This paper analyses the effect of corporate governance on value creation. It relies upon a dataset that includes the companies listed on the Spanish Stock Exchange for the period from 2005 to 2012. Attention is focused on the structure and composition of boards. In particular, four variables are analyzed: BOARD_SIZE, BOARD_INDEPENDENCE, BOARD_DILIGENCE (measured by the number of meetings), and DUALITY (chairman and chief executive officer being the same person). Over the period of the deepest economic crisis (2009–2012) the most significant variables that had a positive effect on value creation were BOARD_INDEPENDENCE and BOARD_SIZE. Hence, the global financial crisis has highlighted the need for effective corporate governance. Policy makers should think about translating the recommendations of the Good Governance Codes into legislation (mandatory), to improve corporate governance.

Financial scandals (Enron, Parmalat, Tyco, WorldCom, and others) have led to an increasing interest in the relationship between corporate governance and firm performance when control mechanisms are challenged. In this context, the board is considered to be a mechanism for corporate governance, assigned the task of protecting and increasing assets and maximizing the return on corporate investments (Castro et al., 2010; Silva et al., 2011; Huang et al., 2012; Rossi et al., 2015). The board becomes the main internal control mechanism for companies, allowing agency problems arising from the separation of ownership, and management control problems that cause information asymmetries, to be overcome. In this way, the board serves as a link between shareholders and the management team, with supervision as its main task; it sometimes plays a disciplinary role, replacing executives when there is poor or negative performance. Therefore, the literature mainly analyses board size and board composition as characteristics that influence the supervisory capacity of the board. In line with this, the different codes set out a series of recommendations on the ideal structure and composition of boards.

For this reason, the drafting and implementation, through national laws and regulations, of corporate governance codes significantly increased at the beginning of the new millennium (He et al., 2009). Nowadays, more than sixty countries have drafted codes for good governance. Companies, as well as countries, seek to make their corporate governance practices more effective, in part because of corporate governance scandals, but also to attract investors (Aguilera and Cuervo-Cazurra, 2009). Worldwide, codes provide sets of recommendations that listed companies should take into account when issuing their annual reports on corporate governance. In particular, they include several key universal principles for effective corporate governance, to achieve a balance between executive and non-executive directors and a clear division of responsibilities between the chairman and the chief executive officer.

The aim of this paper is to analyze the effect of board composition and structure on firm performance under adverse economic conditions. It involves studying whether board size, CEO – chairman duality, board independence and the frequency of board meetings are relevant for a company. We propose as main hypothesis that there is a direct effect of board on firm value under adverse economic conditions. The idea is clear-cut: the board of directors is much less relevant when market conditions are favourable, and when market conditions are not, the board is crucial in explaining differences in value creation. To test this set of hypotheses, we have carried out an econometric study using panel data for listed companies on the Spanish Stock Exchange over the period 2005–2012.

Our results confirm the idea that board structure and composition are far more relevant in difficult and challenging times. Moreover, the number of independent board members and the board size are significant variables during a crisis period, having a positive effect on value creation. These results allow us to come to the conclusion that companies should worry about their board structure and composition when economic conditions are adverse. With regards to composition, the bigger the board size, the better the performance of the company during the crisis period. Regarding structure, companies should bear in mind that the greater the independence of the board, the greater the firm value; furthermore, in order for the board members’ presence to be sufficiently relevant for them to influence board decisions, it is not only the number of board members that is important, but also the relative weight of independent members.

From the institutional point of view, they have drawn different good governance codes that have not had the desired effect. It would be desirable that the recommendations included in these codes became laws which allow improving the corporate governance of companies.

While the link between corporate governance and firm performance has been widely studied in the financial literature (Brown and Caylor, 2006), the analysis of the effect of corporate governance on value creation in adverse economic contexts is much more limited (Gupta et al., 2013). In addition, we should bear in mind the fact that these studies have focused on financial entities (Erkens et al., 2012), while our paper sheds light on the behaviour of non-financial companies with regards to their responsiveness, through corporate governance, to value creation in times of economic crisis. Specifically, our work focuses on how the effect of corporate governance on performance differs according to the economic context for the company (performing a post-crisis versus a pre-crisis comparative analysis).

The paper is organized as follows. The next section presents the institutional background, to provide the characteristics of the Spanish context and describe the set of Spanish codes of corporate governance. The third section reviews the literature, to determine the relationship between the different variables and the process of value creation, and establishes several hypotheses. The fourth section describes the methodology, data and variables, empirical analysis and results. Finally, we draw conclusions and discuss implications.

Institutional backgroundOn top of the recent financial crises, we should add the economic crisis that has affected many countries in recent years, rocking countless economies. The so-called “Great Recession” has shocked the world economy as a whole, but in an asymmetrical way. Some countries are facing the worst economic scenario in decades. Among the biggest economies in the OECD, Spain provides the most interesting case for a study of the causes and consequences of this recession, including the influence of corporate governance on value creation in different economic scenarios. In the years running up to the crisis, Spain was characterized by strong credit growth, which was derived from the low interest rates that prevailed throughout the country following the Monetary Union and that led to a housing bubble. Real estate prices grew year after year as the result of a sharp increase in market demand, to the extent that by 2006 the building sector represented 16% of the country's GDP in real terms and up to 20% of all employment generated within the country. The building sector caused significant increases in GDP until 2008, when the first results of the crisis triggered by the financial scandals in the US the previous year appeared. Unemployment rose from 8% to 25%, and real GDP growth rates have been significantly negative since 2009. The crisis also led to an increase in credit risk, and in Spain the effect was observed in the restrictions imposed by financial entities on new loan authorizations. Despite having diminished in the years prior to the crisis, public debt once again grew in 2008 because of economic efforts to mitigate the effects of the recession. In the financial markets, the IBEX 351 lost 50% of its value between 2010 and mid-2012 (BME, 2007-2014).

In this context, corporate governance has gained great importance in recent years in society, with an increased interest in all types of companies and institutions (Agudo et al., 2008). Spain has drawn up four codes of good governance in the last decade (the Olivencia Report, 1998; the Aldama Report, 2003; the Unified Code, 2006, updated 2013; and more recently, the Good Governance Code, 2015).

The first report (hereafter the Olivencia Report, 1998) was the result of the work of the Special Commission for the study of an ethical code for boards, which was chaired by Manuel Olivencia and was established in 1998 with a dual purpose: on the one hand, to draft a report on board problems and, on the other hand, to develop an ethical code of good governance, keeping in mind the need for reform in corporate governance. After this first report, the Special Commission to foster transparency and security in the markets and in listed companies, chaired by Enrique Aldama, published a report in 2003 (hereafter, the Aldama Report, 2003) that was aimed primarily at improving transparency and security in financial markets, and was derived from the implementation analysis of the Olivencia Report. It should be noted that one of the main contributions of this report was the recommendation to consolidate the relevant information into a special document called “Annual report on corporate governance”, which would be a standard and structured instrument to give information on corporate governance. The structure of the report would provide a uniform presentation basis to enable investors to evaluate and monitor this area.

