Over decades, research on multinational enterprises’ (MNEs) strategies has been anchored in internalization theory. Strongly grounded in transaction cost economics to explain foreign market entry, it hardly explains how MNEs can build and sustain a competitive advantage.

Thus, this paper aims at understanding how the nature of strategic thinking has influenced the research in the field of MNEs’ strategy. A content analysis of 1116 papers was conducted. The intellectual structure and dynamics of research to date are provided, without losing sight of the key foundations of strategy and strategic management.

The links between human capital and knowledge are the factors on which to underpin the explanation of the MNEs’ strategies and support the coevolving theory. This theory is a promising avenue of research under the umbrella of RBV and KBV approaches. The context-dependency of strategy implies that different contexts require different approaches. Accordingly, we provide insights for future research by combining main schools of strategy thought.

The current global economic environment has brought to fore internationalization as a key corporate strategy for most firms (Furrer, 2011; Buckley and Ghauri, 2004). The globalization of both markets and competition compels firms to move into the global arena and to become multinational enterprises (MNEs). MNEs can be defined as firms that own and control significant business activities in two or more countries (Buckley and Casson, 2009; Bartlett and Beamish, 2010). This trend toward increasing internationalization brings new challenges to scholars studying MNEs strategies, especially to those concerned with how MNEs implement their strategy to achieve and sustain a competitive advantage (Madhok and Liu, 2006).

To date, transaction cost economics (TCE), as incorporated in Dunning's eclectic theory (1977, 1988, 1993), has been one of the main approaches to explain the existence of MNEs. TCE extensions are also part of the internalization theory, and it is also present in the research on MNEs’ location strategies and foreign market entry modes (Buckley and Casson, 1976, 2009). More recently, MNEs’ strategy research moved its focus from the reasons of the existence of MNEs to the explanation of heterogeneity of MNEs’ performance (Kogut and Zander, 1993). To this aim, Barney's (1991) resource-based theory of competitive advantage has been used as a key approach to explain this heterogeneity (Peng, 2001). In addition, as highlighted by Verbeke and Brugman (2009), the relationship between multinationality and MNEs’ performance also depends on both environmental and firms’ specific characteristics, which calls for integrated and contingent approaches. Both of these latter approaches have recently been adopted by scholars who have begun to investigate how MNEs could achieve and sustain a competitive advantage over time based on the co-evolution of firms and their environments (e.g., Madhok and Phene, 2001; Madhok, 2002; Madhok and Liu, 2006).

As this paper shows, several approaches have been used to explain MNEs’ strategy and their performance consequences, such as transaction cost economics (TCE), agency theory (AT), the resource-based view (RBV), the knowledge-based view (KBV), game theory (GT), and institutional theory. However, despite several attempts to merge the operative concepts of these approaches, research on MNEs’ strategy remains fragmented (Li, 1994). It is, therefore, necessary to map the field and highlight similarities and differences among these approaches, in order to be able to combine them efficiently into the eclectic approach of co-evolving theory.

Strategy is context-dependent in nature, thereby creating an on-going need for firms to fit and adapt to changing environmental conditions (Barney, 1991). In addition, theories are affected by both the time and circumstances under which they were born (Dunning, 1993; Buckley and Hashai, 2004), and by the responses offered by evolving managerial practices and research approaches (Furrer et al., 2008). Therefore, there is an interest in disclosing the intellectual structure of research on MNE's strategy to date. Scholars will find this structure meaningful when developing their theories about how MNEs compete and change depending on both local and global contexts. Meanwhile, practitioners will find it useful to adapt the MNE's strategy according to those increasingly changing conditions either at the local or global levels. All in all, combinations of different approaches may be required to face the challenges stemming from different contexts.

Similar investigations have been conducted in general related fields, and strategic management, in particular. For example, content analyses of the strategic management field and its evolution over time uncovered that the interaction between initial circumstances and emerging factors caused a pendulum swing between internally and externally focused approaches (Furrer et al., 2008; Hoskisson et al., 1999). A recent analysis of the strategy field has also provided insights about the changes in the structure and meaning of the concept of ‘strategy,’ as well as about how those changes have shaped the evolution of the strategic management field (Ronda-Pupo and Guerras-Martin, 2012). This evolution fostered the emergence of new research topics during the development of the strategic management discipline. In a similar vein, we aim at finding new research issues on MNE's strategy in this paper, while trying to seek appropriate answers to new challenges, such as globalization, knowledge management in large organizations, building local capabilities which also function globally, or how to adapt the strategy to local conditions in transitional economies, among many others. To date, no extensive study of the content of the MNEs’ strategy literature has ever been conducted to identify the idiosyncratic characteristics of this field. Therefore, this study aims at filling this gap.

In so doing, this study contributes to the MNEs literature by an in-depth investigation of the structure and content of the MNE's strategy research in order to identify and map gaps in this field and to propose directions for future research. To do so, a multiple correspondence analysis was conducted of 1116 papers published by 336 authors in 95 journals concerning MNEs and strategy, published between 1975 and 2012. As a result, this study offers a map of the intellectual structure of MNE's strategy, as well as changes in that structure.

The remainder of the paper is organized as follows. First, the theoretical background that has guided this approach on MNEs’ strategy is introduced. In the next section, the rationale for the methods used is provided. Then, the intellectual structure and dynamics of research on MNEs’ strategy to date are presented. Finally, it is concluded that there is a need for combined approaches to deal with MNE's strategy. Accordingly, several avenues for future research are proposed, by combining the emerging eclectic approach of the co-evolutionary theory with other key approaches.

An overview of research on MNEs and strategyThe examination of the historical roots of MNEs’ strategy research is relevant to understand the structure of the field. The foundations of the theory of the MNE are twofold: on one hand, theories seeking to explain the existence of MNEs stem from foreign investment theory (Hymer, 1976), which included the theorems of Heckscher–Ohlin (Heckscher, 1919; Ohlin, 1933). On the other hand, Buckley and Casson's (1976) internalization theory explains why firms internalize some foreign operations rather than exporting or using local partners. The former is rooted in Ricardian determinants of trade and builds on the work of the effect of foreign trade on the distribution income of Heckscher (1919) and the work of Ohlin (1933). As noticed by Quyen (2011), until Hymer's work, there was a lack of attention drawn to foreign direct investments as a specific phenomenon of strategy. In subsequent periods, the combination of the Coasian tradition (Coase, 1937) with the Hymer assumptions leads to an important stream of research seeking to explain why firms engage in foreign production instead of selling their advantages to foreign local competitors (Buckley and Casson, 1976). This research stream is labeled as the “internalization” theory of MNEs’ strategic behavior and was the dominant approach during the first period of research on MNE's strategy.

Two dominant economic approaches span the latter research period on MNEs’ strategy: industrial organization (IO) economics and the RBV (Foss, 1999; Kraaijenbrink et al., 2010). These two approaches are built on the idea that strategy is about the pursuit of economic rents (Foss, 1999) and focuses on the explanations of organizations’ performance (Furrer et al., 2008). Ronda-Pupo and Guerras-Martin (2012, pp. 180–182) further propose a consensual definition of strategy based on a dynamic analysis of the evolution of past definitions: strategy is about “the dynamics of the firm's relation with its environment for which the necessary actions are taken to achieve its goals and/or to increase performance by means of the rational use of resources.” IO research (e.g., Porter, 1979, 1991) focuses on the key external factors, such as industry structure, to explain a firm's performance as well as performance differences across firms. Meanwhile, RBV research concentrates on internal factors, arguing that above average performance is due to a firm's idiosyncratic resources and capabilities (e.g., Barney, 1991, 2000).

The latter approaches along with some others have been also adopted by scholars in the field of MNE's strategy. For instance, Connelly et al.’s (2007) study on corporate-level international strategy combined arguments from agency theory (AT) and KBV. Gomez-Haro et al.’s (2011) study on the impact of the external environment on corporate entrepreneurship is grounded on institutional theory. In a similar vein, the study of institutional distance made by Caracuel et al. (2010) is also grounded on institutional theory. Qu (2007) studies the role of market orientation on MNEs’ global strategies from an agency theory perspective to account for the relationship between headquarters and their subsidiaries. Baena Gracia and Cervino Fernandez (2009) study foreign entry modes and franchisors companies from a TCE approach.

However, the two dominant approaches in strategic management research—IO economics and the RBV—may not perfectly encompass all the important issues related to MNEs’ strategy. This is because of the international context of their activities and the different shapes an MNE may take as a response to its multifaceted environment. TCE and internalization theories have become the dominant approaches in MNE research (Buckley and Casson, 2009). The main proposition under TCE (Williamson, 1971, 1996) is that firms seek efficiency in their decisions, as if to internalize all those operations whose transaction costs exceed the costs of managing them within the firm. TCE shares some common aspects with AT (Holmstrom, 1982; Holmstrom and Milgrom, 1991), because imperfect relationships are regulated by contracts among the multiple parts in the very Coasian sense (Alchian and Demsetz, 1972; Williamson, 1975). Therefore, the AT, as a regulatory framework of strategic decision-making, also fits well regarding the needs of research in this field of MNEs’ strategies.

In addition, internalization theory can also be considered as a specific case of TCE. According to their main proponents (e.g., Buckley and Casson, 1976, 2009), the internalization strategic behavior of MNEs obey three main principles: (a) an MNE internalizes markets when the benefits of doing so outperforms their costs, (b) they locate each activity according to the least-cost principle, and (c) the dynamics of both the firm's profitability and growth are based upon a continuous process of innovation stemming from R&D. This leads to the idea of internalizing operations and knowledge.

Notwithstanding the relevance of knowledge in this internalizing theory, both RBV and KBV are still a black-box in processing terms, from the perspective of how it enables the acquisition and control of valuable, rare, inimitable and non-substitutable (VRIN) resources and capabilities in order to make a difference. The theory is valid to explain the MNE's strategic behavior concerning location and entry modes. Nevertheless, it hardly explains the sources of heterogeneity in the MNEs performance while disregarding the interaction between a fragmented and complex environment and the MNE-subsidiaries. Internalization theory is, in essence, a combination of a TCE approach—principles (a) and (b)—and a KBV approach—principle (c). This combined approach calls for additional investigation and theorization in order to explain how MNEs can build a sustained competitive advantage (SCA).

That was the motivation of Madhok and colleagues (Madhok and Phene, 2001; Madhok, 2002; Madhok and Liu, 2006), who began to develop a knowledge-based approach to SCA of MNEs based on two determinants: the absorptive capacity—based on Cohen and Levinthal's (1990) definition—and the causal ambiguity inherent in the knowledge transfer process across the whole MNE (including inter- and intra-subsidiaries and headquarters). Additionally, those two drivers are framed by the co-evolution of the macro- and micro-environments. Therefore, this approach fits in the external–internal interaction that, at least, a minimal conceptualization of “strategy” as a process requires, according to Ronda-Pupo and Guerras-Martin's definition (2012).

