We examine the relation between the gender diversity on boards of corporations and the levels of information asymmetry in the stock market. Prior evidence suggests that the presence of women on director boards increases the quantity and quality of public disclosure by firms, and we therefore expect firms with higher gender diversity on their boards to show lower levels of information asymmetry in the market. Using a Spanish sample, proxies for information asymmetry estimated from high-frequency data along with system GMM panel methodology, we find that the gender diversity on boards is negatively associated with the level of information asymmetry in the stock market. Our findings support the changes in the laws that have been introduced in several countries to increase the proportion of female company directors by providing evidence that gender diverse boards have beneficial effects on stock markets.

In this paper we analyse whether gender diversity on the board of directors is related to the level of information asymmetry of listed firms in the equity market. Therefore, this paper links two crucial topics of corporate governance and market microstructure in the financial literature of recent decades. On the one hand, information asymmetry is a key point for financial markets and a cornerstone of modern finance. Informational asymmetries play a crucial role in company financing and investment decisions (Myers and Majluf, 1984), thereby affecting stock liquidity (Kyle, 1985), which in turn have an effect on asset pricing (Amihud and Mendelson, 1986) and the cost of capital (Easley and O’Hara, 2004). On the other hand, in recent years, gender diversity on corporate boards has become an important issue which has attracted the attention of policy makers, shareholders, and academics (Dezso and Ross, 2012). As a result, a great number of studies have analysed the impact of female presence on corporate boards on different aspects of management such as decision-making (e.g. Nielsen and Huse, 2010), risk-taking (e.g. Faccio et al., 2016), managing (e.g. Loden, 1985), general firm performance (e.g. Harel et al., 2003), value of the firm (e.g. Carter et al., 2003), transparency and disclosure (e.g. Adams and Ferreira, 2009). Nevertheless, little direct evidence exists on the relationships between gender diverse boards and information asymmetry across market participants.

The previous literature finds that gender diverse boards increase the quantity and quality of public disclosure by firms. Adams and Ferreira's (2009) findings suggest that women are more likely to join committees that have monitoring functions, such as audit, and corporate governance committees, which are directly involved in increasing transparency. Similarly, female participation on boards promotes more effective board communication to investors (Joy, 2008) and increases the diffusion and the quality of value-relevant firm-specific information (Nalikka, 2009; Srinidhi et al., 2011). In addition, empirical evidence has shown a negative relation between disclosure quality and information asymmetry (e.g. Brown and Hillegeist, 2007; Heflin et al., 2005). Therefore, if gender diversity leads to an improvement in the information disclosure of companies and greater transparency and disclosure reduces information risk for market participants, we would expect a negative link between the gender diversity on boards and the average level of information asymmetry in the market.

We examine the impact of board gender diversity on information asymmetry using a data panel of 531 firm-year observations of companies listed on the Spanish Stock Exchange in the period 2004–2009. To estimate the perception in the financial markets of the adverse selection that exists between informed and uninformed traders, we compute various market microstructure proxies for information asymmetry using high frequency data: the relative spread, intraday price impact, and the probability of informed trading (PIN). We use the system generalized method of moment (System GMM) and dynamic panel technique to control the endogenity and heterogeneity effects. By controlling for corporate governance, company characteristics and the firm's information environment, we find a negative relationship between gender diversity and the degree of information asymmetry in the market.

This paper contributes to the prior literature in several ways. First, it extends previous literature on the economic and market effects of board gender diversity by providing new empirical evidence on the association between female presence on corporate boards and the level of information asymmetry in the market. We could not identify any paper in the previous literature that specifically analyses this association. Only Gul et al. (2011, 2013) investigate the effects of the presence of women on director boards on the firm's information environment (by using as proxies the idiosyncratic volatility and analyst earnings forecasts, respectively). Although they do not explicitly analyse the association between gender diversity on boards and the information asymmetry among traders, they provide findings that may be considered contradictory regarding this relationship as seen in the next section. Consequently, we consider that it is still an open empirical question.

Second, we are also the first to examine the relationship between gender diverse boards and information asymmetry in the market by using microstructure proxies for adverse selection risk and conducting an association study. Previous papers have analysed the relationship between the quality of corporate governance and the information environment of firms in the stock market around different corporate events (e.g. Cai et al., 2006; Kanagaretnam et al., 2007). Unlike these studies, we examine how gender diversity on boards is related to the average level of information asymmetry over a year, which avoids the weaknesses of the short-run event study methodology (i.e. difficulty in clearly determining the correct event date and measuring the unanticipated component of an announcement).

Finally, this paper provides evidence from Spain, one of the pioneer countries in developing laws to encourage the presence of women on boards of directors. Following the example of Norwegian legislation, which required that 40% of board seats be taken by female directors by the end of 2008, the Spanish Gender Equality Act (Ley de Igualdad) encouraged companies to increase the share of female directors to 40% by 2015. Companies that achieved this target were to be given priority in the allocation of government contracts but there would be no formal sanctions. In a similar way, other European countries (e.g. France, Italy, the Netherlands, Belgium) have required listed companies to reach minimum quotas for female representation on boards of directors. These legislative advances, to prevent discrimination (Mateos de Cabo et al., 2011) and to promote diversity in management positions, may have a positive influence on the management of the firm. In this way CNMV (Comisión Nacional del Mercado de Valores) describes the inclusion of women on the board of directors as “an efficiency objective”, representing “economically rational conduct”, and not only social justice and ethics. Therefore, gender diversity on boards has become a key policy focus in many countries as well as having generated an intense debate on its effects on corporate governance and company performance in academic and professional literature.

In this context, it is important to consider the characteristics of corporate governance. In Spain, the separation between owners and managers is much less clear than in the US or UK. Directors are, in many cases, direct representatives of the controlling shareholders of the company, and may even act as senior managers (La Porta et al., 1999). Thus, this governance context presents a principal–principal conflict, where the dominant shareholders, although having both the incentive and power to monitor, may also connive with senior managers (Young et al., 2008). This situation may give rise to a lack of independence and supervisory effectiveness of the board. Board gender diversity may be a useful mechanism for compensating the lack of effective governance in Spanish listed companies. Our findings support those changes in the legal framework that have been introduced with the intention of increasing the proportion of women on boards of companies in several countries, including Spain, as well as other legislative steps for gender equality. Consequently, since our paper provides evidence of benefits of gender diversity on boards for equity market participants, it may be of interest to investors, managers, regulators and standard setters.

The paper is organized as follows. The second section revises the related literature and develops the testable hypothesis. The third section describes the research design, with the measures, model, and sample employed. The fourth section presents the empirical results and the final section concludes.

