebersberger and Herstad (2011).

However, it is important to remark that we should examine our results from the side of the dependent variable, in the sense that the heterogeneity on the impact is not driven by increased levels of the brokerage but by changes in innovation levels. In this regard, our results are compatible with the findings by Ebersberger et al. (2010), reporting a similar pattern for R&D efforts. We can therefore conclude that our Hypothesis 1 is supported.

Regarding the role of coordinator, we obtained a positive and significant effect on average and, again, an inverted U-shaped curve when we analyze the results from quantile regression. The arguments given to justify this pattern in the liaison role also apply for the coordinator. However, note that the coefficients are relatively smaller for the coordinator. This may suggest that the information transferred vertically from actors in a different position of the value chain (liaison) is actually more useful to innovate than that in the horizontals (coordinator). This gives support to the arguments by Boschma and Ter Wal (2007) or Burt (2004), suggesting that information flowing horizontally is not so powerful to provide the diversity needed to generate new ideas. Indeed, it can be expected that competitors share similar and redundant information. In addition, considering results from Model 4, accounting for the interaction with the absorptive capacity, we observe that the significance of the effect of the coordinator is lost for most of the quantiles and for the average (OLS model) as well. This can be explained by the fact that the absorptive capacity measured as R&D investment is capturing (perhaps substituting) the role of coordinator.

From the results, we can state that Hypothesis 2 is only partially supported, since the positive and nonlinear effect of the coordinator alongside the different levels of the dependant variable, is only found for some model specifications.

Finally, regarding the Hypothesis 3, the interaction term with firm's absorptive capacity is negative for both the coordinator and the liaison roles, but only significant for the liaison case. Therefore, our hypothesis of a positive moderation effect is not supported.

The interpretation of this result is complex, as not only contradicts Hypothesis 3, but also varies for the case of coordinator (non-significant) and liaison (negative). First, it is important to highlight that even though the interaction coefficient is negative the liaison brokerage remains positive as it can be observed in Table 4 and Fig. 7. In this graphical representation of the interaction, we can appreciate the moderation effect on the slope that diminishes under high absorptive capacity but remains positive. However, this negative result contradicts the majority of the literature that predicts a complementarity between external knowledge sources and its application through R&D related activities. In fact, our outcome is more aligned with studies that argue about the existence of certain drawbacks associated with companies that invest high amounts on R&D (Leonard-Barton, 1992; Chesbrough, 2003). Hence, our work adds empirical evidence of these considerations to other research efforts that obtained similar results (Laursen and Salter, 2006; Ebersberger and Herstad, 2011). This is important, as it might contribute to the stream of literature supporting a complementarity effect and that was the basis for our hypothesis formulation.

Furthermore, taking into account that the absorptive capacity can be broken down in two main roles, we can interpret our negative moderation as the possible overlapping of the potential absorptive capacity, associated to external knowledge acquisition, with brokerage activities. In fact, our results show that high absorptive capacity yields into a less importance of external knowledge obtained through brokerage. As the brokerage effect remains positive, it is possible that the increase on R&D expenditures in the form of external knowledge acquisition is partially substituting the impact of brokerage.

Finally, the nonsignificant interaction of the coordinator role can be a consequence of the lack of impact of that simpler brokerage activity once R&D effort is considered. In our specific context, geographical proximity and rivalry are two important characteristics of the horizontal relationships. Hence, the knowledge obtained through this particular type of intermediation is much more redundant and its impact on innovation is likely to be overshadowed by internal R&D efforts.

Conclusions, limitations and future researchThe motivation of this paper was to shed some light on how firms improve innovation by acting as brokers, that is, by connecting other (unconnected) actors in the corresponding network. In the industrial cluster context and triggered by other related findings in similar contexts reporting nonlinear patterns, we investigate whether the effects of different brokerage roles vary depending on the level of innovation achieved by the firm. Further, we speculate about the indirect effects that distinct individual organization attributes may have on potential brokerage benefits, in particular the absorptive capacity. We analyzed the specific case of the Spanish ceramic tile cluster, where knowledge creation is conditional on intra-cluster relations (Arikan and Schilling, 2011).

Our work is in line with those studies reported in the cluster literature that assumed the network model for these industrial contexts (Branston et al., 2005; Boschma and Ter Wal, 2007; Parrilli and Sacchetti, 2008), more particularly in the Spanish context (Parra-Requena et al., 2010; Molina-Morales and Expósito-Langa, 2012). Within this context we focused on the notion of knowledge brokers, understanding them as actors exchanging different types of knowledge between otherwise unconnected actors in the same location (Graf, 2011; Graf and Kruger, 2011).