Today's competition evolved into new forms of the so-called “co-opetition”, under a game theory approach (Von Neumann and Morgenstern, 1947; Brandenburger and Nalebuff, 1995). This approach posits that a producer can capture more than its valued added, which allow small and medium sized enterprises to challenge the advantage of large multinational corporations in terms of resources and capacities. Essentially, SMEs can compete against large MNEs by co-ompeting. This implies a step forward and a different approach to the problems of “value” assessment of RBV and KBV for MNEs. The indeterminate nature of the concepts “value” and “resources” challenges the explanation of how organizations achieve a SCA (Kraaijenbrink et al., 2010). Additionally, the latter authors and Furrer and Thomas (2000) emphasized that RBV performs at their best within predictable markets or, at least, predictable up to a reasonable extent. However, MNEs operating all over the world act in rather unpredictable markets. This gives rise to the need for including and merging approaches.

Game theory may play a key role to explain the principal–agent relationship and the paths that MNEs might follow when implementing their strategic alternatives as a process view. Even from KBV, relational capital can be added as a determinant issue; this is how MNEs create value while relating with key agents in a win–win solution, following the co-opetition principles. Although it is desirable to have a universalistic theory of MNEs’ strategy, theory cannot be counterfactual and disregard the fact that MNEs may change their approach in the decision-making process when developing their strategy. Different paths stem from different scenarios where MNEs act.

Finally, it is imperative to point out the usefulness of the institutional approach, which is complementary to the aforementioned approaches. Particularly, this is because MNEs often operate with local partners in markets where the price mechanism does not work properly. Market failures bring to the fore the development of “pragmatic” and “organic” institutions, as well as “planned” and “spontaneous orders” (Hayek, 1973; Menger, 1883), or in the words of Williamson (1991) “spontaneous” and “intentional governance,” where the essential distinctions between market socialism and price-mediated exchange is on the basis of private property rights issues (Foss, 1994). Frequently, MNEs highly depend upon the regulating institutions. This requires a proactive management of the complex macro-environment dynamics (Madhok and Phene, 2001; Madhok and Liu, 2006).

Methods and data collectionData sourcesUnlike other literature review articles on the field of strategy, this study is not limited to only some specific journals. For instance, Ramos-Rodríguez and Ruíz-Navarro (2004) as well as Ronda-Pupo and Guerras-Martín (2010) focused their investigation only on research articles published in the Strategic Management Journal. Similarly, Nag et al. (2007) and Furrer et al. (2008) only studied articles from the top-five journals on strategy. In our case, we preferred not to restrict the search to any journal in particular but on articles dealing with the topic. A most comprehensive map of the intellectual structure of research is the benefit of this search strategy, regardless of the number of citations or influence.

However, this paper determines (for the impact of the research analyzed) to only include what Ramos-Rodríguez and Ruíz-Navarro (2004) labeled as ‘certified knowledge.’ To do so, only articles from journals indexed and abstracted in the Social Science Citation Index (SSCI) were included, as they can be considered certified. Additionally, the SSCI database comprises the most relevant journals for international business research, as for instance the Journal of International Business Studies, Journal of World Business, International Business Review, and Management International Review, as well as other applicable outlets for international business scholars.

The lexemes related to MNEs, such as multinational or transnational corporations or enterprises, were searched and then combined with the lexeme “strateg*” to identify articles dealing with MNEs and strategy. We used a broad scope perspective to identify articles from a wide variety of academic disciplines such as business economics or psychology. A subsequent manual filter of the results was conducted to ensure that each article actually dealt with the thematic scope of the investigation.

In addition, the aim was to disclose whether scholars had included the main schools of thought on strategic management and on the firm's view in their arguments on MNE's strategy. Therefore, among the results yielded by the previous step, the search was particularly for keywords related to transaction cost economics, agency theory, institutional theory, resource and knowledge-based views, and game theory.

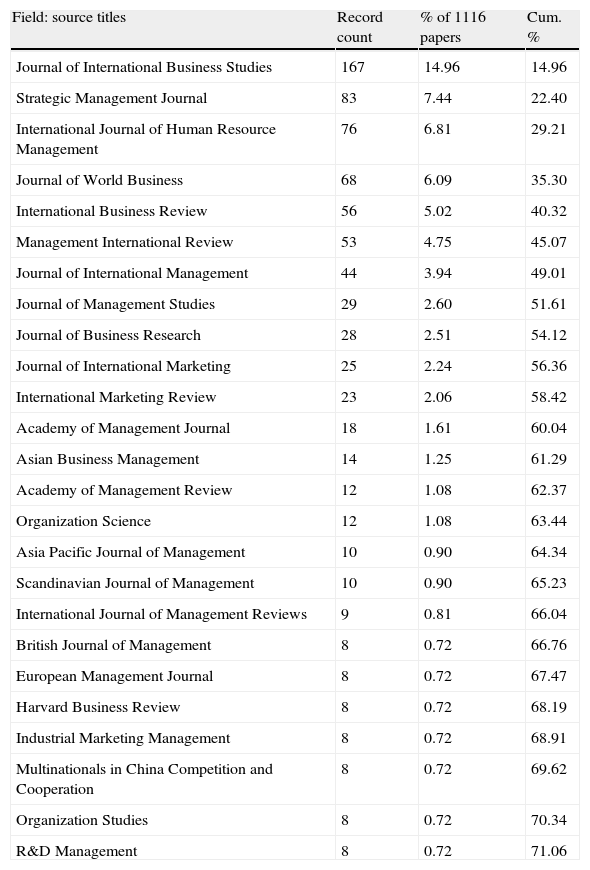

The search was finished on May 2nd, 2012 and resulted in 1116 papers published between 1975 and April 2012 by 336 authors in 95 journals. Table 1 reports the top-25 journals in terms of the total number of articles, which account for over 71% of the selected articles. It can be further highlighted that MNE's strategy research is concentrated in a small number of journals: the top-eight journals (in quantity of papers) account for more than 50% of the total number. This distribution may be partly explained by three empirical laws developed in library sciences: the Matthew's effect (Merton, 1968), the Lotka's Law for explaining authors’ productivity (Lotka, 1926) and the Bradford's Law of journals covering a field (Bradford, 1934). The Matthew-effect was originally described by Merton (1968), as the “rich get richer”: most productive authors in a field increase their number of articles each year in a multiplicative pace. The Lotka's Law states that “[…]the number (of authors) making n contributions is about 1/n2 of those making one[…]” (Lotka, 1926, p. 323). When speaking about journals, Bradford (1934) found empirical evidence that a large number of the relevant articles in a field was concentrated in a small number of journal titles (the core of the field). All of them pointed out the kind of hyperbolic distribution explaining how an input increasing geometrically produces a result increasing arithmetically (read further in the Special Issue of Library Trends edited by Potter, 1981).1

Top-25 journals publishing articles related to MNEs strategies.

| Field: source titles | Record count | % of 1116 papers | Cum. % |

| Journal of International Business Studies | 167 | 14.96 | 14.96 |

| Strategic Management Journal | 83 | 7.44 | 22.40 |

| International Journal of Human Resource Management | 76 | 6.81 | 29.21 |

| Journal of World Business | 68 | 6.09 | 35.30 |

| International Business Review | 56 | 5.02 | 40.32 |

| Management International Review | 53 | 4.75 | 45.07 |

| Journal of International Management | 44 | 3.94 | 49.01 |

| Journal of Management Studies | 29 | 2.60 | 51.61 |

| Journal of Business Research | 28 | 2.51 | 54.12 |

| Journal of International Marketing | 25 | 2.24 | 56.36 |

| International Marketing Review | 23 | 2.06 | 58.42 |

| Academy of Management Journal | 18 | 1.61 | 60.04 |

| Asian Business Management | 14 | 1.25 | 61.29 |

| Academy of Management Review | 12 | 1.08 | 62.37 |

| Organization Science | 12 | 1.08 | 63.44 |

| Asia Pacific Journal of Management | 10 | 0.90 | 64.34 |

| Scandinavian Journal of Management | 10 | 0.90 | 65.23 |

| International Journal of Management Reviews | 9 | 0.81 | 66.04 |

| British Journal of Management | 8 | 0.72 | 66.76 |

| European Management Journal | 8 | 0.72 | 67.47 |

| Harvard Business Review | 8 | 0.72 | 68.19 |

| Industrial Marketing Management | 8 | 0.72 | 68.91 |

| Multinationals in China Competition and Cooperation | 8 | 0.72 | 69.62 |

| Organization Studies | 8 | 0.72 | 70.34 |

| R&D Management | 8 | 0.72 | 71.06 |

A content analysis was conducted of the words in the title and abstract of the articles, as well as the keywords provided by authors. Both manual and computer-aided checks were conducted to ensure the reliability of this procedure. Wordstat 6.1 software was used in the analysis. This software has been used in more than 300 similar studies on diverse academic fields including management and strategy (e.g., Gray et al., 2004 or Morris, 1994; see Pollach, 2011 for a critical review). The main outcome of this step was a list of 263 keywords most commonly used to describe this research. From this, up to 43 keywords were short-listed that were meaningful for the analysis, either in quantitative terms (total number of papers) or qualitatively (key issues on MNE's strategy).

In a second stage of analysis, following the recommendations of Furrer and Sollberger (2007) and Furrer et al. (2008), a multiple correspondence analysis (MCA) was conducted. Following the methodology described by Hoffman and De Leeuw (1992), a matrix with the 43 most relevant keywords was constructed, computing a “1” when each of the latter keywords was present in each of the 1116 articles, and “0” otherwise. The MCA was computed by using the Homals procedure in SPSS (v20). The results are represented in a two-dimensional map, where the proximity among keywords can be understood as a real distance among keywords (Hoffman and Franke, 1986). According to the latter authors, if a large portion of articles used two keywords together, then they will appear closely in the map. Conversely, large absences of two keywords will be graphically depicted distantly in the map, which will mean that those keywords have not been covered jointly over literature, hence pointing out possible gaps of research.

Rationale for the time spanThe time frame of the study was split into two different stages: a first period from 1975 to 1999 and a second one from 2000 onward. The year 2000 was used for splitting the sample to evaluate if studies published in the new century differ from older studies. Its rationale is based on two key facts extremely relevant to interpret our results. First, in 1976 Buckley and Casson published their theory of internalization, a theory that has been dominant to explain the behavior and formation of MNEs over the last four decades by a vast majority of scholars (Buckley and Casson, 2009). Second, the Barney's resource-based view of the firm (1991) had drawn the attention of scholars on the strategy and strategic management field over that decade. By late 1990s, the RBV was still securing and reflecting on its main foundations from initial definitions stated by the early 1990s. In fact, Barney (2000) revisited his own roots. Hence evolution of the strategic management field (Furrer et al., 2008) and dynamics of the concept of strategy (Ronda-Pupo and Guerras-Martin, 2012) may also have had an impact on MNE strategy research. In addition, a still emerging research dawned at the beginning of the new century: the co-evolutionary approach of MNE's strategy (Madhok and Phene, 2001; Madhok, 2002; Madhok and Liu, 2006). Therefore, two different periods seem to exist, influenced by both the irruption of RBV and KBV in the general strategic management field and this new approach to MNE's strategy.