Related literature and hypothesis developmentWhile board diversity may generally be defined as the variety inherent in a board's composition (Milliken and Martins, 1996), gender diversity may be considered as being among the issues that has generated more debate with regard to its influence on boardroom dynamics and on company performance. In addition to the manager's operating and investment decisions, the composition of a corporate board influences the quantity and quality of the information disclosed by the firm, which may affect the information asymmetry faced by investors. Although the majority of previous literature on gender diversity on corporate boards is mainly descriptive, with no explicit theoretical models (Terjesen et al., 2009), the effect of gender diversity on the manager's reporting decisions and a firm's information environment can be justified by several theoretical approaches from various academic fields.1 We will focus on the agency theory, as well as on theoretical arguments provided by economic sociology and psychology.2

The agency theory suggests that corporate governance mechanisms facilitate the reduction of asymmetric information between insider and outsider investors, as well as among market participants (Chung et al., 2010). From this perspective, the board of directors is the principal mechanism of internal control for promoting and protecting the interests of shareholders (Jensen and Meckling, 1976). Diversity can provide the directors board with members who bring to it diverse experiences, skills and abilities, which is likely to positively affect the effectiveness of its critical function of management control and supervision (Hillman and Dalziel, 2003; Bear et al., 2010), favouring the reduction of agency conflicts (Adams and Ferreira, 2009; Terjesen et al., 2009). In this regard, female directors provide greater insight and closer monitoring, are more active on corporate boards, as well as being more inclined to ask questions that would not be asked by male directors. Consequently, the presence of women on corporate board enhances its independence and improves its efficiency (e.g. Carter et al., 2003; Adams and Ferreira, 2009; Tejersen et al., 2016). In turn, to fulfil their fiduciary duties to their shareholders, independent boards take actions to promote corporate transparency and to curb managers from adopting opportunistic/self-serving behaviours, such as earnings management, thereby improving the quality of financial reporting (e.g. Fama and Jensen, 1983; Ajinkya et al., 2005; Armstrong et al., 2010). Therefore, if female directors improve management control and enhance the independence of corporate boards, the presence of women on boards may improve the transparency and disclosure quality of the firm.

The improvement in the firm's public disclosure induced by the presence of women on boards may not come only from better monitoring. According to theories from economic sociology and psychology, given the well-known differences in behavioural characteristics between males and females, the presence of women could affect the nature and dynamics of board deliberations (Gul et al., 2011), which may have positive effects on the information environment of the firm. For instance, in comparison to male members, women directors tend to have better interpersonal skills, show greater trustworthiness, their communication style is more participative and process-oriented, which may improve decision-making processes by creating an atmosphere of greater communication of information and by encouraging the board to consider different perspectives and to incorporate more varied opinions into a discussion (e.g. Jelinek and Adler, 1988; Eagly and Johnson, 1990; Daily and Dalton, 2003; MacLeod Heminway, 2007). Besides, women are more likely to contribute with fresher perspectives for solving complicated issues, which may reduce informational biases in strategy formulation (Francoeur et al., 2008). Additionally, the presence of female on boards also may favour the establishment of a good communication and the formation of better links between the firm and different groups of external stakeholders (Hillman et al., 2007). Therefore, gender diversity might imply better informed and more extensive discussions within the board, greater information exchange both within the board and between board members and other stakeholders. This may result in a richer information environment, in which the benefits of producing private information are lower, and, therefore, in a reduction of information asymmetry (Gul et al., 2011; Pucheta-Martínez et al., 2016).

Similarly, it is also well established that women exhibit less overconfidence (Lundeberg et al., 1994), apply higher ethical standards in their decision making (e.g. Ambrose and Schminke, 1999; Pan and Sparks, 2012), are more conservative and more risk-adverse than men (e.g. Byrnes et al., 1999; Powell and Ansic, 1997). All these characteristics lead women directors to require more and better financial reporting, greater audit effort, and moreover, in order to reduce litigation risk and potential reputation loss, they are less likely to manipulate reported earnings and other disclosures (e.g. Gul et al., 2011; Srinidhi et al., 2011).3 Thus, the firm's commitment to gender diversity may be also perceived as a signal of the quality of firms’ governance practices and corporate disclosure (Brammer et al., 2009), and women are more likely to be involved in enhancing financial reporting quality in order to maintain the firm's reputation. Therefore, the greater conservatism, risk aversion, and higher sensitivity to ethical issues on the part of female directors or managers could lead to a reduced likelihood of engagement in earnings management for opportunistic motives and thereby higher quality financial reporting, reducing information asymmetry among investors in the market (Gul et al., 2011).

Nevertheless, there are also arguments to support that greater gender diversity may have negative effects on the management of the firm and, consequently, may not improve its information environment. Some research indicates that greater gender diversity among board members generates more opinions and critical questions or could lead to the formation of barriers within the group as well as potential discrimination (Alexander et al., 1995; Blau, 1977), increasing the likelihood of conflict (Richard et al., 2004), and reducing cohesion, satisfaction and commitment (Jackson et al., 2003; Pfeffer, 1983). Consequently, gender diversity on boards may result in lower effective monitoring or management (Lau and Murnighan, 1998; Carter et al., 2003). In addition, some research provides evidence of female directors being more likely to be considered as tokens on boards (Zelechowski and Bilimoria, 2004), with a significant number of female directors designated with the aim of matching the demographic characteristics of the employees or meeting social or legal expectations (Farrell and Hersch, 2005). A direct consequence of this tokenism is that women directors merely play a simple institutional role with an irrelevant influence on boards (Zelechowski and Bilimoria, 2004). Therefore, accepting this perspective, female presence on boards would not guarantee more efficient monitoring and, consequently, a gender diverse board may not significantly affect a firm's financial information quality and transparency.

Prior empirical research mostly shows that the quality of corporate governance and female presence on the board have a positive influence on the information environment of the firm. Thus, a relatively large number of empirical studies provide evidence that greater board independence and better corporate governance increase corporate transparency, the quality of information released by management, and the analysts’ forecasts accuracy (e.g. Eng and Mak, 2003; Ajinkya et al., 2005; Karamanou and Vafeas, 2005; Beekes and Brown, 2006; Byard et al., 2006). Similarly, empirical evidence shows that gender diversity enhances both the independence and efficiency of boards of directors (e.g. Adams and Ferreira, 2009; Tejersen et al., 2016).

Focusing on the strand of literature that addresses the relationship between board gender diversity and the quantity and quality of corporate disclosure, empirical studies find that female participation on boards is associated with more effective communication to investors (Joy, 2008) and that firms with female Chief Financial Officers are associated with higher voluntary disclosures in annual reports (Nalikka, 2009). Regarding the financial reporting quality, Krishnan and Parsons (2008) find that gender diversity in senior management is positively related to earnings quality, and Srinidhi et al. (2011) show that firms with female directors, especially in the audit committee, exhibit better reporting discipline and higher earnings quality. In the same line, a stream of empirical papers (e.g. Gulzar and Wang, 2011; Qi and Tian, 2012) provide evidence consistent with the argument that gender diverse boards increase financial reporting quality because they are negatively associated with earnings management. In a Spanish sample, Pucheta-Martínez et al. (2016) show that a higher presence of female directors and independent female directors on audit committees, combined with a woman being the chairperson of these committees, enhances financial reporting quality. In contrast to the majority of empirical evidence, only a reduced number of studies do not find any significant association between the female presence in executive positions or on company committees and earnings quality (Sun et al., 2011; Ye et al., 2010).