In 2006 the Unified Good Governance Code was published (hereafter the Unified Code, 2006), which was the result of work done by the Special Working Group on the good governance of listed companies, led by Manuel Conthe. This working group was focused on harmonizing and updating the earlier recommendations in the Olivencia and Aldama reports. Since the Unified Code was approved, a series of intervening legal texts have affected some of its recommendations. In order to adapt or eliminate the recommendations affected by the new legislation, the Comisión Nacional del Mercado de Valores (CNMV) approved a partial update of the Unified Code in June 2013.

In recent years, since the beginning of the international financial crisis, the number of initiatives related to good practice in corporate governance matters has increased, reflecting the widespread conviction that it is important that listed companies are managed properly and transparently in order to generate business value, improve economic efficiency and strengthen investor confidence.

Spain has been no exception to this overall trend, and the country has seen solid advances in good corporate governance. An Experts Commission was established in 2013 with the aim of proposing initiatives and policy reforms to ensure good corporate governance. The result of the Commission's work was the approval of the Good Governance Code for listed companies (hereafter the Good Governance Code, 2015) in February 2015.

Empirical results (Utrero-González and Callado-Muñoz, 2015) show, first, that investors react to governance announcements, and, second, that whether their reaction is positive or negative, and how significant it is, depends crucially on the nature and extent of the code recommendations.

In conclusion, the evolution of the recommendations in the codes has led to a transformation in the legislation, since the desired effect of improving firms’ corporate governance was not achieved through voluntary measures.

Literature review and development of hypothesesTheoretical backgroundThe literature on the relationship between corporate governance and value creation has expanded in recent years (Demsetz and Villalonga, 2001; Carter et al., 2003; Nicholson and Kiel, 2007; Lefort and Urzúa, 2008; De los Ríos et al., 2009; Campbell and Vera, 2010). Most of this research is based on the three theoretical paradigms analyzed by Nicholson and Kiel (2007): (i) agency theory, under which the board's role as supervisor, and the control it exerts, are established; (ii) stewardship theory, according to which the board of directors takes on an advisory role with respect to the management team; and, lastly, (iii) resource dependence theory, according to which the board acts as a link between the organization and its surroundings, and facilitates the capture of resources (Pucheta-Martínez, 2015). Many of the previous studies on the relationship that exists between the board and the creation of value in the company have been based solely on agency theory. However, including the board's advisory role in the analysis has led recent researchers to bear the stewardship perspective in mind and highlight its importance, especially in turbulent contexts (Pucheta-Martínez, 2015). In this sense we have adopted a mixed approach in this paper by considering stewardship theory (Barney, 1990; Donaldson, 1990) complemented by resource dependence theory (Pfeffer and Salancik, 1978). We believe that stewardship theory captures the effect of board composition on value creation in the context of an economic crisis. Resource dependence theory suggests four primary benefits of external linkages: (1) the provision of resources such as information and expertise; (2) the creation of channels of communication with constituents of importance to the firm; (3) the provision of commitments of support from important organizations or groups in the external environment; and (4) the creation of legitimacy for the firm in the external environment (Carter et al., 2010: 398). Neither the different theories nor the existing literature question the fundamental role of the board in guiding and carrying out the necessary controls. The corporate scandals in the early years of the last decade revealed that the non-executive board members in those firms did not report any significant oversights by managers. The recent economic events have indicated that the same was true in many financial institutions. It is perhaps for this reason that the literature on corporate governance and performance during the crisis focuses mainly on financial companies.

According to Bekiaris et al. (2013), one of the major causes of the financial crisis was the failure of corporate governance. Two basic principles of corporate governance (transparency and accountability) were violated by investment and commercial banks in the developed world, and this resulted in the crisis. In an attempt to mitigate these consequences, the codes of Good Governance were created at an international level, establishing recommendations to guide best practice but without making rules to ensure compliance with them. An example of this is the fact that in most of the codes there is a recommendation regarding the presence of independent members, while their influence may have on the board is not explained (Bekiaris et al., 2013). The codes do not say what powers the independent members should be allowed.

Several empirical studies have been carried out to examine the relationship between corporate governance and the financial crisis. These include that of Williams et al. (2015), which analyses 75 listed companies in Australia for two years, 2005 and 2010, considering these years as falling, respectively, before and after the global financial crisis. These authors observe that after the global financial crisis, companies restructured their boards, increasing the number of independent board members. Nevertheless, they highlight the need to explain the concept of “independence”; furthermore, they ask themselves whether this change has come about in order to improve accountability mechanisms or simply to give the appearance of good corporate governance, following the recommendations of the Australian Code of Good Governance (ASX, 2010).

Erkens et al. (2012) studied the impact of corporate governance on the performance of financial companies in a group of 30 countries in the period 2007–2008. In spite of the fact that all the companies were affected by the international financial crisis, the financial companies had the worst results, because of their greater risk-taking prior to the crisis. At the same time, in terms of board composition Erkens et al. (2012) observed that there was a greater impact on the performance of those companies with independent board members because those companies offloaded the wealth of the current shareholders to the debt holders by increasing their equity capital during the financial crisis. These authors therefore concluded that corporate governance had a considerable impact on company performance during the crisis, through financing policies and firms’ risk-taking.

On the other hand, Grove et al. (2011) concluded that the performance of banks is affected by the structure of corporate governance, following a study of 236 public commercial banks in the United States during the years 2005–2008, taking the period between 2005 and 2007 as the pre-crisis period and 2008 as being during the crisis. Thus, CEO duality has a negative relationship with financial performance during the pre-crisis period, and no impact during the crisis. Essen et al. (2013) analyze 1197 firms across 26 European countries between 2004 and mid-2009. They make a distinction between financial and non-financial companies, observing that the results do not coincide. Thus, during the crisis board size and CEO duality had a positive impact on non-financial companies, while these effects were absent among financial companies. On the other hand, they observe that board independence has a direct relationship with company performance in times of crisis, but not for non-financial companies.

According to Berrone (2009), the structure of corporate governance is a key factor for institutional investors when deciding in which company to invest. In addition, 75% of respondents in that study (29 institutional investors in the Spanish market) believe that the current governance mechanisms have had a high or very high responsibility in the current crisis, especially in the financial sector. In this sense, from the perspective of institutional investors, changes in corporate governance are also required. It is considered that although most of the companies listed on the Spanish stock market have introduced changes in recent years around codes, they have not had the desired effect, especially in terms of separation CEO-Chairman. In this paper, we have not specifically analyzed the corporate governance from the perspective of institutional investors, given that their level of influence on the structure of corporate governance is very small.