Although the time scope for this investigation was a 38-year period, it was decided not to split the timespan equally, according to the latter arguments. As a limitation, it should be mentioned that electronic databases generally neither provide comprehensive results when the search period includes very early dates nor the number of articles is high. Therefore this search was limited to the last four decades. The number of articles in previous periods was not relevant enough as to allow any significant comparison. The keywords’ proximity was analyzed over the two periods separately and for the total timespan, additionally. Therefore, the current picture is illuminated as well as the temporal changes in the intellectual structure of research on MNE's strategy. In subsequent sections, the structure of research in this field for the total period (1975–2012) is introduced and, after that, the comparison of the two periods (1975–1999 and 2000–2012) in order to analyze changes.

Results: mapping the intellectual structure of MNEs’ strategy fieldThe list of authors is rather long, with 336 different contributors, which is indicative of the popularity of the MNEs’ strategy field. This field has gained particular attention since the rise of the globalization phenomenon. Different approaches have been adopted.

The importance of the transaction cost theory should be highlighted, since up to 118 articles grounded in this approach were identified. This supports the argument made by Madhok (1997), who states that TCE is at the core of the MNE's strategy. The core assumptions of TCE are fully consistent with Buckley and Casson's (1976, 2009) internalization theory. TCE may also be considered as an extension of the contractual and legitimacy requirements of the relationship among agents addressed by agency theory, and with imperfect relationships regulated by a contract (Kostova and Zaheer, 1999). The latter authors combined an agency theory approach with institutional theory to introduce a number of propositions related to the need for legitimization of both the parent company and its local subsidiaries. In that article, they proposed that the existence of trade-offs and tensions between parent companies and local subsidiaries contribute to maintaining their respective legitimacy. Furthermore, Kostova and Zaheer (1999) showed that these tensions depend on a number of factors, such as the number of countries in which a MNE operates and the institutional distance between the parent and subsidiaries. The concept of institutional distance is one of their key contributions, emphasizing the need for adapting strategy and resources to local conditions.

Since the very early beginning of the Grant's work (1991, 1996), a knowledge-based approach has been extensively adopted in the research on MNEs’ strategy since the very early beginning of the Grant's work (1991, 1996). For instance, Gupta and Govindarajan (1991) investigated the relationship between headquarters and subsidiaries based on this approach, to shed light on issues related to the control of strategy. Oviatt and McDougall's work (1994) can also be classified among this knowledge-based research stream. These authors developed the concept of “internationalized new ventures” (INVs): those newly created firms which start exchanging in international markets shortly after their establishment, even making direct investments and hence these organizations can be considered as MNEs. They suggest that an accelerated knowledge-based process is necessary to gain further knowledge to overcome the liabilities of foreignness and of newness.

How to improve the relationships of headquarters with local subsidiaries or local alliance partners is another relevant topic discussed in the literature on MNEs’ strategy. More specifically, the extent to what local subsidiaries should have more autonomy to be more effective within diversified MNEs, with several barriers hindering it. In this regard, both Tallman and Li (1996) and Hitt et al. (1997) highlight the relevance of international diversification to achieve a competitive advantage (a more complex issue in the case of product-diversified MNEs). They found that there is a point in which performance decreases while international diversification increases. This may hinder the possibility that subsidiaries enjoy more autonomy since the strategic decision in a multiproduct MNE is usually the responsibility of headquarters, while regional knowledge—which is not always shared with headquarters—is usually held by local subsidiaries.

Given the fragmentation of the field of MNEs’ strategy, it is important to map it in order to identify the communalities and differences between approaches. Such a mapping is critical in many ways: (a) to understand which theories could be fruitfully combined into eclectic approaches, (b) to understand which theories are conflicting so that their boundaries can be identified, and (c) to understand where the existing gaps are to set an agenda for future research. Therefore, as a first step in this direction, the structure of research on MNE's strategy to date is introduced in the next section.

Structure of the research on MNE's strategyFirstly, the analysis for the total period is introduced in this section. In a subsequent step, the analysis is split in two periods to highlight changes in the intellectual structure of the field.

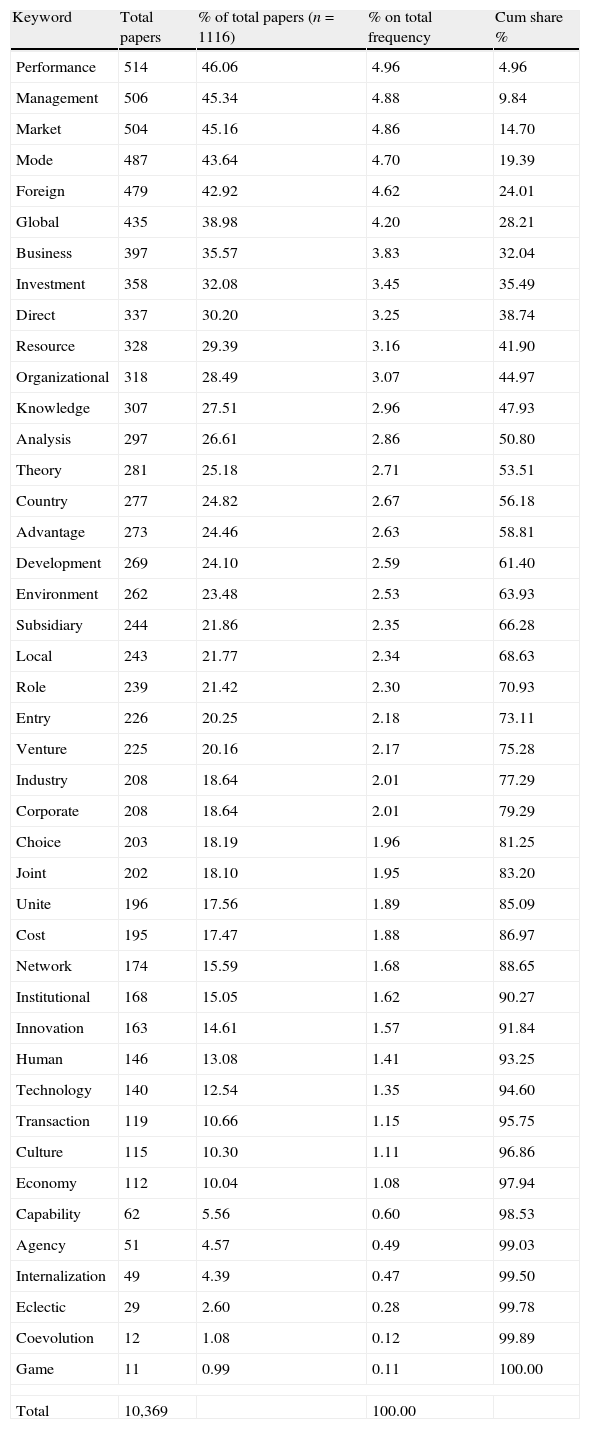

Table 2 shows the 43 main keywords used by scholars within this research field in the period (1975–2012). If the top-10 keywords are considered then a first finding emerges: MNEs’ strategy research is mainly concerned by the MNE's international behavior. This is the mode of entry into foreign markets, which includes the globalization phenomenon; a clear economic viewpoint with references to foreign direct investment. Not surprisingly, the list is governed by the management–performance binomial, which is similar to the findings within the strategic management field (Furrer et al., 2008), as strategy is mainly about performance.

Main keywords on papers dealing with MNEs strategies.

| Keyword | Total papers | % of total papers (n=1116) | % on total frequency | Cum share % |

| Performance | 514 | 46.06 | 4.96 | 4.96 |

| Management | 506 | 45.34 | 4.88 | 9.84 |

| Market | 504 | 45.16 | 4.86 | 14.70 |

| Mode | 487 | 43.64 | 4.70 | 19.39 |

| Foreign | 479 | 42.92 | 4.62 | 24.01 |

| Global | 435 | 38.98 | 4.20 | 28.21 |

| Business | 397 | 35.57 | 3.83 | 32.04 |

| Investment | 358 | 32.08 | 3.45 | 35.49 |

| Direct | 337 | 30.20 | 3.25 | 38.74 |

| Resource | 328 | 29.39 | 3.16 | 41.90 |

| Organizational | 318 | 28.49 | 3.07 | 44.97 |

| Knowledge | 307 | 27.51 | 2.96 | 47.93 |

| Analysis | 297 | 26.61 | 2.86 | 50.80 |

| Theory | 281 | 25.18 | 2.71 | 53.51 |

| Country | 277 | 24.82 | 2.67 | 56.18 |

| Advantage | 273 | 24.46 | 2.63 | 58.81 |

| Development | 269 | 24.10 | 2.59 | 61.40 |

| Environment | 262 | 23.48 | 2.53 | 63.93 |

| Subsidiary | 244 | 21.86 | 2.35 | 66.28 |

| Local | 243 | 21.77 | 2.34 | 68.63 |

| Role | 239 | 21.42 | 2.30 | 70.93 |

| Entry | 226 | 20.25 | 2.18 | 73.11 |

| Venture | 225 | 20.16 | 2.17 | 75.28 |

| Industry | 208 | 18.64 | 2.01 | 77.29 |

| Corporate | 208 | 18.64 | 2.01 | 79.29 |

| Choice | 203 | 18.19 | 1.96 | 81.25 |

| Joint | 202 | 18.10 | 1.95 | 83.20 |

| Unite | 196 | 17.56 | 1.89 | 85.09 |

| Cost | 195 | 17.47 | 1.88 | 86.97 |

| Network | 174 | 15.59 | 1.68 | 88.65 |

| Institutional | 168 | 15.05 | 1.62 | 90.27 |

| Innovation | 163 | 14.61 | 1.57 | 91.84 |

| Human | 146 | 13.08 | 1.41 | 93.25 |

| Technology | 140 | 12.54 | 1.35 | 94.60 |

| Transaction | 119 | 10.66 | 1.15 | 95.75 |

| Culture | 115 | 10.30 | 1.11 | 96.86 |

| Economy | 112 | 10.04 | 1.08 | 97.94 |

| Capability | 62 | 5.56 | 0.60 | 98.53 |

| Agency | 51 | 4.57 | 0.49 | 99.03 |

| Internalization | 49 | 4.39 | 0.47 | 99.50 |

| Eclectic | 29 | 2.60 | 0.28 | 99.78 |

| Coevolution | 12 | 1.08 | 0.12 | 99.89 |

| Game | 11 | 0.99 | 0.11 | 100.00 |

| Total | 10,369 | 100.00 | ||

Different approaches to the latter only begin to appear at the end of the top-10 list of keywords, as for instance resource. It should also be mentioned that knowledge appears close to the latter. Surprisingly, internalization was explicitly mentioned by only a 4.4% of papers. Nevertheless, the main theoretical assumptions of the internalization theory can be considered as implicit within the predominant keywords, since it explains the behavior of MNEs when entering into a foreign market.