The theory of information economics posits that higher and better information disclosure from the firm reduces information asymmetries arising either between the firm and its shareholders or among traders in the stock market. Higher disclosure quality should reduce information asymmetry by reducing incentives to search for private information and/or by lowering the amount of private information relative to publicly available information (Diamond and Verrecchia, 1991; Easley and O’Hara, 2004). Information asymmetries generate costs by introducing adverse selection into transactions between buyers and sellers. Therefore, lower levels of information asymmetry benefit investors because they lead to more precise valuations, reducing the risk of adverse selection for the less informed investors and, thus, increasing market liquidity (e.g. Glosten and Milgrom, 1985). Extensive empirical research on the association between the quality of public disclosure and information asymmetry supports these theoretical predictions (e.g. Brown and Hillegeist, 2007; Heflin et al., 2005).

Hence, as argued above, prior research finds that (i) the quality of corporate governance may have an influence on the quantity and quality of information disclosed, and (ii) a higher level of firm disclosure may itself reduce information asymmetry between participants in stock markets (Kanagaretnam et al., 2007: 501). Based on these findings, it would be expected that firms with better corporate governance were associated with lower information asymmetry. The extensive stream of empirical studies that examine this link reports consistent results with this hypothesis. For instance, Chen et al. (2007) find that poor corporate governance leads to higher levels of information asymmetry and to stock liquidity deteriorations. Cormier et al. (2010) provide evidence that some characteristics of monitoring processes (such as the number of directors on the board, or the number of people on the audit committee) can reduce information asymmetry. In their study on corporate governance characteristics affecting the market reaction to firm-specific news, Cai et al. (2006) provide strong support for the proportion of founding family directors on the board being positively related to the level of information asymmetry in the market. Kanagaretnam et al. (2007), when they examine the effect of board independence, board structure and board activity on market liquidity (bid-ask spread and depth), conclude that good corporate governance diminishes the information asymmetry around quarterly earnings announcements. Finally, Goh et al. (2016) also conclude that greater board independence leads to lower information asymmetry among investors.

There are very few empirical studies that have analysed the specific association between gender diverse boards and the firm information environment and, in our opinion, those that have, do not provided conclusive evidence. Gul et al. (2011), from a sample of US listed companies, find that gender diversity exhibits a significant positive association with idiosyncratic volatility. These authors claim this finding suggests that gender diversity increases the private information collected by traders. We think that this result could be interpreted as an increase in adverse selection risk in the market. However, the findings in Gul et al. (2013) are consistent with the notion that gender-diverse boards are associated with higher corporate disclosure and a better firm information environment, because they show that firms with female directors are related with higher (lower) accuracy (dispersion of range) of analyst earnings forecasts. By implementing an event study, Cai et al. (2006) analyse how multiple corporate governance characteristics affect the market reaction to company-specific news. With regard to the effects of board gender diversity, their results are not conclusive and depend on the information asymmetry measure used. Whilst the results are not significant for PIN measurement, adverse selection cost regressions provide support for the presence of female directors reducing information asymmetry in the market around news announcements. Finally, Upadhyay and Zeng (2014) find gender and ethnic diversity on boards is negatively associated with corporate opacity.

To summarize, the majority of prior research finds that the presence of female directors on boards improves monitoring processes and corporate governance, provides a signal of better governance practices and has a positive impact on both the quantity and quality of corporate information disclosure. Furthermore, information economics literature reports that higher and better information disclosure from the firm reduces information asymmetries between traders in the stock market. Consequently, our hypothesis is stated as follows: Gender diversity on boards is negatively related to the average level of information asymmetry in the equity market.

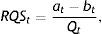

Research design and sampleProxies for information asymmetryAs the degree of information asymmetry is not directly observable, market microstructure literature has proposed different measures and models to capture the perception in the financial markets of the adverse selection that exists between informed and uninformed traders. The first and effortless proxy for asymmetric information is the bid-ask spread, a widely used measure of trading costs (liquidity). Bid-ask spread incorporates a component related to liquidity providers’ protection of being adverse selected. Glosten and Milgrom (1985) show theoretically that merely the presence of traders with different levels of information is enough to explain the existence of the bid-ask spread. The relative quoted spread (RQS) is defined as follows:

where at and bt correspond to the ask and the bid quotes in t, respectively. Qt=(at+bt)/2 is the quoted midpoint in t, commonly used as a proxy for the efficient price.Since the bid-ask spread is a noisy proxy for asymmetric information, due to the fact that it commonly includes other components that are not related with information (inventory costs, order processing cost); we also use more direct measures of information asymmetry. Huang and Stoll (1996) introduce the realized spread and the price impact by considering the quote adjustment that takes place some time after a trade to extract the presence of new information. Price impact (PI) is our second approach to asymmetric information defined as follows:

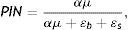

where Qt is the quote midpoint defined previously, Xt is a trade indicator variable taking the value −1 if the trade in t is initiated in the sell side and 1 if it is initiated in the buy side. Finally, τ is the period of time for prices to fully reflect the information content in trade t. In practice and following Huang and Stoll (1996) we used 30min.Finally, we also compute the probability of informed trading (PIN), a measure based on the notion that order imbalances between buys and sells signal the presence of adverse selection risk. The PIN is the unconditional probability that a randomly selected trade originates from an informed trader. The original PIN model was introduced by Easley et al. (1996). This measure is not directly observable but a function of the theoretical parameters of a microstructure model that have to be estimated by numerical maximization of a likelihood function. The only inputs necessary to estimate the model are the number of buy- and sell-initiated trades for each stock and each trading day. Once the parameters of interest are estimated, PIN is calculated as:

where α is the probability of an information event occurs between trading days, μ is the arrival rate of orders from the informed traders, and ¿b and ¿s are the arrival rates of buy and sell orders from uniformed traders, respectively. Thus, the PIN is the ratio of orders from informed traders to the total number of orders. For reasons of space, the description of the model and the estimation process of this well-known methodology are presented in Appendix.Measures of gender diversitySeveral measures of gender diversity have been employed. First, the percentage of women on the board of directors, PWOMEN, is calculated as the number of women board members divided by the total number of directors. This has been traditionally used to quantify the presence of women on boards of directors. However, it is not always a true measure of diversity, as the board of directors composed only of women – the maximum value of the variable – will be signalling a completely homogeneous board. Thus, we calculate two additional measures to indicate whether the boards are diverse in terms of gender or not (Martín Ugedo and Minguez Vera, 2014). These two measures are composite measures that combine two measures of diversity (Stirling, 1998): a measure of ‘variety’, which is defined to measure whether boards include representatives of both genders, and a measure of ‘balance’, which is defined to measure how equally men and women are represented on the board. The first measure of this type is the Blau diversity index, BLAU, calculated as:

where Pi refers to the percentage of female board members. The values fluctuate between 0 and 0.5, at which there is the same percentage of male and female board members and thus the diversity is maximized (Blau, 1977). The other measure is the Shannon diversity index, SHANNON, computed as:where Pi is calculated on the same basis as the Blau index. In this proxy, the values range from 0 to 0.69, the latter figure corresponding to the greatest possible degree of diversity (Shannon, 1948). The Shannon index produces results that are similar to those of the Blau index, but they are always larger than the latter. The Shannon index is more sensitive to small changes in the gender diversity of boards because it is a logarithmic measure. Diversity indexes reach their maximum value when the number of women on the board of directors is the same as the number of men. However, the presence of women on the board of directors is usually low and it is difficult to find boards with a majority of women. For this reason, diversity indexes are not alternative measures of diversity but complementary measures. We include them to add robustness to our results.Control variablesSeveral studies have found that corporate governance mechanisms reduce the asymmetric information and this effectiveness can depend on their characteristics. For example, Cai et al. (2006) argue that the number of directors can influence disclosure activities. Kanagaretnam et al. (2007) find that board independence reduces asymmetric information during an equity offering and around quarterly earnings announcements. Furthermore, insider ownership is an important characteristic for the effectiveness of a board, but its influence is not clear a priori. Hence, Morck et al. (1988) suggest that at low levels of insider ownership, there is more encouragement to carry out effective monitoring (convergence hypothesis). However, once they gain controlling authority in the firm, directors can entrench themselves (entrenchment hypothesis). The existence of this nonlinear relationship has been confirmed in several studies (e.g. Anderson and Reeb, 2003). The empirical evidence on the link between institutional equity ownership and information asymmetry has been mixed (Jennings et al., 2002; Jiang and Kim, 2005). On the one hand, institutional shareholders can improve corporate governance by exerting greater control, which leads to a reduction in the degree of information asymmetry (Bhojraj and Sengupta, 2003; Healy and Palepu, 2001). On the other hand, Pound (1988) states that institutional investors whose investments are diversified, may have few incentives to exercise monitoring. He also argues that managers or directors might either form an alliance with the institutional investors or exert some kind of implicit influence over them, so that insider interests could still take priority over the shareholders’ interest. Accordingly, there is some evidence of certain institutional trade based on private information which may increase information asymmetry among investors (Brown et al., 2004). Finally, Kang et al. (2006) examine the importance of the form of executive compensation in mitigating asymmetric information. They find that compensation packages that reward managerial performance reduce asymmetric information, because executives are encouraged to reveal the level of effort they expend in order to qualify for performance payments.

Following these arguments, we include several control variables relating to the corporate governance mechanisms. The board size, NDIR, measured by natural logarithm of the number of directors on the board. The board independence, PEX, is calculated as the percentage of external directors. Director ownership, DIROWN, is the natural log of the percentage of shares owned by directors. To capture the non-linear relationship between director ownership and the presence of asymmetric information (convergence and entrenchment hypotheses) we also include the square of DIROWN, DIROWN2. We also consider the institutional ownership, INS, defined as the natural log of percentage of shares owned by the institutional shareholders. Finally, to control for compensation packages, we include the percentage of variable pay to total pay received by the board members, PVPAY.

Similarly, SIZE, TURNOVER, and VOLAT have been also included as control variables because microstructure literature shows that large, frequently traded and less volatile firms are more liquid and suffer lower adverse selection problems (e.g. Easley et al., 1996). SIZE is the firm size measured as the natural logarithm of the market value of equity at the end of the year. TURNOVER is the natural logarithm of trading volume (measured as the average daily volume in Euros) scaled by the market value of a firm's equity to facilitate cross-sectional comparison. VOLAT is a proxy for stock return volatility calculated as the standard deviation of daily returns. Finally, since disclosure literature also predicts that the information environment of a firm is affected by the activities of producing and disseminating information performed by the number of following financial analysts, we control by the natural log of the number following a firm, NANA. The great majority of empirical studies on this topic report that analyst coverage is negatively related to information asymmetry (e.g. Easley et al., 1998; Roulstone, 2003). This inverse relation supports the argument that more analysts following increases publicly available information on the firm, which results in a reduction in the risk of information-based trading and an improvement in stock liquidity.

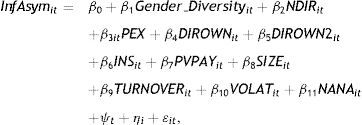

Model specification and estimation procedureTo examine the association between gender diversity on boards and different proxies for information asymmetry, we use the following regression model:

where InfAsym is one of the different proxies analysed for information asymmetry (RQS, PI and PIN) and Gender_Diversity corresponds to the different proxies for gender diversity on boards (PWOMEN, BLAU, and SHANNON). According to our hypothesis, we expect β1<0. The rest of the independent variables of the model are defined in the prior subsection. ψt, ηi, and εit represent the temporal effects, individual effects and the random disturbance, respectively.Regarding the estimation procedure, a System Generalized Method Moments (GMM) technique is applied (Blundell and Bond, 1998). This methodology makes it possible to control for individual heterogeneity as well as controlling for macroeconomic effects. In addition, according to Martín Ugedo and Minguez Vera (2014: 145), System GMM estimation overcomes the endogeneity bias that can occur when the explanatory and explained variables are combined in reciprocal explanations. In order to remove any possible bias arising from simultaneous estimation, this methodology estimates a system of two simultaneous equations. The first equation uses variables in levels (first differences instruments) and the other uses variables in first differences (lagged with respect to instruments). This methodology has important advantages in comparison to others. For example, OLS (Ordinary Least Squares) methodology does not solve the heterogeneity bias (all the variables are included as exogenous). The estimation of fixed effects solves the problem of heterogeneity bias, but not the problem of endogeneity. 2SLS (Two Stage Least Squares) estimation solves the problem of endogeneity bias, but is not appropriate for using in samples where there is a low value of T (number of years) as is the case in this work (Arellano and Bond, 1991). The System GMM methodology has been commonly used to control endogeneity problems (e.g. Beck et al., 2000; López-Gutiérrez et al., 2015; Uotila et al., 2009) and seems to be superior to the other option to control the endogeneity using panel data: Diff GMM. Finally, according to Heid et al. (2012), System GMM is more adequate when data show high persistence as it is in our case.

Sample and dataOur sample is composed of companies whose stocks are traded on the electronic trading platform of the Spanish Stock Exchange, known as the SIBE. The SIBE is an order-driven market where liquidity is provided by a limit order book. Traders can submit three basic types of orders: limit orders, market orders, and market-to-limit orders. When the market is open in continuous session, a trade occurs whenever an incoming order hits the quotes on the other side of the order book. Non-executed orders remain in the order book using a price-time priority rule. Unexecuted orders can be altered or cancelled at any time.

Trade and quote data for this study come from SM data files provided by Sociedad de Bolsas, S.A. SM files comprise detailed time-stamped information about the first level of the limit order book for each stock listed on the SIBE. A new record is generated in the database whenever any trade, order submission and cancellation affect the first level of the book. The classification of trades as buyer or seller-initiated is straightforward given that any trade consumes liquidity at one of the two sides of the book. Governance reports of listed firms were obtained through the Comisión Nacional del Mercado de Valores (CNMV), the Spanish Securities and Exchange Commission. Institutional ownership and analysts’ data were collected from Thomson Reuters Eikon Datastream.