HypothesesBoard sizeA review of the literature on board size yields non-coincident results. Some authors (Lefort and Urzúa, 2008) do not find the BOARD_SIZE variable significant; others, like Hansson et al. (2011), find BOARD_SIZE is significantly negatively associated with firm performance. Other authors (Yermack, 1996) show an inverse relationship between firm value and BOARD_SIZE, explaining their results with agency theory, which suggests that smaller is better. Besides, Yermack (1996) presents evidence that small boards of directors are more effective and that firms with smaller boards achieve higher market value. According to Jensen (1993), “large corporate boards may be less efficient due to difficulties in solving the agency problem among the members of the board” Arosa et al. (2013: 129); they consider that a larger group is less effective because the coordination and process problems outweigh the advantages of having more people on whom to draw. In line with these results, Dowell et al. (2011) suggest (and confirm by empirical results) that small boards have greater capacity for making decisions quickly, which is needed in crisis situations.

Conversely, Nicholson and Kiel (2007) and Jackling and Johl (2009) find a positive and significant relationship. These authors base their results on resource dependence theory, which argues that a greater number of directors provides more information for appropriate decision-making. In line with the latter study, we expect a positive association between the BOARD_SIZE variable and Tobin's Q. This is due to the fact that board size, in a crisis context, seems, in fact, to contradict agency theory, since many studies (such as those by Hambrick and D’Aveni (1992) and Mueller and Barker (1997)) have found that smaller boards are worse, in the sense that they have a higher probability of failure. In a situation of financial stress in which the resource supply becomes essential to a company's survival, large boards offer opportunities for resource capture and networking (Dowell et al., 2011).

The empirical results of Pucheta-Martínez (2015) opened a new route. The number of board members improves performance, but only up to a certain point, after which value decreases as members are added to the board. Similar evidence was revealed by Hillman et al. (2011) and O’Connell and Cramer (2010), who argued that a balance should be sought between the advantages (supervision and advice) and the disadvantages (coordination problems, control, and decision-making) of a large board.

In short, large companies that are already established in the market, like those studied here, are more interested in the benefits of accessing the additional resources derived from their large board size than in the additional agency costs or slower decision-making associated with a certain board size (Dowell et al., 2011). Beyond a certain point, the difficult dynamics of a large board prevail over the skills and expertise that additional directors might bring (Azim, 2012). This leads us to put forward a first hypothesis:H1 Under adverse economic conditions, BOARD_SIZE has a positive effect on value creation

In the Spanish case, the Good Governance Code (2015) declares that CEO–chairman duality has both advantages and disadvantages. The main advantages lie in the reduction in information and coordination costs as well as clear leadership. On the other hand, the main disadvantage is the concentration of power in a sole person. Nevertheless, although it puts forward these arguments, the Code does not lay down any recommendations about separating the two roles, but rather maintains the same lines as the Codes that were published earlier (Unified Code, 2006, updated 2013).

Agency theory (Berle and Means, 1932) considers that CEO–chairman duality increases CEO power but negatively affects CEO independence, hindering the company's ability to establish supervisory mechanisms. From the agency theory perspective, duality has a negative effect on performance. The agency theory argues for a separation of the two positions, and states that the CEO–chairman cannot perform both functions without there being a conflict of interest. Duality generates a powerful CEO who may be driven by self-interest, dominating the board management, and this may result in poor performance (Gabrielsson et al., 2007; Ghosh et al., 2010; Valenti et al., 2011).

The importance of the monitoring role of the board of directors lies in the fact that when directors are evaluating manager performance, they are representing the shareholders (Fama and Jensen, 1983; He et al., 2009). In order to carry out this role properly, the board must be independent, both through the board structure and through the separation of the roles of chairman and CEO.

From the perspective of stewardship theory (Davis et al., 1997), however, the relationship is the opposite, offering a more humanistic approach. Greater power in the hands of the CEO may lead to benefits that are greater than the costs in times of crisis: the CEO's response capacity will be faster when faced with changes, he or she will have greater incentive to lead the company out of the crisis, and thanks to his or her increased power he or she will be able to take extreme but necessary decisions (asset restructuring, mass redundancies, and so on) in unstable times, such as the financial crisis that began in 2007 (Dowell et al., 2011). Stewardship theory offers support to the idea that CEO duality contributes to timely decision-making, effective execution of plans and efficient monitoring, leading the firm to better performance (Huang et al., 2012; Arosa et al., 2013; García-Ramos and García-Olalla, 2014).

The fact that these studies offer mixed results coincides with the description given by Finkelstein and D’Aveni (1994) of this issue as a “double-edged sword”. The authors make the point that the resource dependence advantages offered by the possibility of the CEO, in his or her role as chair, giving the outside directors relevant information regarding firm operation and finances, can appease the agency problems related to CEO duality (Valenti et al., 2011).

In line with the above, other studies find a positive relationship between CEO duality and performance in low munificence and high-complexity environments (Chen, 2014; Chang et al., 2015). Dowell et al. (2011) validated this hypothesis, as duality allows decisions to be taken more quickly as a result of the CEO having more power.

From the approach of the institutional investors, it is considered to maintain the separation between CEO and Chairman encouraging the independence of the board (Berrone, 2009).

Others authors put forward the idea that the degree to which the firm's and/or the CEO's characteristics are suited to CEO duality may be decisive in the way duality affects the firm's performance (Kang and Zardkoohi, 2005; Faleye, 2007).

Duality could be a way of providing firms with the advantages that derive from a unity of command at top management levels, such as a clearer strategic orientation, greater autonomy and better response capacity (Cabrera-Suárez and Martín-Santana, 2015). Essen et al. (2013) put forward the result that CEO duality is positive and significant for the performance of non-financial firms during a crisis. That is, they confirmed that in times of crisis, those boards that allow greater managerial discretion get better results. This reasoning leads us to the following hypothesis:H2 Under adverse economic conditions, CEO–CHAIRMAN DUALITY has a positive effect on value creation

All the written codes of good governance throughout the world recommend greater independence for boards (Zattoni and Cuomo, 2008). Independent board members are understood to be “those that are able to carry out their roles, having been appointed in accordance to their personal and professional conditions, without being influenced by relationships with the company, its significant shareholders or directors” (Unified Code, 2006: 52).

Regarding the number of independent board members, the Spanish Good Governance Code (2015) recommends that they should make up at least half the total number of members, except in cases in which the company does not have a high capitalization rate or when one of the shareholders or several of the shareholders jointly in concert control more than 30% of the capital, in which case a third of the total number of members is recommended. This code differs from the Unified Code published in 2006 and updated in 2013, where the only recommendation was that the independent members should represent at least a third of the total board. Board participation helps strengthen board independence in those countries in which minority shareholders have little protection, since it counters the power of majority groups (Pindado and De la Torre, 2006).

The implication of agency theory, in terms of corporate governance, is that outside directors should defend shareholders’ interests through appropriate monitoring mechanisms that protect the shareholders from the self-interest of the management. In this way, having a large number of outside directors on the board could have a positive impact on performance through service monitoring (Fama and Jensen, 1983; Arosa et al., 2013).