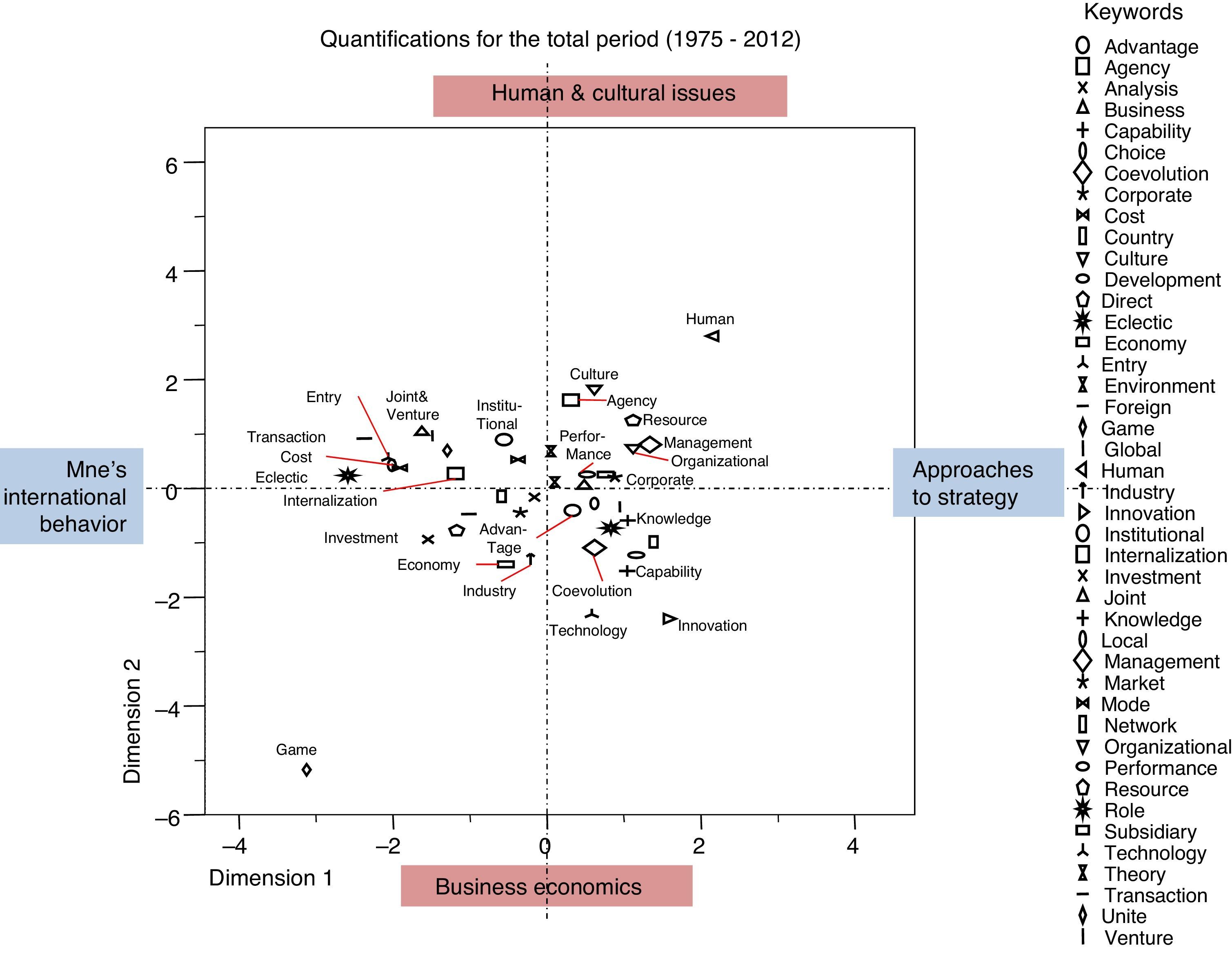

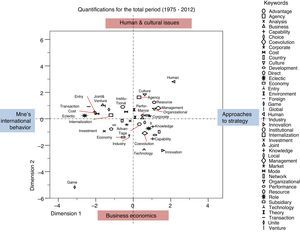

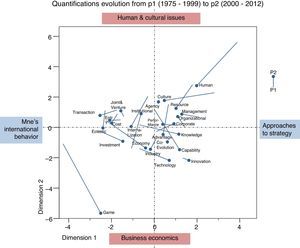

Approaches such as capabilities, game theory, and eclectic view scored low on this list. However, it must be mentioned that this list is somehow influenced by the time scope, because the most recent approaches had lesser prospects to be applied than older ones. The multiple correspondence analysis may help to have an upper view of the intellectual structure of research to date. Fig. 1 depicts graphically the map, where proximity between keywords represents whether or not they were analyzed jointly. This is shared-substance in terms of the average position of the articles that dealt with each keyword.

The two dimensions of the map can be interpreted on the basis of the position of the keywords. For the sake of clarity, only the most relevant keywords were labeled in the map, while all of them are graphically positioned in the map. Performance and environment appear centered in the map hence it is aligned with the definition of strategy provided by Ronda-Pupo and Guerras-Martin (2012): “the dynamics of the firm's relation with its environment to increase performance.”

The vertical dimension separates the articles in two large but different topics. On the upper side, keywords are related to the soft side of MNE's strategy. Human resources, organizational culture, agency relationships, and institutional approach scored high on this axis. On the bottom side, keywords are mainly related to game theory approach, and to a lesser extent to innovation and technology, capability, and most relevantly with industry and economics. Accordingly, the poles of this vertical axis can be labeled as human and cultural issues (upper side) and business economics (lower side).

The horizontal axis has, perhaps, major implications for our analysis, since it opposes two major MNEs’ strategy research streams: transaction cost economics on the left hand, and approaches to management and strategy such as human, knowledge, resources, capabilities or innovation on the right hand.

Traditional approaches for the explanation of MNE as an organization are positioned on the left side, particularly the internalization theory (Buckley and Casson, 1976) and the eclectic approach mainly owed to Dunning (1988) and the OLI paradigm—advantages stemming from Ownership, Location and Internalization. The main keywords positioned here are transaction cost, investment, entry, or joint-venture, along with the latter. This is why this left side of the horizontal axis can be understood as dealing with the behavior of a MNE in an international market.

The right hand pole comprises keywords and articles dealing with combinations of the main schools of strategic management thought. If we combine human or resources then it becomes apparent that the human dimension has been a key issue on MNE's strategy. The keyword resource appears close to management and organization, then it follows that a resource-based approach governs this axis. It is also remarkable that knowledge and capability appear close to each other.

However, a somewhat surprising finding is that a knowledge-based approach to strategy is placed in the opposite side to internalization, transaction cost economics and the eclectic theory. This means that a large portion of articles do not deal with the latter approaches along with knowledge-based views. Furthermore, it seems that internalization theory has overemphasized the transaction-cost and eclectic approaches. However, we should mention that Buckley and Casson's theory of internalization (1976) actually does include the knowledge-based approach as a key explanation of the MNE's very nature and behavior.

Results point out that some kind of research gap exists, at least from an empirical viewpoint, on how the RBV and KBV can be useful to explain MNEs corporate-level strategies, be this from the viewpoint of the headquarters, subsidiaries, or alliance partners. Moreover, the relationship with the external environment also seems to be missing in the MNE's international behavior research pole, which would be somehow counter-theoretical from the viewpoint of the key issues that strategy research must content: the relationship of the organization with environment from a wider point of view (Ronda-Pupo and Guerras-Martin, 2012). Gupta and Govindarajan (1991, 2000) addressed research on MNE's strategy from a KBV approach by emphasizing the role that knowledge plays in the relationship between MNE's headquarters and subsidiaries; a key issue to explain a typical principal–agent relationship. In addition, Hitt et al. (1997) highlighted the bidirectional knowledge flows in the innovation strategy of MNEs. Hence, knowledge is a key element to explain this relationship strategically, a kind of experiential knowledge in the words of Eriksson et al. (1997). Social capital may also help to understand how knowledge is strategically regulated across networks (Inkpen and Tsang, 2005); therefore, absorption and transfer of knowledge are meaningful in the understanding of how an MNE deploys its strategy (Madhok and Liu, 2006).

A relevant topic discussed in the literature on MNEs’ strategy is how to improve the relationships between headquarters and local subsidiaries or alliance partners. More specifically, the extent to what local subsidiaries should have more autonomy to be more effective within diversified MNEs, with several barriers hindering it. In this regard, both Tallman and Li (1996) and Hitt et al. (1997) highlighted the relevance of international diversification to achieve a competitive advantage, a more complex issue in the case of product-diversified MNEs. They found that there is a point in which performance decreases while international diversification increases (i.e., an inversed U-shaped curve between degree of diversification and performance). This may hinder the possibility that subsidiaries enjoy more autonomy since the strategic decision in a multiproduct MNE is usually in the hands of headquarters, while regional knowledge—which is not always shared with headquarters—usually resides in the subsidiaries.

On the other hand, the recent co-evolutionary approach (Madhok and Phene, 2001; Madhok, 2002; Madhok and Liu, 2006) is depicted side by side with knowledge, capability, innovation and technology. Its position in the quadrant suggests some kind of combination between business economics and the main approaches to corporate-level strategy. It must be mentioned that its roots stem from the Dunning's eclectic paradigm, although the low number of papers that mentioned any type of co-evolution positioned this keyword a bit far from that paradigm.

With regard to the vertical axis, the opposite poles are governed by human and cultural issues (on the upper side) and business economics concerns (on the lower side). This is also particularly relevant for our findings. Innovation and technology along with economy and industry govern the lower part of the vertical axis.

The upper pole is clearly governed by the human dimension, and it is combined with approaches such as agency theory and institutional theory. The human dimension has been extensively dealt with over the last four decades, particularly from approaches such as staffing systems as a key to manage international human resources strategically (Harvey et al., 2001). Some other studies dealt with local assets specificities, as an operational issue, a changing of focus to local partners in a typical agent relationship (Hennart, 2009).

The institutional approach seemed to be extremely fruitful when dealing with emerging and transitional economies. Some papers stressed the need for local adaptation in these regions. The latter calls for an institutional approach to better understand such extremely regulated and sometimes black-boxed markets. Examples of this are Meyer and Nguyen (2005), Child and Tsai (2005) and Peng et al. (2008).

Therefore, it seems that the intellectual structure of research on MNEs’ strategy to date shows the existence of some interesting research gaps, from both empirical and theoretical viewpoints. The dynamics of this structure over time may deliver additional perspectives, which we include in the next section.