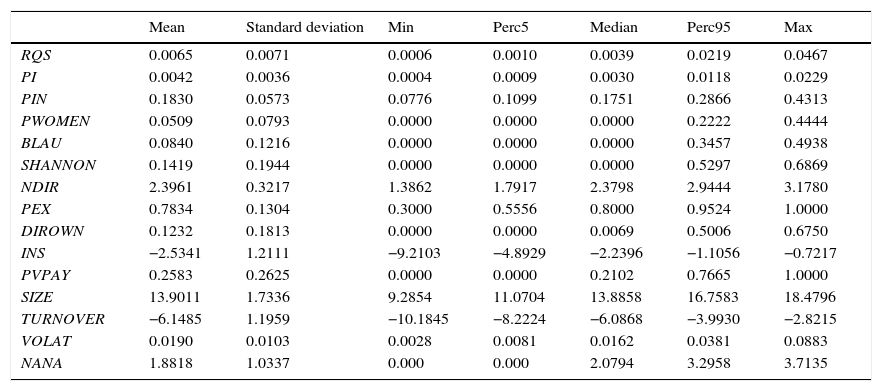

Our main sample contains 531 company-year observations of non-financial companies listed on the SIBE for the period 2004–2009. Table 1 presents summary distributional characteristics of selected variables. The mean (median) of relative bid-ask spread (RQS) is 0.65% (0.39%). The average (median) of price impact measure (PI) is 0.42% (0.30%). As expected, PI shows lower values than RQS since PI is a less noisy measure of information asymmetry than RQS. The mean (median) of PIN is 18.30% (17.51%). These PIN values are consistent with those reported in prior studies that use this information asymmetry proxy (Brown and Hillegeist, 2007; Cai et al., 2006). These figures show that there are clear differences in the degree of asymmetric information among Spanish non-financial firms.

Descriptive statistics.

| Mean | Standard deviation | Min | Perc5 | Median | Perc95 | Max | |

|---|---|---|---|---|---|---|---|

| RQS | 0.0065 | 0.0071 | 0.0006 | 0.0010 | 0.0039 | 0.0219 | 0.0467 |

| PI | 0.0042 | 0.0036 | 0.0004 | 0.0009 | 0.0030 | 0.0118 | 0.0229 |

| PIN | 0.1830 | 0.0573 | 0.0776 | 0.1099 | 0.1751 | 0.2866 | 0.4313 |

| PWOMEN | 0.0509 | 0.0793 | 0.0000 | 0.0000 | 0.0000 | 0.2222 | 0.4444 |

| BLAU | 0.0840 | 0.1216 | 0.0000 | 0.0000 | 0.0000 | 0.3457 | 0.4938 |

| SHANNON | 0.1419 | 0.1944 | 0.0000 | 0.0000 | 0.0000 | 0.5297 | 0.6869 |

| NDIR | 2.3961 | 0.3217 | 1.3862 | 1.7917 | 2.3798 | 2.9444 | 3.1780 |

| PEX | 0.7834 | 0.1304 | 0.3000 | 0.5556 | 0.8000 | 0.9524 | 1.0000 |

| DIROWN | 0.1232 | 0.1813 | 0.0000 | 0.0000 | 0.0069 | 0.5006 | 0.6750 |

| INS | −2.5341 | 1.2111 | −9.2103 | −4.8929 | −2.2396 | −1.1056 | −0.7217 |

| PVPAY | 0.2583 | 0.2625 | 0.0000 | 0.0000 | 0.2102 | 0.7665 | 1.0000 |

| SIZE | 13.9011 | 1.7336 | 9.2854 | 11.0704 | 13.8858 | 16.7583 | 18.4796 |

| TURNOVER | −6.1485 | 1.1959 | −10.1845 | −8.2224 | −6.0868 | −3.9930 | −2.8215 |

| VOLAT | 0.0190 | 0.0103 | 0.0028 | 0.0081 | 0.0162 | 0.0381 | 0.0883 |

| NANA | 1.8818 | 1.0337 | 0.000 | 0.000 | 2.0794 | 3.2958 | 3.7135 |

Note: RQS is the relative quoted spread (ask price minus bid price, divided by the quote midpoint). PI is the price impact measure proposed by Huang and Stoll (1996). PIN is the probability of informed trading based on the Easley et al. (1996) model. PWOMEN is the percentage of women on the board of directors. BLAU is the Blau diversity index. SHANNON is the Shannon diversity index. NDIR is the natural logarithm of the number of directors on the board. PEX is the percentage of external directors on the board. DIROWN is the natural log of the percentage of directors’ ownership. INS is the natural logarithm of the percentage of shares owned by institutional shareholders. PVPAY is the percentage of directors’ variable pay. SIZE is the market value of firm's shares at the end of the year (in millions of euros). TURNOVER is the natural logarithm of the average daily trading volume in euros scaled by the market value of the firm's shares. VOLAT is the standard deviation of daily returns. NANA is the natural logarithm of the number of analysts following a firm.

Regarding the degree of gender diversity measures, the percentage of women on boards is very low with an average of 5.1%. This value is far from the 40% called for by the Spanish Equality Act, although there are companies that exceed this recommended percentage as the maximum value in our sample is 44%. The mean of the Blau and Shannon indexes is 0.05 and 0.08, and ranges between 0 and 0.49 and 0.69, respectively. Therefore, we have a rich dataset that includes firms characterized by a large degree of variation in the gender diversity of their boards. Also, the control variables show a significant level of dispersion in their values reflecting the heterogeneity of our company-year sample.

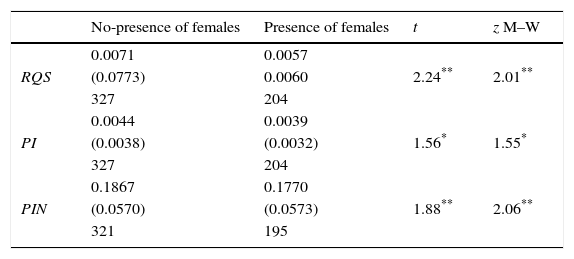

ResultsAs a preliminary and intuitive analysis to investigate the relationship between gender diversity on corporate boards and the information environment of companies, we conduct a univariate analysis to examine whether mean values of our information asymmetry proxies are lower in firms with women on their boards in comparison to firms with no women at all. Table 2 presents mean values for each information asymmetry proxy in both groups, as well as the values of t-test and Mann–Whitney test. As expected, RQS, PI, and PIN measures are significantly lower for firms with female directors on their boards compared to those firms with none. Consistent with our expectation, these preliminary results suggest that firms with female directors on their boards exhibit lower levels of information asymmetry among market participants.