Furthermore, our research extends the work carried out to date by distinguishing different brokerage roles according to the seminal proposal by Gould and Fernandez (1989). This involves the consideration of the distinct individual broker attributes (asymmetric capabilities and incentives) and the great diversity of functions they perform in the cluster network (McEvily and Zaheer, 1999; Giuliani and Bell, 2005; Molina-Morales, 2005; Munari et al., 2005; Giuliani, 2007; Morrison, 2008; Graf, 2011; Graf and Kruger, 2011). In spite of previous evidence, we still found some relevant research questions to be properly addressed on why firms should share their knowledge with other local actors (Boari and Riboldazzi, 2014).

Findings suggest a number of implications at the individual firm level. First, firms should be able to select the most appropriate brokerage role to enhance their innovation capabilities, with a conscious selection of main elements, such as sources, content or directions of the intermediary knowledge. Furthermore, our results concerning the quantile estimations enhanced the recommendations to business managers and policy makers suggested in Boari et al. (2016) and Belso-Martínez et al. (2015). This is very important in the case of firms as now we are able to offer more precise details on the level of innovation to be achieved by the firm in order to design an effective brokerage strategy. From previous research by Boari et al. (2016), it can be interpreted that all firms could benefit from the liaison role in the same extent. Our results are more refined, and showed that the average positive effect of the liaison over innovation is maximized in firms that have medium-low levels of innovation. Similar results are found for the case of the coordinator role, although in this case a much smaller effect is found. In addition, the absorptive capacity always has a positive impact on innovation, and moderates the effect of the roles. For the case of coordinator, the interaction term is non-significant, whereas for the liaison case a negative sign is found.

The implications of these results might derive also relevant contributions. On the one hand, they shed some light on the importance of the diversity of information obtained through vertical and horizontal relationships. Where the liaison role provides knowledge diversity that remains important and positive for innovation even under high absorptive capacity conditions, the coordinator role is much more limited possibly due to the redundant nature of the knowledge shared among well-known rivals. On the other hand, our result concerning the complementarity of the absorptive capacity and the external sources of knowledge is aligned with a stream of the literature that alerts of the possible drawbacks of R&D investments. These authors point to potential problems in relation with closure of innovative process and reluctance to engage in external relationships to avoid intellectual property rights issues (Grimpe and Kaiser, 2010; Ebersberger and Herstad, 2011).

Our study obviously presents some limitations, which can also be understood as potential directions for future research. While we find these patterns for the specific local context analyzed, in other contexts the relations may be different. As frequently happens, a cluster case is a result of an idiosyncratic and particular social, cultural, and historical process that limits the generalization of results. Regarding the specificity of the case, and considering the weight of the final firms in the sample, it is not surprising that the focus is on the suppliers, who are the main actors in the cluster innovation processes. In addition, future research should also be focused on addressing the sources of nonlinear effects of the brokerage roles.

Moreover, inter-firm networks are still constrained by the limitations of considering the firm at a single level. In fact, it is at the individual level where social relationships take place. In addition, a specific limitation refers to the measure of the absorptive capacity. As stated by Prahalad and Bettis (1986), the amount of R&D spending does not always capture the quality of the know-how. Other measures of absorptive capacity could be used and assessed in the specific innovation context. This might allow disentangling the potential overlapping between the absorptive capacity and brokerage activity that our results show.

Finally, as a further development of this research, a more complete study should include the analysis of brokerage activities involving firms located outside the cluster. Other research alternatives could be to explore in greater depth the conditions that explain the distinctive purposes and consequences of each brokerage role and their combination. Despite these limitations, this research makes a relevant contribution to better understand processes of knowledge sharing and transfer within the cluster.

The authors acknowledge the Spanish Minister of Economy and Competitiveness (Projects ECO2015-67122-R and ECO2014-55221-P).

| Over the last three years, has your company introduced any of the following innovations? |

|---|

| Product innovations: |

| 1. New or improved goods and services already available to competitors |

| 2. New or improved goods and services before competitors |

| Process innovations: |

| 3. New or improved goods and services production methods |

| 4. New or improved logistic systems or delivery methods or distribution channels |

| 5. Process-supporting activities |