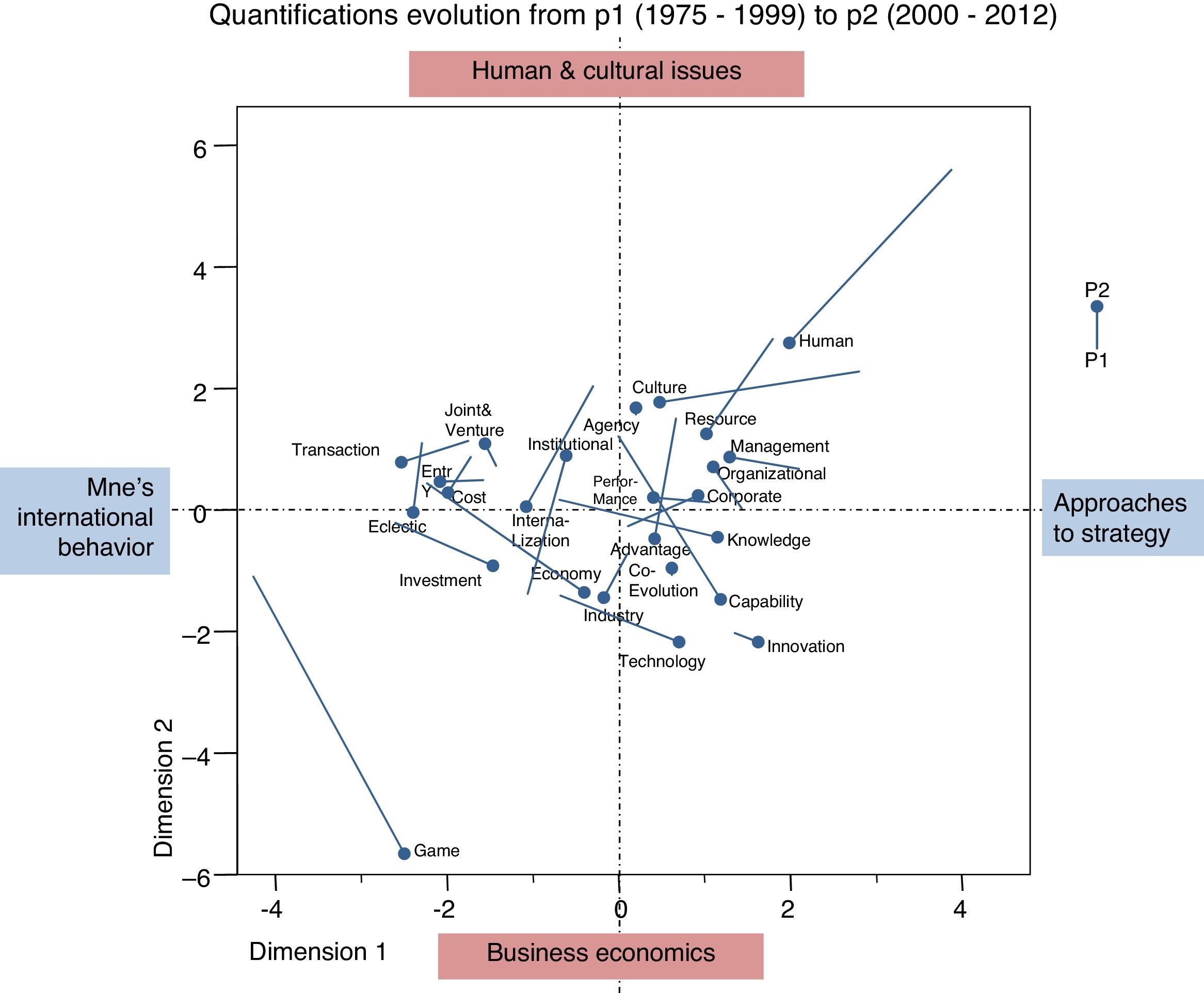

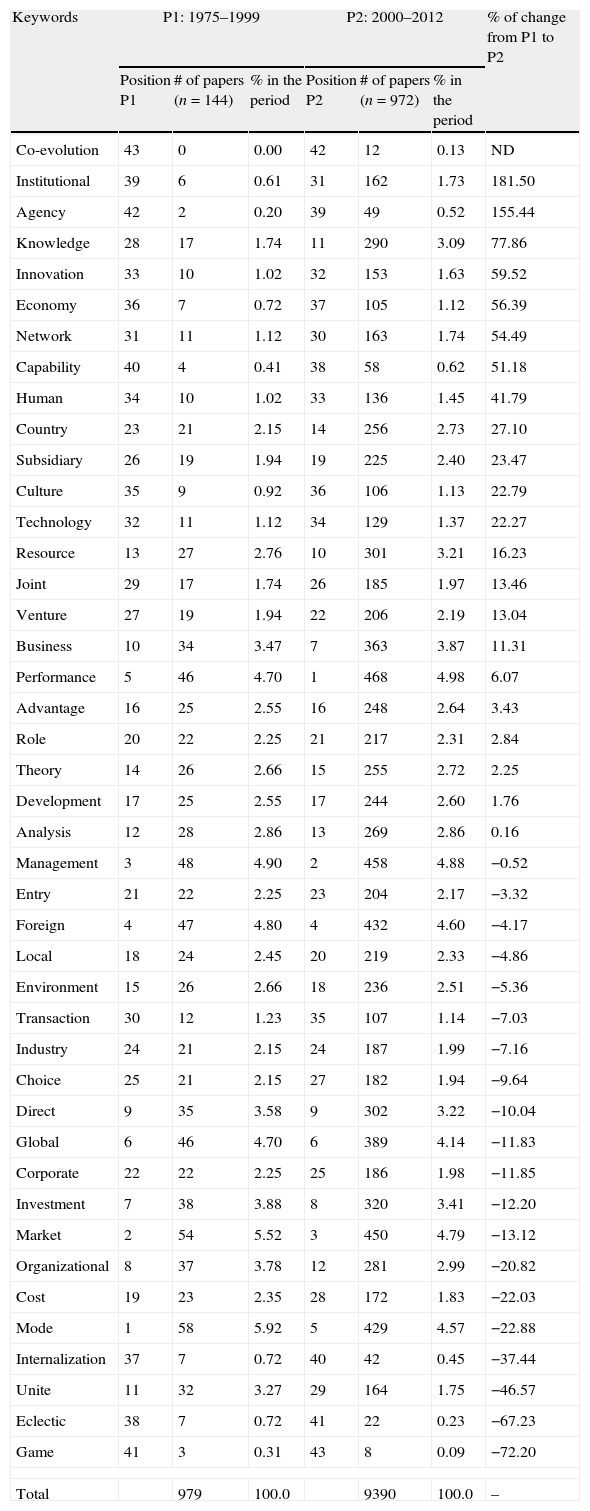

Dynamics of the structure on researching MNEs’ strategy and main findingsIn order to show changes in the structure over time, two complementary tools are used. First, Table 3 presents the dynamics of the total and relative figures of each keyword from Period 1 (1975–1999) to Period 2 (2000–2012). The total number of papers highlights the importance of keywords in each period, while the share of total papers indicates the relative position on the sum of total frequencies. This allows comparisons on relative importance between both periods by simply computing the change in the share from the initial period. Intensity in changes is then measured as the change in the relative share of papers from Period 1 to 2 divided by the initial share in the Period 1. After that, Fig. 2 maps the changes in the structure by depicting the results of the MCA in both periods. For the sake of legibility, the position of the keywords in the map corresponds to its position in the second period, while a line depicts their trajectory from Period 1.

Breakdown of main keywords on papers dealing with MNEs strategies by period (1975–1999 and 2000–2012).

| Keywords | P1: 1975–1999 | P2: 2000–2012 | % of change from P1 to P2 | ||||

| Position P1 | # of papers (n=144) | % in the period | Position P2 | # of papers (n=972) | % in the period | ||

| Co-evolution | 43 | 0 | 0.00 | 42 | 12 | 0.13 | ND |

| Institutional | 39 | 6 | 0.61 | 31 | 162 | 1.73 | 181.50 |

| Agency | 42 | 2 | 0.20 | 39 | 49 | 0.52 | 155.44 |

| Knowledge | 28 | 17 | 1.74 | 11 | 290 | 3.09 | 77.86 |

| Innovation | 33 | 10 | 1.02 | 32 | 153 | 1.63 | 59.52 |

| Economy | 36 | 7 | 0.72 | 37 | 105 | 1.12 | 56.39 |

| Network | 31 | 11 | 1.12 | 30 | 163 | 1.74 | 54.49 |

| Capability | 40 | 4 | 0.41 | 38 | 58 | 0.62 | 51.18 |

| Human | 34 | 10 | 1.02 | 33 | 136 | 1.45 | 41.79 |

| Country | 23 | 21 | 2.15 | 14 | 256 | 2.73 | 27.10 |

| Subsidiary | 26 | 19 | 1.94 | 19 | 225 | 2.40 | 23.47 |

| Culture | 35 | 9 | 0.92 | 36 | 106 | 1.13 | 22.79 |

| Technology | 32 | 11 | 1.12 | 34 | 129 | 1.37 | 22.27 |

| Resource | 13 | 27 | 2.76 | 10 | 301 | 3.21 | 16.23 |

| Joint | 29 | 17 | 1.74 | 26 | 185 | 1.97 | 13.46 |

| Venture | 27 | 19 | 1.94 | 22 | 206 | 2.19 | 13.04 |

| Business | 10 | 34 | 3.47 | 7 | 363 | 3.87 | 11.31 |

| Performance | 5 | 46 | 4.70 | 1 | 468 | 4.98 | 6.07 |

| Advantage | 16 | 25 | 2.55 | 16 | 248 | 2.64 | 3.43 |

| Role | 20 | 22 | 2.25 | 21 | 217 | 2.31 | 2.84 |

| Theory | 14 | 26 | 2.66 | 15 | 255 | 2.72 | 2.25 |

| Development | 17 | 25 | 2.55 | 17 | 244 | 2.60 | 1.76 |

| Analysis | 12 | 28 | 2.86 | 13 | 269 | 2.86 | 0.16 |

| Management | 3 | 48 | 4.90 | 2 | 458 | 4.88 | −0.52 |

| Entry | 21 | 22 | 2.25 | 23 | 204 | 2.17 | −3.32 |

| Foreign | 4 | 47 | 4.80 | 4 | 432 | 4.60 | −4.17 |

| Local | 18 | 24 | 2.45 | 20 | 219 | 2.33 | −4.86 |

| Environment | 15 | 26 | 2.66 | 18 | 236 | 2.51 | −5.36 |

| Transaction | 30 | 12 | 1.23 | 35 | 107 | 1.14 | −7.03 |

| Industry | 24 | 21 | 2.15 | 24 | 187 | 1.99 | −7.16 |

| Choice | 25 | 21 | 2.15 | 27 | 182 | 1.94 | −9.64 |

| Direct | 9 | 35 | 3.58 | 9 | 302 | 3.22 | −10.04 |

| Global | 6 | 46 | 4.70 | 6 | 389 | 4.14 | −11.83 |

| Corporate | 22 | 22 | 2.25 | 25 | 186 | 1.98 | −11.85 |

| Investment | 7 | 38 | 3.88 | 8 | 320 | 3.41 | −12.20 |

| Market | 2 | 54 | 5.52 | 3 | 450 | 4.79 | −13.12 |

| Organizational | 8 | 37 | 3.78 | 12 | 281 | 2.99 | −20.82 |

| Cost | 19 | 23 | 2.35 | 28 | 172 | 1.83 | −22.03 |

| Mode | 1 | 58 | 5.92 | 5 | 429 | 4.57 | −22.88 |

| Internalization | 37 | 7 | 0.72 | 40 | 42 | 0.45 | −37.44 |

| Unite | 11 | 32 | 3.27 | 29 | 164 | 1.75 | −46.57 |

| Eclectic | 38 | 7 | 0.72 | 41 | 22 | 0.23 | −67.23 |

| Game | 41 | 3 | 0.31 | 43 | 8 | 0.09 | −72.20 |

| Total | 979 | 100.0 | 9390 | 100.0 | – | ||

Listed by “% of change between periods”.