Agency theory is not the only theoretical perspective that has been relied on to explain board roles and board composition. The service role can be related to the resource based view and resource dependence theory, where boards are considered to control inter-organizational dependencies and act as a strategic resource for securing critical resources for the firm (Pfeffer and Salancik, 1978). According to resource dependence theory, outsiders are seen as a linking mechanism between the firm and its environment that may support the managers in the achievement of the various goals of the organization (Johnson et al., 1996; Arosa et al., 2013).

One of the positive effects of bringing outside directors onto the board is that they can help monitor and control senior managers, making sure that their actions take investors’ interests into consideration (Osma, 2008).

Among the reasons why outside directors are considered to be more effective than inside directors when monitoring managers is the fact that they often have experience in decision-making in other companies, as well as a tendency to consider their reputation in the managerial work market (Fama and Jensen, 1983; Ghosh et al., 2010). Independent directors are also expected to show greater objectivity and to have more expertise than affiliated directors. For these reasons, there is a belief that those boards with more outside directors are more independent.

Nevertheless, in spite of what the different theories suggest, the empirical studies carried out present differing results. The level of board independence, measured in terms of the percentage of external members, can create or destroy value in a company. Mínguez and Martin (2003) cite empirical studies that obtained varying results. There are studies that found no significant relationship (Hermalin and Weisbach, 1991; Mínguez and Martin, 2003), some that found a positive effect (Barnhart et al., 1994; Yermack, 1996), and others that found a significant but negative relationship (Agrawal and Knoeber, 1996).

Lefort and Urzúa (2008) found that an increase in the proportion of outside directors positively affects value creation. However, Carter et al. (2010) found that board independence is not significant. Hermalin and Weisbach (1988) indicate that there is a tendency in times of crisis to reduce the power of the CEO and to increase board independence. Chang et al. (2015) also observed a positive and significant relationship between board composition and firm performance for the period of the deepest crisis, 2008 to 2010. On the other hand, Francis et al. (2012) found that board independence could enhance board efficacy and thereby firm performance during a crisis period; they took the percentage of outsiders on the board as a measure of independence (thus looking at outside directors, whether they were truly independent or were financial experts).

From the view of the institutional investors, one of the future challenges in the field of Corporate Governance would be to ensure the independence of directors. This would allow improving the firm performance (Berrone, 2009).

In view of the above, we believe that independent directors can provide more resources to the firm and improve networking, positively affecting value creation. This leads us to the following hypothesis:H3 Under adverse economic conditions BOARD_INDEPENDENCE enhances value creation

The number of board meetings is an indicator of board diligence. Infrequent board meetings may indicate limited interest in the company, or even a lack of interest, on the part of the board. In the same way, a higher number of meetings would imply a greater supervision of the company's management, with a positive effect on its performance (Azim, 2012). In line with this, the Spanish Good Governance Code (2015) recommends that a board meets as many times as necessary in order to carry out its duties effectively, and also indicates that there should be at least eight meetings a year; this last recommendation differs from those of previous codes (Unified Code, 2006, updated 2013).

From the perspective of agency theory, a large part of each board meeting is taken up by routine tasks, which leaves little time and chance for independent directors to exercise meaningful control over management (Jackling and Johl, 2009). It could be beneficial for boards to keep activity to a minimum, as a high level of board activity is probably indicative of a response to poor performance (Jensen, 1993).

An opposing view from resource dependence theory considers that the intensity of board activity (measured by the frequency of board meetings) is an aspect that is linked with corporate governance and performance. Some authors hold that board meetings should be frequent enough to allow the board to get continuous status update reports on the company (Gabrielsson and Winlund, 2000; Arosa et al., 2013). The importance of a board may be inferred from the number of board meetings held, on the assumption that if more meetings are organized, more information is shared and more issues are dealt with. Meetings are the most usual occasion on which ideas are discussed and exchanged in order to monitor managers. It can therefore be supposed that an increase in the number of meetings would imply greater control over managers and therefore an increase in shareholder wealth. In this way, there is a positive association between a higher number of meetings and higher performance; without meetings, the board has fewer opportunities to monitor firm performance (Gabrielsson and Winlund, 2000). Following this line of argument, several authors have found a positive relationship between board activity and firm value. They believe that the higher the number of board meetings (especially if there is poor performance, a crisis, or a special investment programme such as a merger or acquisition), the greater the positive impact on firm value (Brick and Chidambaran, 2010; Ntim and Osei, 2011). Firms with a worse performance (low values of Tobin's Q) could increase the number of meetings they hold in order to improve results.

Al-Najjar (2012) believes that boards meet more frequently when companies have large boards and a higher proportion of independent directors, finding no significant relationship between the variables “duality” and “board diligence”.

With this caveat in mind, we test the following hypothesis:H4 Under adverse economic conditions, BOARD_DILIGENCE has a positive effect on value creation.