Mean differences in information asymmetry between firms with no-presence and presence of women on corporate boards.

| No-presence of females | Presence of females | t | z M–W | |

|---|---|---|---|---|

| RQS | 0.0071 | 0.0057 | 2.24** | 2.01** |

| (0.0773) | 0.0060 | |||

| 327 | 204 | |||

| PI | 0.0044 | 0.0039 | 1.56* | 1.55* |

| (0.0038) | (0.0032) | |||

| 327 | 204 | |||

| PIN | 0.1867 | 0.1770 | 1.88** | 2.06** |

| (0.0570) | (0.0573) | |||

| 321 | 195 |

Note: Variable definitions are in Table 1. For each measure and each group, mean, standard deviation (in parentheses), and number of observations. The t-test and Mann–Whitney (z-statistics) test are used to test the null hypothesis of no significant differences in each information asymmetry proxy between two groups.

However, this preliminary analysis does not control for the effects of company characteristics and other factors affecting adverse selection measures. Thus, according to Eq. (3), we separately regress each information asymmetry proxy (RQS, PI, and PIN) on the three measures of gender diversity (PWOMEN, BLAU, and SHANNON), controlling for relevant firm characteristics and other factors to isolate the effect of gender diversity on information asymmetry.

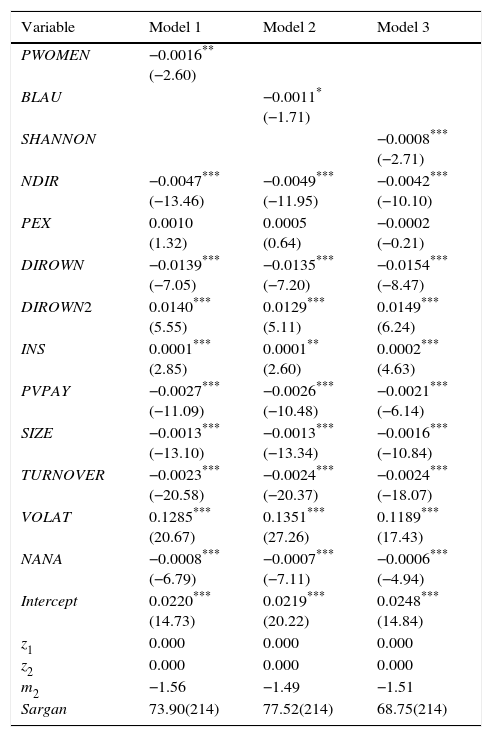

Table 3 presents Eq. (3) estimation results using RQS as the dependent variable. In Model 1, the proportion of women on boards, PWOMEN, has a negative and significant effect on the relative spread. In Models 2 and 3, we employ the Blau index, BLAU, and the Shannon Index, SHANNON, respectively, to examine gender diversity on director boards. As expected, we find that the coefficients on both indexes are negative and significant. These findings suggest that higher gender diversity on boards reduces the adverse selection risk in the market and consequently reduces the cost of liquidity.

System GMM panel data regressions relating to the influence of the female board members ratio and diversity indexes on relative bid-ask spread (RQS).

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| PWOMEN | −0.0016** (−2.60) | ||

| BLAU | −0.0011* (−1.71) | ||

| SHANNON | −0.0008*** (−2.71) | ||

| NDIR | −0.0047*** (−13.46) | −0.0049*** (−11.95) | −0.0042*** (−10.10) |

| PEX | 0.0010 (1.32) | 0.0005 (0.64) | −0.0002 (−0.21) |

| DIROWN | −0.0139*** (−7.05) | −0.0135*** (−7.20) | −0.0154*** (−8.47) |

| DIROWN2 | 0.0140*** (5.55) | 0.0129*** (5.11) | 0.0149*** (6.24) |

| INS | 0.0001*** (2.85) | 0.0001** (2.60) | 0.0002*** (4.63) |

| PVPAY | −0.0027*** (−11.09) | −0.0026*** (−10.48) | −0.0021*** (−6.14) |

| SIZE | −0.0013*** (−13.10) | −0.0013*** (−13.34) | −0.0016*** (−10.84) |

| TURNOVER | −0.0023*** (−20.58) | −0.0024*** (−20.37) | −0.0024*** (−18.07) |

| VOLAT | 0.1285*** (20.67) | 0.1351*** (27.26) | 0.1189*** (17.43) |

| NANA | −0.0008*** (−6.79) | −0.0007*** (−7.11) | −0.0006*** (−4.94) |

| Intercept | 0.0220*** (14.73) | 0.0219*** (20.22) | 0.0248*** (14.84) |

| z1 | 0.000 | 0.000 | 0.000 |

| z2 | 0.000 | 0.000 | 0.000 |

| m2 | −1.56 | −1.49 | −1.51 |

| Sargan | 73.90(214) | 77.52(214) | 68.75(214) |

Note: Variable definitions are in Table 1. z1 and z2 are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses. For each coefficient t-value is showed in brackets.

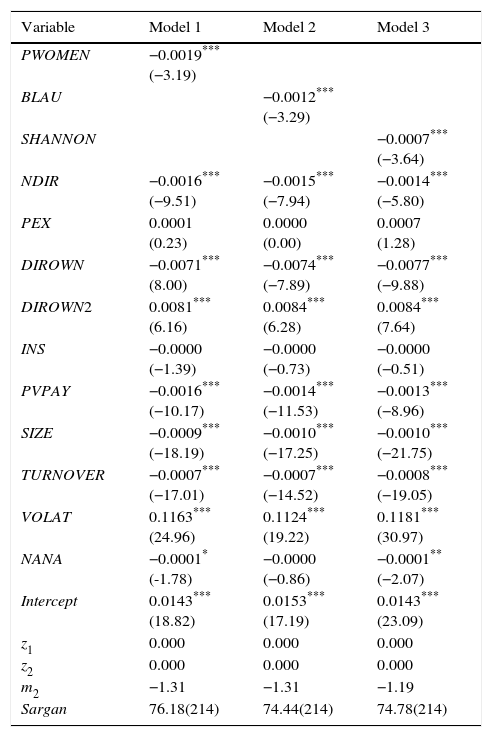

Since bid-ask spread can capture both informational and non-informational costs of liquidity, we re-estimate our three models using more precise microstructure proxies for information asymmetry. Table 4 reports model estimations using PI as the dependent variable. PI is a measure of adverse selection risk perceived by liquidity providers based on price adjustments observed subsequent to a market transaction. Consistent with our prediction, we find a negative and statistically significant (at the 1% level) coefficient associated to our gender diversity measure in each model.

System GMM panel data regressions relating to the influence of the female board members ratio and diversity indexes on price impact (PI).