Period 1 (1975–1999) accounted for a total of 144 different articles, with an average of 5.76 articles every year. Meanwhile, during the second period (2000–2012) the average number of articles skyrocketed to 74.76 articles every year, accounting for a total of 972 papers. This result shows the increasing interest of MNEs’ strategy topic over the last decade, with relevant challenges for MNEs such as globalization and emerging markets.

The top-10 keywords over the first period are mode, market, management, foreign, performance, global, investment, organizational, direct and business. As the map shows, this period is mainly governed by concerns related to the explanation of foreign market entry and investments. Combinations of resources and costs seemed to be the dominant approaches. The relative concentration of the research among a low number of keywords is remarkable, since the first thirteen keywords in the list accounted for more than 51% of total hits. The latter summary of keywords points out that research was following theories of international trade stemming from the traditional foreign investment theory (Hymer, 1976), rather than investigating on a more modern concept of strategy. We should also highlight that internalization does not achieve a relevant position during this period, at least the number of articles does not seem to explicitly mention it, although it is implicit in the TCE approach.

During the second period, the top-10 keywords are performance, management, market, foreign, mode, global, business, investment and direct in terms of total number of papers. Although initially it might seem that virtually no significant changes had occurred quantitatively, they actually had in qualitative terms. For instance, resource and knowledge increased their relative importance dramatically. Anyway, the key underlying issue appears to have been the modes of foreign market entry but with a more modern perspective in terms of how the managerial actions can deliver the best performance as possible.

If changes in relative positions are analyzed, then topics of increasing and decreasing relevance arise. On one hand, increasing interest topics and approaches have been institutions, agency, and knowledge. Co-evolution also appeared recently. However, since our sample did not include any paper dealing explicitly with this evolving viewpoint in the first period, no change could be identified.

First, the significant attention given to the role of the KBV in the relationship between MNEs and their local subsidiaries should be highlighted. Four of the ten most cited articles deal with the issue. These are the papers by Gupta and Govindarajan (1991, 2000), Inkpen and Tsang (2005), and Eriksson et al. (1997). Oviatt and McDougall's work on international new ventures-INVs (1994) can also be classified among this knowledge-based research stream. Although some may argue that an INV is different from an MNE, its inclusion in our research may help to find new research avenues. The latter authors developed the particular case of “internationalized new ventures” (INVs), those newly organizations which start exchanging in international markets shortly after their establishment, even making direct investments and hence these organizations can be considered as MNEs if not immediately, at least in their evolution to other forms after time has passed by. The INV concept usually considers the organization from the viewpoint of its time from inception (most frequently 6 years), so it is a simple question of time that an INV may evolve into other types of forms, for instance an MNE. Stages and strategic behaviors around this connection between INVs and MNEs are still missing in the literature. Oviatt and McDougall (1994) suggested that an accelerated knowledge-based process is necessary to gain further knowledge to overcome the liabilities of foreignness and of newness.

On the other hand, some keywords that lost research interest in terms of relative importance should be highlighted. Among them, game theory, eclectic approach, internalization, and those keywords related to mode of entry in foreign markets, investment, and transaction cost economics.

After this analysis, Fig. 2 provides a clearer picture of the evolution in the structure of research in this field. For the sake of legibility, only the main keywords relevant for this analysis were included in the map. Changes affecting internalization are worth noting. During the first period, research on internalization is located on the upper side of the map and closer keywords were capability, knowledge and even agency. Advantage was also close to it. In the second period, internalization moved away from the latter until it was placed virtually on the horizontal axis at the left of the center, while knowledge and capability went down and toward the right until positioning closer each other. This implies that the knowledge-based dimension of this theory was somehow diluted by the economic view of investment and transaction cost approaches over the second period, perhaps because it was overemphasized during the first period despite the efforts trying to move away from that (e.g., Buckley, 1993). Nevertheless, knowledge is a key element for a complete understanding of this theory, an issue that has been perhaps misunderstood by more recent research.

Rugman and Verbeke (2004, 2008) fall into this view with their dual scope strategy (regional and global) theory, under the internalization and TCE approach. Rugman et al. (2011) is an example of combined approach, where MNEs are split into two units of analysis: at country level through a TCE lens and at a parent firm through an RBV one, in order to explain the specific advantages of both units. Delios and Beamish (2001) can also be included within the RBV and KBV approaches, who found that host country experience has a direct effect on survival but a contingent impact on profitability, with an approach from KBV.

On the other hand, institutional theory was initially located close to technology, mainly because of the fact that innovation systems was being investigating from the viewpoint of public institutions such as universities at that time, and how MNEs could seize from this type of institutions in their foreign market entry decisions (Mathews, 1999). This is somehow aligned with the internalization of knowledge. However, institutionalism evolved to the upper side while internalization went down and technology moved to the left toward innovation and capability, in the end.

Transaction cost, joint-venture and the eclectic paradigm barely moved from initial location in the map. As a dominant approach, TCE has critical implications for the MNEs’ strategy. For example, the profit maximization issue goes beyond merely production costs, to include, among others, search costs to identify and select contractual partners (Abdi and Aulakh, 2012), the costs of monitoring foreign partners (Dimitratos et al., 2010), or establishing safeguards (Feinberg and Gupta, 2009). All the latter are clearly related to corporate governance. This theoretical approach also includes those elements of asymmetric information and bounded rationality pointed by Foss (1994). In the case of MNEs, TCE seeks to explain their decisions to whether “internalize” foreign activities. TCE is also implicitly related to agency theory, as this theory seeks to explain the control mechanisms necessary to effectively organize the relationships between headquarters and foreign subsidiaries (Hennart, 2009, 2010).

TCE is useful to explain relationships between MNEs and their alliance partners and foreign subsidiaries. But it is less useful to explain how MNEs develop competitive strategies in order to build and sustain competitive advantages (SCA). To study this key question, the RBV, KBV, and game theory are, perhaps, more appropriate theoretical approaches. According to RBV and KBV approaches, MNEs must develop and/or control VRIN resources and capabilities to achieve a SCA, following the general principles of Barney (1991, 2002). Apart from MNEs, general studies focusing on core competences put the emphasis on the combination of human abilities and organizational routines (Hamel and Prahalad, 1994). In a similar vein, the dynamic capabilities perspective departs from a static view on strategy and highlights the importance of understanding the external environment–firm interactions (Helfat and Peteraf, 2003; Teece et al., 1997). The KBV emphasizes that resources and capabilities based on knowledge are critical to achieve a sustained competitive advantage (Grant, 1991, 1996).

These views are also useful for MNEs to explain global competition among MNEs and between MNEs and their local competitors. Kraaijenbrink et al. (2010) argue that these views together allow the explanation of the international strategies of profit-maximizing organizations operating in distinct markets. These theories also assume the existence of asymmetric information and bounded rationality, emphasizing the role of managers’ judgment. According to general literature on the theme such as Peteraf and Barney (2003) or Kraaijenbrink et al. (2010), if we applied the latter to the case of MNEs’ strategies, it is not the possession but the use of key assets and intangible resources, mainly knowledge-based components, which enable MNEs to compete successfully in globalized markets. However, in the specific literature on MNEs reviewed, the major issue is still how to apply these views in the mainly unpredictable environments in which these firms operate.

The importance of institutional theory should be noted in combination with other approaches. This importance stems from the fact that MNEs operate in foreign markets embedded in particularly complex institutional environments. For example, those MNEs that are active in the “intentional governance” economies (Williamson, 1991) depend highly on regulating institutions facing free-market failures. Such institutional environments are quite different from those regulated by price-mediated exchanges. Under an institutional approach, MNEs should pay particular attention to the understanding and adaptation to those particularities of the macro-environment when developing their strategies (Madhok and Liu, 2006). Hoskisson et al. (2000) highlight the need to link institutional theory to other theoretical perspectives (such as TCE and the RBV) when studying MNEs strategies in emergent economies, because economic environments and institutional infrastructures may hinder the implementation of market-based strategies. Similarly, Peng (2003) and Peng et al. (2008) studied the role of institutional transitions in affecting MNEs’ strategic choices. The institutional environment cannot be considered independently of MNEs’ in terms of designing and implementation of their strategies, following Ronda-Pupo and Guerras-Martin's (2012) definition of strategy, and hence institutional theory plays a determinant role in this explanation.

In facing these challenges, some authors emphasize the role of expatriates as an efficient mechanism (e.g., Harvey et al., 2001). These authors put the focus onto the role of human capital in MNEs, particularly the role of expatriates and their capabilities to manage efficiently the performance challenge.

Some missing or underestimated approaches to MNEs’ strategy are entrepreneurship and contingent approaches. Chandler's (1962) contingency theory (i.e., the fit between structure and strategy) is frequently a missing element within this field. Some exceptions are owed, for instance to Birkinshaw and Morrison (1995), who studied the configurations of strategy and structure in MNEs’ subsidiaries. Birkinshaw (1997) and Birkinshaw et al. (1998) also studied the entrepreneurial initiatives developed by subsidiaries and their potential to become a source of sustained competitive advantage. Meanwhile, Harzing and Sorge (2003) investigated the relative impact of country of origin and universal contingencies on internationalization strategies and corporate control of MNEs.

Game theory (Brandenburger and Nalebuff, 1995; Von Neumann and Morgenstern, 1947) has also been a missing approach within MNEs strategy literature. Yet, it may play a key role to explain cooperative relationships between MNE and local partners, as well as the paths that MNEs could undertake to implement their strategies in foreign markets. If KBV and GT were brought together, then the determinant role of relational capital arises—i.e., how MNEs create value while relating with key agents, in a win–win solution or even to change the rules of the game (Zhu et al., 2011).