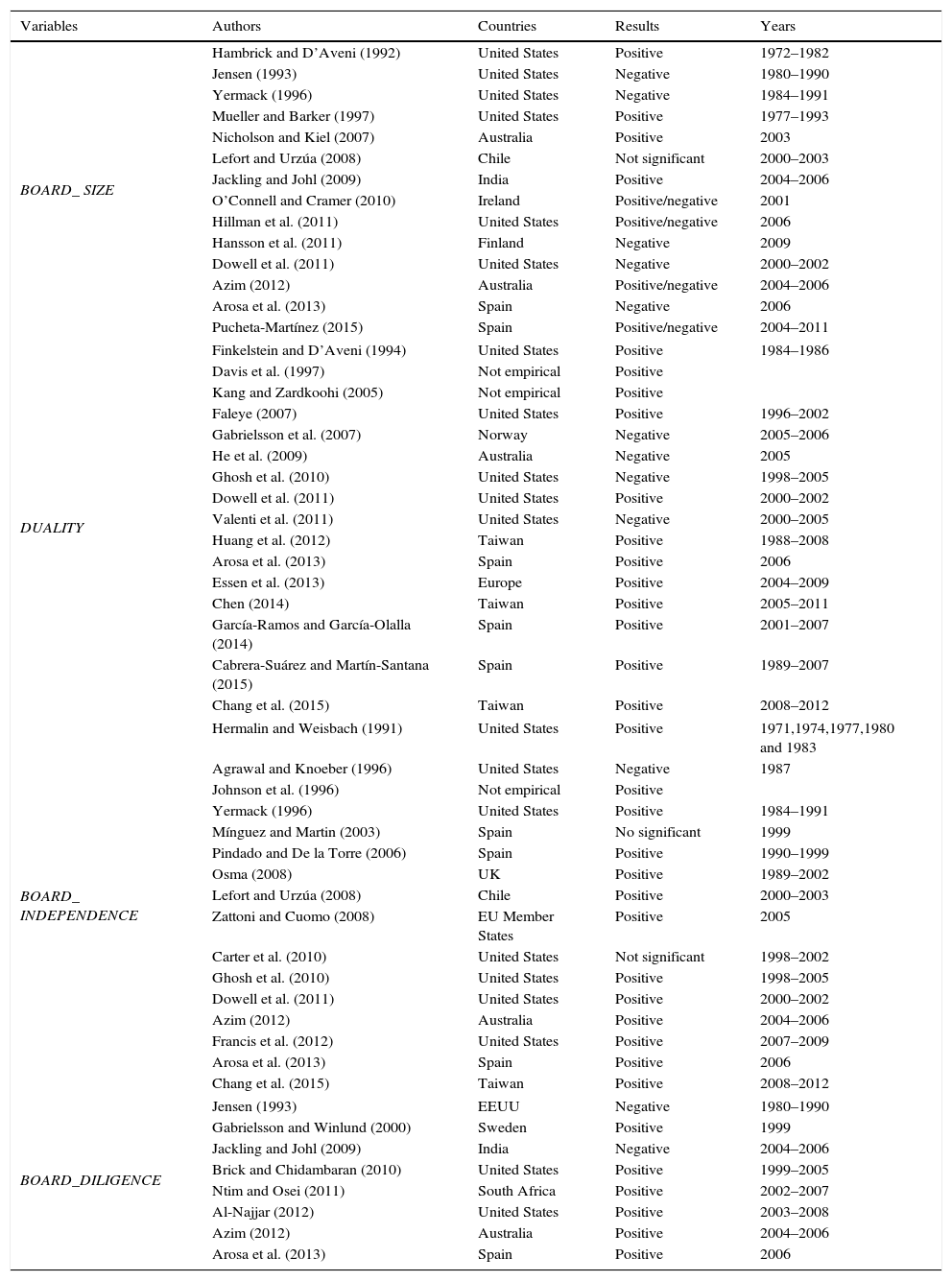

Table 1 reports results on those explicative variables in the articles reviewed.

The effects of explanatory variables in previous studies.

| Variables | Authors | Countries | Results | Years |

|---|---|---|---|---|

| BOARD_ SIZE | Hambrick and D’Aveni (1992) | United States | Positive | 1972–1982 |

| Jensen (1993) | United States | Negative | 1980–1990 | |

| Yermack (1996) | United States | Negative | 1984–1991 | |

| Mueller and Barker (1997) | United States | Positive | 1977–1993 | |

| Nicholson and Kiel (2007) | Australia | Positive | 2003 | |

| Lefort and Urzúa (2008) | Chile | Not significant | 2000–2003 | |

| Jackling and Johl (2009) | India | Positive | 2004–2006 | |

| O’Connell and Cramer (2010) | Ireland | Positive/negative | 2001 | |

| Hillman et al. (2011) | United States | Positive/negative | 2006 | |

| Hansson et al. (2011) | Finland | Negative | 2009 | |

| Dowell et al. (2011) | United States | Negative | 2000–2002 | |

| Azim (2012) | Australia | Positive/negative | 2004–2006 | |

| Arosa et al. (2013) | Spain | Negative | 2006 | |

| Pucheta-Martínez (2015) | Spain | Positive/negative | 2004–2011 | |

| DUALITY | Finkelstein and D’Aveni (1994) | United States | Positive | 1984–1986 |

| Davis et al. (1997) | Not empirical | Positive | ||

| Kang and Zardkoohi (2005) | Not empirical | Positive | ||

| Faleye (2007) | United States | Positive | 1996–2002 | |

| Gabrielsson et al. (2007) | Norway | Negative | 2005–2006 | |

| He et al. (2009) | Australia | Negative | 2005 | |

| Ghosh et al. (2010) | United States | Negative | 1998–2005 | |

| Dowell et al. (2011) | United States | Positive | 2000–2002 | |

| Valenti et al. (2011) | United States | Negative | 2000–2005 | |

| Huang et al. (2012) | Taiwan | Positive | 1988–2008 | |

| Arosa et al. (2013) | Spain | Positive | 2006 | |

| Essen et al. (2013) | Europe | Positive | 2004–2009 | |

| Chen (2014) | Taiwan | Positive | 2005–2011 | |

| García-Ramos and García-Olalla (2014) | Spain | Positive | 2001–2007 | |

| Cabrera-Suárez and Martín-Santana (2015) | Spain | Positive | 1989–2007 | |

| Chang et al. (2015) | Taiwan | Positive | 2008–2012 | |

| BOARD_ INDEPENDENCE | Hermalin and Weisbach (1991) | United States | Positive | 1971,1974,1977,1980 and 1983 |

| Agrawal and Knoeber (1996) | United States | Negative | 1987 | |

| Johnson et al. (1996) | Not empirical | Positive | ||

| Yermack (1996) | United States | Positive | 1984–1991 | |

| Mínguez and Martin (2003) | Spain | No significant | 1999 | |

| Pindado and De la Torre (2006) | Spain | Positive | 1990–1999 | |

| Osma (2008) | UK | Positive | 1989–2002 | |

| Lefort and Urzúa (2008) | Chile | Positive | 2000–2003 | |

| Zattoni and Cuomo (2008) | EU Member States | Positive | 2005 | |

| Carter et al. (2010) | United States | Not significant | 1998–2002 | |

| Ghosh et al. (2010) | United States | Positive | 1998–2005 | |

| Dowell et al. (2011) | United States | Positive | 2000–2002 | |

| Azim (2012) | Australia | Positive | 2004–2006 | |

| Francis et al. (2012) | United States | Positive | 2007–2009 | |

| Arosa et al. (2013) | Spain | Positive | 2006 | |

| Chang et al. (2015) | Taiwan | Positive | 2008–2012 | |

| BOARD_DILIGENCE | Jensen (1993) | EEUU | Negative | 1980–1990 |

| Gabrielsson and Winlund (2000) | Sweden | Positive | 1999 | |

| Jackling and Johl (2009) | India | Negative | 2004–2006 | |

| Brick and Chidambaran (2010) | United States | Positive | 1999–2005 | |

| Ntim and Osei (2011) | South Africa | Positive | 2002–2007 | |

| Al-Najjar (2012) | United States | Positive | 2003–2008 | |

| Azim (2012) | Australia | Positive | 2004–2006 | |

| Arosa et al. (2013) | Spain | Positive | 2006 | |

Source: The authors.

The point of departure for building the sample was to consider all the companies listed on the Spanish Stock Exchange for the period 2004–2012 for which information was available.2 Insurance companies and banks were excluded because of the difficulty in calculating Tobin's Q (their accounting reports are specific to the sector). In addition, both these sectors follow their own regulatory regimes laid down by the General Management of Insurance and the Bank of Spain, respectively. Firms that were not listed, or for which not all the information was available during the whole of the research period, were also excluded.