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| PWOMEN | −0.0019*** (−3.19) | ||

| BLAU | −0.0012*** (−3.29) | ||

| SHANNON | −0.0007*** (−3.64) | ||

| NDIR | −0.0016*** (−9.51) | −0.0015*** (−7.94) | −0.0014*** (−5.80) |

| PEX | 0.0001 (0.23) | 0.0000 (0.00) | 0.0007 (1.28) |

| DIROWN | −0.0071*** (8.00) | −0.0074*** (−7.89) | −0.0077*** (−9.88) |

| DIROWN2 | 0.0081*** (6.16) | 0.0084*** (6.28) | 0.0084*** (7.64) |

| INS | −0.0000 (−1.39) | −0.0000 (−0.73) | −0.0000 (−0.51) |

| PVPAY | −0.0016*** (−10.17) | −0.0014*** (−11.53) | −0.0013*** (−8.96) |

| SIZE | −0.0009*** (−18.19) | −0.0010*** (−17.25) | −0.0010*** (−21.75) |

| TURNOVER | −0.0007*** (−17.01) | −0.0007*** (−14.52) | −0.0008*** (−19.05) |

| VOLAT | 0.1163*** (24.96) | 0.1124*** (19.22) | 0.1181*** (30.97) |

| NANA | −0.0001* (-1.78) | −0.0000 (−0.86) | −0.0001** (−2.07) |

| Intercept | 0.0143*** (18.82) | 0.0153*** (17.19) | 0.0143*** (23.09) |

| z1 | 0.000 | 0.000 | 0.000 |

| z2 | 0.000 | 0.000 | 0.000 |

| m2 | −1.31 | −1.31 | −1.19 |

| Sargan | 76.18(214) | 74.44(214) | 74.78(214) |

Note: Variable definitions are in Table 1. z1 and z2 are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses. For each coefficient t-value is shown in brackets.

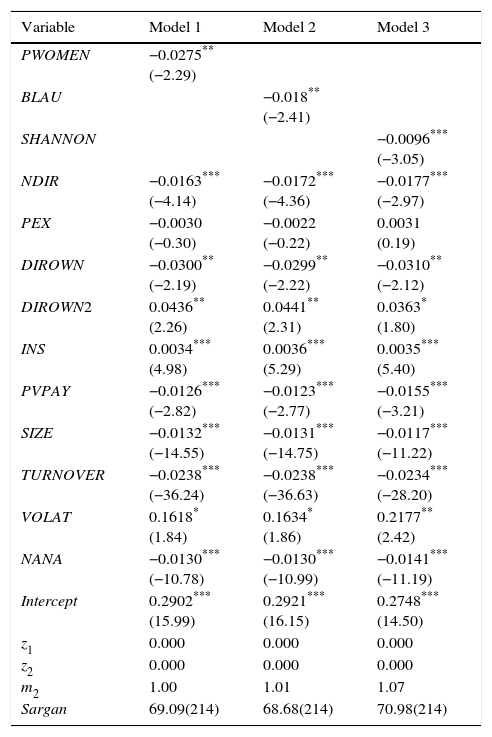

The results using the PIN as a proxy for information asymmetry are shown in Table 5. Just as the results previously reported, the coefficients on PWOMEN, BLAU, and SHANNON are also negative and significant. Once again, these results imply that having more women in the boardroom results in a reduction of informed trading risk. Therefore, we find consistent results across all our information asymmetry proxies indicating that an increase in gender diversity on corporate boards can reduce differences in the level of information held by different actors in the market.

System GMM panel data regressions relating to the influence of the female board members ratio and diversity indexes on PIN.

| Variable | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| PWOMEN | −0.0275** (−2.29) | ||

| BLAU | −0.018** (−2.41) | ||

| SHANNON | −0.0096*** (−3.05) | ||

| NDIR | −0.0163*** (−4.14) | −0.0172*** (−4.36) | −0.0177*** (−2.97) |

| PEX | −0.0030 (−0.30) | −0.0022 (−0.22) | 0.0031 (0.19) |

| DIROWN | −0.0300** (−2.19) | −0.0299** (−2.22) | −0.0310** (−2.12) |

| DIROWN2 | 0.0436** (2.26) | 0.0441** (2.31) | 0.0363* (1.80) |

| INS | 0.0034*** (4.98) | 0.0036*** (5.29) | 0.0035*** (5.40) |

| PVPAY | −0.0126*** (−2.82) | −0.0123*** (−2.77) | −0.0155*** (−3.21) |

| SIZE | −0.0132*** (−14.55) | −0.0131*** (−14.75) | −0.0117*** (−11.22) |

| TURNOVER | −0.0238*** (−36.24) | −0.0238*** (−36.63) | −0.0234*** (−28.20) |

| VOLAT | 0.1618* (1.84) | 0.1634* (1.86) | 0.2177** (2.42) |

| NANA | −0.0130*** (−10.78) | −0.0130*** (−10.99) | −0.0141*** (−11.19) |

| Intercept | 0.2902*** (15.99) | 0.2921*** (16.15) | 0.2748*** (14.50) |

| z1 | 0.000 | 0.000 | 0.000 |

| z2 | 0.000 | 0.000 | 0.000 |

| m2 | 1.00 | 1.01 | 1.07 |

| Sargan | 69.09(214) | 68.68(214) | 70.98(214) |

Note: Variable definitions are in Table 1. z1 and z2 are two Wald tests of the joint significance of the reported coefficients and the joint significance of the time dummy variables, respectively (asymptotically distributed as λ2 under the null hypothesis of no relationship, probability is shown); m2 is a second-order serial correlation test using residuals in first differences, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation; Sargan is a test of the over-identifying restrictions, asymptotically distributed as λ2 under the null hypothesis of no correlation between the instruments and the error term, degrees of freedom in parentheses. For each coefficient t-value is shown in brackets.

The coefficients of control variables included in all the regression models (Tables 3–5) generally present the expected signs according to the literature and, in the majority of the cases, they are also significant. Across all specifications, the coefficients on NDIR are positive and significant at the 1% level. This indicates that larger boards reduce adverse selection problems in line with the findings of Cai et al. (2006). However, the percentage of non-executive directors, PEX, does not show a significant effect on the different dependent variables. Similar to this finding, Gul et al. (2011) document that the number of independent non-executive directors does not have a significant effect on the information content of stock prices. We also find a non-monotonic link between DIROWN and the proxies for information asymmetry. When director ownership is low, a positive sign is found in accordance with convergence hypothesis. However, when we deal with higher levels of director ownership the results show a positive effect on adverse selection measures (entrenchment hypothesis). These findings are consistent with those provided by Morck et al. (1988). The coefficients on INS are not significant for price impact regression models but significantly positive for bid-ask spread and PIN. These latter findings are in line with those from prior studies such as Brown et al. (2004), which suggest that institutions are informed investors with access to private information about the firm, so exacerbating information asymmetry among investors. The effect on PVPAY is negative and significant: a higher proportion of variable payment to directors reduces the asymmetric information (consistent to Kang et al., 2006). Finally, in all model estimations and consistent with the extensive prior evidence, we find that the stocks of larger firms with higher trading volumes and those being followed by more analysts show less information asymmetry, whereas firms with more volatile stock returns are associated with higher levels of information asymmetry.

Finally, as observed in all specifications reported in Tables 3–5, the z1 Wald test indicates that the joint effect of the explanatory variables is significant. On the other hand the z2 Wald test indicates that the effect of all time dummies is significant. The m2 indicator does not show a second-order serial relationship in the first-difference residuals, showing that none of the models are misspecified. The Sargan test reveals that there is no relationship between εit and the instruments. All these tests confirm the validity of the estimation method employed.