Overall, approaches to MNEs’ strategy have been quite diverse and complex, much like the phenomenon under investigation. However, some of them have been largely ignored while some others have dominated research in this field over the last decades. Yet MNEs’ strategy has a missing component that a modern strategy should include. This missing component has emerged only during the recent years with the co-evolutionary theory: relationships with environment and how to capitalize on it in order to outperform competitors whoever they may be.

Some voices (Madhok and Phene, 2001; Madhok, 2002; Madhok and Liu, 2006) also started to question whether the TCE approach is suitable to address competition issues, particularly through global or multi-domestic strategies, even from the transnational solution of Bartlett and Ghoshal (1989). Indeed, research has showed that different approaches could be used to explain MNEs’ multifaceted behavior when choosing and implementing strategies. This has given rise to multiple combinations of approaches that, in a fragmented way, have investigated MNEs’ strategies.

Based on Foss’ (1999) logic, it can be extrapolated that two opposite forces coexist and shape MNEs’ strategies. On one hand, TCE argues that large and inefficient organizations tend to diminish their size. On the other hand, the desire to internalize operations and knowledge for the sake of growth entails more resources and capabilities for organizations to compete. Hence, combinative approaches seem to be required in order to explain complex organizations, such as MNEs. The current economic environment has also brought to fore examples of MNEs that have downsized some previously internalized operations as a consequence of the abovementioned force, some of them related to the country of origin effect on MNEs. This effect, illustrated by Harzing and Sorge (2003), emphasizes the role of country-of-origin as an important predictor of the control mechanisms used by MNEs, influencing largely over their internationalization strategy.

In addition, Kostova et al. (2008) argue that a narrow set of neo-institutional ideas has been put into practice to contribute to the renewal of the theory of MNEs, and call for a more multidisciplinary approach, where the institutional environment dimension is essential. Unexpectedly, we find that the entrepreneurial approach (Foss and Ishikawa, 2007; Foss et al., 2007) is still underestimated in the research on MNEs’ strategies, although it is usually encompassed and combined with a RBV approach. It counts only a limited number of articles (e.g., Di Gregorio, 2005; Pitelis and Teece, 2010). Today, this approach is more relevant than ever because entrepreneurial processes and attitudes could help to cope with knowledge problems and asymmetric information issues (Kirzner, 1973) that recent economic change introduces, particularly important while operating in non-price-mediated economies (Foss, 1994).

MNEs do not follow a unique evolutionary path. This idea was already implicit in the transnational solution of Bartlett and Ghoshal (1989) and in the reinterpretation made by Rugman and Verbeke (1992). For instance, institutional conditions in China are different to those in the Eastern European countries, which require contextual adaptation of universal theories. In these cases, the development of research based on institutional theory is of particular interest.

And yet key proponents of internalization theory explicitly reject the SCA-related issues, claiming that “[the advantage approach] failed to explain why firms did not license their advantage to local firms abroad” (Buckley and Casson, 2009, p. 1572). Nevertheless, as Madhok and Liu (2006) asserted and inasmuch we have tried to enlarge, the constantly changing dynamics of the MNEs environment(s) at both parent's and subsidiaries’ and even the MNEs dynamics call for additional approaches other than only internalization.

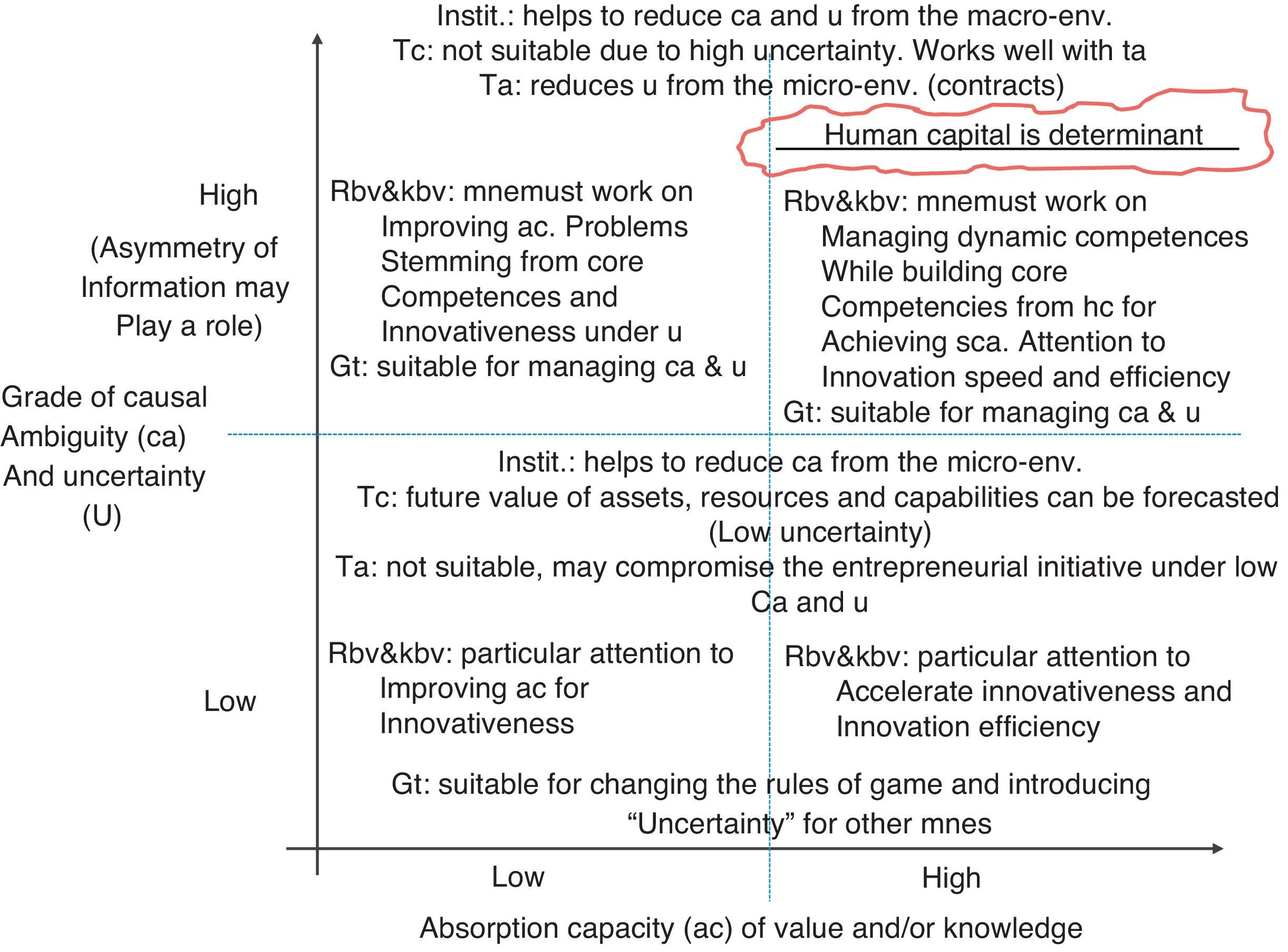

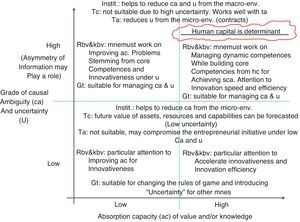

Based on Dunning's eclectic paradigm (1977), a co-evolutionary approach (Madhok and Phene, 2001; Madhok, 2002; Madhok and Liu, 2006) has recently been developed, as a dynamic theory mainly based on a KBV of MNEs. Under the conceptualization of strategy as a dynamic process of interaction between the firm and its environment (Ronda-Pupo and Guerras-Martin, 2012), evolving theory on MNEs’ strategy, other than location or foreign direct investment, cannot obviate the need for a broader scope. Fig. 3 shows how different approaches may help to deal with MNEs properly, in order to serve as guiding highlights for future research. We summarize the key contributions and risks of each approach, according to the emerging co-evolutionary approach.

Quadrants for an eclectic approach to future research on MNE's strategies.

The “value” and “resources” conceptualizations within the RBV and KBV approaches may constrain the evolving research on MNEs’ strategy. The challenge of the causal ambiguity may be faced with game theory, without losing the essence of the KBV: the question is how MNEs and their subsidiaries change the rules of the game, raising their added value while lowering the others’ added value in their competition. Game theory has been somewhat neglected in the MNEs’ strategy literature. This approach is consistent with internalization theory and with the co-evolutionary explanation, and may deserve more attention in future research.

An additional issue arises from the RBV concerning its application in unpredictable environments. Furthermore, the review can address and advance two key critiques of the RBV and KBV: the axiomatic view of knowledge as a non-rivalrous resource and the problems related to “value” of resources and capabilities (Kraaijenbrink et al., 2010). Knowledge is an intangible resource and its deployment by one firm does not prevent its redeployment by the same or another firm, and even its deployment may increase it (Winter and Szulanski, 2001).

The neoclassical economic logic of scarce resources management means that organizations must compete for resources and for customers (Kraaijenbrink et al., 2010). A wrong logic might lead us to assume that knowledge, as non-scarce resource, does not follow that axiom—and it does not—so that organizations cannot really compete for knowledge (McWilliams et al., 2002). Having an agreement on the fact that there is no scarcity of knowledge (Molloy et al., 2011), the key issue is that the possession of the resource (knowledge) is not what makes the difference rather than its use, following the Barney's logic (1991, 2000). Firms do use scarce resources to produce valuable knowledge. In addition, firms must have in place the capacity to absorb and apply them, which is totally aligned with Madhok and Liu's (2006) conceptualization of absorptive capacity as a factor shaping MNEs’ strategies.

Then, it follows that what is really scarce is the human capital, those who actually use that knowledge and those among the human resources whom are really able to create value (Sveiby, 1997) alongside their understanding and judgment. To put it differently, which managers are able to do with a non-rivalrous resource (knowledge). This is how MNEs can transform a non-rivalrous (knowledge) into a rivalrous element (human capital) for which they can and actually compete. This is a relevant nuance that the internalization theory has disregarded and it is quite relevant to explain how MNEs deploy their strategies when competing. That means that MNEs actually compete for the human capital that makes the difference. They are the key resources, they are who really transform the tacit knowledge into value and over which build up the MNEs’ structural capital. We must emphasize that this is related to knowledge other than susceptible of protection mechanisms (intellectual property rights), where the rules of composite rights enters: the rights to appropriate rents and profits are different from assets (Mises, 1945), and in such a case MNEs can compete for that type of knowledge-based elements.