Consequently, the initial sample consisted of 68 companies with a total of 612 observations. A standard analysis of potential outliers affecting either Tobin's Q (hereafter q) or ROA (Return on Assets) was performed. Using the boxplot tool and the standard criteria,3 a total of 107 observations was excluded, 53 of these because of outliers affecting the variable q and 54 for outliers in the case of ROA. Moreover, the first observation is lost because the endogenous variable is included in the specification. Hence, the final sample includes data for 65 firms, and 438 valid observations for the period 2005–2012.

VariablesDependent variableIn order to approximate firm performance, we use q. This ratio has been widely used in the literature (Lang and Stulz, 1994; Demsetz and Villalonga, 2001; Mínguez and Martin, 2003; Lefort and Urzúa, 2008) and it is a good measure to evaluate the effect of board composition and structure on value creation since it is a forward-looking measure that integrates investors’ expectations (Demsetz and Villalonga, 2001; Jiao, 2010).

We define q as the sum of the market value of the stock and the book value of the debt divided by the book value of the total assets (following Campbell and Vera (2010), Jiao (2010) and Shan and McIver (2011)).

It seems logical in our case to adopt this position of the investor for value creation analysis. Shan and McIver (2011: 310) also indicate that “markets favour specific characteristics in boards, particularly independence and professional qualifications as a means to improve corporate performance, and that this will be reflected in the level of companies’ Tobin's Q measures”. Several studies, such as De los Ríos et al. (2009), rely upon Economic Value Added (hereinafter EVA) as an alternative measure. However, a number of relevant caveats and potential problems have been found, related to the fact that this measure is static and is based on accounting (Fernández, 2003).

Independent variablesIn order to analyze the effect of board composition on performance, four independent variables are included in the econometric specification: BOARD_SIZE, DUALITY, BOARD_INDEPENDENCE and BOARD_DILIGENCE. The first variable is measured through the total number of the members of the board. DUALITY is a dichotomous variable; either the same person holds the position of CEO and is the chairman of the board (Duality=1), or the two positions are held by two different people (Duality=0). BOARD_INDEPENDENCE measures the board's level of independence as the percentage of independent advisors out of the total number of board members. Finally, BOARD_DILIGENCE is gauged through the number of board meetings held per year.4

Control variablesWe also included two control variables: SIZE and ROA. SIZE is a control variable that measures the size of the company through the Napierian logarithm of the total assets. According to Mínguez and Martin (2003), Yatim et al. (2006) and Jiao (2010), ROA (Return on Assets) measures the economic profitability ratio. In preliminary estimates, the ratio of total debt to total assets was also included but multicollinearity was troublesome. The effect of other potential time-invariant control variables (like the firm's sector of activity or the fact of a company having a family character) are captured by individual fixed effects.

The results obtained by Carter et al. (2010) for the SIZE variable are not significant. However, most of the previous studies (Campbell and Vera, 2010; Mínguez-Vera and López-Martínez, 2010; Vivel et al., 2015) obtained a negative and significant correlation with q. We expect the same relationship because, like these authors, we consider that smaller firms have a higher firm value. Finally, we expect the firms that have a greater ROA also to have a higher firm value, as shown in the results obtained by Campbell and Vera (2010) and Vivel et al. (2015).

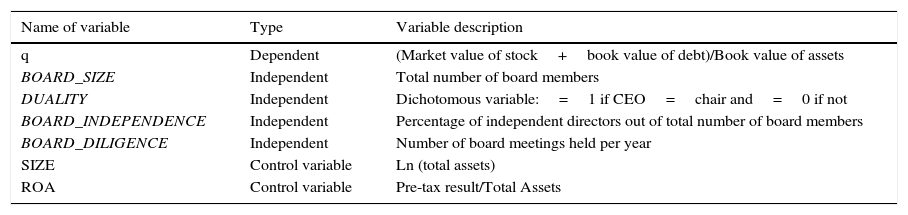

Table 2 includes a description of the dependent, independent and control variables, as well as the way in which they are calculated.

Summary of descriptions of variables.

| Name of variable | Type | Variable description |

|---|---|---|

| q | Dependent | (Market value of stock+book value of debt)/Book value of assets |

| BOARD_SIZE | Independent | Total number of board members |

| DUALITY | Independent | Dichotomous variable:=1 if CEO=chair and=0 if not |

| BOARD_INDEPENDENCE | Independent | Percentage of independent directors out of total number of board members |

| BOARD_DILIGENCE | Independent | Number of board meetings held per year |

| SIZE | Control variable | Ln (total assets) |

| ROA | Control variable | Pre-tax result/Total Assets |

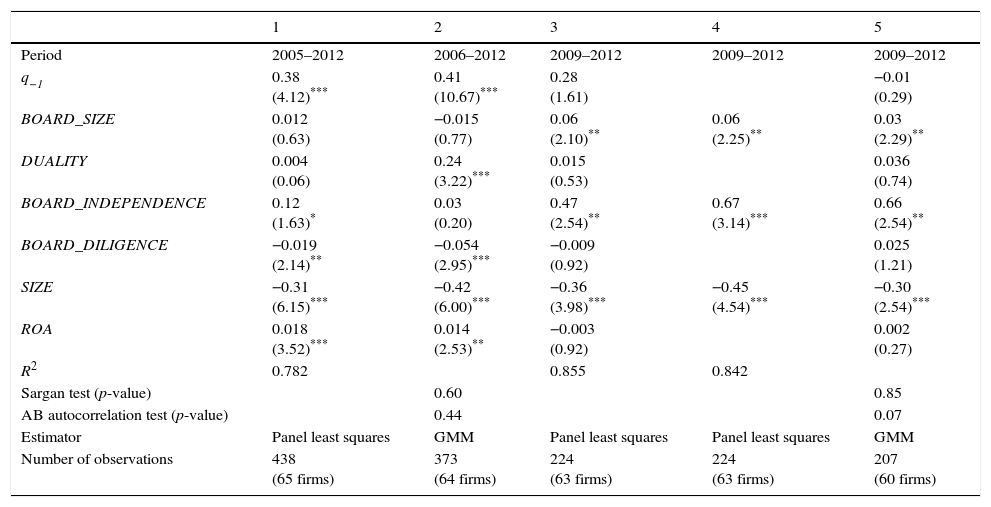

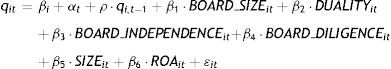

In order to define the econometric specification to be estimated, a number of preliminary estimates and tests were performed. Wald tests on both redundant time-fixed effects and redundant individual-fixed effects confirmed their relevance. Second, the addition of the lagged endogenous effect as a right-hand variable is required in order to deal with dynamics.5 Once both the lagged endogenous and time-fixed effects are included, the Breusch–Godfrey test for first-order autocorrelation clearly rules out this problem. However, including both individual effects and the lagged endogenous effect means that the Panel Least Squares (PLS) estimates become biased (Nickell, 1981). Insofar as the bias is of order 1/T and T is 8 in our case, it cannot be dismissed. Hence the Arellano-Bond 2-step difference GMM estimator is computed, using one lagged value. The p-values for both the Arellano-Bond second-order serial correlation test and the Sargan-Hansen test for over-identifying restrictions are reported in Table 5. The results of both tests support the validity of the GMM specifications. Moreover, the GMM estimator is a better option for dealing with the potential endogeneity of ROA and BOARD_DILIGENCE. Finally, PLS standard errors are replaced by White cross-section errors that are robust to both contemporaneous correlation and cross-section heteroscedasticity.6 All the computations were performed using Eviews 9. The general econometric specification is as follows:

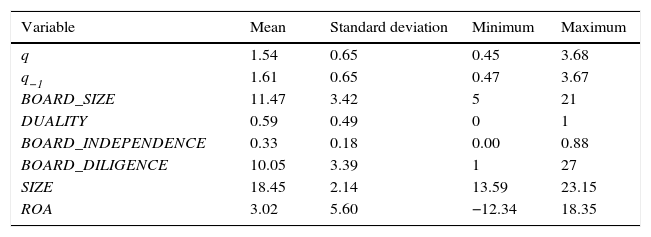

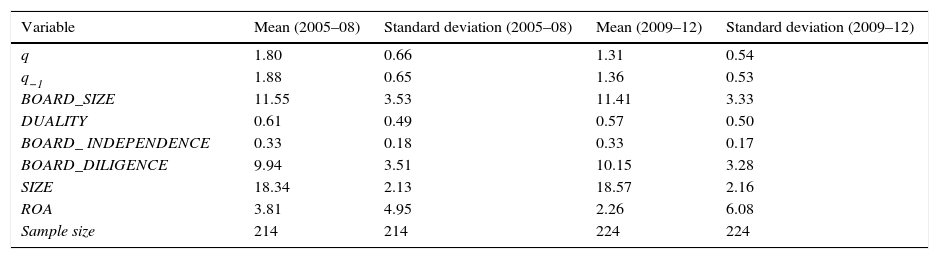

The main descriptive statistics for all the variables are reported in Table 3. Variance Inflation Factors (VIF) were also computed. Insofar as their values were very low (below 1.3 in all cases), multicollinearity problems were discarded (O’Brien, 2007). In Table 4 the values for the average and standard deviations of all variables in both periods are provided. The most relevant differences are in q and ROA. As expected, in both cases, they tend to be higher in the period 2005–2008.

Descriptive statistics.

| Variable | Mean | Standard deviation | Minimum | Maximum |

|---|---|---|---|---|

| q | 1.54 | 0.65 | 0.45 | 3.68 |

| q−1 | 1.61 | 0.65 | 0.47 | 3.67 |

| BOARD_SIZE | 11.47 | 3.42 | 5 | 21 |

| DUALITY | 0.59 | 0.49 | 0 | 1 |

| BOARD_INDEPENDENCE | 0.33 | 0.18 | 0.00 | 0.88 |

| BOARD_DILIGENCE | 10.05 | 3.39 | 1 | 27 |

| SIZE | 18.45 | 2.14 | 13.59 | 23.15 |

| ROA | 3.02 | 5.60 | −12.34 | 18.35 |

Notes: Statistics computed on the common unbalanced sample (438 observations).

Descriptive statistics (subsamples).

| Variable | Mean (2005–08) | Standard deviation (2005–08) | Mean (2009–12) | Standard deviation (2009–12) |

|---|---|---|---|---|

| q | 1.80 | 0.66 | 1.31 | 0.54 |

| q−1 | 1.88 | 0.65 | 1.36 | 0.53 |

| BOARD_SIZE | 11.55 | 3.53 | 11.41 | 3.33 |

| DUALITY | 0.61 | 0.49 | 0.57 | 0.50 |

| BOARD_ INDEPENDENCE | 0.33 | 0.18 | 0.33 | 0.17 |

| BOARD_DILIGENCE | 9.94 | 3.51 | 10.15 | 3.28 |

| SIZE | 18.34 | 2.13 | 18.57 | 2.16 |

| ROA | 3.81 | 4.95 | 2.26 | 6.08 |

| Sample size | 214 | 214 | 224 | 224 |

Notes: Statistics computed on the common unbalanced sample

The econometric results are synthesized in Table 5. In columns 1 and 2 the sample includes all available observations. Column 1 reports the results for the PLS estimation and column 2 those for the GMM estimation. The drop in the number of observations is due to the use of differences in the second case. In columns 3–5, the sample is reduced to results for 2009–2012 in order to focus on the recession years, giving us the chance to check the determinants of firm performance under extremely negative conditions. Goodness of fit is high, with R2 around 0.8.

Econometric estimates of Eq. (1).

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Period | 2005–2012 | 2006–2012 | 2009–2012 | 2009–2012 | 2009–2012 |

| q−1 | 0.38 (4.12)*** | 0.41 (10.67)*** | 0.28 (1.61) | −0.01 (0.29) | |

| BOARD_SIZE | 0.012 (0.63) | −0.015 (0.77) | 0.06 (2.10)** | 0.06 (2.25)** | 0.03 (2.29)** |

| DUALITY | 0.004 (0.06) | 0.24 (3.22)*** | 0.015 (0.53) | 0.036 (0.74) | |

| BOARD_INDEPENDENCE | 0.12 (1.63)* | 0.03 (0.20) | 0.47 (2.54)** | 0.67 (3.14)*** | 0.66 (2.54)** |

| BOARD_DILIGENCE | −0.019 (2.14)** | −0.054 (2.95)*** | −0.009 (0.92) | 0.025 (1.21) | |

| SIZE | −0.31 (6.15)*** | −0.42 (6.00)*** | −0.36 (3.98)*** | −0.45 (4.54)*** | −0.30 (2.54)*** |

| ROA | 0.018 (3.52)*** | 0.014 (2.53)** | −0.003 (0.92) | 0.002 (0.27) | |

| R2 | 0.782 | 0.855 | 0.842 | ||

| Sargan test (p-value) | 0.60 | 0.85 | |||

| AB autocorrelation test (p-value) | 0.44 | 0.07 | |||

| Estimator | Panel least squares | GMM | Panel least squares | Panel least squares | GMM |

| Number of observations | 438 (65 firms) | 373 (64 firms) | 224 (63 firms) | 224 (63 firms) | 207 (60 firms) |

Notes: Estimates include both individual-fixed and time-fixed effects. Corresponding t-statistics or z-statistics are in parentheses.

In columns [1], [3] and [4] t-statistics are computed using White cross-section errors.

Instruments in columns 2 and 5 include first-differences of the lagged endogenous, time-dummies and first-differences of exogenous variables, excluding ROA and BOARD_DILIGENCE. The reduction in the sample size is due to the use of first-differences.