ConclusionsThis paper examines the relation between gender diversity on the board of directors and the levels of information asymmetry in equity markets. Based on prior evidence suggesting that gender diverse boards increase the quantity and quality of public disclosure by firms and that female participation promotes more effective board communication that facilitates the collection of value-relevant company-specific information to investors, we hypothesize a negative link between board gender diversity and the average level of information asymmetry in the stock market.

We provide evidence for our prediction using a sample of Spanish listed firms during the period 2004–2009. We use several market microstructure measures of information asymmetry: the relative bid-ask spread, the price impact measure, and the PIN. We also introduce different proxies for gender diversity on director boards. Consistent to the hypothesis stated, our findings suggest that the presence of women on boards is related to lower levels of information asymmetry among market participants after controlling for different board characteristics, as well as other factor related to adverse selection in the market. Therefore, we report evidence consistent with the expectation that gender-diverse boards improve the information environment by ameliorating the adverse selection problems among market participants.

Our findings have implications for managers, regulators, and researchers. We add new evidence to a current research field about the economic consequences of gender diversity on director boards. Although studies can be found in the literature that have analysed the effect of the presence of females on boards on corporate transparency and firms’ information environments, our study provides novel and relevant evidence about the association between board diversity and the degree of information asymmetry among market participants. Specifically, our paper is the first that conducts an association study and uses market microstructure measures, estimated from high frequency data, to examine this relationship. The empirical evidence provided by prior studies somehow related with this topic is scarce, inconclusive and focused exclusively on the US market. We focus on Spain, a pioneer country in the encouragement of the presence of females in relevant positions within firm management. Our paper shows that the policies recently implemented in several European countries to increase the presence of female directors in company boards could have beneficial effects on stock markets by reducing the risk of informed trading and enhancing stock liquidity. Therefore, our study adds new evidence to the research boosting the benefits of gender diverse boards, which helps shareholders, investors and other firms’ stakeholders to perceive that female presence on boards can lead to their interests being better safeguarded, as well as helping them face up to criticism of tokenism or to defend the role played by females on boards. Hence, our findings suggest that gender diversity makes economic sense and advances the cause of social equity in European boardrooms.

Nevertheless, we should be cautious regarding the relevance of our results due to the existence of several limitations. First, although we have made a great effort to control for many board-governance factors and for market and firm characteristics, our study may still have omitted factors. For instance, the adoption by firms of the good governance codes’ recommendations relating to corporate transparency and public disclosure policy could also affect the firm's information environment and, thereby, our results. As a consequence, the potential influence of these kinds of factors encourages further research. Second, although the sample includes most of the representative non-financial firms on the Spanish stock market over the chosen period, we have to admit that it is a modest sample, focussed only on one country. Consequently, our findings might not be generalized to other time periods nor to other countries. A basic future line of research would be to extend our study to a sample of firms from different countries of the European Union or other areas around the world, as well as to extend the sample period. Furthermore, in order to obtain generalized conclusions on this matter, this kind of analysis should also enable a reasonable comparison on the effectiveness of different gender policies. Similarly, since this paper provides evidence of greater gender diversity on boards causing information asymmetry to decrease, it could be interesting to examine in depth what the specific underlying mechanisms are which lead to this outcome.

The PIN model views trading as a game between liquidity providers and traders (position takers), that is repeated over trading days. Trades can come from informed or uninformed traders. For any given trading day the arrival of buy and sell orders from uniformed traders, who are not aware of the new information, is modelled as two independent Poisson processes with daily arrival rates ¿b and ¿S, respectively. The model assumes that information events occur between trading days with probability α. Informed traders only trade on days with information events, buying if they have seen good news (with probability 1−δ) and selling if they have seen bad news (with probability δ). The orders from the informed traders follow a Poisson process with daily arrival rate μ.

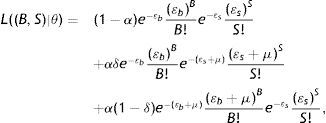

Under this model, the likelihood of observing B buys and S sells on a single trading day is:

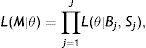

where B and S represent total buy trades and sell trades for the day respectively, and θ=(α, δ, μ, ¿b, ¿s) is the parameter vector. This likelihood function is a mixture of three Poisson probabilities, weighted by the probability of having a “good news day” α(1−δ), a “bad news day” αδ, and “no-news day” (1−α). Assuming cross-trading day independence, the likelihood function across J days is just the product of the daily likelihood functions:where Bj, and Sj are the numbers of buy and sell trades for day j=1, …, J, respectively and M=[(B1, S1), …, (BJ, SJ)] is the data set. Maximization of (2) over θ given the data M yields maximum likelihood estimates for the underlying structural parameters of the model (α, δ, μ, ¿b, ¿s). Once the parameters are estimated, PIN is calculated as seen in Eq. (3).An attractive feature of PIN methodology is its modest data requirement (only the daily number of buy- and sell-initiated is necessary). However, a shortcoming of the methodology is that, although the estimation procedure is straightforward, in practice it often encounters numerical problems when performing the estimation. Especially in stocks with a huge number of trades, the optimization program may clash with computational overflow or underflow (floating-point exception) and, as a consequence, it may not be able to obtain an optimal solution. We use the optimization algorithm of the Matlab software to maximize the likelihood function in (A.2). We usually run the maximum likelihood function 100 times for each stock in our sample, except for several months of large stocks for which we increase the iterations to 1000 to ensure that a maximum is reached. We follow Yan and Zhang (2012) to set initial values for the five parameters in the likelihood function.

For instance, to justify the relationship between gender diversity and financial reporting quality, Gul et al. (2013) focus on organizational, economic psychology, and agency theoretical approaches. Pucheta-Martínez et al. (2016) turn to agency, stewardship, stakeholder and signalling theories to frame the impact of gender diversity on audit committees on financial information quality.

We thank two anonymous reviewers and the editor, Professor Pablo Arocena, for their useful comments and suggestions. We also appreciate the comments made by the participants at the 24th IAFFE Annual Conference. David Abad acknowledges financial support from the Ministerio de Economía y Competitividad through grants ECO2013-4409-P and ECO2014-58434-P. Antonio Minguez-Vera and José Yagüe acknowledge financial support from the Ministerio de Economía y Competitividad through grant FEM2013-40578-P. Encarnación Lucas-Pérez, Antonio Minguez-Vera, and José Yagüe acknowledge financial support from Fundación Caja Murcia.

The reader must take in account that, as is usual in the gender diversity literature, we use board gender diversity and the presence of women on boards as similar concepts. We think this is a valid assumption given the current situation of gender discrimination within corporate boards, which are mainly composed of males. This clarification is important since one board with 100% of women would not present gender diversity. We are grateful to an anonymous reviewer for pointing this out.

Prior works find that lower earnings quality increases litigation risks, and earnings management are associated with reputation loss (Hunton et al., 2006; Kaplan and Ravenscroft, 2004).