The capacity of human capital is limited in terms of time and use, although as an intangible and knowledge-based element, it may be increased through learning when it is used. Furthermore, bounded rationality and information asymmetry are closely related to hiring the adequate human capital to reduce such barriers. Being a rivalrous element, human capital bridges the existing gap and allows a better understanding of how MNEs can transform and protect non-rivalrous resources and capabilities in their competition, under the umbrella of absorption capacity.

The latter calls for future research on how MNEs implement their strategies in the competition for this value absorption and human capital. Expatriates, as key human capital, are likely to play a determinant role, as Harvey and colleagues have emphasized over several studies (Harvey et al., 2001; Harvey and Novicevic, 2005; Harvey and Moeller, 2009). This is consistent with the approach from KBV, where human capital is the starting point, and is not directly related to performance if not through the structural capital linkage (Bontis, 1998; González-Loureiro and Pita-Castelo, 2012).

This approach focuses on key gatekeepers (the human capital) in the scheme of the co-evolutionary theory as introduced by Madhok and Liu (2006): they are determinants to regulate the most valuable knowledge. Managers are those who make and implement the MNE's strategy and, those who determine the central strategic action the MNEs must implement: how to internalize human capital as to transform it into structural capital.

Internalization theory is still a black box, when it comes to how the strategic decisions are made. Additionally, Kraaijenbrink et al. (2010) suggest a process-based approach to open the black-box, where resources and capabilities can be easier related to performance and SCA. Likewise, in the realm of MNEs strategy, there is a need to investigate exactly which resources and capabilities are inputs and which others are outputs from a process view. That would mean to investigate the different stages that a MNE goes through according to its management of causal ambiguity and absorptive capacity.

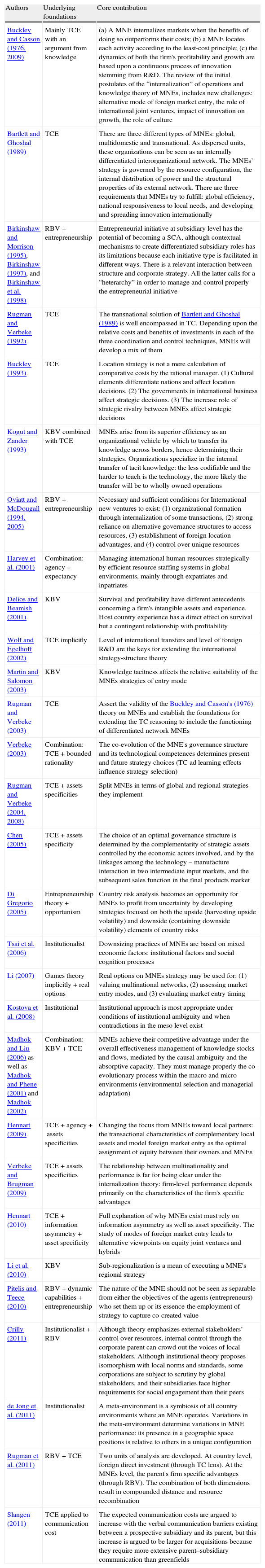

Emerging economies may also pull from an institutional and/or entrepreneurship approach in order to explain still underestimated issues, as for instance examples of MNEs from China and Southeast Asia landing at Western economies, which is challenging the Dunning's OLI paradigm. A sample of key articles approaching from those theoretical perspectives can be consulted in the appendix (Table 4).

MNEs are a complex phenomenon with increasing presence in the today's globalized competition. Therefore, evolving theory on MNEs’ strategy requires a more eclectic explanation. As shown in Fig. 3, the conclusions from this study are outlined to advance a step forward in the co-evolutionary theory from the evolving model initiated by Madhok and Liu (2006). According to them, if causal ambiguity is combined with the inherent environmental uncertainty under the RBV on one hand, and on the other hand with the capacity to absorb value and/or knowledge, a two-by-two matrix is formed. This might reflect the possible stages under which a MNE may fall when deploying its strategy, which requires further empirical investigation.

Conclusions and outlooks for future researchThe main objective of this paper was twofold. On one hand, it was important to present the theoretical foundations of the research on MNEs’ strategy. On the other hand, the review from the key schools of strategic management thinking helps the eclectic co-evolutionary theory of MNEs’ strategy to advance into a next stage of development. The evidence from our analysis shows the existence of one dominant research approach (TCE) and two complementary approaches, the RBV and KBV on MNEs’ strategy. To summarize, scholars are suggested to address the MNE strategy field from an appropriate combination of theoretical approaches, as aforementioned. Each of them would be useful for dealing with specific issues depending on the goal and the context of investigation. There is also room for enriching this field from approaches less frequently used, as for instance, whether the entrepreneurial orientation of MNEs’ managers may help to implement a successful strategy. Interactions between the overlapping streams of research and elements (e.g., absorptive capacity, the learning organization, creating social capital, the impact of “thinking globally while acting locally” in some economies, the “value” of a resource, value absorption, human capital-based advantages, etc.) will benefit the evolution of the field. And, arguably, it remains a major challenge since the current business cycle begun: the process of internalization. Should large multinationals increase their size by internalizing or decrease it by disinvestment may help scholars to open that black-box in terms of process, with the help of the aforementioned tools and approaches?

In a nutshell, more eclectic and integrative studies are required, for instance by using methods such as meta-analysis, in order to increase our knowledge of MNE's strategy along their life cycle. More predictive models useful either for MNEs’ managers and other competing organizational forms should be the object of future research. Transitions between these forms (e.g., from INVs to MNEs) would also benefit this research topic. All in all, the co-evolutionary theory implies a promising advance for a further understanding and explanation of how MNEs actually behave under the strategic competition umbrella.

Authors would like to acknowledge the comments from Prof. Mike Harvey, Distinguished Chair of Global Business at the University of Mississippi & Professor of International Management at Bond University.

We would also like to gratefully acknowledge the comments and helpful suggestions of two anonymous reviewers and guest-editors on an earlier version of this article.

See Table 4.

Key contributions to the theory on MNEs strategy research.

| Authors | Underlying foundations | Core contribution |

| Buckley and Casson (1976, 2009) | Mainly TCE with an argument from knowledge | (a) A MNE internalizes markets when the benefits of doing so outperforms their costs; (b) a MNE locates each activity according to the least-cost principle; (c) the dynamics of both the firm's profitability and growth are based upon a continuous process of innovation stemming from R&D. The review of the initial postulates of the “internalization” of operations and knowledge theory of MNEs, includes new challenges: alternative mode of foreign market entry, the role of international joint ventures, impact of innovation on growth, the role of culture |

| Bartlett and Ghoshal (1989) | TCE | There are three different types of MNEs: global, multidomestic and transnational. As dispersed units, these organizations can be seen as an internally differentiated interorganizational network. The MNEs’ strategy is governed by the resource configuration, the internal distribution of power and the structural properties of its external network. There are three requirements that MNEs try to fulfill: global efficiency, national responsiveness to local needs, and developing and spreading innovation internationally |

| Birkinshaw and Morrison (1995), Birkinshaw (1997), and Birkinshaw et al. (1998) | RBV+entrepreneurship | Entrepreneurial initiative at subsidiary level has the potential of becoming a SCA, although contextual mechanisms to create differentiated subsidiary roles has its limitations because each initiative type is facilitated in different ways. There is a relevant interaction between structure and corporate strategy. All the latter calls for a “heterarchy” in order to manage and control properly the entrepreneurial initiative |

| Rugman and Verbeke (1992) | TCE | The transnational solution of Bartlett and Ghoshal (1989) is well encompassed in TC. Depending upon the relative costs and benefits of investments in each of the three coordination and control techniques, MNEs will develop a mix of them |

| Buckley (1993) | TCE | Location strategy is not a mere calculation of comparative costs by the rational manager. (1) Cultural elements differentiate nations and affect location decisions. (2) The governments in international business affect strategic decisions. (3) The increase role of strategic rivalry between MNEs affect strategic decisions |

| Kogut and Zander (1993) | KBV combined with TCE | MNEs arise from its superior efficiency as an organizational vehicle by which to transfer its knowledge across borders, hence determining their strategies. Organizations specialize in the internal transfer of tacit knowledge: the less codifiable and the harder to teach is the technology, the more likely the transfer will be to wholly owned operations |

| Oviatt and McDougall (1994, 2005) | RBV+entrepreneurship | Necessary and sufficient conditions for International new ventures to exist: (1) organizational formation through internalization of some transactions, (2) strong reliance on alternative governance structures to access resources, (3) establishment of foreign location advantages, and (4) control over unique resources |

| Harvey et al. (2001) | Combination: agency+expectancy | Managing international human resources strategically by efficient resource staffing systems in global environments, mainly through expatriates and inpatriates |

| Delios and Beamish (2001) | KBV | Survival and profitability have different antecedents concerning a firm's intangible assets and experience. Host country experience has a direct effect on survival but a contingent relationship with profitability |

| Wolf and Egelhoff (2002) | TCE implicitly | Level of international transfers and level of foreign R&D are the keys for extending the international strategy-structure theory |

| Martin and Salomon (2003) | KBV | Knowledge tacitness affects the relative suitability of the MNEs strategies of entry mode |

| Rugman and Verbeke (2003) | TCE | Assert the validity of the Buckley and Casson's (1976) theory on MNEs and establish the foundations for extending the TC reasoning to include the functioning of differentiated network MNEs |

| Verbeke (2003) | Combination: TCE+bounded rationality | The co-evolution of the MNE's governance structure and its technological competences determines present and future strategy choices (TC ad learning effects influence strategy selection) |

| Rugman and Verbeke (2004, 2008) | TCE+assets specificities | Split MNEs in terms of global and regional strategies they implement |

| Chen (2005) | TCE+assets specificity | The choice of an optimal governance structure is determined by the complementarity of strategic assets controlled by the economic actors involved, and by the linkages among the technology – manufacture interaction in two intermediate input markets, and the subsequent sales function in the final products market |

| Di Gregorio (2005) | Entrepreneurship theory+opportunism | Country risk analysis becomes an opportunity for MNEs to profit from uncertainty by developing strategies focused on both the upside (harvesting upside volatility) and downside (containing downside volatility) elements of country risks |

| Tsai et al. (2006) | Institutionalist | Downsizing practices of MNEs are based on mixed economic factors: institutional factors and social cognition processes |

| Li (2007) | Games theory implicitly+real options | Real options on MNEs strategy may be used for: (1) valuing multinational networks, (2) assessing market entry modes, and (3) evaluating market entry timing |

| Kostova et al. (2008) | Institutional | Institutional approach is most appropriate under conditions of institutional ambiguity and when contradictions in the meso level exist |

| Madhok and Liu (2006) as well as Madhok and Phene (2001) and Madhok (2002) | Combination: KBV+TCE | MNEs achieve their competitive advantage under the overall effectiveness management of knowledge stocks and flows, mediated by the causal ambiguity and the absorptive capacity. They must manage properly the co-evolutionary process within the macro and micro environments (environmental selection and managerial adaptation) |