In columns 1 and 2, the control variables are highly significant. Smaller firms and those with higher ROA show higher q values. On the contrary, BOARD_SIZE is not significant, and BOARD_INDEPENDENCE is significant only at a 10% level and in the case of the PLS estimate. In contrast, BOARD_DILIGENCE is significant at a 5% level and the coefficient on DUALITY is positive and highly significant in column 2. The sign on BOARD_DILIGENCE is contrary to what was expected: the higher the number of meetings, the lower the q, which would confirm the existence of the inverse relationship suggested above, and lead us to reject the fourth hypothesis. Concerning the variable DUALITY, column 2 reflects a positive coefficient for the total sampling period including pre-crisis and crisis periods. However, in the period of deepest crisis (2009–2012) the positive effect of this duality also fades (column 5); these results do not support the Hypothesis 2.

First, the lagged endogenous, ROA and DUALITY become non-significant variables at the usual levels. The economic interpretation of these results is that value creation is more volatile, the relationship between ROA and q is distorted in recession years, and DUALITY is not relevant in stressful times for firms. From an econometric standpoint, this means that the GMM estimator in column 5 is not required,7 and the PLS estimate is not subject to biases because of the inclusion of the lagged endogenous effect as a right-hand variable or the simultaneity of some regressors. Second, both BOARD_INDEPENDENCE and BOARD_SIZE become statistically significant at the 5% level. Column 4 replicates column 3 excluding the non-significant variables at the 10% level or less in column 3. The Breusch–Godfrey test of autocorrelation rejected autocorrelation at 10% significance or less in both columns 3 and 4. The estimated coefficients in column 4 of Table 5 and the ranks of both variables in Table 3 can be combined to get an idea of the impact of both variables on q. Ceteris paribus, the positive contemporaneous effect of BOARD_INDEPENDENCE on q would range from 0 to +0.59, and the effect of BOARD_SIZE from +0.30 to +1.26. Finally, BOARD_DILIGENCE becomes non-significant (column 5). These results do not support Hypothesis 4 in the worst economic situation. However, for the total sample period the coefficient is negative and significant, reflecting a negative effect of a higher number of meetings on value creation. A possible explanation is that, in times of crisis, the number of meetings adjusts to the real needs of business, having neither positive nor negative effect on value creation.

ConclusionsBased on the analysis carried out in this paper, the empirical evidence supports the idea that the structure and composition of the board has an effect on company performance under adverse economic conditions. Moreover, this effect varies from that arising in stable situations. In times of stress, most of the companies in the study increased the number of members on their boards, an increase that is linked to greater independence. This had a positive effect on the companies’ value creation. A similar result is obtained when the analysis of independence is carried out through measuring the number of directors representing large shareholder ownership, rather than through the number of independent board members. Bigger boards have higher possibilities of creating “links” with their environment than smaller boards (Castro et al., 2010). From our point of view, when economic environmental conditions are highly turbulent, as happened during the period of the study, the possibility of creating more “links” or relations with a company's environment aids the business in attaining good results.

The same person holding the positions of both CEO and chairman does not seem to affect the value generation process when attention is focused on the most stressful scenarios. It seems that the potentially negative effects of this duality are compensated for by the CEO being endowed with greater power, thus allowing him or her to take drastic decisions to deal with the crisis situation. A similar situation arises with regards to the diligence of the board; if the number of meetings per year is adequate (there are neither too many, which would hinder management, nor too few, which would mean that the board hardly exerted any influence on the functioning of the company), this has neither a positive nor a negative effect on value generation for the companies studied here.

Furthermore, our results lead us to believe that current governance structures are not as efficient as they could be. It seems that restructuring companies would lead to greater generation of value. In recent years, many countries have drawn up codes of good governance for listed companies in an attempt to improve the way their governing bodies function (Zattoni and Cuomo, 2008), with most of them proposing that the number of independent directors be increased. Restructuring boards to achieve greater professionalism and independence would lead to greater value creation. We also believe that many financial scandals could have been avoided if the boards had included a greater number of independent members.

In recent years, there has been a flood of initiatives concerning good practice in corporate governance matters. Moreover, these initiatives have multiplied since the start of the global financial crisis, reflecting the widespread conviction that if listed companies are run in a proper and transparent manner this is a key driver of value generation in the corporate sector, improved economic efficiency and the strengthening of investor trust (Good Governance Code, 2015). Therefore, according to Lei and Song (2012), companies that want to increase their value through corporate governance should reorganize their boards by giving them more independence. In line with this, empirical work concludes that, in difficult times, the level of independence has had a positive effect on the creation of value.

According to Perry and Shivdasani (2005), the conclusions of this study are relevant for business management. The observed results indicate that companies that are restructuring their boards should be recommended to move towards greater independence. This change in board composition would have a positive effect on value creation, since greater independence would enable the ratification of more difficult decisions such as asset restructuring or redundancies, which would improve performance. Well-connected independent directors have a greater capacity for networking and fundraising, which leads to increased value creation for the company (Ghosh et al., 2010; Arosa et al., 2013).

The results obtained lead us to think that the current governance structures of listed companies are not the most efficient, and therefore that restructuring these companies will allow for the generation of more value. There have been several attempts to improve the governing bodies of Spanish listed companies, with the publication of several reports and codes of good governance (Olivencia Report, 1998; Aldama Report, 2003; Unified Code, 2006, updated 2013; Good Governance Code, 2015). All of them recommend greater board independence.

In the light of the above, public institutions should be aware that, in order to achieve the desired effect through the drafting of good governance codes, the recommendations would have to become enforceable legal regulations.

We are aware that this article has some limitations. The first is that the work is focused on the analysis of listed companies in Spain alone. Future research should extend this study to other countries for the purpose of comparison. A comparative analysis between two blocks could also be considered: one made up of the nations most affected by the crisis (Greece, Portugal, Italy, and Spain), and the other of countries such as France, Germany and the United Kingdom. In addition, the article only analyzes the composition and structure of the board. Future studies should examine the effect of ownership concentration on performance.

This paper analyses the effect of corporate governance on value creation for listed companies for the period 2006–2012. The empirical work shows that the greater the number of independent directors, the greater the value created. Additionally, it seems that not only is it important to increase the number of independent directors, but also that it is vital that this number should reach a minimum percentage to influence the board.

The authors gratefully acknowledge the helpful comments and suggestions received from the referees and the Associate Editor, Alejandro Escribá. Besides, we would like to thank the financial support by the Family Business Chair (University of Vigo)and research assistance by Alejandro Domínguez.

“The IBEX 35® is the index made up by the 35 most liquid securities traded on the Spanish Market, used as a domestic and international benchmark and as the underlying index in the trading of derivatives. Technically it is a price index that is weighted by capitalization and adjusted according to the free float of each company comprised in the index” (www.bde.es).

Companies necessarily have to be listed because of the value creation measures used in this work.

In particular, observations excluded were those outside the interval (−0.43, 3.73) for Tobin's Q and out of the range (−12.42, 18.62) for ROA. These intervals were computed using the formula: lower limit=Q1–1.5(Q3−Q1) and upper limit=Q3+1.5(Q3−Q1).